TIDMEQLS

RNS Number : 8170T

Equals Group PLC

23 July 2020

23 July 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR")

Equals Group plc

('Equals' or the 'Group)

Trading Update

'Robust current trading against Covid-19 headwinds'

Equals (AIM:EQLS) , the fast-growing B2B focused e-banking and

international payments group, is pleased to provide the following

update on the Group's trading for the six month period ended 30

June 2020 ('H1-2020' or the 'period') and also for the 14 working

days up to 20 July 2020.

Revenues

Against the challenging background of the Covid-19 pandemic, the

Group managed to achieve further growth in H1-2020, with total

revenues of GBP13.7 million (H1-2019: GBP13.6 million*).

Excluding B2C Travel Money (cards and cash), revenues of GBP12.3

million were 23% ahead of H1-2019 (GBP10.0 million). The Group's

strategic focus on B2B revenue streams over its legacy travel money

focus has enabled the business to trade well throughout H1-2020.

B2B represented 66% of total revenue in the period versus 51% in

H1-2019.

Overall, B2B revenues at GBP9.0 million were 30% higher than in

H1-2019 (GBP6.9 million), while B2C revenues were 29% lower at

GBP4.7 million (H1-2019: GBP6.7 million), principally owing to the

Covid-19 pandemic.

International Payments was the Group's strongest performing

segment, supported by the acquisitions of Hermex and Casco last

year, as well as strong organic growth. Revenue of GBP8.2 million

was up by GBP3.4 million or 71%, of which GBP0.6 million is

attributable to organic growth. International Payments now

represents 60% of Group revenue, compared to 35% in H1-2019.

Banking revenues were flat overall, although B2B banking began

to increase in the latest quarter, benefitting from the FY-2019

investment in the Group's technology infrastructure.

Revenue from the Corporate Expenses platform, the Group's B2B

card product, fell by 40% to GBP1.4 million reflecting the

radically reduced corporate activity from late-March 2020 due to

the Covid-19 pandemic. However, revenues from this platform have

started to recover in recent months.

B2C Travel Money (cards and cash) revenue of GBP1.4 million

(down 59%) reflects the Group's strategic focus on B2B revenue

streams and the effects of the Covid-19 pandemic hitting volumes in

historically strong seasonal months for travel. Travel Money

continues to represent a smaller proportion of total revenues, it

now being 11% in H1-2020 versus 26% in H1-2019.

Further detail on segmental revenue for H1-2020 versus H1-2019

as well as the percentage changes can be viewed in Appendix 1

below.

Inevitably there was a slowdown in Q2-2020 across all segments

but there has been resilience particularly in International

Payments. Revenue per working day by segment across the last six

quarters can be viewed below in Appendix 2.

Trading in June 2020, and in the 14 working days to 20 July 2020

was encouraging with average revenues being GBP111k per day.

Travel cash business via both Bureaux and B2C retail cards has

begun to pick up gradually and it is anticipated that corporate

card revenues will continue to increase from current levels. The

Board remains optimistic for revenue growth, particularly in

International Payments, in the current financial year and

beyond.

Employee numbers and cost management

After the considerable investment in development over the last

24 months, and the product and infrastructure improvements which

have been made, the Board had already commenced the process of

re-sizing the Group accordingly.

In addition, the change in economic conditions driven by the

Covid-19 pandemic, especially in the travel markets, has led the

Board to conclude that a number of staff will now be at risk of

redundancy.

The combined consequences of these actions will reduce the

headcount from its high point of 341 in December 2019 (as reported

in the results for that year) by 15-20% net of a few new hires in

revenue generating roles. The financial impact to the Group is that

there will be a one-off redundancy cost of circa GBP0.5 million but

offset by a cash saving to the Group of circa GBP2.5 million per

annum.

A further examination by the Board of the Group's real-estate

expense, the second highest cost category is continuing, and

naturally all other costs are constantly under review.

Outlook

The Group's employees have transitioned to remote working well,

with the investment in improved technical infrastructure

benefitting the Group's operations.

The decision to strategically focus on both International

Payments and B2B markets has greatly helped the Group to trade

robustly not only against the headwinds of Covid-19, but also the

uncertain pattern of Brexit transition trading and the disruption

caused by the FCA's intervention in Wirecard's UK business in late

June.

Whilst the Covid-19 pandemic has naturally affected the Group,

revenues are returning to more normalised levels in most B2B

business segments since the initial impact in late March. The Board

is pleased that overall trading continues to perform in line with

management expectations. The Group intends to provide a full update

on trading and to reinstate financial guidance to analysts and

investors for the twelve months ended 31 December 2020 ('FY-2020')

at the Interim Results, to be reported in September 2020

The Board believes that the Group remains financially stable and

well placed to grow and capitalise on opportunities that may arise

alongside the wider global recovery.

