RNS Number : 4103Y

FRM Credit Alpha Limited

07 July 2008

CIRCULAR

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this document or the

action you should take, you are recommended to seek immediately your own personal financial advice from your independent financial adviser,

stockbroker, bank manager, solicitor, accountant or from an appropriately qualified independent adviser authorised pursuant to the Financial

Services and Markets Act 2000.

This Circular is not being sent to Shareholders with registered addresses in the United States, Canada, Australia or Japan and is not an

offer of securities for sale in any of these jurisdictions. Accordingly copies of this document or any accompanying documents are not being

mailed and must not be, directly or indirectly, mailed or otherwise distributed, forwarded or transmitted into the United States, Canada,

Australia or Japan and all persons receiving such documents (including, without limitation, custodians, nominees and trustees) should

observe these restrictions and must not mail or otherwise distribute, forward or transmit them in, into or from the United States, Canada,

Australia or Japan.

If you have sold or otherwise transferred all of your Shares in the Company, please send this document and the accompanying documents at

once to the purchaser or transferee or to the stockbroker, bank or other person through whom the sale or transfer was effected, for onward

transmission to the purchaser or transferee. However, such documents should not be distributed, forwarded or transmitted in or into the

United States, Canada, Australia or Japan or into any other jurisdiction if to do so would constitute a violation of the relevant laws and

regulations in such other jurisdiction.

FRM CREDIT ALPHA LIMITED

(a closed-ended investment company incorporated with limited liability under the laws of Guernsey with registration number 46497)

Extraordinary General Meeting

Proposals relating to amendments of the Articles of Incorporation and migration of the Company's Shares to the UK Official List and to

trading on the Main Market of the London Stock Exchange

The Proposals described in this document are conditional on Shareholder approval. Notice of an EGM of the Company to be held at 2 p.m.

on 31 July 2008 at the offices of the Company, Trafalgar Court, Admiral Park, St. Peter Port, Guernsey GY1 4HG is set out at the end of this

document.

Shareholders are requested to return the reply-paid Form of Proxy accompanying this document. To be valid, a Form of Proxy must be

completed and returned in accordance with the instructions printed thereon so as to be received by Capita Registrars, Proxies Department,

The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU as soon as possible and, in any event, not later than 48 hours before the time of

the EGM.

Your attention is drawn to the letter from the Chairman of FRM Credit Alpha Limited which is set out in Part I of this document and

which recommends that you vote in favour of the Resolutions to be proposed at the EGM. Your attention is also drawn to the section entitled

"Action to be Taken by Shareholders" on page 10 of this document.

CONTENTS

Page

3

PART I LETTER FROM THE CHAIRMAN 4

PART II TERMS OF THE C SHARES AND CONVERSION RATIO 12

PART III ADDITIONAL INFORMATION 19

DEFINITIONS 20

NOTICE OF EXTRAORDINARY GENERAL MEETING 24

EXPECTED TIMETABLE

Latest time and date for receipt of Forms of Proxy for the EGM 2 p.m. on 29 July 2008

Last time and date for receipt of Election Cards in respect 5 p.m. on 29 July 2008

of the 2008 annual distribution

Record Date in respect of the 2008 annual distribution 29 July 2008

EGM of the Company 2 p.m. on 31 July 2008

De-listing of the Shares from the Irish Official List and from 4 August 2008

trading on the Irish Main Market and the International Bulletin

Board

Admission of Shares to the UK Official List 4 August 2008

Dealings in Shares on the Main Market commence 8.00a.m. on 4 August 2008

Last date for delivery of the relevant share certificate or the 1 p.m. on 22 August 2008

relevant TTE instruction in respect of the 2008 annual distribution

Each of the times and dates in the above expected timetable may be extended or brought forward without further notice.

PART I

LETTER FROM THE CHAIRMAN

FRM CREDIT ALPHA LIMITED

(a closed-ended investment company incorporated with limited liability under the laws of Guernsey with registration number 46497)

Directors: Registered office:

Peter Atkinson (Chairman) PO Box 173

Andrew Duquemin Trafalgar Court

Richard Hotchkis Admiral Park

Damian Johnson St. Peter Port

Guernsey GY1 4HG

7 July 2008

PROPOSALS RELATING TO AMENDMENTS OF THE ARTICLES OF INCORPORATION AND MIGRATION OF THE COMPANY'S SHARES TO THE UK OFFICIAL LIST AND TO

TRADING ON THE MAIN MARKET OF THE LONDON STOCK EXCHANGE

Dear Shareholder,

Introduction

The Company began trading in March 2007 with net assets of approximately �46 million and was admitted to listing on the Irish Official

List and to trading on the Irish Main Market and the International Bulletin Board of the London Stock Exchange.

The Company seeks to generate significant returns over cash, with low volatility and beta to global credit markets when measured over a

market cycle. The Company seeks to achieve this objective by investing in a portfolio of hedge funds pursuing a variety of different credit

and credit related trading strategies.

Since launch, the Company has raised additional funds through the issue of further Shares by way of a placing and a tap issue. As at 31

May 2008, the Company's net assets were approximately �96.4 million.

The Proposals

The Company may, subject to market conditions and investor demand, undertake a capital raising later in the year. It would seek to do

this by way of an issue of C Shares. At present the Company does not have authority to issue C Shares and is now seeking Shareholder

approval to do so. At the same time, the Company is also seeking approval for other amendments to its Articles of Incorporation to enable it

to pay its annual distribution more efficiently in the light of current UK tax law and practice.

In addition, the Board is proposing that the Company should de-list its Shares from the Irish Official List and from trading on the

International Bulletin Board of the London Stock Exchange and seek admission of its Shares to the UK Official List and to trading on the

Main Market of the London Stock Exchange.

