TIDMBOOM

RNS Number : 6419H

Boomerang Plus PLC

25 February 2010

Date: 25 February 2010

On behalf of: Boomerang Plus plc ('Boomerang', 'the Company',

or 'the Group')

Embargoed until: 0700hrs

Boomerang Plus plc

Interim Results

Boomerang Plus plc (AIM: BOOM.L), a profitable and vertically integrated,

multi-genre, independent television production group operating within the

Nations and Regions, today announces its unaudited results for the six months

ended 30 November 2009.

Financial Highlights

* FY 2010 second half weighted compared to FY 09

* Turnover of GBP8.87 million (2008: GBP11.76 million)

* Gross profit margin increased to 19.1% (2008: 16.7%)

* Operating profit of GBP0.49 million (2008: GBP1.10 million)

* Cash and cash equivalents of GBP2.82 million (2008: GBP3.98 million)

Operational Highlights

* Good progress on diversification strategy:

- Acquisition of Indus Films Limited in October 2009

- Investment in winter sports live event joint venture, Big Freeze Limited

- Acquisition of multi-media producer Method

* GBP12 million three year S4C Children's contract

* 482 hours of programming for calendar year 2009

* Continued critical acclaim for the Group's programmes

Outlook

* Full year revenues will be second half weighted due to timing of larger

projects

* Strong visibility over future revenues and commissions with pipeline in excess

of GBP50 million

* Increasing network productions

* Current trading in line with the Board's expectations

* Continuing to examine acquisition opportunities

Huw Eurig Davies, Chief Executive Officer of Boomerang Plus, commented:

"Through this transformational six month period, we have made successful efforts

to diversify our broadcast customer base, genre portfolio, IP and international

reach whilst continuing to win significant commissions.

"In tune with our strategy, we have made considerable progress with acquisitive

and organic growth. We continue to enjoy good revenue visibility and are

delighted to have improved margins in such a difficult period.

"I would like to take this opportunity to thank our exceptional team of creative

and talented people who continue to produce high quality, market leading

content."

- Ends -

For further information, please contact:

+--------------------------------+----------------------------------+

| Boomerang Plus plc | Via Redleaf Communications |

+--------------------------------+----------------------------------+

| Huw Eurig Davies, Chief | |

| Executive | |

+--------------------------------+----------------------------------+

| Mark Fenwick, Finance Director | |

+--------------------------------+----------------------------------+

| | |

+--------------------------------+----------------------------------+

| Redleaf Communications | 020 7566 6731 |

+--------------------------------+----------------------------------+

| Anna Dunkin/ Lucy Salaman | boomerang@redleafpr.com |

+--------------------------------+----------------------------------+

| | |

+--------------------------------+----------------------------------+

| Altium Capital | |

+--------------------------------+----------------------------------+

| Tim Richardson/ Melanie | 020 7484 4040 |

| Szalkiewicz | |

+--------------------------------+----------------------------------+

| | |

+--------------------------------+----------------------------------+

| Evolution Securities | |

+--------------------------------+----------------------------------+

| Adam Lloyd | 020 7071 4317 |

+--------------------------------+----------------------------------+

Boomerang Plus

* Boomerang, founded in 1994, has extensive experience in producing content in a

variety of genres, including extreme sports, youth programming, music,

entertainment, children's programming, and drama

* The market for independent television production companies in the Nations and

Regions has grown following quotas from the regulator Ofcom, which require that,

depending on the broadcaster, between 10 per cent. and 50 per cent. of

qualifying programming hours must be sourced from outside the M25 boundary

* Boomerang is ranked in the top three independent television production

companies, by revenue, in the Nations and Regions according to the Broadcast

Survey (Nations and Regions) 2009

* Boomerang's strategy is both to achieve strong organic growth by leveraging

the Group's existing customer base coupled with strategic acquisitions, with a

view to becoming a major supplier to UK networks looking to satisfy their

Nations and Regions quotas

Chief Executive's Statement

I am pleased to present the Group's results for the six months ended 30 November

2009.

