TIDMFCAP

RNS Number : 7878N

FRM Credit Alpha Limited

24 February 2009

+----------------------------------------------------+

| FRM CREDIT ALPHA LIMITED |

| (Incorporated in Guernsey) |

| INTERIM UNAUDITED FINANCIAL STATEMENTS |

| FOR THE SIX MONTHS ENDED 31 DECEMBER 2008 |

| |

+----------------------------------------------------+

| |

+----------------------------------------------------+

TABLE OF CONTENTSPAGE

DIRECTORS AND OTHER INFORMATION 3-4

DIRECTORS' REPORT5-7

DIRECTORS' RESPONSIBILITY STATEMENT8

CHAIRMAN'S STATEMENT 9-10

INVESTMENT ADVISER'S REPORT11-13

BALANCE SHEET14

INCOME STATEMENT15

STATEMENT OF CHANGES IN NET ASSETS16

STATEMENT OF CASH FLOWS17

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS18-28

DIRECTORS AND OTHER INFORMATION

DIRECTORS Peter Atkinson (Chairman)*

Richard Hotchkis*

Damian Johnson**

Andrew Duquemin*

* independent non-executive

** non-independent non-executive

REGISTERED OFFICEPO Box 173

Trafalgar Court

Admiral Park

St. Peter Port

Guernsey GY1 4HG

MANAGER AND COMPANY SECRETARY FRM Investment Management Limited

PO Box 173

Trafalgar Court

Admiral Park

St. Peter Port

Guernsey GY1 4HG

INVESTMENT ADVISER Financial Risk Management Limited

15 Adam Street

London WC2N 6AH

SOLICITORS Herbert Smith LLP

as to English LawExchange House

Primrose Street

London EC2A 2HS

ADVOCATES Carey Olsen

as to Guernsey LawPO Box 98

7 New Street

St. Peter Port

Guernsey GY1 4BZ

REGISTRAR Capita Registrars (Guernsey) Limited

Longue Hougue House

St Sampson

Guernsey GY2 4JN

RECEIVING AGENT AND UK TRANSFER AGENT Capita Registrars Limited

Corporate Actions

The Registry

34 Beckenham Road

Kent BR3 4TU

DIRECTORS AND OTHER INFORMATION (continued)

INDEPENDENT AUDITORS PricewaterhouseCoopers CI LLP

PO Box 321

National Westminster House

Le Truchot

St. Peter Port

Guernsey GY1 4ND

ADMINISTRATOR JPMorgan Hedge Fund Services (Ireland) Limited

Newenham House

Northern Cross

Malahide Road

Dublin 17

Ireland

CUSTODIAN JPMorgan Chase Bank, National Association

(London Branch)

125 London Wall

London EC2Y 5AJ

United Kingdom

FINANCIAL ADVISER Winterflood Securities Limited

AND CORPORATE BROKERCannon Bridge House

25 Dowgate Hill

London EC4R 2GA

United Kingdom

LENDERCitibank, N.A.

390 Greenwich Street

4th Floor

New York

NY 10013

DIRECTORS' REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

The Directors present their report together with the audited financial

statements of FRM Credit Alpha Limited (the "Company") for the six months ended

31 December 2008.

Company Background

The Company, a closed ended investment company, was incorporated on 1 March 2007

under the laws of Guernsey with registered number 46497. The Company began

trading on 27 March 2007 with a listing on the Irish Stock Exchange following

the placing of 46,000,000 Shares of no par value at 100p each. Up until 4

September 2008 the Sterling Shares were listed on the Irish Stock Exchange and

traded on the International Bulletin Board (ITBB) of the London Stock

Exchange. On 4 September 2008 the Sterling Shares were de-listed from the Irish

Stock Exchange and were listed on the Main Market of the London Stock Exchange.

Principal Activities

The Company seeks to deliver better risk-adjusted returns than those achieved by

making passive investments in corporate debt securities, when measured over a

complete market cycle. The Company seeks to achieve its objective by investing

in a portfolio of hedge funds pursuing a variety of different credit and

credit-related trading strategies.

Results

The results for the period are shown in the Income Statement on page 15.

Directors

The Directors of the Company are set out on page 3.

Directors' Interests

As at 31 December 2008, Richard Hotchkis held 30,000 shares in the Company. For

details of directors' fees paid during the period, see note 3.4.

Corporate Governance

Introduction

As a closed-ended investment company registered in Guernsey, the Company is not

obliged to comply with the requirements of the Combined Code (the "Code") which

sets out the principles of good governance and a code of best practice and is

issued by the UK Listing Authority. However, the Directors acknowledge the

importance of sound corporate governance and, where possible, the Directors

adopt best practice. This may involve the Company having regard to the AIC Code

of Corporate Governance produced by the Association of Investment Companies and

the Combined Code, where appropriate. The Company complies with the Combined

Code to the extent that the Directors consider appropriate having regard to the

Company's size, stage of development and resources.

Since the Company's assets are managed by the Manager, the Company does not

adhere to the provisions relating to the setting of the Company's strategic aims

and there is no separate chief executive officer. There is no formal process for

detailed evaluation of the performance of each of the Directors, and the Company

does not have a formal framework for dialogue with Shareholders

The following statement describes how the relevant principles of governance are

applied to the Company.

DIRECTORS' REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008 (continued)

The Board

The Board currently consists of four non-executive directors, three of whom are

independent of the Investment Manager. Dr Johnson is a director of the

Investment Manager and Company Secretary, FRM Investment Management Limited.

The Board meets at least four times a year and between these formal meetings

there is regular contact with the Investment Manager and the Company Secretary.

The directors are kept fully informed of investment and financial controls and

other matters that are relevant to the business of the Company and should be

brought to the attention of the directors. The directors also have access to the

Secretary and, where necessary in the furtherance of their duties, to

independent professional advice at the expense of the Company.

The Board has a breadth of experience relevant to the Company and the directors

believe that any changes to the Board's composition can be managed without undue

disruption. With any new director appointment to the Board, consideration will

be given as to whether an induction process is appropriate.

Audit Committee

An Audit Committee has been established consisting of Mr Duquemin (chairman), Mr

Atkinson and Mr Hotchkis. Dr Johnson was previously on the Audit Committee but

stepped down on 11 September 2008. The Audit Committee examines the

effectiveness of the Company's internal control systems, the annual report and

financial statements and interim report, the auditors' remuneration and

engagement, as well as the auditors' independence and the non-audit services

provided by them. The Audit Committee receives information from the Company

Secretary and the external auditors.

Internal Controls

The Board is ultimately responsible for the Company's system of internal control

and for reviewing its effectiveness. The Board confirms that there is an ongoing

process for identifying, evaluating and managing significant risks faced by the

Company. This process has been in place for the period under review and up to

the date of approval of this annual report and financial statements and is

reviewed by the Board and accords with the Turnbull Guidance. The Code requires

directors to conduct, at least annually, a review of the Company's system of

internal control, covering all controls including financial, operational,

compliance and risk management.

The Board has reviewed the effectiveness of the system of internal control. In

particular, it has reviewed and updated the process for identifying and

evaluating significant risks affecting the Company and the policies by which

these risks are managed.

