German Smaller Co - Interim Results, etc

November 07 1997 - 12:55PM

UK Regulatory

RNS No 1906e

GERMAN SMALLER COMPANIES INVESTMENT TRUST PLC

7th November 19997

German Smaller Companies Investment Trust plc

Preliminary Results for the half-year ended 30 September 1997

The directors announce the unaudited results for the half-year ended 30

September 1997. The objective of the company is to achieve capital

appreciation through investment primarily in the equity securities of small

and medium-sized German companies.

No interim dividend has been declared but it is the directors' intention to

recommend a final dividend during 1998 in respect of the company's financial

year ending 31 March 1998.

The salient figures in the half-year report, which will be sent to

shareholders in December 1997 and made available to the public at the

company's registered office are:

Statement of Total Return

(incorporating the revenue account)

of the Company

Half-year ended Half-year ended

30 September 1997 30 September 1996

Revenue Capital Total Revenue Capital Total

#'000 #'000 #'000 #'000 #'000 #'000

Gains on investments* - 1,993 1,993 - 409 409

Overseas dividends 764 - 764 1,125 - 1,125

Bank interest and other 18 - 18 27 - 27

income

------ ------ ------ ------ ------ ------

782 1,993 2,775 1,152 409 1,561

Investment management fee (242) - (242) (237) - (237)

Other expenses (51) - (51) (73) - (73)

------ ------ ------ ------ ------ ------

Return on ordinary 489 1,993 2,482 842 409 1,251

activities before taxation

Tax on ordinary (161) - (161) (278) - (278)

activities

------ ------ ------ ------ ------ ------

Return on ordinary 328 1,993 2,321 564 409 973

activities after taxation

Dividends in respect of - - - - - -

ordinary shares

------ ------ ------ ------ ------ ------

Transfer to reserves 328 1,993 2,321 564 409 973

------ ------ ------ ------ ------ ------

Return per ordinary share 0.8p 4.7p 5.5p 1.3p 1.0p 2.3p

===== ===== ===== ===== ===== =====

*Net of exchange losses

The financial information set out above does not constitute the company's

statutory accounts for the year ended 31 March 1997 but is derived

from those accounts.

Statutory accounts for 1997 have been delivered to the registrar of companies.

The auditors have reported on those accounts; their reports did not contain

statements under section 237 (2) (accounting records or returns inadequate or

accounts not agreeing with records and returns) or (3) (failure to obtain

necessary information and explanations) of the Companies Act 1985.

German Smaller Companies Investment Trust plc is registered in England and

Wales No 1879372 and is an investment company within the meaning of section

266 of the Companies Act 1985. Registered office: 10 Fleet Place, London,

EC4M 7RH.

For further information contact:

Alison Powell or Michael Oliver

Hill Samuel Asset Management Limited

0171 203 3000

GSCIT Chairman's Statement

During the half-year to 30 September 1997, the net asset value per ordinary

share (NAV) increased by 4.2%, outperforming the sterling adjusted composite

DAX (ex DAX) Capital index by 6.8%. The share price increased by 3.3% to

109.0p with the discount to fully diluted net asset value (NAV) remaining

steady at 18%.

Exchange rate volatility has continued to impact results. In particular, the

sharp appreciation of sterling against the Deutschmark compared with a year

ago has adversely affected the translation of income into sterling. While the

Trust's final dividend will not be declared until May 1998, a major proportion

of the Trust's income has already been received due to the timing of most

German dividend payments. A reduction in the amount payable to ordinary

shareholders appears likely although this should be viewed against the strong

performance of the NAV which is the principal objective of the Trust.

Economic growth accelerated during the period under review with exports

remaining the key component as capital spending initially failed to respond to

the degree anticipated. Manufacturing order intake and industrial production

increased sharply over the summer and as inventory levels in addition remain

relatively low, investment should make a solid contribution to overall

economic growth for the full year. The momentum of the domestic economy was

further aided by rising consumer expenditure, a surprising development given

continuing high levels of unemployment (11.6% for Pan Germany in August) and

the collapse of the government's major tax reform package in September.

