TIDMCGH

RNS Number : 1976M

Chaarat Gold Holdings Ltd

13 September 2019

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

Interim Statement For The Six Months Ended 30 June 2019

Chaarat Gold Holdings Ltd (AIM: CGH), the AIM-quoted gold mining

company with assets in the Central Asia and the Former Soviet Union

("FSU"), today publishes its unaudited results for the six-month

period ended 30 June 2019.

Corporate and development highlights

-- Completion of the acquisition of Kapan Mining and Processing

Company CJSC ("Kapan") from PMTL Holding Ltd ("PMTL"), a subsidiary

of Polymetal International Plc, on 30 January, adding a producing

gold mine to the Company's portfolio;

-- Re-admission to trading on the AIM market of London Stock

Exchange plc of the Company's entire issued share capital, on 4

February, following completion of the Kapan acquisition;

-- Signed a binding term sheet and agreement post period end -

entering into a Joint Venture with Çiftay İnsaat Tahhüt ve Ticaret

A.S. ("Çiftay"), the Turkish mining and mine construction

contractor, to collaborate on the Tulkubash and Kyzyltash projects

in the Kyrgyz Republic. Çiftay will progressively invest up to

USD31.5 million for a 12.5% equity stake in Chaarat's existing

mining projects in the Kyrgyz Republic;

-- Total new funds raised of approximately USD2.86 million,

USD2.3 million from the issue of 6,927,563 new ordinary shares via

a private placement and USD0.6 million from the issue of

convertible bonds;

-- Appointment of Warren Gilman to the Board as an Independent

Non-Executive Director, effective 21 March 2019; and

-- Appointment of Darin Cooper, with more than 30 years'

experience in the metals and mining industry, as Chief Operating

Officer, effective 1 June 2019.

Operating and project highlights

-- Update of the JORC compliant bankable feasibility study for

Tulkubash Oxide Gold Project ("Tulkubash") in the Kyrgyz Republic,

released:

-- Initial reserve base of 22.2Mt ore grading 0.92g/t Au,

containing 658koz ounces of gold, an increase of 39%;

-- Average gold production of 94,000 ounces per annum over an

initial mine life of 5.3 years;

-- All-in sustaining cost (AISC) of USD819 per ounce, including

all taxes;

-- Significant capital expenditure optimisation, which has

resulted in an overall reduction from USD132 million to USD110

million; and

-- Improved post tax NPV of USD70 million (at 5% discount rate)

and IRR of 20%, using a USD 1,300/oz gold price.

-- New Mineral Resource for Kapan of 1.775Moz AuEq (Measured

& Indicated based on the results of 69,000 meters of drilling

completed in 2018; and

-- One lost time injury ("LTI") involving a contractor was reported at Kapan;

Financial highlights

-- Revenues in the period amounted to USD31.0 million which is

wholly attributable to the five months ownership of Kapan;

-- A positive EBITDA contribution from Kapan of USD3.2 million

for the five-month period, already an improvement on the USD1.6

million achieved in the previous five months under the former

owners;

-- Improvements across all operational metrics at Kapan already

evident, hindered by legacy issues that have been identified since

acquisition, and solutions implemented;

-- On track to reach our targeted run rate of 65 Koz of gold

equivalent ounces per year, before the end of 2019 at Kapan, as

improvements continue on all workstreams, including:

o Fleet availability;

o Grades;

o Recoveries;

o Costs; and

o Alternative ore sourcing.

-- During the first six months of 2019, the Group generated

operating cash flows of USD2.8 million, the positive cash

generation mainly represented positive EBITDA contribution from

Kapan and favourable working capital movements, partly offset by

expenditure on corporate overheads and development costs;

-- The Group raised USD46.4 million during the period which

comprises bank funding to acquire Kapan and other borrowings to

fund the Group's activities, together with the equity raise in the

period.

-- Cash and cash equivalents at 30 June 2019 were USD4.9 million;

Post Period Highlights

-- Polymetal agreed to exchange its USD10 million of Convertible

Notes received as part of original consideration, and a working

capital settlement under the SPA for 14,638,020 newly issued

ordinary shares representing approximately 3.5% of the enlarged

fully diluted share capital of Chaarat post allotment. The New

Shares are subject to a twelve month lock-up arrangement and

Polymetal has granted a right of first refusal effective from the

end of the lock-up arrangement for six months in the event of the

sale of those New Shares to Chaarat;

-- Reported results of 77 drill holes completed at Tulkubash

totalling 12,078 metres of the 2019 planned 20,000 metre drill

programme. Drilling to date has been focused on adding Measured and

Indicated Resources, with potential for conversion into reserves as

part of a year-end Resource and Reserve Update;

-- Secured USD7 million of additional working capital funds via

a USD7 million upsizing of the existing USD10 million loan and

extension of maturity date to March 2020;

-- Closed the previously announced 2021 Convertible Bond raise

to new subscriptions. Following the most recent subscription of

USD0.5 million in July 2019, and the agreement with Polymetal to

exchange USD10 million of notes for equity, the total value of the

2021 notes in issue is USD19.7 million;

-- A further USD2.5 million was drawn from the existing Labro

Investments Ltd ("Labro") facility which brings the total amount

drawn down to USD6 million, with USD5.5 million to be repaid.

