First day of dealings

September 04 2007 - 3:01AM

UK Regulatory

RNS Number:2072D

Hampden Underwriting Plc

04 September 2007

4 September 2007

Hampden Underwriting plc

First Day of Dealings on AIM

Hampden Underwriting plc ("Hampden Underwriting" or the "Company"), which has

been incorporated primarily to provide a limited liability direct investment

into the Lloyd's insurance market through its subsidiary underwriting vehicle,

Hampden Corporate Member Limited ("HCM"), today announces that it has raised an

initial #5.2 million (before expenses) at a price of #1.00 per ordinary share

through an offer for subscription to the public in the UK ("the Offer").

Application has been made for the Admission to AIM of 5,238,566 ordinary shares

of the Company. It is expected that Admission in relation to these ordinary

shares issued to date will become effective and dealings on AIM will commence at

8.00am today under the ticker symbol "HUW". The Offer will remain open until 28

September 2007.

Of the total gross proceeds of the Offer to date, #5.1 million was subscribed in

cash and #0.1 million in shares in Heritage Underwriting Agency plc. The net

cash proceeds from this initial fund raising will be used to acquire

underwriting participations in Lloyd's syndicates and invest in other Lloyd's

related opportunities. HCM will bid in the capacity auctions on 4 and 5

September 2007, 13 and 14 September 2007 and 25 and 26 September 2007.

Smith & Williamson is acting as the Nominated Adviser, Broker and Promoter to

the Company.

Sir Michael Oliver, Chairman of Hampden Underwriting, said:

"We are delighted with investor demand and are very pleased to be joining AIM.

We do not believe that any other company provides the same level of concentrated

exposure to Lloyd's underwriting and this is a key distinction. As we believe

that there is significant further demand amongst UK investors, the Offer has

been extended."

Enquiries:

Hampden Underwriting Jeremy Evans 020 7863 6567

Smith & Williamson Corporate Finance Azhic Basirov 020 7131 4000

Limited David Jones

Joanne du Plessis

Cardew Group Tim Robertson 020 7930 0777

Shan Shan Willenbrock

David Roach

For copies of the prospectus please contact:

Tax Efficient Solutions

Smith & Williamson Investment Management Limited

020 7131 4502

tes@smith.williamson.co.uk

About Hampden Underwriting

* Hampden Underwriting's subsidiary, HCM, will be advised by Hampden

Agencies Limited ("HAL"). HAL is the largest provider of third party

capital to the Lloyd's market, with over #2 billion of capacity under

management in 2007 which, the directors of Hampden Underwriting (the

"Directors") believe, gives it an influential voice in the Lloyd's market

as a whole.

* The Directors believe that Hampden Underwriting will offer the only

opportunity currently available for investment in a quoted company whose

principal purpose is to participate in a spread portfolio of Lloyd's

syndicates rather than manage syndicates itself. There are other companies

whose shares are traded on the London Stock Exchange and whose activities

include underwriting at Lloyd's, but the Directors believe that these do

not provide such concentrated exposure to Lloyd's underwriting as the

Company.

* The Company's strategy is to seek to generate returns for its shareholders

primarily through:

* the acquisition of underwriting participations in Lloyd's syndicates and

providing the necessary supporting funds at Lloyd's.

* the acquisition of corporate members of Lloyd's as suitable opportunities

arise; and

* the acquisition in other Lloyd's insurance-related investments and

products, if and when suitable opportunities arise.

* Hampden Underwriting will seek to benefit from the positive market

conditions created in the wake of the recent US catastrophes. In summary:

* The Directors believe that the main reason why recent results have been

so much better than might have been expected from past experience is that

Lloyd's has undertaken a comprehensive process of internal reform over the

past few years, the most crucial component of which was the establishment

of the Franchise Performance Directive in 2002. For the calendar year 2005

Lloyd's reported a loss of #103 million, in spite of the fact that it was

trading in a year when there were some US$83 billion of major catastrophe

losses. 2006 saw a low catastrophe incidence, which resulted in a reported

calendar year profit of #3.7 billion, which again compares favourably with

Lloyd's peers.

