TIDMHUW

RNS Number : 8912D

Hampden Underwriting Plc

23 May 2012

23 May 2012

Hampden Underwriting plc

("Hampden Underwriting" or the "Company")

Preliminary results for the year ended 31 December 2011

Hampden Underwriting, which provides investors with a limited

liability direct investment into the Lloyd's insurance market,

announces its preliminary results for the year ended 31 December

2011.

Highlights

-- Premium written during the period totalled GBP7.7m

-- Net loss of GBP387,000

-- Loss per share of 5.22p

-- Net assets decrease to GBP7.5m

-- Net assets per share of GBP1.01

Commenting upon these results Chairman, Sir Michael Oliver

said:

"Whilst it gives me no pleasure to be reporting a loss in 2011,

when compared to the Lloyd's quoted sector as a whole, all

companies bar one saw a greater fall in their net tangible assets

as a result of the events of 2011 than we did. The Company was well

placed to deal with the loss and remains well capitalised to take

full advantage of the improved conditions that inevitably follow

losses of such severity."

Enquiries:

Hampden Underwriting Jeremy Evans 020 7863 6567

------------------------------ -------------- --------------

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

------------------------------ -------------- --------------

Chairman's statement

There have been many examples since corporate capital was first

introduced into Lloyd's of companies whose ambition in the early

years was too high and whose underwriting limit in comparison to

its underlying assets was also too high. A substantial loss came

along and the company was not even in a position to meet its

solvency requirements to maintain its existing underwriting levels

let alone take advantage of an improving underwriting climate by

increasing its capacity. I am delighted to be able to say that we

do not fall into that category.

The principal task in the formative years of an underwriting

company has to be the safe custodianship of the company's assets,

all the more so in a difficult underwriting climate. This has also

been achieved.

Whilst it gives me no pleasure to be reporting a loss in 2011,

that has to be looked at in the context of the year being the

second worst on record for catastrophe losses. That said your

Company was well placed to deal with the loss and remains well

capitalised to take full advantage of the improved conditions that

inevitably follow losses of such severity and indeed diversity. Our

net asset value ("NAV") has fallen as a consequence but is still

over GBP1 per share and if one looks at the value of our capacity

using the most recent auction figures as opposed to the amortised

value in the balance sheet, it is actually worth a further GBP1.1m,

equivalent to approximately 15p a share. When compared to the

Lloyd's quoted sector as a whole, all companies bar one saw a

greater fall in their net tangible assets as a result of the events

of 2011 than we did.

We have got off to a good start and have done what we said we

would do. However, we are far too small and that is one of the

reasons why the good start is not reflected in our share price

which remains subject to violent swings when shares are either

bought or sold. As I said last year we need more shares in the

hands of more shareholders. It was always our intention to

endeavour to raise fresh capital to enable us to do more of what we

are currently doing but only when the time was right. That time is

now. We are involved in continuing discussions with our advisers

about raising capital which will of course involve giving you, our

existing shareholders, the opportunity to participate. We hope to

be able to tell you more about these plans in the near future.

We remain committed to implementing the policy of paying steady

and sustained dividends. The uncertainty I spoke of last year

concerning the full implications of the 2011 losses that prevented

us from initiating that policy are still being felt. In these

circumstances, we still feel that it would be imprudent to declare

a dividend at this stage but it is our intention to pay an interim

dividend later in the year.

Sir Michael Oliver

Non-executive Chairman

22 May 2012

Lloyd's Adviser's report

2011 review and outlook for 2012

Total insured losses for the global insurance industry from

natural catastrophes in 2011 totalled $110bn, making 2011 the

second most expensive year for the industry after 2005, when

insured losses, according to Swiss Re Sigma, were $123bn including

over $100bn from Hurricanes Katrina, Rita and Wilma. Most of the

losses in 2011 came from the earthquake in Japan in March costing

an estimated $35bn and the New Zealand earthquake in February

which, while technically an aftershock of the September 2010 event,

cost $12bn, becoming the country's most expensive disaster ever.

Later in the year (between July and November 2011) an area in

Thailand roughly equivalent to the size of Switzerland flooded,

causing the highest insured loss from global fresh water floods,

estimated at $12bn.

