TIDMAEWU

RNS Number : 5763Q

AEW UK REIT PLC

19 October 2023

19 October 2023

AEW UK REIT plc

NAV Update and Dividend Declaration

AEW UK REIT plc (LSE: AEWU) ("AEWU" or the "Company"), which

directly owns a value-focused portfolio of 35 UK commercial

property assets, announces its unaudited Net Asset Value ("NAV") as

at 30 September 2023 and interim dividend for the three-month

period ended 30 September 2023.

Highlights

-- NAV of GBP167.93 million or 106.00 pence per share as at 30

September 2023 (30 June 2023: GBP169.56 million or 107.03 pence per

share).

-- NAV total return of 0.91% for the quarter (30 June 2023 quarter: 3.36%).

-- 0.70% like-for-like valuation increase for the quarter (30

June 2023 quarter increase: 0.74%).

-- EPRA earnings per share ("EPRA EPS") for the quarter of 1.84

pence (30 June 2023 quarter: 1.75 pence).

-- Interim dividend of 2.00 pence per share for the three months

ended 30 September 2023, paid for 32 consecutive quarters and in

line with the targeted annual dividend of 8.00 pence per share.

-- Loan to NAV ratio at the quarter end was 35.73% (30 June

2023: 35.39%). Loan to GAV ratio at the quarter end was 27.35% (30

June 2023: 30.54%). Significant headroom remains on all loan

covenants.

-- Company continues to benefit from a low fixed cost of debt of 2.959% until May 2027.

-- Purchase of a car park asset in central York for GBP10.02

million, reflecting a NIY of 9.3%.

-- Purchase of a mixed-use asset in central Bath for GBP11.50

million, reflecting a NIY of 8.0%.

-- Post quarter-end disposal of Commercial Road, Portsmouth, for

GBP3.90 million, reflecting a 22% premium to the 30 June 2023

valuation.

Laura Elkin, Portfolio Manager, AEW UK REIT, commented:

"We are pleased to report significant progress this quarter

towards the Company's strategic objective of reinvesting capital

generated from recent sales into higher yielding assets in core

urban locations. The purchases of NCP, York, and Cambridge House,

Bath, utilised most of the capital available for deployment and

have strengthened earnings. Despite the short-term negative impact

on NAV of acquisition costs, these purchases are expected to

deliver NAV growth over the medium term.

Following the completion of key asset management transactions at

a number of the Company's holdings, the Company's portfolio

achieved a like-for-like valuation increase of 0.70%, demonstrating

the effectiveness of our active asset management strategy in

delivering counter cyclical performance.

The Company has committed to pay its market-leading dividend of

2.00 pence per share per quarter for 32 consecutive quarters,

funded mainly by EPRA earnings, and supplemented by profit

crystallised on the NAV accretive sale of assets, of which the

recent Commercial Road disposal is another good example. Further

gains in EPS are expected in the coming quarters as the ongoing

programme of new lettings should provide a boost to income streams

and a reduction in void costs."

Valuation movement

As at 30 September 2023, the Company owned investment properties

with a total fair value of GBP219.36 million, as assessed by the

Company's independent valuer, Knight Frank. The like-for-like

valuation increase for the quarter of GBP1.37 million (0.70%) is

broken down as follows by sector:

Sector Valuation 30 September Like-for-like valuation

2023 movement for the

quarter

GBP million % of portfolio GBP million %

------------ --------------- ---------------- --------

Industrial 78.33 35.71 1.04 1.35

------------ --------------- ---------------- --------

Retail

Warehouses 46.25 21.08 1.65 3.70

------------ --------------- ---------------- --------

High

Street

Retail 38.16 17.40 (1.16) (2.95)

------------ --------------- ---------------- --------

Other 30.37 13.84 0.35 1.75

------------ --------------- ---------------- --------

Office 26.25 11.97 (0.51) (3.34)

------------ --------------- ---------------- --------

Total 219.36 100.00 1.37 0.70*

------------ --------------- ---------------- --------

* This is the overall weighted average like-for-like valuation

increase of the portfolio.

