TIDMHUW

RNS Number : 7901S

Helios Underwriting Plc

29 September 2014

29 September 2014

Helios Underwriting plc

("Helios Underwriting" or the "Company")

Interim results for the six months ended 30 June 2014

Helios Underwriting plc, which provides investors with a limited

liability direct investment into the Lloyd's insurance market,

announces its unaudited results for the six months ended 30 June

2014.

Chairman's Statement

This has been another good period where we have utilised the

capital released by the initial quota share and as a result have

been able to continue to increase our underwriting capacity to

GBP21.3 million at the period end through the acquisition of Nomina

No 380 LLP on 16 January 2014 for GBP557,000, Bernul Limited on 27

March 2014 for GBP823,000 and Nomina No 372 LLP on 2 May 2014 for

GBP480,000. The open years of HUW owned vehicles have improved to a

degree that had been anticipated at the time of purchase. We have

also seen an increase in the number of vehicles that are available

for sale, which may lead to lower prices in due course and supports

our ongoing strategy to increase underwriting capacity through

acquisition.

The Parent Company's adjusted net assets plus Humphrey & Co

valuation of the Group's underwriting subsidiaries at the period

end is GBP14.3m or GBP1.69 per share based on current

legislation.

Market conditions over the period continue to worsen. We have

now opted for an increase to the quota share for the 2014

underwriting year of account from 50% to 70% as a result. We have

included two further reinsurers thereby increasing our

diversity.

Sir Michael Oliver

Non-executive Chairman

Condensed Consolidated Statement of Financial Position

At 30 June 2014

30 June 2014 30 June 31 December

2013 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

----------------------------------------- ----- ------------- ---------- ------------

Assets

Intangible assets 3,828 1,571 2,929

Deferred income tax assets - - -

Reinsurance share of insurance

liabilities

- Reinsurers' share of outstanding

claims 3 4,221 3,658 4,154

- Reinsurers' share of unearned

premiums 3 1,637 1,379 800

Other receivables, including

insurance receivables 14,438 9,285 11,554

Prepayments and accrued income 2,307 1,577 1,569

Financial assets at fair value 8 21,909 19,817 22,213

Cash and cash equivalents 3,368 2,270 1,066

Total assets 51,708 39,557 44,285

----------------------------------------- ----- ------------- ---------- ------------

Liabilities

Insurance liabilities:

- Claims outstanding 3 23,668 17,487 21,596

- Unearned premiums 3 9,415 6,694 5,968

Deferred income tax liabilities 1,603 978 1,656

Other payables, including insurance

payables 5,909 4,108 4,116

Accruals and deferred income 1,515 733 1,123

Total liabilities 42,110 30,000 34,459

----------------------------------------- ----- ------------- ---------- ------------

Shareholders' equity

Share capital 9 853 853 853

Share premium 9 6,996 6,996 6,996

Retained earnings 10 1,749 1,708 1,977

----------------------------------------- ----- ------------- ---------- ------------

Total shareholders' equity 9,598 9,557 9,826

----------------------------------------- ----- ------------- ---------- ------------

Total liabilities and shareholders'

equity 51,708 39,557 44,285

----------------------------------------- ----- ------------- ---------- ------------

Condensed Consolidated Income Statement

Six months ended 30 June 2014

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------------ ----- ---------- ---------- -------------

Gross premium written 10,183 7,158 11,938

Reinsurance premium ceded (2,008) (1,634) (2,251)

------------------------------------------------ ----- ---------- ---------- -------------

Net premiums written 8,175 5,524 9,687

Change in unearned gross premium

provision (2,435) (1,626) (29)

Change in unearned reinsurance premium

provision 686 689 43

------------------------------------------------ ----- ---------- ---------- -------------

(1,749) (937) 14

------------------------------------------------ ----- ---------- ---------- -------------

Net earned premium 2 6,426 4,587 9,701

Net investment income 4 268 24 208

Other underwriting income - - -

Other income - 110 -

------------------------------------------------ ----- ---------- ---------- -------------

Revenue 6,694 4,721 9,909

------------------------------------------------ ----- ---------- ---------- -------------