* The Directors believe that two of the main ramifications of the large US

catastrophe losses of 2004 and 2005 are that:

(i) they have led to an improvement of rating levels for certain classes

of business; and

(ii) they have changed the shape of the worldwide insurance industry.

The Directors believe that this gives the best Lloyd's syndicates a significant

trading opportunity for the medium term.

* Rates have increased by substantial margins in classes of insurance

business such as reinsurance, US property and US offshore energy following

these losses. The Directors believe that what is arguably more important,

however, is that there has been an erosion of worldwide competition in some

insurance classes, especially certain sectors of the reinsurance market.

* The Directors do not expect to see a significant softening of rates in

many of the major catastrophe exposed insurance classes in the medium term

and believe that current underwriting conditions offer the capability to

produce good underwriting profits (though not indefinitely).

HAL

Through HCM, Hampden Underwriting will not invest in the Lloyd's market as a

whole, but in a carefully chosen spread portfolio of syndicates that will be

recommended by HCM's Lloyd's adviser, HAL.

HAL's advice will be based upon analysis of the past and forecasted performance

of syndicates to grade their potential to outperform the market through any

given cycle. The table below shows the way in which members advised by HAL have

outperformed relative to the Lloyd's market as a whole since 2001:

Percentage return on

capital invested

HAL-advised Lloyd's

members market

Year of account

2001 (31.1)% (45.9)%

2002 34.3% 28.6%

2003 52.9% 47.0%

2004 26.2% 25.9%

2005 (estimate) (0.5)% (12.2)%

2006 (estimate) 39.8% 36.3%

Past performance should not be seen as an indication of future performance.

Sources: HAL 2001 to 2004 at 36 months, calculated from Synopsis MAIR reports.

Lloyd's Market 2001 to 2004 at 36 months from Lloyd's Global Results/ Year end

QMRs. 2005 estimates calculated from 2007 Q1 QMR returns. Lloyd's 2006 estimate

based on Lloyd's aggregate of the 2006 Q4 QMRs. HAL 2006 estimate based on a

combination of Syndicate official estimates (accounting for 64% of HAL capacity)

and Hampden Underwriting Research Syndicate estimates for remaining 36%. Funds

at Lloyd's are assumed at 40%. All returns include personal expenses but are

before members' agent's charges.

The Directors believe that another potential benefit for the Company is that HAL

has built up strategic relationships with some of the underwriters in the market

and this leaves it well placed to introduce HCM to early investments in new

syndicates and other underwriting opportunities within the Lloyd's market.

Directors

Sir James Michael Yorrick Oliver, aged 67, (Non-executive Chairman)

Sir Michael Oliver is a director of a number of investment funds, and the

chairman of a specialised Central and Eastern European fund. He was previously a

director, Investment Funds at Hill Samuel Asset Management and of Scottish

Widows Investment Partnership Limited. He was a partner in stockbrokers Kitkat &

Aitken for 20 years and subsequently managing director of Carr Kitkat & Aitken

between 1990 and 1993. He is non-executive chairman of Zirax plc and Europa Oil

& Gas (Holdings) plc, both of which are quoted on AIM.

John Andrew Leslie, aged 62, (Non-executive Director)

Andrew Leslie has 40 years' experience as an insurance broker. He started his

career with Leslie & Godwin in 1967, where he held a number of senior positions,

until he left to join Morgan Read and Coleman as a director. In 1991 he and

three others effected a management buy out of the company which was then

purchased by Arthur J. Gallagher (UK) Limited in 1996. Until recently he was a

main board director of Arthur J. Gallagher (UK) Limited.