Portfolio Manager's Review

This quarter has seen the Company make significant advancements

towards achieving full capital deployment through the acquisitions

of Tanner Row, York, and Cambridge House, Bath. These purchases

demonstrate the effective recycling of proceeds received from the

sale of lower yielding assets into higher yielding ones. Critical

to these acquisitions were the strong locations of the assets, both

of which occupy attractive city centre pitches. Moreover, both

assets have robust reversionary potential, each offering yields in

excess of 10%, amplifying their potential accretion to earnings

over time.

This drive towards increasing earnings was furthered by the

Company exchanging on the sale of Commercial Road, Portsmouth,

during the quarter. The disposal price of GBP3,900,000 reflects a

notable 22% premium against the valuation preceding exchange. This

disposal was motivated by the deterioration of the asset's location

since purchase in 2017, since when the high street retail market

has been through considerable structural change. The sale of the

asset demonstrates the Company's strategy to, where needed,

undertake efficient recycling of capital in to higher-performing

pipeline assets. Completion of the sale occurred on 6 October

2023.

Progress on dividend cover was impacted by the demise of Wilko

and the closure of its store at the Company's holding in Union

Street, Bristol, in early October. The decision has been made to

write-off, in full, all historic arrears yet to be provided for, as

well as all amounts charged in the quarter, resulting in a 0.22

pence per share deduction to quarterly EPRA EPS. Following the

write-off of these historic Wilko arrears, the ongoing constraint

to quarterly EPRA EPS caused by its vacant unit will be

considerably less. Development of an asset management plan for the

unit is underway and the Company is confident it will be able to

re-let the unit in the near term, given the attractive location of

the store within a vibrant area of a mixed-use development. We will

continue to pursue the tenant's arrears using all appropriate

means.

We continue to drive performance through a variety of asset

management initiatives. At Central Six Retail Park, Coventry, the

Company obtained planning permission for the amalgamation of Units

6a and 6b, thus facilitating a letting to The Food Warehouse early

next year. This, combined with the post quarter end exchange of

agreement for leases with new tenants, Whitecross Dental Care

Limited and The Salvation Army, has enhanced the tenant mix and

will deliver income growth. Building upon the lettings completed in

the prior quarter, a new letting to Warwick Holdings Ltd at Oak

Park was completed, meaning this property is now fully let. All of

these asset management transactions illustrate the effectiveness of

the Company's value-investment principles, despite negative

sector-focused macroeconomic headwinds.

The Company's focus for the deployment of capital continues to

be on the consideration of further accretive investment

opportunities, alongside re-investment into the existing portfolio

where capex is needed in order to drive future performance

gains.

Net Asset Value

The Company's unaudited NAV at 30 September 2023 was GBP167.93

million, or 106.00 pence per share. This reflects a decrease of

0.96% compared with the NAV per share at 30 June 2023. The

Company's NAV total return, which includes the interim dividend of

2.00 pence per share for the period from 1 April 2023 to 30 June

2023, was 0.91% for the three-month period ended 30 September

2023.

Pence per share GBP million

NAV at 1 July 2023 107.03 169.56

Portfolio acquisition costs (1.04) (1.64)

Capital expenditure (0.66) (1.04)

Valuation change in property portfolio 0.83 1.31

Income earned for the period 3.14 4.98

Expenses and net finance costs for the period (1.30) (2.07)

Interim dividend paid (2.00) (3.17)

NAV at 30 September 2023 106.00 167.93

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards. It incorporates

the independent portfolio valuation at 30 September 2023 and income

for the period, but does not include a provision for the interim

dividend declared for the three-month period to 30 September

2023.

Share price and Discount

The closing ordinary share price at 30 September 2023 was 98.4p.