Hurricane losses were moderate with Hurricane Irene being the

first hurricane to make landfall in the US since Hurricane Ike in

2008, causing an estimated $5.3bn of insured losses. Taken

together, US insured losses in 2011 were the fifth highest on

record, exceeding $35bn with a series of spring tornado losses

estimated at $21.3bn, significantly above the 20 year inflation

adjusted average of $5.2bn between 1991 and 2010.

Catastrophe losses contributed to the US property/casualty

insurance industry making an underwriting loss of $36bn,

representing the second largest annual underwriting loss ever,

behind the $52.3bn underwriting loss in 2001. Despite these

underwriting losses, investment gains (income and realised capital

gains) enabled an overall net profit after tax of $19.2bn.

Industry capital remains strong for both insurers and reinsurers

despite the catastrophe losses suffered in 2011. The policyholders'

surplus of the US property casualty industry, a proxy for

underwriting capacity, boosted by unrealised capital gains declined

by only 1.6% to $550.3bn at year end 2011 compared with the record

policyholders' surplus of $556.9bn at year end 2010. Aon Benfield

Analytics estimated that reinsurers' capital fell by only 3% during

2011 or $15bn to $455bn compared with the record global reinsurance

capital available at year end 2010.

The insurance pricing cycle is a classic supply led cycle with

demand usually playing a more limited role. Typically demand

measured by premium has grown over the long term, being linked to

growth in GDP and levels of insurance penetration. However, since

2007 insurance underwriting has been particularly affected by

deficient demand during the great recession of 2007-2009 when US

net written premiums fell by an aggregate 6.8%, the first three

year decline since 1930-1933. The 3.3% rise in net written premium

growth in 2011 was driven in the main by rate rises rather than

exposure growth with US GDP only increasing by 1.7% in 2011. US net

written premium was 2.8% lower at year end 2011 than at the end of

2006. The demand component is expected to continue to recover with

A M Best projecting an increase of 3.8% in net written premium for

2012, which will have a modest impact on the underwriting capacity

required to write business.

The insurance and reinsurance marketplace is now beginning to

show signs of a recovery in premium and rates but this is not yet

broad, as we saw in 2001/2002. Our outlook is slowly becoming more

positive, although we remain cautious overall due to the

competition that remains evident in much of the non-catastrophe

exposed classes.

Overall, the supply/demand characteristics still mean that we

favour reinsurance underwriting where there is currently greater

margin in an average loss year than in insurance underwriting. We

continue to be more positive about US catastrophe exposed

reinsurance with that market being boosted this year due to a

change in a leading model for catastrophe losses. Since the start

of Q3 2011 a new model from the catastrophe loss modelling company,

Risk Management Solutions (RMS 11.0), has begun to be implemented

by both insurers and reinsurers with exposures to US windstorm and

storm surge for exposed coastal areas. Revised loss protections

have in some cases increased by 40% to 60%, requiring some insurers

to buy increased cover and forcing reinsurance underwriters to

increase rates or reduce the amount of capacity they provide.

Rate rises for US catastrophe reinsurance at 1 January 2012

increased by 8% according to reinsurance broker Guy Carpenter,

although, taking account of reductions in 2010 and 2011, rates are

still lower by 7.5% than they were in 2009. In territories with

significant underwriting losses such as Japan, rate increases have

been much more significant with Guy Carpenter reporting earthquake

excess of loss cover rates now back at 1993/1994 levels with rate

increases of between 35% and 125%.

In 2011 Lloyd's received 41% of its income from the US and

Canada with Lloyd's having overtaken American International Group

as the largest underwriter of US excess and surplus lines

("E&S") insurance business in 2010. As the market leader in

E&S business by premium volume Lloyd's is expected to benefit

from a hardening market leading to business migrating back to the

E&S market from the US admitted market.

We are currently seeing the start of a hardening market in the

US for the commercial property and casualty business, with the

Council of Insurance Agents and Brokers quarterly commercial P/C

market index survey showing an increase for the first quarter of

2012 of 4.4% following a 2.7% increase in the last quarter of 2011.

These increases mark the beginning of a reversal in the trend

following 30 quarters of rate declines. The opportunity for Lloyd's

to take advantage of a hard market when it arrives can be gauged

from the fact that in the last hard market between 2000 and 2003,

E&S income in the US increased from $12bn to over $30bn in a

four year period.

The investment component of an insurer's operating result in

principle should be a powerful force for underwriting discipline.