The internal control systems are designed to meet the Company's particular needs

and the risks to which it is exposed. Accordingly, the internal control systems

are designed to manage rather than eliminate the risk of failure to achieve

business objectives and by their nature can only provide reasonable and not

absolute assurance against misstatement and loss.

DIRECTORS' REPORT FOR THE PERIOD ENDED 31 DECEMBER 2008 (continued)

Going Concern

After making enquiries and given the nature of the Company and its investments,

the directors are satisfied that it is appropriate to continue to adopt the

going concern basis in preparing the financial statements and, after due

consideration, the directors consider that the Company is able to continue as a

going concern in the foreseeable future.

Distribution Facility

Shareholders are entitled to elect to participate in the Distribution Facility

which provides an annual distribution by way of redemption of Shares, subject to

certain limitations and the Directors exercising their discretion to operate the

facility on any relevant occasion. Redemption of Shares on any Distribution Date

will be restricted to a specific percentage of the number of Shares held by a

Shareholder. This percentage will be determined by the Directors in their

discretion when they declare the annual distribution, but it is their intention

to distribute up to two thirds of Total Returns (as defined in the Company's

Prospectus), capped at 3.5 per cent of year-end Net Asset Value.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors are responsible for preparing financial statements for each

financial period which give a true and fair view, in accordance with applicable

Guernsey law and International Financial Reporting Standards, of the state of

affairs of the Company and of the profit or loss of the Company for that period.

In preparing those financial statements, the Directors are required to:

* select suitable accounting policies and then apply them consistently;

* make judgements and estimates that are reasonable and prudent;

* state whether applicable accounting standards have been followed, subject to any

material departures disclosed and explained in the financial statements; and

* prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Company will continue in business.

The Directors confirm that they have complied with the above requirements in

preparing the financial statements.

The Directors are responsible for keeping proper accounting records that

disclose with reasonable accuracy at any time the financial position of the

Company and enable them to ensure that the financial statements comply with The

Companies (Guernsey) Law, 2008. They are also responsible for safeguarding the

assets of the Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The Directors are also responsible for the maintenance and integrity of the

website on which these financial statements can be published.

Legislation in Guernsey governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

As required under the EU Transparency Directive, to the best of our knowledge:

* The financial statements have been prepared in accordance with International

Financial Reporting Standards (IFRS) and give a true and fair view of the

assets, liabilities, financial position and profit of the Company.

* The Investment Adviser's Report which follows includes:

a fair view of the development, performance and position of the Company during

the period; and

a statement of the principal risks and uncertainties the Company faces.

Review of performance, development and position

The Company has operated during the period in accordance with the objectives

outlined in the Prospectus. A review of the Company's performance during the

period is included in the Investment Adviser's Report on pages 11 to 13.

Principal risks and uncertainties

The principal risks and uncertainties are outlined in the Company's Prospectus

and in Note 5 in the Notes to the Financial Statements on pages 21 to 24.

On Behalf of the Board of Directors:

___________________________ ____________________________

Date: 23 February 2009

CHAIRMAN'S STATEMENT

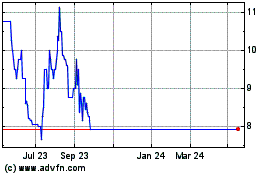

The period has proved extremely challenging for FRM Credit Alpha Limited

including, as it did, the near collapse of the financial system and the worst

ever performance for hedge fund strategies. The Company's net asset value fell

by 23.7%. Over the same period the Merrill Lynch High Yield Master II Index (GBP

hedged) returned -26.7%, JP Morgan Global Government Bonds (GBP Hedged) returned

+7.79% and 1 month Sterling Libor returned +2.64%.

The listed fund of hedge fund universe generally suffered a very poor second

half in 2008. Not only did the underlying assets lose money but many funds have

seen their share prices fall well below their net asset values regardless of

sector focus or specialisation. Your Company was no exception with the share

price falling by 42.7% compared to the fall in net asset value of 23.7%. There

are identifiable reasons for these discounts:

* The fourth quarter of 2008 saw a huge drain on liquidity from capital markets,

often with the most liquid products being sold indiscriminately as investors

sought to reduce risk and raise cash.

* The marginal buyer of hedge fund products disappeared - waiting on the sidelines

until the turmoil had subsided - leaving the market price unsupported on the

bid.

* Some investors were discounting expectations of potential future losses, which

may have been caused by redemption pressures around the year-end.

* Market sentiment reflected the "Madoff scandal" which may have accelerated

losses and increased selling pressure.

Each of these factors has fluctuated in intensity during the recent

difficulties. The Board anticipates these factors are likely to subside to some

degree during 2009 as confidence in the hedge fund industry returns and

investors become less likely to demand liquidity at the expense of long term

returns.

Additional challenges came from our foreign exchange hedging policy. High levels

of volatility in the currency markets increased pressure on short term cash

flow, however we have been able to maintain a fully hedged portfolio throughout

the entire period and we expect to continue to fully hedge our US Dollar

exposure throughout 2009.

The liquidity of the portfolio has also been affected by the market turmoil as

demand for risk assets fell dramatically and previously deep pools of tradeable

assets dried up leaving managers few exit opportunities from positions despite

their requirements for cash. In order to prevent fire sales at unacceptably low

levels many funds have deviated from their standard redemption terms;

suspending, applying gates or issuing side pockets. Analysing and maintaining a

suitable liquidity profile for the portfolio as a whole has required a more

complex, fluid analysis and the investment manager has expended considerable

effort in redesigning their suite of analytical tools.

In a direct reflection of the deteriorating environment for credit the Company

suffered from a worsening of terms offered by its credit provider. In the

Board's opinion the deterioration was sufficient to merit a full review and we

are currently considering alternative providers.

Having regard to the continuing discount in the share price, and having

considered a range of proposals with its advisers and taken account of the

Company's current level of cash and the liquidity of its underlying holdings it

was announced by the Board on 18 February 2009 that it has resolved to take the

following actions:

* To propose a tender offer of up to 20 per cent. of the Company's shares based on

the 30 June 2009 NAV, with payment expected by 30 September 2009.

* Following the completion of the tender offer, to propose to replace the existing

tender offer provisions with an annual redemption facility, to be offered at the

absolute discretion of the Directors.

CHAIRMAN'S STATEMENT (continued)

* To provide shareholders with an opportunity to vote on the Company's

continuation at the Company's annual general meeting to be held in November

2011.

The Board believes the proposals will bring the Company onto a more flexible

capital basis, are a positive step to address some of the structural issues

facing certain closed-ended funds, particularly funds of hedge funds, and should

narrow the discount at which the Company's shares presently trade.

Peter Atkinson

Chairman

23 February 2009

INVESTMENT ADVISER'S REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

This period brought the worst ever performances for hedge funds when the

effective collapse of the investment banking industry and stress in the retail

banking industry impacted all corners of the financial landscape, including

hedge funds. We have always understood that the integrity of the financial

system was vital for the smooth operation of the hedge fund industry. So when

this was called into question it was not surprising to see that hedge fund

returns were driven less by strategy differences than by a common risk factor.