Martin Andersson, Executive Chairman of Chaarat, commented: "We

continue to make rapid progress towards achieving our goal to

become a leading gold producer. This strategy is now broader, as we

look to grow our production organically, but also through a

disciplined M&A strategy in a region with significant

potential. Creating shareholder value remains at the core of this

strategy.

"We look forward to the second half of the financial year, in

which we expect to have bedded down our newly acquired Armenian

gold mine, while further advancing our next producing asset,

Tulkubash."

Enquiries

Chaarat Gold Holdings Limited

Artem Volynets (CEO) +44 (0)20 7499 2612

info@chaarat.com

Numis Securities Limited

John Prior, Paul Gillam (NOMAD) +44 (0) 20 7260 1000

James Black (Corporate Broking)

SP Angel

Ewan Leggat (Joint Broker)

Tavistock Communications +44 (0) 20 3470 0470

Charles Vivian +44 7977297903

Gareth Tredway +44 7785974264

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on

Central Asia and the FSU through organic growth and selective

M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com.

CHIEF EXECUTIVE OFFICER'S REPORT

Dear Shareholder

I am pleased to report on the six-month period in which we

became a producer, following the acquisition of the Kapan Gold Mine

in Armenia in February.

Not only did the transaction allow us to achieve the status of

operator, but perhaps more importantly, it allowed us to begin to

execute our transformational strategy for Chaarat, namely: to

create a leading emerging markets gold producer focused on the FSU

region.

We are targeting organic growth towards an approximate 500,000oz

Au per annum production rate as we bring Tulkubash online and

develop Kyzyltash further. Additionally, selective and disciplined

mergers and acquisitions using management's broad experience and

network will enable the consolidation of a highly fragmented gold

mining region with significant potential.

Of course, with any acquisition there are legacy issues that can

only be identified and dealt with once the asset is within one's

control. These types of issues were identified at Kapan and

remedial work began immediately with encouraging results. More

specifically, management is streamlining both mine planning and

maintenance programmes, as well as improving the metallurgical

performance of the mill. To redress a temporary shortfall in ore

mined due to legacy haul truck constraints, the Company has taken

immediate action to obtain the required engine replacements on an

expedited basis. During the interim period Chaarat's mining

contractor has assisted by increasing its fleet size resulting in

increased trucking rates.

Additional efforts are also in place to achieve targeted grades,

reduce costs, and increase margins, including: A cost reduction

program reviewing all major expenditures, identification of

additional sources of feed to fill the mill, a review of the Mining

Methods and Mine Planning, as well as mill improvements. Based on

the current work programme, the Company believes the mine will

reach its operational targets by the end of the current quarter to

end-September, as well as reach our targeted run rate of 65 Koz of

gold equivalent ounces per year before the end of 2019.

We have also reported a new measured and indicated mineral

resource for Kapan of 1.775Moz AuEq, giving us the confidence,

based on historical resource to reserve conversion rates at Kapan,

that the mine will continue to replace mined reserves and should

continue to extend mine-life for several years beyond the current

life of the mine.

This work programme has the added value of improving the

Company's understanding of the ore body and will help to optimize

short, medium and long-term operational planning and execution.

At Tulkubash in the Kyrgyz Republic, we updated the JORC

compliant bankable feasibility study for the oxide gold project

during the period. Importantly it included a significant reduction

in capital expenditure from USD132 million to USD110 million, while

increasing gold reserves by almost 40% year-on-year, an impressive

achievement by the project team.

In March, we signed a binding term sheet to enter into a Joint

Venture with Çiftay, the Turkish mining and mine construction

contractor, to collaborate on the Tulkubash and Kyzyltash projects

in the Kyrgyz Republic.

This partnership has since been secured with a Joint Venture

Agreement announced post period end which details the same terms as

the initial binding term sheet signed in March, namely the

progressive investment of up to USD31.5 million for a 12.5% equity

stake in our existing mining projects in the Kyrgyz Republic.

As mentioned in the announcement confirming the agreement,

Çiftay's investment provides a significant amount of the remaining

equity requirement for the Tulkubash project, with the remaining

funds expected from senior project debt, with a process launched in

June. Discussions with potentially interested funders are

progressing as expected with the Company receiving preliminary term

sheets. Financial close is targeted for the end of this year or

early next year.

