TIDMSLI

RNS Number : 6668R

Standard Life Invs Property Inc Tst

29 October 2013

29 October 2013

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED (LSE:

SLI)

Unaudited Net Asset Value as at 30 September 2013

Key Highlights

-- Net asset value per ordinary share was 59.7p as at 30

September 2013, an increase of 2.4% from 30 June 2013.

-- Dividend yield of 6.7% based on share price of 68.0p (28 October 2013).

-- Cash held by the Company was GBP23.4m at 30 September 2013,

of which GBP17.3m is earmarked for purchases in progress.

-- Development profits taken following the GBP15.2m sale of the Hydrasun building in Aberdeen.

Net Asset Value ("NAV")

The unaudited net asset value per ordinary share of Standard

Life Investments Property Income Trust Limited ("SLIPIT") at 30

September 2013 was 59.7 pence. This is an increase of 2.4% over the

net asset value of 58.3 pence per share at 30 June 2013. The net

asset value is calculated under International Financial Reporting

Standards ("IFRS").

The net asset value incorporates the external portfolio

valuation by Jones Lang LaSalle at 30 September 2013. The property

portfolio will next be valued by the external valuer during

December 2013 and the next quarterly net asset value will be

published thereafter.

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited NAV

per share calculated under IFRS over the period 30 June 2013 to 30

September 2013.

GBPm Pence % of opening

per NAV

share

Unaudited Net Asset Value at 30 June

2013 88.2 58.3 -

Gain - realised and unrealised following

revaluation of property portfolio (including

the effect of gearing) 1.6 1.1 1.9%

Decrease in unrealised interest rate 1.1 0.7 1.2%

swap valuations

Other movement in reserves (0.6) (0.4) (0.7)%

New shares issued 0.7 - -

Unaudited Net Asset Value at 30 September

2013 91.0 59.7 2.4%

European Public Real Estate Association 30 Sept 2013 30 Jun 2013

("EPRA")*

EPRA Net Asset Value GBP93.1m GBP91.3m

EPRA Net Asset Value per share 61.0p 60.3p

The Net Asset Value at 30 September 2013 is based on 152,519,237

shares of 1p each.

* The EPRA net asset value measure is to highlight the fair

value of net assets on an on going, long-term basis. Assets and

liabilities that are not expected to crystallise in normal

circumstances, such as the fair value of financial derivatives, are

therefore excluded.

Investment Manager Commentary

During the quarter the Company's cash position increased

following the sale of the Hydrasun building in Aberdeen. As

reported before the sale crystallised profit on the development,

and followed the purchase of Hertford Place in Rickmansworth.

Solicitors are instructed to finalise the acquisition of a

portfolio of well let retail warehouse investments at a total cost

of GBP13.4m at a yield of 8% and negotiations are in hand that if

finalised will result in the acquisition of a small industrial

investment of two units for GBP3.9m at a yield of 10.5% with 5

years left on the lease.

The Company's occupancy rate increased over the quarter from

89.6% to 94.6% with lettings at Norwich and Aberdeen completing. We

are also in advanced negotiations on an agreement for lease on our

largest void (Bourne House Staines), where the lease will be

conditional on the refurbishment we are undertaking.

Cash position

As at 30 September 2013 the Company had borrowings of GBP84.4m

and a cash position of GBP23.4m (excluding rent deposits) therefore

cash as a percentage of debt was 27.7%.

Dividend

The Company paid an interim dividend, in respect of the quarter

ended 30 June 2013, of 1.133p per Ordinary Share, with ex-dividend

and payment dates of 7 August and 23 August 2013 respectively.

Loan to value and interest rate

As at 30 September 2013 the loan to value ratio (assuming all

cash is placed with RBS as an offset to the loan balance) was 39.1%

(30 June 2013: 44.8%). The covenant level is 65%. The Company has a

current weighted average interest rate of 6.3% to December 2013.

From 1 January 2014 the weighted average interest rate will fall to

3.8%, of which 100% is fixed with a maturity to December 2018.

The interest rate swaps had a positive impact on the NAV of 0.7p

per share or 1.2% over the quarter, and the fair value liability

was GBP2.0m as at 30 September 2013. The Company has one interest

rate hedge maturing in December 2013 with a current liability of

GBP0.8m (30 June 2013: GBP1.6m). This liability will have fallen to

zero by maturity in December 2013. The other interest rate hedges

mature in December 2018, and have a current liability of GBP1.2m

(30 June: GBP1.5m).