To make matters worse for the Credit Alpha portfolio the primary cause and

epicentre of the collapse was imbalances within the credit markets.

The scale of current events goes beyond anything experienced by the vast

majority of people currently active in finance and while we feel it is too soon

to draw firm conclusions about the implications for the future of asset

management, we do think a few clearly positive facts are apparent.

The most important is that despite widespread significant losses, the hedge fund

business model looks remarkably robust. Many of the banks are suffering from

size, complexity and the difficulty of drawing in to a common goal the different

objectives of traders, management and shareholders. The effective disappearance

of the US investment banking industry is the most obvious demonstration of this.

By contrast, hedge funds benefit from simplicity. Typically one, or perhaps a

few, key people run the investments and the business and there is a clear

alignment of interests among all stakeholders.

Investment banks have to-date provided the main competition to hedge funds in

the search for attractive absolute return trades. Their effective disappearance

(Morgan Stanley and Goldman Sachs are now banks that must dramatically de-lever

and de-risk) leaves hedge funds with a greatly increased set of opportunities

and the expected return on unlevered capital should increase significantly in

their absence. For all that we read about the range of problems afflicting hedge

funds, it is notable that in contrast to the serial failure of regulated,

listed, audited financial services companies around the world, the largest hedge

funds remain going concerns.

Market Environment

In July the credit market indices celebrated the anniversary of the credit

crunch with a mixed performance. In high yield, there was a marked deterioration

in spreads as the widening trend that started in mid-May continued to drag the

market down but Treasuries ended the month stronger. An intra-month rally failed

to stop high yield indices ending near their monthly lows, with a loss for the

month of -1.6% (ML US HY Master II Index). New issuance was relatively quiet in

July with only 7 new issues worth $3bn pricing during the month, compared to 25

deals worth $9.2bn in June. Meanwhile, defaults continued to increase with seven

defaults in July, including four loan only issuers. Bank loan activity hit a

record high for the number of defaults and dollars affected and rather unusually

given their place in the capital structure market participants expected default

rates to continue rising due to the proportion of the loan market that was

issued in the relatively lax times of 2006 and 2007.

August was a relatively quiet month for the credit markets. High yield credit

spreads barely moved with low volumes traded and lower than average market

liquidity. The ML High Yield Master II Index returned 0.3% with spreads widening

from 800bps to 836bps at month end. Cash loans were marginally down on the month

and government bonds rose 1.2% (JP Morgan Global Government Bond Index LC).

Spreads in cash and synthetic bonds remain below their March highs. Defaults

continue to increase, with seven companies defaulting during the month,

affecting $1.1bn of high yield bonds and $644m of loans. The largest defaulting

company was homebuilder WCI Communities which had $525m of bonds outstanding and

$225m of loans, therefore representing around half of the months defaulted

assets total. Given that value stories tend to develop over longer time periods,

Credit Value managers reduced risk in order to mitigate persistent monthly

drawdowns while the market appeared to be in risk aversion mode. On the short

side of the portfolio, managers were faced with short-covering rallies that

resulted in painful squeezes.

INVESTMENT ADVISER'S REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

(continued)

Market Environment (continued)

September's environment was characterised by an ever-changing regulatory and

market framework. The failure of Lehman Bros may have been the pinnacle event

that eroded all confidence in market order, but the 'saving' of Fannie Mae,

Freddie Mac, AIG, Washington Mutual and Wachovia sent equally confusing signals.

In spite of having correctly identified the problems at these institutions, and

warned of them for some time, managers were unable to realise gains because

central authority intervention ensured that both short positions and capital

structure arbitrage trades moved irrationally. Risk asset returns collapsed as

hedge fund managers scrambled to set up positions that suited the new world

order, and liquidity evaporated. Instruments traded with liquidity the sole

consideration, resulting in massive dispersion between (amongst other things):

cash bonds and synthetic CDS, bank debt and high yield, and equity and credit.

The ML US HY Master II fell -8.3% while derivatives referencing the same

instruments declined only 2.5%. The S&P LCD Leveraged Loan index was down -6.2%.

High yield bond spreads widened 260 bps; leveraged loan spreads widened 350 bps.

Value opportunities abounded, but managers were unable to take full advantage:

redemption pressure resulting from poor performance across hedge fund strategies

weighed over the market, with even the healthiest funds impacted. As asset

prices spiralled lower, managers were faced with an increasingly difficult task

estimating actual redemptions versus precautionary while balancing the demands

of redeeming investors with those of ongoing investors.

October proved to be the worst month on record in credit markets on all fronts.

The S&P LCD Leveraged Loan Index fell -13.2% while the ML US HY Master II Index

was down -16.3%. Dispersion between asset classes continued to increase: the

differential between cash bonds and CDS (the 'basis') for investment grade and

high yield names widened significantly. Market participants, already reeling

from September's events, were hit by substantial increases in margin

requirements as prime brokers reacted to the increased price volatility. This

triggered a massive wave of forced deleveraging and liquidations across credit

markets, in particular in bank debt, which itself fed a vicious circle of

further price declines. The average leveraged loan priced at 70.9% of par,

implying a 15% annual default rate on conservative assumptions of 50% recovery

(versus 70% historically). Although managers found extreme value in credits they

know well, the technical picture remained poor, with a preponderance of sellers

and very few remaining buyers.

November saw continued investor deleveraging, gloomy economic data and falling

corporate earnings. Whilst managers are intrigued by today's historically wide

spreads (especially on leveraged loans), they are currently unwilling to stand

against the crowd and buy for fear of being trampled like all those that bought

in the aftermath of the July 2007, January 2008, and September 2008 sell-offs.

While it is clear that the price declines of the past three months in particular

have set credit markets up for a period of outsized returns, the timing of these

returns remains uncertain. everaged loans delivered the worst performance (S&P

LCD Leveraged Loan Index -8.5%), underperforming High Yield bonds (ML US HY

Master II Index -8.4%), equities (S&P 500 Index -7.5%), investment grade bonds

(ML US Corporate Index +3.9%) and the 10-year Treasury (+9.1%).

Going into year end markets were impacted strongly by technical and flow driven

factors, with indices behaving inconsistently. The ML US HY Master II Index rose

7.5% while the on the run 5-year synthetic investment grade index returned 2.1%.

Leveraged loans fell -3%, while lower quality equities, as measured by the

Credit Suisse Leveraged Equity Index, rose 2.7%. The basis (which could be

thought of as the difference between bond yields and yields implied by bond

derivatives) continues to remain at record levels. For comparison, from January

2005 to August 2008 the basis averaged at -4bps while in Q4 2008 it averaged at

-600bps. These moves can be directly linked to the unwind of leveraged positions

within banks and hedge funds. December proved to be an extraordinarily bad month

in terms of fundamentals, as 45% of high yield borrowers reported EBITDA numbers

below both previous year's as well as analysts' expectations. This heightened

leverage ratios (debt/EBITDA), putting additional cash flow pressure on

companies and increasing the risk of covenant breaches. Moody's reported the

2008 default rate for US high yield issuers as 4.4% and projected a 15% default

rate by end-2009. Of the 15 defaults during the month, 3 were significant to

hedge fund managers: Trump Entertainment ($1.25bn debt), media company Tribune

($11bn), and chemical company Lyondell Basell ($12bn).

