TIDMCREI

RNS Number : 0355X

Custodian REIT PLC

21 November 2017

21 November 2017

Custodian REIT plc

("Custodian REIT" or "the Company")

Interim Results

Custodian REIT (LSE: CREI), the UK commercial real estate

investment company focused on smaller lot sizes, today reports its

interim results for the six months ended 30 September 2017 ("the

Period").

Financial highlights and performance

-- NAV per share total return(1) of 4.2% (2016: 3.3%)

-- EPRA(2) earnings per share(3) 3.4p (2016: 3.0p)

-- Portfolio value of GBP474.3m (2016: GBP385.3m(4) )

-- Profit after tax of GBP13.2m (2016: GBP8.3m)

-- GBP24.8m(5) of new equity raised at an average premium of 11.0% to dividend adjusted NAV

-- Dividends of 3.2p per share paid in the Period(6)

-- Dividend approved for the quarter ended 30 September 2017 of 1.6125p per share

-- GBP56.1m(7) invested in 12 acquisitions during the Period

-- GBP1.7m valuation uplift from successful asset management

initiatives, GBP0.3m net valuation increase(8)

-- GBP1.0m profit on disposal of three properties for an aggregate consideration of GBP6.1m

-- EPRA occupancy(9) 96.7% (2016: 97.8%)

1. Net Asset Value ("NAV") movement including dividends paid and

approved relating to the Period on shares in issue at 31 March

2017.

2. The European Public Real Estate Association ("EPRA").

3. Profit after tax excluding net gain on investment property

divided by weighted average number of shares in issue.

4. Restated to reclassify the value of deferred lease incentives

from receivables to investment property.

5. Before costs and expenses of GBP0.3m.

6. Dividends per share of 1.5875p and 1.6125p paid during the

Period relating to the quarters ended 31 March 2017 and 30 June

2017 respectively.

7. Before acquisition costs of GBP3.4m.

8. Comprising GBP1.7m (2016: GBP3.3m) of valuation uplift from

successful asset management initiatives and GBP2.0m (2016: GBP0.2m)

of other valuation increases, less GBP3.4m (2016: GBP3.8m) of

acquisition costs.

9. Estimated rental value ("ERV") of let property divided by

total portfolio ERV.

Unaudited Unaudited

6 months 6 months Audited

to to 12 months

30 Sept 30 Sept to 31

2017 2016 Mar 2017

------------------------------ ---------- ---------- -----------

Total return

NAV per share total

return 4.2% 3.3% 8.5%

Share price total return(10) 5.3% 0.9% 10.3%

EPRA earnings per share

(p) 3.4 3.0 6.6

Capital values

NAV (GBPm) 378.6 297.1 351.9

NAV per share (p) 104.9 101.7 103.8

Share price (p) 114.75 105.0 112.0

Portfolio valuation

(GBPm) 474.3 385.3(4) 418.5(4)

Market capitalisation

(GBPm) 414.1 306.7 379.7

Premium to NAV per share 9.4% 3.2% 7.9%

Net gearing(11) 19.7% 21.0%(4) 14.4%(4)

10. Share price movement including dividends paid and approved

for the period.

11. Gross borrowings less unrestricted cash, divided by

portfolio value. Net gearing at 30 September 2017 was reported as

22.4% in the Q2 NAV statement due to incorrectly using a prior

period property valuation.

Alternative performance measures, including EPRA Best Practice

Recommendations, are used to assess the Company's performance.

Explanations as to why alternative performance measures give

valuable further insight into the Company's performance are given

in the Company's Annual Report. Supporting calculations for

alternative performance measures and reconciliations between

non-statutory performance measures and their IFRS equivalents are

set out in the Additional disclosures section of the interim

financial statements.

David Hunter, Chairman of Custodian REIT, said:

"I am pleased to report another successful period of capital

raising and investment. We continue to target growth to realise the

potential economies of scale offered by the Company's relatively

fixed cost base and the amendment to the Investment Manager's

charging structure announced in June, while maintaining the quality

of both properties and income.

"Occupational demand remains healthy and we are witnessing

rental growth and low vacancy rates across the portfolio, giving us

comfort that there is still an opportunity to invest. I believe the

current market supports our strategy of targeting high quality

properties across regional markets, with the type of institutional

grade property targeted by the Company showing value relative to

larger lots through a higher net income return and opportunities

for future rental growth.

"We remain well placed to meet our target of paying further

quarterly dividends, fully covered by income, to achieve an annual

dividend for the year of 6.45p per share. I expect occupational

demand, combined with a limited supply of new development, to drive

rental growth and lower vacancy rates across regional markets,

which will support our objectives to both grow the dividend on a

sustainable basis and deliver capital value growth for our

shareholders over the long-term."

Further information

Further information regarding the Company can be found at the

Company's website www.custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240

Imlach / Ian Mattioli MBE 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan/Nathan Brown Tel: +44 (0)20 7260

1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757

4984

www.camarco.co.uk

Chairman's statement

I am pleased to report the Company delivered further positive

returns for the six months ended 30 September 2017 with EPRA

earnings per share increasing from 3.0p to 3.4p, while expanding

the property portfolio through the investment of GBP56.1m in 12 new

acquisitions, funded by GBP24.8m raised from the issue of new

shares and GBP35m drawn from a new GBP50m term debt facility. We

continue to target growth to realise the potential economies of

scale offered by the Company's relatively fixed cost base and the

amendment to the Investment Manager's charging structure announced

in June, while adhering to the Company's investment policy and

maintaining the quality of both properties and income.

At the same time as growing the portfolio, we have continued to

pay fully covered dividends in line with target and minimised 'cash

drag' on the issue of new shares by taking advantage of the

flexibility offered by the Company's GBP35m revolving credit

facility.

The successful deployment of new monies on the acquisition of

high quality assets at an average net initial yield of 6.8%

supports our objective to deliver strong income returns from a

portfolio principally of sub GBP10m lots in strong, regional

markets.

The Company's share price performance has allowed the Board to

issue equity at an average premium of 11% above dividend adjusted

NAV, more than covering costs of issue and deployment.

Market

There has been significant new share issuance in the listed

property investment company space in 2017, largely focused on

specialist mandates such as social housing, student property and

healthcare, and on commercial property funds targeting long leases.

This activity is positive for the sector, demonstrating commercial

property's strength as an income generating asset in a low return

environment.

We believe an absolute focus on long leases can detract from a

property-focused approach and is making commercial property with

long income relatively expensive. Custodian REIT retains a

'property first' strategy, which we believe will deliver

sustainable long-term returns for shareholders.

Net asset value

The Company delivered NAV per share total return of 4.2% for the

Period. The first half was a period of significant new investment,

where the initial costs (primarily stamp duty) of investing

GBP56.1m in property acquisitions diluted NAV per share total

return by circa 1.0p, partially offset by raising GBP24.5m from the

issue of new equity (net of costs), which added 0.6p per share(12)

.

12. 0.5p per share through new issuance at a premium to NAV,

plus 0.1p per share notional dividend saving due to new shares

being issued ex-dividend.

Pence

per share GBPm

---------------------------------- ----------- -------

NAV at 31 March 2017 103.8 351.9

Issue of equity (net of costs) 0.5 24.5

104.3 376.4

---------------------------------- ----------- -------

Valuation movements relating

to:

* Asset management activity 0.5 1.7

* Other valuation movements 0.5 2.0

---------------------------------- ----------- -------

1.0 3.7

Impact of acquisition costs (1.0) (3.4)

---------------------------------- ----------- -------

Net valuation movement 0.0 0.3

Profit on disposal of investment

property 0.3 1.0

---------------------------------- ----------- -------

Net gain on investment property 0.3 1.3

---------------------------------- ----------- -------

Income 4.7 16.7

Expenses and net finance costs (1.3) (4.8)

Dividends paid(13) (3.1) (11.0)

NAV at 30 September 2017 104.9 378.6

---------------------------------- ----------- -------

13. Dividends of 3.2p per share were paid on shares in issue

throughout the Period. Dividends paid on shares in issue at the end

of the Period averaged 3.1p per share due to new shares being

issued after the Period's first ex-dividend date.

