UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

|

|

ý

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Quarter Ended March 31, 2009

OR

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period from

to ________

Woodstock Financial Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Georgia

|

|

6211

|

|

58-2161804

|

|

(State of Jurisdiction of Incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

117 Towne Lake Pkwy, Ste 200

Woodstock, Georgia

|

|

30188

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

770-516-6996

(Telephone Number)

Raike Financial Group, Inc.

(Former name)

Check whether the issuer: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES

X

NO __

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or small reporting company in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer

|

£

|

|

Accelerated filer

|

£

|

|

Non-accelerated filer

|

£

|

|

Smaller reporting company

|

S

|

|

(Do not check if smaller reporting company)

|

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).___ Yes

X

No

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 17,619,028 shares of common stock, $.01 par value per share, issued and outstanding as of May 1, 2009.

WOODSTOCK FINANCIAL GROUP, INC.

INDEX

|

|

|

|

|

|

|

|

|

Page No.

|

|

PART I

|

FINANCIAL STATEMENTS

|

|

|

|

|

|

|

|

|

Item 1.

|

Financial Statements

|

|

3

|

|

|

Balance Sheets (unaudited) at March 31, 2009 and (audited) at December 31, 2008

|

|

3

|

|

|

Statements of Operations (unaudited) for the Three Months Ended

March 31, 2009 and 2008

|

|

4

|

|

|

Statements of Cash Flows (unaudited) for the Three Months Ended

March 2009 and 2008

|

|

5

|

|

|

Notes to Financial Statements (unaudited)

|

|

6

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

|

|

8

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

10

|

|

Item 4.

|

Controls and Procedures

|

|

10

|

|

|

|

|

|

|

PART II

|

OTHER INFORMATION

|

|

|

|

|

|

|

|

|

Item 1.

|

Legal Proceedings

|

|

11

|

|

Item 1A.

|

Risk Factors

|

|

11

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

|

11

|

|

Item 3.

|

Defaults Upon Senior Securities

|

|

11

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

|

11

|

|

Item 5.

|

Other Information

|

|

11

|

|

Item 6.

|

Exhibits

|

|

11

|

This Report contains statements which constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements appear in a number of places in this Report and include all statements regarding the intent, belief or current expectations of the Company, its directors or its officers with respect to, among other things: (1) the Company’s financing plans; (2) trends affecting the Company’s financial condition or results of operations; (3) the Company’s growth strategy and operating strategy; and (4) the declaration and payment of dividends. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors discussed herein and those factors discussed in detail in the Company’s filings with the Securities and Exchange Commission.

-2-

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

WOODSTOCK FINANCIAL GROUP, INC.

Balance Sheets

|

|

|

|

|

|

|

|

|

March 30,

|

|

December 31,

|

|

|

|

2009

|

|

2008

|

|

|

|

(unaudited)

|

|

(audited)

|

|

Assets

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

633,945

|

|

976,450

|

|

Clearing deposit

|

|

130,964

|

|

130,887

|

|

Commissions receivable

|

|

532,348

|

|

555,309

|

|

Furniture, fixtures, and equipment, at cost, net of accumulated

|

|

|

|

|

|

depreciation of $160,627 and $157,892, respectively

|

|

23,338

|

|

25,786

|

|

Building, net of accumulated depreciation of $112,930 and

$104,253 respectively

|

|

1,164,357

|

|

1,173,035

|

|

Other assets

|

|

230,839

|

|

78,829

|

|

|

|

|

|

|

|

|

$

|

2,715,791

|

|

2,940,296

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

Accounts payable

|

$

|

25,047

|

|

46,710

|

|

Commissions payable

|

|

414,825

|

|

427,426

|

|

Preferred dividends payable

|

|

15,137

|

|

30,274

|

|

Other liabilities

|

|

3,450

|

|

3,479

|

|

Long term mortgage payable

|

|

963,524

|

|

967,408

|

|

|

|

|

|

|

|

Total Liabilities

|

|

1,421,983

|

|

1,475,297

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

Series A preferred stock of $.01 par value;