The New York based Insurance Information Institute estimates that a

100% combined ratio, i.e. breakeven underwriting result before

investments, would have generated a 5.5% return on equity in

2009/2010 compared with 10% in 2005 and 16% in 1979 when interest

rates were so much higher. The recovery in asset markets since 2009

accompanied by further declines in interest rates and credit

spreads have benefited insurers' profit and loss accounts with

realised gains as well as balance sheets with unrealised gains.

However, these may be one-off gains as maturing bonds and new

premium are being invested at much lower yields and importantly

locking in these low yields for the duration of the bond.

This long-term loss of investment yield will have a particular

impact on casualty underwriting where premiums can be held for a

"tail" of five to eight years before a claim is paid. Most lines of

casualty, both in the US and non-US, other than loss affected

business, remain competitive with rates stable overall. The reason

for this is that in particular the 2004 through to 2007 accident

years have continued to run off well, showing reserve releases,

although recent research from Moody's indicates that the more

recent accident years from 2009 and 2010 may have small

deficiencies in reserves. So far, the predominant influence has

been reserve releases, although going forward this is expected to

abate over the next two years and contribute to the transition we

are seeing from a soft market to a hardening market.

Overall, the market is "turning the corner" with signs of a

broadening out of rate increases from business with loss experience

and US catastrophe reinsurance to direct classes, particularly for

US business. Disappointingly, casualty remains soft and we do not

envisage this changing over the next 12 months.

The economy is likely to continue to have an influence during

2012. If the US economy continues its recovery exposure growth will

improve and we would expect rates to continue to harden. Lloyd's is

well placed to take advantage given its market position as one of

the largest US catastrophe reinsurers and the No.1 US excess and

surplus lines insurer measured by premium volume.

However, a further US recession could lead again to curtailed

demand and the potential for recession sensitive claims as well as

slowing the rate of recovery in the sectors where rates are rising.

The continuing impact of the sovereign debt crisis in peripheral

Europe is something which has the potential to impact both the

asset (investments) and liability (claims) sides of the balance

sheet. Lloyd's is well prepared having carried out stress tests on

the potential impact of any euro sovereign debt write downs and

restructurings.

Hampden Underwriting's 2011 results

The traditional method for comparing the performance of

competing insurance business is an analysis of the combined ratio,

which is the sum of net claims and expenses divided by net earned

premiums. The combined ratio of Hampden Underwriting's portfolio

for 2011 was 107.9% due in the main to catastrophe losses from

property reinsurance as well as a continued disappointing

performance by UK motor. This puts Hampden's Underwriting's

performance in line with the average of its peers in Lloyd's as

well as industry peer groups.

Syndicate profit distributions

Profit distributions from Hampden Underwriting's portfolio of

syndicates continue to be made by reference to the traditional

three year accounts. Using this measure of performance Hampden

Underwriting's portfolio has outperformed Lloyd's on the 2009

account at 31 December 2011 and is estimated to outperform Lloyd's

on the 2010 account.

The 2009 account result at 31 December 2011, before members'

fees, was a profit of 18.27%, which is just over one percentage

point above the Lloyd's market average result of 17.25%. The 2009

account benefited from good rates for property catastrophe

reinsurance business coinciding with a year of low catastrophe

losses and the absence of a large hurricane making landfall.

Hampden Underwriting's portfolio benefited in particular from its

participation on reinsurance business through special purpose

reinsurance syndicates managed by managing agency partners, Hiscox

and Amlin, which compensated for losses on two UK motor

syndicates.

The 2010 account estimated result after eight quarters at Q4

2011 is a small loss at the mid-point of (2.04%) with Hampden

Underwriting again outperforming the estimated loss of the Lloyd's

market as a whole (3.95%). The majority of the insured losses on

the 2010 account were due to catastrophe losses occurring in

2011.

Again, like 2009, no hurricanes made direct landfall in the US

but insured catastrophe losses were 65% higher at $43bn compared

with 2009. At this stage of development most syndicates do not

report any prior year releases, which provides potential for the

estimated result to improve, before closure at the end of 2012.

At this early stage of development of the 2011 account a

complete set of published estimates is not available until the end

of May 2012. This account is expected to produce a modest loss in

line with the 2010 account, with the largest loss expected to be

due to the Thai floods.

Hampden Underwriting's capital position

Net tangible assets reduced by only 2.5% during 2011 to GBP6.43m

despite the catastrophe losses suffered, which puts the Company in

a strong financial position to develop the portfolio as and when

opportunities arise. Net tangible assets provide a significant

capital surplus over the Lloyd's minimum capital requirement as at

November 2011 which was just under GBP4m.

