TIDMDIA

RNS Number : 7553N

Dialight PLC

27 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES (INCLUDING ITS TERRITORIES AND DEPENCIES, ANY STATE

OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA), AUSTRALIA,

CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF SOUTH AFRICA OR ANY

OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN DIALIGHT PLC OR ANY OTHER ENTITY IN

ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF DIALIGHT PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF EU REGULATION 596/2014 WHICH

FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018 ("MAR").

27 September 2023

Dialight plc

("Dialight", the "Company", or the "Group")

Results of Placing

Dialight (LSE: DIA.L) a global leader in sustainable LED

lighting for industrial applications, is pleased to announce the

results of the placing and retail offer announced by the Company

yesterday (the "Placing Announcement").

A total of 6,635,257 new ordinary shares of 1.89 pence each in

the capital of the Company (the "New Ordinary Shares") have been

allotted pursuant to the Placing and the retail offer via the REX

platform (the "REX Retail Offer") to raise gross proceeds of

approximately GBP10.55 million (the "Fundraising"), conditional on

the shareholder approval detailed below. The net proceeds from the

Fundraising will be used to support an ambitious transformation

plan designed to materially improve financial performance over the

medium term.

All directors of the Company have participated in the

Fundraising totalling, in aggregate, GBP0.22 million.

The New Ordinary Shares being issued pursuant to the Fundraising

represent approximately 19.99 per cent. of the existing issued

ordinary share capital of the Company immediately prior to the

Fundraising. The offer price of 159 pence per New Ordinary Share

(the "Offer Price") represents a discount of approximately 9.4 per

cent. to the mid-market closing share price of 175.5 pence on 26

September 2023.

Schroder Investment Management ("Schroder") is a substantial

shareholder of the Company and a related party of the Company for

the purposes of the Listing Rules and has agreed to subscribe for

2,075,472 Placing Shares in the Placing at the Offer Price,

representing an aggregate consideration of approximately

GBP3,300,000. The participation in the Placing by Schroder

constitutes a related party transaction requiring shareholder

approval in accordance with Listing Rule 11.1.7R. Accordingly,

settlement of the New Ordinary Shares and Admission is conditional

on approval by the Company's shareholders at a general meeting. The

Company will publish a circular and make a further announcement in

due course regarding the timing of such general meeting.

Peel Hunt LLP ("Peel Hunt") acted as Sole Bookrunner and Sponsor

in connection with the Placing. Peel Hunt is also the corporate

broker to the Company (the "Corporate Broker").

Capitalised terms used in this Announcement have the meanings

given to them in the Placing Announcement unless otherwise

defined.

Enquiries:

Dialight plc +44 (0)203 058 3542

Neil Johnson, Non-Executive Chairman

Fariyal Khanbabi, Group Chief Executive

Peel Hunt LLP (Bookrunner and Corporate Broker) +44 (0) 20 7418 8900

Mike Bell / Ed Allsopp / Tom Graham (Investment

Banking)

Sohail Akbar / Jock Maxwell Macdonald / Nick

Wilks (Equity Syndicate)

Director participation

Certain directors of the Company have subscribed in the Placing,

amounting to proceeds of approximately GBP 0.22 million in

aggregate, as set out in the table below.

Name Number Percentage Number of Number of Ordinary Percentage

of existing of existing New Ordinary Shares on Admission of Enlarged

Ordinary issued Shares Share Capital

Shares share capital on Admission

Neil Johnson 0 0.00% 62,893 62,893 0.16%

------------- --------------- -------------- --------------------- ---------------

Fariyal Khanbabi 26,338 0.08% 12,578 38,916 0.10%

------------- --------------- -------------- --------------------- ---------------

Nigel Lingwood 5,000 0.02% 6,289 11,289 0.03%

------------- --------------- -------------- --------------------- ---------------

Steve Blair 0 0.00% 31,446 31,446 0.08%

------------- --------------- -------------- --------------------- ---------------

Lynn Brubaker 0 0.00% 25,157 25,157 0.06%

------------- --------------- -------------- --------------------- ---------------

Related party transactions

Schroder is a substantial shareholder of the Company and a

related party of the Company for the purposes of the Listing Rules

and has agreed to subscribe for 2,075,472 Placing Shares in the

Placing at the Offer Price, representing an aggregate consideration

of approximately GBP3,300,000. The participation in the Placing by

Schroder constitutes a related party transaction requiring

shareholder approval in accordance with Listing Rule 11.1.7R.

