RNS Number:8602Q

Cyan Holdings Plc

27 March 2008

Press Release 27 March 2008

Cyan Holdings Plc

("Cyan" or "the Group")

Final Results

Cyan Holdings Plc (AIM:CYAN.L), a fabless semiconductor company providing

configurable application software and production ready modules based on feature

rich, low power, microcontroller chips, announces its Final Results for the year

ended 31 December 2007.

Highlights

* First 6 months phase of reorganization complete on time

* Loss of �4.6m (2006: loss of �3.0m) after �1.0m of restructuring and

non-recurring costs

* Identification of new sales opportunities in China

* Identification of further partnership opportunities

Commenting on the results, Kenn Lamb, Chief Executive of Cyan, said: "As of the

year ended 31 December 2007, Cyan completed its restructuring program and

introduced new products in the European and Asian markets. The progress

achieved is ahead of our expectations and the new products have been well

received in each market. We look forward to reporting further evidence of

progress and growing sales traction over the next quarter. Feedback from

partners, sales channels and early prospects indicate that Cyan is now well

positioned to deliver the true potential of the business."

-Ends-

For further information, please contact:

Cyan Holdings plc

Kenn Lamb, CEO Tel: +44 (0) 1954 234 400

Andrew Lee, Finance Director

www.cyantechnology.com

Collins Stewart Europe Limited

Chris Howard/Oliver Quarmby Tel: +44 (0) 20 7523 8350

Corporate Finance

www.collinsstewart.com

Media enquiries:

Abchurch Communications

Heather Salmond / Franziska Boehnke Tel: +44 (0) 20 7398 7700

franziska.boehnke@abchurch-group.com www.abchurch-group.com

Chairman's Statement

2007 has been a year of change for Cyan. The Group entered the year with a new

range of products but without any notable sales traction. Since its inception

Cyan has established a good track record of creating quality products, but it

has struggled to match them with market needs. With this in mind the senior

management of Cyan has been thoroughly restructured during the year, most

significantly through the appointment of Kenn Lamb as CEO. The commercial

experience that Kenn has brought to Cyan has been critical to repositioning the

group so that it enters 2008 in a much stronger position.

Kenn identified two core problems with the Group's strategy. On the one hand

there was a dogged persistence to compete at a component level with industry

majors such as Texas Instruments and Renesas, while on the other, producing

product which was technically excellent, but could not be manufactured at a cost

customers were willing to pay for it.

Kenn has led the senior management of the Group in addressing these two core

weaknesses head on and is in the process of executing a new business strategy

that will offer the potential for the Group to enjoy sales penetration for the

first time.

Inevitably the results that follow do not reflect the outcome of that strategy

indeed the sales performance with a turnover of �33,000 (2006: �269,000) is

indicative of the lack of sales penetration effected by the former strategy. We

do however, expect to see the fruits of our restructuring efforts come through

in the first half of 2008. In the same way the cost burden of 2007 which

resulted in an operating loss of �4,648,000 (2006: �3,009,000) is inflated by a

number of one off restructuring costs, both in restructuring the management team

and re-engineering the company's product range. These costs, amounting to

�1,047,000 (2006: � nil) have been necessary in order to get the Group into a

position where it can deliver sales and market penetration at the earliest

possible opportunity.

We believe the Group has now faced up to the challenges that have held it back

and enters 2008 in a strong position to succeed.

Other matters

During the year Mike Hughes (in October), Paul Barwick (in March) and Paul

Johnson (in November) resigned from the board to pursue other interests. I would

like to take this opportunity to thank all of them for the contribution they

made to the Group and in particular for their contribution to the flotation of

the business in 2005. Following the board changes, the Group entered 2008

seeking to strengthen the non executive team and I am pleased to welcome David

Gutteridge to our board. David joined us with effect from 5 February 2008 and

we look forward to benefiting from his experience.

In the autumn, the new management team undertook a detailed review of progress

on the sale of tax terminals in China through Pinnacle. Although by this stage,

it is clear that the Chinese tax terminal project is well underway in a number

of provinces, with orders already having been placed, our conclusion is that

Pinnacle has failed to gain any significant market traction. Accordingly the

Group has written off the �157,780 debt due from Pinnacle in the accounts to 31

December 2007. We are aware that high expectations in previous years attached to

the success of this contract. The Company's new strategy was in part developed

in response to the lack of progress of the Tax Control opportunity, but the

success of the new strategy is in no way dependent upon the success of the Tax

Control opportunity. Management's view is that this write-off does not affect

the prospects for the future direction of the company, which have been defined

independent of the Tax Control market.