In connection with the migration of the Company's listing to the UK Official List and admission to trading on the Main Market of the

London Stock Exchange and to enable it to be well placed to manage the Company's rating, the Company is also proposing to introduce or renew

the following:

* provide for the Shares to be redeemable;

* provide for the issue of C Shares;

* introduce pre-emption rights in respect of the allotment of Shares for cash;

* dis-apply pre-emption rights on the allotment of Shares for cash;

* grant authority for the allotment of Shares by the Company; and

* renew the Company's authority to make market purchases of its Shares.

The purpose of this document is to provide you with details of, and to seek your approval for, the Proposals, details of which are set

out below.

Implementation of the Proposals requires the approval of Shareholders at the EGM convened for 2 p.m. on 31 July 2008 (or at any

adjournment thereof). A notice of EGM is set out at the end of this Circular.

The Board believes that the Proposals are in the best interests of Shareholders as a whole and recommends that you vote in favour of the

Resolutions at the EGM. You are therefore urged to complete and return the enclosed Form of Proxy without delay, whether or not you intend

to attend the EGM.

C Shares

The Company intends to seek the requisite authorities at the EGM from Shareholders to allow it to raise additional capital in the future

by way of a C Share issue.

The Board considers that any raising of additional capital should bring benefits to the Company including broadening the Company's

investor base, improving market liquidity, enabling further growth, providing the means to further diversify the Company's investment

portfolio, creating further economies of scale and increasing the Company's profile within the investor community.

Reasons for raising additional capital by way of a C Share issue

The issue of further equity in the form of C Shares is designed to overcome the potential disadvantages for both existing and new

investors which would arise out of a conventional fixed price issue of further shares for cash. In particular:

* the investments from time to time representing the proceeds of the issue of any class of C Shares will be accounted for as a

distinct pool of assets until the Conversion Date, by which time it is expected they will have been substantially invested in accordance

with the Company's investment policy. As a result, holders of existing Shares should not be prejudiced by being exposed to a portfolio

containing substantial uninvested cash, which could otherwise cause a performance drag;

* the Net Asset Value of the existing Shares will not be diluted by the expenses associated with any C Share issue, which will be

borne by the subscribers for C Shares; and

* the Conversion Ratio basis upon which the C Shares will convert into Shares is such that the number of Shares to which holders of

C Shares will become entitled will reflect the relative investment performance since issue and Net Asset Value of the pool of additional

capital attributable to the C Shares as of the Calculation Date, described further below, as compared to the Net Asset Value of the existing

Shares at that time. As a result, neither the Net Asset Value attributable to the existing Shares nor the Net Asset Value attributable to

the C Shares will be adversely affected by Conversion.

Benefits of raising capital by way of a C Share issue

The Board considers that the issue of C Shares has a number of benefits:

* an increase in the capital of the Company will enable the Manager to increase the Company's investment exposure and access larger

investment opportunities than might otherwise be possible.

* the increase in capitalisation should raise the profile of the Company and widen its appeal to the investor community.

* it is expected that an increase in the Company's investor base should, following Conversion, improve the market liquidity for all

Shareholders.

* the enlarged size of the Company should mean that the fixed costs of operating the Company will be spread across a larger asset

base than at present, which will benefit all Shareholders.

The full terms and conditions of the C Shares and the Conversion Ratio are set out in Part II of this document.

Restructure of current Dividend Payment Facility

Restructure due to change in capital gains tax legislation

The Company's Articles of Incorporation currently provide that the holders of each class of Shares have the right to receive in

proportion to their holdings all the revenue profits of the Company (including accumulated net income plus the net of accumulated realised

and unrealised capital gains and accumulated realised and unrealised capital losses) attributable to the relevant class of Shares available

for distribution and determined to be distributed by way of interim and/or final dividend at such times as the Directors may determine.

In the prospectus published by the Company at the time of its launch, the Company stated that its intention is to pay an annual dividend

to holders of Shares an amount equal to two thirds of Total Returns, capped at 3.5 per cent. of year end Net Asset Value, available as cash

or scrip. Dividends would be paid out of income recognised in the income statement which includes realised and unrealised capital gains (the

"Dividend Payment Facility").

Cash dividends received by Shareholders as well as cash dividends reinvested by Shareholders in new Shares under the Dividend Payment

Facility are treated as dividend income receipts chargeable to United Kingdom taxation. Individuals resident for tax purposes in the United

Kingdom who are liable to income tax as a basic rate tax payer will be taxed at the dividend ordinary rate (currently 10 per cent.) and

those who are liable to income tax as a higher rate taxpayer will be taxed at the dividend upper rate (currently 32.5 per cent.).

Under changes to taxation legislation in the United Kingdom, effective from 6 April 2008, a single 18 per cent. rate of tax applies to

capital gains realised by individuals. As a result, the Directors propose that the Dividend Payment Facility be restructured, such that

Shareholders who make the relevant election would receive a capital distribution equal, nearly as possible, to the cash amount of the

dividend payments described above by way of a partial redemption of their Shareholding (the "Distribution Facility"). The Directors consider

that restructuring the Dividend Payment Facility as a Distribution Facility is in the best interests of Shareholders. A distribution by way

of redemption of Shares will constitute, under current United Kingdom taxation law and practice, a capital gains event which for United

Kingdom tax purposes will be taxed at 18 per cent., considerably lower than the higher rate of income tax.

Shareholders should note that the taxation treatment of the Distribution Facility for United Kingdom tax residents is based on current

taxation law and practice, and no assurance is given that such law and practice will not change in the future.

Shareholders who are in any doubt about the tax treatment of their redemption under the Distribution Facility should seek their own tax

advice as necessary.

