Interim Management Statement

May 17 2010 - 2:01AM

UK Regulatory

TIDMCLI

RNS Number : 0141M

CLS Holdings PLC

17 May 2010

Release date: 17 May 2010

Embargoed until: 7:00am

CLS HOLDINGS PLC

("CLS", THE "COMPANY" OR THE "GROUP")

INTERIM MANAGEMENT STATEMENT

FOR THE PERIOD 1 JANUARY 2010 TO 17 MAY 2010

The Company today announces its Interim Management Statement for the period 1

January 2010 to 17 May 2010.

HIGHLIGHTS

· New leases, lease renewals and extensions completed on 12,214 sq m

(131,500 sq ft)

· Completed site assembly for substantial development adjacent to Spring

Gardens, Vauxhall

· 40% of rent roll let to Government tenants

· Vacancy rate at 4.8% by rental value (31 December 2009: 4.5%)

· Weighted average cost of debt of 4.1%

· GBP9.4 million of gain realised on sale of corporate bonds

· Over GBP130 million of internal resources available for investment

PROPERTY REVIEW

UK - Since 1 January 2010, sentiment in the investment market in central London

has continued to improve, although bank financing remains relatively expensive.

The occupational market in central London has also seen a gradual increase in

demand from occupiers and, with a lack of grade A accommodation, this demand has

focused on good quality, second-hand space in good locations.

In the Group's portfolio, lease renewals were completed on 580 sq m (6,250 sq

ft), and 2,791 sq m (30,000 sq ft) of space became vacant, of which new lettings

were achieved on 2,269 sq m (24,500 sq ft), resulting in a net increase of the

vacancy rate by rental value from 4.5% at 31 December 2009 to 5.2%. Part of the

upcoming vacant space is planned to be used by our serviced office business.

In April we acquired 100 Vauxhall Walk, SE11, adjacent to our existing holdings,

for GBP1.6 million. This completed the site assembly for a substantial

development of over 28,000 sq m (301,400 sq ft) adjacent to our successful

Spring Gardens holding in Vauxhall.

FRANCE - In 2010 to date, the French investment market has been characterised by

investor demand significantly exceeding the supply of good quality product,

generating a fall of 25 basis points in yields, and we expect these to fall

further in Q2. Investment market activity has more than doubled to EUR900 million

against the equivalent quarter in 2009, whereas the letting market has remained

at the same level as a year earlier.

Whilst we believe there will be no significant rental growth in France during

2010, the void rate remains low at 4.4% by rental value, marginally up from 4.2%

at the end of 2009. In the period under review leases on 7,629 sq m (82,100 sq

ft) of space expired and 7,643 sq m (82,300 sq ft) was leased or renewed.

GERMANY - There has been a material increase in investment market activity in

Germany in the first quarter of 2010 compared to the same quarter in 2009.

Since the end of 2009, prime yields have fallen by 10 basis points due to a lack

of core investment product, but the letting market remains weak and is not

expected to improve before the end of the year.

Intensive asset management of our German portfolio has maintained the vacancy

rate at 5.6% (31 December 2009: 5.8%), with leases expiring on 1,706 sq m

(18,400 sq ft) of space, and 1,722 sq m (18,500 sq ft) being leased or renewed.

Tenant discussions are ongoing in respect of a number of buildings and we expect

the occupational markets to remain challenging for some time.

SWEDEN - The void rate of the Vänerparken portfolio, the Group's only property

investment in Sweden, remained at 1.9% throughout the period under review.

FINANCIAL UPDATE

At 31 March 2010 borrowings were GBP553.6 million (31 December 2009: GBP592.8

million) and the weighted average cost of debt was 4.1%. Cash and undrawn

facilities stood at GBP79.8 million (31 December 2009: GBP70.3 million), and the

Group held corporate bonds with a value of GBP58.8 million (31 December 2009:

GBP70.0 million).

At 31 March 2010 the Group had 54 bank loans from 18 banks; none of the bank

loan covenants was in breach.

Underlying profit continues to be resilient, with stable net rental income, high

debt collection rates, and tightly controlled costs. In Q1 2010, the Group

realised a gain of GBP9.4 million on the sale of corporate bonds.

The Company's Half-yearly financial report will be published in late August.

DIRECTORATE CHANGES

On 11 May 2010, Richard Tice joined the Board as Deputy Chief Executive, Jennica

Mortstedt as a Non-Executive Director and Bengt Mortstedt retired as a

Non-Executive Director.

Executive Chairman of CLS, Sten Mortstedt, commented:

"Our focus on active portfolio management has been successful and has kept our

vacancy rate low across the portfolio. Our average cost of debt is low, and,

with significant resources at its disposal, the Company remains well placed to

take advantage of investment opportunities as they arise."

-ends-

For further information, please contact:

CLS Holdings plc

+44 (0)20 7582 7766

Sten Mortstedt, Executive Chairman

Henry Klotz, Chief Executive Officer

Richard Tice, Deputy Chief Executive Officer

Kinmont Limited

+44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants

+44 (0)20 7360 4900

Alex Simmons / Will Swan

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSLIFEEEIIDLII

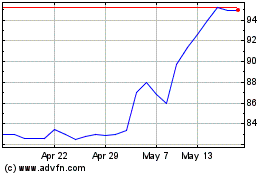

Cls (LSE:CLI)

Historical Stock Chart

From Jun 2024 to Jul 2024

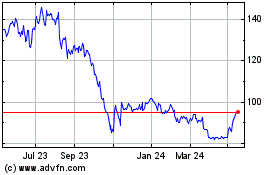

Cls (LSE:CLI)

Historical Stock Chart

From Jul 2023 to Jul 2024