Gross claims paid (3,291) (2,855) (5,867)

Reinsurance share of gross claims

paid 593 575 1,134

------------------------------------------------ ----- ---------- ---------- -------------

Claims paid, net of reinsurance (2,698) (2,280) (4,733)

------------------------------------------------ ----- ---------- ---------- -------------

Change in provision for gross claims (464) 4 1,148

Reinsurance share of change in provision

for gross claims (328) (95) (478)

------------------------------------------------ ----- ---------- ---------- -------------

Net change in provision for claims (792) (91) 670

------------------------------------------------ ----- ---------- ---------- -------------

Net insurance claims and loss adjustment

expenses 2 (3,490) (2,371) (4,063)

Expenses incurred in insurance activities 2 (2,203) (1,300) (4,042)

Other operating expenses 2 (477) (222) (524)

------------------------------------------------ ----- ---------- ---------- -------------

Operating expenses (2,680) (1,522) (4,566)

------------------------------------------------ ----- ---------- ---------- -------------

Operating profit before goodwill 2 524 828 1,280

Goodwill on bargain purchase 11 115 - 133

Impairment of goodwill 11 (5) - (98)

Amortisation of syndicate capacity (438) (226) (462)

------------------------------------------------ ----- ---------- ---------- -------------

Profit before tax 196 602 853

Income tax charge 5 (40) (140) (122)

Profit attributable to equity shareholders 10 156 462 731

------------------------------------------------ ----- ---------- ---------- -------------

Earnings per share attributable to

equity shareholders

Basic and diluted 6 1.83p 5.42p 8.57p

------------------------------------------------ ----- ---------- ---------- -------------

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2014

6 months 6 months 12 months

ended ended ended

30 June 2014 30 June 31 December

2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------------- -------------- ---------- -------------

Cash flow from operating activities

Results of operating activities 196 602 853

Interest received (3) - (2)

Investment income (240) (49) (381)

Goodwill on bargain purchase (115) - (133)

Impairment of goodwill 5 - 98

Profit on sale of intangible assets - - - 8

Amortisation of intangible assets 438 226 462

Change in fair value of investments 41 93 137

Changes in working capital:

(Increase)/decrease in other receivables (1,214) (303) 2,687

Increase(Decrease) in other payables 978 (479) (1,336)

Net increase in technical provisions 274 (381) (3,273)

Income tax paid (49) (93) (86)

Net cash inflow/(outflow) from operating

activities 311 (384) (966)

-------------------------------------------------- -------------- ---------- -------------

Cash flows from investing activities

Interest received 3 - 2

Investment income 240 49 381

Purchase of intangible assets - - (3)

Net inflow of financial assets at fair

value 3,749 1,161 3,276

Acquisition of subsidiary, net of cash

acquired (1,617) - (3,070)

Proceeds from disposal of intangible

assets - - 2

Net cash used in investing activities 2,375 1,210 588

-------------------------------------------------- -------------- ---------- -------------

Cash flows from financing activities

Dividends paid (384) - -

-------------------------------------------------- -------------- ---------- -------------

Net cash used in financing activities (384) - -

-------------------------------------------------- -------------- ---------- -------------

Net increase/(decrease) in cash and

cash equivalents 2,302 826 (378)

Cash and cash equivalents at beginning

of period 1,066 1,444 1,444

Cash, cash equivalents and bank overdrafts

at end of period 3,368 2,270 1,066

-------------------------------------------------- -------------- ---------- -------------

Condensed Statement of Changes in Shareholders' Equity

Six months ended 30 June 2014

For the six months ended 30 June 2014

Ordinary Share Retained

share capital Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- --------- ---------- --------

At 1 January 2014 853 6,996 1,977 9,826

Profit for the period attributable

to equity shareholders - - 156 156

Dividends paid - - (384) (384)

At 30 June 2014 853 6,996 1,749 9,598

---------------------------------------- --------------- --------- ---------- --------

For the six months ended 30 June 2013

Ordinary Share Retained

share capital Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- --------- ---------- --------