Jeremy Richard Holt Evans, aged 49, (Non-executive Director)

Jeremy Evans joined Minories Underwriting Agencies in 1993, which was

subsequently transferred to Aberdeen Underwriting Advisers Limited, with

specific responsibility for its corporate capital plans, including the

development of a conversion scheme for existing members. He has been a director

of HAL since 1999 and is also the managing director of Nomina plc.

Harold Michael Clunie Cunningham, aged 59, (Non-executive Director)

Michael Cunningham joined Neilson Hornby Crichton & Co in 1976, becoming a

partner in 1981. In 1986, he became a director of Neilson Cobbold Limited,

formerly Neilson Milnes Limited, which is now part of Rathbone Brothers. He has

worked in the investment management business for over 20 years and formerly had

responsibility for venture capital trusts and Rathbones Enterprise Investment

Scheme portfolios and Inheritance Tax service, which have raised over #100

million in total.

Hampden Agencies Limited

Nigel Hanbury, Chief Executive

Nigel Hanbury joined Lloyd's in 1979 as an external member and became a Lloyd's

broker in 1982. He later moved to the Members' Agency side. He serves on the

board of the Association of Lloyd's Members and was elected to the Council of

Lloyd's for "Working Names" constituency and served on that body between 1999

and 2001, as well as participating on the Market Board and other Lloyd's

committees. In January 2005, Nigel was re-elected to the Council for his second

three year term.

Nick Carrick, Hampden Underwriting Research

Nick Carrick joined Lloyd's in 1977 and moved into an underwriting agency role

in 1983. He is a Fellow of the Chartered Insurance Institute and was appointed

head of Hampden Underwriting Research in 2002.

Jeremy Evans, Director

Jeremy Evans, also a director of Hampden Underwriting, as detailed above, is an

executive director of HAL where he has particular responsibility for business

development.

This document has been approved as a financial promotion under the Financial

Services and Markets Act 2000 by Smith & Williamson Corporate Finance Limited

("S&W"), which is authorised and regulated by the Financial Services Authority.

S&W is acting for Hampden Underwriting plc and no-one else and will not be

responsible to anyone other than Hampden Underwriting plc for providing the

protections afforded to customers of S&W. This document is for information only

and does not form part of any offer or invitation to subscribe for shares. This

document is not a prospectus, but an advertisement, and investors should not

subscribe for the shares referred to in this document except on the basis of the

prospectus dated 13 August 2007 which is available from: Tax Efficient

Solutions, Smith & Williamson Investment Management Limited, 25 Moorgate,

London, EC2R 6AY (tel: +44(0)20 7131 4502; email: tes@smith.williamson.co.uk).

This document should not be distributed directly or indirectly, to any persons

with addresses in the United States of America (or any of its territories or

possessions), Canada, Japan, Australia or the Republic of South Africa, or to

any corporation, partnership or other entity created or organised under the laws

thereof, or in any other country outside the United Kingdom where such

distribution may lead to a breach of any legal or regulatory requirement. The

shares referred herein have not been and will not be registered under the United

States Securities Act 1933 (as amended) or under any of the applicable

securities laws of Canada, Japan, Australia or the Republic of South Africa and

may not, subject to certain exceptions, be offered for sale or sold or

subscribed directly or indirectly within the United States, Canada, Japan,

Australia or the Republic of South Africa or to or by any national, resident or

citizen of any such countries.

This document does not represent advice about subscribing for, purchasing or

selling shares and is not a substitute for independent professional advice about

legal, investment or tax matters. It is only intended to provide some basic

information. If you are in any doubt as to the action you should take, you are

recommended to seek your own personal financial advice immediately from your

stockbroker, bank manager, solicitor, accountant or other qualified financial

adviser authorised under the Financial Services and Markets Act 2000. Please

note that neither Hampden Underwriting nor S&W is permitted to provide you with

legal, investment or tax advice.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOUNRBRRKRAR

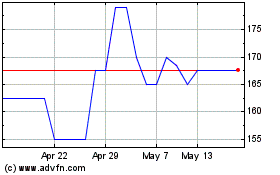

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024