Post period end we were able to report some promising new drill

results from Tulkubash, having completed 12,078 metres of the 2019

planned 20,000 metre drill programme, with a focus on adding

Measured and Indicated Resources, with potential for conversion

into reserves as part of a year-end Resource and Reserve Update.

Additionally, the Company has begun drilling on an approximately

3,000 metre programme in the Karator and Ishakuldy areas

respectively 1.5 kilometres and 5 kilometres northeast of the

current resource limits. This programme is designed to test drill

targets identified along strike and to validate the district-scale

potential of Tulkubash, another key part of our strategy.

At board level, we welcomed Warren Gilman as an independent

non-executive director, in March. Warren brings decades of

experience and success in the mining sector. At the same time,

Martin Wiwen-Nilsson decided to step down from his role as

Non-Executive Director of the Company and instead take on a role as

Senior Advisor of Chaarat.

From a human capital perspective, we continue to strengthen

management where required and in June we were pleased to welcome

Darin Cooper, with more than 30 years' experience in the metals and

mining industry, as Chief Operating Officer. Darin has a proven

track record of increasing performance across a range of mining

operations and his expertise will be immensely valuable. Robert

Benbow, previous Chief Operating Officer of Chaarat, will continue

to serve on the Board of the Company as an Non-Executive Director

and will remain the Chair of the Technical Committee.

From a financing perspective we recently announced the injection

of USD9.5 million of additional working capital funds. The Company

has agreed a new maturity date for the US10 million loan agreement

(the "Loan"), announced on 15 November 2018, to 31 March 2020. The

loan was also increased by USD7 million to a total size of USD17

million. In addition, Chaarat has drawn a further USD2.5 million

from Labro Investments for additional working capital. I am

confident in the Group's ability to raise additional funds as

demonstrated by the Group's established track record in historical

fund raisings and refinancing events.

Considering this positive loan fundraising, we decided to close

the previously announced 2021 Convertible Bond raise to new

subscriptions. Following the most recent subscription of USD0.5

million in July 2019, and the agreement with Polymetal to exchange

USD10 million of notes for equity, the total value of the 2021

notes in issue is USD19.7 million.

It would be remiss of me not to make mention of the strong gold

price that currently prevails in world markets. While it is of

course beneficial to our operations, we remain focused on efficient

cost control and disciplined M&A, to ensure that we are

sustainable through the cycle.

With highest regards,

Artem Volynets

Financial review

Income statement

Revenues in the period amounted to USD31.0 million, compared

with nil in the corresponding period in 2018. This represented

sales of concentrate at Kapan for the five-month period following

acquisition by the Group from 31 January to 30 June. During this

period, Kapan sold 4,025dmt of copper concentrate and 5,283dmt of

zinc concentrate, containing a combined 23,327 ounces Au Eq.

The operating loss for the Group during the period was USD7.5

million. This included a positive EBITDA contribution from Kapan of

USD3.2 million, offset by depreciation and amortisation as well as

corporate and overhead costs of USD6.5 million at head office and

in the Kyrgyz Republic to fund the ongoing development of the

Group. The increased operating loss of USD7.5 million compared with

USD3.7 million in the first half of 2018 resulted mainly from the

higher level of corporate and development activity in the

Group.

Finance costs were USD4.9 million compared with USD1.4 million

in the first half of 2018. This resulted from additional funding

taken out both in the second half of 2018 and the first half of

2019 to finance the Group's activities, including the bank loans

for the acquisition of Kapan.

Consequently, the Group made a loss in the period of USD12.3

million compared with USD5.1 million in the first half of 2018.

Balance sheet

The Group's balance sheet at 30 June 2019 includes the

consolidation of Kapan following its acquisition on 30 January

2019. Kapan's assets and liabilities have been consolidated under

the acquisition accounting method using provisional fair values at

31 January 2019.

Non-current assets increased from USD48.7 million at 31 December

2018 to USD94.5 million at 30 June 2019. The increase was mainly

due to inclusion of property, plant and equipment at Kapan and a

deferred tax asset on acquisition fair value adjustments which will

be amortised over the life of the Kapan operation. Additionally,

exploration and evaluation costs of USD3.0 million were capitalised

in the period relating to the asset in the Kyrgyz Republic.

Current assets of USD34.1 million at 30 June 2019 compared with

USD6.4 million at 31 December 2018. The increase mainly related to

the inclusion of inventories (both spare parts and concentrate

stocks) and receivables at Kapan. Current assets at 30 June 2019

included cash and cash equivalents of USD4.9 million.

Total liabilities at 30 June 2019 were USD112.1 million compared

with USD31.4 million at 31 December 2019. This was mainly due to an

increase in borrowings of USD57.1 million, mainly due to the

third-party bank funding and convertible loan notes issued directly

to the seller (since converted into equity) totalling USD50.0

million to fund the acquisition of Kapan, as well as additional

borrowings to fund the Group's corporate and development

activities. The movement in borrowings is set out in more detail in

Note 2. In addition, there is a rehabilitation provision of USD13.1

million relating to Kapan following its acquisition and

consolidation.

