Notice of compulsory partial redemption of shares (4404K)

July 14 2011 - 12:02PM

UK Regulatory

TIDMFCAP

RNS Number : 4404K

FRM Credit Alpha Limited

14 July 2011

FRM Credit Alpha Limited

(the "Company")

Notice of compulsory partial redemption of shares

Further to the approval by the Company's shareholders of the

managed wind-down proposals as described in the circular to

shareholders dated 4 February 2011, and following on from the first

distribution of cash to shareholders announced on 3 May 2011, the

Company has resolved to return approximately GBP8,000,000 by way of

a further compulsory partial redemption of shares (the

"Redemption") at a price based on the Company's final NAV per share

as at 30 June 2011. The Company's NAV as at 30 June2011 is expected

to be published on or around 21 July 2011. Payments of Redemption

monies are expected to be effected either through CREST (in the

case of shares held in uncertificated form) or by cheque (in the

case of shares held in certificated form) by 29 July 2011.

Certificated shareholders must send all of their share certificates

to the Company's Registrar in order to receive their Redemption

monies.

The Redemption will be effected pro rata to holdings of shares

on the register at the close of business on 22 July 2011 (the

"Redemption Date"). Based on the Company's current estimated NAV,

approximately 29 per cent. of the Company's issued share capital

(that is 29 shares for every 100 held (the "Redemption Ratio"))

would be redeemed on the Redemption Date. Further more detailed

information will be released in due course. Fractions of shares

produced by the Redemption Ratio will not be redeemed and so the

number of shares to be redeemed for each shareholder will be

rounded down to the nearest whole number of shares. The Redemption

is equivalent to approximately 25.69 pence per share.

The Redemption amount comprises the monies from the realisation

of the Company's investments received up to and including 13 July

2011 pursuant to the managed wind-down of the Company, less the

costs and expenses of this Redemption and cash being retained for

the Company's working capital requirements. The costs and expenses

of this Redemption are estimated not to exceed GBP5,000.

The Company currently has 31,135,738 shares in issue. All of the

shares redeemed on the Redemption Date will be cancelled.

The shares will be disabled in CREST on the Redemption Date and

the existing ISIN number GG00B3ZPG020 (the "Old ISIN") will expire.

The new ISIN number GG00B4K46K11 (the "New ISIN") in respect of the

remaining shares which have not been redeemed will be enabled and

available for transactions from and including 25 July 2011. Up to

and including the Redemption Date, shares will be traded under the

Old ISIN and as such, a purchaser of such shares may have a market

claim for a proportion of the Redemption proceeds following the

activation of the New ISIN. CREST will automatically transfer any

open transactions as at the Redemption Date to the New ISIN.

Enquiries:

Chris Brierley 020 7968 6136

(Financial Risk Management Limited)

Jane Lewis 020 3100 0295

(Winterflood Investment Trusts)

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAKXLFEFFEFF

Finncap (LSE:FCAP)

Historical Stock Chart

From Jun 2024 to Jul 2024

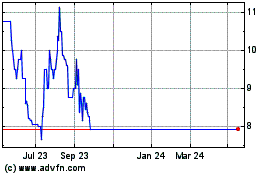

Finncap (LSE:FCAP)

Historical Stock Chart

From Jul 2023 to Jul 2024