TIDMHOC

RNS Number : 2262F

Hochschild Mining PLC

20 April 2011

Production Report and Interim Management Statement

for the 3 months ended 31 March 2011

Highlights

-- Q1 2011 production of 5.6 million attributable silver

equivalent ounces, on track to deliver 2011 production target of

22.5 million attributable silver equivalent ounces

-- Ongoing delivery of organic growth strategy:

- In January, the Company announced a positive scoping study at

100% owned Crespo property with initial projected production of 2.3

million silver equivalent ounces per annum from the end of 2013

- In February, Hochschild announced a significant increase in

grades & resources at the Inmaculada project - Measured &

Indicated resources, up 59% to 76.0 million silver equivalent

ounces

- Feasibility studies on track at all three advanced projects,

Inmaculada, Azuca and Crespo

-- Cesar Aguirre appointed Vice President of Exploration &

Geology and David Hopper appointed Exploration Manager for

Chile

-- In January 2011, the Company repaid its entire existing

syndicated loan facility of US$114.3 million

-- In February 2011, Hochschild disposed of its remaining 6%

stake in Lake Shore Gold with total net proceeds of C$79.7

million

-- Solid financial position with total cash of approximately

US$540 million as at 31 March 2011 and minority investments of over

US$450 million

Ignacio Bustamante, Chief Executive, commented:

"I am pleased to announce a solid set of production results,

which place us firmly on track to achieve our full year production

target of 22.5 million attributable silver equivalent ounces. We

are progressing well with our advanced projects at Inmaculada,

Azuca, and Crespo, which have the potential to significantly

increase our production profile. Our exploration programme is also

moving forward with active drilling at each of our three core

operations as well as across our greenfield targets in Peru, Chile,

Mexico and Argentina.

I am also pleased to welcome Cesar Aguirre as our new Vice

President of Exploration & Geology and David Hopper as

Exploration Manager for Chile, both of whom bring extensive

experience and expertise to the Company."

Overview

Hochschild delivered attributable production of 5.6 million

silver equivalent ounces in Q1 2011, comprised of 3.7 million

ounces of silver and 31.3 thousand ounces of gold, placing it

firmly on track to achieve its full year production target of 22.5

million attributable silver equivalent ounces in 2011.

Compared to Q1 2010, attributable silver equivalent production

decreased 8% due to the expected decline in production from the

Company's two ageing mines, Ares and Moris, which are scheduled for

closure this year, and lower production from the Arcata operationas

the Company moves towards its previously mentioned long term goal

of mining close to the average reserve grade at each of its core

operations. Compared to the previous quarter, production at all

operations has been impacted by the seasonal effect of fewer

production days in the first quarter relative to the fourth quarter

of the year.

Production

Main operations

San Jose delivered a solid performance in Q1 with silver

equivalent production of 2.8 million ounces, up 55% compared to Q1

2010. This is due to the anticipated increase in volume and grades

from new mining areas, including the high grade Kospi vein, which

has resulted in silver grades and production rising 57% and 85%

year-on-year respectively.

As mentioned, Arcata's production decreased in Q1 as the Company

reduces the extraction grade towards the average reserve grade

level in order to ensure a consistent and sustainable level of

production. Silver equivalent production of 1.8 million ounces was

19% lower than Q1 2010, comprised of 1.6 million ounces of silver

and 4.3 thousand ounces of gold.

At Pallancata, the Company's other main Peruvian operation,

silver equivalent production decreased 12% year-on-year to 2.5

million silver equivalent ounces, mainly driven by lower grades

which decreased 11% and 6% year-on-year for silver and gold

respectively. The first quarter 2011 mine plan focused on deeper

and narrower veins compared to Q1 2010 with mined grades in line

with the reserve grade.

Other operations

The Company's ageing Ares mine produced 0.5 million silver

equivalent ounces in Q1 2011 (Q1 2010: 0.8 million silver

equivalent ounces), while Moris, the Company's operation in Mexico,

produced 0.3 million silver equivalent ounces (Q1 2010: 0.4 million

silver equivalent ounces).As previously reported, both operations

are scheduled to cease production in 2011. Management is monitoring

the grade and cost profile of each mine to ensure that they are in

line with the Company's policy of producing profitable ounces.

Average realisable prices and sales

Average realisable precious metal prices (which are reported

before the deduction of commercial discounts) in Q1 2011 were

US$1,391.4/ounce for gold and US$36.2/ounce for silver.