Total equity was USD16.5 million at 30 June 2019 compared with

USD23.6 million at 31 December 2018, mainly reflecting the loss for

the period. On 1 May 2019, the group closed a placing having raised

gross proceeds of approximately USD2.71 million from the issue of

6,927,563 ordinary shares of USD0.01 each.

Cash flow

During the first six months of 2019, the Group generated

operating cash flows of USD2.8 million, compared with operating

cash flow consumed of USD3.2 million in the first six months of

2018. The positive cash generation mainly represented positive

EBITDA contribution from Kapan and favourable working capital

movements, partly offset by expenditure on corporate overheads and

development costs.

Net cash used in investing activities in the period was USD40.4

million, compared with USD5.2 million in the corresponding period

for 2018. This mainly reflected the payment for the acquisition of

Kapan together with capitalised exploration and development spend

in the Kyrgyz Republic.

Cash flow from financing activities in the period amounted to

USD45.2 million, compared with USD7.0 million in the first half of

2018. This mainly related to the bank funding to acquire Kapan and

other borrowings to fund the Group's activities as explained in the

balance sheet section above, together with the equity raise in the

period.

Cash and cash equivalents at 30 June 2019 were USD4.9 million

compared with USD3.7 million at the start of the year.

Further details of the Group's status as a going concern and

expected future financing plans are set out below in note 1 to the

interim financial statements.

Unaudited Consolidated Income Statement

For the six months ended 30 June 2019

6 months

6 months ended ended

30 June 2019 30 June 2018

US$'000 US$'000

Revenue 30,956 -

Cost of Sales (27,968) -

----------------------------------------------- ------------------- -------------

Gross profit 2,988 -

General, administrative and selling expenses (10,495) (3,702)

Other operating income - 5

Operating loss (7,507) (3,697)

Finance costs (4,921) (1,407)

Loss before tax for the year, attributable

to equity shareholders of the parent (12,428) (5,104)

Income tax credit 81 -

Loss after tax for the year, attributable

to equity shareholders of the parent (12,347) (5,104)

Loss per share (basic and diluted) -

US$ cents (3.06) (1.38)

Unaudited Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2019

6 months 6 months

ended ended

30 June 30 June

2019 2018

US$'000 US$'000

Loss for the year, attributable to equity

shareholders of the parent (12,347) (5,104)

Other comprehensive income:

Items which have been reclassified to profit

and loss

Exchange differences on translating foreign

operations liquidated during the year

Items which may subsequently be reclassified

to profit and loss - (74)

Exchange differences on translating foreign 1,108 -

operations and investments

Other comprehensive income for the year,

net of tax 1,108 (74)

Total comprehensive loss for the year attributable

to equity shareholders of the parent (11,239) (5,178)

----------------------------------------------------- ---------- ---------

Unaudited Consolidated Balance Sheet

As at 30 June 2019

As at

As at 31 December

30 June 2019 2018

(Unaudited) (Audited)

Note US$'000 US$'000

------------------------------------------- ----- ---------- ------------

Assets

Non-current assets

Exploration and evaluation costs 46,571 43,527

Other Intangible assets 1,226 54

Property, plant and equipment 36,361 5,094

Prepayments 213 -

Other receivables 590 -

Deferred tax asset 9,541 -

Total non - current assets 94,502 48,675

------------------------------------------- ----- ---------- ------------

Current assets

Cash and cash equivalents 4,905 1,168

Inventories 13,721 -

Trade and other receivables 15,308 190

Prepayments 209 5,000

Total current assets 34,143 6,358

Total assets 128,645 55,033

------------------------------------------- ----- ---------- ------------

Equity and liabilities

* Equity attributable to shareholders

Share capital 4,020 3,951

Share premium 154,780 152,063

Share warrant reserve 1,352 1,352

Convertible loan note reserve 3,542 2,360

Merger reserves 10,885 10,885

Share option reserve 1,567 1,414

Translation reserve (14,290) (15,398)

Accumulated losses (145,331) (132,984)

------------------------------------------- ----- ---------- ------------

Total equity 16,525 23,643

------------------------------------------- ----- ---------- ------------

Liabilities

Non-current liabilities

Non-current borrowings 2 4,629 -

Provision for rehabilitation 13,059 -

Trade and other payables 590 -

Convertible loan note 2 27,492 16,303

------------------------------------------- ----- ---------- ------------

Total non-current liabilities 45,770 16,303

------------------------------------------- ----- ---------- ------------

Current liabilities

Trade and other payables 14,879 4,924

Other provisions 124 -

Current borrowings 2 51,347 10,163

Total current liabilities 66,350 15,087

------------------------------------------- ----- ---------- ------------

Total liabilities 112,120 31,390

------------------------------------------- ----- ---------- ------------

Total liabilities and equity 128,645 55,033

------------------------------------------- ----- ---------- ------------

Unaudited Consolidated Statement of Changes in Equity

For the six Share Convertible Share Shares

months ended Share Share warrant loan note Merger option to be Translation Accumulated