At 1 January 2013 853 6,996 1,246 9,095

Profit for the period attributable

to equity shareholders - - 462 462

At 30 June 2013 853 6,996 1,708 9,557

---------------------------------------- --------------- --------- ---------- --------

For the twelve months ended 31 December 2013

Ordinary Share Retained

share capital Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- --------------- --------- ---------- --------

At 1 January 2013 853 6,996 1,246 9,095

Profit for the year attributable

to equity shareholders - - 731 731

-------------------------------------- --------------- --------- ---------- --------

At 31 December 2013 853 6,996 1,977 9,826

-------------------------------------- --------------- --------- ---------- --------

Notes to the Interim Financial Statements

Six months ended 30 June 2014

1. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2014.

The Condensed Consolidated Interim Financial Statements

incorporate the results of Helios Underwriting plc, Hampden

Corporate Member Limited, Nameco (No. 365) Limited, Nameco (No.

605) Limited, Nameco (No. 321) Limited, Nameco (No. 917) Limited,

Nameco (No. 229) Limited, Nameco (No. 518) Limited, Nameco (No.

804) Limited, Halperin Limited, Bernul Limited, Nomina No 035 LLP,

Nomina No 342 LLP, Nomina No 380 LLP, Nomina No 372 LLP and Helios

UTG Partner Limited.

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 June 2014 and 2013 are unaudited, but have been

subject to review by the Group's auditors. The Condensed

Consolidated Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the year ended

31 December 2013.

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention. The same

accounting policies, presentation and methods of computation are

followed in these Condensed Consolidated Interim Financial

Statements as were applied in the preparation of the Group

Financial Statements for the year ended 31 December 2013. The new

standards and amendments to standards and interpretations effective

after 1 January 2014, as disclosed in the Annual Report for the

year ended 31 December 2013, have not had a significant impact on

the Condensed Consolidated Interim Financial Statements at 30 June

2014.

2. Segmental information

The Group has three primary segments which represent the primary

way in which the Group is managed:

-- Syndicate participation;

-- Investment management;

-- Other corporate activities.

6 months ended 30 June 2014 Syndicate Investment Other corporate

Unaudited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- --------

Net earned premium 6,502 - (76) 6,426

Net investment income 244 24 - 268

Other income - - - -

Net insurance claims and loss

adjustment expenses (3,490) - - (3,490)

Expenses incurred in insurance

activities (2,030) - (173) (2,203)

Other operating expenses - - (477) (477)

Goodwill on bargain purchase - - 115 115

Impairment of goodwill - - (5) (5)

Amortisation of syndicate capacity - - (438) (438)

Profit before tax 1,226 24 (1,054) 196

------------------------------------ --------------- ------------ ---------------- --------

6 months ended 30 June 2013 Syndicate Investment Other corporate

Unaudited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- --------

Net earned premium 4,587 - - 4,587

Net investment income 21 3 - 24

Other income - - 110 110

Net insurance claims and loss

adjustment expenses (2,397) - 26 (2,371)

Expenses incurred in insurance

activities (1,300) - - (1,300)

Other operating expenses (139) - (83) (222)

Goodwill on bargain purchase - - - -

Impairment of goodwill - - - -

Amortisation of syndicate capacity - - (226) (226)

Profit before tax 772 3 (173) 602

------------------------------------ --------------- ------------ ---------------- --------

12 months ended 31 December Syndicate Investment Other corporate

2013 Audited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- --------

Net earned premium 9,723 - (22) 9,701

Net investment income 247 (39) - 208

Other income - - - -

Net insurance claims and loss

adjustment expenses (4,063) - - (4,063)

Expenses incurred in insurance

activities (4,042) - - (4,042)

Other operating expenses 51 - (575) (524)

Goodwill on bargain purchase - - 133 133

Impairment of goodwill - - (98) (98)

Amortisation of syndicate capacity - - (462) (462)

Profit before tax 1,916 (39) (1,024) 853

------------------------------------ --------------- ------------ ---------------- --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

Net earned premium within 2014 other corporate activities

totalling (GBP76,000) (2013: (GBP22,000) includes the net Group

quota share reinsurance premium payable to Hampden Insurance PCC

(Guernsey) Limited - Cell 6 for the 2013 and 2014 underwriting

years of accounts of (GBP26,000) (2013: GBP22,000) and the Stop

loss premium payable to Hampden Insurance PCC (Guernsey) Limited -

Cell 7 for the 2014 underwriting year of account of (GBP50,000)

(2013: GBPnil).

