TIDMGRIT

RNS Number : 5421S

Global Resources Investment Tst PLC

21 December 2016

For immediate release 21 December 2016

GLOBAL RESOURCES INVESTMENT TRUST PLC

Approval of the new Manager Agreements as a related party

transaction under the Listing Rules

Adoption of New Investment Policy

and

Notice of General Meeting

The Company announces that it is posting a circular to

Shareholders convening a general meeting at 12.00 noon on 16

January 2017 at the offices of DMH Stallard LLP at 6 New Street

Square, New Fetter Lane, London EC4A 3BF to consider the related

party transaction and the adoption of the new investment policy as

described further below. The circular will also be available on the

Company's website www.grit.london and will shortly be available

from the National Storage Mechanism.

1. INTRODUCTION

On 21 December 2016, the Company announced that it was proposing

to change the arrangements with RDP (the Investment Manager as at

the date of this announcement) for managing the Company, which is a

related party transaction under the Listing Rules.

The Board considers that it is more practical for the Company

and its Portfolio to become self- managed and have reached

agreement with RDP in respect of an early termination of the

Investment Management Agreement, as set out in the Termination

Agreement, together with the continuing provision of certain back

office functions to GRIT as set out in the Transitional Services

Agreement.

Under the terms of the Termination Agreement, the Company will

pay the Investment Manager an early termination fee comprising the

issue of new Ordinary Shares on the basis set out below.

In addition, the Company is proposing to appoint David Hutchins,

a partner of RDP, as an Executive Director of GRIT under the

Service Agreement entered into by GRIT and Mr Hutchins.

The arrangements under the Termination Agreement, the

Transitional Services Agreement and the Service Agreement, together

the 'new Manager Agreements', are classified as a 'related party

transaction' under the Listing Rules as together they are a

transaction with the Investment Manager and are therefore subject

to, and conditional upon the approval of the Independent

Shareholders at the General Meeting.

The Company is also proposing that, subject to Shareholder

approval, the New Investment Policy is adopted from Completion

Further details of the Termination Agreement, the Transitional

Services Agreement, and New Investment Policy and the

recommendation of the Directors are set out in paragraphs 3 and 9

respectively below.

The purpose of the Document is to explain the background to, and

reasons for, the Proposals and why the Directors believe that the

Proposals are in the best interests of the Company and Shareholders

as a whole and to recommend that Shareholders vote in favour of the

Resolutions at the General Meeting to be held on 16 January

2017.

2. BACKGROUND TO AND REASONS FOR THE PROPOSALS

Shareholders will recall that due to the perilous market

conditions in the minerals sector the Company fell in breach of the

cover ratio resulting in it being in default with regard to the

GBP5,000,000 of Loan Notes. Following several financing proposals

announced during the course of this year, we announced on 19 August

that the latest proposal would not proceed due to the lack of

Shareholder support and that we would repay GBP1,000,000 of Loan

Notes due to LIM (now done) to be followed by a balance of

GBP2,500,000 in full and final settlement. As announced on 2

November 2016, the Company has nevertheless been able to repay

GBP1,000,000 of the outstanding amount from other portfolio

realisations, leaving a balance of GBP1,500,000 due to LIM. Further

to the announcement of 6 December 2016 which notified the market

that the proposed sale of 26,100,000 shares in Merrex Gold was no

longer proceeding, the Company reported that it remains confident

of realizing further funds which can be used to discharge the

remaining liability to LIM. In addition, there remain GBP1,200,000

nominal of Loan Notes due to other parties. The Board is therefore

pleased that the pressing need to repay LIM is now being dealt with

without what would have been a very dilutive issue to Shareholders.

However, given the reduced size of the portfolio and the need to

run an efficient and cost effective operation, the Board has

resolved that it should press ahead with the cancellation of the

Investment Management Contract so that in the future the Company

will be self-managed.

The current management arrangements under the Investment

Management Agreement provide for an annual fee of 1.5 per cent. to

the manager based upon net asset value. For the years ended 31

December 2014 and 2015, the amounts of such fee were GBP316,696 and

GBP255,434 respectively, and in the current year the fee has been

GBP145,057. If the net asset base of the Company were to grow, then

the fee could rise without limit and this would represent a large

cash cost to the Company. The Proposals eliminate this cash cost in

return for the issue of Ordinary Shares under the termination

arrangements set out in paragraph 3 below. In addition, it is

considered more practical for the Company to take direct charge of

the investment strategy and thus eliminate a layer of costly

bureaucracy inherent in a formal investment management agreement.

As discussed in paragraph 3 below, the impetus for the Proposals

came from certain major Shareholders, who had expressed a concern

about the cash cost of running what had become a relatively small

investment trust.

The Board therefore consider that it is in Shareholders'

interests to eliminate the cash management fee and replace this

with an arrangement that more closely aligns the reward of the key

executives with the interests of Shareholders, being share price

performance.

The Board have also been giving consideration to the Company's

investment policy given the commodity markets have started to

recover this year: after a prolonged and severe downturn, investor

interest has been focused only towards the large capitalisation

stocks or those with operational assets and positive cash flows.