We appreciate that 2007 has been a difficult year for Cyan and a number of hard

decisions have been necessary. However the board believes that having

successfully completed the restructuring of the business, the Group enters 2008

in a much stronger position to succeed. I would like to finish by welcoming

those new shareholders who joined us at the Placing in July and thanking our

existing shareholders for their patience and support in 2007. I trust that we

will all see the benefits of a reinvigorated group in a successful 2008.

Dr John Read

Chairman

27 March 2008

Chief Executive's Review of Operations

When I joined the Group on 11 April last year, it was apparent that its future

success would depend on a major reappraisal of the business strategy and further

funds to implement that strategy. On completing that reappraisal, in July 2007

the group successfully closed a �5 million (net) fundraising so that it could

execute our new strategic business plan. At the time of the Placing, the Group

set out its goals and expectations, explaining that the plan would in total

require eighteen months to execute, divided into three phases.

The first six months post fundraising were allocated to a restructuring of the

Group to ensure that it possessed the skills, products, market position and

partners necessary to deliver the second and third phases of the plan. That six

month phase was up to 31 December 2007 and the board is pleased to report that

all the targeted restructuring activities have been completed either on time, or

ahead of expectations. Among the achievements of this first phase are:

* Establishing a completely new European sales team

* The creation and recruitment of an experienced operations team

* Expansion of the marketing team

* Significant investment in expanding the software development team

* A restructured Board of Directors.

Western Markets

For Western Markets, Cyan has positioned itself to offer clients "end

applications", not just MCUs. This means that Cyan now offers "user customisable

application solutions" and not simply components to be used by customers in

their designs. As we aim to compete at the application level, we look to work

with partners to develop application solutions incorporating our feature rich

configurable microcontrollers.

In consequence of this new strategy, Cyan has therefore concentrated on

developing new partnerships. In addition to its already announced partnership

with Adaptive Modules, a company active in the RF Module market, Cyan is moving

forward with four further partnerships, of which two are at an advanced stage of

negotiation, with a further two progressing well but at an earlier stage. These

partnerships are intended to establish mutually profitable relationships with

established companies operating in all three global geographies (USA, Europe and

Asia) who can offer Cyan a channel to market, and/or complementary technology.

Negotiations will be concluded during the first half of 2008.

Application solutions comprise production quality application software running

on production ready modules. Such modules are supplied by partners established

in the relevant market segments. A particularly exciting development is the

extension of CyanIDE so that it can offer system level design, rather than

simply configuring the Cyan MCU. This new capability will support end user

modification of the complete system, which in turn enables easy addition of

additional market specific features required for an individual customer's

products. The enhanced version of CyanIDE has been converted to a new open

standard. It is already in Beta testing and will be released to all customers

in Q2 08. The company is confident that the new feature rich CyanIDE software

is set to become dominant in the industry.

To emphasise this new application level capability, we have completely

overhauled our marketing and branding communications. The application solutions

are now marketed under the Cy-Solved brand and this is prominent on the

rebranded Cyan Technology web site which went live ahead of schedule in

December.

China and Asia

For Asian Markets, Cyan has a new entry level product which was released for new

designs in Asia earlier this month. This device, available today, is less than

half the cost of the previous lowest priced Cyan MCU and is pin and functionally

compatible with a completely new device, the first of a new entry level family

of MCUs, compatible with the existing eCOG1X family. These devices, which will

be manufactured by a new foundry partner, achieve lower cost through production

engineering techniques introduced by Cyan's new operations team. When released

in production volumes in 2H08, they will reduce end user costs to one third of

the lowest price previously available. Early indications are that Cyan now has

the ability to meet the price aspirations for high volume design opportunities

in China similar to those for which we have previously bid unsuccessfully.

Through new manufacturing partners in China, Cyan has reduced the end user cost

for a development system by a factor of twenty. The consequence of this

achievement is that for the first time, Cyan has its core development system

priced at a cost easily within the budget of the smallest Chinese design

business; management believes that this achievement has eliminated a significant

barrier to securing new customers.