In addition to new acquisitions, activity during the Period also

centred on pro-active asset management, which generated GBP1.7m of

the GBP3.7m valuation uplift. During the remainder of this

financial year we intend to continue our asset management

activities and complete on the current acquisition pipeline,

deploying the new monies raised from recent equity issues and

drawing down debt to maintain net gearing at or around our target

level of 25% loan to value ("LTV").

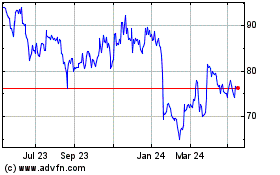

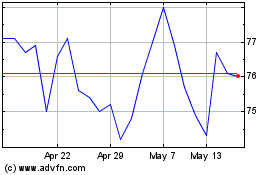

Share price

Share price total return for the first half of the financial

year was 5.3%, with a closing price of 114.75p per share on 30

September 2017 representing a 9.4% premium to NAV. During the

Period the Company traded consistently at a premium to NAV, with

low volatility offering shareholders stable returns. I believe the

increasing premium to NAV has been a function of strong demand for

closed-ended property funds, the Company's regional property

investment strategy, focused asset management and the attractive

level of income offered by the Company's dividend policy.

Placing of new ordinary shares

The Company issued 21.8m new shares during the Period at an

average premium to dividend adjusted NAV of 11%. These issues have

been accretive to NAV, with positive investor demand for the

Company's shares a testament to the successful implementation of

our strategy to date.

Since the Period end, a further 7m new shares have been issued

raising GBP8.0m (before costs and expenses).

Borrowings

As at 30 September 2017 net gearing equated to 19.7% LTV. The

Board's strategy is to:

-- Increase debt facilities in line with portfolio growth, targeting net gearing of 25% LTV;

-- Facilitate expansion of the portfolio to take advantage of

expected rental growth and reduce ongoing charges; and

-- Reduce shareholders' exposure to risk by:

- Taking advantage of the prevailing low interest rates to

secure long-term, fixed rate borrowing; and

- Managing the weighted average maturity ("WAM") of the

Company's debt facilities.

The Company entered into an agreement with Aviva Investors Real

Estate Finance ("Aviva") on 5 April 2017 for Aviva to provide a new

15 year GBP50m term loan facility comprising two tranches of GBP35m

("Tranche 1") and GBP15m ("Tranche 2") respectively, resulting in

the Company now having the following agreed debt facilities:

-- A GBP35m revolving credit facility ("RCF") with Lloyds Bank

plc, which attracts interest of 2.45% above three month LIBOR and

expires on 13 November 2020;

-- A GBP20m term loan with Scottish Widows plc, which attracts

interest fixed at 3.935% and is repayable on 13 August 2025;

-- A GBP45m term loan facility with Scottish Widows plc which

attracts interest fixed at 2.987% and is repayable on 5 June 2028;

and

-- A GBP50m term loan facility with Aviva comprising:

a) GBP35m Tranche 1 repayable on 6 April 2032, attracting fixed annual interest of 3.02%; and

b) GBP15m Tranche 2 repayable on 3 November 2032, attracting fixed annual interest of 3.26%.

At the Period end the Company had circa GBP57m of available

funds to deploy on property acquisition opportunities, comprising

GBP7m uncommitted cash, GBP35m undrawn RCF and GBP15m Tranche

2.

The weighted average cost of the Company's agreed debt

facilities is 3.1% with a WAM of 10 years and 77% of the Company's

agreed debt facilities are at a fixed rate of interest,

significantly reducing interest rate risk.

Investment Manager

The Board is pleased with the performance of the Investment

Manager, particularly the timely deployment of new monies on high

quality assets, securing the earnings required to fully cover the

target dividend.

The Investment Manager is appointed under an investment

management agreement ("IMA") to provide property management and

administrative services to the Company. On 1 June 2017, the

Investment Manager was appointed for a further three years and fees

payable to the Investment Manager under the IMA were amended to

include:

-- A step down in the property management fee from 0.75% to

0.65% of NAV applied to NAV in excess of GBP500m; and

-- A step down in the administrative fee from 0.125% to 0.08% of

NAV applied to NAV between GBP200m and GBP500m and a further step

down to 0.05% of NAV applied to NAV in excess of GBP500m.

These amendments to the IMA secured an immediate reduction in

the administrative fee, increasing cover on target dividends for

the current year. Further growth in NAV, particularly above

GBP500m, will further reduce the Company's ongoing charges ratio

and increase dividend capacity.

Dividends

Income is a major component of total return. The Company paid

dividends totalling 3.2p per share during the six month Period, all

classified as property income distributions, comprising interim

dividends of 1.5875p per share and 1.6125p per share relating to

the quarters ended 31 March 2017 and 30 June 2017 respectively.

The Board has approved an interim dividend of 1.6125p per share

for the quarter ended 30 September 2017, which will be paid on 30

November 2017. In the absence of unforeseen circumstances the Board

believes the Company is well placed to meet its target of paying

further quarterly dividends, fully covered by income, to achieve an

annual dividend per share for the year ending 31 March 2018 of

6.45p (2017: 6.35p).

The Board's objective is to grow the dividend on a sustainable

basis, at a rate which is fully covered by projected net rental

income and does not inhibit the flexibility of the Company's

investment strategy.

Outlook

Our focus is on maintaining and enhancing cash flow from the

portfolio to support our objectives to pay fully covered dividends

and secure sustainable growth. We believe rental growth in regional

markets will be a key driver of the Company's performance, which

can be enhanced through the careful deployment of new debt and

equity and continued asset management of the portfolio. While we

can never rule out some future impact on NAV as a result of falling

confidence in the property market or general economic and political

turbulence, we believe our strategy of securing sustainable income

will support future dividends through any medium term market

volatility and deliver capital growth for shareholders over the

long-term.

David Hunter

Chairman

20 November 2017

Investment Manager's report

Investment market

Assets that produce reliable income returns secured against

contractual lease terms continue to attract a wide range of

investors. Last month Property Week reported that allocations to

commercial property now exceed 10% in global institutional

portfolios, up from 8.9% in 2013(14) . While a small percentage

increase, the absolute impact is significant, resulting in strong

competition for such assets when they come to market.

Our challenge in this environment is to find value and identify

areas of the market that appear mispriced against forecast

performance. There are more buyers than sellers in our target

market so we remain ever vigilant to pay a fair price, which is not

always the market price, and in many instances we are holding back

in the face of excessive competition. This issue is particularly

acute for properties let on long leases. However, we believe that

with greater liquidity in property markets and an increased supply

of investment opportunities the market should normalise before a

bubble emerges.

We have consciously targeted out of town retail (retail

warehousing) over the last 18 months, with the sector now

accounting for 16% of portfolio income (March 2017: 11%). We

believe retail warehousing is the sector of the physical retail

market that is complementary to online retailing, or at least not

negatively correlated to the growth of online retailing which, when

combined with a restricted planning regime, explains the record low

vacancy rates and rental growth we are experiencing.

14. Source: Propertyweek.com 13 October 2017.

Occupational market

Occupational demand remains healthy and we are witnessing rental

growth and low vacancy rates across the portfolio, giving us

comfort that there is still an opportunity to invest. There are no

signs of an oversupply of property in the occupational market and

there continues to be a low level of development. It is this,

rather than excessive demand, that is driving rental growth so we

believe the market should be better insulated from shocks than it

was in previous rental growth cycles.