This has been a transformational six months for the Group. We have advanced our

strategy of building on a strong platform of visible revenues in our local

market by diversifying the Group's operations and, in particular, investing in

IP strong businesses with global footprints and significant organic inroads into

Network broadcasters.

We were delighted in July 2009 to be awarded, in open tender, a three-year GBP12

million contract from S4C for the provision of programming and links for their

older children schedule. This is a great endorsement of the creative talent

within the Group and confirms our position as one of the UK's largest producers

of children's content, a position that we are seeking to exploit internationally

through co-productions and sales.

On 18 August 2009, we announced the acquisition of 25% of Big Freeze Limited as

part of a joint venture with broadcaster Channel 4 and events organiser Sports

Vision. Big Freeze Limited is a production company created to organise and

produce the Freesports on 4 Freeze live event franchise, the UK's biggest winter

sports and music festival, as well as other broadcast related and advertiser

funded events.

On 14 September 2009, our newly incorporated 75% subsidiary, Boom Extreme

Publishing Limited, announced the acquisition of the intellectual property and

certain assets of Method, a multimedia publisher offering snowboarding news and

action across print, motion, audio and interactive platforms.

On 20 October 2009, we announced the acquisition of Indus Films Limited, a Welsh

based, network focussed independent television production company. Indus will

significantly diversify the Group's broadcast customer base and genre portfolio

to include adventure, environmental, living history, natural history and arts.

Steve Robinson and Paul Islwyn Thomas, founders of Indus, offer extensive

creativity and experience to add to Boomerang's talented team of programme

makers.

We continue to be among the market leaders in advertiser funded programming

('AFP') and this division continues to see growth and opportunities with a broad

range of UK and global clients such as Red Bull, Nissan, McCain, Sony

Playstation, Sony Ericsson and Quiksilver. Changes to product placement rules,

pressure on programming budgets and widening distribution platforms are

providing a strong base for growth which our talented team are well placed to

exploit.

The economic difficulties facing all UK broadcasters continued to have a knock

on effect on the television production sector, leading to increased pressure on

tariffs and margins. However, investment in people, technology and new working

practices means that we have managed to improve our margins in this difficult

period and at the same time have continued to invest significant resources into

programme development and into growing our existing and new businesses.

Financial Review

As anticipated, the Group's full year revenues for 2010 will be second half

weighted due to the timing of certain dramas and other larger commissions. As a

consequence, during the period under review, turnover was GBP8.87 million (2008:

GBP11.76 million). Gross profit margins were significantly improved to 19.1 per

cent from 16.7 per cent in the prior period partly due to the mix of genres as

well as improved working practices.

Operating profit was GBP0.49 million (2008: GBP1.10 million) and profit before

tax was GBP0.47 million (2008: GBP1.08 million).

The Group had cash and cash equivalents of GBP2.82 million at 30 November 2009

(2008: GBP3.98 million) after outflows for acquisitions, including deferred

consideration payments in respect of acquisitions in prior periods, of GBP1.22

million (2008: GBP0.1 million), GBP0.48 million (2008: 0.1 million) due to the

acquisition of publishing rights, and debt repayments of GBP0.2 million (2008:

GBP0.1 million) during the period.

Programming

The Group's content production businesses, Boomerang, Fflic, Alfresco and

Apollo, together with the recently acquired Indus, contributed towards a strong,

multi-genre portfolio of programmes for our broadcast customers during the

period.

We have had noted success in increasing our Network presence in a number of key

genre during the period. In comedy drama we had our first network commission for

BBC4/BBC2 for "A Child's Christmases in Wales"; in children's we have won our

first commission for CBBC "My Dad in Prison" building on our position as one of

the largest children's producers in the UK and in factual we are in production

of "Too Poor for Posh School?" for Channel 4's Cutting Edge strand.

Complementing this success, the addition of Indus to the Group brings the world

renowned and award winning expertise of the producers of "Amazon" (Bruce Parry),

"Living with Monkeys", "Coalhouse", "Everest ER" and "Venom Hunter". Indus is

currently in the middle of a strong slate of productions, including "Artic"

(with Bruce Parry) and "Snowdonia 1890".