INVESTMENT ADVISER'S REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

(continued)

Portfolio

As you would expect our dedicated short credit manager in the hedge section of

the portfolio delivered strong performance of approximately +46% as Retail,

Building and Real Estate sector shorts provided outsized returns.

Credit Value and Long-Short managers both lost money, as key themes failed to

generate returns and managers struggled to cope with the combination of

portfolio redemptions and illiquid positions. The difference between price

levels of cash bonds and credit default swaps (CDS) commonly referred to as the

basis continued to widen during the quarter, which is inherently bad for

portfolios that hold long cash bonds hedged by CDS.

The most common theme that led to losses was long bank loans versus short

corporate bonds - a trade which makes sense when one considers the capital

structure and the relative price of the two asset classes, but the relationship

has become more stressed as liquidity in the credit market deteriorated.

2008 has been an extraordinarily bad year for all asset classes, with credit

hedge funds proving to be no exception. What began in July as a reversal of the

commodity bull market and the first of a series of landmark government

interventions has yielded a landscape that is today littered with battered

portfolios, record levels of hedge fund redemptions and a market that for all

intent and purpose has ceased to function. Sadly, our managers do not expect

that the New Year will bring an immediate reprieve from volatility in the asset

class. Managers continued to suffer from long bank loan exposure being hurt by

continued forced selling.

Outlook

The illiquidity of credit markets has resulted in difficulty for hedge funds to

sell enough assets to meet investor redemptions. Accordingly, a number of

managers have implemented a gate, a suspension of redemptions or some

combination thereof. This includes managers with cash on the balance sheet, as

they are hit by the knock on effect of other funds withholding liquidity. Some

of the portfolio's holdings have had to change their liquidity terms, whilst a

few have implemented side pockets or restructurings. These different solutions

reflect varying liquidity and contract terms. The key, as managers have pointed

out, is surviving until the technical overhang is lifted and the market once

again pays attention to fundamentals. If they can survive, as we largely expect

will be the case, there will be significant opportunities for outsized returns.

For now, expect managers to stay close to home until there is more evidence that

a turning point is in sight. Looking forward, the opportunity to benefit from a

'bounce' in the value of bank loans should not be ignored, but it is entirely

dependant on the return of risk capital to the credit space, something which may

not happen for some time yet. The longer term opportunities surrounding the

distressed arena are traditionally very strong for Credit Value managers, but

these funds need to deal with weak investor and prime broker support first

before they can properly capitalise on risk-taking opportunities.

Financial Risk Management Limited

Date: 23 February 2009

BALANCE SHEET AS AT 31 DECEMBER 2008

+------------------------------------------------+----------+--+--------------+-------------+

| | | | 31/12/2008 | 30/06/2008 |

+------------------------------------------------+----------+--+--------------+-------------+

| | Note | | US$ | US$ |

+------------------------------------------------+----------+--+--------------+-------------+

| Assets | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Cash and cash equivalents | 2(d) | | 14,962,500 | 7,455,141 |

+------------------------------------------------+----------+--+--------------+-------------+

| Financial assets at fair value through profit | 2(b),13 | | 102,352,237 | 195,874,312 |

| or loss | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Interest receivable | 2(c) | | 640 | 3,019 |

+------------------------------------------------+----------+--+--------------+-------------+

| Prepaid expenses | | | 113,344 | 12,791 |

+------------------------------------------------+----------+--+--------------+-------------+

| Purchases in advance | | | - | 4,000,000 |

+------------------------------------------------+----------+--+--------------+-------------+

| Amounts due from lender | | | - | 285,603 |

+------------------------------------------------+----------+--+--------------+-------------+

| Sales awaiting settlement | | | 5,191,408 | - |

+------------------------------------------------+----------+--+--------------+-------------+

| Other assets | | | 13,039 | - |

+------------------------------------------------+----------+--+--------------+-------------+

| Total assets | | | 122,633,168 | 207,630,866 |

+------------------------------------------------+----------+--+--------------+-------------+

| | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Liabilities | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Financial liabilities at fair value through | 2(b),13 | | 7,007,623 | 1,292,014 |

| profit or loss | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Credit Facility | 4 | | 6,600,580 | - |

+------------------------------------------------+----------+--+--------------+-------------+

| Performance fees payable | 3.2 | | - | 1,838,234 |

+------------------------------------------------+----------+--+--------------+-------------+

| Management fees payable | 3.1 | | 186,267 | 164,008 |

+------------------------------------------------+----------+--+--------------+-------------+

| Interest payable | 2(c) | | 358,864 | 216,581 |

+------------------------------------------------+----------+--+--------------+-------------+

| Directors fees payable | 3.4 | | 30,753 | 42,510 |

+------------------------------------------------+----------+--+--------------+-------------+

| Administration & custody fees payable | 3.3 | | 13,435 | 29,245 |

+------------------------------------------------+----------+--+--------------+-------------+

| Audit fees payable | | | 17,384 | 21,749 |

+------------------------------------------------+----------+--+--------------+-------------+

| Sales in advance | | | - | 10,000,000 |

+------------------------------------------------+----------+--+--------------+-------------+

| Commitment fees payable | | | 120,929 | 100,682 |

+------------------------------------------------+----------+--+--------------+-------------+

| Payable for investments in other funds | | | 546,292 | - |

+------------------------------------------------+----------+--+--------------+-------------+

| Organisational costs | | | - | 30,870 |

+------------------------------------------------+----------+--+--------------+-------------+

| Other liabilities | | | 119,537 | 142,568 |

+------------------------------------------------+----------+--+--------------+-------------+

| Total liabilities | | | 15,001,664 | 12,586,447 |

+------------------------------------------------+----------+--+--------------+-------------+

| | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Net assets | | | 107,631,504 | 196,336,433 |

+------------------------------------------------+----------+--+--------------+-------------+

| | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Represented by: | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Shareholders' capital and reserves | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Share capital | | | 174,658,739 | 174,952,713 |

+------------------------------------------------+----------+--+--------------+-------------+

| Reserves | 8 | | (67,027,235) | 21,383,720 |

+------------------------------------------------+----------+--+--------------+-------------+

| Total shareholders' funds | | | 107,631,504 | 196,336,433 |

+------------------------------------------------+----------+--+--------------+-------------+

| | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Sterling Shares: | | | | |

+------------------------------------------------+----------+--+--------------+-------------+

| Number of Shares | 7 | | 82,666,926 | 82,790,071 |

+------------------------------------------------+----------+--+--------------+-------------+

| Net Asset Value per Share | | | GBP0.900 | GBP1.191 |

+------------------------------------------------+----------+--+--------------+-------------+

On Behalf of the Board of Directors:

___________________________ ____________________________

Date: 23 February 2009

The accompanying notes on pages 18 to 28 are an integral part of these interim

unaudited financial statements

INCOME STATEMENT FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

+--------------------------------------------------+-------+--------------+-------------+

| | | 31/12/2008 | 31/12/2007 |

+--------------------------------------------------+-------+--------------+-------------+

| | Note | US$ | US$ |

+--------------------------------------------------+-------+--------------+-------------+

| Investment income/(loss) | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Interest income | 2(c) | 29,626 | 74,583 |

+--------------------------------------------------+-------+--------------+-------------+

| Net change in financial assets and financial | 11 | (38,496,041) | 9,577,958 |

| liabilities at fair value through | | | |

| profit or loss | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Net loss on foreign currency transactions | 11 | (48,728,746) | (4,960,739) |

+--------------------------------------------------+-------+--------------+-------------+

| Other income | | 2,339 | - |

+--------------------------------------------------+-------+--------------+-------------+

| Total investment (loss)/income | | (87,192,822) | 4,691,802 |

+--------------------------------------------------+-------+--------------+-------------+

| | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Expenses | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Administration & custodian fees | 3.3 | (60,509) | (58,611) |

+--------------------------------------------------+-------+--------------+-------------+

| Management fees | 3.1 | (733,286) | (621,370) |

+--------------------------------------------------+-------+--------------+-------------+

| Performance fees | 3.2 | - | (717,094) |

+--------------------------------------------------+-------+--------------+-------------+

| Commitment fees | | (24,275) | (77,426) |

+--------------------------------------------------+-------+--------------+-------------+

| Legal fees | | (116,390) | (19,679) |

+--------------------------------------------------+-------+--------------+-------------+

| Audit fees | | (28,436) | (33,657) |

+--------------------------------------------------+-------+--------------+-------------+

| Directors fees | 3.4 | (68,108) | (90,903) |

+--------------------------------------------------+-------+--------------+-------------+

| Printing and postage | | (11,614) | - |

+--------------------------------------------------+-------+--------------+-------------+

| Other operating expenses | | (33,204) | (508,180) |

+--------------------------------------------------+-------+--------------+-------------+

| Total expenses | | (1,075,822) | (2,126,920) |

+--------------------------------------------------+-------+--------------+-------------+

| | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Finance costs | | | |

+--------------------------------------------------+-------+--------------+-------------+

| Interest expense | 2(c) | (142,311) | (169,142) |

+--------------------------------------------------+-------+--------------+-------------+

| | | (142,311) | (169,142) |

+--------------------------------------------------+-------+--------------+-------------+

| | | | |

+--------------------------------------------------+-------+--------------+-------------+

| (Loss)/profit for the period | | (88,410,955) | 2,395,740 |

+--------------------------------------------------+-------+--------------+-------------+

The accompanying notes on pages 18 to 28 are an integral part of these interim

unaudited financial statements

STATEMENT OF CHANGES IN NET ASSETS FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

+-------------------------------------------------------+--------------+-------------+

| | 31/12/2008 | 31/12/2007 |

+-------------------------------------------------------+--------------+-------------+

| | US$ | US$ |

+-------------------------------------------------------+--------------+-------------+

| | | |

+-------------------------------------------------------+--------------+-------------+

| Net assets at the start of the period | 196,336,433 | 94,713,332 |

+-------------------------------------------------------+--------------+-------------+

| | | |

+-------------------------------------------------------+--------------+-------------+

| Proceeds from issue of shares | - | 68,024,058 |

+-------------------------------------------------------+--------------+-------------+

| Redemption of shares | (293,974) | - |

+-------------------------------------------------------+--------------+-------------+

| Net (decrease)/increase from share transactions | (293,974) | 68,024,058 |

+-------------------------------------------------------+--------------+-------------+

| | | |

+-------------------------------------------------------+--------------+-------------+

| (Loss)/profit for the period | (88,410,955) | 2,395,740 |

+-------------------------------------------------------+--------------+-------------+

| Net assets at the end of the period | 107,631,504 | 165,133,130 |

+-------------------------------------------------------+--------------+-------------+

The accompanying notes on pages 18 to 28 are an integral part of these interim

unaudited financial statements

STATEMENT OF CASH FLOWS FOR THE SIX MONTHS ENDED 31 DECEMBER 2008

+--------------------------------------------------------------+--------------+---------------+

| | 31/12/2008 | 31/12/2007 |

+--------------------------------------------------------------+--------------+---------------+

| | US$ | US$ |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Cash flows from operating activities | | |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| (Loss)/profit for the period | (88,410,955) | 2,395,740 |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Operating activities: | | |

+--------------------------------------------------------------+--------------+---------------+

| Increase in interest receivable and prepaid expenses | (111,213) | (1,739) |

+--------------------------------------------------------------+--------------+---------------+

| Sales awaiting settlement | (5,191,408) | - |

+--------------------------------------------------------------+--------------+---------------+

| Increase in payable for investments in other funds | 546,292 | - |

+--------------------------------------------------------------+--------------+---------------+

| Increase in receivable for financial assets sold | - | (7,651) |

+--------------------------------------------------------------+--------------+---------------+

| Increase in liabilities and accrued expenses | (1,453,675) | 1,381,729 |

+--------------------------------------------------------------+--------------+---------------+

| Decrease in amounts payable for investments purchased | - | (383,177) |

+--------------------------------------------------------------+--------------+---------------+

| Purchase of investments at fair value through profit or loss | (49,752,134) | (165,338,355) |

+--------------------------------------------------------------+--------------+---------------+

| Sale of investments at fair value through profit or loss | 98,778,168 | 100,453,731 |

+--------------------------------------------------------------+--------------+---------------+

| Realised gain/(loss) on investments at fair value through | 5,923,412 | (11,268,443) |

| profit or loss | | |

+--------------------------------------------------------------+--------------+---------------+

| Unrealised gain/(loss) on investments at fair value through | 32,572,629 | (1,690,485) |

| profit or loss | | |

+--------------------------------------------------------------+--------------+---------------+

| Unrealised gain on forwards | 8,299,637 | - |

+--------------------------------------------------------------+--------------+---------------+

| Net cash inflow/(outflow) from operating activities | 1,200,753 | (74,458,650) |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Cash flows from financing activities | | |

+--------------------------------------------------------------+--------------+---------------+

| Loan received | 6,600,580 | 5,600,000 |

+--------------------------------------------------------------+--------------+---------------+

| Issuance of shares | - | 68,024,058 |

+--------------------------------------------------------------+--------------+---------------+

| Redemption proceeds from shares | (293,974) | - |

+--------------------------------------------------------------+--------------+---------------+

| Net cash (outflow)/inflow from financing activities | 6,306,606 | 73,624,058 |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Net increase in cash and cash equivalents | 7,507,359 | (834,592) |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Cash and cash equivalents at the beginning of the period | 7,455,141 | 1,056,449 |

+--------------------------------------------------------------+--------------+---------------+

| | | |

+--------------------------------------------------------------+--------------+---------------+

| Cash and cash equivalents at the end of the period | 14,962,500 | 221,857 |

+--------------------------------------------------------------+--------------+---------------+

+--------------------------------------------------------------+-----------+-----------+

| Net cash flow from operating activities and financing | | |

| activities includes: | | |

+--------------------------------------------------------------+-----------+-----------+

| | | |

+--------------------------------------------------------------+-----------+-----------+

| Interest received | 32,005 | 61,518 |

+--------------------------------------------------------------+-----------+-----------+

| Interest paid | (28) | (9,745) |

+--------------------------------------------------------------+-----------+-----------+

The accompanying notes on pages 18 to 28 are an integral part of these interim

unaudited financial statements

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED TO

31 DECEMBER 2008

1.GENERAL INFORMATION

The Company, a closed ended investment company was incorporated in Guernsey on 1

March 2007 under the laws of Guernsey, with registered number 46497. The Company

has three share classes that are authorised for issue; Euro Shares, Sterling

Shares and US Dollar Shares. At 31 December 2008 only Sterling Shares were in

issue.

