RNS Number:0840V

Andrews Sykes Group PLC

25 April 2002

Andrews Sykes Group plc

Preliminary Announcement

For the 52 weeks ended 29 December 2001

FINANCIAL HIGHLIGHTS

Turnover decreased from £86.9 million to £84.2 million

EBITDA decreased from £24.1 million to £22.8 million

Operating profit before exceptional items increased from £12.7 million to £13.4

million

Profit on ordinary activities before taxation and exceptional items increased

from £10.3 million to £11.9 million

The adjusted diluted earnings per share increased from 7.81 pence to 10.15 pence

Cash inflow from operations fell from £27.0 million to £26.6 million

In excess of £12.6 million spent of the share buy back programme to enhance

shareholder value

Cash decreased during the period by £5.2 million

Gearing (net debt as a proportion of equity funds) further reduced from 55.3% to

42.2%

SUMMARY OF RESULTS

52 weeks ended 52 weeks ended

29 December 2001 30 December 2000

£'000 £'000

Turnover 84,184 86,869

EBITDA* 22,769 24,088

Profit on ordinary activities before taxation and

exceptional items

11,916 10,283

Goodwill charges 44 10,217

Profit on ordinary activities before taxation 12,252 500

Operating cash flow per share (diluted basis, pence)** 33.6p 29.8p

Adjusted diluted earnings per share (pence) 10.15p 7.81p

Gearing 42.2% 55.3%

* Earnings before interest, taxation, depreciation, exceptional

items and goodwill charges

** Operating cash flow before exceptional items

Chairman's statement

The 2001 financial year proved to be one of mixed fortunes for our Group.

Overall, as shown by the financial highlights, the operating profit before

exceptional items was £13.4 million compared with £12.7 million last year.

Our strategy to focus upon the UK specialist hire and rental markets continues

to be successful. In total, excluding Cox Plant and its subsidiaries, the

Group's continuing UK based activities generated an operating profit before

exceptional items of £12.2 million compared with £11.8 million last year. The

result would have been even better this year had there not been a deterioration

in the fixed air conditioning business, which eroded a very satisfactory

performance by the main UK based hire and sales operation sector. I am

confident that our strategy of organic growth within the UK supplemented by

niche acquisitions in the appropriate market sectors remains appropriate and

will therefore continue to be followed.

On 17 April 2002 we commenced the employee consultation process regarding the

proposed sale of the general plant hire business and assets of Cox Plant Limited

as the sale negotiations had reached an advanced stage. A further announcement

in relation to the proposed disposal will be made in due course. The Board

believes that this is a positive move both for the Andrews Sykes Group and for

the Cox Plant employees as the new management will be able to direct their

efforts to develop and market the general plant business. We will continue with

our strategy of focusing upon and investing in the Group's traditional core

business activities.

Accommodation Hire, however, performed well during 2001 with a turnover of £9.2

million and an operating profit of £1 million. Investment will continue to be

made into this business sector which will be further integrated into our

traditional core business activities.

As reported last year, the Board undertook a full review of our subsidiary,

Refrigeration Compressor Remanufacturers Limited, in the light of a decline in

the margins being achieved. During the first half of this year the trading

performance continued to decline and therefore the operation was closed in the

second half of the year. The closure costs are not significant and have been

fully absorbed in the reported figures.

The Group's well established overseas business in Holland generated an operating

profit of £0.6 million this year compared with £0.3 million last year. The

operation in the United Arab Emirates performed less well mainly due to a

deterioration in the general market conditions in the middle east. This year

the operating profit was virtually break even compared with £0.2 million last

year. Opportunities to further develop these companies will be pursued as and

when they arise.

During the period under review the Group has purchased a total of 15,158,838

ordinary 20 pence shares for cancellation at a cost of £12,628,997. During

January and February 2002 a further 10,000 ordinary 20 pence shares were

purchased for cancellation at a cost of £9,580.