Exploration and early stage development companies, which were the

original focus of the portfolio have remained largely ignored by

investors and have continued to underperform. Consequently, we have

been reducing our portfolio exposure to those grass root, early

exploration companies and focusing more heavily on those companies

with potentially large scale assets that also have the ability to

bring them into production over the coming years. Consequently we

would like to increase our focus on those types of companies, as we

believe that they offer the best value within the junior resources

market. However, such a change in focus will require a change to

the investment policy.

We will continue to maintain a diversified portfolio, both

geographically and by commodity, and we will also continue to

maintain a spread of investments. However, it will become a more

focused portfolio, on those companies that we have identified with

a significant asset base and who also have the ability to make the

transition from development company to producer.

3. DETAILS OF THE RELATED PARTY TRANSACTION

RDP has been the Company's Investment Manager since IPO

Admission and remains as such as at the date of this Document.

David Hutchins, the Proposed Director, is one of two partners of

RDP. As at the LPD, RDP held the 50,000 Existing Ordinary Shares

and 50,000 Deferred Shares.

RDPL is wholly owned by David Hutchins. RDPL is a management

services company which provides office space and support services

to RDP. David Hutchins, the Proposed Director, is on the board of

RDPL. As at the LPD, RDPL held 400,000 Existing Ordinary Shares and

GBP50,000 nominal of Loan Notes.

It is proposed that the Investment Management Agreement is

terminated under the terms of which the consideration in full

settlement of the Company's obligations under the agreement is as

follows:

3.1. The payment by the Company to RDP of:

(i) GBP100,000 ("First Payment") on Admission ("First Trigger")

(ii) GBP100,000 ("Second Payment") when the Closing Price

remains for a period of at least one month at or above each of 14p

("Second Trigger");

(iii) GBP100,000 ("Third Payment") when the Closing Price

remains for a period of at least one month at or above each of 16p

("Third Trigger"); and

(iv) GBP100,000 ("Fourth Payment") when the Closing Price

remains for a period of at least one month at or above each of 18p

("Fourth Trigger").

3.2. Subject to:

(i) the occurrence of the First Trigger, RDP shall subscribe at

GBP0.05 per Ordinary Share for 2,000,000 Ordinary Shares ("First

Subscription");

(ii) the occurrence of the Second Trigger, RDP shall subscribe

at GBP0.05 per Ordinary Share for 2,000,000 Ordinary Shares

("Second Subscription");

(iii) the occurrence of the Third Trigger, RDP shall subscribe

at GBP0.05 per Ordinary Share for 2,000,000 Ordinary Shares ("Third

Subscription"); and

(iv) the occurrence of the Fourth Trigger, RDP shall subscribe

at GBP0.05 per Ordinary Share for 2,000,000 Ordinary Shares

("Fourth Subscription").

3.3. The Company and RDP have the right to set off the First

Payment against the First Subscription, the Second Payment against

the Second Subscription, the Third Payment against the Third

Subscription, and the Fourth Payment against the Fourth

Subscription.

3.4. In the case of each issuance of Ordinary Shares in 3.2

above, RDP has agreed to a lock-in period of six months from the

date of each respective issue.

3.5. The Company shall not be required to issue any Ordinary

Shares to RDP to the extent that doing so will require it to issue

a prospectus. Any Ordinary Shares not issued by the Company

pursuant to the Termination Agreement will be issued as soon as the

Company is able to issue such Ordinary Shares.

3.6. The Company shall not be required to issue any Ordinary

Shares to RDP, or make the corresponding payment to RDP, to the

extent that the Company does not have authority to issue shares.

Any Ordinary Shares not issued, or payment not made, by the Company

pursuant to this deed will be issued and/or paid as soon as the

Company is able to issue such Ordinary Shares.

The terms of the Proposals set out above have been determined

following consultation with certain major Shareholders who had

expressed concern about the cash cost of the ongoing management

arrangements under the Investment Management Agreement, and of whom

three are providing irrevocable undertakings as referred to in

paragraph 9 below. The value of the subscriptions set out above

reflect the share price at the time of these discussions and when

the "in principle" support of these Shareholders was obtained.

The New Ordinary Shares will rank pari passu in all respects

with the Existing Ordinary Shares, including the right to receive

all dividends and other declarations, made or paid on the Existing

Ordinary Shares after Admission.

Applications are being made for the 2,000,000 New Ordinary

Shares now being issued pursuant to the Proposals to be admitted to

listing on the premium listing segment of the Official List and to

trading on the Main Market. It is expected that such admission will

become effective and such dealings will commence on or around 17

January 2017 and the Termination Agreement is conditional on this

taking place.

The Board considers that it is attractive to terminate the

Investment Management Agreement on a basis that aligns the

Investment Manager's interests with those of the Shareholders,

considering the termination fee to be paid in accordance with the

termination provisions of the Investment Management Agreement which

would have been GBP309,891 in cash. The Board has taken into

account that whilst the value of the New Ordinary Shares is in

excess of this amount, only 2,000,000 New Ordinary Shares to an

agreed value of GBP100,000 are being issued at this stage, and the

remainder will depend on the significant increases in the prices of

the Ordinary Shares as set out above, which will be in the

interests of Shareholders as a whole.