Hampden Underwriting's portfolio for 2012

Hampden's underwriting portfolio for 2012 continues to provide a

good spread of business across managing agents and classes of

business with motor and liability providing a balance to the

catastrophe exposed reinsurance and property business, as well as

contributing to lower capital requirements. 29.9% of the capacity

is in the three syndicates rated "A" by Hampden Agencies, being

Syndicates 386, 609 and 2791, with Syndicate 2791 being the largest

holding at 16.4% of capacity.

Risk management

The two major risks faced by insurers and reinsurers are

deficient loss reserves and inadequate pricing, which, taken

together, account for 40% of insurer impairments according to A M

Best. The pricing cycle is easier to identify in real time. The

reserving cycle is more difficult to identify in real time as

typically reserving standards slip after a period of reserve

releases and there is a lag before this is recognised. Hampden

Agencies approaches the management of portfolio risk by

diversifying across classes of business, syndicates and managing

agents and importantly understanding the cycle management and

reserving strategy of each syndicate as well as the rate

environment.

We also assess the downside in the event of a major loss through

monitoring the aggregate losses estimated by managing agents to

realistic disaster scenarios. Risk is assessed in the context of

potential return with catastrophe exposure being actively managed

dependent on market conditions. With improved rating in reinsurance

business for 2012 this class of business is likely to increase its

share of gross premium. Hampden Underwriting's largest modelled

exposures net of reinsurance on the basis of Lloyd's realistic

disaster scenarios are similar for 2012 compared with 2011, with

the largest remaining a two-event scenario incorporating two

consecutive Atlantic seaboard windstorms in the north-east of

America at 19.2% of capacity net of reinsurance.

The next highest is a Gulf of Mexico windstorm at 18.7% of

capacity net. Realistic disaster scenario exposure as a percentage

of capacity remains for all scenarios within the 20% net of

reinsurance Hampden Agencies guideline.

Top 10 syndicate holdings

2012 2012 2012

Syndicate HCM portfolio HCM portfolio

capacity capacity % of

--------- --------------------------- ----------- ------------- ------------- ------------------

Syndicate Managing agent GBP'000 GBP'000 total Largest class

--------- --------------------------- ----------- ------------- ------------- ------------------

Managing Agency Partners

2791 Ltd 508,003.7 1,527.4 16.4 Reinsurance

510 R. J. Kiln & Co. Ltd 1,064,000.0 1,479.9 15.9 US$ property

US$ Non-marine

623 Beazley Furlonge Ltd 214,697.1 1,158.8 12.5 liability

609 Atrium Underwriters Ltd 420,000.0 941.7 10.1 Energy

33 Hiscox Syndicates Ltd 949,995.6 734.2 7.9 Reinsurance

Equity Syndicate Management

218 Ltd 437,624.0 566.9 6.1 Motor

Omega Underwriting Agents

958 Ltd 279,999.7 434.9 4.7 Reinsurance

6111 Catlin 60,000.0 398.4 4.3 Reinsurance

Non-US$ Non-marine

386 QBE Underwriting Ltd 413,000.9 312.0 3.4 liability

557 R. J. Kiln & Co. Ltd 60,000.0 271.2 2.9 Reinsurance

--------- --------------------------- ----------- ------------- ------------- ------------------

Subtotal 7,825.3 84.1

--------- ------------------------------------------------------- ------------- ------------------

Total 9,307.0 100.0

--------- ------------------------------------------------------- ------------- ------------------

The top ten syndicates comprise 84.1% of the portfolio. Two new

syndicates were joined for 2012, managed by the Catlin and Pembroke

agencies.