Introduction of redeemable shares

In order to give effect to the proposed Distribution Facility, it will be necessary for the Shares to be redeemable. It is proposed that

the Articles be amended to allow the Company to re-classify Shares (which are currently not redeemable) as redeemable shares and the

existing Shares be re-classified (as permitted under the Companies Laws) as redeemable shares.

Terms of the Distribution Facility

Shareholders will be entitled to elect to participate in the Distribution Facility which provides an annual distribution by way of a

redemption of Shares, subject to certain limitations and the Directors exercising their discretion to operate the facility on any relevant

occasion.

Redemption of Shares on any Distribution Date will be restricted to a specific percentage of the number of Shares held by a Shareholder.

This percentage will be determined by the Directors at their discretion when they declare the annual distribution which will be no greater

than 3.5 per cent. of the Net Asset Value of the Company.

The Company will notify Shareholders as to the proportion of their holding which may be redeemed not less than 25 days prior to the

relevant Distribution Date. Shareholders may elect to participate by delivering to the Company (or such other person as the Directors may

designate for the purpose) an Election Card in accordance with the procedures described by the Directors and notified to a Regulatory

Information Service provider in advance of the Distribution Date. It is expected that in order to be eligible to participate, Shareholders

will be required to submit a Transfer To Escrow ("TTE") message to the Receiving Agent within a 14 day period ending no later than 1.00 p.m.

(London time) on the day falling 5 days before the Distribution Date. Upon receipt of the TTE message it is expected that the Shares which

are the subject of an Election Card will be transferred into an escrow account within the relevant system, currently being CREST, following

which time such Shares may not be dispensed of, encumbered, charged or dealt in any way whatsoever.

2008 Distribution Facility

The first annual Distribution Date will be on or around 29 August 2008. Shareholders who wish to participate in the Distribution

Facility for the distribution to be made on or after 29 August 2008 should complete the enclosed Election Card and return it to the

Registrar in accordance with the instructions printed thereon by 29 July 2008. All Shareholders on the Company's register as at close

business London time on 29 July 2008 will be entitled to participate in the distribution to be made on or after 29 August 2008.

Redemptions will be effected at not less than the Net Asset Value per Share as at 30 June 2008 (less any costs which may include early

redemption penalties in respect of the underlying funds). However, the Company (through its broker) may use reasonable endeavours to procure

buyers for some or all of the elected Shares in the secondary market at a market price (less associated costs) which exceeds the Net Asset

Value per Share as at 30 June 2008 (an "Excess Amount"). The Company does not anticipate utilising this mechanism to procure buyers in the

secondary market in respect of the Distribution Facility in August 2008.

The Company will in advance of 29 August 2008 issue an announcement through a Regulatory Information Service provider to provide details

of the Net Asset Value as at 30 June 2008 together with the percentage of the Net Asset Value that it will distribute through the

Distribution Facility and an illustrative number of Shares that this represents.

It is expected that the proceeds of the redemption of Shares less any associated costs will be paid to Shareholders through CREST or by

cheque, within ten Business Days of the Distribution Date and will be calculated on the basis of the Net Asset Value per Share as at 30 June

2008.

Other matters for which Shareholder approval is sought as part of the Proposals

Re-purchases of Shares by the Company

The Company is seeking Shareholder approval to renew its authority from Admission to make market purchases of up to 14.99 per cent. of

each class of Shares in issue. Purchases will only be made through the market for cash at prices below the estimated prevailing Net Asset

Value per Share of the relevant class where the Directors believe such purchases will result in an increase in the Net Asset Value per Share

of the relevant class of the remaining Shares and as a means of addressing any imbalance between the supply of, and demand for, the Shares.

Such purchases will only be made in accordance with the Companies Laws, the LSE Admission Standards and the Listing Rules, which currently

provide that the maximum price to be paid per Share must not be more than the higher of (i) five per cent. above the average of the market

values of the Shares for the five Business Days before the purchase is made or (ii) the higher of the price of the last independent trade

and the highest current independent bid for the Shares.

Shareholders should note that the exercise by the Directors of the Company's powers to repurchase Shares is entirely discretionary and

they should place no expectation or reliance on the Directors exercising such discretion on any one or more occasions.

Authority for the allotment of Shares

As a matter of Guernsey law, the Board did not previously require authority from the Shareholders to allot Shares. The law was changed

on 1 July 2008 and any allotment of Shares by the Board will now require authority from the Shareholders.

The Company is therefore seeking authority for the Board to exercise all powers of the Company to allot, grant rights to subscribe for,

or to convert any security into, Shares in the Company, up to a total of 1 billion Shares (including C Shares) of each class for a period of

5 years.

Dis-application of pre-emption rights

Conditional upon Shareholder approval for the adoption of the New Articles of Incorporation by the Company, the Board will seek to

dis-apply the pre-emption rights of Shareholders until the next annual general meeting of the Company in November 2009. Furthermore, it is

currently the Board's intention to dis-apply such rights thereafter on an annual basis. This will allow the Company to allot Shares for cash

without the need to make a pre-emptive offer to existing Shareholders or to seek specific authority from Shareholders to make a non

pre-emptive offer.

Shareholders should note that irrespective of any such dis-application, the Listing Rules currently prevent the Company from allotting

Shares (including treasury shares) for cash at a discount to Net Asset Value without first offering such Shares pro rata to existing holders

of such class or obtaining Shareholder approval.

Migration to listing on the UK Official List and to trading on the Main Market of the London Stock Exchange

The Listing Rules of the FSA were amended with effect from 6 March 2008 such that the Company is now eligible in principle for admission

to listing on the UK Official List and to trading on the Main Market of the London Stock Exchange.

The Board is proposing that the Company should cease to be admitted to listing on the Irish Official List and should cancel its

admission to trading on the Irish Stock Exchange and on the International Bulletin Board of the London Stock Exchange. The Company will seek

admission to the UK Official List and to trading on the Main Market of the London Stock Exchange for all its Shares ("Main Market Listing").