In accordance with the Termination Agreement, and in order to

provide ongoing office support services, GRIT and RDP have also

entered into the Transitional Services Agreement, under which RDP

will provide certain back office functions to GRIT. This agreement

is for a period of 12 months and RDP shall be entitled to recover

the costs and expenses of providing these services to GRIT, such

amount not to exceed GBP40,000.

In addition, the Company is proposing to enter into the Service

Agreement with the Proposed Director for an annual salary of

GBP20,000, further details of which are set out in paragraph

2.8(iv) of Part II of the Document.

Following the Proposals, RDP will continue to hold GBP50,000

nominal of Loan Notes and initially 2,400,000 Ordinary Shares

rising to a maximum of 8,400,000 Ordinary Shares under the

arrangements set out above.

The new Manager Agreements (comprising the Termination

Agreement, the Transitional Services Agreement and the Service

Agreement) are classified as a 'related party transaction' under

the Listing Rules as they are a transaction with the Investment

Manager. Consequently, these agreements are subject to, and

conditional upon, inter alia, the approval of Shareholders at the

General Meeting.

4. PROPOSED BOARD CHANGE

On approval of the Proposals, it is intended that David

Hutchins, the Proposed Director, will be appointed as an Executive

Director of GRIT. Further details, including details of current and

past directorships and/or partnerships of the Proposed Director are

as follows:

The business address of the Proposed Director is 4(th) Floor,

Vintners Place, 68 Upper Thames Street, London EC4V 3BJ(Tel: +44

(0) 20 7290 8540) on appointment.

David (Sam) James Hutchins (aged 56) (Executive Director)

David has 30 years' experience as a resources analyst and fund

manager. His career began with the Melbourne Stock Exchange in 1979

and he subsequently became an executive director of M&G

Investment Management in London. He headed the International Desk

at M&G Investment Management from 1995, where he was

concurrently responsible for M&G's investments in the precious

metals and commodities sector globally. He later became involved in

Fund Management with Yorkton and AWI Administration Services. He

was a founding director of Resources Investment Trust plc at its

launch in January 2002, and Chief Executive of Ocean Resource

Capital Holdings plc which was admitted to the AIM Market of the

London Stock Exchange from 2003 to 2007.

In 2008, he became a director and fund manager of Grafton

Resource Investments Limited, a Cayman Island exempt company

investing in the resource sector. David was also a founding partner

of www.minesite.com, a resource industry specific news related

website and conference business, and is a member of the FTSE gold

mines index committee. David is also one of two partners of RDP,

the Company's Investment Manager as at the date of this Document,

and has been a designated member of the team managing GRIT's

Portfolio since IPO Admission. David is also a member of the

Chartered Institute for Securities and Investment.

Director / Current Past

Proposed Director Directorships/Partnerships Directorships/Partnerships

------------------- -------------------------------- ----------------------------

David Hutchins Endstone Capital Limited Napolean Energy

(Proposed RDP Fund Management Limited

Director) LLP U30 Limited

Grafton Resource Investments Global Resources

Limited Investment Trust

Resources Development PLC

Partners Limited Coinworks Limited

Global Resources International Toxic Friction

Limited Limited

Robdale Investments GRIT ZDP Limited

Limited

Aresa Investments

Limited

------------------- -------------------------------- ----------------------------

5. ADOPTION OF THE NEW INVESTMENT POLICY

Current Investment Policy

As at the date of this Document, the Company's investment

policy, as it has been since IPO Admission, is as follows:

"GRIT will seek to achieve its investment objective through

investment in companies globally which have a significant focus on

natural resources and mining. GRIT will invest in companies that

are in the field of the exploration and production of oil, gas,

precious and industrial metals, and industrial and commercial

minerals which, in the opinion of GRIT's investment manager, have

the potential to increase their value considerably. These companies

may be producing companies with a historical track record of

production or they may be development companies or companies with

exploration potential. GRIT will seek to ensure, through active

shareholder involvement, that investee companies act to maximise

long-term shareholder value. GRIT will invest primarily in

companies with shares and securities which are listed, quoted or

are admitted to dealing, on a relevant exchange (including debt

securities which are convertible into quoted equity securities).

For the purpose of this investment policy, a "relevant exchange" is

(i) a regulated market, recognised investment exchange, recognised

stock exchange, recognised overseas investment exchange or

designated investment exchange, or (ii) a junior market operated by

the operator of an exchange referred to in (i).

However GRIT may hold some investments in non-quoted, seed

capital or pre-IPO companies.

Any material changes to GRIT's investment policy will only be

made with the approval of Shareholders by ordinary resolution.