Consolidated statement of comprehensive income

Year ended 31 December 2011

Year ended Year ended

31 December 31 December

2011 2010

Note GBP'000 GBP'000

------------------------------------------------------ -------------- -------------

Gross premium written 7,715 7,887

Reinsurance premium ceded (1,445) (1,436)

------------------------------------------------------ -------------- -------------

Net premiums written 6,270 6,451

Change in unearned gross premium provision 238 462

Change in unearned reinsurance premium provision (17) (122)

------------------------------------------------------ -------------- -------------

221 340

------------------------------------------------------ -------------- -------------

Net earned premium 6,491 6,791

Net investment income 3 247 368

Other underwriting income - 4

Other income 22 116

------------------------------------------------- ------------------- -------------

269 488

---------------------------------------------------------------------- -------------

Revenue 6,760 7,279

------------------------------------------------- ------------------- -------------

Gross claims paid (4,726) (4,582)

Reinsurance share of gross claims paid 842 729

------------------------------------------------- ------------------- -------------

Claims paid, net of reinsurance (3,884) (3,853)

------------------------------------------------- ------------------- -------------

Change in provision for gross claims (1,115) (398)

Reinsurance share of change in provision for

gross claims 486 58

------------------------------------------------- ------------------- -------------

Net change in provision for claims (629) (340)

------------------------------------------------- ------ ------------- -----------

Net insurance claims and loss adjustment expenses (4,513) (4,193)

Expenses incurred in insurance activities (2,277) (2,425)

Other operating expenses (574) (533)

------------------------------------------------- ------------------- -------------

Operating expenses (2,851) (2,958)

------------------------------------------------- ------------------- -------------

Operating (loss)/profit before tax 4 (604) 128

Income tax credit 217 4

------------------------------------------------- ------ ------------- -----------

(Loss)/profit and total comprehensive income attributable

to equity shareholders (387) 132

------------------------------------------------- ------ ----------- -------------

(Loss)/earnings per share attributable to equity shareholders

Basic and diluted 5 (5.22)p 1.78p

------------------------------------------------- ------ ----------- -------------

The (loss)/profit attributable to equity shareholders and

(loss)/earnings per share set out above are in respect of

continuing operations.

Consolidated statement of financial position

At 31 December 2011

31 December 31 December

2011 2010

Note GBP'000 GBP'000

Assets

Intangible assets 6 1,052 1,274

Deferred income tax assets - 12

Reinsurance share of insurance liabilities:

- reinsurers' share of outstanding

claims 3,044 2,592

- reinsurers' share of unearned premiums 409 425

Other receivables, including insurance

receivables 6,628 6,039

Prepayments and accrued income 842 901

Financial assets at fair value 7 13,675 13,841

Cash and cash equivalents 3,020 3,320

----------------------------------------- -------- -----------

Total assets 28,670 28,404

----------------------------------------- -------- -----------

Liabilities

Insurance liabilities:

- claims outstanding 14,234 13,104

- unearned premiums 3,137 3,377

Deferred income tax liabilities 415 655

Other payables, including insurance

payables 2,911 2,819

Accruals and deferred income 488 577

----------------------------------------- -------- -----------

Total liabilities 21,185 20,532

----------------------------------------- -------- -----------

Shareholders' equity

Share capital 8 741 741

Share premium 8 6,261 6,261

Retained earnings 483 870

----------------------------------------- ------- -----------

Total shareholders' equity 7,485 7,872

----------------------------------------- -------- -----------

Total liabilities and shareholders'

equity 28,670 28,404

----------------------------------------- -------- -----------

Consolidated statement of cash flows

Year ended 31 December 2011

Year ended Year ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Cash flows from operating activities

Results of operating activities (604) 128

Interest received (4) (31)

Investment income (275) (315)

Recognition of negative goodwill - (116)

Profit on sale of intangible assets 11 -

Amortisation of intangible assets 270 246

Change in fair value of investments (5) (21)

Changes in working capital:

- increase in other receivables (530) (1,157)

- increase in other payables 3 955

- net increase in technical provisions 454 4,691

----------------------------------------------------- ----- -----------

Net cash (outflow)/inflow from operating activities (680) 4,380

----------------------------------------------------- ----- -----------

Cash flows from investing activities

Interest received 4 31

Income tax (paid)/receipt (16) 68

Investment income 275 315

Purchase of intangible assets (49) (26)

Purchase of financial assets at fair value 166 (3,400)

Acquisition of subsidiary, net of cash acquired - (159)

----------------------------------------------------- ----- -----------

Net cash inflow/(outflow) from investing activities 380 (3,171)

----------------------------------------------------- ----- -----------

Net (decrease)/increase in cash and cash equivalents (300) 1,209

Cash and cash equivalents at beginning of year 3,320 2,111

----------------------------------------------------- ----- -----------

Cash and cash equivalents at end of year 3,020 3,320

----------------------------------------------------- ----- -----------

The accounting policies and notes are an integral part of these

Financial Statements.