Syndicate participation represents the Groups direct share of

the underlying syndicate's results for the period.

3. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------- -------- ------------ --------

At 1 January 2014 21,596 4,154 17,442

Increase in reserves arising from acquisition of subsidiary undertaking 4,198 (818) 5,016

Movement of reserves 464 (328) 792

Other movements (2,590) 1,213 (3,803)

------------------------------------------------------------------------- -------- ------------ --------

At 30 June 2014 23,668 4,221 19,447

------------------------------------------------------------------------- -------- ------------ --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------- -------- ------------ --------

At 1 January 2014 5,968 800 5,168

Increase in reserves arising from acquisition of subsidiary undertaking 1,108 (147) 1,255

Movement of reserves 2,435 686 1,749

Other movements (96) 298 (394)

------------------------------------------------------------------------- -------- ------------ --------

At 30 June 2014 9,415 1,637 7,778

------------------------------------------------------------------------- -------- ------------ --------

Included within other movements are the 2011 and prior years'

reinsured into the 2012 year of account on which the Group does not

participate and currency exchange differences.

4. Net investment income

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------- ---------- -------------

Investment income 240 49 381

Realised gains on financial investments

at fair value through income statement 2 129 5

Unrealised gains/(losses) on financial

investments at fair value through income

statement 23 (144) (137)

Investment management expenses - (10) (43)

Bank interest 3 - 2

------------------------------------------- ---------- ---------- -------------

Net investment income 268 24 208

------------------------------------------- ---------- ---------- -------------

5. Income tax expense

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------- ---------- ---------- -------------

Income tax expense (40) (140) (122)

-------------------- ---------- ---------- -------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 20% (2013: 23.25%). Material disallowed terms have been

adjusted for in the income tax calculation.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS

33.

Reconciliation of the earnings and weighted average number of

shares used in the calculation is set out below.

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

Profit for the period GBP156,000 GBP462,000 GBP731,000

-------------------------------------- ----------- ----------- -------------

Weighted average number of shares in

issue 8,526,948 8,526,948 8,526,948

-------------------------------------- ----------- ----------- -------------

Basic and diluted earnings per share

(p) 1.83p 5.42p 8.57p

-------------------------------------- ----------- ----------- -------------

7. Dividends

During the period dividends of 4.5p per share (2013 - Nil) were

paid, totalling GBP384,000 (see note 10).

8. Financial assets at fair value

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs that have a significant

effect on the recorded fair value that are not based on observable

market data.

As at 30 June 2014, the Group held GBP18,408,000 (31 December

2013: GBP17,709,000) Level 1 Financial Assets and GBP3,501,000 (31

December 2013: GBP2,108,000) Level 2 Financial Assets. The Group

has no level 3 investments (31 December 2013 GBPNil).

9. Share capital and share premium

Ordinary

Share

Capital Share Premium Total

Allotted, called up and fully paid GBP'000 GBP'000 GBP'000

------------------------------------------------- --------- -------------- ---------

8,526,948 ordinary shares of 10p each and share

premium at 30 June 2013 853 6,996 7,849

8,526,948 ordinary shares of 10p each and share

premium at 31 December 2013 853 6,996 7,849

8,526,948 ordinary shares of 10p each and share

premium at 30 June 2014 853 6,996 7,849

------------------------------------------------- --------- -------------- ---------

10. Retained earnings

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ---------- ------------

Group

At 1 January 2014 1,977 1,246 1,246

Profit attributable to equity shareholders 156 462 731

Dividends paid (384) - -

-------------------------------------------- ---------- ---------- ------------

At 30 June 2014 1,749 1,708 1,977

-------------------------------------------- ---------- ---------- ------------

11. Acquisition of limited liability vehicles

In order to increase the Group's underwriting capacity, the

Company has, since the balance sheet date, acquired 100% of the

voting rights (either directly or indirectly) of the following

Limited Liability Vehicles:

Nomina No 380 LLP

On 16 January 2014 Helios UTG Partner Limited, a 100% subsidiary

of the Company, became a 100% corporate partner in Nomina No 380

LLP for a total consideration of GBP557,000. Nomina No 380 LLP is

incorporated in England and Wales and is a member of Lloyd's.