The Board believes that a Main Market Listing should enhance liquidity and provide the Company with exposure to a wider investor base

and greater visibility and transparency in the trading in the Company's Shares.

In addition, admission of the Shares to listing on the Official List and to trading on the Main Market of the London Stock Exchange

will, subject to the Company satisfying certain other requirements, mean that the Shares will be eligible for inclusion in certain financial

market indices.

Listing on the Main Market is conditional upon the UKLA granting admission of the Shares to the UK Official List and the London Stock

Exchange confirming that the Shares can commence trading on the Main Market.

To facilitate listing on the Main Market, the Company will make the necessary amendments to its investment policy, such that it complies

with the listing requirements of the UKLA. It will do this by specifically setting out certain investment limits by reference to geography,

strategies and managers and by complying with the applicable investment restrictions under the Listing Rules.

New Articles of Incorporation

It is proposed that the New Articles of Incorporation be adopted in connection with the Proposals. The new provisions are summarised

below:

* Inclusion of C Share provisions: in order to enable the Company to implement secondary fundraisings in the future, it is proposed

that the New Articles of Incorporation include provisions creating and setting out the rights of the C Shares.

* Introduction of pre-emption rights: in order to facilitate inclusion in certain financial market indices, it is proposed that

Shareholders be granted with pre-emption rights such that any Shares proposed to be issued by the Company (save for any such Shares which

are proposed to be wholly or partly paid otherwise than in cash) must first be offered to existing Shareholders pro rata to their existing

shareholdings. Such pre-emption rights may be dis-applied by special resolution of the Company. It is the Board's intention to seek

dis-application of such pre-emption rights on an annual basis commencing on the date of the EGM and thereafter at each annual general

meeting of the Company. These rights are in addition to the requirement of the Listing Rules that Shares may not be issued for cash at a

price below their Net Asset Value without first being offered to Shareholders pre-emptively.

* Introduction of provisions relating to redeemable shares: it is proposed that the New Articles of Incorporation enable the Company

to reclassify Shares as redeemable Shares in order to facilitate the restructure of the Company's Dividend Payment Facility as a

Distribution Facility. The restructure of the Dividend Payment Facility is further discussed in paragraph of this Part I.

A copy of the proposed New Articles of Incorporation will be available for inspection from the date of this Circular until the

conclusion of the EGM at the addresses referred to at paragraph of Part III of this Circular and at the place of the EGM for at least 15

minutes prior to, and during, the meeting. A copy of the proposed New Articles of Incorporation is also available free of charge in Guernsey

from the Company's Secretary and Manager, FRM Investment Management Limited, PO Box 173, Trafalgar Court, Admiral Park, St. Peter Port,

Guernsey GY1 4HG.

Shareholder Approval

Approval for the Proposals will be sought at the EGM of the Company to be held at 2 p.m. on 31 July 2008.

The notice convening the EGM and setting out details of the resolutions relating to the Proposals is set out at the end of this

Circular.

The resolutions to be proposed at the EGM will be: (i) as a special resolution, to adopt the New Articles of Incorporation containing

provisions relating to C Shares, provisions enabling Shares to be redeemed, and provisions granting Shareholders with certain pre-emption

rights; (ii) as a special resolution, to dis-apply pre-emption rights; (iii) as an ordinary resolution, to grant the Directors the authority

to allot Shares; (iv) conditional upon the passing of the first special resolution, as an ordinary resolution, to reclassify the existing

ordinary Shares as redeemable Shares; and (v) as an ordinary resolution, to renew the Company's authority to make market purchases of its

Shares.

ACTION TO BE TAKEN BY SHAREHOLDERS

Form of Proxy

Shareholders will find enclosed a Form of Proxy for use at the EGM. Whether or not you intend to attend the EGM, you should complete and

return the Form of Proxy by post or by hand (during normal business hours) to Capita Registrars, Proxies Department, The Registry, 34

Beckenham Road, Beckenham, Kent BR3 4TU so as to arrive not later than 48 hours before the time of the EGM. Completion and return of the

Form of Proxy will not affect a Shareholder's right to attend and vote at the EGM.

A quorum consisting of two Shareholders entitled to vote and attending in person or by proxy is required for the EGM.

Where a Shareholder being a body corporate wishes to attend and vote at the EGM an appropriate letter of representation and suitable

identification of the person nominated to represent the body corporate must be presented before the EGM commences.

Election Card

Shareholders will find enclosed an Election Card for use if they wish to participate in the 2008 Distribution Facility. Shareholders who

wish to participate should complete and return the Election Card by post or by hand (during normal business hours) to Capita Registrars,

Corporate Actions Department, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU so as to arrive not later than 5 p.m. on 29 July

2008.

Recommendation

The Board, which has been so advised by Winterflood Securities Limited, considers that the Proposals are in the best interests of

Shareholders as a whole. Accordingly, the Board unanimously recommends Shareholders to vote in favour of the Resolutions relating to the

Proposals at the EGM. In providing its advice, Winterflood Securities Limited has relied upon the Directors' commercial assessment of the

Proposals.

The Directors intend to vote in favour of the Resolutions to be proposed at the EGM in respect of their entire beneficial shareholdings

of 30,000 Shares, representing 0.036 per cent. of the total number of issued Shares in the Company.