Over the last few years we have received critical acclaim for a wide number of

our programmes, including RTS awards for "ABC" and "Freesports on 4"; a Golden

Rose D'or for "Con Passionate"; Welsh BAFTA 2009 wins for "Con Passionate", "Y

Saith Magnifico a Matthew Rhys" and six for "Martha, Jac a Sianco". Boomerang's

success has continued during the period with "Rhestr Nadolig Wil" winning a

Bafta Children's award for best drama as well as a nomination at the inaugural

KidScreen in New York.

Post-production and Facilities

The Group is in the process of further expanding its post production department

(in-house and Mwnci) by the addition of six further AVID editing suites, an ISIS

central storage system and a further dubbing suite.

In readiness for the launch of our new GBP12 million three year Children's

contract with S4C, we are planning to upgrade our studio gallery to HD and add

an outside broadcast SNG truck to our in-house technical facilities.

Investment in HD tapeless cameras is also being made through both our in-house

Children's department and the Group's camera facilities joint venture, Zoom,

ensuring we are employing the latest technologies and work flow practices.

Radio

The Group continues to supply a diverse range of radio programmes particularly

for BBC Radio Wales and Radio Cymru.

Talent management

Boom Talent, a management company representing singers, actors and presenters in

film, television, theatre, radio, corporate and voice-over work, continues to

increase its profile and client base.

Digital media

With our digital media partner, Cube Interactive, we continue to explore and

develop opportunities in digital media including websites, web streaming and

interactive media. Significant interactive contracts include content creation

for the "Royal Welsh" and "Planed Plant" and multi-platform distribution is at

the forefront of most of our AFP content.

Freeze

October saw the second year of the Freeze snow sports and music festival. With

our partners Channel 4 and Sportsvision, we managed to build significantly on

the success of the event's first year with large increases in both visitor

numbers and infrastructure, providing a good platform to profitably grow the

brand in future years.

Boom Extreme Publishing

In the first period of trading which, as expected, was set against a backdrop of

a very challenging advertising market, Method magazine has been restructured,

relocated to Biarritz and integrated into the Group. Synergy with our AFP

division and its large global, digital platform provides exciting potential for

its future within the Group.

Outlook

Our position as a multi-genre independent television production company based in

the Nations and Regions means that we are well placed to benefit from the

regulatory framework operating within our markets.

We have strong visibility of revenue. Our current pipeline of commissions,

boosted by the recent acquisition of Indus, including the current year to date,

is in excess of GBP50 million.

Increasing network commissions, a growing AFP department supplemented by Freeze

and Method and the Indus acquisition are providing a good platform for increased

growth and diversification.

The Group continues to trade in line with the Board's expectations and remains

active in exploring further acquisition opportunities.

Huw Eurig Davies

Chief Executive

25 February 2010

Condensed Consolidated Income Statement

Six months ended 30 November 2009 (unaudited)

+--------------------------------+------+----------+----------+------------+

| | Note | Six | Six | |

| | | months | months | Year |

| | | ended | ended | ended |

| | | 30 | 30 | 31 May |

| | | November | November | 2009 |

| | | 2009 | 2008 | |

+--------------------------------+------+----------+----------+------------+

| | | GBP'000 | GBP'000 | GBP'000 |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Revenue | | 8,866 | 11,759 | 19,759 |

+--------------------------------+------+----------+----------+------------+

| Cost of sales | | (7,176) | (9,793) | (16,882) |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Gross profit | | 1,690 | 1,966 | 2,877 |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Administrative expenses | | | | |

+--------------------------------+------+----------+----------+------------+

| Other administrative | | (1,320) | (946) | (1,862) |

| expenses | | | | |

+--------------------------------+------+----------+----------+------------+

| Professional fees in | | | | |

| relation to unsuccessful | | - | - | (66) |

| corporate transactions | | | | |

+--------------------------------+------+----------+----------+------------+

| Amortisation of intangibles | | | | |

| arising on business | | (6) | (10) | (21) |

| acquisitions | | | | |

+--------------------------------+------+----------+----------+------------+

| Equity settled share based | | (4) | (11) | (23) |

| payments | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Total administrative expenses | | (1,330) | (967) | (1,972) |