Risk diversification, asset allocation and maximum exposures

GRIT will seek to diversify its investments across a number of

companies, with a range of natural resource assets, in

jurisdictions globally. There are no restrictions as to the

commodity classes and geographical regions into which GRIT may

invest, however, GRIT will invest and manage its assets in a way

which is consistent with its object of spreading risk. GRIT will

adhere to the following investment restrictions:

Ø GRIT may only invest up to 10 per cent. of its Gross Asset

Value (at the time of investment) in non-quoted, seed capital or

pre-IPO;

Ø GRIT will not invest more than 15 per cent. of its Gross Asset

Value in any one company (measured at the time of investment);

Ø GRIT will not take legal or management control over

investments in its Portfolio;

Ø GRIT will not invest more than 10 per cent., in aggregate, of

its Gross Asset Value in other listed closed-ended investment

funds;

Ø distributable income (if any) will be principally derived from

investments. GRIT will not conduct a trading activity which is

significant in the context of the activities of GRIT as a

whole;

Ø GRIT will not enter into derivative transactions for

speculative purposes. GRIT does not expect to enter into any

hedging transactions, although it may do so for the purposes of

efficient portfolio management and to hedge against exposure to

changes in currency rates to the full extent of any such

exposure.

GRIT will hold any uninvested funds in cash, cash equivalents or

other liquid instruments with a view to maximising the returns on

any such funds.

For the purpose of this investment policy, "Gross Asset Value"

shall mean the aggregate value of the gross assets of GRIT,

calculated in accordance with the accounting policies adopted by

GRIT from time to time."

Background to Proposed New Investment Policy

As the commodity markets have started to recover this year:

after a prolonged and severe downturn, investor interest has been

focused only towards the large capitalisation stocks or those with

operational assets and positive cash flows. Exploration and early

stage development companies, which were the original focus of the

portfolio have remained largely ignored by investors and have

continued to underperform. Consequently, we have been reducing our

portfolio exposure to those grass root, early exploration companies

and focusing more heavily on those companies with potentially large

scale assets that also have the ability to bring them into

production over the coming years. Consequently, we would like to

increase our focus on those types of companies, as we believe that

they offer the best value within the junior resources market.

However, such a change in focus will require a change to the

investment policy.

We will continue to maintain a diversified portfolio, both

geographically and by commodity, and we will also continue to

maintain a spread of investments. However, it will become a more

focused portfolio, on those companies that we have identified with

a significant asset base and who also have the ability to make the

transition from development company to producer.

It is proposed that as part of the New Investment Policy, the

investment limit for any single investment is increased to above 15

per cent. but limited to not more than 40 per cent of Gross Asset

Value. There are currently no specific agreements or proposals to

either make new investments or to increase existing holdings above

15 per cent, but the Board would like to have the ability to

increase any investment beyond 15 per cent. if the opportunity

presented itself. An investment beyond 15 per cent will not be the

norm. It is anticipated that the Board will maintain a diverse

portfolio with only 1 or 2 investments going beyond 15 per cent at

any point in time. With the remainder of the portfolio being spread

amongst a number of diverse investments in line with the New

Investment Policy, the Board is of the view that the Company will

be able to invest and manage its assets in a way which is

consistent with its objective of spreading investment risk.

It should be noted that due to the reduction in net asset value

since IPO Admission, and share performance of the investments, a

number of holdings which are in compliance with the Current

Investment Policy now represent over 20 per cent. of Gross Asset

Value (being: Siberian Goldfields - 30.7 per cent.; and Merrex Gold

- 20.0 per cent.) will also be in line with the New Investment

Policy if agreed.

New Investment Policy

It is proposed that from Completion, the Company will adopt the

New Investment Policy which will enable the Company to focus on

specific opportunities that may arise, which the Directors and the

Proposed Director believe demonstrate the potential to become major

mining projects.

The New Investment Policy is set out below and the bold

underlined text indicates the changes proposed:

"GRIT will seek to achieve its investment objective through

investment in companies globally which have a significant focus on

natural resources and mining. GRIT will invest in companies that

are in the field of the exploration and production of oil, gas,

precious and industrial metals, and industrial and commercial

minerals which, in the opinion of GRIT's investment manager, have

the potential to increase their value considerably. These companies

may be producing companies with a historical track record of

production or they may be development companies or companies with

exploration potential. GRIT will seek to ensure, through active

shareholder involvement, that investee companies act to maximise

long-term shareholder value. GRIT will invest primarily in

companies with shares and securities which are listed, quoted or

are admitted to dealing, on a relevant exchange (including debt

securities which are convertible into quoted equity securities).

For the purpose of this investment policy, a "relevant exchange" is

(i) a regulated market, recognised investment exchange, recognised

stock exchange, recognised overseas investment exchange or

designated investment exchange, or (ii) a junior market operated by

the operator of an exchange referred to in (i).

However GRIT may hold some investments in non-quoted, seed

capital or pre-IPO companies.

Any material changes to GRIT's investment policy will only be

made with the approval of Shareholders by ordinary resolution.