This represents a discount to the NAV per share of 7.17% and an

increase of 6.15% compared with the share price of 92.7p at 30 June

2023. The Company's share price total return, which includes the

interim dividend of 2.00 pence per share for the period from 1

April 2023 to 30 June 2023, was 8.31% for the three-month period

ended 30 September 2023.

Dividend

Dividend declaration

The Company today announces an interim dividend of 2.00 pence

per share for the period from 1 July 2023 to 30 September 2023. The

dividend payment will be made on 1 December 2023 to shareholders on

the register as at 27 October 2023. The ex-dividend date will be 26

October 2023. The Company operates a Dividend Reinvestment Plan

("DRIP"), which is managed by its registrar, Link Group. For

shareholders who wish to receive their dividend in the form of

shares, the deadline to elect for the DRIP is 10 November 2023.

The dividend of 2.00 pence per share will be designated 1.50

pence per share as an interim property income distribution ("PID")

and 0.50 pence per share as an interim ordinary dividend

("non-PID").

The Company has now paid a 2.00 pence quarterly dividend for 32

consecutive quarters (1) , providing high levels of income

consistency to our shareholders.

(1) For the period 1 November 2017 to 31 December 2017, a pro

rata dividend of 1.33 pence per share was paid for this two-month

period, following a change in the accounting period end.

Dividend outlook

It remains the Company's intention to continue to pay dividends

in line with its dividend policy and this will be kept under

review. In determining future dividend payments, regard will be

given to the circumstances prevailing at the relevant time, as well

as the Company's requirement, as a UK REIT, to distribute at least

90% of its distributable income annually.

Financing

Equity:

The Company's share capital consists of 158,774,746 Ordinary

Shares, of which 350,000 are currently held by the Company as

treasury shares.

Debt:

The Company has a GBP60.00 million, five-year term loan facility

with AgFe, a leading independent asset manager specialising in

debt-based investments. The loan is priced as a fixed rate loan

with a total interest cost of 2.959% until May 2027.

The loan was fully drawn at 30 September 2023, producing a Loan

to NAV ratio of 35.73%.

Headroom on the debt facility's loan to value ("LTV") covenant

continues to be conservative. For those properties secured under

the loan, a 48.90% fall in valuation would be required before the

LTV covenant were to be breached.

Investment Update

During the quarter the Company completed the following

purchases:

Tanner Row, York (car park) - in July, the Company completed the

acquisition of a mixed-use asset within York city centre for

GBP10,020,000, reflecting an attractive net initial yield of 9.3%.

The site totals 0.8 acres and is well located inside the York City

Wall, bounding the historic centre of the city.

The 99,769 sq ft asset is multi-let to five tenants, with 75% of

the income received from National Car Parks Ltd who have a further

9 years remaining. NCP have occupied the 297-space car park since

2005 and the lease benefits from a 2027 rent review which will

increase rent payable in line with uncapped Retail Price Index,

resulting in a forecast reversionary yield in excess of 10%. A

further four tenants occupy ground and first floor retail and

office accommodation fronting onto George Hudson Street.

Cambridge House, Bath (office) - in early September, the Company

completed the acquisition of a freehold, mixed-use asset in Bath

city centre for GBP11,500,000, reflecting an attractive net initial

yield of 8.0% and a capital value of GBP223 per sq ft.

The property comprises a rare freehold island site totalling

circa 0.4 acres and is located immediately adjacent to the South

Gate Shopping Centre which forms part of the city's core retail

provision. Bath Spa Train Station is less than a five-minute walk

from the property, with other key tourist attractions such as Bath

Cathedral, the Roman Baths and Pulteney Bridge within a short

distance.