The Company seeks to generate significant returns over cash, with low volatility

and beta to global credit markets, when measured over a market cycle. By

investing in a combination of investee Funds managed by managers who adopt

research-based value/event driven or long-short approaches, the Company believes

that volatility and peak-to-through drawdowns will be lower than those typically

delivered by long-only approaches. The Company will seek to achieve its

objective by investing in a portfolio of hedge funds pursuing a variety of

different credit and credit-related trading strategies. In addition, the Company

may invest in a wide variety of financial instruments.

Up until 4 September 2008 the Sterling Shares were listed on the Irish Stock

Exchange and traded on the International Bulletin Board (ITBB) of the London

Stock Exchange. On 4 September 2008 the Sterling Shares were de-listed from the

Irish Stock Exchange and were listed on the Main Market of the London Stock

Exchange.

2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of financial

statements are set out below. The accounting policies used in these interim

unaudited financial statements are consistent with the accounting policies used

in the last audited financial statements.

* Basis of preparation

The financial statements have been prepared in accordance with International

Financial Reporting Standards (IFRS). The financial records and statements are

maintained and presented in US Dollars.

The financial statements have been prepared under the historical cost convention

as modified by the revaluation of financial assets and financial liabilities

held at fair value through profit or loss.

The preparation of financial statements in conformity with IFRS requires the use

of accounting estimates. It also requires management to exercise its judgement

in the process of applying the Fund's accounting policies.

The following interpretations are mandatory for the Fund's accounting periods

beginning on or after 1 January

2009:

* IFRS 8, Operating Segments

* Amendment to IAS 32 and IAS 1 Financial Instruments Puttable at Fair Value and

Obligations arising on Liquidation

All references to net assets throughout this document refer to net assets

attributable to the Company unless otherwise stated. The balance sheet presents

assets and liabilities in decreasing order of liquidity and does not distinguish

between current and non-current items. All the Company's assets and liabilities

are held for the purpose of being traded or are expected to be realised within

one year.

* Financial Instruments

(i)Classification

In accordance with IAS 39, the Company classifies its investments as financial

assets and liabilities at fair value through profit or loss. These financial

assets and liabilities are classified as held for trading or designated by the

Board of Directors at fair value through profit or loss at inception.

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX

MONTHS ENDED 31 DECEMBER 2008 (continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

(b)Financial instruments (continued)

(i)Classification (continued)

Financial assets or financial liabilities held for trading are those acquired or

incurred principally for the purposes of selling or repurchasing in the short

term. The Company does not classify any derivatives as hedges in a hedging

relationship. All investments held by the Company have been designated by the

Board of Directors as held for trading.

(ii)Recognition/derecognition

The Company recognises financial assets and financial liabilities at fair value

through profit or loss on the trade date; that is the date it commits to

purchase the instruments. From this date any gains and losses arising from

changes in fair value of the assets or liabilities are recognised. Investments

are derecognised when the rights to receive cashflows from the investments have

expired or the Company has transferred substantially all risks and rewards of

ownership.

(iii)Valuation of investments

Investments in securities, comprising of investments in investment funds, for

which market quotations are not readily available are valued at their fair value

using methods which are in accordance with recognised accounting and financial

principles and which have been approved by the Directors. In this context, other

funds which are not publicly traded are fair valued at unaudited valuations

provided by the administrators or managers of the other funds unless the

Directors are aware of good reasons why such a valuation would not be the most

appropriate indicator of fair value. Such valuations may differ significantly

from the values that would have been used had ready markets existed, and the

difference could be material.

Forward foreign exchange contracts are valued at the forward rate at the closing

date through the residual period of the contracts. Realised and unrealised gains

or losses resulting from forward exchange contracts are recognised in the income

statement.

(c)Interest income and expense

Interest income and expense are recorded in the income statement using the

effective yield method.

(d) Cash and cash equivalents

For the purpose of the cash flow statement, cash and cash equivalents include

cash in hand, deposits held at call with banks, other short term highly liquid

investments with original maturities of three months or less, and bank

overdrafts.

(e)Functional and presentation currency

The Financial Statements are prepared in US Dollars (US$) this being the

Company's functional currency. Management has chosen US$ as the functional and

presentation currency for the Company unless otherwise stated.

(f) Transactions and balances

Foreign currency transactions are translated into the functional currency using

the exchange rates prevailing at the dates of the transactions. Foreign exchange

gains and losses resulting from the settlement of such transactions and from the

translation at period-end exchange rates of monetary assets and liabilities

denominated in foreign currencies are recognised in the Income Statement.

(g)Statement of cash flows

The cash amount shown on the Statement of Cash Flows is the net amount reported

in the Balance Sheet as cash and cash equivalents. The indirect method has been

applied in the preparation of the Statement of Cash Flows.

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX

MONTHS ENDED 31 DECEMBER 2008 (continued)

3.FEES AND EXPENSES

3.1 Management Fee

The Company pays the Manager a management fee together with reimbursement of

reasonable out of pocket expenses incurred by it in the performance of its

duties. The management fee in respect of the Sterling Shares is at the rate of

1% per annum of the Company's net assets attributable to the Sterling Shares

(before deduction of accruals in respect of the management fee for the current

month and any performance fee) as at the first Business Day of each calendar

month payable monthly in arrears. The management fee for the period was

US$733,286 (31 December 2007: US$621,370) and the amount outstanding at period

end was US$186,267 (30 June 2008: US$ 164,008).

3.2 Performance Fee

The Company pays the Manager a performance fee if the Net Asset Value of a Share

at the end of a performance period (a) exceeds its Net Asset Value at the start

of the performance period by more than the performance hurdle and (b) exceeds

the highest previously recorded Net Asset Value per Share as at the end of a

performance period in respect of which a performance fee was last paid.

The performance hurdle applicable in respect of a performance period is one

month LIBOR of the currency of the corresponding Share class compounded monthly

and is pro-rated where the performance period is greater or shorter than one

period. The performance period is each 12 month period ending on 30 June in each

period.

If the performance hurdle and high water mark for a performance period are met

then a performance fee will be calculated and payable to the Manager equal to

10% of the total increase in Net Asset Value per Share at the end of the

relevant performance period over the performance hurdle multiplied by the

weighted average number of Shares in issue at the end of the relevant

performance period. The Company had no performance fees for the period (31

December 2007: 717,094). (There was US$1,838,234 payable at 30 June 2008).