+--------------------------------+------+----------+----------+------------+

| Other operating income | | 112 | 37 | 232 |

+--------------------------------+------+----------+----------+------------+

| (Loss)/profit on disposal of | | (3) | 37 | - |

| fixed assets | | | | |

+--------------------------------+------+----------+----------+------------+

| Share of results of joint | | 24 | 25 | 3 |

| ventures and associates | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Operating profit | | 493 | 1,098 | 1,140 |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Investment income | | - | 15 | 25 |

+--------------------------------+------+----------+----------+------------+

| Finance costs | | (23) | (35) | (71) |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Profit before tax | | 470 | 1,078 | 1,094 |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Tax on profit on ordinary | 2 | (143) | (324) | (207) |

| activities | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Profit for the period | | 327 | 754 | 887 |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Earnings per share | 3 | | | |

+--------------------------------+------+----------+----------+------------+

| Basic | | 3.67p | 8.47p | 9.96p |

| | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Diluted | | 3.60p | 8.09p | 9.70p |

| | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Adjusted - basic | | 3.78p | 8.70p | 11.20p |

| | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

| Adjusted - diluted | | 3.71p | 8.31p | 10.91p |

| | | | | |

+--------------------------------+------+----------+----------+------------+

| | | | | |

+--------------------------------+------+----------+----------+------------+

All activities derive from continuing operations.

The Group has no other items of comprehensive income and as such has not

presented a separate condensed consolidated statement of comprehensive income.

Condensed Consolidated Balance Sheet

As at 30 November 2009 (unaudited)

+---------------------------------------+--+----------+----------+----------+

| | | 30 | 30 | 31 |

| | | November | November | May |

| | | | | 2009 |

| | | 2009 | 2008 | GBP'000 |

| | | GBP'000 | GBP'000 | |

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| NON-CURRENT ASSETS | | | | |

+---------------------------------------+--+----------+----------+----------+

| Goodwill | | 2,102 | 2,108 | 2,131 |

+---------------------------------------+--+----------+----------+----------+

| Other intangible assets | | 3,802 | 1,201 | 1,161 |

+---------------------------------------+--+----------+----------+----------+

| Property, plant and equipment | | 1,613 | 1,841 | 1,686 |

+---------------------------------------+--+----------+----------+----------+

| Investments | | 496 | 175 | 147 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| | | 8,013 | 5,325 | 5,125 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| CURRENT ASSETS | | | | |

+---------------------------------------+--+----------+----------+----------+

| Inventories | | - | 3 | - |

+---------------------------------------+--+----------+----------+----------+

| Trade and other receivables | | 3,423 | 3,766 | 3,625 |

+---------------------------------------+--+----------+----------+----------+

| Current tax assets | | - | - | 219 |

+---------------------------------------+--+----------+----------+----------+

| Cash and cash equivalents | | 2,818 | 3,983 | 3,027 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| | | 6,241 | 7,752 | 6,871 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| TOTAL ASSETS | | 14,254 | 13,077 | 11,996 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| CURRENT LIABILITIES | | | | |

+---------------------------------------+--+----------+----------+----------+

| Trade and other payables | | 2,945 | 2,829 | 2,106 |

+---------------------------------------+--+----------+----------+----------+

| Current tax liabilities | | 376 | 505 | 407 |

+---------------------------------------+--+----------+----------+----------+

| Interest-bearing loans and borrowings | | 250 | 410 | 307 |

+---------------------------------------+--+----------+----------+----------+

| Deferred consideration | | 268 | 194 | 209 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| | | 3,839 | 3,938 | 3,029 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| NON-CURRENT LIABILITIES | | | | |

