TIDMAEWU

RNS Number : 2618H

AEW UK REIT PLC

27 November 2015

NAV Update and Dividend Declaration for the period 1 August to

31 October 2015

27 November 2015

AEW UK REIT plc (LSE: AEWU) (the "Company") announces its Net

Asset Value and interim dividend for the period ended 31 October

2015.

Highlights

-- 12 Properties acquired during the period for total of

GBP47.71 million (net of acquisition costs).

-- Fair Value independent valuation of the property portfolio as

at 31 October 2015 of GBP71.36 million. Acquisitions costs on new

property purchases have been written-off. The valuation of the

property portfolio on a like for like basis compared with 31 July

2015 has increased by 1.31%.

-- AEW UK Core Property Fund valuation of GBP9.94 million.

-- The Company has secured a GBP40m 5 year term loan facility

with RBS International. This facility will provide gearing up to

20% loan to Net Asset Value measured at drawdown.

-- NAV per share at 31 October 2015 of 97.09 pence.

-- Earnings per share (excluding revaluation gains and losses on

fair value of investments) for the period from inception of the

Company to 31 October 2015 of 1.36 pence per share ('PPS').

-- Earnings per share (excluding revaluation gains and losses on

fair value of investments) as adjusted for amounts received from

rental guarantees and rental top-ups for the period from inception

of the Company to 31 October of 1.53 pps.

Net Asset Value

The Company's unaudited NAV as at 31 October 2015 was GBP97.58m,

or 97.09 pence per share. As at 31 October 2015, the Company owned

investment properties with a Fair Value of GBP71.36m. The Company's

investment in AEW UK Core Property Fund is valued at GBP9.94m and

the Company had cash balances of GBP15.8m for capital

investment.

Pence per GBP

share million

NAV at 1 August 2015 97.12 97.60

Portfolio acquisition costs (2.47) (2.47)

Valuation change in property portfolio 1.09 1.09

Valuation change in AEW UK Core

Property Fund 0.15 0.15

Income earned for the period 1.47 1.48

Expenses for the period (0.27) (0.27)

NAV at 31 October 2015 97.09 97.58

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards and incorporates

the independent portfolio valuation as at 31 October 2015 and

income for the period but does not include a provision for the

first interim dividend, which will be paid in December 2015.

Dividend

The Company announces an interim dividend of 1.50 pps for the

period from the inception of the Company to 31 October 2015. The

dividend payment will be made on 31 December 2015 to shareholders

on the register as at 11 December 2015. The ex-dividend date will

be 10 December 2015.

The dividend of 1.50 pps will be designated 1.50 pps as an

interim property income distribution ('PID').

Portfolio activity

During the 3 month period ending 31 October 2015, the Company

has acquired a further 12 properties as described below:

225 Bath Street, Glasgow was purchased for GBP12.2 million

(including an amount for rent top up; net of acquisition costs).

This property comprises a refurbished 87,827 square foot office

building and is currently fully let to 6 tenants. This property has

a net initial yield of 10.0% and a weighted average unexpired lease

term ("WAULT") of 2.3 years to break and 4.5 years to expiry. The

Estimated Rental Value ('ERV') for the property is just over

GBP1,315,000 which equates to a reversionary yield of 10.2%.

Valley Retail Park, Belfast was purchased for GBP7.15 million

(net of acquisition costs). This property is a modern 100,413

square foot retail park located in Newtonabbey, Belfast. This

property has a net initial yield of 12.8% and a WAULT of 3.5 years

to break and 7 years to expiry. The ERV for the property is

GBP953,923 and the reversionary yield is 13.8%.

Stoneferry Retail Park, Hull was purchased for GBP2.16 million

(net of acquisition costs). Stoneferry Retail Park occupies a

prominent roundabout site totalling 17,656 sq ft approximately 2

miles to the north of Hull city centre. The scheme comprises 2

retail warehouse units along with a drive thru Burger King and 113

customer parking spaces. This property has a net initial yield of

10.0% and a WAULT of just under 7 years to expiry. The ERV for the

property is GBP210,481 and a reversionary yield of 9.2%.

710 Brightside Lane, Sheffield was purchased for GBP3.5 million

(net of acquisition costs). This property is located to the

north-east of Sheffield, with good access from both the city centre

and the M1 and within one mile of the Meadowhall Shopping Centre.

This property has a net initial yield of 9.5% and the lease

provides for a tenant break option in just under 10 years' time.

The ERV for the property is GBP350,000 and the reversionary yield

is 9.5%.