3.3 Administration and Custodian Fee

The Administrator and Custodian are entitled to receive from the Company an

aggregate annual fee equivalent to 0.07% of the Company's Net Asset Value, such

fee to be payable generally pro-rata monthly in arrears, plus other transaction

costs and out of pocket expenses. The Company's administration fee for the

period was US$60,509 (31 December 2007: US$58,611) (30 June 2008: US$11,570) and

US$13,435 remained outstanding at period end (30 June 2008: US$17,675).

Custodian fees are included in administration fees.

3.4 Directors' fees

Each Director (other than the Chairman) is entitled to receive a fee from the

Company at such rate as may be determined in accordance with the Articles of

Association. The current fees are GBP20,000 per annum for each Director and

GBP25,000 for the Chairman. All of the Directors are entitled to be paid all

reasonable expenses properly incurred by them in attending general meetings,

board or committee meetings or otherwise in connection with the performance of

their duties. Directors earned US$68,108 (31 December 2007: US$90,903) during

the period and the amount outstanding at the period end was US$30,753 (30 June

2008: US$42,510).

4. BORROWING

As and when required for operational reasons, including, without limitation,

for managing cash flow, settling foreign exchange transactions, funding

conversions and taking advantage of short-term investment opportunities, the

Company may borrow money, provide leverage and give guarantees, and mortgage,

pledge or charge all or part of its property or assets as security for any

liability or obligation. Any leverage which arises in the Company is not

intended to be permanent and will be repaid over a short time frame. Such

borrowing is subject always to the availability of a credit line facility on

such terms as the Directors deem acceptable in their sole and absolute

discretion.

In aggregate, therefore, the total borrowings of the Company will not exceed

35% of the Net Asset Value at the point of drawdown.

At the balance sheet date the Company had a US$6,600,580 uncommitted credit

facility from Citibank N.A. The facility is due to expire on 30 June 2009.

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31

DECEMBER 2008 (continued)

1. RISKS ASSOCIATED WITH FINANCIAL INSTRUMENTS

Strategy in using financial instruments

The Company's long term objective will be to seek to achieve its investment

objective by investing through one or more hedge funds. The Company's investment

activities expose it to various types of risk taken by the Company and the

managers of the underlying funds, which are associated with the financial

instruments and markets in which they invest. The following summary is not

intended to be a comprehensive list of all risks and investors should refer to

the Prospectus for a more detailed discussion of the risks inherent to investing

in the Company. These risks apply to each class of Shares in varying degrees.

Interest rate risk

The Company by virtue of its borrowing facility can be directly exposed to

interest rate risks when this facility is in use. In practice, whilst borrowing

is constrained by the Offering Memorandum to be less than 35% of the Net Asset

Value of the Company, it is unlikely that borrowing levels of more than 10% of

Net Asset Value will occur for any sustained period.

The borrowing facility for the Company is a floating rate facility referenced to

US Dollar LIBOR and as such a 1% increase in the LIBOR rate could potentially

detract up to 0.35% per annum from the gross returns of the portfolio in the

extreme scenario that the facility was fully utilised throughout the financial

period.

In practice the returns of the Company's underlying investments have been, for

the most part, positively correlated with LIBOR and as such the increase in the

returns of the investments has more than offset any increased borrowing costs

over the long term, thereby neutralising any long term interest rate risk.

It is, however, possible that underlying investments within the portfolio will

incur interest rate risk as an intentional or unintentional part of their

investment strategies.

Market risk

The Company is not directly exposed to any market risk. However, the underlying

managers that the Company invests in may take exposure to a wide range of market

factors including equity, credit, FX, interest rate, emerging and commodity

markets. Additionally they may make use of complex derivative instruments to

take and manage these exposures. FRM analysts monitor the underlying managers on

a continuing basis on behalf of the Company to ensure that managers have the

correct operational controls, systems and skills to manage these risks.

Additionally, FRM has an automated fund performance exception reporting process

to identify funds that are performing out of line with expectations (which will

include relative analysis to their historic track record and their peer group).

Exceptions are discussed at a monthly meeting with the Chief Investment Officer

and recorded by the risk team. For a more detailed analysis of concentrations of

risk refer to note 13.

Market risks at the funds of funds portfolio level are controlled via the use of

diversification across a wide range of Hedge Fund styles and holdings. This

diversification is monitored and controlled via the use of a Value at Risk (VAR)

system. This system uses a proprietary methodology to estimate the monthly loss

that will happen one month in twenty using the current portfolio holdings. The

methodology takes into account underlying funds with short track records and

places greater weight on more recent information to ensure that the estimates

are representative of current conditions. The VAR system is also used to

identify concentrations of risk within the portfolio.

These estimates are produced on a monthly basis by FRM's risk management team

and compared against a set of limits. If the actual values exceed these limits

then deviation is discussed with the relevant portfolio manager to agree a

relevant course of action. Courses of action may include reducing certain

positions, hedging certain factor exposures or changing the limit. Limits are

reviewed and signed off by the Chief Investment Officer and Head of Portfolio

Management on a quarterly basis.Currently these expected maximums are set at a

value of -2%. Since inception, the actual values for the portfolio have ranged

from -1.0% to -6.1%.

As at 31 December 2008 the VAR estimate for the Company was -6.1%.

Through the year, as invested fund returns have become more volatile, the VAR of

the portfolio has risen. In response to this the portfolio composition has been

adjusted to lower the risk level. These actions are occurring on an ongoing

basis and over a period of time we expect the VAR levels to fall towards the

expected values.

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31

DECEMBER 2008 (continued)

5. RISKS ASSOCIATED WITH FINANCIAL INSTRUMENTS (continued)

Market risk (continued)

The VAR at risk is calculated using a proprietary methodology, the broad

characteristics are as follows:

Using return data for the funds in each portfolio, estimates for the covariance

matrix and means of returns of each fund are calculated. A maximum of five years

data is used in this calculation. For the covariance calculation, in the event

of less than 24 months data being available for a fund, the covariance is

estimated using strategy performance data from the FRM's Hedge Fund database. An

estimate of the mean return of each fund is also calculated, with a requirement

for at least twelve months data to be available. Again for funds with short

histories the data is replaced with strategy estimates. Both statistics are

calculated using an exponentially smoothing methodology with a decay factor of

0.97.

To take into account effects such as fat tailed distributions, the VAR estimate

does not use a normal distribution. Instead a proprietary distribution, the

"theta" distribution is used. This models the fat tailed distribution of hedge

funds, whilst still accurately representing the body of the return distribution.

Limitations of the VAR methodology include the following:

* The measure is a point-in-time calculation, reflecting positions as recorded at

that date, which do not necessarily reflect the risk positions held at any other

time;

* That VAR is a statistical estimation and therefore it is possible that there

could be, in any period, a greater number of days in which losses could exceed

the calculated VAR than implied by the confidence level; and

* That although losses are not expected to exceed the calculated VAR on, say 95%

of occasions, on the other 5% of occasions, losses will be greater and might be

substantially greater than the calculated VAR.

