Result of EGM (1535D)

March 17 2011 - 9:46AM

UK Regulatory

TIDMFCAP

RNS Number : 1535D

FRM Credit Alpha Limited

17 March 2011

FRM Credit Alpha Limited (the "Company")

Result of General Meeting

At the extraordinary general meeting of the Company's

shareholders held today, the special resolution facilitating the

managed wind-down of the Company was passed. A copy of this

resolution can be accessed via the National Storage Mechanism,

which is located at http://www.hemscott.com/nsm.do.

As indicated in the circular to shareholders dated 4 February,

2011 (the "Circular") the Company's new investment policy will be

"to realise the Company's existing investments in an orderly and

timely manner, with a view to distributing cash to Shareholders (in

accordance with their rights to distributions on a winding-up as

set out in the Articles) at appropriate times as sufficient

investments are realised. The Company will not make any new

investments other than in cash or cash equivalents pending

distribution of cash to Shareholders".

The return of cash to Shareholders will be effected through

compulsory redemptions of Shares at times determined by the

Directors. In determining the timing of any redemption, the

Directors will take into account the amount of cash available for

distribution and the costs associated with such redemption.

Shareholders will receive the proceeds of redemption at a value

equal to the prevailing Net Asset Value per Share as at the

relevant Redemption Date. The costs of redemption will be reflected

in such Net Asset Value per Share. Before each redemption of

Shares, the Company will announce:

-- the relevant Redemption Date (on which redemptions will

become effective);

-- the percentage of the Company's issued share capital to be

redeemed by the Company on that

Redemption Date;

-- the Net Asset Value Date for the calculation of the

applicable percentage of Shares in issue; and

-- any additional information that the Board deems necessary to

advise Shareholders in connection

with the redemption.

Subject to the assumptions and risks outlined in the Circular,

the Directors expect to make a first distribution of cash to

Shareholders by the end of May 2011.

The Company estimates that it will be able to pay out

approximately 45-48% of the Company's Net Asset Value as at 31,

January 2011 (the most recently published final Net Asset Value as

at the date of this announcement) by the end of May 2011. However,

market movements and other matters or events, such as the Company

not receiving redemption proceeds from its underlying holdings in a

timely manner, may result in a lower or higher amount being

available for distribution to Shareholders. An announcement will be

made in due course setting out further details in relation to the

proposed first cash distribution.

Unless otherwise defined, terms used in this announcement have

the same or equivalent meaning as in the Circular.

The Board reserves the right at its discretion to extend or

bring forward any of the dates referred to in this announcement, or

to alter any estimated cash distribution amount. Any revised date

or amount will be notified to Shareholders by a further

announcement through a Regulatory Information Service provider.

Enquiries:

Chris Brierley

Financial Risk Management Limited

020 7968 6136

Jane Lewis

Winterflood Investment Trusts

020 3100 0295

This information is provided by RNS

The company news service from the London Stock Exchange

END

REGSFIFDWFFSELD

Finncap (LSE:FCAP)

Historical Stock Chart

From Jun 2024 to Jul 2024

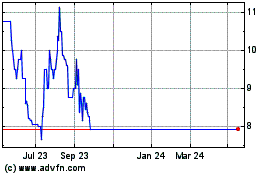

Finncap (LSE:FCAP)

Historical Stock Chart

From Jul 2023 to Jul 2024