TIDMGLR

RNS Number : 3962N

Galileo Resources PLC

29 January 2021

Galileo Resources PLC

("Galileo" or "the Company" or "the Group")

Unaudited interim results for the six months ended 30 September

2020

Galileo (AIM: GLR) , the exploration and development mining

company, announces its unaudited interim results for the six-month

period ended 30 September 2020. A copy of the interim results is

available on the Company's website, www.galileoresources.com .

Operational Highlights

BOTSWANA

Acquisition of Exploration Assets in Botswana

Period under review

-- Galileo acquired 100% of Botswana-incorporated Crocus-Serv

(Pty) Ltd ("Crocus"), whose assets comprise of 21 copper and

nickel-PGE (Platinum Group Elements) exploration Prospecting

Licences ("PLs") in the highly prospective Kalahari Copper Belt

("KCB") and the Limpopo Mobile Belt ("LMB") in western and eastern

Botswana respectively. The consideration of GBP163,020 for the

acquisition comprised the issue of a total 38,814,246 new Galileo

ordinary shares of 0.1p at 0.42p each and a separate cash payment

of GBP10,828.

-- The Company commenced development of an exploration programme for the KCB properties.

-- The Company's subsidiary, Crocus, submitted, in terms of the

Botswana Environmental Assessment Act (2011), a draft Environmental

Management Plan ("EMP") for the KCB project to the Department of

Environmental Affairs ("DEA") Botswana for review.

Post the period under review

-- Galileo undertook a heliborne-EM geophysical surveying over

several licences in its highly prospective Kalahari Copper Belt

Project, specifically PL250/2018, PL251/2018, PL39/2018 and

PL40/2018. Preliminary overview of the results is considered very

promising, with the EM data interpreted to show several highly

prospective geological settings for copper-silver mineralisation.

Detailed data interpretation is under way, utilising Spectral

Geophysics, a consultancy that was involved in the discovery of the

A4 Dome deposit (targeted from EM data) and the Company will

announce these conclusions once known. The most prospective EM

targets will be selected for early drill testing.

-- On 16 October 2020, Galileo completed (the "Completion Date")

of the acquisition of 100% of Africibum Co Pty Ltd ("Africibum")

and its interests in the North East Kalahari Copper Belt Project in

Botswana. The Company acquired 100% of Africibum Co (Pty) Ltd,

incorporated in Botswana (Company number 1828747) ("Africibum") and

its 100% interest in five prospecting licences PL366/2018,

PL367/2018, PL368/2018, PL122/2020, PL123/2020 and two mining

tenement applications in Botswana (the "North East Kalahari Copper

Belt Project").

-- The Africibum licences include the Quirinus copper-silver

prospect with historic shallow drill intercepts in a three- hole RC

drilling programme which include 4m @ 1.7% Cu, 13g/t Ag and 6m @

0.9% Cu, 14g/t Ag. The intercepts occur within a series of

copper-in-soil anomalies that extend for 13.4km in total, much of

it untested.

-- The Quirinus prospect lies within 15km of major copper-silver

discoveries, part of Cupric Canyon Capital's Khoemacau Project.

-- On 25 January 2021 Galileo entered into two legally binding

agreements with ASX listed Sandfire Resources Limited (ASX: SFR)

("Sandfire"). The first agreement being a conditional licence sale

agreement (the "Licence Sale Agreement") and the second a share

subscription agreement (the "Share Subscription Agreement"). The

Licence Sale Agreement provides for the sale of 9 of the Company's

Kalahari Copper Belt Licences (the "Included Licences") which the

Company acquired in May and October 2020. Sandfire will pay an

aggregate consideration of US$3 million payable on the Settlement

Date of which US$1.5 million will be paid in cash and US$1.5

million by the issue of 370,477 Sandfire ordinary shares to the

Company at an issue price of A$5.227 per share, being the VWAP of

the Sandfire share price for the 10 trading days prior to the date

of signing the Licence Sale Agreement. Under the terms of the

agreements Sandfire committed to spend US$4 million on the Included

Licences within two years of settlement and if the US$4 million is

not spent, any shortfall will be paid to the Company. (Sandfire

will have a first right of refusal in relation to the acquisition

of the 15 Kalahari Copper Belt Licences being retained by the

Company (the "Excluded Licences") ("ROFR: Excluded Licences").