Statements of changes in shareholders' equity

Year ended 31 December 2011

Attributable to owners of the parent

-------------------------------------------------------------------------------------------

Preference Retained

Ordinary share capital share capital Share premium earnings Total

Consolidated GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- -------------- ------------- --------- -------

At 1 January 2010 741 - 6,261 738 7,740

Profit and total comprehensive

income for the year - - - 132 132

------------------------------- ------- -------------- ------------- --------- -------

At 31 December 2010 741 - 6,261 870 7,872

------------------------------- ------- -------------- ------------- --------- -------

At 1 January 2011 741 - 6,261 870 7,872

Loss and total comprehensive

income for the year - - - (387) (387)

------------------------------- ------- -------------- ------------- --------- -------

At 31 December 2011 741 - 6,261 483 7,485

------------------------------- ------- -------------- ------------- --------- -------

Notes to the financial statements

Year ended 31 December 2011

1. Accounting policies

The principal accounting policies adopted in the preparation of

the financial information set out in this announcement are set out

in the full financial statements for the year ended 31 December

2011 (the "Financial Statements").

Basis of preparation

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") endorsed by

the European Union ("EU"), IFRIC interpretations and those parts of

the Companies Act 2006 applicable to companies reporting under

IFRS.

The Financial Statements have been prepared under the historical

cost convention as modified by the revaluation of financial assets

at fair value through profit or loss. A summary of the more

important Group accounting policies is set out below.

The preparation of Financial Statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

Financial Statements and the reported amounts of revenues and

expenses during the reporting year. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from these

estimates.

The Group participates in insurance business through its Lloyd's

corporate member subsidiaries. Accounting information in respect of

syndicate participations is provided by the syndicate managing

agents and is reported upon by the syndicate auditors.

International Financial Reporting Standards

The following standards and amendments to standards are

mandatory for the first time for the financial year beginning 1

January 2011. The adoption of these standards does not have a

material impact on the Group's Financial Statements.

-- IFRS 7 (amended) "Financial Instruments: Disclosures". The amendments

require an explicit statement that the interaction between qualitative

and quantitative disclosures better enables users to evaluate an entity's

exposure to risks arising from financial instruments.

-- IAS 1 (amended) "Presentation of Financial Statements". IAS 1 is amended

to clarify that reconciliation from opening to closing balances is

required to be presented in the statement of changes in equity for

each component of equity. IAS 1 is also amended to allow the analysis

of the individual other comprehensive income line items by component

of equity to be presented in the notes.

-- IAS 32 (amended) "Financial Instruments: Presentation". The amendment

requires that rights, options or warrants to acquire a fixed number

of the entity's own equity instruments for a fixed amount of any currency

are equity instruments if the entity offers the rights, options or

warrants pro rata to all of its existing owners of the same class of

its own non-derivative equity instruments.

-- IFRIC 19 "Extinguishing Financial Liabilities with Equity Instruments".

IFRIC 19 deals with measurement of equity instruments issued in a debt

for equity swap. It addresses the accounting for such a transaction

by the debtor only.

-- IFRIC 14 (amended) "Prepayment of a Minimum Funding Requirement". The

amendment to IFRIC 14 removes unintended consequences arising from

the treatment of prepayments when there is a minimum funding requirement

("MFR"). The amendment results in prepayments of contributions in certain

circumstances being recognised as an asset rather than an expense.

-- ISA 24 (amended) "Related Party Disclosures" simplifies the disclosure

requirements for government related entities and clarifies the definition

of a related party.

In addition, the following is a list of standards that are in

issue but are not effective in 2011, or have not yet been adopted

in the EU, together with the effective date of application to the

Group:

-- IAS 12 (amendment) "Deferred Tax: Recovery of Underlying Assets" (effective

1 January 2012)

-- IAS 1 (amendment) "Presentation of Items of Other Comprehensive Income"

(effective 1 July 2012)

-- IFRS 9 "Financial Instruments" (effective 1 January 2015)

-- IRFS 10 "Consolidated Financial Statements" (effective 1 January 2015)

-- IFRS 11 "Joint Arrangements" (effective 1 January 2013)

-- IFRS 12 "Disclosure of Interests in Other Entities" (effective 1 January

2013)

-- IFRS 13 "Fair Value Measurement" (effective 1 January 2013)

-- IAS 19 (amendment) "Defined Benefit Plans" (effective 1 January 2013)