The 2001 share buy back programme increased the adjusted diluted earnings per

share figure for the current year by approximately one pence per share and the

full year effect will be to increase the diluted earnings per share figure by a

further one pence. Therefore, as reported in both last years annual report and

the half yearly statement, the Board continues to believe that shareholder value

will be optimised by a judicious purchase of our own shares coupled with

investment in organic growth. At the next Annual General Meeting the Board will

request that shareholders vote in favour of a resolution to give authority to

purchase up to 12.5% of the ordinary shares in issue. At such time that the

Board considers the interests of the shareholders will be best served by the

payment of dividends, this policy will be resumed.

As I reported in my interim statement John Hall retired from the main Board on

28 February 2002. John was appointed Operations Director of our main UK

subsidiary company in June 1990 and he became a main Board Director in December

1994. He made a valuable contribution to the Group over the years and I wish

him well in his retirement. The role of Operations Director has temporarily

been assumed by Robert Stevens who will be assisted by key members of the senior

management team.

2001 was a year of change and development for Andrews Sykes. We consolidated

our position as being a market leader in our core business activities.

The first quarter of 2002 has not started particularly well for our Group. The

winter has continued to be mild. Nevertheless we will persist in our efforts

and continue to add value to our shareholders.

JG Murray

Chairman

24 April 2002

Andrews Sykes Group plc

Consolidated profit & loss account

For the 52 weeks ended 29 December 2001

Continuing 52 Continuing

weeks ended 52 weeks ended

29 December 30 December 2000

2001

Before

Total exceptional Exceptional Total

items items

£'000 £'000 £'000 £'000

Turnover 84,184 86,869 - 86,869

Cost of sales (46,449) (49,904) (9,783) (59,687)

Gross profit 37,735 36,965 (9,783) 27,182

Distribution costs (6,753) (6,045) - (6,045)

Administrative expenses (17,627) (18,292) - (18,292)

Other operating income - 35 - 35

Operating profit 13,355 12,663 (9,783) 2,880

EBITDA * 22,769 24,088 - 24,088

Depreciation and asset disposals (9,370) (10,991) - (10,991)

Operating profit before exceptional items and 13,399 13,097 - 13,097

goodwill charges

Goodwill charges (44) (434) (9,783) (10,217)

Operating profit 13,355 12,663 (9,783) 2,880

Profit on the disposal of property 336 - - -

Net interest payable (1,439) (2,380) - (2,380)

Profit/(loss) on ordinary activities before 12,252 10,283 (9,783) 500

taxation

Tax on profit on ordinary activities (3,914) (3,635) - (3,635)

Profit/(loss) on ordinary activities after 8,338 6,648 (9,783) (3,135)

taxation being retained profit/(loss) for the

financial period attributable to ordinary

shareholders

Basic earnings/(loss) per ordinary share 10.52p (3.48)p

Diluted earnings/(loss) per share 10.51p (3.48)p

Add back: Goodwill amortisation 0.06p 0.48p

Exceptional items (0.42)p 10.79p

Negative dilutive effect 0.00p 0.02p

of share options

Adjusted diluted earnings per share 10.15p 7.81p

Dividends per share:

Equity shares 0.00p 0.00p

There were no material acquisitions or discontinued operations during either

period.

* Earnings before interest, taxation, depreciation, and amortisation excluding

exceptional items.