Economists are forecasting growth in 1997 of around 2.7%.

The Bundesbank continued to follow its loose monetary policy stance of the

last two years in the review period and this, in combination with the

continued depreciation of the Deutschmark until July provided a supportive

environment for business activity. In contrast, the German government failed

the corporate sector through its inability to make any real progress in

structural reform, most notably the simplification of the tax system. This

project is now shelved until after the general election in September 1998.

Given the improvement in the real economy, expectations rose over the summer

that interest rates might increase and this led to a 2% strengthening of the

Deutschmark on a trade weighted basis from July. The Bundesbank did nothing

to deter this speculation, which helped stabilise the Deutschmark/US Dollar

exchange rate. On 9th October 1997 the repo rate was raised to 3.3% from 3%

previously, and although this could be seen as a pre-emptive strike against

possible inflationary pressures next year when the economy is forecast to grow

by 3%, most commentators feel the Bundesbank was acting in concert with other

potential EMU participants, to aid the convergence of European money market

rates, ahead of the start date of monetary union. Further tightening for this

purpose is deemed likely over the next six months.

The German stock market enjoyed a spectacular run until August, in part

supported by the weaker Deutschmark and in anticipation of economic recovery.

Most notable was the influx of liquidity into the market both from domestic

and international sources. A change in the pattern of investment became

clear, away from sector rotation in favour of individual stocks, particularly

those involved in major restructuring and/or merger and acquisition activity.

Several of the Trust's large holdings benefited from this. In addition, there

was a perceptible shift from growth to value orientated companies and a number

of these were introduced into the Trust's portfolio. Following a substantial

correction in the market in August (down 14% in local currency terms) on fears

of US interest rate rises, there has been a rebound, led by smaller companies.

Many new companies are seeking stock market listings, particularly on the

newly launched Neuer Markt (New Market) for small issues, and this is

encouraging investors to look at opportunities outside the leader board.

The performance of the stock market is likely to remain volatile in the near

term with the possibility of further small increases in short term interest

rates. Earnings momentum will therefore be key to outperformance, and there

is still scope for this to be achieved from a reviving economy and from

corporate profits growth in excess of analysts' expectations. Nowhere is this

more likely than in the smaller company sector which makes up 70% of Germany's

Gross Domestic Product and which is particularly sensitive to improvements in

the domestic economy in the later stages of an economic cycle.

P D Minchin

5 November 1997

German Smaller Companies Investment Trust plc

Ten largest equity holdings

% of Trust's equity

holdings at 30

September 1997

Name and description

1. MLP Insurance 4.0

2. Hugo Boss Textiles 3.8

3. Fresenius Chemicals 3.5

4. SKW Trostberg Chemicals 3.4

5. Depfa Mortgage Banks 3.3

6. Kolnische Insurance 3.2

Ruckversicherung

7. Adidas Textiles 3.2

8. Adolf Ahlers Textiles 3.1

9. Fried Krupp Iron & Steel 2.8

Hoesch

10. Tarkett Construction 2.7

____

33.0

Other equity holdings 65.3

Cash awaiting 1.7

investment

____

100.0

====

Investment portfolio % of Trust % sector weightings

at equity C Dax (ex Dax) Index

30 September 1997 holdings

Automobiles 1.9 3.8

Breweries 1.8 1.5

Building & 12.9 8.6

Construction

Chemicals 9.0 15.5

Electricals 2.3 2.5

Financials 18.1 27.2

Engineering 12.6 9.1

Utilities 0.0 8.5

Textiles 13.1 4.4

Consumer goods & 20.5 9.0

services

Steel 7.2 4.4

Miscellaneous 0.6 3.1

Paper 0.0 2.4

____ ____

100.0 100.0

==== ====

END

IR FLMGMNNNLNMM

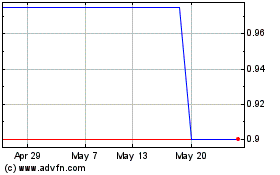

Gs Chain (LSE:GSC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gs Chain (LSE:GSC)

Historical Stock Chart

From Jul 2023 to Jul 2024