Risk diversification, asset allocation and maximum exposures

GRIT will seek to diversify its investments across a number of

companies, with a range of natural resource assets, in

jurisdictions globally. There are no restrictions as to the

commodity classes and geographical regions into which GRIT may

invest, however, GRIT will invest and manage its assets in a way

which is consistent with its object of spreading risk. GRIT will

adhere to the following investment restrictions:

Ø GRIT may only invest up to 10 60 per cent. of its Gross Asset

Value (at the time of investment) in non-quoted, seed capital or

pre-IPO companies provided that at any one time such new

investments above a 15 per cent. limit will not be in more than two

companies, with an emphasis in such instances on potentially large

scale assets that also have the ability to bring them to production

in the coming years ;

Ø GRIT will not invest more than 15 40 per cent. of its Gross

Asset Value in any one company (measured at the time of investment)

provided that at any one time such new investments above a 15 per

cent. limit will not be in more than two companies, with an

emphasis in such instances on potentially large scale assets that

also have the ability to bring them to production in the coming

years;

Ø GRIT will not take legal or management control over

investments in its Portfolio;

Ø GRIT will not invest more than 10 per cent., in aggregate, of

its Gross Asset Value in other listed closed-ended investment

funds;

Ø distributable income (if any) will be principally derived from

investments. GRIT will not conduct a trading activity which is

significant in the context of the activities of GRIT as a

whole;

Ø GRIT will not enter into derivative transactions for

speculative purposes. GRIT does not expect to enter into any

hedging transactions, although it may do so for the purposes of

efficient portfolio management and to hedge against exposure to

changes in currency rates to the full extent of any such

exposure;

Ø GRIT will not incur any debt beyond such amount that is

covered four times by the gross value of its investments at the

time of incurring such debt (ie a "4 to 1 cover ratio);

Ø GRIT will manage the overall portfolio to ensure that there is

a spread of investments to provide diversification, with a target

of having between 10 and 20 different investments at any one

time.

GRIT will hold any uninvested funds in cash, cash equivalents or

other liquid instruments with a view to maximising the returns on

any such funds.

For the purpose of this investment policy, "Gross Asset Value"

shall mean the aggregate value of the gross assets of GRIT,

calculated in accordance with the accounting policies adopted by

GRIT from time to time."

Investment Objective

At Completion, GRIT's investment objective will be as it has

been since IPO Admission which is to generate medium and long-term

capital growth through investing in a diverse portfolio of

primarily small and mid-capitalisation natural resources and mining

companies which are listed, traded or quoted on a Relevant

Exchange.

6. GENERAL MEETING AND UNDERTAKINGS

You will find at the end of this Document the Notice of General

Meeting, to be held at the offices of DMH Stallard LLP at 6 New

Street Square, New Fetter Lane, London EC4A 3BF at 12.00 noon . At

the General Meeting Resolutions to approve the new Manager

Agreements as a related party transaction under the Listing Rules

will be proposed, as an ordinary resolution (resolution 2). In

addition, ordinary resolution 1, and special resolution 4 (together

the "Share Resolutions") will be proposed to grant authorities to

issue Ordinary Shares to RDP pursuant to the Termination Agreement,

and ordinary resolution 3 will be proposed to adopt the New

Investment Policy.

RDP is a related party of the Company under the Listing Rules.

RDPL is a Connected Person of RDP. RDP and RDPL will therefore not

be permitted to vote, and have undertaken not to vote, (and to take

all reasonable steps to ensure that each of their Connected Persons

and/or associates (as defined in the glossary to the Listing Rules)

do not vote) on any of the Resolutions in respect of their

aggregate holding of Existing Ordinary Shares amounting to 450,000

Existing Ordinary Shares, representing approximately 1.13 per cent.

of the Existing Ordinary Share Capital.

7. ACTION TO BE TAKEN

A Form of Proxy is enclosed for use by Shareholders at the

General Meeting. Whether or not Shareholders intend to be present

at the General Meeting, they are asked to complete, sign and return

the Form of Proxy by post to the Company's Registrars,

Computershare Investor Services PLC, The Pavilions, Bridgwater

Road, Bristol, BS99 6ZY or by hand to Computershare Investor

Services PLC, The Pavilions, Bridgwater Road, Bristol, BS13 8AE as

soon as possible, but in any event so as to be received by 12.00

noon on 12 January 2017. The completion and return of a Form of

Proxy will not preclude a Shareholder from attending the General

Meeting and voting in person should he or she wish to do so.

Shareholders who hold their Existing Ordinary Shares through a

nominee should instruct the nominee to submit the Form of Proxy on

their behalf.

CREST members who wish to appoint a proxy or proxies through the

CREST electronic proxy appointment service may do so for the

General Meeting and any adjournment(s) thereof by using the

procedures described in the CREST manual. CREST personal members or

other CREST sponsored members and those CREST members who have

appointed (a) voting service provider(s) should refer to their

CREST sponsor or voting service provider(s), who are able to take

the appropriate action on their behalf. In order for a proxy

appointment or instruction made using the CREST service to be

valid, the appropriate CREST message (a 'CREST Proxy Instruction')

must be properly authenticated in accordance with CREST

specifications and must contain the information required for such

instructions, as described in the CREST manual.

For this purpose, the time of receipt will be taken to be the

time (as determined by the timestamp generated by the CREST system)

from which the issuer's agent is able to retrieve the message. All

messages relating to the appointment of a Proxy or an instruction

to a previously appointed Proxy must be transmitted so as to be

received by Computershare Investor Services PLC (ID: 3RA50) by no

later than 12.00 noon on 12 January 2017. Normal system timings and

limitations will apply in relation to the input of CREST Proxy

Instructions. It is therefore the responsibility of the CREST

member concerned to take such action as shall be necessary to

ensure that a message is transmitted by means of the CREST system

by any particular time. In this connection, CREST members and,

where applicable their CREST sponsor(s) or voting service

provider(s) are referred, in particular, to those sections of the

CREST manual concerning practical limitations of the CREST system

and timings. The Company may treat as invalid an appointment sent

by CREST in the circumstances set out in Regulation 35(5)(a) of the

Uncertificated Securities Regulations 2001.