Exploration appointments

Hochschild is pleased to announce the appointment of Cesar

Aguirre as Vice President of Exploration and Geology. Cesar has

over 20 years' experience in exploration and project management in

South America, principally in Peru, Argentina and Chile. Prior to

joining Hochschild, he worked for Newcrest Mining, Yanacocha,

Noranda Inc. and Barrick Gold Corp. Cesar holds a BSc in Geological

Engineering from the Universidad Nacional de Ingenieria and an MSc

in Economic Geology from the University of Tasmania.

The Company is also pleased to announce the appointment of David

Hopper to the role of Exploration Manager for Chile. David is a

geologist with over 20 years of global experience within major

diversified mining companies. Between 1990 and 2009, David held

various positions at Rio Tinto plc, primarily in South America, and

was most recently Exploration Manager for Kinross Gold Corp in

Chile.

Advanced projects

Crespo

During the quarter, Hochschild reported positive results from a

scoping study completed by an independent company, Ausenco, at the

Company's 100% owned Crespo project, located in the Company's

existing operating cluster in southern Peru. The scoping study is

based on resources of 31.3 million silver equivalent ounces

(measured and indicated) and estimates initial production of 2.3

million silver equivalent ounces per annum starting from 2013.

Hochschild already has 5.0 million ounces of Measured &

Indicated resources that will be added for the feasibility study.

For further details of the scoping study, please see the press

release published on 19 January 2011.

Inmaculada

On 25 February 2011, the Company announced an increase in both

the total Mineral Resource estimate and Measured and Indicated

Resources for the Inmaculada gold-silver project located in

Hochschild's existing southern Peru cluster, following the

announcement of a positive scoping study published by International

Minerals Inc ("IMZ") in September 2010. The project, in which

Hochschild now owns a controlling 60% stake (IMZ holds the

remaining 40%), is currently at feasibility stage with completion

expected in Q4 2011. The Company expects to commence production in

December 2013 at a processing capacity of 3,000 tonnes per day. The

highlights of the announcement were:

-- 59% increase in Measured & Indicated Resources to 76.0

million silver equivalent ounces

-- 29% increase in silver equivalent grades to 498 g/t

-- Total resources of 128.3 million silver equivalent ounces

Hochschild expects the results to significantly improve the

economics of the project detailed in the 2010 scoping study. A

14,360 metre campaign commenced at the property in March 2011 with

800 metres of discontinuous quartz outcrops recognised to the

northeast of the property. Brownfield drilling commenced at the

Jimena vein and mapping and sampling were completed at the Angela

vein with geophysical magnetometry testing scheduled for March. A

total drill programme of 36,000 metres is planned for the full year

2011.

Azuca

Intensive drilling continues at the 100% owned Azuca property

with the aim of expanding the scale of the project. The Company

expects to complete feasibility in Q1 2012 with production targeted

for Q4 2013 at an initial estimate of 3.5 million silver equivalent

ounces per year.

Year to date, 40,116 metres of infill drilling has been

completed at the Yanamayo, Vivian and Azuca veins which aims to

transform Inferred Resources to the Indicated category and advance

the project to feasibility study. Assays are pending from drilling

at the Karina, Milagros and Yola veins where magnetometry

geophysical anomalies have been identified. The Environmental

Impact Study is also underway and is expected to be submitted in Q3

2011.

Core operations

Arcata

The 2011 drill programme is underway at Arcata and aims to

incorporate new resources at the Blanca, Amparo and Baja veins. A

magnetometry geophysical survey started in March to test northern

and western targets. Positive results from the drill programme have

been reported in Q1 with intercepts including:

Amparo DDH-935: 3.0 metres at 3.3 g/t Au and 1,736 g/t

Ag

DDH-951: 0.7 metres at 0.4 g/t Au and 641g/t Ag

------- -------------------------------------------------

Blanca DDH-948: 0.4 metres at 2.3 g/t Au and 924 g/t Ag

DDH-914: 0.9 metres at 4.3 g/t Au and 2,579 g/t

Ag

DDH-971: 0.8 metres at 6.0 g/t Au and 1,450 g/t

Ag

------- -------------------------------------------------

Baja DDH-185: 0.8 metres at 7.1 g/t Au and 360 g/t Ag

------- -------------------------------------------------

Pallancata

Underground development continues at the Pallancata, San Javier

and Virgen del Carmen veins. Drill results in Q1 2011 include:

Thalia DLPL-A713 triple intersected:

0.9 metres at 2.84 g/t Au and 837 g/t Ag;

1.4 metres width at 0.65 g/t Au and 245 g/t Ag;

0.8 metres at 5.0 g/t Au and 3,069 g/t Ag

---------------- -------------------------------------------------

Pallancata West DLPL-A708 double intersect:

0.4 metres at 1.7 g/t Au and 461 g/t Ag;

3.1 metres at 1.3 g/t Au and 332 g/t

DLPL-A710: 1.8 metres at 0.9 g/t Au and 294 g/t

Ag

---------------- -------------------------------------------------

San Jose

During the quarter, diamond drilling was carried out at the

Antonella and Sanson veins.

Greenfield pipeline

Victoria

The Victoria project in Chile is 60% owned by Hochschild, with

the remaining 40% held by Iron Creek Capital. Eight drill holes

were completed at the Cenizas, Incahausi and Vida targets in Q1

2011 totaling 2,327 metres.

Valeriano

At the Valeriano property which is located 27 kilometres north

of Barrick Gold Corporation's Pascua Lama project, preliminary

results received to date have confirmed the anomalies identified in

past drill reports. Results of the geophysical survey have been

very good with the definition of a porphyry-like anomaly at depth

which corresponds with the surface geochemistry studies as well as

the historic magnetic survey. Preliminary drill targets have been

selected and the Company is planning to commence a 2,500 metre

drill campaign in H2 2011.

Mercurio

At the 100% owned Mercurio project in Mexico, surface mapping

and sampling have taken place at the southern end of the property

identifying a number of new vein sets which tend to be associated

with local zones of silicification in this region. Soil sampling

lines are also planned to help locate traces of veins on surface.

The drilling campaign in 2011 will be focused on deeper areas of

the project to evaluate potential areas similar to comparable

mineralised mines in the vicinity.

Mosquito

At the 100% owned Mosquito project in Argentina, strong

anomalous mineralisation results have been reported for a number of

the drill holes completed in Q1 2011 with results due to be

assessed at the end of the drill programme and new targets

identified.

Drill programmes are also scheduled to commence at the Company's

other key targets including Company Makers, Sabina, Parihuana and

Apacheta and at its medium scale projects Encrucijada, Cricket and

La Flora.

Financial position

In the period from 1 January 2011, Hochschild's operating and

financial performance continues to be strong. The Company's

financial position remains robust with total cash of approximately

US$540 million as at 31 March 2011 and minority investments of over

US$450 million.

Other than as described in this announcement, there have been no

material events or transactions in the period from 1 January 2011

to 20 April 2011 which have affected Hochschild's financial

position.

Outlook

The Company is well positioned to achieve its full year

production target of 22.5 million attributable silver equivalent

ounces in 2011 with broadly stable production at San Jose and

Pallancata, offset by lower production at Arcata. Key stage

development at all three advanced projects remains on track and we

will provide further updates on progress over the course of the

year.

__________________________________________________________________

A conference call will be held at 2pm (London time) on Wednesday

20 April 2011 for analysts and investors.

Dial in details as follows:

UK +44 (0)20 3003 2666

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

UK +44 (0)20 8196 1998

Access code 5322353#

__________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 7907 2934

Head of Investor Relations

Finsbury

Faeth Birch +44 (0)20 7251 3801

Public Relations

__________________________________________________________________

About Hochschild Mining plc:

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over forty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru, one in southern Argentina and one open pit mine in

northern Mexico. Hochschild also has numerous long-term projects

throughout the Americas.

PRODUCTION & SALES INFORMATION*

TOTAL GROUP PRODUCTION(1)

Q1 Q4 Q1

2011 2010 2010

-------------------------- ------- ------- -------

Silver production (koz)(

) 5,240 6,780 5,290

Gold production (koz)(

) 44.92 54.27 46.29

Total silver equivalent

(koz) 7,935 10,037 8,068

Total gold equivalent

(koz) 132.24 167.28 134.46

Silver sold (koz) 5,100 6,826 5,031

Gold sold (koz) 39.12 56.18 37.14

-------------------------- ------- ------- -------

1Total production includes 100% of all production, including

production attributable to joint venture partners at San Jose and

Pallancata.