Andrews Sykes Group plc

Consolidated Balance Sheet

At 29 December 2001

29 December 30 December

2001 2000

£'000 £'000

Fixed assets

Intangible assets: Goodwill 128 172

Tangible fixed assets 24,560 29,775

Investments 605 688

25,293 30,635

Current assets

Stocks 4,675 5,758

Overseas tax - 174

Other debtors 17,779 20,941

Cash at bank and in hand 7,821 10,423

30,275 37,296

Creditors: Amounts falling due within one year

Loans, overdraft and finance lease obligations (12,350) (20,213)

Other creditors (12,229) (12,422)

Corporation and overseas tax (2,351) (2,384)

(26,930) (35,019)

Net current assets 3,345 2,277

Total assets less current liabilities 28,638 32,912

Creditors: Amounts falling due after more than

one year

Loans (5,000) (5,000)

Provisions for liabilities and charges (1,029) (1,160)

Net assets 22,609 26,752

Capital and reserves

Called up share capital 14,686 17,593

Share premium account 10,421 10,406

Revaluation reserve 762 767

Other reserves 4,236 1,202

Profit and loss account (7,506) (3,226)

Equity shareholders' funds 22,599 26,742

Minority interests (equity) 10 10

22,609 26,752

Analysis of net debt

Cash at bank and in hand 7,821 10,423

Total loans, overdrafts and finance lease (17,350) (25,213)

obligations

Net debt (9,529) (14,790)

As a percentage of equity shareholders' funds 42.2% 55.3%

Andrews Sykes Group plc

Consolidated cash flow statement

For the 52 weeks ended 29 December 2001

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Net cash inflow from operating activities 26,648 27,018

Returns on investments and servicing of finance

Net interest paid (1,270) (2,145)

Net cash outflow for returns on investments and (1,270) (2,145)

servicing of finance

Cash outflow for taxation (4,005) (2,931)

Capital expenditure and financial investment

Purchase of own shares by ESOP - (151)

Sale of own shares by ESOP 68 -

Purchase of tangible fixed assets (5,749) (7,303)

Sale of tangible fixed assets 2,057 1,966

Net cash outflow for capital expenditure (3,624) (5,488)

Cash inflow before the use of liquid resources

and financing 17,749 16,454

Management of liquid resources

Movement in bank deposits (2,580) (90)

Financing

Issue of ordinary share capital net of issue 140 73

costs

Loan and loan note repayments (7,800) (7,273)

Capital element of finance lease repayments (63) (126)

Purchase of own shares (12,629) (2,551)

Net cash outflow from financing (20,352) (9,877)

(Decrease)/increase in cash in the period (5,183) 6,487

Andrews Sykes Group plc

Notes to the financial statements

For the 52 weeks ended 29 December 2001

1. Segmental analysis

The Group's turnover may be analysed between the following principal products

and activities:

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Product Group:

Pumps 19,850 19,387

Heating and ventilation 13,822 12,836

Air conditioning 21,138 22,904

General Plant and accommodation 25,877 28,589

Other 3,497 3,153

Total 84,184 86,869

Activity:

Hire 58,891 58,018

Sales 16,269 15,837

Installation 9,024 13,014

Total 84,184 86,869

The integrated nature of the Group's operation does not permit a meaningful

analysis of net assets by the above product groups or activities.

The results can be further analysed by class of business as follows:

Profit before Profit/

exceptionals (loss)

Exceptionals & before

& goodwill goodwill interest

amortisation amortisation and tax

Turnover £'000 £'000 £'000 Net assets

£'000 £'000

52 weeks ended 29 December 2001:

Pumps, heating, ventilation, air 58,307 12,814 (44) 12,770 18,525

conditioning and other

General plant and accommodation 25,877 585 336 921 4,084

84,184 13,399 292 13,691 22,609

52 weeks ended 30 December 2000:

Pumps, heating, ventilation, air

conditioning and other

58,280 11,997 (2,985) 9,012 22,420

General plant and accommodation 28,589 1,100 (7,232) (6,132) 4,332

86,869 13,097 (10,217) 2,880 26,752

The geographical analysis of the Group's turnover was as follows:

By geographical origin By geographical

destination

52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended

29 December 30 December 29 December 30 December

2001 2000 2001 2000

£'000 £'000 £'000 £'000

United Kingdom 79,248 82,203 77,714 80,865

Rest of Europe 2,284 1,849 3,311 2,575

Middle East and Africa 2,652 2,532 2,834 2,865

The Americas - - 299 281

Rest of World - 285 26 283

84,184 86,869 84,184 86,869

The analysis of profit before interest and tax and net assets by geographical

origin was as follows:

Profit before interest Net assets Net assets

and tax

52 weeks 52 weeks 52 weeks 52 weeks ended

ended ended ended 30 December

29 December 30 December 29 December

2001 2000 2001 2000

£'000 £'000 £'000 £'000

United Kingdom 13,035 2,813 26,941 35,360

Rest of Europe 600 240 5,803 5,171

Middle East and Africa 56 213 1,745 1,541

The Americas - (88) - -

Rest of World - (298) - -

13,691 2,880 34,489 42,072

Net debt (9,529) (14,790)

Taxation and dividends payable (2,351) (530)

22,609 26,752

2. Exceptional items

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Goodwill impairment (note 3) - 9,783

3. Amortisation of goodwill

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Annual goodwill amortisation charge (44) (434)

Charge arising from impairment review of Cox Plant - (6,812)

Limited

(44) (7,246)

Other pre FRS 10 goodwill

Provision against goodwill previously written off - (2,971)

to reserve

(44) (10,217)

During last year and in accordance with FRS 11: Impairment of fixed assets and

goodwill, the directors performed an impairment review of the carrying value of

the goodwill attributable to Cox Plant Limited at 30 December 2000. Having due

regard to the results of Cox Plant Limited during the period and the early part

of 2001 the directors considered the cashflows for the business discounted at a

rate of 10%. Accordingly, full provision was made against the balance of

goodwill as at 30 December 2000.

The directors consider that the goodwill arising on the acquisition of

Refrigeration Compressor Remanufacturers Limited suffered a permanent diminution

in value last year and the value of the goodwill arising on acquisition of

£2,971,000, which was previously charged directly to reserves in accordance with

SSAP 22: Accounting for goodwill, was no longer justified. The full amount was

credited back to reserves and charged to last year's profit and loss account in

accordance with the Group's stated accounting policy.

4. Reconciliation of operating profit to net cash inflow from operating

activities

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Operating profit 13,355 2,880

Amortisation and impairment of goodwill 44 10,217

Depreciation 9,638 11,120

Provision against investments - 85

Profit on sale of tangible fixed assets (268) (129)

Decrease in stocks 1,083 2,071

Decrease in debtors 3,154 3,760

Decrease in creditors and provisions (358) (2,986)

Net cash inflow from operating activities 26,648 27,018

5. Reconciliation of net cash flow to movement in net debt

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

(Decrease)/increase in cash in the period (5,183) 6,487

Cash outflow from movement in debt and lease 7,863 7,399

financing

Cash outflow from movement in liquid resources 2,580 90

Changes in net debt resulting from cash flows 5,260 13,976

Translation differences 1 82

Movement in period 5,261 14,058

Opening net debt (14,790) (28,848)

Closing net debt (9,529) (14,790)

6. Consolidated statement of total recognised gains and losses

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Profit/(loss) for the financial period 8,338 (3,135)

Currency translation differences on foreign

currency net investments 8 136

Total gains and losses in the period 8,346 (2,999)

7. Reconciliation of movements in Group shareholders' funds

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Profit/(loss) for the financial period 8,338 (3,135)

Other recognised gains and losses 8 136

Proceeds from ordinary shares issued 140 73

Consideration on the purchase of own shares (12,629) (2,551)

Goodwill previously written off to reserves

expensed in the year - 2,971

Net decrease in shareholders' funds (4,143) (2,506)

Shareholders' funds at the beginning of the period 26,742 29,248

Shareholders funds at the end of the period 22,599 26,742

8. Earnings per ordinary share

The basic figures have been calculated by reference to the weighted average

number of ordinary 20 pence shares in issue during the period of 79,221,681 (52

weeks ended 30 December 2000: 90,156,589).