If you are in any doubt as to what action you should take, or

the contents of this Document, you are recommended to consult

immediately your stockbroker, bank manager, solicitor, accountant,

fund manager or other appropriate independent financial adviser

being a firm authorised under the FSMA, or otherwise from another

appropriately authorised independent financial adviser if you are

in a territory outside the United Kingdom.

8. FURTHER INFORMATION

The Document is available, subject to certain restrictions, to

Shareholders on the Company's website (www.grit.london) and at its

registered office.

Shareholders should read the whole of the Document, which

provides additional information on the Company and the Proposals,

and should not rely on summaries of, or individual parts only of

the Document.

9. RECOMMATION

The Board, having been so advised by Beaumont Cornish (the

Company's Sponsor and Financial Adviser), considers that the new

Manager Agreements are fair and reasonable as far as the

Shareholders are concerned. In giving its advice, Beaumont Cornish

has taken account of, but not relied on, the commercial assessments

of the Directors.

The Board consider that the new Manager Agreements and the

adoption of the New Investment Policy are in the best interests of

the Shareholders and the Company as a whole and unanimously

recommend that Shareholders vote in favour of the Resolutions to be

proposed at the General Meeting. If one or more of these

Resolutions is not passed, then the existing manager agreements and

the current investment policy will remain. The Board, however,

would like Shareholders to consider what we say above in that the

new Manager Agreements are proposed as a means of streamlining the

management of the Company, together with the associated costs, and

the New Investment Policy is being proposed to provide the Company

with the opportunity of making investments in larger scale projects

with the intention of enhancing the returns to Shareholders

RDP is a related party of the Company under the Listing Rules

and RDPL is a Connected Person of RDP. RDP and RDPL will not

therefore be permitted to vote, and have undertaken not to vote,

(and to take all reasonable steps to ensure that each of their

Connected Persons and/or associates (as defined in the glossary to

the Listing Rules) do not vote) on the Resolutions in respect of

their aggregate holding of Existing Ordinary Shares amounting to

450,000 Existing Ordinary Shares, representing approximately 1.13

per cent. of the Existing Ordinary Share Capital.

The Company has received irrevocable undertakings in relation to

the Proposals from the following, which represent a total holding

of 4,957,290 Existing Ordinary Shares or 12.4% of the Ordinary

Share Capital: Arakan Resources Limited, representing a holding of

826,090 Existing Ordinary Shares or 2.06 per cent of the Ordinary

Share Capital; NuLegacy Gold Corporation representing a holding of

1,731,200 of Existing Ordinary Shares or 4.33 per cent. of the

Ordinary Share Capital; and RS and CA Jennings, representing a

holding of 2,400,000 Existing Ordinary Shares or 6.00 per cent. of

the Ordinary Share Capital.

Enquiries to:

David ("Sam") Hutchins, Tel: +(020) 7290

RDP Fund Management LLP 8540

Investment Manager

------------------------------------- -----------------

Martin Cassels Tel: +(0) 131

R&H Fund Services Limited 524 6140

Company Secretary and Administrator

------------------------------------- -----------------

Roland Cornish / Felicity Geidt Tel: +(020) 7628

Beaumont Cornish Limited 3396

Financial Adviser

------------------------------------- -----------------

APPIX

DEFINITIONS

The following defined terms apply throughout this announcement

and are extracted from the Document, unless the context requires

otherwise:

"Act" Companies Act 2006 (as amended)

"Adjusted NAV" the audited Net Asset Value of

GRIT adjusted to add back the

value of any distributions paid

during the relevant performance

period

"Administrator" R&H Fund Services Limited

or "Secretary"