Many regional markets are witnessing rental levels which remain

below the threshold necessary to bring forward new development. It

would appear that there is the opportunity for rental growth on

which the market must deliver before we see supply reach

equilibrium with demand, thus maintaining pressure on rents to

grow.

Across the market many tenant negotiations remain finely

balanced, with strong tenants keenly aware of their value to

landlords. However tenants are also accepting rental growth, which

they may have avoided for as long as 10 years in some instances.

This greater general acceptance of rental growth, combined with

limited supply of alternative premises, should make it possible to

minimise rental voids and secure rental growth across the Company's

portfolio in the remainder of the financial year ahead. The

Company's occupancy rate now stands at 96.7%.

Pipeline

We continue to find opportunities that fit our investment

strategy, as demonstrated by the investment of GBP56.1m during the

Period at an average net initial yield ("NIY") of 6.8%. We have

terms agreed on a further GBP18.9m of properties and are

considering an active and growing pipeline of new acquisition

opportunities as vendors prepare to conclude sales prior to the end

of 2017.

Investment objective

The Company's key objective is to provide shareholders with an

attractive level of income by maintaining the high level of

dividend, fully covered by earnings, with a conservative level of

gearing.

We continue to pursue a pipeline of new investment opportunities

with the aim of deploying the Company's undrawn debt facilities up

to the net gearing target of 25% LTV. While the cost of debt

remains near historical lows, we believe this strategy will improve

dividend cover as gearing increases towards the target level.

We remain committed to a strategy principally focused on sub

GBP10m lot size regional property. We expect to see long-term total

return out-performance from the higher income component of total

return compared to portfolios more concentrated on London and the

South East. Furthermore we expect strong asset management

performance as we secure rental increases and extend contractual

income.

The diversification strategy to invest principally in sub GBP10m

lots across sector, geography and a broad tenant mix stands the

portfolio in good stead against market shocks. The largest tenant

in the portfolio, B&M, represents only 2.7% of the rent roll

across three properties, with the average tenant representing only

0.5% of the rent roll.

Portfolio performance

During the Period the Company completed the following 12

property acquisitions:

Industrial

Location: Langley Mill Location: Eurocentral,

Tenant: Warburtons Motherwell

NIY: 6.29% Tenant: Next

Purchase price(15) : GBP2.15m NIY: 6.91%

Purchase price: GBP4.75m

Location: Livingston

Tenant: SCS

NIY: 7.50% (subject to

completion of rent review)

Purchase price: GBP2.59m

--------------------------

15. Purchase price represents purchase consideration before

acquisition costs of GBP3.5m and rent-free top-ups of GBP1.5m.

Retail Warehouse

Location: Gloucester Location: Galashiels

Tenant: Smyths Toys and Tenant: B&Q

Magnet NIY: 8.24%

NIY: 7.41% Purchase price: GBP3.15m

Purchase price: GBP4.73m

Location: Sheldon, Birmingham Location: Ashton-under-Lyne

Tenant: Dreams, Halfords Tenant: B&M

and Pets at Home NIY: 6.00%

NIY: 6.64% Purchase price: GBP6.6m

Purchase price: GBP5.1m

----------------------------

Location: Plymouth Location: Plymouth

Tenant: B&M and Magnet Tenant: SCS, Oak Furniture

NIY: 6.79% Land and McDonald's

Purchase price: GBP5.53m NIY: 6.74%

Purchase price: GBP7.49m

----------------------------

Other

Location: York Location: Stockport

Tenant: Evans Halshaw Tenant: Williams BMW

NIY: 5.75% and Mini

Purchase price: GBP3.92m NIY: 6.99%

Purchase price: GBP8.84m

Location: Salisbury

Tenant: Parkwood Health

& Fitness

NIY: 6.75%

Purchase price: GBP2.79m

--------------------------

At 30 September 2017 the Company's property portfolio comprised

141 assets, 206 tenants and 255 tenancies. The portfolio is split

between the main commercial property sectors, in line with the

Company's objective to maintain a suitably balanced investment

portfolio, but with a relatively low exposure to office and a

relatively high exposure to industrial and to alternative sectors,

often referred to as 'other' in property market analysis. Sector

weightings are:

Valuation Weighting Weighting Gross Gross Net

30 Sept by income(16) by income valuation valuation valuation

2017 30 Sept 31 March movement movement(17) movement

Sector GBPm 2017 2017 GBPm % GBPm

------------------ ---------- --------------- ----------- ----------- -------------- -----------

Industrial 202.1 42% 45% 4.6 2.3% 4.0

Retail warehouse 80.2 16% 11% 1.3 1.9% (0.5)

Other(18) 73.3 15% 13% - - (1.0)

High street

retail 66.2 14% 17% (1.9) (2.6%) (1.9)

Office 52.5 13% 14% (0.3) (0.5%) (0.3)

474.3 100% 100% 3.7 0.3

------------------ ---------- --------------- ----------- ----------- -------------- -----------

16. Current passing rent plus ERV of vacant properties.

17. Excluding the impact of acquisitions and disposals.

18. Includes car showrooms, petrol filling stations, children's

day nurseries, restaurants, gymnasiums, hotels and healthcare

units.

Industrial property is a very good fit with the Company's

strategy where it is possible to acquire modern, 'fit-for-purpose'

buildings with high residual values (i.e. the vacant possession

value is closer to the investment value than in other sectors) and

where the real estate is less exposed to obsolescence. GBP1.6m of

the GBP4.6m gross valuation increase in the industrial sector was

driven by asset management initiatives, with occupational demand

driving rental growth and generating positive returns.

Retail represents 30% of total portfolio income, comprising 14%

high street and 16% out-of-town retail (retail warehousing). Retail

warehousing is witnessing close to record low vacancy rates as a

restricted planning policy and lack of development combine with

retailers' requirements to offer large format stores, free parking

and 'click and collect' to consumers. These factors made retail

warehousing a target sector for acquisitions throughout the

Period.

While deemed to be outside the core sectors of office, retail

and industrial the 'other' sector offers diversification of income

without adding to portfolio risk, containing assets considered

mainstream but which typically have not been owned by institutional

investors. The 'other' sector has proved to be an out-performer

over the long-term and continues to be a target for

acquisitions.

Office rents in regional markets are still growing and supply is

constrained by a lack of development and the extensive conversion

of secondary offices to residential. However, we are conscious that

obsolescence and lease incentives can be a real cost of office

ownership, which can hit cash flow and be at odds with the

Company's relatively high target dividend.

For details of all properties in the portfolio please see

www.custodianreit.com/portfolio.

Portfolio risk

The portfolio's security of income is enhanced by 14% of income

benefitting from either fixed or indexed rent reviews, with

increasingly strong evidence of open market rental growth across

all sectors.

Short-term income at risk is a relatively low proportion of the

portfolio's total income, with 34% expiring in the next three years

(12% within one year).

Asset management

Our continuing focus on active asset management including new

lettings, lease extensions and the retention of tenants beyond

their contractual break clauses resulted in GBP1.7m of the GBP3.7m

valuation uplift during the Period, with further initiatives

expected to complete in the coming months.

Key asset management initiatives completed during the Period

include:

-- Finalising a rent review with DHL in Warrington at GBP0.31m

per annum, increasing valuation by GBP0.6m;

-- Exchanging on an agreement to lease a unit in Gateshead to WH

Partnership on a 10 year lease at GBP0.14m per annum, increasing

valuation by GBP0.4m;

-- Agreeing a rent review with Yesss Electrical in Normanton at

GBP0.33m per annum, increasing valuation by GBP0.4m; and

-- Removing an August 2018 break clause in Bunzl's lease in

Castleford increasing weighted average unexpired lease term to the

first lease break or expiry ("WAULT") from 1.2 years to 6.2 years,

increasing valuation by GBP0.2m.