30 June 2019 Capital Premium reserve reserve Reserve Reserve issued Reserve losses Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

As at 31

December 2018

(Audited) 3,951 152,063 1,352 2,360 10,885 1,414 - (15,398) (132,984) 23,643

Loss for the

six months

ended 30 June

2019 - - - - - - - - (12,347) (12,347)

Currency

translation - - - - - - - 1,108 - 1,108

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Total

comprehensive

income

for the year - - - - - - - 1,108 (12,347) (11,239)

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Share options

expense - - - - - 153 - - - 153

Issuance of

shares for

cash 69 2,717 - - - - - - - 2,786

Equity element

of convertible

loan note - - - 1,182 - - - - - 1,182

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

As at 30 June

2019 4,020 154,780 1,352 3,542 10,885 1,567 - (14,290) (145,331) 16,525

Share Convertible Share Shares

Share Share warrant loan note Merger option to be Translation Accumulated

Capital Premium reserve reserve Reserve Reserve issued Reserve losses Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

As at 31

December 2017

(Audited) 3,569 138,184 1,352 867 10,885 2,912 1,926 (15,472) (118,952) 25,271

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Loss for the

year - - - - - - - - (17,042) (17,042)

Previously

recognised

translation

losses for

liquidated

subsidiary - - - - - - - 74 - 74

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Total

comprehensive

income

for the year - - - - - - - 74 (17,042) (16,968)

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Share options

lapsed - - - - - (1,857) - - 1,857 -

Share options

expense - - - - - 377 - - - 377

Share options

exercised 2 63 - - - (18) - - - 47

Issuance of

shares 145 4,738 - - - - (1,926) - - 2,957

Conversion of

loan notes 230 8,858 - (1,153) - - - - 1,153 9,088

Equity element

of convertible

loan note - - - 2,646 - - - - - 2,646

Issuance of

shares for

a fee 5 220 - - - - - - - 225

As at 31

December 2018 3,951 152,063 1,352 2,360 10,885 1,414 - (15,398) (132,984) 23,643

---------------- ------- ------- ------- ----------- ------- ------- ------- ----------- ----------- --------

Unaudited Consolidated Cash Flow Statement

For the six months 30 June 2019 6 months 6 months

ended 30 ended 30

June 2019 June 2018

US$'000 US$'000

---------------------------------------------------- ---------- ----------

Cash flows generated by/(used in) operating

activities

Operating loss (7,507) (3,697)

Depreciation and amortisation 4,213 146

(Gain) on disposal of property, plant and equipment 156 (5)

(Profit)/Loss on sale of inventories 145 -

Provision for inventories (101) -

Share based payments 153 275

Provision for rehabilitation 1,264 -

Decrease in inventories 4,627 -

(Increase) in accounts receivable (5,387) (126)

Decrease in prepayments 341 -

Increase in accounts payable 4,892 180

Net cash flow generated by/(used in) operations 2,796 (3,227)

----------------------------------------------------- ---------- ----------

Investing activities

Purchase of tangible fixed assets (299) (966)

Investment in subsidiary (40,000) -

Exploration and evaluation costs (3,044) (4,283)

Purchase of other intangible fixed assets (887) -

Proceeds from sale of property, plant & equipment 5 7

Interest received 8 6

----------------------------------------------------- ---------- ----------

Net cash used in investing activities (44,217) (5,236)

----------------------------------------------------- ---------- ----------

Financing activities

Proceeds from issue of share capital, net of

costs 2,286 3,004

Proceeds from convertible loan notes issued,

net of costs 572 3,950

Proceeds from loans 43,500 -

Principal loan repaid (500) -

Interest paid (694) -

----------------------------------------------------- ---------- ----------

Net cash from financing activities 45,164 6,954

----------------------------------------------------- ---------- ----------

Net change in cash and cash equivalents 3,743 (1,509)

Cash and cash equivalents at beginning of the

year 1,168 7,461

Effect of changes in foreign exchange rates (6) -

----------------------------------------------------- ---------- ----------

Cash and cash equivalents at end of the year 4,905 5,952

----------------------------------------------------- ---------- ----------

Notes to the Financial Statements

1 Basis of preparation of interim financial statements

The financial information set out in this interim statement does

not constitute statutory accounts.

