RNS No 2041c

ANDREW SYKES GROUP PLC

17th March 1999

Another record year for Andrews Sykes Group plc

Preliminary results for the 12 months ended 26 December 1998.

Financial Highlights

Turnover #83.8 million up 40%

EBITDA #23.2 million up 52%

Profit before tax #12.1 million up 3%

Operating cash flow #21.6 million up 72%

Operating cash flow per share 23.9p up 64%

Proposed ordinary dividend 3.6p per 20p share up 20%

Commenting on the results, Chairman Mr J G Murray said:

"I am pleased to report another record year for the Group despite the

anticipated first year exceptional and interest costs associated with the

acquisition of Cox in June.

The strong cash flow generated by Cox has helped us to reduce gearing from

254% at the date of acquisition to just 138% at the end of December and we

expect gearing to continue to reduce rapidly.

The integration of Cox is being completed and interest costs will fall rapidly

as gearing reduces.

With our commitment to continuous improvement within the existing businesses

we remain optimistic for the remainder of 1999."

For further information please contact:

Eric Hook (Chief Executive) Telephone today 0171 329 0096

Andrews Sykes Group plc Telephone company 01902 328700

John Goold / Emily Bruning

Shandwick Consultants Limited Telephone 0171 329 0096

Chairman's Statement

I am pleased to report on the further progress made by our Group during 1998.

Group turnover has increased to #83.8 million, including #19.6 million from

businesses acquired during the year, principally a seven month contribution

from Cox Plant Hire. Profit before tax has risen by 3% to #12.1 million which

is another record for the Group. The increase has been achieved despite the

anticipated first year exceptional and interest costs of Cox. The integration

is being completed and interest costs will fall rapidly as gearing reduces. We

are proposing an increased final dividend of 2.4 pence per ordinary share,

bringing the total for the year to 3.6 pence, an increase of 20% on 1997.

1998 was a very challenging year for the Group and a lot has been achieved.

The acquisition of Cox Plant Hire in June added a fourth leg to the heating,

pumping and air-conditioning hire businesses of Andrews Sykes. Although

dilutive in the short term, this strategy has already proved beneficial, as

general plant hire is less directly related to the weather cycle than heating

and air-conditioning. Good contributions from pumping, and some of the other

UK and overseas subsidiaries ensured that turnover in the continuing

businesses of Andrews Sykes grew by 7% to #64.2 million. The acquisition of

Cox ensures that Group profitability will be less affected by extremes in the

weather patterns in the future and adds a business with a strong cash flow and

growth potential, particularly by acquisition.

We set ourselves very ambitious targets for the integration of Cox in order to

benefit from the savings and operational benefits as quickly as possible. The

head office and the central administration centres were closed and Andrews

Sykes' own computer systems were introduced to the 41 plant and accommodation

depots of Cox from the beginning of October. The hire fleet was rationalised

and the surplus plant in poor condition was sold. Improved management

information from our systems and better workshop procedures have begun to

improve utilisation. New management has been introduced and this, together

with a more focused approach to customer service, will lead to further

improvements during 1999. Additionally, we can now approach some of the larger

industrial customers with a much wider spread of products from the combined

Andrews Sykes and Cox portfolios.

Net cash flow from operating activities rose 72% to #21.6 million helped by

the strong cash flows generated by Cox. This has enabled us to reduce gearing

from 254% at the date of acquisition to just 138% at the end of December and,

without further acquisitions, we expect gearing to continue to reduce rapidly.

The large majority of the debt is within Cox and is without recourse to the

Andrews Sykes Group whose own borrowing capacity is largely untouched.

Diluted earnings per share excluding amortisation and exceptionals showed a

modest improvement from 9.29 pence to 9.33 pence after the issue of a further

4.3 million shares to partially finance the Cox acquisition. On the same basis

cash flow from operations rose by 64% from 14.6 pence to 23.9 pence per share.

So far in 1999 we have seen an improvement in trading conditions compared with

the same period last year and the economic uncertainty of the late summer and

autumn of 1998 highlighted by many commentators has not affected our

businesses. With further gains expected in the operational performance of Cox

together with our commitment to continuous improvement within the existing

businesses, we remain optimistic for the remainder of 1999.

Thanks to the staff who have worked so hard to achieve these results in a

challenging year.