A key part of effective portfolio management is the disposal of

assets which either no longer meet the long-term investment

strategy of the Company or which can be disposed of significantly

ahead of valuation, often to a special purchaser, such that holding

the asset is no longer appropriate. After focused pre-sale asset

management, the following three properties were sold during the

Period for a total of GBP6.1m, realising a profit on disposal of

GBP1m at an aggregate NIY of 5.5%, with gross proceeds 19.8% ahead

of aggregate valuation:

-- An 8,326 sq ft retail unit in Colchester for GBP4.25m, GBP0.7m ahead of valuation;

-- A 15,330 sq ft multi-tenanted industrial estate in Hinckley

for GBP1.2m, GBP0.2m ahead of valuation; and

-- A 9,332 sq ft multi-tenanted retail parade in Redcar for

GBP0.6m, GBP0.1m ahead of valuation.

The gains made on these disposals were primarily the result of a

sale to a special purchaser and the current strong market demand

for regional industrial units. We intend to use the proceeds from

these disposals to fund acquisitions better aligned to the

Company's long-term investment strategy.

The portfolio's WAULT decreased to 5.8 years from 5.9 years at

31 March 2017, primarily due to the completion of acquisitions

during the Period with a WAULT of 7.7 years partially offsetting

the 0.5 years natural decline through the passing of time. Although

we believe long leases are currently being over-valued by the

market and are unwilling to over-pay for long leases simply to

support the WAULT, we will continue to take advantage of situations

where we can find fair value and still benefit from long leases.

Our target WAULT for the portfolio is five years, but we believe

that with the current strength of the occupational market and a

portfolio comprising high quality properties, risk is better

managed by pursuing a strategy of buying high quality properties

that are likely to re-let should the tenant vacate, rather than

buying highly priced properties with long leases simply to mitigate

an artificial measure of risk.

Outlook

We expect to see larger funds selling smaller lots regarded as

being sub-scale for their ambitions, once they have further

invested their cash balances. While a number of competitor funds

are targeting sub GBP10m lot size properties, most are focused on

'value-add' opportunities. Custodian REIT follows a low to moderate

risk investment strategy, known as 'core' to 'core-plus', so we

anticipate the pipeline of new acquisition opportunities will offer

fundamentally strong investment credentials, but be subject to less

market competition relative to 'value-add' opportunities or larger

lots.

Rental growth in regional markets, driven by the significant

lack of supply of good quality, modern real estate combined with

healthy occupational demand, will be a key driver of

performance.

I am confident the Company's strategy of targeting income with

conservative gearing in a well-diversified regional portfolio will

continue to deliver the stable long-term returns demanded by our

shareholders.

Richard Shepherd-Cross

for and on behalf of Custodian Capital Limited

Investment Manager

20 November 2017

Portfolio

Town Tenant % Portfolio

Income(19)

Industrial

Assa Abloy (sub-let to

Wolverhampton Kuehne + Nagel) 1.46%

Burton Kings Road Tyres 1.45%

Gateshead Multi-let 1.44%

Chesford Grange JTF Wholesale 1.38%

Ashby Teleperformance 1.32%

Winsford H&M 1.20%

Elma Electronics and

Bedford Vertiv Infrastructure 1.20%

Salford Restore 1.15%

Doncaster Portola Packaging 1.01%

Eurocentral,

Motherwell Next 1.00%

Normanton YESSS Electrical 0.96%

Stone Revlon International 0.92%

Redditch Amco Services 0.90%

Warrington DHL Supply Chain 0.88%

Redditch SAPA Profiles 0.87%

Biggleswade Turpin Distribution Services 0.85%

Cannock HellermannTyton 0.81%

Chepstow Multi-let 0.80%

Milton Keynes Massmould 0.80%

Kettering Multi-let 0.78%

Nuneaton DX Network Services 0.76%

Saint-Gobain Building

Milton Keynes Distribution 0.75%

EAF Supply Chain and

Warrington Synertec 0.74%

Plymouth Sherwin-Williams 0.73%

Bristol BSS 0.71%

West Bromwich OyezStraker 0.71%

Bedford Heywood Williams Components 0.67%

Coventry Royal Mail 0.67%

Stevenage Morrison Utility Services 0.64%

Daventry Cummins 0.63%

Manchester Unilin Distribution 0.63%

Avonmouth Superdrug Stores 0.61%

Oldbury Sytner 0.60%

Aberdeen DHL Supply Chain 0.59%

Southwark Constantine 0.57%

Christchurch Interserve Project Services 0.57%

Cambuslang Brenntag 0.56%

Sovereign Air Movement

and Nationwide Crash

Leeds Repair 0.53%

Warrington Dinex Exhausts 0.52%

Warwick Semcon 0.51%

Hamilton Ichor Systems 0.50%

Livingston SCS 0.50%

West Midlands Ambulance

Erdington Service NHS Trust 0.43%

Langley Mill Warburtons 0.41%

Sheffield Parkway Synergy Health 0.40%

Farnborough Triumph Structures 0.40%

Irlam Northern Commercials 0.40%

Liverpool Powder Systems 0.38%

Westerham Aqualisa Products 0.38%

Coalville MTS Logistics 0.37%

Castleford Bunzl 0.36%

Sheffield Arkote 0.34%

Liverpool DHL International 0.34%

Kettering Sealed Air 0.34%

North Warwickshire Borough

Atherstone Council 0.33%

River Island and Andrew

Sheffield Page 0.30%

Huntingdon PHS 0.30%

Kilmarnock Royal Mail 0.27%

Glasgow DHL Global Forwarding 0.26%

Normanton Acorn Web Offset 0.25%

Vacant units 0.91%

-------------------------------------------------- ------------

42.05%

-------------------------------------------------- ------------

19. % of portfolio passing rent plus ERV of vacant units.