Accordingly, settlement of the New Ordinary Shares and Admission is

conditional on approval by the Company's shareholders at a general

meeting. The Company will publish a circular and make a further

announcement in due course regarding the timing of such general

meeting. The Company can call a general meeting on 21 clear days'

notice.

Aberforth Partners LLP is a substantial shareholder of the

Company and a related party of the Company for the purposes of the

Listing Rules and has agreed to subscribe for 1,336,780 Placing

Shares in the Placing at the Offer Price, representing an aggregate

consideration of approximately GBP2,125,480. The participation in

the Placing by Aberforth Partners LLP constitutes a smaller related

party transaction for the purpose of Listing Rule 11.1.10R, and

will not require shareholder approval.

Sterling Strategic Value Fund is a substantial shareholder of

the Company and a related party of the Company for the purposes of

the Listing Rules and has agreed to subscribe for 787,305 Placing

Shares in the Placing at the Offer Price, representing an aggregate

consideration of approximately GBP1,251,814. The participation in

the Placing by Sterling Strategic Value Fund constitutes a smaller

related party transaction for the purpose of Listing Rule 11.1.10R,

and will not require shareholder approval.

Settlement and Total Voting Rights

Applications have been made to the Financial Conduct Authority

("FCA") for the New Ordinary Shares to be admitted to trading on

the Official List of the FCA a nd to London Stock Exchange plc for

the New Ordinary Shares to be admitted to trading on the Main

Market ("Admission").

As described above, settlement of the New Ordinary Shares and

Admission is conditional on approval by the Company's shareholders

in accordance with Listing Rule 11.1.7R. Accordingly, settlement of

the New Ordinary Shares and Admission will only take place

following shareholder approval being obtained at the relevant

general meeting. As set out in the Placing Announcement, pursuant

to the terms of the Placing Agreement, all conditions to the

Placing Agreement, including the latest date for Admission, must be

satisfied by not later than the earlier of (i) the fifth dealing

day after the date of the relevant general meeting; and (ii) 10

November 2023. The Company will make a further announcement in due

course regarding the timing of the general meeting and expected

timetable of principal events.

The Placing and the REX Retail Offer are each conditional upon,

inter alia, Admission becoming effective and upon the placing

agreement entered into by the Company and Peel Hunt (the "Placing

Agreement") not being terminated in accordance with its terms prior

to Admission.

The New Ordinary Shares will, when issued, be credited as fully

paid and will rank pari passu in all respects with each other and

with the existing ordinary shares in the capital of Company,

including, without limitation, the right to receive all dividends

and other distributions declared, made or paid after the date of

issue.

Following the Placing, the Company shall be subject to a lock-up

for a period of 120 days following the date of Admission, subject

to waiver by Peel Hunt LLP and certain customary carve-outs agreed

between Peel Hunt and the Company.

Following Admission, the total number of ordinary shares in

issue in Dialight will be 39,828,141. The Company holds no shares

in treasury, therefore, following Admission, the total number of

voting shares will be 39,828,141. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

The below notification made in accordance with the requirements

of the EU Market Abuse Regulation, provides further detail:

1. Details of the person discharging managerial

responsibilities / person closely associated

a) Name 1. Neil Johnson

2. Fariyal Khanbabi

3. Nigel Lingwood

4. Steve Blair

5. Lynn Brubaker

------------------------------- -----------------------------------

2. Reason for the Notification

--------------------------------------------------------------------

a) Position/status 1. Non-Executive Chairman

2. Group Chief Executive

3. Non-Executive Director

4. Non-Executive Director

5. Non-Executive Director

------------------------------- -----------------------------------

b) Initial notification/amendment Initial notification

------------------------------- -----------------------------------

3. Details of the issuer, emission allowance market

participant, auction platform, auctioneer or

auction monitor

--------------------------------------------------------------------

a) Name Dialight plc

------------------------------- -----------------------------------

b) LEI GB0033057794

------------------------------- -----------------------------------

4. Details of the transaction(s): section to be

repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and

(iv)each place where transactions have been

conducted

--------------------------------------------------------------------

a) Description of the Ordinary shares of 1.89 pence each

Financial instrument,

type of instrument

------------------------------- -----------------------------------

Identification code GB0033057794

------------------------------- -----------------------------------

b) Nature of the Transaction Purchase of shares

------------------------------- -----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. 159p 1. 62,893