J G Murray

Chairman

Andrews Sykes Group plc

Consolidated profit and loss account

For the 12 months ended 26 December 1998

12 months

to

12 months to 26 December 1998 27 December

------------------------------- 1997

Continuing Acquisitions Total Total

operations

#'000 #'000 #'000 #'000

Turnover 64,190 19,624 83,814 59,915

Cost of Sales -35,014 -13,164 -48,178 -31,126

---------- ---------- -------- ---------

Gross profit 29,176 6,460 35,636 28,789

Distribution costs -5,342 -813 -6,155 -5,932

Administrative expenses -10,781 -5,217 -15,998 -11,171

(including exceptional items

set out in note 2)

Other operating income 124 0 124 115

--------- --------- -------- -----------

Operating profit 13,177 430 13,607 11,801

----------------------------- --------- --------- -------- -----------

EBITDA* 16,275 6,972 23,247 15,254

Depreciation, asset disposals

and property revaluation (4,168) (5,297) (9,465) (3,453)

---------- ---------- -------- -----------

Operating profit before

exceptional items 12,107 1,675 13,782 11,801

and amortisation of goodwill

Exceptional items 1,070 -989 81 0

Amortisation of Goodwill 0 -256 -256 0

----------------------------- --------- --------- -------- -----------

Operating profit 13,177 430 13,607 11,801

--------- --------- -------- -----------

Share of operating profit of associates 122 0

Income from other participating interests 459 0

Net interest payable (group) -2,138 -98

------------------------------------------------------ -------- ---------

Profit on ordinary activities before taxation 12,050 11,703

Tax on profit on ordinary activities -3,810 -3,752

----------------------------------------------------- -------- ---------

Profit on ordinary activities after taxation

being profit for the financial period 8,240 7,951

Dividends paid and proposed:

Equity shares -2,980 -2,311

Non equity shares -460 -546

-------- ---------

Retained profit for the financial period attributable

to ordinary shareholders 4,800 5,094

======== =========

Earnings per ordinary share 9.67 9.98

Earnings per share excluding goodwill 9.99 9.98

Amortisation

Diluted earnings per share 9.14 9.29

Goodwill amortisation 0.28 0.00

Exceptional items -0.09 0.00

-------- ---------

Adjusted diluted earnings per share 9.33 9.29

======== =========

Dividends per share:

Equity shares 3.60 3.00

Non equity shares 7.00 7.00

*Earnings Before Interest, Taxation, Depreciation and Amortisation

There were no discontinued operations during the period.

The comparative figures for earnings and dividends per share have been

restated to take account of the sub division of the #1 ordinary shares into

five 20 pence ordinary shares which was effective from 4 June 1998 and the

implementation of Financial Reporting Standard No. 14: Earnings Per Share.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 26 December 1998

26 December 27 December

1998 1997

(as restated)

#'000 #'000

Fixed assets

Intangible assets 7,852 0

Tangible assets 44,125 13,369

Investments 515 237

---------------- -------------

52,492 13,606

---------------- -------------

Current assets

Stocks 9,392 7,059

Debtors 24,075 13,887

Cash at bank and in hand 10,171 4,328

---------------- -------------

43,638 25,274

Creditors: Amounts falling due within

one year

Loans, overdrafts and finance lease

obligations -8,863 -2,767

Other creditors -22,640 -16,824

Deferred consideration -7,100 -700

Corporation tax -3,633 -4,383

---------------- -------------

Net current assets 1,402 600

---------------- -------------

Total assets less current liabilities 53,894 14,206

Creditors: Amounts falling due after

more than one year

Loans and finance lease obligations -28,192 -1,332

Other creditors and provisions -1,041 -1,060

Deferred consideration 0 -600

---------------- -------------

Net assets 24,661 11,214

---------------- -------------

Capital and reserves

Called up share capital 19,739 18,857

Share premium account 8,168 782

Revaluation reserve 787 361

Other reserves 278 270

Profit and loss account -4,321 -9,066

---------------- -------------

24,651 11,204

---------------- -------------

Shareholders' funds

Equity 21,467 7,795

Non equity 3,184 3,409

---------------- -------------

24,651 11,204

Minority interests (equity) 10 10

---------------- -------------

24,661 11,214

---------------- -------------

Analysis of net debt

Cash at bank and in hand 10,171 4,328

Deferred consideration -7,100 -1,300

Total loans, overdrafts and finance -37,055 -4,321

lease obligations

---------------- -------------

Net debt -33,984 -1,293

---------------- -------------

Net debt as a percentage of

shareholders' funds 138% 12%

Andrews Sykes Group plc

Consolidated cash flow statement

For the 12 months ended 26 December 1998

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Net cash inflow from operating