The 51,632 sq ft asset is multi-let to five tenants across

office and retail accommodation. The majority of the building is

let to four office tenants at a low average passing rent of circa

GBP22 per sq ft. Income levels are expected to improve via rent

reviews in the short-term and through lease renewals and

re-lettings over the medium-term. Light refurbishment may also be

considered in order to fully capitalise on the building's prime

location and prominence. A vacant retail unit, fronting Philip

Street and Ham Gardens, is currently under offer to an established

local retailer. We expect market conditions to remain favourable in

this location given the low level of available and consented

supply, coupled with strong demand for well-specified and

well-located accommodation.

Post quarter end, the Company completed the following

disposal:

Commercial Road, Portsmouth (high-street retail) - earlier in

October, the Company completed the sale of its freehold high-street

retail holding at 208-220 Commercial Road and 7-13 Crasswell

Street, Portsmouth, for GBP3,900,000, reflecting a net initial

yield of 9.9% and a capital value of GBP251 per sq ft. A sale at

this price reflects a circa 22% premium to the 30 June 2023

valuation of GBP3,200,000.

Asset Management Update

The Company completed the following asset management

transactions during the quarter:

40 Queens Square, Bristol (office) - the Company has recently

completed a new five-year ex-Act lease to Environmental Resources

Limited with a tenant break option at the end of the third year at

a rent of GBP69,230 per annum (GBP35 per sq ft). The tenant has the

benefit of an initial six-month rent-free period, with a further

four months incentive if they do not serve their break option.

Central Six Retail Park, Coventry (retail warehousing) - In

September, the Company received formal confirmation of the planning

permission for the amalgamation of Unit 6a and Unit 6b and extended

delivery hours in order to facilitate the letting to The Food

Warehouse. The letting is expected to complete in February

2024.

Post quarter end, the Company also exchanged an agreement for

lease with a new tenant, Salvation Army Trading Company Ltd, for

Unit 12. The tenant will enter into a new lease expiring on 2

November 2032 with a tenant only break in year 5 at a rent of

GBP140,000 per annum, reflecting GBP13.97 per sq ft. The letting

includes nine months' rent free. The letting is subject to the

landlord securing vacant possession, as the unit is currently

occupied by Oak Furnitureland, who are currently paying an annual

rent of GBP25,000, and carrying out Landlord works budgeted at

GBP147,336.

Also, post quarter end, the Company exchanged an agreement for

lease with new tenant Whitecross Dental Care Limited, trading as

MyDentist, for vacant Unit 4. The tenant will enter into a new

15-year lease with a 10-year tenant break option, at a rent of

GBP145,000 per annum, reflecting GBP14.29 per sq ft, to be reviewed

every five years based on open market value (upward only). The

letting includes a GBP217,500 cash incentive and is subject to the

landlord works, at a cost of GBP237,500.

The Railway Centre, Dewsbury (leisure) - Mecca Bingo, whose

lease expires on 24 December 2023, have surrendered their lease

early on 29 September 2023, paying all their rent, service charge

and insurance to lease expiry. In doing so, the Company has also

settled Mecca's dilapidations at GBP285,000. The full and final

combined settlement totals GBP365,126. The Manager is in the

process of agreeing terms with an incoming tenant where landlord

enabling works will be required. An early surrender of Mecca's

lease will facilitate the new letting completing a quarter earlier

than otherwise possible.

Oak Park, Droitwich (industrial) - having completed two new

leases in the previous quarter, totalling a rent of GBP193,000 per

annum, the Company has completed a letting at units 272 and 273 to

J Warwick Holdings Ltd for a new 15-year term, with rolling tenant

break options every three years at a rent of GBP79,000 per annum.

The tenant has the benefit of a six-month rent-free period. The

property is now fully let.

Diamond Business Park (industrial) - the Company has settled

Compac UK's July 2023 RPI rent review at GBP53,517 per annum,

representing an GBP11,517 per annum (circa 27%) increase. The unit

is still considered under-rented, with an ERV of GBP4.00 per sq ft,

compared to the new passing rent of GBP3.90 per sq ft.