Vantage Point, 23 Mark Road, Hemel Hempstead was purchased for

GBP2.18 million (net of acquisition costs). This property comprises

a two storey office building of 18,407 sq ft located within the

established Maylands Business Park. The property is fully let to

two tenants, providing a WAULT of 5 years to break and 9.4 years to

expiry. This property has a net initial yield of 8.4%. The ERV for

the property is GBP193,722 and the reversionary yield is 8.4%.

11-15 Fargate & 18-36 Chapel Walk, Sheffield was purchased

for GBP5.3 million (net of acquisition costs). This property

provides a total of 40,128 sq ft with 8 retail units spread over

basement, ground and first floors. Tenants include Paperchase, H

Samuel and Claire's Accessories with the lettings providing a WAULT

of 3.8 years to break and 5.3 years to expiry. This property has a

net initial yield of 8.25%, inclusive of rental guarantees. The ERV

for the property is GBP487,500 and the reversionary yield is

9.1%.

Barnstaple Retail Park was purchased for GBP6.79m (net of

acquisition costs). This property comprises a fully let retail

warehouse scheme, extending to 50,950 sq ft. The Park is anchored

by a 35,690 sq ft B&Q store and includes a 9,605 sq ft unit let

to Sports Direct and a 5,717 sq ft unit let to Poundland. This

property has a net initial yield of 8.5% and a WAULT of 7.3 years

to break and 8.6 years to expiry. The ERV for the property is

GBP610,680 and the reversionary yield is 8.5%.

Carrs Coatings, Eagle Road, Redditch was purchased for GBP2.0m

(net of acquisition costs). This property is located on the

established North Moons Moat Industrial Estate to the east of

Redditch, a short distance from Junction 3 of the M42. The site

extends to circa 1.7 acres and accommodates an industrial warehouse

building of 37,833 sq ft. This property has a net initial yield of

9.5% and the reversionary yield is 7.5%. The property is single let

to Carrs Coatings Ltd providing an unexpired terms of 13 years with

annual fixed rental uplifts in line with RPI. The ERV for the

property is GBP170,249.

A portfolio comprising of 3 industrial warehouses was purchased

for GBP3.06m (net of acquisition costs). This portfolio comprises

of properites in Swinton, Mossley and Milton Keynes, all trading as

Nationwide Crash Repair Centres. The leases, expiring in August

2023, provide a WAULT of just under 8 years and product a total

rental income of GBP269,000 per annum which is considered to be

rack rented. The portfolio has a net initial yield and reversionary

yield of 8.3%.

Units 1001-1004, Sarus Court, Runcorn was purchased for GBP3.37m

(net of acquisition costs). The site extends to 3.6 acres and

accommodates four industrial warehouse buildings totalling 56,153

sq ft. The property is fully let to two tenants on four leases

providing a WAULT of 3.8 years to break and 5.2 years to expiry.

The property has a net initial yield is 8.0% and a reversionary

yield of 7.9%. The ERV for the property is GBP280,765.

The sector weighting, by value, of the direct investment

portfolio as at 31 October 2015 was 39.6% offices, 43.7% retail and

16.7% industrial.

Post quarter end activity

The Company has made 2 further acquisitions during November 2015

and has approximately GBP88 million invested.

Equinox, Castlegate Business Park, Salisbury was purchased for

GBP2.0 million (net of acquisition costs). This property is

situated at the western end of Castlegate Business Park, an

established industrial area located 3 miles north of Salisbury town

centre. This property has a net initial yield of 11.3% and a WAULT

of 1 year to break and 6 years to expiry. The ERV for the property

is GBP195,000 and the reversionary yield is 9.2%.

Langthwaite Business Park, South Kirkby was purchased for GBP5.8

million (net of acquisition costs). This Business Park consists of

two neighbouring industrial warehouses totalling 221,145 sq ft, let

to Ardagh Glass Limited with a WAULT of c. 1 year to break and 2.5

years to expiry. The properties have a net initial yield of 11% and

a reversionary yield of 12%. The ERV for the properties totals just

over GBP742,000.

Taking into account the above acquisitions, the sector weighting

by value of the direct investment portfolio as at 27 November 2015

was 35.7% offices, 39.4% retail and 24.9% industrial.

The Company will publish the unaudited half yearly report for

the period ended 31 October 2015 during December 2015.

Portfolio Manager's comment

(MORE TO FOLLOW) Dow Jones Newswires

November 27, 2015 11:27 ET (16:27 GMT)

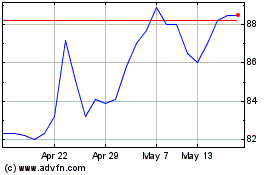

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2024 to Jul 2024

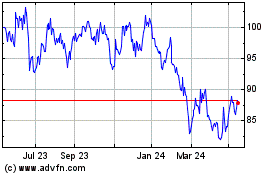

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jul 2023 to Jul 2024