The unaudited results for the period ended 30 June 2019 have

been prepared on the basis of the accounting policies adopted in

the audited accounts for the year ended 31 December 2018 and in

addition, as disclosed below in relation to Revenue Recognition and

Provision for Rehabilitation which, subsequent to the acquisition

of Kapan Mining and Processing Company CJSC, have now been adopted.

These are expected to be consistent with the financial statements

of the Group as at 31 December 2019 that will be prepared in

accordance with IFRS and their interpretations issued by the

International Accounting Standards Board as adopted by the European

Union. The results for the period are derived from continuing

activities. The figures for the period ended 31 December 2018 have

been extracted from the statutory financial statements, prepared

under IFRS as adopted by the European Union, which are available on

the Group's website www.chaarat.com. The auditor's report on those

financial statements was unqualified and noted a material

uncertainty in respect of the Group's ability to continue as a

going concern.

During the period a new Standard became effective. IFRS 16 -

Leases took effect on 1 January 2019. The Group has identified its

lease arrangements as at 30 June 2019 and the impact of this new

Standard did have a material effect on the Group's consolidated

financial statements for the six months ended 30 June 2019 which is

as a result of the acquisition of Kapan.

Revenue recognition

The Group has one stream of revenue being the sale of copper and

zinc concentrate. Revenue is measured at the fair value of

consideration to which an entity expects to be entitled in a

contract with a customer in exchange for transferring promised

goods, excluding amounts collected on behalf of third parties, such

as value added tax (VAT). The Group recognises revenue when it

transfers control of a product or service to a customer.

Sales of copper and zinc concentrate

The Group sells copper and zinc concentrate under pricing

arrangements where final prices are determined by quoted market

prices in a period subsequent to the date of sale. Concentrate

sales are initially recorded based on spot prices. Revenue is

recorded at the time of shipment, when control passes to the buyer.

Provisional revenue is calculated based on the copper and zinc

content in the concentrate and using the spot London Bullion Market

Association (LBMA) or London Metal Exchange (LME) price, adjusted

for the specific terms of the relevant agreement. Revenue is

presented net of refining and treatment charges which are

subtracted in calculating the amount to be invoiced. Until end of

the quotation period revenue is adjusted monthly based on the

forward prices. After quotation period end final revenue is

calculated based on the spot prices in accordance with the relevant

agreements.

Provision for rehabilitation

An obligation to incur environmental restoration, rehabilitation

and decommissioning costs arises when disturbance is caused by the

development or ongoing production of mining assets. Such costs

arising from the decommissioning of plant and other site

preparation work, discounted to their net present value using a

risk-free rate applicable to the future cash flows, are provided

for and capitalised at the start of each project, as soon as the

obligation to incur such costs arises. These costs are recognised

in the consolidated income statement over the life of the

operation, through the depreciation of the asset in the cost of

sales line and the unwinding of the discount on the provision in

the finance costs line.

Changes in the measurement of a liability relating to the

decommissioning of plant or other site preparation work (that

result from changes in the estimated timing or amount of the cash

flow or a change in the discount rate), are added to or deducted

from the cost of the related asset in the current period. If a

decrease in the liability exceeds the carrying amount of the asset,

the excess is recognised immediately as a reduction in the

underlying asset.

Going Concern

As at 12 September 2019 the Group had USD7.1 million of cash and

cash equivalents, USD9 million in available undrawn facilities and

USD82.0 million of debt, excluding working capital, comprising

mainly of the following:

-- USD27.5million convertible loan note, repayable on 31 October

2021, including interest to 30 June 2019. On 30 July 2019 USD10

million of the total Convertible loans outstanding, which was

issued in connection with the acquisition of Kapan was exchanged by

Polymetal for 14,638,020 newly issued ordinary shares of USD0.01

each. Following the most recent subscription of USD0.5 million in

July 2019, and the agreement with Polymetal, the total principal

value of the 2021 notes in issue is USD19.7 million.

-- USD10.8 million loan, repayable in August 2019, including

interest to 30 June 2019. This loan has been increased from USD10

million to USD17 million on 11 September 2019, with a revised

repayment date of 31 March 2020.

-- Remaining term loan for USD38 million entered into in

connection with the acquisition of Kapan after the year end. The

loan is repayable through quarterly instalments over a period of

four years, the final payment being January 2023. The Company did

not meet one of its covenants at 30 June 2019 and as such the full

bank debt has been disclosed as a current liability. However a

waiver was received in September 2019, with regards to the relevant

covenant not being met on June 30, 2019 and therefore the Company

remains in full compliance with the loan. Further details are given

in Note 2 under "Kapan Bank Debt".

-- On 12 December 2018, the Group entered into a committed

revolving term loan facility agreement with Labro Investments

Limited ("Labro") for a total amount of USD15 million (the "Labro

Loan Agreement"). The facility is for the general corporate

purposes of the Group and can be drawn down at the full discretion

of the Group at any time before its maturity. As at 30 June 2019,

USD3.5 million has been drawn down, USD0.5 million has subsequently

been repaid, USD3.0 million is still outstanding and a further

USD11.5 million remains available to the Group. On August 8, 2019 a

further USD2.5million has been drawn down and a further USD9.0

million remains available to the Group as at the date of this

review statement.