Town Tenant % Portfolio

Income

Retail Warehouse

Winnersh Wickes and Pets at Home 1.63%

Swindon B&M and Go Outdoors 1.50%

Leighton Buzzard Homebase 1.49%

Banbury B&Q 1.36%

SCS and Oak Furniture

Plymouth Land 1.32%

Ashton-under-Lyne B&M 1.20%

Milton Keynes Staples UK 1.19%

Plymouth B&M and Magnet 1.14%

Gloucester Magnet and Smyths Toys 1.06%

Dreams, Halfords and

Sheldon Pets at Home 1.03%

Laura Ashley, Poundstretcher

Grantham and Carpetright 0.92%

Galashiels B&Q 0.78%

Stourbridge Multi-let 0.61%

Majestic Wine and Home

Portishead Bargains 0.54%

------------------- ------------------------------ ------------

15.77%

-------------------------------------------------- ------------

Town Tenant % Portfolio

Income

Other

Stockport Williams BMW and Mini 1.88%

Liverpool Multi-let 1.35%

Stoke Nuffield Health 0.99%

Gillingham Co-Op 0.76%

Leicester Magnet 0.71%

Perth Bannatyne Fitness 0.69%

York Evans Halshaw 0.68%

Portishead Travelodge 0.63%

Crewe MFA Bowl 0.57%

Salisbury Parkwood Health & Fitness 0.57%

Lincoln MKM Buildings Supplies 0.55%

Crewe Mecca Bingo 0.42%

Redhill Honda Motor Europe 0.40%

Bath Prezzo 0.35%

High Wycombe Stonegate Pub Co 0.33%

Mecca Bingo (sub-let

Crewe to Odeon Cinemas) 0.33%

Castleford MKM Buildings Supplies 0.31%

Torquay Las Iguanas 0.31%

Perth Frankie & Benny's 0.29%

Shrewsbury ASK 0.27%

Plymouth McDonald's 0.26%

Torquay Le Bistrot Pierre 0.26%

Leicester Pizza Hut 0.25%

Watford Pizza Hut 0.24%

Perth KFC 0.20%

Portishead JD Wetherspoons 0.20%

Basingstoke Bright Horizons 0.18%

Crewe Tile Giant 0.18%

Crewe Pizza Hut 0.18%

Torquay Loungers 0.17%

Chesham Bright Horizons 0.15%

Crewe F1 Autocentres 0.14%

Knutsford Knutsford Day Nursery 0.14%

Shrewsbury House of the Rising Sun 0.12%

Crewe Edmundson Electrical 0.08%

Torquay Costa Coffee 0.07%

Vacant units 0.05%

------------------------------------------ ------------

15.26%

------------------------------------------ ------------

Town Tenant % Portfolio

Income

High street

retail

Shrewsbury Multi-let 1.51%

Portsmouth Multi-let 1.49%

Southampton URBN 0.63%

Torpoint Sainsbury's 0.62%

Norwich Specsavers 0.57%

Guildford Reiss 0.56%

Shrewsbury Cotswold Outdoor 0.45%

Colchester Poundland 0.43%

Llandudno WHSmith 0.43%

Birmingham Multi-let 0.41%

Nottingham The White Company 0.40%

Weston-Super-Mare Superdrug Stores 0.35%

Glasgow Greggs 0.34%

Colchester Laura Ashley 0.33%

Edinburgh Phase Eight 0.31%

Der Touristik and Aslan

Chester Jewellery 0.31%

Portsmouth The Works 0.30%

Colchester Kruidvat Real Estate 0.28%

Scarborough Waterstones 0.26%

Taunton Wilko Retail 0.26%

Dumfries Iceland Foods 0.26%

Bury St Edmunds The Works 0.26%

Chester Ernest Jones 0.26%

Bedford Waterstones 0.24%

Colchester H Samuel 0.22%

Southsea Portsmouth City Council 0.22%

Colchester Lush 0.21%

Hinckley WHSmith 0.20%

Chester Chesca 0.20%

Edinburgh Tesco 0.20%

Chester Lloyds TSB 0.17%

Bury St Edmunds Savers Health & Beauty 0.15%

Chester Lakeland 0.14%

Cheltenham Betfred 0.12%

Southsea Superdrug Stores 0.11%

Cirencester Framemakers Galleries 0.10%

Colchester Leeds Building Society 0.10%

Cirencester Noa Noa 0.09%

Edinburgh R Scott Bathrooms 0.05%

Vacant Units 0.87%

--------------------------------------------- ------------

14.41%

--------------------------------------------- ------------

Town Tenant % Portfolio

Income

Office

West Malling Regus 1.59%

Birmingham Multi-let 1.33%

Edinburgh Multi-let 1.09%

Leeds Enact Conveyancing 0.97%

Leicester Mattioli Woods and Regus 0.92%

Castle Donnington National Grid 0.92%

Cheadle Wienerberger 0.86%

Leeds Enact Conveyancing 0.83%

Derby Edwards Geldards 0.73%

Mattioli Woods and Erskine

Leicester Murray 0.72%

Glasgow Multi-let 0.61%

Solihull Lyons Davidson 0.54%

Vacant units 1.40%

------------------------------------------------ ------------

12.51%

------------------------------------------------ ------------

Condensed consolidated statement of comprehensive income

For the six months ended 30 September 2017

Unaudited Audited

6 months Unaudited 12 months

to 30 6 months to

Sept to 30 31 Mar

2017 Sept 2016 2017

Note GBP000 GBP000 GBP000

----------------------------------- ----- ---------- ----------- -----------

Revenue 4 16,711 12,575 27,610

Investment management

fee (1,537) (1,245) (2,671)

Operating expenses of

rental property

- rechargeable to tenants (627) (590) (630)

- directly incurred (417) (569) (1,239)

Professional fees (202) (169) (337)

Directors' fees (84) (80) (160)

Administrative expenses (277) (232) (475)

Expenses (3,144) (2,885) (5,512)

Operating profit before

financing and revaluation

of investment property 13,567 9,690 22,098

----------------------------------- ----- ---------- ----------- -----------

Unrealised gains/(losses)

on revaluation of investment

property:

- relating to gross property

revaluations 9 3,747 3,502 9,016

- relating to acquisition

costs 9 (3,452) (3,759) (6,103)

----------------------------------- ----- ---------- ----------- -----------

Net valuation increase/(decrease) 295 (257) 2,913

Profit on disposal of

investment property 979 128 1,599

----------------------------------- ----- ---------- ----------- -----------

Net gains/(losses) on

investment property 1,274 (129) 4,512

Operating profit before

financing 14,841 9,561 26,610

----------------------------------- ----- ---------- ----------- -----------

Finance income 5 83 25 186

Finance costs 6 (1,693) (1,291) (2,591)

----------------------------------- ----- ---------- ----------- -----------

Net finance costs (1,610) (1,266) (2,405)

Profit before tax 13,231 8,295 24,205

----------------------------------- ----- ---------- ----------- -----------

Income tax 7 - - -

Profit and total comprehensive

income for the Period,

net of tax 13,231 8,295 24,205

Attributable to:

Owners of the Company 13,231 8,295 24,205

Earnings per ordinary

share:

Basic and diluted (p) 3 3.8 3.0 8.1

EPRA (p) 3 3.4 3.0 6.6

The profit for the Period arises from the Company's continuing

operations.

Condensed consolidated statement of financial position

As at 30 September 2017

Registered number: 08863271

Unaudited Unaudited Audited

30 Sept 30 Sept 31 Mar

2017 2016 2017

Note GBP000 GBP000 GBP000

(restated) (restated)

------------------------------- ----- ---------- ------------ ------------

Non-current assets

Investment property 9 474,318 385,348 418,548

Total non-current assets 474,318 385,348 418,548

------------------------------- ----- ---------- ------------ ------------

Current assets

Trade and other receivables 10 9,056 2,234 4,453

Cash and cash equivalents 12 8,054 6,661 5,807

Total current assets 17,110 8,895 10,260

------------------------------- ----- ---------- ------------ ------------

Total assets 491,428 394,243 428,808

------------------------------- ----- ---------- ------------ ------------

Equity

Issued capital 14 3,609 2,921 3,390

Share premium 183,339 110,913 159,101

Retained earnings 191,610 183,250 189,386

Total equity attributable

to equity holders of the

Company 378,558 297,084 351,877

------------------------------- ----- ---------- ------------ ------------

Non-current liabilities

Borrowings 13 98,472 85,901 63,788

Other payables 571 571 571

------------------------------- ----- ---------- ------------ ------------

Total non-current liabilities 99,043 86,472 64,359

------------------------------- ----- ---------- ------------ ------------

Current liabilities

Trade and other payables 11 7,611 5,664 7,014

Deferred income 6,216 5,023 5,558

Total current liabilities 13,827 10,687 12,572

------------------------------- ----- ---------- ------------ ------------

Total liabilities 112,870 97,159 76,931

------------------------------- ----- ---------- ------------ ------------

Total equity and liabilities 491,428 394,243 428,808

------------------------------- ----- ---------- ------------ ------------

These interim financial statements of Custodian REIT plc were

approved and authorised for issue by the Board of Directors on 20

November 2017 and are signed on its behalf by:

David Hunter

Director

Condensed consolidated statement of cash flows

For the period ended 30 September 2017

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30 to 30 to 31

Sept 2017 Sept Mar

2016 2017

Note GBP000 GBP000 GBP000

--------------------------------- ----- ----------- ---------- -----------

Operating activities

Profit for the Period 13,231 8,295 24,205

Net finance costs 5,6 1,610 1,266 2,405

Increase in fair value

of investment property 9 (295) 257 (2,913)

Profit on disposal of

investment property (excluding

costs of disposal) (1,067) (128) (1,807)

Income tax 7 - - -

Cash flows from operating

activities before changes

in working capital and

provisions 13,479 9,690 21,890

--------------------------------- ----- ----------- ---------- -----------

(Increase)/decrease in

trade and other receivables (4,605) 453 (3,225)

