Contingent equity consideration 600,000 -

Retained earnings - deficit (26,332,437) (25,207,673)

------------- -------------

Equity attributable to equity holders

of the parent 5,541,235 (1,725,340)

Non-controlling interest - 898,010

------------- -------------

Total equity/(deficit) 5,541,235 (827,330)

------------- -------------

Non-current liabilities

Borrowings 12 2,498,212 2,425,025

Share of net liabilities of jointly

controlled entities 9 - 509,599

Total non-current liabilities 2,498,212 2,934,624

------------- -------------

Current liabilities

Amounts due to customers under construction

contracts - 1,110,090

Trade and other payables 2,411,471 2,595,766

Borrowings 12 1,351,519 9,661,645

Finance lease liabilities - 373

------------- -------------

3,762,990 13,367,874

Liabilities associated with assets

held for resale - 2,630,581

Total current liabilities 3,762,990 15,998,455

------------- -------------

Total equity and liabilities 11,802,437 18,105,749

============= =============

Kedco plc

Condensed Consolidated Statement of Changes in Equity

for the six months ended 31 December 2011 and the six months

ended 31 December 2012

Attributable

to equity

Contingent Share-based holders

Share Share Retained equity payment of the Non-controlling

capital premium earnings consideration reserve parent interest Total

EUR EUR EUR EUR EUR EUR EUR EUR

Balance at 1

July 2011 3,543,999 19,038,300 (22,316,689) - 492,580 758,190 799,228 1,557,418

(Loss)/Profit

for the

financial

period - - (431,972) - - (431,972) 65,276 (366,696)

Unrealised

foreign

exchange loss - - (194,261) - - (194,261) - (194,261)

Balance at 31

December 2011 3,543,999 19,038,300 (22,942,922) - 492,580 131,957 864,504 996,461

============ =========== ============= =============== ============= ============== ================= ============

Balance at 1

July 2012 4,106,808 19,375,525 (25,207,673) - - (1,725,340) 898,010 (827,330)

Issue of

ordinary shares

in Kedco

plc 951,296 4,959 - - - 956,255 - 956,255

Conversion of

debt into

equity 5,724,229 44,046 - - - 5,768,275 - 5,768,275

Issue of

ordinary shares

and contingent

equity

consideration

on acquisition

of subsidiary 1,393,867 6,133 - 600,000 - 2,000,000 - 2,000,000

Share issue

costs - (333,191) - - - (333,191) - (333,191)

(Loss)/Profit

for the

financial

period - - (919,591) - - (919,591) 32,865 (886,726)

Elimination of

profit from

jointly

controlled

entity - - (256,358) - - (256,358) - (256,358)

Disposal of

non-controlling

interest

in subsidiary - - - - - - (930,875) (930,875)

Unrealised

foreign

exchange gain - - 51,185 - - 51,185 - 51,185

Balance at 31

December 2012 12,176,200 19,097,472 (26,332,437) 600,000 - 5,541,235 - 5,541,235

============ =========== ============= =============== ============= ============== ================= ============

Kedco plc

Condensed Consolidated Statement of Cash Flows

for the six months ended 31 December 2012

Notes 6 months 6 months

ended ended

31 Dec 31 Dec

2012 2011

Cash flows from operating activities EUR EUR

Loss before taxation (886,726) (366,696)

Adjustments for:

Depreciation of property, plant and equipment 256,890 295,069

Amortisation of intangible assets - 505

Profit on disposal of property, plant

and equipment (83,537) (13,710)

Loss on disposal of subsidiary 8,866 -

Unrealised foreign exchange gain 146,260 70,788

Share of losses of jointly controlled

entities after tax 20,208 190,437

Decrease in provision for impairment

of trade receivables - (10,922)

Increase in impairment of inventories (177,571) (169,442)

Decrease in deferred income (4,293) (5,151)

Interest expense 183,820 566,924

Interest income - (241)

---------- ------------

Operating cash flows before working capital

changes (536,083) 557,561

Decrease/(increase) in:

Amounts due from customers under construction

contracts 843,212 8,027,508

Trade and other receivables (801,606) 726,346

Inventories 656,403 304,021

(Decrease)/increase in:

Amounts due to customers under construction

contracts (110,090) 528,106

Trade and other payables (426,694) (4,248,933)

(374,858) 5,894,609

Income taxes paid - -

---------- ------------

Net cash (used in)/from operating activities (374,858) 5,894,609

---------- ------------

Cash flows from investing activities

Payments for property, plant and equipment (146,701) (729,511)

Proceeds from sale of property, plant

and equipment 109,584 382,708

Payments to acquire financial assets - (6,361,966)

Net cash inflow on acquisition of subsidiaries 14 156,781 -

Net cash inflow on disposal of subsidiary 13 226,094 -

Interest received - 241

---------- ------------

Net cash from/(used in) investing activities 345,758 (6,708,528)

---------- ------------

Cash flows from financing activities

Proceeds from borrowings 292,308 2,192,761

Repayments of borrowings (182,925) (1,653,260)

Proceeds from issue of equity 902,993 -

Payments for share issue costs (178,916) -

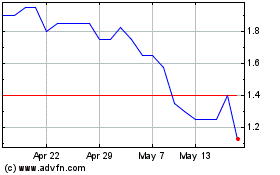

Eqtec (LSE:EQT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Eqtec (LSE:EQT)

Historical Stock Chart

From Sep 2023 to Sep 2024