The Board has reviewed the Group's cash flow forecast for the

period to 31 December 2020. As explained further below, the Board

expects that additional funding will be received. However, for the

purpose of making an assessment of going concern, the cash flow

forecasts reviewed by the Board exclude additional funding which is

not contractually committed.

Plans to develop the Tulkubash project remain subject to the

Group raising sufficient funds. The Group is in the process of

completing a 20,000-metre exploration programme in 2019 to increase

the Tulkubash heap leachable resources, and this also remains

subject to the Group raising sufficient funds.

The Board have based the cash flow forecasts for Kapan on the

most recent forecasts, taking into account actual performance to

date. Whilst Kapan is forecasted to generate a minimal amount of

free cash flow to fund the Group's other projects, additional fund

raising is intended to be completed before the end of the fourth

quarter of 2019 in order to maintain the growth projects across the

group and repay the Group's USD17 million loan obligations which

fall in Q1 2020. Additional funds would be required to repay the

outstanding Labro Loan which is due on 14 July 2020.

There are currently minimal commitments in respect of Tulkubash

and the Group has the discretion and ability to reduce cash

expenditures across the group in order to conserve cash.

The Board has confidence in the Group's ability to raise

additional funds as demonstrated by the Group's established track

record in historical fund raisings and refinancing events.

Furthermore, as a result of the updated Feasibility Study for

Tulkubash, management has launched a Project Finance process which

is expected to provide funding for the construction of

Tulkubash.

Subject to the above, which the Board is confident can be

achieved, the Directors have concluded that it is appropriate to

prepare the financial statements on a going concern basis. However,

there are currently no binding agreements in place in respect of

any additional funding and therefore, as set out above, this

indicates the existence of a material uncertainty which may cast

significant doubt over the Group's ability to continue as a going

concern and, therefore, it may be unable to realise its assets and

discharge its liabilities in the normal course of business. The

financial statements do not include the adjustments that would

result if the Group was unable to continue as a going concern.

2 Liabilities

Convertible loan notes US$'000

--------------------------------------------- --------

At 1 January 2019 16,303

Cash proceeds 600

Consideration for acquisition of subsidiary 10,000

Transaction costs (28)

Amount classified as equity (1,182)

Accrued interest 1,799

--------------------------------------------- --------

At 30 June 2019 27,492

--------------------------------------------- --------

Convertible loan notes

In January 2019, Chaarat received USD0.6 million from two new

investors for the subscription and issue of secured convertible

notes for USD350,000 and USD250,000.

On 30 January 2019, Chaarat completed the acquisition of Kapan

Mining and Processing Company CJSC from PMTL Holding Ltd, a

subsidiary of Polymetal International Plc for a total consideration

of USD55 million (subject to net debt and working capital

adjustments). This included USD10 million settled on completion in

convertible loan notes; USD5 million paid as a deposit in November

2018; and as explained below USD40 million of third-party bank

funding.

Principally as a result of the above, the liability in respect

of convertible loan notes increased during the period from USD16.3

million to USD27.5 million.

As explained in Note 4, on 30 July 2019 an agreement was reached

whereby Polymetal has agreed to exchange its USD10 million

convertible note for 14,638,020 newly issued ordinary shares of

USD0.01 each.

Non-current Borrowings US$'000

------------------------ --------

At 1 January 2019 -

Lease liability 1,500

Labro Facility 3,129

At 30 June 2019 4,629

------------------------ --------

Labro facility

At 12 December 2018 the Company's Chairman, Martin Andersson,

via Labro Investments Limited ("Labro"), had entered into an

agreement with Chaarat Gold Holdings Limited whereby Labro agreed

to provide committed funding facility to the Company in the amount

of USD15 million.

The Company drew down the amount of USD0.5 million on 1 April

2019. The Company offset the amount owed against Labro's obligation

to pay for 1,276,666 shares on 5 April 2019. The shares issued

formed part of the 1,914,999 shares issued to Labro as part of the

capital raising of 1 May 2019, the balance of which were settled by

Labro in cash. On 23 May 2019, the Company drew a further USD2

million and on 22 June 2019 a further USD1 million was drawn

down.

Current Borrowings US$'000

------------------------------------- --------

At 1 January 2019 10,163

Kapan bank debt, including interest 40,534

Interest on other loan 650

At 30 June 2019 51,347

------------------------------------- --------

Kapan bank debt

On 30 January 2019, the documentation was finalised for the

Kapan Acquisition Financing totalling USD40 million, which is

syndicated with Ameriabank CJSC (USD32 million), HSBC Bank Armenia

CJSC (USD5 million) and Ararat Bank OJSC (USD3 million). The loan

is repayable through quarterly payments over a four-year period and

incurs interest at Libor plus 8%.