Notes

*Revenues from card rebates and similar in 2019 had been

reported as 'one-off' revenues in the month they were recognised.

H1-2019 has been restated to spread these revenues over the

accounting period to which it relates. The impact of this change in

recognition has been to restate H1-2019 revenue from GBP14.6

million to GBP13.6 million.

- Ends -

For more information, please contact:

Equals Group plc

Ian Strafford-Taylor, CEO Tel: +44 (0) 20 7778

Richard Cooper, CFO 9308

www.equalsplc.com

Cenkos Securities plc (Nominated Advisor

/ Joint Broker)

Max Hartley / Callum Davidson Tel: +44 (0) 20 7397

Nick Searle (Sales) 8900

Canaccord Genuity (Joint Broker)

Bobbie Hilliam / David Tyrell Tel: +44 (0) 20 7523

Alex Aylen (Sales) 8150

Buchanan (Financial Communications)

Henry Harrison-Topham / Steph Watson Tel: +44 (0) 20 7466

/ Toto Berger 5000

equals@buchanan.uk.com www.buchanan.uk.com

Notes to Editors:

Equals is a leading challenger brand in banking and payments

that disintermediates the incumbent banks with a superior user

experience and low-cost operating model. The Group enables its

personal and business customers to make easy, low-cost payments

both domestically and in a broad range of currencies across a range

of products all via one integrated system.

Equals provides money movement services to both business and

personal customers through five inter-connected channels -

International Payments, Corporate Expenses platform, Bank Accounts,

Travel Money (comprising currency cards and physical currency).

International Payments channel supports wire transfer foreign

exchange transactions direct to bank accounts. For corporates,

Equals has a market-leading business-expenses solution based around

its corporate platform and prepaid card which yields significant

cost savings via tighter control on expenses before they are

incurred coupled with eliminating inefficient processes. Equals

also offers business and retail bank accounts with all the

functionality offered by banks, namely faster payments, BACs,

direct debits, international payments and a debit card. The Travel

Money offerings (retail currency card and physical currency)

represent cost-effective and secure methods for travelers to spend

abroad.

Appendix 1

H1-2020 H1-2019

GBP000's B2B B2C Total B2B B2C Total

International Payments 6,269 1,976 8,245 3,186 1,632 4,818

Banking & Group

treasury 1,326 1,264 2,590 1,326 1,275 2,601

Cards 1,416 1,097 2,513 2,372 2,638 5,010

Bureaux 11 383 394 33 1,115 1,148

------ ------ ------- ------ ------ -------

Total 9,022 4,720 13,742 6,916 6,660 13,576

------ ------ ------- ------ ------ -------

% of total 66% 34% 100% 51% 49% 100%

Memo: Travel Money 10 1,438 1,448 33 3,523 3,555

------ ------ ------- ------ ------ -------

As % of total revenue 0% 30% 11% 0% 53% 26%

Period on period percentage changes:

B2B B2C Total

International Payments +97% +21% +71%

Banking & Group treasury 0% -1% 0%

Cards -40% -58% -50%

Bureaux -69% -66% -66%

----- ----- ------

Total +30% -29% +1%

----- ----- ------

Memo: Travel Money -69% -59% -59%

Appendix 2

Revenue per working day by segment across the last six quarters

was as below:

GBP000's Q1-2019 Q2-2019 Q3-2019 Q4-2019 Q1-2020 Q2-2020

International Payments 24 27 48 65 54 46

Banking and Group treasury 20 22 21 24 21 21

Cards 33 47 55 45 27 13

Bureaux 9 10 12 8 6 1

-------- -------- -------- -------- -------- --------

Total 86 106 136 142 107 81

-------- -------- -------- -------- -------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUURWRRVUBUAR

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

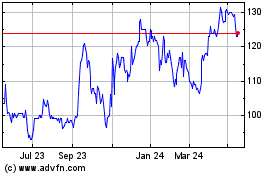

Equals (LSE:EQLS)

Historical Stock Chart

From Jun 2024 to Jul 2024

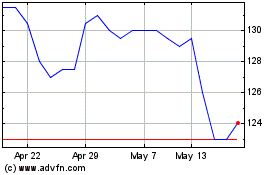

Equals (LSE:EQLS)

Historical Stock Chart

From Jul 2023 to Jul 2024