Increase in trade and

other payables 595 2,521 4,401

Cash generated from operations 9,469 12,664 23,066

--------------------------------- ----- ----------- ---------- -----------

Interest paid 6 (1,583) (1,026) (2,233)

--------------------------------- ----- ----------- ---------- -----------

Net cash flows from operating

activities 7,886 11,638 20,833

--------------------------------- ----- ----------- ---------- -----------

Investing activities

Purchase of investment

property (56,132) (66,591) (104,968)

Acquisition costs (3,452) (3,759) (6,103)

Disposal of investment

property 6,052 5,650 18,945

Interest received 5 21 25 33

Net cash from investing

activities (53,511) (64,675) (92,093)

--------------------------------- ----- ----------- ---------- -----------

Financing activities

Proceeds from the issue

of share capital 24,814 43,033 92,425

Payment of costs of share

issue (358) (585) (1,320)

New borrowings (net of

costs) 34,423 20,514 (1,000)

Dividends paid 8 (11,007) (8,719) (18,493)

Net cash from financing

activities 47,872 54,243 71,612

--------------------------------- ----- ----------- ---------- -----------

Net increase in cash and

cash equivalents 2,247 1,206 352

Cash and cash equivalents

at start of the Period 5,807 5,455 5,455

--------------------------------- ----- ----------- ---------- -----------

Cash and cash equivalents

at end of the Period 8,054 6,661 5,807

--------------------------------- ----- ----------- ---------- -----------

Condensed consolidated statements of changes in equity

For the period ended 30 September 2017

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

------------------------- ------- --------- ---------- ---------- ----------

As at 31 March 2017

(audited) 3,390 159,101 189,386 351,877

Profit and total

comprehensive income

for Period - - 13,231 13,231

Transactions with

owners of the Company,

recognised directly

in equity

Dividends 8 - - (11,007) (11,007)

Issue of share capital 14 219 24,238 - 24,457

As at 30 September

2017 (unaudited) 3,609 183,339 191,610 378,558

------------------------- ------- --------- ---------- ---------- ----------

For the period ended 30 September 2016

Issued Share Retained Total

capital premium earnings equity

Note GBP000 GBP000 GBP000 GBP000

------------------------- ------- --------- ---------- ---------- ----------

As at 31 March 2016

(audited) 2,512 68,874 183,674 255,060

Profit and total

comprehensive income

for Period - - 8,295 8,295

Transactions with

owners of the Company,

recognised directly

in equity

Dividends 8 - - (8,719) (8,719)

Issue of share capital 409 42,039 - 42,448

As at 30 September

2016 (unaudited) 2,921 110,913 183,250 297,084

------------------------- ------- --------- ---------- ---------- ----------

Notes to the interim financial statements for the period ended

30 September 2017

1. Corporate information

The Company is a public limited company incorporated and

domiciled in England and Wales, whose shares are publicly traded on

the London Stock Exchange plc's main market for listed securities.

The interim financial statements have been prepared on a historical

cost basis, except for the revaluation of investment property, and

are presented in pounds sterling with all values rounded to the

nearest thousand pounds (GBP000), except when otherwise indicated.

The interim financial statements were authorised for issue in

accordance with a resolution of the Directors on 20 November

2017.

2. Basis of preparation and accounting policies

2.1. Basis of preparation

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting. The interim

financial statements do not include all the information and

disclosures required in the annual financial statements. The annual

report for the year ending 31 March 2018 will be prepared in

accordance with International Financial Reporting Standards adopted

by the International Accounting Standards Board ("IASB") and

interpretations issued by the International Financial Reporting

Interpretations Committee ("IFRIC") of the IASB (together "IFRS")

as adopted by the European Union, and in accordance with the

requirements of the Companies Act applicable to companies reporting

under IFRS.

The information relating to the Period is unaudited and does not

constitute statutory financial statements within the meaning of

section 434 of the Companies Act 2006. A copy of the statutory

financial statements for the year ended 31 March 2017 has been

delivered to the Registrar of Companies. The auditor's report on

those financial statements was not qualified, did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and did not contain

statements under section 498(2) or (3) of the Companies Act

2006.

The interim financial statements have been reviewed by the

auditor and its report to the Company is included within these

interim financial statements.

Certain statements in this report are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements.

2.2. Significant accounting policies

The principal accounting policies adopted by the Company and

applied to these interim financial statements are consistent with

those policies applied to the Company's annual report and financial

statements, except for the change in accounting presentation

described in paragraph 2.6.

2.3. Going concern

The Directors believe the Company is well placed to manage its

business risks successfully. The Company's projections show that

the Company should continue to be cash generative and able to

operate within the level of its current financing arrangements.

Accordingly, the Directors continue to adopt the going concern

basis for the preparation of the interim financial statements.

2.4. Segmental reporting

An operating segment is a distinguishable component of the

Company that engages in business activities from which it may earn

revenues and incur expenses, whose operating results are regularly

reviewed by the Company's chief operating decision maker to make

decisions about the allocation of resources and assessment of

performance and about which discrete financial information is

available. As the chief operating decision maker reviews financial

information for, and makes decisions about, the Company's

investment property as a portfolio the Directors have identified a

single operating segment, that of investment in commercial

properties.

2.5. Principal risks and uncertainties

The Company's assets consist of direct investments in UK

commercial property. Its principal risks are therefore related to

the UK commercial property market in general, the particular

circumstances of the properties in which it is invested and their

tenants. Other risks faced by the Company include economic,

strategic, regulatory, management and control, financial and

operational.

These risks, and the way in which they are mitigated and

managed, are described in more detail under the heading 'Principal

risks and uncertainties' within the Company's Annual Report for the

year ended 31 March 2017. The Company's principal risks and

uncertainties have not changed materially since the date of that

report. The Company's principal risks and uncertainties are not

expected to change materially for the remaining six months of the

Company's financial year.

2.6. Change in accounting presentation

During the Period the classification of deferred lease

incentives has been reviewed and compared with industry peers,

resulting in a presentational change with no impact on total return

or NAV. These assets were previously reported as a separate

receivable and deducted from the independent property valuation in

arriving at the reported investment property balance. To align the

Company's accounting presentation with that adopted by many

industry peers, assets totalling GBP2.7m at 31 March 2017 and

GBP1.8m at 30 September 2016 have been reclassified from

receivables to investment property in retrospectively restating the

statement of financial position at those dates in these interim

financial statements.

3. Earnings per ordinary share

Basic earnings per share ("EPS") amounts are calculated by

dividing net profit for the Period attributable to ordinary equity

holders of the Company by the weighted average number of ordinary

shares outstanding during the Period.

Diluted EPS amounts are calculated by dividing the net profit

attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares outstanding during the

Period plus the weighted average number of ordinary shares that

would be issued on the conversion of all the dilutive potential

ordinary shares into ordinary shares. There are no dilutive

instruments.