FRS 14 strictly requires that potentially ordinary shares should be treated as

potentially dilutive when they increase net loss per share. This disclosure is

not given for the 52 weeks ended 30 December 2000 as it would not provide any

meaningful information. This is consistent with IAS 33.

The calculation of the diluted earnings per ordinary share is based on a profit

of £8,338,000 (52 weeks ended 30 December 2000: loss of £3,135,000) and on

79,305,491 (52 weeks ended 30 December 2000: 90,690,403) ordinary shares. The

share options have a dilutive effect for the period ended 29 December 2001

calculated as follows:

52 weeks ended 29 December 52 weeks ended 30

2001 December 2000

Earnings Number of Losses Number of

£'000 shares £'000 shares

Basic earnings/(loss)/weighted average

number of shares

8,338 79,221,681 (3,135) 90,156,589

Weighted average number of shares

under option - 225,000 - 995,000

Number of shares that would have been

issued at fair value - (141,190) - (461,186)

Earnings/(loss)/diluted weighted

average number of shares 8,338 79,305,491 (3,135) 90,690,403

Diluted earnings/(loss) per ordinary

share (pence) 10.51p (3.46)p

The adjusted diluted earnings per share excluding goodwill amortisation and

exceptional items is based upon the weighted average number of ordinary shares

as set out in the table above. The earnings/(losses) can be reconciled to the

adjusted earnings as follows:

52 weeks 52 weeks

ended ended

29 December 30 December

2001 2000

£'000 £'000

Earnings/(losses) 8,338 (3,135)

Goodwill amortisation 44 434

Exceptional items (336) 9,783

Adjusted earnings 8,046 7,082

Adjusted diluted earnings per share (pence) 10.15p 7.81p

The above figures have been disclosed to demonstrate maintainable earnings.

9. Basis of accounting

The financial statements are prepared under the historical cost

convention, modified by the revaluation of freehold and long leasehold land and

buildings, and in accordance with applicable Accounting Standards. In

accordance with FRS 18 the directors reviewed the accounting standards adopted

by the company during the year to ensure they are the most appropriate ones to

follow. No amendments were required. The transitional requirements of FRS 17 "

Retirement benefits" have also been adopted.

10. Classification of loans

Cox Plant Limited has credit facilities which are non -recourse to the rest of

the Group and are only secured on the assets of Cox Plant Limited and

Accommodation Hire Limited. These are made available to Cox Plant Limited

subject to that company meeting a number of performance criteria. During the

period ended 29 December 2001 certain of these criteria were not achieved and

hence the company is technically in breach of its covenants. Loans of

£12,350,000 are repayable on demand and have therefore been reclassified as

falling due within one year.

Since the end of the year the bank has formally waived the breach of covenants

and has indicated that facilities will be made available until at least 24 April

2003.

11. The above financial information has been extracted from the Company's

financial statements for the 52 weeks ended 29 December 2001 and the 52 weeks

ended 30 December 2000. The financial statements for the 52 weeks ended 30

December 2000 have been filed and those for the 52 weeks ended 29 December 2001

will be filed with the Registrar of Companies. The Company's auditors gave

unqualified reports on the accounts for both these periods and the reports did

not contain a statement under section 237 (2) or (3) of the Companies Act 1985.

12. Copies of the Annual Report and Financial Statements will be circulated

to shareholders shortly and will be available from the Registered office of the

Company; Premier House, Darlington Street, Wolverhampton, WV1 4JJ.

13. The Company's Annual General Meeting will be held at 10.30 a.m. on 29

May 2002 at The Grosvenor House Hotel, Park Lane, London, W1A 3AA.

This information is provided by RNS

The company news service from the London Stock Exchange

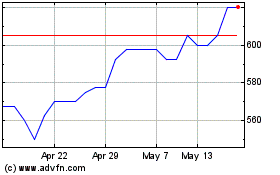

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jul 2024 to Aug 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Aug 2023 to Aug 2024