Net Asset analysis as at 30 September 2013 (unaudited)

GBPm %

-------------------------- ------- -------

Office 75.4 83.0

-------------------------- ------- -------

Retail 35.4 38.9

-------------------------- ------- -------

Industrial 45.5 50.0

-------------------------- ------- -------

Total Property Portfolio 156.3 171.9

-------------------------- ------- -------

Adjustment for lease

incentives (3.6) (4.0)

-------------------------- ------- -------

Fair value of Property

Portfolio 152.7 167.9

-------------------------- ------- -------

Cash 23.4 25.7

-------------------------- ------- -------

Other Assets 5.4 5.9

-------------------------- ------- -------

Non-current liabilities (85.9) (94.4)

-------------------------- ------- -------

Current liabilities (4.6) (5.1)

-------------------------- ------- -------

Total Net Assets 91.0 100.0

-------------------------- ------- -------

Breakdown in valuation movements over the period 1 Jul 2013 to

30 Sept 2013

Exposure Capital Value GBPm

as at 30 Movement

Sept 2013 on Standing

(%) Portfolio

(%)

------------------------ ----------- -------------- ------

External Valuation at

30/06/2013 154.7

------------------------ ----------- -------------- ------

Sub Sector Analysis:

------------------------ ----------- -------------- ------

RETAIL

------------------------ ----------- -------------- ------

South East Retail 6.7 3.4 0.4

------------------------ ----------- -------------- ------

Retail Warehouses 15.9 0.0 0.0

------------------------ ----------- -------------- ------

OFFICES

------------------------ ----------- -------------- ------

Central London Offices 12.2 1.1 0.2

------------------------ ----------- -------------- ------

South East Offices 20.5 (0.2) (0.1)

------------------------ ----------- -------------- ------

Rest of UK Offices 15.6 (0.3) (0.1)

------------------------ ----------- -------------- ------

INDUSTRIAL

------------------------ ----------- -------------- ------

South East Industrial 4.9 4.1 0.3

------------------------ ----------- -------------- ------

Rest of UK Industrial 24.2 2.4 0.9

------------------------ ----------- -------------- ------

External Valuation at

30/09/2013 100.0 0.9 156.3

------------------------ ----------- -------------- ------

Top 10 Properties

Weighting 30

Sept 2013

------------------------------------ -------------

Tesco Distribution, Bolton 8.8%

------------------------------------ -------------

White Bear Yard, London 7.2%

------------------------------------ -------------

Hollywood Green, London 6.7%

------------------------------------ -------------

Hertford Place, Rickmansworth 6.4%

------------------------------------ -------------

St. James's House, Cheltenham 5.8%

------------------------------------ -------------

Ocean Trade Centre, Aberdeen 5.6%

------------------------------------ -------------

Clough Road Retail Park, Hull 5.1%

------------------------------------ -------------

New Palace Place, Monck St, London 5.0%

------------------------------------ -------------

Fleming Way, Crawley 3.9%

------------------------------------ -------------

Bathgate Retail Park, Bathgate 3.8%

------------------------------------ -------------

Total 58.3%

------------------------------------ -------------

The Board is not aware of any further significant events or

transactions which have occurred between 30 September 2013 and the

date of publication of this statement which would have a material

impact on the financial position of the Company.

Details of the Company may also be found on the Investment

Manager's website which can be found at:

www.standardlifeinvestments.com/its

For further information:-

Jason Baggaley - Real Estate Fund Manager Standard Life

Investments

Tel +44 (0) 131 245 2833 or jason_baggaley@standardlife.com

Gordon Humphries - Head of Investment Companies Standard Life

Investments

Tel +44 (0) 131 245 2735 or

gordon_humphries@standardlife.com

The Company Secretary

Northern Trust International Fund Administration Services

(Guernsey) Ltd

Trafalgar Court

Les Banques

St Peter Port

GY1 3QL

Tel: 01481 745001

Fax: 01481 745085

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVPGGPCUUPWGCB

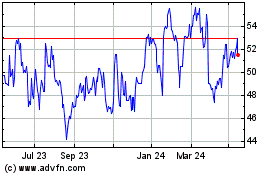

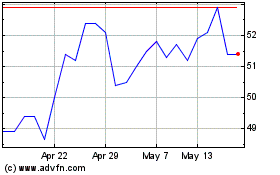

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Jun 2024 to Jul 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Jul 2023 to Jul 2024