-- IAS 32 (amendment) "Offsetting Financial Assets and Financial Liabilities"

(effective 1 January 2014)

-- IFRS 7 (amendment) "Offsetting Financial Assets and Liabilities" (effective

1 January 2013)

-- IAS 27 "Separate Financial Statements" (effective 1 January 2013)

-- IAS 28 "Investments in Associates and Joint Ventures" (effective 1

January 2013)

-- IFRS 1 (amendment) "Severe Hyperinflation and Removal of Fixed Dates

for First-time Adopters" (effective 1 July 2011)

-- IFRS 1 (amendment) "Government Loans" (effective 1 January 2013)

-- IFRS 7 (amendment) "Disclosures - Transfers of Financial Assets" (effective

1 July 2011)

-- IFRIC 20 "Stripping Costs in the Production Phase of a Surface Mine"

(effective 1 January 2013)

The Directors do not anticipate that the adoption of these

standards will have a material impact on the Financial

Statements.

2. Segmental information

The Group has three segments that represent the primary way in

which the Group is managed:

syndicate participation;

investment management; and

other corporate activities.

Syndicate Investment Other corporate

participation management activities Total

Year ended 31 December 2011 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ------- ----------- --------------- -------

Net earned premium 6,491 - - 6,491

Net investment income 245 2 - 247

Other underwriting income - - - -

Other income 22 - - 22

Net insurance claims and loss adjustment

expenses (4,513) - - (4,513)

Expenses incurred in insurance activities (2,277) - - (2,277)

Amortisation of syndicate capacity - - (158) (158)

Other operating expenses (192) - (224) (416)

------------------------------------------ ------- ----------- --------------- -------

Results of operating activities (224) 2 (382) (604)

------------------------------------------ ------- ----------- --------------- -------

Syndicate Investment Other corporate

participation management activities Total

Year ended 31 December 2010 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ------- ----------- --------------- -------

Net earned premium 6,791 - - 6,791

Net investment income 365 3 - 368

Other underwriting income 4 - - 4

Other income - - 116 116

Net insurance claims and loss adjustment

expenses (4,193) - - (4,193)

Expenses incurred in insurance activities (2,425) - - (2,425)

Amortisation of syndicate capacity - - (158) (158)

Other operating expenses (156) - (219) (375)

------------------------------------------ ------- ----------- --------------- -------

Results of operating activities 386 3 (261) 128

------------------------------------------ ------- ----------- --------------- -------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

3. Net investment income

Year ended Year ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Investment income 275 315

Realised gains on financial assets at fair value through

profit or loss 74 137

Unrealised gains on financial assets at fair value through

profit or loss 5 21

Investment management expenses (111) (136)

Bank interest 4 31

----------------------------------------------------------- ----- -----------

Net investment income 247 368

----------------------------------------------------------- ----- -----------

4. Operating (loss)/profit before tax

Year ended Year ended

31 December 31 December

2011 2010

GBP'000 GBP'000

Operating (loss)/profit before tax is stated after charging:

Directors' remuneration 65 65

Amortisation of intangible assets 270 246

Auditors' remuneration:

- audit of the Parent Company and Group Financial

Statements 25 24

- audit of subsidiary company Financial Statements 8 3

- services relating to taxation - 5

- other services pursuant to legislation - 15

- other services - 9

--------------------------------------------------- --- -----------

The Group has no employees.

5. (Loss)/earnings per share

Basic (loss)/earnings per share is calculated by dividing the

(loss)/earnings attributable to ordinary shareholders by the

weighted average number of ordinaryshares outstanding during the

period.

The Group has no dilutive potential ordinary shares.

Earnings per share has been calculated in accordance with IAS

33.

Reconciliation of the (loss)/earnings and weighted average

number of shares used in the calculation is set out below:

Year ended Year ended

31 December 31 December

2011 2010

(Loss)/profit for the period GBP(387,000) GBP132,000

-------------------------------------------- ------------ -----------

Weighted average number of shares in issue 7,413,376 7,413,376

-------------------------------------------- ------------ -----------

Basic and diluted (loss)/earnings per share (5.22)p 1.78p

-------------------------------------------- ------------ -----------

6. Intangible assets

Syndicate

capacity

GBP'000

Cost

At 1 January 2010 1,649

Additions 26

Acquired with subsidiary undertaking 304

------------------------------------- -----

At 31 December 2010 1,979

------------------------------------- -----

At 1 January 2011 1,979

Additions 49

Disposals (1)