Yours faithfully

Peter Atkinson

Chairman

PART II

TERMS OF THE C SHARES AND CONVERSION RATIO

The following definitions apply (for the purposes of this Part II of this circular only) in addition to, or (where applicable) in

substitution for, the definitions applicable elsewhere in this circular:

"Back Stop Date" means such date as determined by the Directors and set out in the

Specified Conversion Criteria

"C Share Issue Date" means the date on which the Company receives the net proceeds of the issue

of the relevant class of C Shares

"C Share Surplus" means the net assets of the Company attributable to the relevant C Share

class (including, for the avoidance of doubt, any income and/or revenue

(net of expenses) arising from or relating to such assets) less such

proportion of the Company's liabilities as shall reasonably be allocated

by the Directors to the assets of the Company attributable to that C Share

class

"Calculation Date" means the earliest of:

the close of business on a date specified by the Directors occurring on or

after the day on which the Investment Manager shall have given notice to

the Directors, and the Directors agree, that the Specified Proportion of

the assets attributable to the relevant C Share class has been invested in

accordance with the investment policy of the Company;

the close of business on such date as the Directors may decide is

necessary to enable the Company to comply with its obligations in respect

of Conversion of the relevant C Share class;

the close of business on the Back Stop Date; and

the close of business on the date specified by the Directors falling after

the date on which the Directors resolve that any Early Investment

Condition in respect of a particular class of C Shares has been satisfied

For the purposes of paragraph (a) of the definition of Calculation Date,

the assets attributable to a relevant C Share class shall be treated as

having been "invested" if they have been expended by o

"Conversion" means in relation to any class of C Shares, conversion of that class of C

Shares in accordance with the Articles of Incorporation

"Conversion Date" means in relation to any class of C Shares, a time falling after the

Calculation Date at which the admission of the Shares arising on

Conversion to listing on the Official List of the UK Listing Authority

becomes effective and which is the opening of business on such Business

Day as is selected by the Directors for the purpose

"Conversion Ratio" means A divided by B calculated to four decimal places (with 0.00005 being

rounded upwards) where:

and

and where:

"C" is the aggregate of:

* the value of all investments of the Company in funds or similar vehicles

attributable to a relevant C Share class at their respective valuations as

provided by the managers or administrators of such funds or similar

vehicles which valuations are accepted by the Directors, subject to such

adjustments as the Directors may deem appropriate to be made for any

variations in the value of such investments between the date of valuation

and the Calculation Date and where such valuations are not available,

calculated by reference to the Directors' estimate of the value that is

deemed appropriate to be made;

all other investments of the Company attributable to a relevant C Share

class as reflected in the most recently published audited annual accounts

of the Company, or, at the Directors' discretion, in such other audited or

unaudited accounts (drawn up as at such date as may b

"Disclosure Document" means a disclosure document, or prospectus (as the case may be) issued by

the Company from time to time in connection with the issue of C Shares

"Early Investment Condition" means any such condition specified in the Specified Conversion Criteria

"Share Surplus" means the net assets of the Company attributable to the Shares less the C

Share Surplus of all C Share classes

"Specified Conversion means in respect of any issue of C Shares, such criteria as may be

Criteria" determined by the Directors and announced by the Company through a

Regulatory Information Service, setting out, among other things, the

Specified Proportion, the Back Stop Date, any post-Conversion dividend

limitations and any Early Investment Condition

"Specified Proportion " means a specified percentage of the assets attributable to the C Shares of

the relevant class as determined by the Directors and set out in the

Specified Conversion Criteria

For the purposes of these provisions, assets or investments attributable to the C Shares of a particular class or the C Share holders of

a particular class shall mean the net cash proceeds (after all expenses relating thereto) of the issue of such C Shares as invested in or

represented by investments or cash or other assets from time to time.

* Issue of C Shares

Subject to the Companies Laws, the Directors are authorised to issue C Shares of such classes, of such number of tranches and on such

terms as they determine, provided that such terms are consistent with the provisions of the Articles of Incorporation.

If there are in issue at the same time C Shares carrying different rights, each shall be deemed to be a separate class of shares. The

Directors may, if they so decide, designate each class of C Shares in such manner as they see fit in order that each class of C Shares can

be separately identified.

* Dividends and Pari Passu Ranking of Shares Post Conversion

Pending Conversion, the holders of C Shares of a particular class shall not be entitled to receive any dividends or other distributions

in respect of the assets attributable to that class of C Shares.

The new Shares of the relevant class arising on Conversion shall rank in full for all dividends and other distributions declared, made

or paid after the Conversion Date and otherwise rank pari passu with the Shares of the relevant class in issue at the Conversion Date, save

to the extent of any post-Conversion dividend limitation which may be specified by the Directors in the Specified Conversion Criteria.

* Voting and Transfer

Except as provided under "Class Consents and Variation Rights", C Shares shall not have the right to attend or vote at any general

meetings of the Company.

C Shares are transferable in the same manner as Shares.

* Class Consents and Variation Rights

Until Conversion the consent of the holders of the relevant C Shares as a class shall be required for and, accordingly, the special

rights attached to any class of C Shares shall be deemed to be varied inter alia, by:

(a) any alteration to the Memorandum of Incorporation or the Articles of Incorporation; or

(b) any alteration, increase, consolidation, division, sub-division, cancellation, reduction or purchase by the Company of any share

capital of the Company (other than on the issue of further C Shares of the same or any other class, or on Conversion or on the issue of

further Shares or classes of Shares on terms which do not adversely affect the interests of the holders of the C Shares, or on the purchase

of any Shares by the Company at a discount to their estimated prevailing Net Asset Value per Share); or

(c) the selection of any accounting reference date other than that declared in the Disclosure Document; or

(d) any material change to the investment objective or policy of the Company; or

(e) the passing of any resolution to wind up the Company.

In respect of such matters, holders of C Shares shall have the right to attend, receive notice of and vote at a separate general meeting

of the holders of C Shares of all classes meeting as a single body. In respect of voting at such general meetings:

(a) each holder of C Shares shall, on a show of hands, have one vote; and

(b) on a poll, each holder of C Shares attending in person, by proxy or by corporate representative shall have one vote for each C

Share held by him.