2. 159p 2. 12,578

3. 159p 3. 6,289

4. 159p 4. 31,446

5. 159p 5. 25,157

----------------

------------------------------- -----------------------------------

d) Aggregated information Aggregate volume: 138,363

Aggregated volume Aggregate price: GBP219,997

/price

------------------------------- -----------------------------------

e) Date of the transaction 27 September 2023

------------------------------- -----------------------------------

f) Place of the transaction London Stock Exchange (XLON)

------------------------------- -----------------------------------

Name of issuer Dialight plc

Transaction details In aggregate, the Fundraising of 6,635,257

New Ordinary Shares represents approximately

19.99 per cent. of the Company's issued ordinary

share capital.

Schroder is a substantial shareholder of

the Company and a related party of the Company

for the purposes of the Listing Rules and

has agreed to subscribe for 2,075,472 Placing

Shares in the Placing at the Offer Price.

The participation in the Placing by Schroder

constitutes a related party transaction requiring

shareholder approval in accordance with Listing

Rule 11.1.7R.

Settlement for the New Ordinary Shares and

Admission will therefore take place after

the relevant general meeting. T he latest

date for all conditions under the Placing

Agreement, including Admission, to be satisfied

will be not later than the earlier of (i)

the fifth dealing day after the date of the

relevant general meeting; and (ii) 10 November

2023.

----------------------------------------------------

Use of proceeds The net proceeds of the Fundraising will

be used to reduce the Company's net indebtedness

and fund the transformation plan investment

expected to be made before the end of 2024.

The balance of the net proceeds of the Fundraising

is expected to be used to fund working capital

and for general corporate purposes.

----------------------------------------------------

Quantum of proceeds The Fundraising raised gross proceeds of

approximately GBP10.55 million and net proceeds

of approximately GBP10 million.

----------------------------------------------------

Discount The Offer Price of 159 pence represents a

discount of 9.4 per cent. to the closing

mid-market share price on 26 September 2023.

----------------------------------------------------

Allocations Soft pre-emption has been adhered to in the

allocations process. Management were involved

in the allocations process, which has been

carried out in compliance with the MIFID

II Allocation requirements. Allocations made

outside of soft pre-emption were preferentially

directed towards existing shareholders in

excess of their pro rata, and wall-crossed

accounts.

----------------------------------------------------

Consultation Peel Hunt LLP undertook a pre-launch wall-crossing

process, including consultation with the

Company's major shareholders, to the extent

reasonably practicable and permitted by law.

----------------------------------------------------

Retail investors The Fundraising included a retail offer of

up to GBP1 million, via the REX platform.

Retail investors who participated in the

REX Retail Offer were able to do so on the

same terms as all investors in the Placing.

The REX Retail Offer was made available to

existing shareholders in the UK. Investors

had the ability to participate in the REX

Retail Offer through ISAs and SIPPs, as well

as General Investment Accounts (GIAs). This

combination of participation routes meant

that, to the extent practicable on the transaction

timetable, eligible UK retail investors had

the opportunity to participate in the Fundraising

alongside institutional investors.

----------------------------------------------------

IMPORTANT NOTICES

This Announcement and the information contained in it is not for

publication, release, transmission distribution or forwarding, in

whole or in part, directly or indirectly, in or into the United

States, Australia, Canada, Japan, New Zealand or the Republic of

South Africa or any other jurisdiction in which publication,

release or distribution would be unlawful. This Announcement is for

information purposes only and does not constitute an offer to sell

or issue, or the solicitation of an offer to buy, acquire or

subscribe for shares in the capital of the Company in the United

States, Australia, Canada, Japan, New Zealand or the Republic of

South Africa or any other state or jurisdiction. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of such jurisdictions.