The following reflects the income and share data used in the

basic and diluted earnings per share computations:

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30 to 30 to

Sept 2017 Sept 2016 31 Mar

2017

---------------------------------- -------------- -------------- --------------

Net profit and diluted

net profit attributable

to equity holders of the

Company (GBP000) 13,231 8,295 24,205

Net (gains)/losses on investment

property (GBP000) (1,274) 129 (4,512)

---------------------------------- -------------- -------------- --------------

EPRA net profit attributable

to equity holders of the

Company (GBP000) 11,957 8,424 19,693

Weighted average number

of ordinary shares:

Issued ordinary shares

at start of the Period 339,013,345 251,242,071 251,242,071

Effect of shares issued

during the Period 8,829,071 25,045,659 47,489,151

---------------------------------- -------------- -------------- --------------

Basic and diluted weighted

average number of shares 347,842,416 276,287,730 298,731,222

Basic and diluted EPS (p) 3.8 3.0 8.1

---------------------------------- -------------- -------------- --------------

EPRA EPS (p) 3.4 3.0 6.6

---------------------------------- -------------- -------------- --------------

4. Revenue

Unaudited 6 months Unaudited Audited 12 months to

to 30 Sept 6 months 31 Mar

2017 to 30 Sept 2016 2017

GBP000 GBP000 GBP000

--------------------------------------------- ------------------ ---------------- --------------------

Gross rental income from investment property 16,084 11,985 26,980

Income from recharges to tenants 627 590 630

16,711 12,575 27,610

--------------------------------------------- ------------------ ---------------- --------------------

5. Finance income

Unaudited 6 months Unaudited 6 months Audited 12 months to

to 30 Sept 2017 to 30 Sept 2016 31 Mar

GBP000 GBP000 2017

GBP000

--------------- ------------------ ------------------ --------------------

Bank interest 21 25 33

Finance income 62 - 153

83 25 186

--------------- ------------------ ------------------ --------------------

6. Finance costs

Unaudited 6 months Unaudited Audited 12 months to

to 30 Sept 2017 6 months 31 Mar

GBP000 to 30 Sept 2017

2016 GBP000

GBP000

---------------------------------------------------- ------------------ ----------- --------------------

Amortisation of arrangement fees on debt facilities 110 265 358

Bank interest 1,583 1,026 2,233

1,693 1,291 2,591

---------------------------------------------------- ------------------ ----------- --------------------

During the period ended 30 September 2016 the Company repaid a

GBP20m term loan with Lloyds Bank plc resulting in one-off costs of

GBP0.165m related to the accelerated amortisation of the associated

deferred arrangement fees.

7. Income tax

The effective tax rate for the Period is lower than the standard

rate of corporation tax in the UK during the Period of 19.0%. The

differences are explained below:

Unaudited 6 months Unaudited Audited 12 months to

to 30 Sept 2017 6 months 31 Mar

GBP000 to 30 Sept 2016 2017

GBP000 GBP000

---------------------------------------------------------- ------------------ ---------------- --------------------

Profit before income tax 13,231 8,295 24,205

---------------------------------------------------------- ------------------ ---------------- --------------------

Tax charge on profit at a standard rate of 19.0% (30

September 2016 20.0%, 31 March 2017:

20.0%) 2,514 1,659 4,841

Effects of:

REIT tax exempt rental profits and gains (2,514) (1,659) (4,841)

Income tax expense for the Period - - -

---------------------------------------------------------- ------------------ ---------------- --------------------

Effective income tax rate 0.0% 0.0% 0.0%

---------------------------------------------------------- ------------------ ---------------- --------------------

The Company operates as a Real Estate Investment Trust and hence

profits and gains from the property investment business are

normally exempt from corporation tax.

8. Dividends

Unaudited Unaudited Audited

6 months 6 months 12 months

to 30 to 30 to

Sept Sept 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

------------------------------ ---------- ---------- -----------

Interim equity dividends

per ordinary share relating

to the quarters ended:

31 March 2016: 1.6625p - 4,227 4,227

30 June 2016: 1.5875p - 4,492 4,492

30 September 2016: 1.5875p - - 4,638

31 December 2016: 1.5875p - - 5,136

31 March 2017: 1.5875p 5,398 - -

30 June 2017: 1.6125p 5,609 - -

11,007 8,719 18,493

------------------------------ ---------- ---------- -----------

All dividends paid are classified as property income

distributions.

The Directors approved an interim dividend relating to the

quarter ended 30 September 2017 of 1.6125p per ordinary share in

October 2017 which has not been included as a liability in these

interim financial statements. This interim dividend is expected to

be paid on 30 November 2017 to shareholders on the register at the

close of business on 27 October 2017.

In the absence of unforeseen circumstances, the Board intends to

pay further quarterly dividends to achieve an annual dividend of

6.45p per share for the financial year ending 31 March 2018(20)

.

20. This is a target only and not a profit forecast. There can

be no assurance that the target can or will be met and it should

not be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

9. Investment property

GBP000

(Restated)

------------------------------------ --- ------------

At 31 March 2017 (as previously

reported) 415,812

Prior period adjustment (Note 2.6) 2,736

----------------------------------------- ------------

At 31 March 2017 (as restated) 418,548

Gross valuation gain 3,747

Acquisition costs (3,452)

----------------------------------------- ------------

Net revaluation gain 295

Lease incentives 876

Additions (including acquisition

costs) 59,584

Disposals (4,985)

As at 30 September 2017 474,318

----------------------------------------- ------------

Included in investment property is GBP3.6m relating to an

ongoing development at Stevenage.

The investment property is stated at the Directors' estimate of

its 30 September 2017 fair values. Lambert Smith Hampton Group

Limited ("LSH"), a professionally qualified independent valuer,

valued the properties as at 30 September 2017 in accordance with

the Appraisal and Valuation Standards published by the Royal

Institution of Chartered Surveyors. LSH has recent experience in

the relevant location and category of the properties being

valued.

Investment property has been valued using the investment method

which involves applying a yield to rental income streams. Inputs

include yield, current rent and ERV. For the Period end valuation,

the equivalent yields used ranged from 4.9% to 9.0%. Valuation

reports are based on both information provided by the Company e.g.

current rents and lease terms which are derived from the Company's

financial and property management systems are subject to the

Company's overall control environment, and assumptions applied by

the valuer e.g. ERVs and yields. These assumptions are based on

market observation and the valuer's professional judgement. In

estimating the fair value of the property, the highest and best use

of the properties is their current use.

10. Trade and other receivables

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

(restated) (restated)

Trade receivables 3,437 1,653 1,342

Other receivables 5,167 308 2,771

Prepayments and accrued

income 452 273 340

9,056 2,234 4,453

------------------------- ---------- ------------ ------------

The Company has provided fully for those receivable balances

that it does not expect to recover. This assessment has been

undertaken by reviewing the status of all significant balances that

are past due and involves assessing both the reason for non-payment

and the creditworthiness of the counterparty.

11. Trade and other payables

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

Falling due in less than

one year:

Trade and other payables 638 958 608

Social security and other

taxes 3,142 1,607 2,423

Accruals 2,442 2,652 2,761

Rental deposits and retentions 1,389 447 1,222

7,611 5,664 7,014

-------------------------------- ---------- ---------- --------

The Directors consider that the carrying amount of trade and

other payables approximates their fair value. Trade payables and

accruals principally comprise amounts outstanding for trade

purchases and ongoing costs. For most suppliers interest is charged

if payment is not made within the required terms. Thereafter,

interest is chargeable on the outstanding balances at various

rates. The Company has financial risk management policies in place

to ensure that all payables are paid within the credit

timescale.

12. Cash and cash equivalents

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

Cash and cash equivalents 8,054 6,661 5,807

--------------------------- ---------- ---------- --------

Cash and cash equivalents include GBP1.4m (30 September 2016:

GBP0.4m and 31 March 2017: GBP1.3m) of restricted cash comprising

rental deposits and retentions held on behalf of tenants.

13. Borrowings

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

2017 2016 2017

GBP000 GBP000 GBP000

Falling due in more than

one year:

Bank borrowings 100,000 87,000 65,000

Costs incurred in the arrangement

of bank borrowings (1,528) (1,099) (1,212)

98,472 85,901 63,788

----------------------------------- ---------- ---------- --------

On 5 April 2017, the Company and Aviva entered into an agreement

for Aviva to provide the Company with a new term loan facility of

GBP50m. The loan is secured by way of a first charge over a

discrete portfolio of properties, providing the lender with a

maximum LTV ratio of 50% on those properties specifically charged

to it and a floating charge. The Company drew down the first

tranche of GBP35m on 6 April 2017, which is repayable on 6 April

2032 with a fixed rate of interest of 3.02% per annum payable on

the balance, and drew down the second tranche of GBP15m on 3

November 2017, which is repayable on 3 November 2032 with a fixed

rate of interest of 3.26% per annum payable on the balance.