Settlement is conditional upon:

o The parties having executed the Share Subscription

Agreement;

o Ministerial consent for the transfer of the Included Licences

by the Botswana Minister of the Ministry of Minerals, Energy and

Water Resources ("Ministerial Consent");

o ASX and AIM regulatory approvals;

o Approval of the acquisition of the Included Licences by the

Competition Authority of Botswana (or confirmation from such

authority or from either party's Botswana legal counsel that such

approval is not required) ("Competition Approval");

o Duly executed transfers of the Included Licences in the form

required by the Mining Act under which a 100% interest in the

Included Licences may be transferred.

I f the Ministerial Consent and / or the Competition Approval is

not granted by the Long Stop Date (31 July 2021 or such later date

agreed by the parties) the agreement shall automatically terminate

and cease to have effect and no Party shall have any obligation or

liability to any other Party.

ZAMBIA

Star Zinc & Kashitu

Period under review

-- Galileo agreed an arrangement ("Arrangement") with BMR to

assume the rights to BMR's Mauritian subsidiary, Enviro Mining

Limited and its wholly-owned Zambian subsidiaries, which include,

amongst other things the title to the licences for Star Zinc and

Kashitu (zinc willemite) Projects. The Arrangement, which is

subject to Zambian Ministry approval, is for nil consideration

since the Company has earned-in its 95% right to the two projects.

Galileo has decided to cease seeking Ministry approval and

therefore will no longer be assuming the rights from BMR.

Post the period under review

-- On 25 November 2020 Galileo announced that it had signed a

Marketing Agreement with Zopco S.A. ("ZopCo") in relation to the

potential sale of zinc willemite ore from the group's 95% owned

Star Zinc project. Zopco is a Geneva based independent trading

company focused on non-ferrous metals and concentrates.

SOUTH AFRICA

Glenover Phosphate Project ("Glenover")

Period under review

-- Glenover continued to progress Department of Mineral

Resources approval of its application for a mining right, for which

the only outstanding matter remains a Record of Decision ("RoD")

from the Department of Water and Sanitation ("DWS") on the proposed

Tailings Storage Facility ("TSF") design.

-- Glenover continued to identify potential investors in the

Glenover project and initiated preliminary discussions, which are

ongoing.

Post the period under review

-- The final TSF design report was completed by Golder

Associates (Pty) Ltd in November 2020 and has been submitted to the

DWS for its RoD, with a decision expected during Q1 2021.

FUNDRAISING

Period under review

-- In June 2020, the Company raised GBP900,000 before expenses

(1 June 2020: AIM - RNS number 45490) by way of a placing of

112,500,000 Galileo ordinary 0.1p shares at a 14% discounted price

of 0.8p per share. The Company intended to use the proceeds of the

placing for general working capital towards exploration on the 15

Kalahari Copper Belt Licences in Botswana being retained by the

Company under the Licence Sale Agreement and progressing its two

Zambian zinc projects.

Post the period under review

-- On 25 January 2021, the Company entered into a Share

Subscription Agreement with Sandfire who agreed to subscribe for

41,100,124 ordinary shares of 0.1p in the Company ("Sandfire

Shares") at a price of 2.68p per share, being a 25% premium to the

10 day VWAP of the Company's share price as at 22 January 2021,

raising GBP1.1 million (US$1.5 million at current conversion

rates). The Sandfire Shares will be issued at a premium of 17% to

the closing mid-price of the Galileo Shares on 25 January 2021 of

2.30p and admitted for trading on AIM on or around 9 February 2021.

This will represent a 4.62% interest in Galileo.

For further information, please contact:

Colin Bird, Chairman & CEO Tel +44 (0) 20 7581 4477

Edward Slowey, Executive Tel +353 (1) 601 4466

Director

www.galileoresources.com

Beaumont Cornish Limited

Nominated Advisor

Roland Cornish/James Biddle Tel +44 (0)20 7628 3396

Novum Securities Limited

- Broker Tel +44 (0)20 7382 8416

Colin Rowbury/ Jon Belliss

Statement of Responsibility for the six months ended 30

September 2020

The directors are responsible for preparing the consolidated

interim financial statements for the six months ended 30 September

2020 and they acknowledge, to the best of their knowledge and

belief, that:

-- the consolidated interim financial statements for the six

months ended 30 September 2020 have been prepared in accordance

with IAS 34 - Interim Financial Reporting, as adopted by the

EU;

-- based on the information and explanations given by

management, the system of internal control provides reasonable

assurance that the financial records may be relied on for the

preparation of the consolidated interim financial statements.