Looking Forward

The group enters 2008 with a range of new products, some of which have already

been released and with others still in development. All such products have been

costed to allow pricing that enables manufacture and sale in China at prices

that are competitive in the Chinese market. As a direct result of this strategy

change Cyan has already identified three separate opportunities each in excess

of one million pieces. While initial margins will be lower than plan, we expect

significant margin growth throughout the second half of 2008 as the full impact

of our cost reduction strategy comes on stream.

In summary, the Group is pleased to announce that the first phase of the

turn-around plan has been completed on schedule. The company therefore enters

2008 having already started on the the plan's second phase, in which we expect

to announce new product launches and to see early stage sales for product

already released to the market.

The new strategy is showing early and positive signs of traction and management

remain confident in their ability to deliver on this strategy.

2007 has been a year of transition for the Group which has meant a large number

of substantial changes. These changes have been enthusiastically embraced by our

staff and by my colleagues on the board. I want to finish by acknowledging the

hard work of the Cyan team in bringing about the change in direction and the

wholehearted support they have given me and the board in implementing our

strategy.

Kenn Lamb

Chief Executive Officer

27 March 2008

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2007

2007 2006

� �

Continuing Operations

Revenue 32,596 269,333

Cost of sales (26,934) (205,776)

Gross profit 5,662 63,557

Administrative expenses (3,728,792) (3,080,863)

Other operating expenses (21,903) (173,529)

Restructuring and non recurring costs (1,047,267) -

Operating loss (4,792,300) (3,190,835)

Investment revenues 144,795 182,216

Finance costs (121) (227)

Loss before tax (4,647,626) (3,008,846)

Tax 360,000 475,557

Loss for the period attributable to equity (4,287,626) (2,533,289)

holders of the parent

Loss per share (pence)

Basic (4.0) (3.0)

Diluted (4.0) (3.0)

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE

For the year ended 31 December 2007

2007 2006

� �

Exchange differences on translation of foreign operations 31,876 26,209

Net income recognised directly in equity 31,876 26,209

Loss for the period (4,287,626) (2,533,289)

Total recognised income and expense for the period (4,255,750) (2,507,080)

attributable to equity holders of the parent

CONSOLIDATED BALANCE SHEET

At 31 December 2007

2007 2006

� �

Non-current assets

Intangible assets 28,792 57,586

Property, plant and equipment 96,680 78,663

125,472 136,249

Current assets

Inventories 180,240 107,922

Trade and other receivables 503,225 520,942

Cash and cash equivalents 4,079,534 2,820,801

4,762,999 3,449,665

Total assets 4,888,471 3,585,914

Current liabilities

Trade and other payables 704,223 249,662

Current tax liabilities - -

Provisions - -

704,223 249,662

Non-current liabilities - -

Total liabilities 704,223 249,662

Net assets 4,184,248 3,336,252

EQUITY

Share capital 279,252 170,070

Share premium account 13,600,291 8,627,630

Share option reserves 209,398 187,495

Own shares - -

Retained earnings (9,904,693) (5,648,943)

Total equity being equity attributable to equity 4,184,248 3,336,252

holders of the parent

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2007

2007 2006

� �

Net cash from operating activities (3,927,362) (2,939,992)

Investing activities

Interest received 144,795 182,216

Purchases of property, plant and equipment (73,426) (48,542)

Net cash used in investing activities 71,369 133,674

Financing activities

Interest paid (121) (227)

Proceeds on issue of shares 5,081,843 30,849

Net cash from financing activities 5,081,722 30,622

Net increase/(decrease) in cash and cash 1,225,729 (2,775,696)

equivalents

Cash and cash equivalents at beginning of 2,820,801 5,567,680

year

Effect of foreign exchange rate changes 33,004 28,817

Cash and cash equivalents at end of year 4,079,534 2,820,801

NOTES TO THE FINANCIAL INFORMATION

For the year ended 31 December 2007

1. Basis of Preparation

The financial information set out in this announcement has been based on the

company's financial statements which are prepared in accordance with

International Financial Reporting Standards as adopted for use in the EU. The

Company's specific IFRS accounting policies are available on the Company's

website www.cyantechnology.com. The financial information does not constitute

statutory financial statements within the meaning of section 240 of the

Companies Act 1985.

The results for the year ended 31 December 2006 have been extracted from the

statutory financial statements of Cyan Holdings plc and restated in accordance

with the accounting principles applied by the Company. Statutory financial

statements for the year ended 31 December 2006 are available on the Company's

website and have been filed with the Registrar of Companies. The Company's

auditors issued a report on those financial statements that was unqualified and

did not contain a statement under section 237(2) or section 237(3) of the

Companies Act 1985; however the auditor's report was modified to emphasise the

uncertainty over the timing and quantum of amounts which may be recovered from

one of the Group's customers.