All of the Company's borrowing facilities require minimum

interest cover of 250% of the net rental income of the security

pool. The maximum LTV of the Company combining the value of all

property interests (including the properties secured against the

facilities) must be no more than 35%.

The Company's borrowing position at 31 March 2017 is set out in

the Annual Report for the year ended 31 March 2017.

14. Issued capital and reserves

Ordinary shares

Share capital of 1p GBP000

------------------------ ---------------- ---------

At 30 September 2016 292,132,071 2,921

Issue of share capital 46,881,274 469

At 31 March 2017 339,013,345 3,390

Issue of share capital 21,840,000 219

At 30 September 2017 360,853,345 3,609

------------------------ ---------------- ---------

The Company has made further issues of new shares since the

Period end, which are detailed in Note 17.

The following table describes the nature and purpose of each

reserve within equity:

Reserve Description and purpose

------------------ ------------------------------

Share premium Amounts subscribed for

share capital in excess

of nominal value less any

associated issue costs

that have been capitalised.

Retained earnings All other net gains and

losses and transactions

with owners (e.g. dividends)

not recognised elsewhere.

15. Financial instruments

Fair values

The fair values of financial assets and liabilities are not

materially different from their carrying values in the interim

financial statements. The IFRS 13 Fair Value Measurement fair value

hierarchy levels are as follows:

-- Level 1 - quoted prices (unadjusted) in active markets for identical assets and liabilities;

-- Level 2 - inputs other than quoted prices included within

level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from prices);

and

-- Level 3 - inputs for the assets or liability that are not

based on observable market data (unobservable inputs).

There have been no transfers between Levels 1, 2 and 3 during

the Period. The main methods and assumptions used in estimating the

fair values of financial instruments and investment property are

detailed below.

Investment property - level 3

Fair value is based on valuations provided by an independent

firm of chartered surveyors and registered appraisers. These values

were determined after having taken into consideration recent market

transactions for similar properties in similar locations to the

investment property held by the Company. The fair value hierarchy

of investment property is level 3. At 30 September 2017, the fair

value of investment property was GBP474.3m and during the Period

the net valuation increase was GBP0.3m.

Interest bearing loans and borrowings - level 3

As at 30 September 2017 the amortised cost of the Company's

loans with Lloyds Bank plc, Scottish Widows plc and Aviva

approximated their fair value.

Trade and other receivables/payables - level 3

The carrying amount of all receivables and payables deemed to be

due within one year are considered to reflect the fair value.

16. Related party transactions

Transactions with directors

Each of the directors is engaged under a letter of appointment

with the Company and does not have a service contract with the

Company. Under the terms of their appointment, each director is

required to retire by rotation and seek re-election at least every

three years. Each director's appointment under their respective

letter of appointment is terminable immediately by either party

(the Company or the director) giving written notice and no

compensation or benefits are payable upon termination of office as

a director of the Company becoming effective.

Ian Mattioli is Chief Executive of Mattioli Woods plc ("Mattioli

Woods"), the parent company of the Investment Manager, and is a

director of the Investment Manager. As a result, Ian Mattioli is

not independent. The Company Secretary, Nathan Imlach, is also a

director of Mattioli Woods and the Investment Manager.

Investment Management Agreement ("IMA")

On 25 February 2014 the Company entered into a three year IMA

with the Investment Manager commencing on Admission, under which

the Investment Manager was delegated responsibility for the

property management of the Company's assets, subject to the overall

supervision of the Directors. The Investment Manager manages the

Company's investments in accordance with the policies laid down by

the Board and the investment restrictions referred to in the

IMA.

During the first two months of the Period the Investment Manager

was paid an annual management fee calculated by reference to the

NAV of the Company each quarter as follows:

-- 0.9% of the NAV of the Company as at the relevant quarter day

which is less than or equal to GBP200m divided by 4; plus

-- 0.75% of the NAV of the Company as at the relevant quarter

day which is in excess of GBP200m divided by 4.

The Investment Manager provides day-to-day administration of the

Company and provides the services of the Company Secretary,

including maintenance of accounting records and preparing the

annual financial statements of the Company. During the first two

months of the Period the Company paid the Investment Manager an

administrative fee equal to 0.125% of the NAV of the Company at the

end of each quarter.

On 1 June 2017 the terms of the IMA were varied with effect from

that date to extend the appointment of the Investment Manager for a

further three years and to introduce further fee hurdles, such that

annual management fees payable to the Investment Manager for the

last four months of the Period were:

-- 0.9% of the NAV of the Company as at the relevant quarter day

which is less than or equal to GBP200m divided by 4;

-- 0.75% of the NAV of the Company as at the relevant quarter

day which is in excess of GBP200m but below GBP500m divided by 4;

plus

-- 0.65% of the NAV of the Company as at the relevant quarter

day which is in excess of GBP500m divided by 4.

Administrative fees payable to the Investment Manager for the

last four months of the Period were:

-- 0.125% of the NAV of the Company as at the relevant quarter

day which is less than or equal to GBP200m divided by 4;

-- 0.08% of the NAV of the Company as at the relevant quarter

day which is in excess of GBP200m but below GBP500m divided by 4;

plus

-- 0.05% of the NAV of the Company as at the relevant quarter

day which is in excess of GBP500m divided by 4.

The IMA is terminable by either party by giving not less than 12

months' prior written notice to the other, which notice may only be

given after the expiry of the three year term. The IMA may also be

terminated on the occurrence of an insolvency event in relation to

either party, if the Investment Manager is fraudulent, grossly

negligent or commits a material breach which, if capable of remedy,

is not remedied within three months, or on a force majeure event

continuing for more than 90 days.

The Investment Manager receives a fee of 0.25% (2016: 0.25%) of

the aggregate gross proceeds from any issue of new shares in

consideration of the marketing services it provides to the

Company.

During the Period the Company paid the Investment Manager

GBP1.54m (H1 2016: GBP1.24m, 2017: GBP2.67m) in respect of annual

management charges, GBP0.20m (H1 2016: GBP0.17m, 2017: GBP0.36m) in

respect of administrative fees and GBP0.05m (H1 2016: GBP0.13m,

2017: GBP0.25m) in respect of marketing fees.

Properties

The Company owns MW House and Gateway House located at Grove

Park, Leicester, which are partially let to Mattioli Woods.

Mattioli Woods paid the Company rentals of GBP0.21m (H1 2016:

GBP0.21m, 2017: GBP0.41m) during the Period.

17. Events after the reporting date

Property acquisitions and disposals

On 4 October 2017 the Company acquired two further

properties:

-- A high street retail unit in Cardiff for GBP5.16m let to Card

Factory and Specsavers with a NIY of 7.46%; and

-- A retail park in Burton upon Trent for GBP8.45m, comprising

three units let to Wickes, The Range and HSS Hire with a NIY of

6.45%.

New equity

Since the reporting date the Company raised GBP8.0m (before

costs and expenses) through the issue of 7,000,000 new ordinary

shares of 1p each in the capital of the Company.

Borrowings

On 3 November 2017, the Company drew down Tranche 2 of the Aviva

facility, repayable on 3 November 2032 with a fixed rate of

interest of 3.26% per annum payable on the balance.

Independent auditor's review report to Custodian REIT plc for

the period ended 30 September 2017

We have been engaged by the Company to review the condensed set

of interim financial statements in the interim financial statements

for the period ended 30 September 2017 which comprise the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of financial position, the condensed

consolidated statement of cash flows, the condensed consolidated

statement of changes in equity and the related notes 1-17. We have

read the other information contained in the interim financial

statements and considered whether they contain any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

Company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The interim financial statements are the responsibility of, and

have been approved by, the Directors. The Directors are responsible

for preparing the interim financial statements in accordance with