The acquisition has been accounted for using the purchase method

of accounting. After the alignment of accounting policies and other

adjustments to the valuation of assets and liabilities to reflect

their fair value at acquisition, the fair value of the net assets

was GBP622,000. Negative goodwill of GBP65,000 arose on acquisition

and has been immediately recognised as goodwill on bargain purchase

in the income statement. The following table explains the fair

value adjustments made to the carrying values of the major

categories of assets and liabilities at the date of

acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- ------------ -----------

Intangible assets 442 82 524

Reinsurance assets:

- reinsurers' share of claims outstanding 279 - 279

- reinsurers' share of unearned premium 109 - 109

Other receivables, including insurance receivables 724 - 724

Prepayments and accrued income 104 - 104

Financial assets at fair value 1,228 - 1,228

Cash and cash equivalents 81 - 81

Insurance liabilities:

- claims outstanding (1,451) - (1,451)

- unearned premiums (579) - (579)

Deferred income tax liabilities - (55) (55)

Other payables, including insurance payables (293) - (293)

Accruals and deferred income (49) - (49)

---------------------------------------------------- --------- ------------ -----------

Net assets acquired 595 27 622

---------------------------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 557 - 557

---------------------------------------------------- --------- ------------ -----------

Negative goodwill (38) (27) (65)

---------------------------------------------------- --------- ------------ -----------

Bernul Limited

On 27 March 2014 Helios Underwriting plc acquired 100% of the

issued share capital of Bernul Limited for a total consideration of

GBP823,000. Bernul Limited is incorporated in England and Wales and

is a corporate member of Lloyd's.

The acquisition has been accounted for using the purchase method

of accounting. After the alignment of accounting policies and other

adjustments to the valuation of assets and liabilities to reflect

their fair value at acquisition, the fair value of the net assets

was GBP818,000. Goodwill of GBP5,000 arose on acquisition. The

following table explains the fair value adjustments made to the

carrying values of the major categories of assets and liabilities

at the date of acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- ------------ -----------

Intangible assets 1 322 323

Reinsurance assets:

- reinsurers' share of claims outstanding 147 - 147

- reinsurers' share of unearned premium 59 - 59

Other receivables, including insurance receivables 768 - 768

Prepayments and accrued income 80 - 80

Financial assets at fair value 1,056 - 1,056

Cash and cash equivalents 79 - 79

Insurance liabilities:

- claims outstanding (970) - (970)

- unearned premiums (358) - (358)

Deferred income tax liabilities (52) (64) (116)

Other payables, including insurance payables (215) - (215)

Accruals and deferred income (35) - (35)

---------------------------------------------------- --------- ------------ -----------

Net assets acquired 560 258 818

---------------------------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 823 - 823

---------------------------------------------------- --------- ------------ -----------

Goodwill 263 258 5

---------------------------------------------------- --------- ------------ -----------

Nomina No 372 LLP

On 2 May 2014 Helios UTG Partner Limited, a 100% subsidiary of

the Company, became a 100% corporate partner in Nomina No 372 LLP

for GBP480,000. Nomina No 372 LLP is incorporated in England and

Wales and is a member of Lloyd's.