However, any system of internal financial control can provide only

reasonable, and not absolute, assurance against material

misstatement or loss;

-- the going concern basis has been adopted in preparing the

consolidated interim financial statements and the directors of

Galileo have no reason to believe that the Group will not be a

going concern in the foreseeable future, based on forecasts and

available cash resources;

-- these consolidated interim financial statements support the viability of the Company; and

-- having reviewed the Group's financial position at the balance

sheet date and for the period ending on the anniversary of the date

of approval of these financial statements they are satisfied that

the Group has, or has access to, adequate resources to continue in

operational existence for the foreseeable future.

Colin Bird Chairman and Chief Executive Officer

29 January 2021

CONSOLIDATED STATEMENT OF FINANCIAL Six months Six months Year

POSITION ended ended ended

30 September 30 September 31 March

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

ASSETS

Intangible assets 3,610,194 3,268,814 3,348,019

Investment in joint ventures 1,867,227 2,185,144 1,834,710

Loans to joint ventures and

associates 339,420 448,388 291,442

Other financial assets 351,881 408,885 344,523

----------------- --------------- -------------

Non-current assets 6,168,722 6,311,231 5,818,694

----------------- --------------- -------------

Trade and other receivables 5,452 56,077 2,228

Cash and cash equivalents 1,054,247 135,506 356,485

----------------- --------------- -------------

Current assets 1,059,699 191,583 358,713

----------------- --------------- -------------

Total Assets 7,228,421 6,502,814 6,177,407

----------------- --------------- -------------

EQUITY AND LIABILITIES

Share capital and share premium 27,774,345 26,073,551 26,469,319

Reserves 749,594 599,753 621,131

Accumulated loss (21,589,733) (20,774,084) (21,222,788)

----------------- --------------- -------------

Equity 6,934,206 5,899,220 5,867,662

----------------- --------------- -------------

Liabilities

Other financial liabilities 5 4,078 5

Non-current liabilities 5 4,078 5

----------------- --------------- -------------

Trade and other payables 294,210 599,516 309,740

----------------- --------------- -------------

Total liabilities 294,215 603,594 309,745

----------------- --------------- -------------

Total Equity and liabilities 7,228,421 6,502,814 6,177,407

----------------- --------------- -------------

Joel Silberstein

29 January 2021

Company number: 05679987

CONSOLIDATED STATEMENT OF

COMPREHENSIVE Six months Six months Year

INCOME FOR THE SIX MONTHSED ended ended ended

30 SEPTEMBER 2020 30 September 30 September 31 March

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

Revenue - - -

Operating expenses (360,390) (189,189) (630,384)

--------------------- --------------- ---------------------------

Operating loss (360,390) (189,189) (630,384)

Investment revenue - 1 2

Share of loss from equity accounted

investments (6,555) (4,296) (11,806)

Loss for the period (366,945) (193,484) (642,188)

Other comprehensive loss:

Exchange differences on translating

foreign operations (119,646) 81,015 26,078

--------------------- --------------- ---------------------------

Total comprehensive loss (486,591) (112,469) (616,110)

--------------------- --------------- ---------------------------

Total comprehensive loss

attributable

to:

Owners of the parent (486,591) (112,469) (616,110)

Weighted average number of shares

in issue 600,066,170 353,542,063 484,524,276

Basic loss per share - pence (0.06) (0.03) (0.14)

STATEMENT OF CHANGES IN EQUITY as at 30 September 2020

Share Total Foreign Convertible Share Total Accumulated Total

Share share based reserves equity

-------- ------

Capital capital currency instruments payment loss

premium

-------- ------

Figures in Pound Sterling translation reserve

reserve

reserve

-------------------------------------------------------------------------------------------- ------- ----------- ----------- ------- -------- ----------- ------

Balance at 1

April 2019 5,915,231 19,525,088 25,440,319 (736,060) 1,047,821 149,793 461,554 (20,580,600) 5,321,273

Loss for the

year - - - - - - - (642 188) (642,188)

Other

comprehensive

income - - - 26 078 - - 26,078 - 26,078

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Total

comprehensive

income for

the year - - - 26 078 - - 26,078 (642 188) (616,110)

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Issue of

warrants - (133,499) (133,499) - - 133,499 133,499 - -

Issue of shares 253,215 909,284 1,162,499 - - - - - 1,162,499

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Total

contributions

by and

distributions

to owners of

company

recognised

directly in -

equity 253,215 775,785 1,029,000 - - 133,499 133,499 - 1,295,998

Balance at 1

April 2020 6,168,446 20,300,873 26,469,319 (709 982) 1,047,821 283,292 621,131 (21 222 788) 5,867,662