This bank financing has certain covenants attached to it that

the Company needs to adhere to, one of which is the Net debt to

last twelve months ('LTM') EBITDA of 2.5x as at 30 June 2019. The

Company did not meet this covenant as at 30 June 2019 and as such

the full bank debt has been disclosed as a current liability. The

LTM EBITDA calculation is based on EBITDA from July 1, 2018 to June

30, 2019. Chaarat ownership of Kapan commenced on January 31, 2019

and as such seven-months of the LTM calculation, is based on Kapan

whilst being operated by Polymetal International Plc.

A waiver was received in September 2019, with regards to the

relevant covenant not being met on June 30, 2019 and therefore the

Company remains in full compliance with the loan.

Other short-term loan

The loan was initially repayable after nine months in August

2019, post period end it has been extended by 7 months to March

2020 and increased by USD7 million to USD17 million. The annualised

interest on the loan is 13%. The loan contains various

representations, undertakings and events of default which are

common for a loan of this nature.

3 Loss per share

Loss per share is calculated by reference to the loss for the 6

months ended 30 June 2019 of USD12.3 million (2018: USD5.1 million)

and the weighted average number of ordinary shares in issue of

402,094,578 (2018: 369,001,753) during the period. There is no

dilutive effect of share options.

4 Kapan Acquisition

The Kapan acquisition has been accounted for in line with the

accounting policy as set out in the 31 December 2018 annual report.

As at the date of this interim report, the fair value exercise is

in progress and as such the values are still considered provisional

with specific reference to the rehabilitation provision and

inventory (spare parts) amount as these will both require an expert

valuation.

5 Post Balance Sheet Events

Incentive scheme

The Directors intend to implement an incentive scheme to reward

Directors and certain employees in 2019. Its proposed terms were

disclosed in the Company's admission document published on 14

December 2018. The incentive scheme now provides for two main

elements: conversion of existing option plans into a new uniform

scheme and a one-off grant of equity equal to 5 percent of the

outstanding share capital at the date of Re-Admission and options

equal to 3 times of equity granted under the scheme at a strike

price of 42p per Ordinary Share to the Board and top managers which

will be subject to a vesting schedule.

The first element of the scheme will require conversion of

vested and unvested options into Ordinary Shares based on a price

of 33p per Ordinary Share; these will have a lock-up till the end

of 2020 (shares to be issued to replace unvested options will also

have a one-year vesting period and if an employee leaves during

this period the unvested shares will lapse). This first element

requires consent from the existing option holders and, if all

holders consent, would result in approximately 3,000,000 new

Ordinary Shares.

The second element of the scheme has a three-year vesting

period, one-third of the award vests annually starting from 2019.

Delivery of vested Ordinary Shares will be made in the end of each

year. All vested Ordinary Shares are subject to a lock-up until the

end of 2020.

The Board has full discretion to amend the incentive scheme or

adjust unvested Ordinary Shares and options.

Issuance of new shares

On 23 July 2019, the group announced that it had issued

1,496,556 ordinary shares of USD0.01 each ("New Ordinary Shares").

These comprise:

-- 250,000 New Ordinary Shares issued to Labro Investments

Limited ("Labro") pursuant to a guarantee fee agreement announced

by the Company on 31 January 2019 (RNS number 7446O);

-- 34,435 New Ordinary Shares issued to Labro pursuant to a

drawdown made by the Company on 29 March 2019 on a committed

revolving term loan facility with Labro announced by the Company on

14 December 2018 (RNS number 5046K); and

-- 1,212,121 New Ordinary Shares issued to remunerate a former

board member for services provided to the Company.

Agreement with Polymetal

On 30 July 2019, the Group announced that Polymetal had agreed

to exchange its USD10 million of Convertible Notes received as part

of original consideration, and a working capital settlement under

the SPA for 14,638,020 newly issued ordinary shares of USD 0.01

each ("New Shares"). This shall represent 3.5% of the enlarged

fully diluted share capital of Chaarat post allotment. The New

Shares shall be subject to a twelve-month lock-up arrangement and

Polymetal shall grant a right of first refusal effective from the

end of the lock-up arrangement for six months in the event of the

sale of those New Shares to Chaarat. The shares were subsequently

issued on 16 August 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR GGUQWBUPBGMP

(END) Dow Jones Newswires

September 13, 2019 02:00 ET (06:00 GMT)

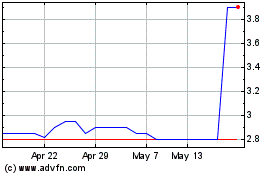

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Jul 2023 to Jul 2024