* Undertakings

Until Conversion, and without prejudice to its obligations under the Companies Laws, the Company undertakes in relation to each class of

C Shares to:

(a) procure that the Company's records and bank accounts shall be operated so that the assets attributable to the C Shares of the

relevant class can, at all times, be separately identified and, in particular but without prejudice to the generality of the foregoing, the

Company shall procure that separate cash accounts shall be created and maintained in the books of the Company for the assets attributable to

the C Shares of the relevant class;

(b) allocate to the assets attributable to the C Shares such proportion of the expenses or liabilities of the Company incurred or

accrued between the C Share Issue Date and the Calculation Date (both dates inclusive) as the Directors fairly consider to be attributable

to the C Shares of the relevant class including, without prejudice to the generality of the foregoing, those liabilities specifically

identified in the definition of "Conversion Ratio" above; and

(c) give appropriate instructions to the Investment Manager to manage the Company's assets so that such undertakings can be complied

with by the Company.

* Conversion

The Directors shall procure that:

(a) the Administrator shall be requested to calculate, within 10 Business Days after the Calculation Date, the Conversion Ratio as at

the Calculation Date and the number of Shares of the relevant class to which each holder of C Shares of the relevant class shall be entitled

on Conversion. For the avoidance of doubt C Shares designated in a particular currency shall convert into Shares of the same currency; and

(b) the Auditor, or failing which an independent accountant selected for the purpose by the Directors, shall be requested to report,

within 15 Business Days after the date on which the Conversion Ratio has been calculated, that such calculations:

(i) have been performed in accordance with the Articles of Incorporation; and

(ii) are arithmetically accurate,

whereupon such calculations shall become final and binding on the Company and all holders of Shares of the relevant class and the

relevant C Share class.

The Directors shall further procure that, as soon as practicable following such certification, a Regulatory Information Service

announcement is made advising holders of C Shares of that class of the Conversion Date, the Conversion Ratio and the aggregate number of new

Shares of the relevant class to which holders of C Shares of that class are entitled on Conversion.

The Shares of the relevant class arising upon Conversion shall be divided amongst the former holders of the C Shares of the relevant

class pro rata according to their respective former holdings of C Shares of the relevant class (provided always that the Directors may deal

in such manner as they think fit with fractional entitlements to Shares of the relevant class including, without prejudice to the generality

of the foregoing, selling any such Shares representing such fractional entitlements and retaining the proceeds for the benefit of the

Company) and for such purposes any Director is hereby authorised as agent on behalf of the former holders of C Shares, in the case of a

Share in certificated form, to execute any stock transfer and to do any other act or thing as may be required to give effect to the same

including, in the case of a Share in uncertificated form, the giving of directions to or on behalf of the former C Share holder who shall be

bound by them.

Forthwith upon Conversion, any certificates relating to the C Shares of the relevant class shall be cancelled and the Company shall

issue to each such former C Share holder new certificates in respect of the Shares of the relevant class which have arisen upon Conversion

unless such former C Share holder elects to hold their Shares of the relevant class in uncertificated form.

The Company will use its reasonable endeavours to procure that upon Conversion the new Shares are admitted to the Official List of the

UK Listing Authority.

In connection with any issue of a C Share class, the Directors shall state the Specified Conversion Criteria in:

(a) any relevant Disclosure Document or press announcement published; and

(b) in a Regulatory Information Service release,

at the time of offer of such C Shares for subscription.

PART III

ADDITIONAL INFORMATION

* Miscellaneous

Winterflood Securities Limited, which is authorised and regulated in the UK by the Financial Services Authority, has given and has not

withdrawn its consent to the issue of this document and the inclusion herein of its name and the references to it in the form and context in

which they appear.

Documents available for inspection

Copies of the following documents are available for inspection at the offices of Herbert Smith LLP, Exchange House, Primrose Street,

London EC2A 2HS and at the registered office of the Company during normal business hours on any business day (Saturdays and public holidays

excepted) until the conclusion of the EGM:

the Memorandum and Articles of Incorporation of the Company and a draft of the proposed New Articles of Incorporation (containing the

full terms of the amendments proposed to be made); and

this Circular (which includes explanatory notes on the Proposals).

Copies of these documents are also available free of charge in Guernsey from the Company's Registrar, Capita Registrars (Guernsey)

Limited, Longue Hougue House, St. Sampson, Guernsey GY2 4JN.

Copies will also be available for download from the Company's website (www.frmcredit.com).

The Articles of Incorporation (including the draft of the proposed New Articles of Incorporation containing the full terms of the

amendments proposed to be made) will be available at the EGM for at least 15 minutes prior to and during the meeting.

7 July 2008

DEFINITIONS

"Administrator" JPMorgan Hedge Fund Services (Ireland) Limited and/or such

other person or persons from time to time appointed by the

Company

"Admission" admission to the UK Official List and/or admission to trading

on the London Stock Exchange, as the context may require, of

the Shares becoming effective in accordance with the Listing

Rules and/or the LSE Admission Standards as the context may

require

"Articles of Incorporation" the articles of incorporation (formerly known as the articles

or "Articles" of association) of the Company in force from time to time

"Board" the board of directors of the Company from time to time

"Business Day" a day on which the London Stock Exchange, the Irish Stock

Exchange and banks in Guernsey are normally open for business

"C Shares" shares of no par value in the capital of the Company which will

be issued as C Shares of such classes as the Directors may

determine having the rights and privileges and being subject to

the restrictions contained in the New Articles of

Incorporation, which will convert into Shares in accordance

with the terms of the New Articles of Incorporation and which,

together with the Shares, constitute the ordinary share capital

of the Company

"Calculation Date" the date at which the Conversion Ratio is calculated in

accordance with the terms of the Revised Articles

"Circular" this document

"Companies Laws" the Companies (Guernsey) Laws 2008 (as amended)