------------------------------------- -----

At 31 December 2011 2,027

------------------------------------- -----

Amortisation

At 1 January 2010 433

Charge for the year 246

Acquired with subsidiary undertaking 26

------------------------------------- -----

At 31 December 2010 705

------------------------------------- -----

At 1 January 2011 705

Charge for the year 270

------------------------------------- -----

At 31 December 2011 975

------------------------------------- -----

Net book value

As at 31 December 2010 1,274

------------------------------------- -----

As at 31 December 2011 1,052

------------------------------------- -----

7. Financial assets at fair value through profit or loss

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs that have a significant

effect on the recorded fair value that are not based on observable

market data.

The Group has no level 3 investments.

As at 31 December 2011, the Group held the following financial

assets carried at fair value on the statement of financial

position:

Assets measured at fair value

2011 Level 1 Level

2

Group GBP000 GBP000 GBP000

-------------------------------------------------- ------ ------- ------

Shares and other variable yield securities 1,071 1,071 -

Debt securities and other fixed income securities 7,821 7,821 -

Participation in investment pools 484 484 -

Loans guaranteed by mortgage 81 - 81

Holdings in collective investment schemes 80 - 80

Deposits with credit institutions 43 - 43

Funds held at Lloyd's 4,090 4,090 -

Other 5 - 5

-------------------------------------------------- ------ ------- ------

Total - market value 13,675 13,466 209

-------------------------------------------------- ------ ------- ------

2010 Level 1 Level 2

Group GBP000 GBP000 GBP000

-------------------------------------------------- ------ ------- -------

Shares and other variable yield securities 1,149 1,149 -

Debt securities and other fixed income securities 8,502 8,502 -

Participation in investment pools 504 504 -

Loans guaranteed by mortgage 77 - 77

Holdings in collective investment schemes 76 - 76

Deposits with credit institutions 55 - 55

Funds held at Lloyd's 3,473 3,473 -

Other 5 - 5

-------------------------------------------------- ------ ------- -------

Total - market value 13,841 13,628 213

-------------------------------------------------- ------ ------- -------

Funds at Lloyd's represents assets deposited with the

Corporation of Lloyd's (Lloyd's) to support the Group's

underwriting activities as described in the Accounting Policies.

The Group has entered into a Lloyd's Deposit Trust Deed which gives

the Corporation the right to apply these monies in settlement of

any claims arising from the participation on the syndicates. These

monies can only be released from the provision of this Deed with

Lloyd's express permission and only in circumstances where the

amounts are either replaced by an equivalent asset, or after the

expiration of the Group's liabilities in respect of its

underwriting.

The Directors consider any credit risk or liquidity risk not to

be material.

8. Share capital and share premium

Ordinary Preference

share share

capital capital Total

Authorised GBP'000 GBP'000 GBP'000

----------- -------------------------------------------------- ---------- -------

29,500,000 ordinary shares of 10p each and 100,000 preference shares

of 50p each

at 1 January 2011 2,950 50 3,000

------------------------------------------------ ------------- ---------- -------

29,500,000 ordinary shares of 10p each and 100,000 preference shares

of 50p each

at 31 December 2011 2,950 50 3,000

------------------------------------------------ ------------- ---------- -------

Ordinary

share Share

capital premium Total

Allotted, called up and fully paid GBP'000 GBP'000 GBP'000

------------------------------------------------ ------- ------- -------

7,413,376 ordinary shares of 10p each and share

premium at 1 January 2011 741 6,261 7,002

------------------------------------------------ ------- ------- -------

7,413,376 ordinary shares of 10p each and share

premium at 31 December 2011 741 6,261 7,002

------------------------------------------------ ------- ------- -------

9. Financial statements

The financial information set out in this announcement does not

constitute statutory accounts but has been extracted from the

Group's Financial Statements which have not yet been delivered to

the Registrar. The Group's annual report and Financial Statements

will be posted to shareholders shortly. Further copies will be

available from the Company's registered office: Hampden House,

Great Hampden, Great Missenden, Buckinghamshire HP16 9RD and on the

Company's website www.hampdenplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEEFWEFESESI

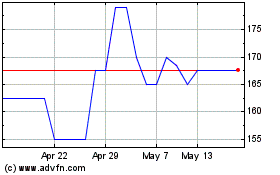

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024