activities 21,554 12,533

-------------- --------------

Returns on investments and

servicing of finance

Loan facility fees -953 0

Net interest paid -1,228 -75

Dividends received 459 0

Preference dividends paid -462 -560

Interest element of finance lease

payments -38 -41

-------------- --------------

Net cash outflow for returns on

investments and servicing of

finance -2,222 -676

-------------- --------------

Cash outflow for taxation -3,714 -2,212

-------------- --------------

Capital expenditure

Purchase of tangible fixed assets -6,266 -6,274

Sale of tangible fixed assets 4,023 1,024

-------------- --------------

Net cash outflow for capital

expenditure -2,243 -5,250

-------------- --------------

Acquisitions

Purchase of subsidiary undertakings -45,379 -869

Net cash acquired with subsidiary

undertakings 359 97

Payment of deferred consideration

on previous acquisitions -46 -1,405

Purchase of interests in associates -156 -73

-------------- --------------

Net cash outflow for acquisitions -45,222 -2,250

Equity dividends paid -2,541 -1,710

-------------- --------------

Cash (outflow)/inflow before the

use of liquid resources

and financing -34,388 435

-------------- --------------

Management of liquid resources

Movement in bank deposits 2,080 -1,838

-------------- --------------

Financing

Issue of ordinary share capital net

of issue costs 8,276 412

New loan draw downs and factoring

advances 37,823 94

New hire purchase and finance lease

agreements 277 0

Loan repayments -5,922 -1,000

Capital element of finance lease

repayments -186 -298

Purchase of own shares -85 -92

-------------- --------------

Net cash inflow/(outflow) from

financing 40,183 -884

-------------- --------------

Increase / (decrease) in cash in

the period 7,875 -2,287

-------------- --------------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

1. Segmental analysis

The Group's turnover may be analysed between the following principal products

and activities:

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Product Group:

Pumps 23,389 22,279

Heating and ventilation 9,553 10,949

Air conditioning 22,487 18,980

General plant 19,023 0

Other 9,362 7,707

-------------- --------------

Total 83,814 59,915

-------------- --------------

Activity:

Hire 47,988 31,424

Sales 23,057 18,036

Installation 12,769 10,455

-------------- --------------

Total 83,814 59,915

-------------- --------------

The integrated nature of the Group's operations does not permit a meaningful

analysis of operating profit and net assets by product group or activity.

The geographical analysis of the Group's turnover was as follows:

By geographical origin By geographical destination

12 months 12 months to 12 months 12 months

to to to

26 December 27 December 26 December 27 December

1998 1997 1998 1997

#'000 #'000 #'000 #'000

United Kingdom 75,413 52,825 72,474 49,768

Rest of Europe 3,078 3,326 4,155 4,287

Middle East and

Africa 4,064 3,764 5,607 5,191

The Americas 1,073 0 1,149 218

Rest of World 186 0 429 451

----------- ------------ ----------- -----------

83,814 59,915 83,814 59,915

----------- ------------ ----------- -----------

The analysis of operating profit and net assets by geographical origin was as

follows:

Operating Profit Net assets

12 months 12 months

to to

26 December 27 December 26 December 27 December

1998 1997 1998 1997

#'000 #'000 #'000 #'000

United Kingdom 12,133 10,617 49,554 14,312

Rest of Europe 765 567 5,130 722

Middle East and

Africa 633 617 836 1,006

The Americas 50 0 -289 0

Rest of World 26 0 -9 0

----------- ----------- ----------- -----------

13,607 11,801 55,222 16,040

----------- ----------- ----------- -----------

Net (debt) / funds -26,884 7

Taxation and

dividends payable -3,677 -4,833

----------- -----------

24,661 11,214

----------- -----------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

2. Exceptional items 12

months

to

12 months to 26 December 1998 27

December

1997

Continuing Acquisitions Total Total

#'000 #'000 #'000 #'000

Redundancy and reorganisation 0 -989 -989 0

Release of bonus provisions 1,370 0 1,370 0

Abortive acquisition costs -300 0 -300 0

---------- ---------- ------- --------

1,070 -989 81 0

---------- ---------- ------- --------

At an Extraordinary General Meeting held on 1 June 1998 the shareholders voted

to replace cash bonuses for three directors linked to the Company's share

price with equivalent share options. Accordingly, provisions relating to the

cash bonuses built up in previous periods have been released.

3. Reconciliation of operating profit to net cash inflow from operating

activities

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Operating profit 13,607 11,801

Amortisation of goodwill 256 0

Depreciation 9,379 3,603

Deficit on revaluation of freehold

and long leasehold properties 165 0

(Profit) on sale of fixed assets -79 -150

(Increase) in stocks -1,807 -2,029

(Increase) in debtors -911 -1,234

Increase in creditors and

provisions 944 542

0 0

------------ ------------

Net cash inflow from operating

activities 21,554 12,533

------------ ------------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

4. Reconciliation of net cash flow to movement in net (debt) / funds

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Increase/ (decrease) in cash in the

period 7,875 -2,287

Cash (inflow) / outflow from movement

in debt and lease financing -31,992 1,204

Cash (inflow) / outflow from movement

in liquid resources -2,080 1,838

------------- ------------

Change in net debt resulting from cash

flows -26,197 755

------------- ------------

Finance lease, hire purchase and other

financing arrangements acquired with

subsidiaries -42 -285

Loan notes issued -700 -1,600

Translation differences 48 -43

------------- ------------

Movement in period -26,891 -1,173

Opening net funds 7 1,180

------------- ------------

Closing net (debt) / funds -26,884 7

------------- ------------

5. Consolidated statement of total recognised gains and losses

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Profit for the financial period 8,240 7,951