+---------------------------------------+--+----------+----------+----------+

| Interest-bearing loans and borrowings | | 90 | 327 | 175 |

+---------------------------------------+--+----------+----------+----------+

| Other payables | | 14 | 52 | 17 |

+---------------------------------------+--+----------+----------+----------+

| Deferred tax liabilities | | 109 | 167 | 116 |

+---------------------------------------+--+----------+----------+----------+

| Deferred consideration | | 1,212 | 81 | - |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| | | 1,425 | 627 | 308 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| TOTAL LIABILITIES | | 5,264 | 4,565 | 3,337 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

| NET ASSETS | | 8,990 | 8,512 | 8,659 |

+---------------------------------------+--+----------+----------+----------+

| | | | | |

+---------------------------------------+--+----------+----------+----------+

Condensed Consolidated Balance Sheet

As at 30 November 2009 (unaudited)

+---------------------------------------+--+----------+----------+---------+

| | | 30 | 30 | 31 |

| | | November | November | May |

| | | | | 2009 |

| | | 2009 | 2008 | GBP'000 |

| | | GBP'000 | GBP'000 | |

| | | | | |

+---------------------------------------+--+----------+----------+---------+

| EQUITY | | | | |

+---------------------------------------+--+----------+----------+---------+

| Share capital | | 89 | 89 | 89 |

+---------------------------------------+--+----------+----------+---------+

| Share premium account | | 3,933 | 3,931 | 3,933 |

+---------------------------------------+--+----------+----------+---------+

| Merger reserve | | 1,217 | 1,217 | 1,217 |

+---------------------------------------+--+----------+----------+---------+

| Retained earnings | | 3,751 | 3,275 | 3,420 |

+---------------------------------------+--+----------+----------+---------+

| | | | | |

+---------------------------------------+--+----------+----------+---------+

| Equity attributable to equity holders | | 8,990 | 8,512 | 8,659 |

| of the parent | | | | |

+---------------------------------------+--+----------+----------+---------+

| | | | | |

+---------------------------------------+--+----------+----------+---------+

These financial statements were approved by the Board of Directors on 25

February 2010

Signed on behalf of the Board of Directors

H E Davies

M W Fenwick

Director

Director

Condensed Consolidated Cash Flow Statement

Six months ended 30 November 2009 (unaudited)

+---------------+--------+-----------+-----------+---------+

| | | 30 | 30 | 31 |

| | | November | November | May |

| | | 2009 | 2008 | 2009 |

| | Note | GBP'000 | GBP'000 | GBP'000 |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| NET | | | | |

| CASH | 4 | 1,745 | (2,106) | (2,828) |

| (OUTFLOW)/ | | | | |

| INFLOW | | | | |

| FROM | | | | |

| OPERATING | | | | |

| ACTIVITIES | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| INVESTING | | | | |

| ACTIVITIES | | | | |

+---------------+--------+-----------+-----------+---------+

| Interest | | - | 15 | 25 |

| received | | | | |

+---------------+--------+-----------+-----------+---------+

| Purchase | | (97) | (134) | (183) |

| of | | | | |

| property, | | | | |

| plant and | | | | |

| equipment | | | | |

+---------------+--------+-----------+-----------+---------+

| Acquisition | | | | |

| of | | (768) | - | - |

| subsidiaries | | | | |

| - net cash | | | | |

| outflow | | | | |

| arising on | | | | |

| acquisition | | | | |

+---------------+--------+-----------+-----------+---------+

| Acquisition | | (128) | (58) | (146) |

| of | | | | |

| subsidiaries | | | | |

| - deferred | | | | |

| consideration | | | | |

| payments | | | | |

+---------------+--------+-----------+-----------+---------+

| Acquisition | | (326) | (27) | (33) |

| of | | | | |

| associates | | | | |

+---------------+--------+-----------+-----------+---------+

| Acquisition | | (480) | - | - |

| of | | | | |

| intangible | | | | |

| fixed | | | | |

| assets | | | | |

+---------------+--------+-----------+-----------+---------+

| Proceeds | | - | 54 | 54 |

| on | | | | |

| disposal | | | | |

| of | | | | |

| property, | | | | |

| plant and | | | | |

| equipment | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| NET | | (1,799) | (150) | (283) |