The acquisition has been accounted for using the purchase method

of accounting. After the alignment of accounting policies and other

adjustments to the valuation of assets and liabilities to reflect

their fair value at acquisition, the fair value of the net assets

was GBP530,000. Negative goodwill of GBP50,000 arose on acquisition

and has been immediately recognised as goodwill on bargain purchase

in the income statement. The following table explains the fair

value adjustments made to the carrying values of the major

categories of assets and liabilities at the date of

acquisition:

Carrying

value Adjustments Fair value

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- ------------ -----------

Intangible assets 380 62 442

Reinsurance assets:

- reinsurers' share of claims outstanding 231 231

- reinsurers' share of unearned premium 80 80

Other receivables, including insurance receivables 521 521

Prepayments and accrued income 95 95

Financial assets at fair value 1,007 1,007

Cash and cash equivalents 84 84

Insurance liabilities:

- claims outstanding (1,173) (1,173)

- unearned premiums (457) (457)

Deferred income tax liabilities - (40) (40)

Other payables, including insurance payables (213) (213)

Accruals and deferred income (47) (47)

---------------------------------------------------- --------- ------------ -----------

Net assets acquired 508 22 530

---------------------------------------------------- --------- ------------ -----------

Satisfied by:

Cash and cash equivalents 480 - 480

---------------------------------------------------- --------- ------------ -----------

Negative goodwill (28) 22 (50)

---------------------------------------------------- --------- ------------ -----------

12. Related party transactions

Helios Underwriting plc has provided inter-company loans to its

subsidiaries which are repayable on three months' notice provided

it does not jeopardise each subsidiary's ability to meet its

liabilities as they fall due. All inter-company loans are therefore

classed as falling due within one year. The amounts outstanding as

at 30 June 2014 are set out below:

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ---------- ------------

Balances due from/(to) Group companies

at the period end:

Hampden Corporate Member Limited 807 3,109 1,257

Nameco (No. 365) Limited 65 330 136

Nameco (No. 605) Limited 210 1,092 362

Nameco (No. 321) Limited 74 321 134

Nameco (No. 917) Limited 569 1,449 573

Nameco (No. 229) Limited 42 355 110

Nameco (No. 518) Limited (17) (163) 34

Nameco (No. 804) Limited 298 - 1,429

Halperin Limited (184) - -

Nomina No 035 LLP - - -

Nomina No 342 LLP - - -

Nomina No 380 LLP - - -

Bernul Limited (263) - -

Nomina No 372 LLP - - -

Helios UTG Partner Limited 2,143 - 1,238

Total 3,744 6,493 5,273

---------------------------------------- ---------- ---------- ------------

The Limited Liability Vehicles are 100% subsidiaries of the

Company (either directly or indirectly) and have entered into a

management agreement with Nomina plc. Jeremy Evans, a Director of

Helios Underwriting plc and its subsidiary companies, is also a

director of Nomina plc. Under the agreement, Nomina plc provides

management and administration, financial, tax and accounting

services to the Group for an annual fee of GBP66,250 (2013:

GBP42,750).

The Limited Liability Vehicles have entered into a member's

agent agreement with Hampden Agencies Limited. Jeremy Evans, a

Director of Helios Underwriting plc and its subsidiary companies,

is also a director of Hampden Capital plc which controls Hampden

Agencies Limited. Under the agreement the Limited Liability

Vehicles will pay Hampden Agencies Limited a fee based on a fixed

amount, plus a fee which will vary depending upon the total level

of Group underwriting capacity. In addition, some Limited Liability

Vehicles will pay profit commission on a sliding scale from 1% of

the net profit up to a maximum of 10%. The total fees payable for

2014 and 2013 are set out below:

30 June 30 June 31 December

2014 2013 2013

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------- ------------

Hampden Corporate Member Limited 38 20 20

Nameco (No. 365) Limited 7 5 5

Nameco (No. 605) Limited 18 15 15

Nameco (No. 321) Limited 7 6 6

Nameco (No. 917) Limited 6 10 10

Nameco (No. 229) Limited 7 6 6

Nameco (No. 518) Limited 10 7 7

Nameco (No. 804) Limited 24 - 8

Halperin Limited 9 - 7

Nomina No 035 LLP 9 - 7

Nomina No 342 LLP 9 - 6

Nomina No 380 LLP 14 - -

Bernul Limited 10 - -

Nomina No 372 LLP 12 - -

Helios UTG Partner Limited - - -

---------------------------------- ---------- ---------- ------------

Total 180 69 97

---------------------------------- ---------- ---------- ------------

The Group has entered into a 50% quota share reinsurance

contract for the 2013 underwriting year of account and a 70% quota

share reinsurance contact for the 2014 underwriting year of account

with Hampden Insurance PCC (Guernsey) Limited, a company registered

in Guernsey.