"Company" FRM Credit Alpha Limited

"Conversion" the conversion of a C Share class into Shares (including as may

be agreed in writing by the Directors in relation to a

particular C Share class), in accordance with the terms of the

revised Articles

"Conversion Date" the date on which Conversion occurs in accordance with the

terms of the revised Articles

"Conversion Ratio" the ratio at which a C Share class converts into Shares in

accordance with the terms of the revised Articles

"CREST" the facilities and procedures for the time being of the

relevant system of which Euroclear has been approved as

operator pursuant to the Regulations

"Directors" the directors of the Company

"Distribution Date" such date as the Directors may determine as at which

Shareholders may elect to participate in the Distribution

Facility

"Distribution Facility" the proposed annual Distribution Facility described on page

of the Circular

"Election Card" an election card is such form as the Directors may from time to

time prescribe and may include an instruction sent by means of

a relevant system for Shareholders to elect to redeem a

percentage of their Shares under the terms of the Distribution

Facility

"Euroclear" Euroclear UK and Ireland Limited, being the operator of CREST

"Extraordinary General the extraordinary general meeting of the Company convened for 2

Meeting" or "EGM" p.m on 31 July 2008 (or any adjournment thereof), notice of

which is set out at the end of the Circular

"Form of Proxy" the form of proxy for use at the EGM

"FSA" the United Kingdom Financial Services Authority

"International Bulletin Board" the International Bulletin Board, being a trading platform

operated by the London Stock Exchange plc

"Irish Main Market" the main market of the Irish Stock Exchange

"Irish Official List" the Official List of the Irish Stock Exchange

"Irish Stock Exchange" or the Irish Stock Exchange Limited

"ISE"

"Listing Rules" the listing rules made by the UK Listing Authority under

section 73A of the Financial Services and Markets Act 2000

"London Stock Exchange" the London Stock Exchange plc

"Manager" FRM Investment Management Limited

"Main Market" the London Stock Exchange's main market for listed securities

"Main Market Listing" the de-listing of the Company's issued Shares from the Irish

Stock Exchange and from trading on the International Bulletin

Board and the admission of such Shares to the UK Official List

and to trading on the Main Market of the London Stock Exchange.

"Memorandum of Incorporation" the memorandum of incorporation (formerly known as the

memorandum of association) of the Company in force from time to

time

"NAV Calculation Date" the last Business Day of each calendar month or such other date

as the Directors may, in their absolute discretion, determine

"Net Asset Value" the value of the assets of the Company less its liabilities

determined in accordance with the principles adopted by the

Directors or, where the context requires, the part of that

amount attributable to a particular class of Shares or C Shares

"Net Asset Value per Share" the Net Asset Value attributable to each class of Shares, as

provided in the Articles, divided by the number of Shares in

issue of each class and expressed in Sterling, Euro and US$ as

the case may be

"New Articles of the draft amended Articles of Incorporation to be considered at

Incorporation" the EGM

"Proposals" the proposals described in this document and relating to the

New Articles of Incorporation to enable the Company to issue C

Shares, to restructure the dividend payment facility, introduce

and dis-apply pre-emption rights, provide for the Shares to be

redeemable, granting of authority to allot Shares, renewal of

share buy-back authority and to effect migration of the Company

from the Irish Stock Exchange and the International Bulletin

Board to the Official List and to trading on the Main Market of

the London Stock Exchange

"Registrar" and "Receiving Capita Registrars (Guernsey) Limited, or such other person or

Agent" persons from time to time appointed by the Company

"Regulations" The Uncertificated Securities Regulations 2001 (SI 2001/3755)

"Regulatory Information means a primary information provider service approved to

Service" disseminate regulatory information to the market by the FSA

"Resolutions" the ordinary and special resolutions to be proposed at the EGM

and contained in the notice of the EGM

"Shareholders" holders of Shares and/or C Shares, as the context may require

"Shares" ordinary shares of no par value in the capital of the Company

and/or C Shares, as the context may require

"Total Return" means in respect of each Performance Period:

(i) the Net Asset Value per Share of the relevant class on

the last day of such Performance Period adjusted for any

interim capital return and/or dividends payable in respect of

such Share in such Performance Period, over

(ii) the Net Asset Value per Share of the relevant class on

the first day of such Performance Period

"UKLA" UK Listing Authority, the FSA acting in its capacity as the

competent authority for the purposes of Part VI of the FSMA

"UK Official List" the Official List of the UKLA

"US$" refers to the lawful currency of the United States

"�" refers to the lawful currency of the United Kingdom

"EUR" refers to the single currency of the European Union

FRM CREDIT ALPHA LIMITED

(a closed-ended investment company incorporated with limited liability under the laws of Guernsey with registration number 46497)

(the "Company")

NOTICE OF EXTRAORDINARY GENERAL MEETING

NOTICE is hereby given that an extraordinary general meeting of the Company will be held at Trafalgar Court, Admiral Park, St. Peter

Port, Guernsey GY1 4HG on 31 July 2008 at 2 p.m. to consider and, if thought fit, to pass the following resolutions:

SPECIAL RESOLUTIONS

1. THAT the existing Articles of Incorporation be rescinded in whole and substituted with the New Articles of Incorporation

incorporating, inter alia, the rights of the C Shares, provisions enabling Shares to be redeemed and provisions granting Shareholders with

certain pre-emption rights in relation to issues of Shares by the Company, in the form produced to the meeting and initialled by the

Chairman for the purpose of identification.

2. THAT the Shareholders' pre-emption rights as set out in the New Articles of Incorporation adopted under Special Resolution 1 above

be and are hereby dis-applied from the date of the passing of this Special Resolution 2 until and including the date of the Company's next

annual general meeting expected to take place in November 2009.