The statutory accounts for the year ended 31 December 2007 have been finalized

on the basis of the financial information presented by the directors in this

announcement and will be delivered to the Registrar of Companies shortly. The

audit report for the year ended 31 December 2007 was unqualified and did not

contain a statement under section 237(2) or section 237(3) of the Companies Act

1985; however the auditor's report has been modified to reflect uncertainty

around the Company's ability to continue as a going concern.

2. Restructuring and non-recurring costs

During the latter half of 2007 the group undertook a radical restructuring of

its senior management and product portfolio. As a result the Group has incurred

a number of restructuring and other non-recurring costs as itemised below

Restructuring

2007 2006

� �

Impairment loss recognised in respect of assets 147,090 -

Compensation for loss of office 350,619 -

Cost of senior management time in respect of restructuring 104,000

Costs to commercialise product range 287,778 -

889,487 -

Non recurring costs

Write off of a bad debt 157,780 -

1,047,267 -

3. Earnings per share

The calculation of the basic and diluted earnings per share is based on the

following data:

Earnings

2007 2006

� �

Earnings for the purposes of basic earnings per share being

net loss attributable to equity holders of the parent 4,287,626 2,533,289

Number of shares

2007 2006

Weighted average number of ordinary shares for the purposes

of basic and diluted earnings per share 107,962,482 84,814,709

4. Share capital

2007 2006

number number

Authorised:

Ordinary shares of 0.2 pence each 200,000,000 150,000,000

2007 2006

� �

Issued and fully paid:

139,626,314 (2006: 85,034,814) ordinary shares of 0.2 pence

each 279,252 170,070

On 24th August 2007 the company completed a placing as a result of which

53,300,000 ordinary shares of 0.2 pence each were issued at a price of 10 pence

per share to raise �5 m after expenses. The funds were raised to develop and

execute on the group's new strategy. A further 1,291,500 shares (2006: 724,065)

were issued as a result of the exercise of share options.

5. Notes to the consolidated cash flow statement

2007 2006

� �

Operating loss for the year (4,792,300) (3,190,835)

Adjustments for:

Depreciation of property, plant and equipment 54,282 44,129

Amortisation of intangible assets 28,794 32,792

Share-based payment expense 21,903 173,529

Operating cash flows before movements in working capital (4,687,321) (2,940,385)

Increase in inventories (72,318) (48,339)

Decrease/(increase) in receivables 17,716 (338,382)

Increase/(decrease) in payables 454,561 108,370

Cash generated by operations (4,287,362) (3,218,736)

Income taxes paid 360,000 278,744

Interest paid - -

NET CASH FROM OPERATING ACTIVITIES (3,927,362) (2,939,992)

Cash and cash equivalents (which are presented as a single class of assets on

the face of the balance sheet) comprise cash at bank and other short-term highly

liquid investments with maturity of three months or less.

6. Going Concern

The directors have prepared a business plan which has formed the basis on which

they are satisfied that the Group has adequate financial resources to continue

to operate for the next twelve months. This business plan assumes a certain

level of sales, which the directors believe to be both achievable and the best

estimate of the Group's future activities. However there is a risk that the

actual level of sales achieved may be significantly lower than is assumed in

that business plan. There is a risk that new and existing partnerships may not

lead to significant sales and that new iterations of the product range may not

be received well by the market.

Having taken into account the above material uncertainties, the directors

consider it is appropriate that the financial statements should be prepared on a

going concern basis. The conditions facing the Group nevertheless give rise to

material uncertainties related to events or conditions which may cast

significant doubt on the Group's ability to continue as a going concern and

therefore it may be unable to realise its assets and discharge its liabilities

in the normal course of business.

7. Annual Report and Accounts

A copy of the Annual Report and Accounts will be sent to all shareholders

shortly and will also be available from the Company's registered office: Cyan

Holdings plc, Buckingway Business Park, Swavesey,Cambridge, CB24 4UQ.

The Annual Report and Accounts will also be published on the Company's website

www.cyantechnology.com

-Ends-

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JFMRTMMJTBPP

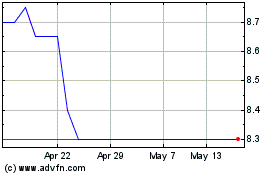

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024