"Admission" admission of the New Ordinary

Shares to the premium listing

segment of the Official List and

to trading on the Main Market

becoming effective

"Articles" the articles of association of

the Company from time to time

"Beaumont Cornish" Beaumont Cornish Limited, the

or "Sponsor" Company's financial adviser and

sponsor, a member of the London

Stock Exchange and which is authorised

and regulated by the FCA with

its registered office at 3 Hardman

Street Manchester M3 3HF

"Benchmark" (a) as at the first calculation

date the NAV on IPO Admission

as increased by the Benchmark

Hurdle Rate in respect of the

period from IPO Admission to such

calculation date and (b) on each

subsequent calculation date the

Target NAV on the immediately

preceding calculation date, increased

by the Benchmark Hurdle Rate,

in respect of the period from

the immediately preceding calculation

date to the relevant calculation

date

"Benchmark Hurdle a rate of 7 per cent. per period

Rate" between calculation dates save

that where such period is more

or less than 12 months the rate

shall be increased or decreased

pro rata by the amount the period

is greater or less than 12 months

"Board" the directors of the Company from

time to time

"Business Day" any day (other than a Saturday,

Sunday or a public holiday) on

which banks are generally open

in the City of London for the

transaction of normal banking

business

"certi cated" a share or other security recorded

or "in certi on the relevant register of the

cated form" company as being held in certi

cated form and title to which

may be transferred by means of

a stock transfer form

"Closing Price" the closing middle-market quotation

of an Ordinary Share, as established

in the daily official list of

the London Stock Exchange

"Company" or Global Resources Investment Trust

"GRIT" Plc, a company incorporated in

England and Wales with registered

number 8256031

"Completion" completion of the Proposals which

is conditional on Admission

"Connected Persons" has the meaning set out in section

252 and section 254 of the Act

and includes a spouse, children

under 18 and any company in which

the relevant person is interested

in shares comprising at least

one-fifth of the share capital

of that company and set out in

1122(2) of the CTA 2010 and includes

a company being connected with

another company

"Control" the power (whether by way of ownership

of shares, proxy, contract, agency

or otherwise) to: (a) cast, or

control the casting of, 30 per

cent. or more of the maximum number

of votes that might be cast at

a general meeting of the Company;

or (b) appoint or remove all,

or the majority, of the directors

of the Company; and/or (ii) the

holding beneficially 30 per cent.

or more of the issued share capital

of the Company (excluding any

part of that issued share capital

that carries no right to participate

beyond a specified amount in a

distribution of either profits

or capital)

"CREST" the relevant system, as de ned

in the CREST Regulations, for

the paperless settlement of share

transfers and the holding of shares

in uncerti cated form in respect

of which Euroclear is the operator

(as de ned in the CREST Regulations)

"CREST Regulations" the Uncerti cated Securities Regulations

2001 (SI 2001 No. 2001/3755) (as

amended)

"CREST Rules" the rules governing the operation

of CREST, consisting of the CREST

Reference Manual, CREST International

Manual, CREST Counterparty Service

Manual, CREST Rules, Registrars

Service Standards, Settlement

Discipline Rules, CCSS Operations

Manual, Daily Timetable, CREST

Application Procedures and CREST

Glossary of Terms (all as defined

in the CREST Glossary of Terms

promulgated by Euroclear on 15

July, 1996 and as amended since

that date)

"CTA 2010" the Corporation Tax Act 2010 and

any statutory modification or

re-enactment thereof for the time

being in force

"Deferred Shares" the existing 50,000 deferred shares

of GBP0.99 each in the capital

of the Company

"Directors" the directors of the Company as

at the date of the Document

"Document" the document

"Excluded Territory" the United States, the Republic

of South Africa, the Republic

of Ireland, Australia, or Japan

or any other jurisdiction where

access to this Document would

constitute a violation of the

relevant laws of such jurisdiction

"Existing Ordinary the issued Ordinary Shares as

Share Capital" at the date of this Document

"Existing Warrants" the existing warrants to subscribe

for new Ordinary Shares

"Existing Ordinary the 39,970,012 Ordinary Shares

Shares" in issue at the date of this Document

"FCA" the United Kingdom Financial Conduct

Authority

"Form of Proxy" the form of proxy accompanying

this Document to be used by Shareholders

in respect of the General Meeting

"FSMA" the Financial Services and Markets

Act 2000 of the United Kingdom

and any statutory modification

or re-enactment thereof for the

time being in force

"General Meeting" the general meeting of the Company

convened for 12.00 noon on 16

January 2017, the notice convening

which is set out in Part IV at

the end of the Document

"Gross Asset the aggregate value of the gross

Value" assets of GRIT, calculated in

accordance with the accounting

policies adopted by GRIT from

time to time

"Investment Management the investment management agreement

Agreement" dated 20 February 2014 between

the Company and RDP, a summary

of which is summarised in paragraph

4.1 of Part II (Additional Information)

of this Document, which is proposed

to be terminated by mutual consent

on Completion

"IPO Admission" the admission of the Ordinary

Shares issued pursuant to the

Company's initial public offering

to the premium listing segment

of the Official List and to trading

on the Main Market, which occurred

on 7 March 2014

"ISIN" International Securities Identifying

Number

"LIM" LIM Asia Multi-Strategy Fund Inc

"Listing Rules" the listing rules made by the

UKLA under section 73A of FSMA,

as amended from time to time

"Loan Note Holders" the holders of the Loan Notes

"Loan Note Instrument" the loan note instrument executed

by GRIT constituting the Loan

Notes and dated 27 February 2014,

which is summarised in paragraph

4.4 of Part II (Additional Information)

of the Document

"Loan Notes" the GBP5 million nominal of 9

per cent. convertible unsecured

loan notes of the Company which

were issued to the Loan Note Holders

pursuant to the Loan Note Instrument

of which GBP4,850,000 were issued

since IPO Admission

"London Stock London Stock Exchange plc

Exchange"