| CASH | | | | |

| USED | | | | |

| IN | | | | |

| INVESTING | | | | |

| ACTIVITIES | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| FINANCING | | | | |

| ACTIVITIES | | | | |

+---------------+--------+-----------+-----------+---------+

| Repayments | | (155) | (86) | (340) |

| of | | | | |

| obligations | | | | |

| under | | | | |

| finance | | | | |

| leases | | | | |

+---------------+--------+-----------+-----------+---------+

| Proceeds | | - | - | 3 |

| on issue | | | | |

| of | | | | |

| shares | | | | |

+---------------+--------+-----------+-----------+---------+

| Grants | | - | - | 150 |

| received | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| NET | | (155) | (86) | (187) |

| CASH | | | | |

| USED | | | | |

| IN | | | | |

| FINANCING | | | | |

| ACTIVITIES | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| NET | | (209) | (2,342) | (3,298) |

| DECREASE | | | | |

| IN CASH | | | | |

| AND CASH | | | | |

| EQUIVALENTS | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| CASH | | | | |

| AND | | 3,027 | 6,325 | 6,325 |

| CASH | | | | |

| EQUIVALENTS | | | | |

| AT | | | | |

| BEGINNING | | | | |

| OF PERIOD | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

| CASH | | 2,818 | 3,983 | 3,027 |

| AND | | | | |

| CASH | | | | |

| EQUIVALENTS | | | | |

| AT END OF | | | | |

| PERIOD | | | | |

+---------------+--------+-----------+-----------+---------+

| | | | | |

+---------------+--------+-----------+-----------+---------+

Condensed Consolidated Statement of Changes in Equity

Six months ended 30 November 2009 (unaudited)

+---------------------+---------+---------+---------+----------+---------+

| | | Share | | | Total |

| | Share | premium | Merger | Retained | GBP'000 |

| | capital | account | reserve | earnings | |

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Balance at 1 June | 89 | 3,931 | 1,217 | 2,510 | 7,747 |

| 2008 | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Profit for the | - | - | - | 754 | 754 |

| financial period | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Equity-settled | | | | | 11 |

| share-based | - | - | - | 11 | |

| payments | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Balance at 30 | 89 | 3,931 | 1,217 | 3,275 | 8,512 |

| November 2008 | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Profit for the | - | - | - | 133 | 133 |

| financial period | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| New shares issued | - | 2 | - | - | 2 |

+---------------------+---------+---------+---------+----------+---------+

| Equity-settled | | | | | 12 |

| share-based | - | - | - | 12 | |

| payments | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Balance at 31 May | 89 | 3,933 | 1,217 | 3,420 | 8,659 |

| 2009 | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Profit for the | - | - | - | 327 | 327 |

| financial period | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Equity-settled | | | | | 4 |

| share-based | - | - | - | 4 | |

| payments | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| Balance at 30 | 89 | 3,933 | 1,217 | 3,751 | 8,990 |

| November 2009 | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

| | | | | | |

+---------------------+---------+---------+---------+----------+---------+

The Group has taken advantage of section 612 of the Companies Act 2006 and so

the excess over the nominal value of shares issued other than for cash has been

allocated to the merger reserve.

The interim financial information does not constitute statutory accounts for the

purpose of section 435 of the Companies Act 2006. The figures for the year

ended 31 May 2009 have been extracted from the Group audited accounts for that

year. Those accounts have been reported on by the Group's auditors and

delivered to the Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their report, and

(iii) did not contain a statement under section 498 (2) or (3) of the Companies

Act 2006

The interim financial information for the six months ended 30 November 2009 and

30 November 2008 have not been audited or reviewed by the auditors. The interim

results have been prepared using the same accounting policies and estimation

techniques that are expected to apply at the year-end and is consistent with the

accounting policies disclosed in the Group's annual report for the year ended 31

May 2009.

2. tax

Taxation for the six-month period is charged at the best estimate of the average

annual effective income tax rate expected for the full year, applied to the

pre-tax income of the six-month period.