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Loss for the 6

months - - - - - - - (366 945) (366,945)

Other

comprehensive

income - - - (119 646) - - (119,646) - (119,646)

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Total

comprehensive

income for

the 6 months - - - (119 646) - - (119,646) - (486,591)

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Warrants issued - (150,544) (150,544) - - 150,544 150,544 - -

Warrants

exercised - 65,650 65,650 - - (65,650) (65,650) - -

Options granted - - - - - 163,215 163,215 - 163,215

Issue of shares 216,964 1,172,957 1,389,920 - -- - - - - 1,389,920

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

Total

contributions

by and

distributions

to owners of

company

recognised

directly in

equity 216,964 1,088,063 1,305,026 - - 248,109 248,109 - 1,553,135

Balance at 30

September 2020 6,385,410 21,388,936 27,774,345 (829,628) 1,047,821 531,401 749,594 - 6,934,206

------------ ----------- --------------------- -------------------- -------------------- ----------- ------------ ------------ -----------

CONSOLIDATED STATEMENT OF Six months Six months Year

CASH FLOW FOR THE SIX MONTHS ended ended endedED 30 SEPTEMBER 2020 30 September 30 September 31 March

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

Cash used in operations (315 552) (179 723) (331,288)

Interest income - 1 2

Net cash from operating activities (315 552) (179 722) (331,286)

-------------- -------------- ----------

Investment in intangible assets (167 738) (94 778) (290,232)

Increase in investment in - (54 602) -

joint ventures

Loans advanced (45 848) (4 384) (13,072)

Net cash from investing activities (213 586) (153 764 (303,304)

-------------- -------------- ----------

Proceeds on share issue 1 226 900 467 917 990,000

-------------- -------------- ----------

Net cash flows from financing

activities 1 226 900 467 917 990,000

Total cash movement for the

period 697 762 134 431 355,410

Cash at the beginning of the

period 356 485 1 075 1,075

-------------- -------------- ----------

Total cash at end of the period 1 054 247 135 506 356,485

-------------- -------------- ----------

Notes to the Financial Statements

1. Status of interim report

The Group unaudited condensed interim results for the 6 months

ended 30 September 2020 have been prepared using the accounting

policies applied by the Company in its 31 March 2020

annual report, which are in accordance with International

Financial Reporting Standards (IFRS and IFRC interpretations)

issued by the International Accounting Standards Board ("IASB") as

adopted for use in the EU ("IFRS"), including the SAICA financial

reporting guides as issued by the Accounting Practices Committee,

IAS 34 - Interim Financial Reporting, , the AIM rules of the London

Stock Exchange and the Companies Act 2006 (UK). This condensed

consolidated interim financial report does not include all notes of

the type normally included in an annual financial report.

Accordingly, this report is to be read in conjunction with the

annual report for the year ended 31 March 2020 and any public

announcements by Galileo Resources Plc. All monetary information is

presented in the presentation currency of the Company being Great

British Pound. The Group's principal accounting policies and

assumptions have been applied consistently over the current and

prior comparative financial period. The financial information for

the year ended 31 March 2020 contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified and did not contain a

statement under section 498(2)-(3) of the Companies Act 2006.

2. Basis of preparation

The consolidated annual financial statements incorporate the

annual financial statements of the Company and all entities,

including special purpose entities, which are controlled by the

Company. Control exists when the Company has the power to govern

the financial and operating policies of an entity to obtain

benefits from its activities. The results of subsidiaries are

included in the consolidated annual financial statements from the

effective date of acquisition to the effective date of disposal.

Adjustments are made when necessary to the annual financial

statements of subsidiaries to bring their accounting policies in

line with those of the Group.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation. Non-controlling interests in

the net assets of consolidated subsidiaries are identified and

recognised separately from the Group's interest therein and are

recognised within equity. Losses of subsidiaries attributable to

non-controlling interests are allocated to the non-controlling

interest even if this results in a debit balance being recognised

for non-controlling interest. Transactions which result in changes

in ownership levels, where the Group has control of the subsidiary

both before and after the transaction, are regarded as equity

transactions and are recognised directly in the statement of

changes in equity. The difference between the fair value of

consideration paid or received and the movement in non-controlling

interest for such transactions is recognised in equity attributable

to the owners of the parent.