ATTRIBUTABLE GROUP PRODUCTION(1)

Q1 Q4 Q1

2011 2010 2010

--------------------------- ------ ------- -------

Silver production (koz)(

) 3,687 4,758 3,953

Gold production (koz)(

) 31.31 37.44 34.95

Attrib. silver equivalent

(koz) 5,565 7,005 6,051

Attrib. gold equivalent

(koz) 92.76 116.75 100.84

--------------------------- ------ ------- -------

1Attributable production includes 100% of all production from

Arcata, Ares and Moris, 60% from Pallancata and 51% from San

Jose.

QUARTERLY PRODUCTION BY MINE

ARCATA

Q1 Q4 Q1

Product 2011 2010 2010

---------------------------- -------- -------- --------

Ore production (tonnes) 156,976 171,270 142,680

Average head grade

silver (g/t) 349 404 458

Average head grade

gold (g/t) 0.95 1.20 1.53

Silver produced (koz) 1,550 1,945 1,867

Gold produced (koz) 4.34 5.81 6.14

Silver equivalent produced

(koz) 1,810 2,294 2,236

Silver sold (koz) 1,316 2,077 1,815

Gold sold (koz) 3.69 5.77 5.24

---------------------------- -------- -------- --------

ARES

Q1 Q4 Q1

Product 2011 2010 2010

---------------------------- ------- ------- -------

Ore production (tonnes) 73,502 76,596 78,641

Average head grade

silver (g/t) 64 82 112

Average head grade

gold (g/t) 3.03 3.35 3.94

Silver produced (koz) 134 182 242

Gold produced (koz) 6.69 7.72 9.34

Silver equivalent produced

(koz) 535 646 802

Silver sold (koz) 102 214 238

Gold sold (koz)( ) 5.57 8.75 4.21

---------------------------- ------- ------- -------

PALLANCATA(1)

Q1 Q4 Q1

Product 2011 2010 2010

---------------------------- -------- -------- --------

Ore production (tonnes) 242,061 281,035 248,032

Average head grade

silver (g/t) 303 358 339

Average head grade

gold (g/t) 1.31 1.51 1.39

Silver produced (koz) 2,018 2,763 2,334

Gold produced (koz) 7.78 10.04 8.22

Silver equivalent produced

(koz) 2,485 3,365 2,827

Silver sold (koz) 2,327 2,549 2,204

Gold sold (koz) 8.63 8.33 7.20

---------------------------- -------- -------- --------

(1) The Company holds a 60% interest in Pallancata.

SAN JOSE(1)

Q1 Q4 Q1

Product 2011 2010 2010

---------------------------- -------- -------- -------

Ore production (tonnes)(

) 113,696 135,710 96,484

Average head grade

silver (g/t) 459 475 293

Average head grade

gold (g/t) 6.08 6.34 5.92

Silver produced (koz)(

) 1,522 1,871 823

Gold produced (koz) 21.41 26.14 16.43

Silver equivalent produced

(koz) 2,807 3,440 1,809

Silver sold (koz)(

) 1,342 1,962 749

Gold sold (koz)( ) 17.63 27.45 14.58

---------------------------- -------- -------- -------

(1) The Company holds a 51% interest in San Jose.

MORIS

Q1 Q4 Q1

Product 2011 2010 2010

---------------------------- -------- -------- --------

Ore production (tonnes) 305,411 249,150 302,321

Average head grade

silver (g/t) 4.12 4.30 3.86

Average head grade

gold (g/t) 0.76 0.83 1.23

Silver produced (koz) 16 19 24

Gold produced (koz) 4.69 4.55 6.16

Silver equivalent produced

(koz) 298 292 394

Silver sold (koz)(

) 12.8 24.8 23.9

Gold sold (koz)( ) 3.59 5.87 5.90

---------------------------- -------- -------- --------

* Q1 2010 ounces sold have been restated to include gross

revenue divided by gross ounces sold (previously included net

revenue divided by net ounces sold)

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGUPACUPGGMB

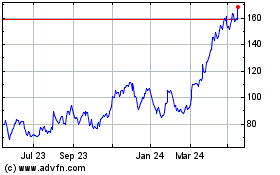

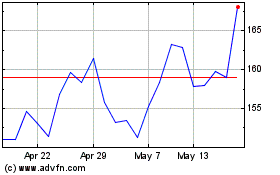

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Jul 2023 to Jul 2024