|

|

|

|

|

|

5,000,000 shares authorized,

|

|

|

|

|

|

86,500 shares issued and outstanding

(liquidation value of $865,000)

|

|

865

|

|

865

|

|

Common stock of $.01 par value; 50,000,000 shares authorized;

|

|

|

|

|

|

17,941,772 shares issued

|

|

179,418

|

|

179,418

|

|

Additional paid-in capital

|

|

3,689,778

|

|

3,689,778

|

|

Accumulated deficit

|

|

(2,420,298)

|

|

(2,249,107)

|

|

Treasury stock 322,744 shares, carried at cost

|

|

(155,955)

|

|

(155,955)

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

1,293,808

|

|

1,464,999

|

|

|

|

|

|

|

|

|

$

|

2,715,791

|

|

2,940,296

|

See accompanying notes to unaudited financial statements.

-3-

WOODSTOCK FINANCIAL GROUP, INC.

Statements of Operations

(unaudited)

For the Three Months Ended March 31, 2009 and 2008

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

March 31,

|

|

|

|

2009

|

|

2008

|

|

|

|

|

|

|

|

Operating income:

|

|

|

|

|

|

Commissions

|

$

|

1,438,942

|

|

1,860,494

|

|

Interest income

|

|

31,770

|

|

41,471

|

|

Other fees

|

|

124,234

|

|

197,482

|

|

|

|

|

|

|

|

Total operating income

|

|

1,594,946

|

|

2,099,447

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

Commissions to brokers

|

|

1,195,723

|

|

1,560,199

|

|

Clearing costs

|

|

35,719

|

|

41,625

|

|

Selling, general and administrative expenses

|

|

519,557

|

|

516,634

|

|

|

|

|

|

|

|

Total operating expenses

|

|

1,750,999

|

|

2,118,458

|

|

|

|

|

|

|

|

Net loss

|

$

|

(156,053)

|

|

(19,011)

|

|

|

|

|

|

|

|

Basic and diluted loss per share

|

$

|

(0.01)

|

|

(0.00)

|

See accompanying notes to unaudited financial statements.

-4-

WOODSTOCK FINANCIAL GROUP, INC.

Statements of Cash Flows

(unaudited)

For the Three Months Ended March 31, 2009 and 2008

|

|

|

|

|

|

|

|

|

2009

|

|

2008

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

Net income (loss)

|

$

|

(156,053)

|

|

(19,011)

|

|

Adjustments to reconcile net earnings to net cash used

|

|

|

|

|

|

by operating activities:

|

|

|

|

|

|

Depreciation

|

|

11,412

|

|

13,277

|

|

Change in commissions and fees receivable

|

|

22,961

|

|

56,853

|

|

Change in other assets

|

|

(152,087)

|

|

8,971

|

|

Change in accounts payable

|

|

(21,663)

|

|

(9,683)

|

|

Change in commissions payable

|

|

(12,601)

|

|

(75,780)

|

|

Change in other liabilities

|

|

(29)

|

|

(276)

|

|

|

|

|

|

|

|

Net cash provided (used) by operating activities

|

|

(308,060)

|

|

(25,649)

|

|

|

|

|

|

|

|

Cash flows used by investing activities consisting of

|

|

|

|

|

|

purchases of furniture, fixtures and equipment

|

|

(287)

|

|

(1,712)

|

|

|

|

|

|

|

|

Cash flows used by financing activities:

|

|

|

|

|

|

Cash dividends paid on preferred stock

|

|

(30,274)

|

|

(30,274)

|

|

Repayment of borrowings

|

|

(3,884)

|

|

(3,365)

|

|

|

|

|

|

|

|

Net cash used by financing activities

|

|

(34,158)

|

|

(33,639)

|

|

|

|

|

|

|

|

Net change in cash

|

|

(342,505)

|

|

(61,000)

|

|

|

|

|

|

|

|

Cash at beginning of period

|

|

975,450

|

|

1,118,542

|

|

|

|

|

|

|

|

Cash at end of period

|

$

|

633,945

|

|

1,057,542

|

|

|

|

|

|

|

|

Supplemental cash flow information:

|

|

|

|

|

|

Cash paid for interest

|

$

|

20,528

|

|

21,031

|

See accompanying notes to unaudited financial statements.