3. Segmental analysis

Business segments

The Company's investments in subsidiaries and associates, that

were operational during the period, operate in four geographical

locations being South Africa, Zambia, Botswana and USA, and are

organised into one business unit, namely Mineral Assets, from which

the Group's expenses are incurred and future revenues are expected

to be earned. This being the exploration for and extraction of its

mineral assets through direct and indirect holdings. The reporting

on these investments to the board focuses on the use of funds

towards the respective projects and the forecasted profit earnings

potential of the projects. An analysis of the loss on ordinary

activities before taxation is given below:

Six months Six months Year

ended 30 ended 30

September September ended

2020 2019 31 March

(Unaudited) (Unaudited) 2020

(Audited)

GBPs GBPs GBPs

Loss on ordinary activities

before taxation:

Rare earths, aggregates

and iron ore and manganese (6,555) (4,296) (11,806)

Gold, Copper - (191) (23,187)

Corporate costs (360,390) (188,997) (607,195)

(366,945) (193,484) (642,188)

------------- ------------- ------------

An analysis of the assets and liabilities of the geographical

segments as at 30 September 2020 are presented below:

Corporate Corporate Gold/Copper Zinc Copper

GBPs (UK) (RSA) (USA/RSA) Zambia Botswana Total

------------------- ---------------- ------------------ ---------------- -------- ---------------- ---------------

Non-current 2 320 1 705 1 608 6 168

Assets 237 568 960 271 231 296 691 721

Current 1 050 1 059

Assets 909 7 701 1 093 - - 702

Non-current

liabilities - (5) - - - (5)

Current

liabilities (275 186) (19 026) - - - (294 213)

---------------- ------------------ ---------------- --------

1 013 2 309 1 706 1 608 6 934

Net assets 288 629 364 231 296 691 206

---------------- ------------------ ---------------- -------- ---------------- ---------------

An analysis of the assets and liabilities of the geographical

segments as at 30 September 2019 are presented below:

Corporate Corporate Gold/Copper Zinc

GBPs (UK) (RSA) (USA/RSA) Zambia Total

------------------------------- ------------- ------------------ --------------- -------- ---------------

1 718 1 550 6 311

Non-current Assets 330 037 2 712 381 744 070 231

Current Assets 160 396 2,714 28 473 - 191 583

Non-current liabilities - (6) (4 072) - (4 078)

Current liabilities (240 181) (31 569) (327 766) - (599 516)

------------- ------------------ --------------- -------- ---------------

1 415 1 550 5 899

Net assets 250 252 2 680 806 379 070 220

------------- ------------------ --------------- -------- ---------------

An analysis of the assets and liabilities of the geographical segments

as at 31 March 2020 are presented below:

Corporate Corporate Gold/Copper Zinc

GBPs (UK) (RSA) (USA/RSA) Zambia Total

------------------- ------------- -------------------- ------------------ ----------- ------------------

Non-current 1 574

Assets 357 354 2 287 255 1 773 859 160 5 992 628

Current

Assets 422 341 2 405 28 102 - 455 848

Non-current

liabilities - (5) (4 047) - (4 052)

Current

liabilities (216 849) (34 137) (325 775) - (576 761)

1 574

Net assets 562 846 2 258 518 1 472 139 160 5 867 662

------------- -------------------- ------------------ ----------- ------------------

4. Financial review

The Group reported a net loss of GBP 366 945 (2019: GBP 193 484)

before and after taxation. Basic loss reported is 0.06 pence (2019:

0.03 pence) per share. Loss per share is based on a weighted

average number of ordinary shares of 600 066 170 (2019: 345 966 425

).

5. Share Capital

Six months Six months Year

Six months Six months Six months

ended ended ended

30 September 30 September 30 September

2020 2020 2020

ended ended ended

30 September 30 September 31 March

September

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

Authorise d sha re capital

Unlimi t e d o r dinary sha r es

of 0.01 pen ce (2019: 0.01) pen

c e)

I s sue d sha re capital

R epor t e d as at 1 April 557,811,947 304,596,562 304,596,562

Sha r e i s su es 216,964,246 128,215,385 253,215,385

============= ============= ===============

R epor t e d as at 30 September 774,776,193 432,811,947 557,811,947

============= ============= ===============

R e c oncili a tio n of sha re capital:

O r dinar y sha r es of 0.1p 774,776 432,812 557,812

5 ,61 0 ,63 5 ,61 0 ,63 5 ,61 0 ,63

D e f er r e d sha r es of 4.9p 4 4 4

Sha r e p r emium 21,323,286 20,030,105 20,300,873

============= ============= ===============

27,708,695 26,073,551 26,469,319

============= ============= ===============

During the period under review the Company issued new ordinary

shar es as follows:

Number of

Da te ordinary shar Issue price Purpose of issue

es

================ ============================ ========================================== ==================

Opening balance 557,811,947

28-May-20 38,814,246 0.40p Acquisition

================ ============================ ========================================== ====================

28-May-20 26,505,000 0.60p Warrants exercised

================ ============================ ========================================== ====================

2-Jun-20 18,625,000 0.60p Warrants exercised

================ ============================ ========================================== ====================

4-Jun-20 11,820,000 0.60p Warrants exercised

================ ============================ ========================================== ====================

12-Jun-20 54,562,500 0.80p Placing for cash

================ ============================ ========================================== ====================

24-Jun-20 57,937,500 0.80p Placing for cash

================ ============================ ========================================== ====================

28-Aug-20 1,200,000 0.60p Warrants exercised

================ ============================ ========================================== ====================

14-Sep-20 1,250,000 0.60p Warrants exercised

================ ============================ ========================================== ====================

22-Sep-20 6,250,000 0.60p Warrants

exercised

================ ============================ ========================================== ====================

Closing balance 774,776,193

================ ============================ ========================================== ====================

During the period under review the Company issued a total of

216,964,246 ordinary shares, through the placing of 112,500,000

shares for cash to raise GBP900,000 before expenses, 38,814,246

shares issued for the acquisition of its Botswana-incorporated

Crocus-Serv (Pty) Ltd and further 65,650,000 shares through the

exercise of warrants with total proceeds of GBP393,900.

Post the period under review to the date of this report, the

Company issued 73,925,000 new ordinary shares as follows:

Number of

Date ordinary shares Issue price Purpose of issue

=========== ===================== =========== ==================

22-Oct-20 42,000,000 0.78p Acquisition

----------- --------------------- ----------- ------------------

18-Nov-20 300,000 0.60p Warrants exercised

----------- --------------------- ----------- ==================

26-Nov-20 1,125,000 0.60p Warrants exercised

=========== ===================== =========== ==================

07-Dec-20 12,500,000 0.60p Warrants exercised

=========== ===================== =========== ==================

21-Dec-20 1,000,000 0.60p Warrants exercised

----------- --------------------- ----------- ==================

06- Jan-21 3,750,000 0.60p Warrants exercised

----------- --------------------- ----------- ==================

13-Jan-21 5,000,000 0.60p Warrants exercised

=========== ===================== =========== ==================

18-Jan-21 3,000,000 0.60p Warrants exercised

=========== ===================== =========== ==================

28-Jan-21 3,000,000 0.75p Warrants exercised

=========== ===================== =========== ==================

28-Jan-21 2,250,000 0.60p Warrants exercised

----------- --------------------- ----------- ==================

6. Going concern

The Group has sufficient financial resources to enable it to

continue in operational existence for the foreseeable future, to

continue the current development programme and meet its liabilities

as they fall due. During the period under review the Group raised

GBP900,000 before expenses and the Company has no external debt or

overdrafts. Up to the date of this report the Group raised a

further GBP1.1 million net of expenses.

The directors have further reviewed the Group's cash flow

forecast, and in light of this review and the financial position at

the date of this report, they are satisfied that the Company and

Group have access to adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the directors

consider it appropriate to continue to adopt the going-concern

basis in preparing these financial statements. This basis presumes

that funds will be available to finance future operations and that

the realisation of assets and settlement of liabilities, contingent

obligations and commitments will occur in the ordinary course of

business.

7. Changes to the Board

As announced on 4 September 2020, Andrew Sarosi has, because of

his retirement, resigned as a director of the Company and its

subsidiaries and Edward (Ed) Slowey has joined the Board as

Technical Director on the same date. As announced on 7 October,

Joel Silberstein was appointed Finance Director of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEAFFUEFSEIF

(END) Dow Jones Newswires

January 29, 2021 07:03 ET (12:03 GMT)

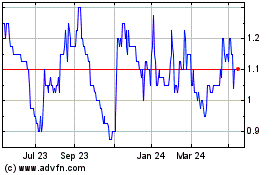

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Aug 2024 to Sep 2024

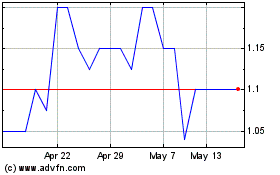

Galileo Resources (LSE:GLR)

Historical Stock Chart

From Sep 2023 to Sep 2024