Nigel Hanbury, a Director of Helios Underwriting plc and its

subsidiary companies, is also a director and majority shareholder

in Hampden Insurance PCC (Guernsey) Limited. Hampden Capital Plc, a

substantial shareholder in Helios Underwriting plc is also a

substantial shareholder in Hampden Insurance PCC (Guernsey)

Limited. Under the agreements, the Group accrued a net reinsurance

premium payable of GBP26,000 during the period. A total cumulative

amount owed to Hampden Insurance PCC (Guernsey) Limited of

GBP49,000 (2013: GBP22,000) has been recognised in the balance

sheet.

The underwriting year of account quota share reinsurance

contract that each group subsidiary participates in is detailed

below:

Company

------------------------- ----- -----

Hampden Corporate Member 2013 2014

Limited

Nameco (No. 365) Limited 2013 2014

Nameco (No. 605) Limited 2013 2014

Nameco (No. 321) Limited 2013 2014

Nameco (No. 917) Limited 2013 2014

Nameco (No. 229) Limited 2013 2014

Nameco (No. 518) Limited 2013 2014

Nameco (No. 804) Limited - 2014

Halperin Limited - 2014

Nomina No 035 LLP - 2014

Nomina No 342 LLP - 2014

Nomina No 380 LLP - 2014

Bernul Limited - 2014

Nomina No 372 LLP - 2014

13. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's are as follows:

Syndicate Allocated capacity

or Year of account

MAPA Number Managing or Members' Agent 2012 2013 2014

------------ ------------------------------- -------------- --------------- ---------------

33 Hiscox Syndicates Limited 754,377 754,377 1,524,940

Equity Syndicates Management

218 Limited 359,400 438,285 824,344

308 R.J. Kiln & Co Limited 73,125 70,000 84,528

386 QBE Underwriting Limited 179,894 179,894 493,385

510 RJ Kiln & Co. Limited 1,265,425 1,240,770 2,548,439

557 RJ Kiln & Co. Limited 767,556 308,582 446,063

609 Atrium Underwriters Limited 1,098,065 1,047,455 1,947,561

623 Beazley Furlonge Limited 727,450 859,870 2,103,700

S.A. Meacock & Company

727 Limited 375,222 375,222 457,055

ANV Syndicate Management

779 Limited 20,000 20,000 -

Canopius Managing Agency

958 Limited 416,434 327,200 466,880

1176 Chaucer Syndicates Limited 214,874 261,818 327,712

1200 Argo Managing Agency Limited 240,542 63,551 64,252

1729 Asta Managing Agency Limited - - 35,685

Cathedral Underwriting

2010 Limited 249,769 249,769 510,544

Pembroke Managing Agency

2014 Limited - - 925,079

Argenta Syndicate Management

2121 Limited 156,969 11,691 -

2525 Asta Managing Agency Limited 17,206 - 96,690

Managing Agency Partners

2791 Limited 1,415,120 1,471,095 2,430,679

ANV Syndicate Management

5820 Limited - 107,754 60,000

Managing Agency Partners

6103 Limited 332,500 405,307 392,320

6104 Hiscox Syndicates Limited 345,000 415,730 810,730

Ark Syndicate Management

6105 Limited 116,569 64,724 314,592

6106 Amlin Underwriting Limited 308,251 271,170 -

6107 Beazley Furlonge Limited 135,000 10,000 350,000

Pembroke Managing Agency

6110 Limited 393,302 879,892 -

Catlin Underwriting Agencies

6111 Limited 428,894 589,808 1,066,267

Barbican Managing Agency

6113 Limited - 30,000 20,000

6117 Asta Managing Agency Limited - - 963,112

Members' Agents Pooling

7200 Arrangement 455,323 455,302 151,688

Members' Agents Pooling

7201 Arrangement 2,318,974 2,318,948 762,204

Members' Agents Pooling

7202 Arrangement 828,123 828,098 275,470

Members' Agents Pooling

7203 Arrangement 108,289 108,262 47,678

Members' Agents Pooling

7211 Arrangement 5,439,354 5,439,337 687,749

Members' Agents Pooling

7217 Arrangement 95,912 95,911 95,913

Total 19,636,919 19,699,822 21,285,259

------------ ------------------------------- -------------- --------------- ---------------

14. Group owned net assets

The Group balance sheet includes the following assets and

liabilities held by the syndicates on which the Group participates.