"LPD" 20 December 2016, being the last

practicable date prior to the

publication of the Document

"Main Market" the regulated market of the London

Stock Exchange for officially

listed securities

"Manager Agreements" the Termination Agreement, the

Transitional Services Agreement

and the Service Agreement as further

set out in paragraph 3 of Part

I (Letter from the Chairman) of

the Document

"Month" calendar month

"Monthly Average the aggregate daily NAVs for each

NAV" Month divided by the number of

Business Days in that Month adjusted

to add back the value of any distributions

paid during the relevant performance

period

"Net Asset Value" the value of the assets of GRIT

or "NAV" less its liabilities in total

calculated in accordance with

the accounting policies adopted

by GRIT from time to time

"Net Asset Value NAV divided by the number of Ordinary

per Share" Shares in issue from time to time

"New Investment the proposed new investment policy

Policy" to be adopted by the Company on

Completion and as set out in paragraph

5 of Part I (Letter from the Chairman)

of this Document

"New Ordinary the 2,000,000 ordinary shares

Shares" of GBP0.01 each to be issued to

RDP pursuant to the Termination

Agreement

"Notice of General the notice of the General Meeting

Meeting" set out in Part IV at the end

of the Document

"Official List" the official list maintained by

the UKLA

"Ordinary Shares" the issued ordinary shares of

GBP0.01 each in the capital of

the Company from time to time

"Portfolio" the portfolio of investments of

GRIT from time to time

"Proposals" the new Manager Agreements, the

adoption of the New Investment

Policy and the Share Resolutions

"Proposed Director" David Hutchins, the proposed director

to be appointed to the Board on

Completion

"RDP" or "Investment RDP Fund Management LLP, being

Manager" the Company's investment manager

as at the date of this Document,

whose principal place of business

and registered office is at 4(th)

Floor, Vintners Place, 68 Upper

Thames Street, London EC4V 3BJ

(Tel: +44 (0)20 7290 8540)

"RDPL" Resources Development Partners

Limited, a company wholly owned

by David Hutchins, the Proposed

Director

"Registrar" or Computershare Investor Services

"Receiving Agent" PLC

"Related Party the related party transaction

Transaction" as set out in part II (Letter

from the Chairman) of the Document

"Relevant Exchange" (i) a regulated market, recognised

investment exchange, recognised

stock exchange, recognised overseas

investment exchange or designated

investment exchange, or (ii) a

junior market operated by the

operator of an exchange referred

to in (i)

"Resolutions" the resolutions set out in the

Notice of General Meeting in Part

IV at the end of this Document

"Service Agreement" the service agreement with the

Proposed Director to be entered

into between GRIT and David Hutchins

whereby David Hutchins will be

appointed as a Director, conditional

upon Admission

"Share Resolutions" resolutions 1 and 4 set out in

the Notice of General Meeting

in Part IV at the end of the Document

relating to sections 551 (1)(a)

and (b) and section 570 of the

Act respectively

"Shareholders" person(s) who is/are registered

holder(s) of Ordinary Shares from

time to time

"Sterling" "GBP" the lawful currency of the UK

or "pence"

"Target NAV" at any calculation date the higher

of the (a) NAV, and (b) the Benchmark,

as at the preceding calculation

date as increased by the Benchmark

Hurdle Rate in respect of the

period from the preceding calculation

date to the relevant calculation

date

"Termination the agreement to be entered into

Agreement" between the Company and RDP and

which formalises the Manager Arrangements,

further details of which are summarised

in paragraph 4.6 of Part II (Additional

Information) of the Document

"Transitional the agreement to be entered into

Services Agreement" between the Company and RDP further

details of which are contained

in paragraph 4.7 of Part II (Additional

Information) of the Document

"UK Listing Authority" the FCA acting in its capacity

or "UKLA" as the competent authority for

the purposes of Part VII of FSMA

"UK" or "United the United Kingdom of Great Britain

Kingdom" and Northern Ireland

"uncerti cated" a share or other security recorded

or "in on the relevant register of the

uncerti cated relevant company concerned as

form" being held in uncerti cated form

in CREST and title to which, by

virtue of the CREST Regulations,

may be transferred by means of

CREST

"United States" the United States of America,

or "U.S." its territories and possessions,

any State of America and the District

of Columbia

"U.S. Commodity the United States Commodity Exchange

Exchange Act" Act of 1936, as amended

"US Person" a citizen or resident of the United

States, a corporation, partnership

or other entity created or organised

in or under the laws of the United

States or any person: (i) falling

within the definition of the term

"United States Person" in Regulation

S promulgated under the U.S. Securities

Act; or (ii) who is not a "Non-United

States person" as that term is

defined in Rule 4.7 promulgated

under the U.S. Commodity Exchange

Act

"U.S. Securities the U.S. Securities Act of 1933,

Act" or "Securities as amended

Act"

"US$" or "US the legal currency of the United

Dollars" or "cents" States

"VAT" value added tax

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUASBRNBAUUAA

(END) Dow Jones Newswires

December 21, 2016 12:55 ET (17:55 GMT)

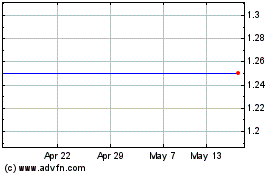

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

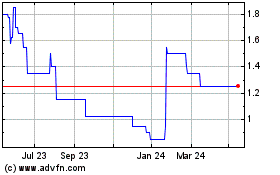

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Jul 2023 to Jul 2024