Trading Statement

November 22 2002 - 10:18AM

UK Regulatory

RNS Number:1830E

Swallowfield PLC

22 November 2002

Swallowfield plc announces today that, despite high order books and an increased

level of sales, it is not achieving the level of profits expected in the current

trading period. A combination of severe pressure on margins and some erosion

due to increases in our natural cost base, coupled with the delayed 'ramp up' of

production output due to labour unavailability, have combined to hold back the

levels of profit levels.

It is likely that profits on the Wellington site will finish the current half

year on or around last year's performance levels. Our cosmetics business at

Bideford however has been particularly hit by competition from the Far East,

severely reducing margin expectations on our Christmas gift packing. Our very

high gift packing programme this year, on both sites, required a high labour

content and we have found ourselves facing a severe shortage of trained

personnel over the first few months of the period, requiring us to use core

labour on gift pack production to avoid penalties, thereby incurring delays on

our main business. Against this background it is unlikely that the cosmetics

business will break even in our first trading half.

At this time both sites are very busy and we still have relatively high order

books, particularly for our core products on the Wellington site. We have a

detailed profit improvement plan in place but feel, this will be insufficient on

a Group basis to make up for the weak margins in our cosmetics business which do

not look like improving until the last quarter of this financial year. Our

overall expectation against this weak cosmetics performance and a very tough

trading background, is for the Group to finish this financial year at a better

running rate in terms of production levels and order book than in previous

years.

When measured against current industry performance we believe that our order

levels, margin mix and overall profitability are better than industry

expectations and we do not anticipate any changes to our dividend policy.

Enquiries:

Tony Wardell, Chief Executive Tel: 0182 366 2241

Barrie Newton, Rowan Dartington & Co. Limited Tel: 0117 925 3377

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTFEMFIESESEFF

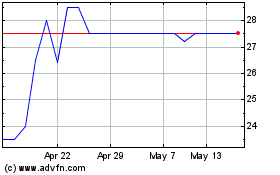

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brand Architekts (LSE:BAR)

Historical Stock Chart

From Jul 2023 to Jul 2024