The Company has also settled Economy Packaging Ltd's August 2023

open market rent review at GBP79,065 per annum, representing a

GBP26,565 per annum (circa 50%) increase. This letting equates to

GBP3.75 per sq ft and will provide good evidence for further asset

management activity.

Westlands Distribution Park, Weston-Super-Mare (industrial) -

the Company has completed a lease renewal with JN Baker who have

extended their occupation of Unit 2A for a further two years from

April 2023, with a mutual break option exercisable after nine

months. The agreed rent is GBP159,000 per annum inclusive of

insurance.

The Company has settled three outstanding April 2022 rent

reviews with North Somerset Council at units 2, 5 and 6. The

combined rental increase is GBP35,864 per annum (circa 20%).

Carr Coatings, Redditch (industrial) - the Company has settled

Carrs Coatings Ltd's August 2023 annual uncapped RPI rent review at

GBP294,348 per annum (GBP7.75 per sq ft), representing a GBP24,385

per annum (circa 9%) increase. The unit is single-let to Carrs

Coatings Ltd until August 2028. The lease was entered into as a

sale and leaseback in 2008 at an initial starting rent of

GBP170,300 per annum (GBP4.50 psf).

Glossary of Commonly Used Terms

For assistance with the interpretation of any industry specific

terms used in the Company's communications, please refer to our

glossary of commonly used terms which can be found on the Company's

website in the following location:

https://www.aewukreit.com/investors/glossary

AEW UK

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Henry Butt henry.butt@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the Financial

Conduct Authority and admitted to trading on the Main Market of the

London Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW

AEW is one of the world's largest real estate asset managers,

with EUR83.1bn of assets under management as at 30 June 2023. AEW

has over 890 employees, with its main offices located in Boston,

London, Paris and Hong Kong and offers a wide range of real estate

investment products including comingled funds, separate accounts

and securities mandates across the full spectrum of investment

strategies. AEW represents the real estate asset management

platform of Natixis Investment Managers, one of the largest asset

managers in the world.

As at 30 June 2023, AEW managed EUR39.0bn of real estate assets

in Europe on behalf of a number of funds and separate accounts. AEW

has over 485 employees based in 10 office across Europe and has a

long track record of successfully implementing core, value-add and

opportunistic investment strategies on behalf of its clients. In

the last five years, AEW has invested and divested a total volume

of over EUR21bn of real estate across European markets.

www.aew.com

AEW UK Investment Management LLP is the Investment Manager. AEW

is a group of companies which includes AEW Europe SA and its

subsidiaries as well as affiliated company AEW Capital Management,

L.P. in North America and its subsidiaries. AEW Europe SA, together

with its subsidiaries AEW UK Investment Management LLP, AEW

S.à.r.l., AEW Invest GmbH and AEW SAS, is a European real estate

investment manager with headquarter offices in Paris and London.

AEW Europe SA and AEW Capital Management, L.P. are owned by Natixis

Investment Managers. Natixis Investment Managers is an

international asset management group based in Paris, France, that

is principally owned by Natixis, a French investment banking and

financial services firm. Natixis is principally owned by BPCE,

France's second largest banking group.

Disclaimer

This communication cannot be relied upon as the basis on which

to make a decision to invest in AEWU. This communication does not

constitute an invitation or inducement to subscribe to any

particular investment. Issued by AEW UK Investment Management LLP,

33 Jermyn Street, London, SW1Y 6DN.

Company number : OC367686 England. Authorised and regulated by

the Financial Conduct Authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMPBATMTABBBJ

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

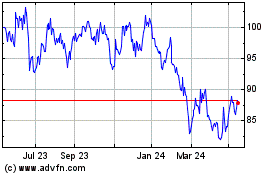

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Oct 2024 to Nov 2024

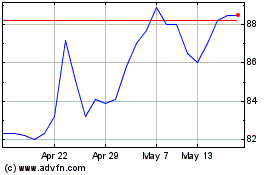

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Nov 2023 to Nov 2024