+-------------------------------------------+----------+----------+----------+----------+---------+

| | | | 30 | 30 | 31 |

| | | | November | November | May |

| | | | 2009 | 2008 | 2009 |

| | | | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+----------+----------+----------+----------+---------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+----------+---------+

| UK taxation at standard rate | | | 155 | 260 | 194 |

+-------------------------------------------+----------+----------+----------+----------+---------+

| Deferred taxation | | | (12) | 64 | 13 |

+-------------------------------------------+----------+----------+----------+----------+---------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+----------+---------+

| | | | 143 | 324 | 207 |

+-------------------------------------------+----------+----------+----------+----------+---------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+----------+---------+

3. earnings per share

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| | | | 30 | 30 | 31 |

| | | | November | November | May |

| Earnings | | | 2009 | 2008 | 2009 |

| | | | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Profit for the period | | | 327 | 754 | 887 |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Professional fees in relation to | | | | | |

| unsuccessful corporate transactions | | | - | - | 66 |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Amortisation of intangibles | | | 6 | 10 | 21 |

| arising on business acquisitions | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Equity settled share based | | | 4 | 11 | 23 |

| payments | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Adjusted profit | | | 337 | 775 | 997 |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Number of shares | | | No. | No. | No. |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Weighted average number of ordinary | | | 8,911,231 | 8,901,231 | 8,903,478 |

| shares | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Dilutive weighted average number of | | | 9,079,154 | 9,317,125 | 9,141,655 |

| shares | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Earnings per ordinary share - basic | | | 3.67p | 8.47p | 9.96p |

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Earnings per ordinary share - diluted | | | 3.60p | 8.09p | 9.70p |

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Adjusted earnings per share - basic | | | 3.78p | 8.70p | 11.20p |

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

| Adjusted earnings per share - diluted | | | 3.71p | 8.31p | 10.91p |

| | | | | | |

+-------------------------------------------+----------+----------+-------------+-------------+-------------+

4. notes to the condensed consolidated cash flow statement

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | 30 | 30 | 31 |

| | | | November | November | May |

| | | | 2009 | 2008 | 2009 |

| | | | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Profit from operations | | | 493 | 1,098 | 1,140 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Adjustment for: | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Amortisation of intangible fixed assets | | | 27 | 27 | 68 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Depreciation of property, plant and | | | 207 | 193 | 396 |

| equipment | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| (Loss)/profit on property, plant and | | | 4 | (37) | (37) |

| equipment disposals | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Government grants | | | (60) | (31) | (165) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Results of joint ventures and associates | | | (24) | (25) | 5 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Equity-settled share-based payments | | | 4 | 11 | 23 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Operating cash flows before movement in | | | 651 | 1,236 | 1,430 |

| working capital | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Decrease/ (increase) in receivables | | | 640 | (915) | (775) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Increase/ (decrease) in payables | | | 457 | (2,048) | (2,823) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Decrease in inventory | | | - | - | 3 |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Cash generated from/ (used by) operations | | | 1,748 | (1,727) | (2,165) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Income taxes received/ (paid) | | | 20 | (344) | (592) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Interest paid | | | (23) | (35) | (71) |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| Net cash inflow/ (outflow) from operating | | | 1,745 | (2,106) | (2,828) |

| activities | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

| | | | | | |

+-------------------------------------------+----------+----------+----------+-----------+-----------+

5. AVAILABILITY OF INTERIM RESULTS

A copy of the interim report will be available for members of the public by

application to the Company's Registered Office or on the Company's website at

www.boomerang.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SESFALFSSEEE

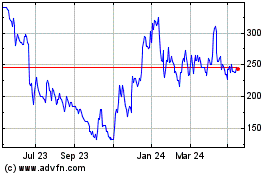

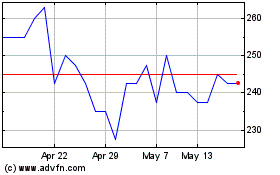

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Audioboom (LSE:BOOM)

Historical Stock Chart

From Aug 2023 to Aug 2024