TIDMDLN

RNS Number : 1958L

Derwent London PLC

24 April 2015

24 April 2015

Derwent London plc ("Derwent London" / "the Group")

DERWENT LONDON SECURES OVER GBP3M OF ADDITIONAL RENT TAKING

NEW LETTINGS TO GBP10.6M SO FAR IN 2015

Derwent London has secured GBP10.6m pa of rents from new

lettings in the year to date, which already exceeds the GBP9.2m we

achieved in the whole of 2014. Recent transactions total more than

GBP3m pa, with the principal ones shown below.

At the recently acquired Angel Square, Islington EC1 the Group

has let 40,700 sq ft of offices in Block Two to The Office Group,

the flexible office space provider. The occupier is taking a

10-year lease with a landlord's break from year five at a base rent

of GBP1.4m pa, reflecting GBP35 per sq ft. The incentives are

equivalent to a nine-month rent free period. The Group will receive

a share of The Office Group's profits above a minimum level. Angel

Square is a 128,700 sq ft office property acquired in November

2014. The passing rent at acquisition was GBP2.4m pa, but the

majority of the leases expired in March 2015. In the last two

months we have re-let over 75% of the building, and renewed one

lease for a combined income of GBP3.7m pa. This newly let income

alone represents a 54% increase on the property's income at the

time of acquisition, and the Group will refurbish the 25,000 sq ft

balance of the property upon vacant possession.

At the Davidson Building, Covent Garden WC2, where four floors

totalling 23,200 sq ft have recently been refurbished, the Group

has let 10,600 sq ft to two occupiers on 10-year leases with breaks

in year five. The combined rent is GBP0.8m pa equating to GBP80 per

sq ft on the terraced penthouse fifth floor (4,370 sq ft) and

GBP72.50 per sq ft on the fourth floor (6,230 sq ft). Both leases

have minimum rental uplifts in year five. There is a further 12,600

sq ft available at this property.

At the Tea Building, Shoreditch E1, a rent of GBP47.50 per sq ft

(GBP0.4m pa) was attained after Feed, an independent communications

agency, took just under 8,000 sq ft on a five-year lease. This

exceeded the previous high of GBP39 per sq ft which was achieved

last year.

At Morelands, Clerkenwell EC1, existing tenant Spark44, a

marketing and communications agency, has taken further space at a

rent of GBP55 per sq ft or GBP0.3m pa, with a minimum uplift to

GBP60 per sq ft on first review, on a 5,370 sq ft unit for nine

years with a tenant's break at five years.

John Burns, Chief Executive Officer of Derwent London,

commented:

"These recent deals are further confirmation of the continuing

strength of the central London letting market that we reported with

our results in February. We are delighted that we have achieved our

initial plans for Angel Square so quickly."

For further information, please contact:

Derwent London John Burns, Chief Executive Officer

Tel: +44 (0)20 7659 3000 Celine Thompson, Head of Leasing

Quentin Freeman, Head of Investor

Relations

Brunswick Group Simon Sporborg

Tel: +44 (0)20 7404 5959 Nina Coad

Notes to editors

Derwent London plc

Derwent London plc owns a portfolio of commercial real estate

predominantly in central London valued at GBP4.2 billion as at 31

December 2014, making it the largest London-focused real estate

investment trust (REIT).

Our experienced team has a long track record of creating value

throughout the property cycle by regenerating our buildings via

development or refurbishment, effective asset management and

capital recycling.

We typically acquire central London properties off-market with

low capital values and modest rents in improving locations, most of

which are either in the West End or the Tech Belt. We capitalise on

the unique qualities of each of our properties - taking a fresh

approach to the regeneration of every building with a focus on

anticipating tenant requirements and an emphasis on design.

Reflecting and supporting our long-term success, the business

has a strong balance sheet with modest leverage, a robust income

stream and flexible financing.

Landmark schemes in our portfolio of 5.7 million sq ft as at 31

December 2014 include Angel Building EC1, The Buckley Building EC1,

White Collar Factory EC1, 1-2 Stephen Street W1, Horseferry House

SW1 and Tea Building E1.

In December 2014 Derwent London topped the real estate sector

for the fifth year in a row and was placed ninth overall in the

Management Today awards for 'Britain's Most Admired Companies'.

Also in 2014 the Group won the Property Week 'Developer of the

Year' and the RICS London Commercial Award, and was shortlisted for

awards by Architects' Journal, BCO, NLA and OAS. The Group was also

awarded EPRA Gold for corporate and sustainability reporting.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon

Forward-looking statements

This document contains certain forward-looking statements about

the future outlook of Derwent London. By their nature, any

statements about future outlook involve risk and uncertainty

because they relate to events and depend on circumstances that may

or may not occur in the future. Actual results, performance or

outcomes may differ materially from any results, performance or

outcomes expressed or implied by such forward-looking

statements.

No representation or warranty is given in relation to any

forward-looking statements made by Derwent London, including as to

their completeness or accuracy. Derwent London does not undertake

to update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSELFWDFISEEL

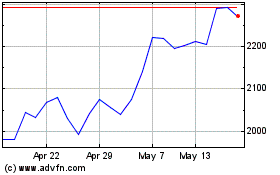

Derwent London (LSE:DLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

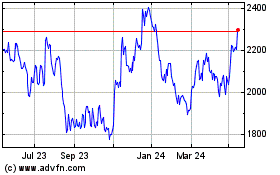

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2023 to Jul 2024