The New Ordinary Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "Securities

Act") or with any securities regulatory authority of any state or

other jurisdiction of the United States, and may not be offered,

sold, pledged, taken up, exercised, resold or transferred or

delivered, directly or indirectly, in or into the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

in compliance with any applicable securities laws of any state or

other jurisdiction of the United States. Subject to limited

exceptions, the New Ordinary Shares are being offered and sold only

outside of the United States in "offshore transactions" within the

meaning of, and in accordance with, Regulation S under the

Securities Act and otherwise in accordance with applicable laws. No

public offering of the New Ordinary Shares is being made in the

United States, United Kingdom or elsewhere.

This Announcement is being distributed and communicated to

persons in the UK only in circumstances to which section 21(1) of

the Financial Services and Markets Act 2000, as amended ("FSMA")

does not apply.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the UK Prospectus Regulation) to be

published.

This Announcement is for information purposes only and is

directed only at: (a) in Member States of the European Economic

Area, persons who are "qualified investors" (within the meaning of

article 2(e) of the Prospectus Regulation (EU) 2017/1129, as

amended (the "EU Prospectus Regulation"); (b) in the United

Kingdom, persons who are "qualified investors" within the meaning

of article 2(e) of the UK version of the Regulation (EU) 2017/1129

as it forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended (the "UK Prospectus Regulation")

who are (i) "investment professionals" within the meaning of

article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 as amended (the "Order"); or (ii)

persons falling within article 49(2)(a) to (d) of the Order; or (c)

other persons to whom it may otherwise be lawfully communicated

(all such persons in (a), (b) and (c), together being referred to

as "Relevant Persons"). This Announcement must not be acted on or

relied on by persons who are not Relevant Persons. Persons

distributing this Announcement must satisfy themselves that it is

lawful to do so. Any investment or investment activity to which

this Announcement and the terms and conditions set out herein

relates is available only to Relevant Persons and will be engaged

in only with Relevant Persons.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Peel Hunt or by any of its affiliates as

to or in relation to, the accuracy or completeness of this

Announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Peel Hunt is authorised and regulated in the United Kingdom by

the FCA and is acting solely for the Company and no one else in

connection with the Fundraising and will not be responsible to

anyone other than the Company for providing the protections

afforded to its clients nor for providing advice in relation to the

Fundraising and/or any other matter referred to in this

Announcement. Apart from the responsibilities and liabilities, if

any, which may be imposed on Peel Hunt by FSMA or by the regulatory

regime established under it, neither Peel Hunt nor any of its

affiliates accepts any responsibility whatsoever for the contents

of the information contained in this Announcement or for any other

statement made or purported to be made by or on behalf of Peel Hunt

or any of its affiliates in connection with the Company, the New

Ordinary Shares or the Fundraising. Peel Hunt and its affiliates

accordingly disclaim all and any responsibility and liability

whatsoever, whether arising in tort, contract or otherwise (save as

referred to above) in respect of any statements or other

information contained in this Announcement.

The distribution of this Announcement and/or the offering of the

Placing Shares in certain jurisdictions may be restricted by law.

No action has been taken by the Company or Peel Hunt or any of

their respective affiliates that would, or which is intended to,

permit an offering of the New Ordinary Shares in any jurisdiction

or result in the possession or distribution of this Announcement or

any other offering or publicity material relating to New Ordinary

Shares in any jurisdiction where action for that purpose is

required.

Persons distributing any part of this Announcement must satisfy

themselves that it is lawful to do so. Persons (including, without

limitation, nominees and trustees) who have a contractual or other

legal obligation to forward a copy of this Announcement should seek

appropriate advice before taking any such action. Persons into

whose possession this Announcement comes are required by the

Company and Peel Hunt to inform themselves about, and to observe,

such restrictions.

Each investor or prospective investor should conduct his, her or

its own investigation, analysis and evaluation of the business and

data described in this Announcement and publicly available

information. The price and value of securities can go down as well

as up. Past performance is not a guide to future performance.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFFFVVALIRFIV

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

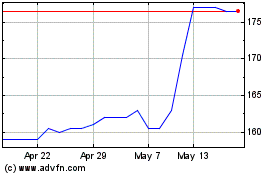

Dialight (LSE:DIA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dialight (LSE:DIA)

Historical Stock Chart

From Jan 2024 to Jan 2025