TIDMCEY

RNS Number : 1255N

Centamin PLC

18 May 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014

18 May 2020

Centamin plc

("Centamin" or "the Company")

(LSE:CEY, TSX:CEE)

Payments to Governments Report

for the twelve months ended 31 December 2019

Centamin mining operations, including exploration projects,

generate economic benefit for the countries and communities where

we operate through payments to government, employee and contractor

wages, payments to suppliers and contractors, vocational training,

community investment and academic investment. We care deeply about

the communities and environments with which we operate. Fundamental

to creating lasting stakeholder relationships is good governance,

including reliable, transparent disclosure.

In accordance/compliance with the Payments to Governments

Regulations of 2014 (the "Regulations"), this report provides an

overview of the Centamin's payments to governments. Whilst the

Regulations are a part of UK law, and the Company is governed by

Jersey law, they are applicable by virtue of the Company's listing

on the London Stock Exchange (pursuant to Disclosure and

Transparency Rule 4.3A).

The Regulations require companies active in the extractive

industries to report certain payments they have made to their host

governments in the form of taxes, bonuses, royalties, fees and for

infrastructure improvements. The Regulations implement Chapter 10

of the EU Accounting Directive. The Regulations are part of an EU

-- wide effort to curb corruption and promote transparency in the

extractives sector. Their stated objectives are to provide citizens

of resource -- rich countries with the information they need to

hold their governments to account; and to provide greater insight

(for investors and all other stakeholders) into how the sector

operates and the range of economic contributions that can

result.

The Regulations require disclosure of the following:

a) production entitlements;

b) taxes levied on the income, production or profits of

companies, excluding taxes levied on consumption such as value

added taxes, personal income taxes or sales taxes;

c) royalties;

d) dividends, other than dividends paid to a government as an

ordinary shareholder unless they are paid in lieu of a production

entitlement or royalty;

e) signature, discovery and production bonuses;

f) licence fees, rental fees, entry fees and other

considerations for licences and/or concessions; and

g) payments for infrastructure improvements.

Where a payment or series of related payments do not exceed

GBP86,000 they do not need to be disclosed but, in the interests of

transparency, the Company has included these costs.

The Company is also subject to equivalent Canadian legislation -

the Extractive Sector Transparency Measures Act ("ESTMA") which

came into force on 1 June 2015. Canada's requirements are aligned

with those in the EU Directive and this report is deemed equivalent

for Canadian purposes.

Payments in this report have been disclosed in US dollars, which

is the Company's reporting currency. Where actual payments have

been made in a local currency they have been converted using the

prevailing exchange rate at the time of the payment.

Summary table showing payments to governments made during the

year ended 31 December 2019 in US$

Type Note Egypt Burkina Côte Total

Faso d'Ivoire

-------------------------------- -------- ------------ ---------- ---------- ------------

Profit share 87,075,000 - - 87,075,000

Corporate taxes (i) 2,467,802 - - 2,467,802

Royalties 18,389,686 - - 18,389,686

Exploration licence fees - 249,380 89,262 338,642

Mining and other licence

fees 179,512 824,617 - 1,004,129

Infrastructure improvements (ii) 24,015 70,090 493,456 587,560

108,136,014 1,144,086 582,718 109,862,819

---------------------------------------- ------------ ---------- ---------- ------------

(i) In accordance with the Regulations, this figure excludes

taxes levied on consumption such as VAT, payroll or sales

taxes.

(ii) Community projects in Egypt including financial assistance

to local fire department, contributions towards Ramadan

celebrations and a Ramadan football tournament in Marsa Alam,

computers for a local police station and sponsorship of Marsa Alam

Youth Football Team.

Community projects in Burkina Faso including drilling of

boreholes for villages, installation of toilets and solar panels at

a local high school, funding initiatives of local woman's

development and support groups

Community projects in Cote d'Ivoire including drilling of

boreholes for villages and providing seeds and fertilisers for

farmers.

Payments split by payee during the year ended 31 December 2019

in US$

Country Note Payee Royalties Profit Taxes License Other Total

/ Project share or permit

fees

------------- ------- ------------------- ----------- ----------- ---------- ----------- -------- ------------

Egypt:

Egyptian

Mineral

Sukari Resources

Gold Mine Authority 18,389,686 87,075,000 - - - 105,464,686

----------------------

Egyptian

Tax Authority - - 2,467,802 - - 2,467,802

Other payees - - - 179,512 24,015 203,526

----------------------------------------- ----------- ----------- ---------- ----------- -------- ------------

Burkina

Faso:

Konkera Ministry

Project (iii) of Mines - - - 824,617 - 824,617

-------------

Burkina Faso

Tax Office - - - - - -

------------- ------- ------------------- ----------- ----------- ---------- ----------- -------- ------------

Burkina

Faso:

Exploration Ministry

projects of Mines - - - 247,329 - 247,329

----------------------

Burkina Faso

Tax Office - - - - - -

-------------

Other payees - - - 2,051 70,090 72,140

----------------------------------------- ----------- ----------- ---------- ----------- -------- ------------

Côte

d'Ivoire:

Exploration Ministry

projects (iii) of Mines - - - 89,262 - 89,262

-------------

Côte

d'Ivoire

Tax Office - - - - - -

-------------

Other payees 493,456 493,456

----------------------------------------- ----------- ----------- ---------- ----------- -------- ------------

18,389,686 87,075,000 2,467,802 1,342,771 587,560 109,862,819

----------------------------------------- ----------- ----------- ---------- ----------- -------- ------------

(iii) In accordance with the definition of 'project' in the

Regulations, the Company treats its exploration licence holding

areas in Côte d'Ivoire and Burkina Faso as single projects each for

the purposes of the Regulations. This is because the licence areas

are operationally and geographically linked.

_____________________________________________________________________________________

For more information, please visit the website www.centamin.com or contact:

Centamin plc Buchanan

Alexandra Carse, Investor Relations Bobby Morse

+44 (0) 7700 713 738 Chris Judd

alexandra.carse@centamin.je Kelsey Traynor

+ 44 (0) 20 7466 5000

centamin@buchanan.uk.com

____________________________________________________________________________________

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKOBPFBKDQPD

(END) Dow Jones Newswires

May 18, 2020 02:01 ET (06:01 GMT)

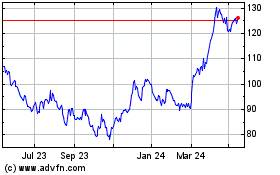

Centamin (LSE:CEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

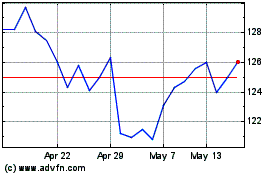

Centamin (LSE:CEY)

Historical Stock Chart

From Jul 2023 to Jul 2024