TIDMDIA

RNS Number : 6963O

Dialight PLC

04 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN DIALIGHT PLC OR ANY OTHER ENTITY IN

ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF DIALIGHT PLC.

4 October 2023

Dialight plc

("Dialight", the "Company", or the "Group")

Publication of Circular and Notice of General Meeting

Further to conditional offering of 6,635,257 new ordinary shares

of 1.89 pence each in the capital of the Company (the "New Ordinary

Shares") to raise gross proceeds of approximately GBP10.55 million

(the "Fundraising"), announced on 27 September 2023, the Company

announces that the circular referred to in that announcement is

being published today (the "Circular"). The Circular will be

available on the Company's website www.dialight.com.

As described in the announcement of 27 September 2023, the

participation in the Fundraising by Schroder Investment Management

("Schroder") constitutes a related party transaction requiring

shareholder approval in accordance with Listing Rule 11.1.7R.

Accordingly, settlement of the New Ordinary Shares and Admission is

conditional on approval by the Company's shareholders at a general

meeting.

The Circular contains further details of the proposed related

party transaction (within the meaning of Listing Rule 11.1.4R) and

will be posted to shareholders that have elected to receive hard

copies of shareholder documentation as soon as practicable. The

Circular also contains a notice convening a general meeting to be

held at 9.30 a.m. on 27 October 2023 at the offices of Ashurst LLP,

London Fruit & Wool Exchange, 1 Duval Square, London, E1 6PW.

Completion of the Fundraising will be conditional upon receiving

shareholder approval to the related party transaction proposal at

the General Meeting.

The expected timetable of principal events in relation to the

General Meeting is as follows:

Event Expected time/date

Deadline for receipt of Form of Proxy and CREST voting

instructions 9.30 a.m. on 25 October 2023

Voting Record Time 6.30 p.m. on 25 October 2023

General Meeting 9.30 a.m. on 27 October 2023

Admission and Settlement 8.00 a.m. on 30 October 2023

A copy of the Circular has been submitted to the National

Storage Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Capitalised terms used but not defined in this announcement have

the same meaning as set out in the announcement of the Results of

Placing announcement released by the Company on 27 September

2023.

Enquiries:

Dialight plc +44 (0)203 058 3542

Neil Johnson, Non-Executive Chairman

Fariyal Khanbabi, Group Chief Executive

Peel Hunt LLP +44 (0) 20 7418 8900

Mike Bell / Ed Allsopp / Tom Graham

IMPORTANT NOTICES

This Announcement and the information contained in it is not for

publication, release, transmission distribution or forwarding, in

whole or in part, directly or indirectly, in or into any

jurisdiction in which publication, release or distribution would be

unlawful. This Announcement is for information purposes only and

does not constitute an offer to sell or issue, or the solicitation

of an offer to buy, acquire or subscribe for shares in the capital

of the Company. Any failure to comply with these restrictions may

constitute a violation of the securities laws of such

jurisdictions.

The New Ordinary Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "Securities

Act") or with any securities regulatory authority of any state or

other jurisdiction of the United States, and may not be offered,

sold, pledged, taken up, exercised, resold or transferred or

delivered, directly or indirectly, in or into the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

in compliance with any applicable securities laws of any state or

other jurisdiction of the United States. Subject to limited

exceptions, the New Ordinary Shares are being offered and sold only

outside of the United States in "offshore transactions" within the

meaning of, and in accordance with, Regulation S under the

Securities Act and otherwise in accordance with applicable laws. No

public offering of the New Ordinary Shares is being made in the

United States, United Kingdom or elsewhere.

This Announcement is being distributed and communicated to

persons in the UK only in circumstances to which section 21(1) of

the Financial Services and Markets Act 2000, as amended ("FSMA")

does not apply.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the UK Prospectus Regulation) to be

published.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Peel Hunt or by any of its affiliates as

to or in relation to, the accuracy or completeness of this

Announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Peel Hunt is authorised and regulated in the United Kingdom by

the FCA and is acting solely for the Company and no one else in

connection with the Fundraising and will not be responsible to

anyone other than the Company for providing the protections

afforded to its clients nor for providing advice in relation to the

Fundraising and/or any other matter referred to in this

Announcement. Apart from the responsibilities and liabilities, if

any, which may be imposed on Peel Hunt by FSMA or by the regulatory

regime established under it, neither Peel Hunt nor any of its

affiliates accepts any responsibility whatsoever for the contents

of the information contained in this Announcement or for any other

statement made or purported to be made by or on behalf of Peel Hunt

or any of its affiliates in connection with the Company, the New

Ordinary Shares or the Fundraising. Peel Hunt and its affiliates

accordingly disclaim all and any responsibility and liability

whatsoever, whether arising in tort, contract or otherwise (save as

referred to above) in respect of any statements or other

information contained in this Announcement.

The distribution of this Announcement and/or the offering of the

New Ordinary Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Company or Peel Hunt or any of

their respective affiliates that would, or which is intended to,

permit an offering of the New Ordinary Shares in any jurisdiction

or result in the possession or distribution of this Announcement or

any other offering or publicity material relating to New Ordinary

Shares in any jurisdiction where action for that purpose is

required.

Persons distributing any part of this Announcement must satisfy

themselves that it is lawful to do so. Persons (including, without

limitation, nominees and trustees) who have a contractual or other

legal obligation to forward a copy of this Announcement should seek

appropriate advice before taking any such action. Persons into

whose possession this Announcement comes are required by the

Company and Peel Hunt to inform themselves about, and to observe,

such restrictions.

Each investor or prospective investor should conduct his, her or

its own investigation, analysis and evaluation of the business and

data described in this Announcement and publicly available

information. The price and value of securities can go down as well

as up. Past performance is not a guide to future performance.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRBGBDGBUGDGXS

(END) Dow Jones Newswires

October 04, 2023 06:52 ET (10:52 GMT)

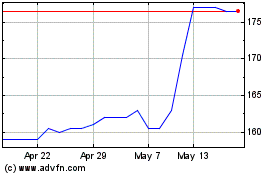

Dialight (LSE:DIA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dialight (LSE:DIA)

Historical Stock Chart

From Jan 2024 to Jan 2025