-5-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements

(1)

Organization

Woodstock Financial Group, Inc. (the “Company”) is a full service securities brokerage firm, which has been in business since 1995. The Company is registered as a broker-dealer with the Financial Industry Regulatory Authority (“FINRA”) in 49 states, Puerto Rico, Washington D.C. and also as a municipal securities dealer with the Municipal Securities Regulation Board (“MSRB”). The Company is subject to net capital and other regulations of the U.S. Securities and Exchange Commission (“SEC”). The Company offers full service commission and fee-based money management services to individual and institutional investors. The Company maintains a custody-clearing relationship with Southwest Securities, Inc. In 2005, the Company, as a registered investment advisor, created a managed account program named “RFG Stars”. Through the RFG Stars Program, the Company provides investment advisory services to clients. All RFG Stars Program client accounts are maintained with Fidelity Registered Investment Advisor Group (“FRIAG”), an arm of Fidelity Investments. FRIAG provides brokerage, custody, and clearing services to RFG Stars Program clients.

The interim financial statements included herein are unaudited but reflect all adjustments which, in the opinion of management, are necessary for a fair presentation of the financial position and results of operations for the interim period presented. All such adjustments are of a normal recurring nature. The results of operations for the period ended March 31, 2009 are not necessarily indicative of the results of a full year’s operations.

The accounting principles followed by the Company and the methods of applying these principles conform with accounting principles generally accepted in the United States of America (GAAP). In preparing financial statements in conformity with GAAP, management is required to make estimates and assumptions that affect the reported amounts in the financial statements. Actual results could differ significantly from those estimates.

(2)

Stock-Based Compensation

The Company sponsors a stock-based incentive compensation plan for the benefit of certain employees.

The Company did not grant any options during the first quarter of 2009 and did not recognize any related expense during the period.

(3)

Recent Accounting Pronouncements

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” (SFAS 162). This standard identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with GAAP. SFAS 162 is effective as of November 15, 2008. The adoption of this standard did not have an effect on our financial position or results of operations.

The following accounting standards that have been issued or proposed by the Financial Accounting Standards Board and other standard setting entities that do not require adoption until a future date are not expected to have a material impact on the Company’s financial statements upon adoption.

In December 2007, the FASB issued SFAS No. 141(R) “Business Combinations.” This Statement replaces the original SFAS No. 141. This Statement retains the fundamental requirements in SFAS No. 141 that the acquisition method of accounting (which SFAS No. 141 called the

purchase method

) be used for all business combinations and for an acquirer to be identified for each business combination. The objective of SFAS No. 141(R) is to improve the relevance, and comparability of the information that a reporting entity provides in its financial reports about a business combination and its effects. To accomplish that, SFAS No. 141(R) establishes principles and requirements for how the acquirer:

a.

Recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree.

b.

Recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase.

c.

Determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination.

-6-

WOODSTOCK FINANCIAL GROUP, INC.

Notes to Financial Statements, continued

Recent Accounting Pronouncements, continued

This Statement applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008 and may not be applied before that date. The Company does not expect that its adoption of SFAS No. 141(R) will have a material effect on the results of operations and financial condition.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements — an amendment of ARB No. 51” (SFAS 160). The purpose of SFAS 160 is to improve relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 is effective for fiscal years beginning on or after December 15, 2008, with earlier adoption prohibited. The Company does not expect the adoption of this standard to have an effect on its financial position or results of operations.

-7-

Item 2.

WOODSTOCK FINANCIAL GROUP, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

For the Three Months Ended March 31, 2009 and 2008

OVERVIEW

The following discussion should be read in conjunction with the Financial Statements of the Company and the Notes thereto appearing elsewhere herein.

FORWARD-LOOKING STATEMENTS

The following is our discussion and analysis of certain significant factors that have affected our financial position and operating results during the periods included in the accompanying financial statements. This commentary should be read in conjunction with the financial statements and the related notes and the other statistical information included in this report.