The syndicate assets are subject to trust deeds for the benefit of

the relevant syndicates' insurance creditors. The table below shows

the split of the Group balance sheet between Group and syndicate

assets and liabilities.

30 June 2014 30 June 2013 31 December 2013

Group Syndicate Total Group Syndicate Total Group Syndicate Total

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

Assets

Intangible

assets 3,828 - 3,828 1,571 - 1,571 2,929 - 2,929

Deferred income - - - - - - - - -

tax

assets

Reinsurance

share

of insurance

liabilities

- Reinsurers'

share

of

outstanding

claims - 4,221 4,221 - 3,658 3,658 - 4,154 4,154

- Reinsurers'

share

of unearned

premiums - 1,637 1,637 - 1,379 1,379 - 800 800

Other

receivables,

including

insurance

receivables 774 13,664 14,438 386 8,899 9,285 793 10,761 11,554

Prepayments and

accrued

income 16 2,291 2,307 34 1,543 1,577 36 1,533 1,569

Financial

assets

at fair value 4,226 17,683 21,909 7,881 11,936 19,817 5,932 16,281 22,213

Cash and cash

equivalents 1,055 2,313 3,368 296 1,974 2,270 86 980 1,066

Total assets 9,899 41,809 51,708 10,168 29,389 39,557 9,776 34,509 44,285

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

Liabilities

Insurance

liabilities

- Claims

outstanding - 23,668 23,668 - 17,487 17,487 - 21,596 21,596

- Unearned

premiums - 9,415 9,415 - 6,694 6,694 - 5,968 5,968

Deferred income

tax

liabilities 1,603 - 1,603 978 - 978 1,656 - 1,656

Other payables,

including

insurance

payables 349 5,560 5,909 233 3,875 4,108 34 4,082 4,116

Accruals and

deferred

income 1,165 350 1,515 487 246 733 866 257 1,123

Current income - - - - - - - - -

tax

liabilities

Total

liabilities 3,117 38,993 42,110 1,698 28,302 30,000 2,556 31,903 34,459

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

Shareholders'

equity

Share capital 853 - 853 853 - 853 853 - 853

Share premium 6,996 - 6,996 6,996 - 6,996 6,996 - 6,996

Retained

earnings (1,066) 2,815 1,749 621 1,087 1,708 (629) 2,606 1,977

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

Total

shareholders'

equity 6,783 2,815 9,598 8,470 1,087 9,557 7,220 2,606 9,826

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

Total

liabilities

and

shareholders'

equity 9,900 41,808 51,708 10,168 29,389 39,557 9,776 34,509 44,285

---------------- -------- ---------- -------- -------- ---------- -------- -------- -------------- ----------

15. Events after the reporting period

Dumasco Limited

On 16 September 2014 Helios Underwriting plc acquired 100% of

the issued share capital of Dumasco Limited for a total

consideration of GBP2,500,000. No information is available at

present to accurately determine the fair value of the net assets

acquired. Dumasco Limited is incorporated in England and Wales and

is a corporate member of Lloyd's.

For further information please contact:

Helios Underwriting Nigel Hanbury nigel.hanbury@hampdenplc.com

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

Robert Finlay

Westhouse Securities Darren Vickers 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing GBP23 million of capacity for the 2014

account. The portfolio provides a good spread of classes of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZMGZLVVMGDZM

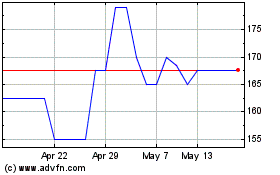

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2024 to Aug 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2023 to Aug 2024