ORDINARY RESOLUTIONS

THAT the Directors be authorised to exercise all powers of the Company to allot, grant rights to subscribe for, or to convert any

security into, Shares in the Company, up to 1 billion Shares (including C Shares) of each class for a period of 5 years from the date of the

passing of this resolution (save that the Company may prior to the expiry or such period make an offer or agreement which would or might

require Shares to be allotted after such expiry and the Directors may allot Shares in pursuance of such an offer or agreement as if the

authority conferred hereby had not expired) and this authority may be varied or revoked, or renewed or further renewed for a further period

not exceeding 5 years by an ordinary resolution of the Company.

THAT, conditional upon the passing of Special Resolution 1 above, the Shares of the Company be and are hereby re-classified as

redeemable Shares, having attached thereto the rights and privileges and being subject to the restrictions contained in the New Articles of

Incorporation of the Company to be adopted pursuant to Special Resolution 1 below.

THAT the Company be authorised, in accordance with section 5 of The Companies (Purchase of Own Shares) Ordinance 1998 (the "Ordinance"),

to make market purchases (within the meaning of section 18 of the Ordinance) of Shares and to cancel such Shares or hold such Shares as

treasury shares, provided that:

5.1 the maximum number of Shares hereby authorised to be purchased shall be 14.99 per cent. of each class of Shares in issue on the

date on which this resolution is passed;

5.2 the maximum price which may be paid for a Share shall be limited to an amount which must not exceed the higher of (a) 105 per

cent. of the average market value for the 5 Business Days before the purchase is made and, (b) the higher price of the last independent

trade and the highest current independent bid price;

5.3 the minimum price which may be paid for a Share shall be �0.01 (in the case of Shares designated as Sterling Shares), EUR0.01 (in

the case of Shares designated as Euro Shares); or US$0.01 (in the case of Shares designated as Dollar Shares);

5.4 unless previously varied, revoked or renewed, the authority hereby conferred shall expire at the conclusion of the next Annual

General Meeting of the Company to be held in November 2009, save that the Company may, prior to such expiry, enter into a contract to

purchase Shares under such authority and may make a purchase of Shares pursuant to any such contract.

By order of the Board Registered Office

FRM Investment Management Limited PO Box 173

Secretary Trafalgar Court

Admiral Park

St. Peter Port Guernsey

GY1 4HG

Dated: 7 July 2008

Notes:

(1) A member entitled to attend and vote at the EGM is entitled to appoint one or more proxies to attend and vote instead of him. A

proxy need not be a member of the Company.

(2) For the convenience of members who may be unable to attend the EGM, a reply-paid Form of Proxy is enclosed with this document. To

be valid, the Form of Proxy should be completed in accordance with the instructions printed on it and sent, so as to reach the Company's

Registrar, Capita Registrars, Proxies Department, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU no later than 48 hours before the

time fixed for the EGM. The fact that members may have completed Forms of Proxy will not prevent them from attending and voting in person

should they subsequently decide to do so.

(3) Only Shareholders registered in the register of members of the Company on the close of business on 29 July 2008 shall be entitled

to attend or vote at the aforesaid general meeting in respect of the number of Shares registered in their name at that time or in the event

that the meeting is adjourned, in the register of members at close of business two days before the time of any adjourned meeting. Changes to

entries on the register of members after such time or, in the event that the meeting is adjourned, to entries in the register of members

after close of business two days before the time of the adjourned meeting, shall be disregarded in determining the rights of any person to

attend or vote at the meeting.

(4) In the event that a Form of Proxy is returned without an indication as to how the proxy shall vote on the Resolutions, the proxy

will exercise his discretion as to whether, and if so how, he votes.

(5) CREST members who wish to appoint a proxy or proxies by utilising the CREST electronic proxy appointment service may do so for

the EGM to be held on 31 July 2008 at 2 p.m. and any adjournment(s) thereof by utilising the procedures described in the CREST manual. CREST

personal members or other CREST sponsored members, and those CREST members who have appointed a voting service provider(s), should refer to

their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf. CREST members who wish

to appoint a proxy or proxies by utilising the CREST electronic proxy appointment service must submit their vote no less than 48 hours

before the time fixed for the EGM. In order for a proxy appointment made by means of CREST to be valid, the appropriate CREST message (a

"CREST Proxy Instruction") must be properly authenticated in accordance with Euroclear's specifications and must contain the information

required for such instructions, as described in the CREST manual. The message must be transmitted so as to be received by the issuer's agent (ID : RA10) by the latest time(s) for receipt of proxy

appointments specified in the notice of meeting. For this purpose, the time of receipt will be taken to be the time (as determined by the

timestamp applied to the message by the CREST applications host) from which the issuer's agent is able to retrieve the message by enquiry to

CREST in the manner prescribed by CREST. CREST members and, where applicable, their CREST sponsors or voting service providers should note

that Euroclear does not make available special procedures in CREST for any particular messages. Normal system timings and limitations will

therefore apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if

the CREST member is a CREST personal member or sponsored member or has appointed a voting service provider(s), to procure that his CREST

sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this

connection, CREST members and, where applicable, their CREST sponsors or voting service providers are referred, in particular, to those

sections of the CREST manual concerning practical limitations of the CREST system and timings. The Company may treat as invalid a CREST

Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001.

This announcement has been issued through the Companies Announcement Service of

The Irish Stock Exchange

This information is provided by RNS

The company news service from the London Stock Exchange

END

ISEEAKXLEFAPEFE

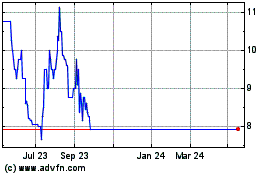

Finncap (LSE:FCAP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Finncap (LSE:FCAP)

Historical Stock Chart

From Jul 2023 to Jul 2024