This report contains “forward-looking statements” relating to, without limitation, future economic performance, plans and objectives of management for future operations, and projections of revenues and other financial items that are based on the beliefs of management, as well as assumptions made by and information currently available to management. The words “may,” “will,” “anticipate,” “should,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” and “intend,” as well as other similar words and expressions of the future, are intended to identify forward-looking statements. Our actual results may differ materially from the results discussed in the forward-looking statements, and our operating performance each quarter is subject to various risks and uncertainties that are discussed in detail in our filings with the Securities and Exchange Commission, including, without limitation:

·

significant increases in competitive pressure in the financial services industries;

·

changes in political conditions or the legislative or regulatory environment;

·

general economic conditions, either nationally or regionally and especially in our primary service area, becoming less favorable than expected;

·

changes occurring in business conditions and inflation;

·

changes in technology;

·

changes in monetary and tax policies;

·

changes in the securities markets; and

·

other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission.

OVERVIEW AND GENERAL INDUSTRY CONDITIONS

Our primary sources of revenue are commissions earned from brokerage services. Our principal business activities are, by their nature, affected by many factors, including general economic and financial conditions, movement of interest rates, security valuations in the marketplace, regulatory changes, competitive conditions, transaction volume and market liquidity. Consequently, brokerage commission revenue and investment banking fees can be volatile. While we seek to maintain cost controls, a significant portion of our expenses is fixed and does not vary with market activity. As a result, substantial fluctuations can occur in our revenue and net income from period to period.

The Company is a licensed insurance broker and we receive commission revenue as a result of our insurance operations. The Company continues to grow this business; however does not regard insurance revenue as material at this time.

-8-

Item 2.

WOODSTOCK FINANCIAL GROUP, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS, continued

For the Three Months Ended March 31, 2009 and 2008

RESULTS OF OPERATIONS – QUARTERS ENDED MARCH 31, 2009 AND 2008

Total revenue for the quarter ended March 31, 2009 decreased by $504,501 or by 24% to $1,594,946 from $2,099,447 for the comparable period in 2008.

Commission revenue decreased by $421,552 or 23% to $1,438,942 from $1,860,494 for the comparable period in 2008.

This decrease was principally due to a slight decrease in transactional business and also a decrease in commissions charged to customers’ accounts per transaction. Concessions were made on commissions charged to customers in order to retain business.

Interest income decreased by $9,701 or 23% during the quarter ended March 31, 2009 compared to the same period in 2008. This decrease in interest earned is from margin accounts and customer accounts held by our clearing agent is due primarily to a decrease in the Company’s marginal rate received and the overall declining short-term rates in the market place.

Fees from clearing transaction charges and other income decreased by $73,248 or 37% for the quarter ended March 31, 2009 compared to the same period in 2008. This decrease is due to the decrease in transactional fees due to in part to lower volume as well as a reduction in the clearing fees passed on to customers per transaction, in order to retain business during a time when financial markets have experienced a down turn.

Total operating expenses for the quarter ended March 31, 2009 decreased by $367,459 or 17% to $1,750,999 from $2,118,458 for the same period in 2008. The decreased expense was due primarily to the decrease commission paid to brokers, which correlates to the decrease in commission revenue.

Commissions to brokers decreased by $364,476 or 23% to $1,195,723 for the quarter ended March 31, 2009 from $1,560,199 in the prior year. This decrease coincides with the decrease in commission revenue during the quarter.

Clearing costs were $35,719 for the quarter ended March 31, 2009 from $41,625 the prior year

.

As a percentage of commission income clearing costs were 2.5% in 2009 compared to 2.2% in 2008.

Selling, general and administrative expense increased $2,923 or 1% to $519,557 for the quarter ended March 31, 2009 from $516,634 in the prior year.

Net loss was $156,053 for the quarter ended March 31, 2009 compared to a net loss of $19,011 for the comparable period in prior year.