Currency Risk

The Company can be directly exposed to foreign exchange risks by virtue of

investments in share classes of funds that are not denominated in its base

currency. When such investments are made, the Investment Manager has a policy of

hedging the capital value of such exposure using a rolling program of currency

swaps initiated on a monthly basis. In addition there is a secondary policy to

adjust the hedge, where possible, for material movements in the intra-month

profit and loss of the underlying investment. Where intra-month performance data

is available for a non-base currency denominated investment, and the estimated

Net Asset Value movement of the investment exceeds 0.9% of the total net asset

value of the fund, additional non-deliverable forwards that mature at the expiry

of the relevant swap are executed to hedge these movements. In view of this

policy, it is unlikely that the Company will be intentionally, directly exposed

to any material FX risk. It is however possible that the underlying investments

within the portfolio will incur FX risk as an intentional or unintentional part

of their investment strategies.

In accordance with the Company's policy, the Investment Manager monitors the

Company's currency exposure twice a month.

Liquidity risk

Liquidity risk is the risk that the Company is unable to meet its obligations as

and when they fall due. The Company invests in alternative investment products,

which can be highly illiquid. With some hedge funds, the Company can only sell

their units at certain dates, which may occur monthly, quarterly, annually or

worse. A lack of liquidity may also result from limited trading opportunities in

alternative investment products.

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED

31 DECEMBER 2008 (continued)

5. RISKS ASSOCIATED WITH FINANCIAL INSTRUMENTS (continued)

Liquidity risk (continued)

At December 31, 2008, 0% (30 June 2008: 37%) of the net assets of the Company

were held in investment funds allowing monthly withdrawals, 44% (30 June 2008:

22%) were held in investment funds allowing quarterly withdrawals, 15% (30 June

2008: 3%) were held in investment funds allowing semi-annual withdrawals, 15%

were held in investment funds allowing annual withdrawals and 7% (30 June 2008:

17%) were held in investment funds allowing withdrawals in periods greater than

two years or on liquidation. This liquidity profile is based upon the terms as

set out in the underlying funds' offering documents.

The Company may, from time to time, invest in derivative contracts traded over

the counter, which are not traded in an organised market and may be illiquid. As

a result, the Company may not be able to liquidate quickly its investments in

these instruments at an amount close to their fair value to meet its liquidity

requirements or to respond to specific events.

In accordance with the Company's policy, the Investment Manager monitors the

Company's liquidity position on a regular basis with regard to maintaining a

reasonable level of liquidity. Significant variation from reasonable levels will

result in notification to the Board of Directors.

The Portfolio Management team is responsible for constructing portfolios to

achieve liquidity profiles, which may be specified directly by clients or by

third party credit providers. The liquidity impact of any given trade or

corporate action is considered by the portfolio managers who will seek advice

from the respective sector analyst when making trading decisions. When trades

are requested by the Portfolio Management team, the Investment Administration

team will review the proposed to trade to ensure that it complies with any

specified liquidity constraints. Trades which do not comply with portfolio

liquidity constraints are not executed and referred back to the respective

portfolio manager.

The table below analyses the Company's financial liabilities into relevant

maturity groupings based on the remaining period at the balance sheet date to

the contractual maturity date. The amounts in the table are the contractual

undiscounted cash flows. Balances due within 12 months equal their carrying

balances, as the impact of discounting is not significant.

There follows a table to split the liabilities into periods of up to 1 Month,

1-3 months, 3-7 months and 'no stated maturity'.

+--------------------------------------+-----------+----------+-----------+--------------+

| | Up to 1 | 1 to 3 | 3 to 7 | Total |

| | Month | Months | Months | |

+--------------------------------------+-----------+----------+-----------+--------------+

| Financial liabilities at fair value | 7,007,623 | - | - | 7,007,623 |

| through profit and loss | | | | |

+--------------------------------------+-----------+----------+-----------+--------------+

| Interest Payable | 358,864 | - | - | 358,864 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Management fees payable | 186,267 | - | - | 186,267 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Administration & custody fees | 13,435 | - | - | 13,435 |

| payable | | | | |

+--------------------------------------+-----------+----------+-----------+--------------+

| Audit fees payable | 17,384 | - | - | 17,384 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Directors fees payable | 30,753 | - | - | 30,753 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Credit facility | - | - | 6,600,580 | 6,600,580 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Commitment fees payable | 120,929 | - | - | 120,929 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Payable for investments in other | 546,292 | - | - | |

| funds | | | | 546,292 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Other liabilities | 119,537 | - | - | 119,537 |

+--------------------------------------+-----------+----------+-----------+--------------+

| Total Liabilities | 8,401,084 | - | 6,600,580 | 15,001,664 |

+--------------------------------------+-----------+----------+-----------+--------------+

NOTES TO THE INTERIM UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31

DECEMBER 2008 (continued)

5. RISKS ASSOCIATED WITH FINANCIAL INSTRUMENTS (continued)

Credit risk

Credit Risk is the risk that an issuer or counterparty will be unable or

unwilling to meet a commitment that it has entered into with the Company. Assets

held by the Company which potentially expose the Company to credit risk,

comprise cash balances and receivables in respect of redeemed investments in

underlying hedge funds. The Company's cash balances are held by its custodian.

From time to time the Company may additionally place cash deposits with banks,

limited to those rated AA or higher.

The Company will not have direct exposure to credit instruments or derivatives,

other than to foreign currency hedging transactions. As a consequence of such

hedging the Company is exposed to the daylight exposure on settlement of such

transactions, which is however mitigated under a netting agreement, and to

unrealised profits on foreign exchange hedges. Foreign exchange transactions are

executed solely with Citibank N.A., with whom the Company has borrowing and

foreign exchange trading lines under a committed credit facility. The facility

inclusively provides for margin on forward foreign exchange contracts which,

rather than being paid as cash is treated as a notional drawing.

Receivables for redeemed investments in underlying hedge funds are typically

received within one month of the redemption date. Before initial investments are

made in hedge funds they are subject to due diligence review by the Fund Manager

which includes an assessment of the principal service providers to the hedge

fund including administrator, auditors and prime brokers. These service

providers are then reviewed annually to eighteen months.

6.TAXATION

The Company has applied for and has been granted exempt status for Guernsey tax

purposes. A company that has exempt status for Guernsey tax purposes is exempt

from Guernsey income tax under the provisions of the Income Tax (Exempt Bodies)

(Guernsey) Ordinance, 1989 and is charged an annual exemption fee of GBP600.

From January 1, 2008, the Income Tax Authority in Guernsey abolished the exempt

regime for some entities. At the same time the standard rate of income tax was

reduced from 20% to 0%. Therefore some entities previously exempt from tax under

the Income Tax (Exempt Bodies) (Guernsey) ordinance 1989 are now taxed at 0%,

however the Income Tax Authority has confirmed that collective investment

schemes such as FRM Credit Alpha Limited can continue to apply for exempt

status.

7. SHARE CAPITAL

The Company has an authorised share capital of a minimum of two shares and up to

an unlimited number of shares of no par value. The Company has three share

classes that are authorised for issue: Euro Shares, Sterling Shares and US