Currency translation differences on

foreign currency net investments 49 -51

Surplus on revaluation of freehold and

long leasehold properties 407 0

------------- -------------

Total gains and losses in the period 8,696 7,900

------------- -------------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

6. Reconciliation of movements in group shareholders' funds

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Profit for the financial period 8,240 7,951

Dividends -3,440 -2,857

Other recognised gains and losses 49 -51

Goodwill taken to reserves on the

purchase of subsidiary undertakings 0 -3,347

Proceeds from ordinary shares issued 8,276 412

Consideration on the purchase of own

shares -85 -92

Revaluation of freehold and long

leasehold properties 407 0

------------- -------------

Net increase in shareholders' funds 13,447 2,016

Shareholders' funds at the beginning of

the period 11,204 9,188

Shareholders' funds at the end of the

period 24,651 11,204

------------- -------------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

7. Earnings per ordinary share

The basic figures have been calculated by reference to the weighted average

number of 20 pence ordinary shares in issue during the period of 80,457,940

(1997: 74,209,585) after adjusting for the bonus element of the open offer.

The earnings are the Group's profit after taxation and preference dividends.

The figures can be reconciled to the adjusted earnings per share numbers given

on the face of the profit and loss account as follows:

12 months 12 months

to to

26 December 27 December

1998 1997

#'000 #'000

Basic earnings 7,780 7,405

Add back goodwill amortisation 256 0

------------- ------------

Adjusted basic earnings 8,036 7,405

------------- ------------

Adjusted basic earnings per

ordinary share 9.99 9.98

------------- ------------

The calculation of the diluted earnings per ordinary share is based on diluted

earnings of #8,249,000 (1997: #8,006,000) and on 90,228,030 (1997:

86,139,786) ordinary shares calculated as follows:

12 months to 12 months to

26 December 1998 27 December 1997

Earnings Number of Earnings Number of

#'000 shares #'000 Shares

Basic earnings / weighted

average number of shares 7,780 80,457,940 7,405 74,209,585

Weighted average number of

shares under option 0 6,071,497 0 3,800,883

Number of shares that would

have been issued at fair

value 0 -3,752,557 0 -1,415,160

Dividend saving / weighted

average number of ordinary

shares arising from the

conversion of the preference

shares 469 7,451,150 601 9,544,478

--------- ---------- -------- -----------

Diluted earnings / weighted

average number of shares 8,249 90,228,030 8,006 86,139,786

--------- ---------- -------- -----------

Diluted earnings per

ordinary share 9.14 9.29

---------- -----------

The adjusted diluted earnings per share is based upon the weighted average

number of ordinary shares as set out in the table above. The diluted earnings

can be reconciled to the adjusted diluted earnings as follows:

12 months to 12 months to

26 December 27 December

1998 1997

#'000 #'000

Diluted earnings 8,249 8,006

Add back goodwill amortisation 256 0

Less net exceptional credits -81 0

------------ ----------------

Adjusted diluted earnings 8,424 8,006

------------ ----------------

Adjusted diluted earnings per

share 9.33 9.29

------------ ----------------

Andrews Sykes Group plc

Notes to the financial statements

For the 12 months ended 26 December 1998

8. The proposed final dividend of 2.4 pence per ordinary share will, subject

to approval at the Annual General Meeting, be paid on 28 May 1999 to

shareholders on the register on 6 April 1999.

9. The above financial information has been extracted from the Company's

financial statements for the 12 months ended 26 December 1998 and the 12

months ended 27 December 1997. The financial statements for the 12 months

ended 27 December 1997 have been filed and those for the 12 months ended 26

December 1998 will be filed with the Registrar of Companies. The Company's

auditors gave unqualified reports on the accounts for both these periods and

the reports did not contain a statement under section 237 (2) or (3) of the

Companies Act 1985.

10. Copies of the Annual Report and Financial Statements will be circulated

to shareholders shortly and will be available from the Registered office of

the Company; Premier House, Darlington Street, Wolverhampton, WV1 4JJ.

11. The Company's Annual General Meeting will be held at 12.00 noon on 26 May

1999 at The Grosvenor House Hotel, Park Lane, London, W1A 3AA.

END

FR CCACDDDKBQND

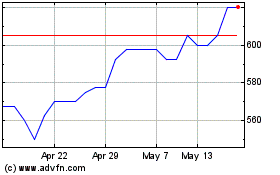

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jul 2024 to Aug 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Aug 2023 to Aug 2024