LIQUIDITY AND CAPITAL RESOURCES

Our assets are reasonably liquid with a substantial majority consisting of cash and cash equivalents, and receivables from other broker-dealers and our clearing agent, all of which fluctuate depending upon the levels of customer business and trading activity. Receivables from broker-dealers and our clearing agent turn over rapidly. Both our total assets as well as the individual components as a percentage of total assets may vary significantly from period to period because of changes relating to customer demand, economic, market conditions and proprietary trading strategies. Our total net assets at March 31, 2009 were $1,293,808 of which $633,945 is cash.

As a broker-dealer, we are subject to the Securities and Exchange Commission Uniform Net Capital Rule (Rule15c3-1). The Rule requires maintenance of minimum net capital and that we maintain a ratio of aggregate indebtedness (as defined) to net capital (as defined) not to exceed 15 to 1. Our minimum net capital requirement is $100,000. Under the Rule we are subject to certain restrictions on the use of capital and its related liquidity. Our net capital position at March 31, 2009 was $838,798 and our ratio of aggregate indebtedness to net capital was .54 to 1.

-9-

Historically, we have financed our operations through cash flow from operations and the private placement of equity securities. We have not employed any significant leverage or debt to fund operating needs.

We believe that our capital structure is adequate for our current operations. We continually review our overall capital and funding needs to ensure that our capital base can support the estimated needs of the business. These reviews take into account business needs as well as the Company's regulatory capital requirements. Based upon these reviews, to take advantage of strong market conditions and to fully implement our expansion strategy, we will continue to pursue avenues to decrease costs and increase our capital position.

The Company's cash and cash equivalents decreased by $342,505 to $633,945 as of March 31, 2009, from $976,450 as of December 31, 2008. This overall decrease was due to net cash used by operating activities of $308,060, cash used in investing activities of $286, and cash used by financing activities of $34,158.

EFFECTS OF INFLATION AND OTHER ECONOMIC FACTORS

Market prices of securities are generally influenced by changes in rates of inflation, changes in interest rates and economic activity generally. Our revenues and net income are, in turn, principally affected by changes in market prices and levels of market activity. Moreover, the rate of inflation affects our expenses, such as employee compensation, occupancy expenses and communications costs, which may not be readily recoverable in the prices of services offered to our customers. To the extent inflation, interest rates or levels of economic activity adversely affect market prices of securities, our financial condition and results of operations will also be adversely affected.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Company does not invest or trade in market sensitive investments.

Item 4.

Controls and Procedures

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures as defined in Exchange Act Rule 13a-15(e). Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that our current disclosure controls and procedures are effective in timely alerting them to material information relating to the Company that is required to be included in the Company’s periodic filings with the Securities and Exchange Commission. There have been no significant changes in the Company’s internal controls over financial reporting during the quarter ended March 31, 2009 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

-10-

PART II. OTHER INFORMATION

Item 1.

Legal Proceedings

Currently, the Company has no pending claims by retail customers. We are the subject of routine examinations by self regulatory organizations including the SEC, FINRA and individual states and are not aware of any regulatory examinations at this time that would have a material impact on the company’s financial position.

Item 1A. Risk Factors

None

Item 2.

Unregistered Sales of Equity Securities and Use of Proceeds

Not applicable.

Item 3.

Defaults Upon Senior Securities

Not applicable.

Item 4.

Submission of Matters to a Vote of Security Holders

None

Item 5.

Other Information

None.

Item 6.

Exhibits

31.1

Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

31.2

Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

32

Certification of the Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

-11-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

WOODSTOCK FINANCIAL GROUP, INC.

Date: May 12, 2009

By: /S/WILLIAM J. RAIKE, III

William J. Raike, III

President, Chief Executive Officer and Director

Date: May 12, 2009

By: /S/MELISSA L. WHITLEY

Melissa L. Whitley

Chief Financial and Accounting Officer

-12-

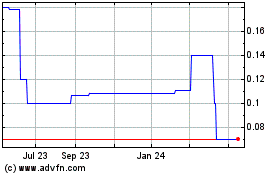

Woodstock (CE) (USOTC:WSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Woodstock (CE) (USOTC:WSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024