Information Statement

Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

[ ]

Preliminary Information Statement

[ ]

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

[X]

Definitive Information Statement

|

|

|

Woodstock Financial Group, Inc.

|

|

(Name of Registrant as Specified in its Charter)

|

Payment of Filing Fee (check the appropriate box):

[X]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(1)

Title of each class of securities to which transaction applies: ______________.

(2)

Aggregate number of securities to which transaction applies: ______________.

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ________________.

(4)

Proposed maximum aggregate value of transaction:_______________.

(5)

Total fee paid: ______________.

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount previously paid: ___________.

(2)

Form, Schedule or Registration Statement No.:_________.

(3)

Filing party: _____________.

(4)

Date filed: ______________.

Woodstock Financial Group, Inc.

117 Towne Lake Parkway, Suite 200

Woodstock, Georgia 30188

Woodstock Financial Group, Inc.

Annual Meeting of Shareholders, April 21, 2009

Information Statement

Pursuant to Section 14(c) of the Securities Exchange Act of 1934

The Rules of the U.S. Securities Exchange Commission require that we provide you with this Information Statement prior to the Annual Meeting

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

The only matter to be acted upon at the Annual Meeting is the election of Directors

Item 1

Date, Time and Place of Meeting

|

|

|

|

DATE:

|

April 21, 2009

|

|

TIME:

|

10:00 a.m.

|

|

PLACE:

|

117 Towne Lake Parkway, Suite 200

Woodstock, Georgia 30188

|

Item 2

.

Voting Securities and Percentage Required

|

|

|

|

Voting Securities:

|

17,619,028 shares of Common Stock each entitled to one (1) vote per share.

|

|

|

|

|

Record Date:

|

March 31, 2009

|

|

|

|

|

Percentage Required:

|

51% of shares present and voting

|

Item 3.

Principal Holders of Common Stock

The following table sets forth the record ownership of our Common Stock as of December 31, 2008, as to (i) each person or entity who owns more than five percent (5%) of any class of our Securities (including those shares subject to outstanding options), (ii) each person named in the table appearing in "Remuneration of Directors and Officers", and (iii) all officers and directors of the Company as a group.

|

|

|

|

|

|

|

Name & Address

|

|

Shares Owned

|

|

Percent of Class

|

|

|

|

|

|

|

|

William J. Raike III

|

|

14,647,000

|

|

83.02%

|

|

|

|

|

|

|

|

Officers & Directors as a Group

|

|

14,687,000

|

|

83.25%

|

To the best of our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock owned by them, subject to community property laws where applicable. The above referenced number of shares does not include shares available upon exercise of the options described below.

Item 4.

Directors and Executive Officers

Set forth below is information regarding our directors and executive officers. We have no other management employees besides those described below, and there are currently no other persons under consideration to become directors or executive officers.

|

|

|

|

|

|

|

NAME

|

|

AGE

|

|

POSITION

|

|

|

|

|

|

|

|

William J. Raike, III

|

|

50

|

|

Chairman, President and CEO

|

|

Melissa L. Whitley

|

|

32

|

|

Treasurer, CFO and Director

|

|

Morris L. Brunson

|

|

69

|

|

Director

|

|

William D. Bertsche

|

|

64

|

|

Director

|

|

Geoffrey T. Chalmers

|

|

73

|

|

Director

|

The Board of Directors has designated an Audit Committee of the Board of Directors consisting of one member, which will review the scope of accounting audits, review with the independent auditors the corporate accounting practices and policies and recommend to whom reports should be submitted within the Company, review with the independent auditors their final report, review with independent auditors overall accounting and financial controls, and be available to the independent auditors during the year for consultation purposes. The Board of Directors has also designated a Compensation Committee of the Board of Directors consisting of three Directors, which will review the performance of senior management, recommend appropriate compensation levels and approve the issuance of stock options pursuant to the Company's stock option plan. All Directors and officers of the Company serve until their successors are duly elected and qualify.

The Audit Committee consists of Morris Brunson.

The Compensation Committee consists of Morris Brunson, William Raike, and William Bertsche.

William J. Raike, III, Chairman, President and CEO (Since 1995)

Mr. Raike has been licensed in the financial services industry for approximately 20 years. His brokerage career began as a financial representative in 1985 with an FINRA member brokerage headquartered in Denver, Colorado. In 1988, Mr. Raike accepted a position as Vice President and Branch Manager of the Atlanta, Georgia regional office. Mr. Raike later joined Davenport & Company, a NYSE member firm headquartered in Richmond, Virginia and subsequently owned an independently operated branch office of an FINRA member firm. Mr. Raike formed Raike Financial Group, Inc. in March of 1995 and was successful in growing the company from tworegistered representatives and approximately $200,000 in revenues to over 100 representatives and close to $10,000,000 in revenues by year2000. Mr. Raike currently holds positions as Chairman of the Board,Chief Executive Officer and President and is licensed with the Series 4 (Registered Options Principal), 7 (General Securities Representative), 24 (General Securities Principal), 55 Equity Trader), 63 (State Securities License).

Melissa L. Whitley, Treasurer, CFO and Director (Since 2003)

Mrs. Whitley has been with Woodstock Financial Group, Inc. since its inception in March 1995. Prior to joining Woodstock Financial, she was the operations manager of an independently owned OSJ branch office. Mrs. Whitley has served in several capacities during her tenure at Raike Financial including: trading operations, administrative operations, as well as accounting and payroll. Mrs. Whitley currently holds a Series 27 Financial Operations Principal License.

Morris L. Brunson, Director (Since 1995)

Mr. Brunson graduated from Berry College in 1958 with a degree in Business Administration with a concentration in Accounting. His career has been spent in the accounting and financial areas primarily in the health care business. He was the Accounting Manager for Floyd Medical Center, a Cost Accountant for Ledbetter Construction Co. and has held several positions at the American Red Cross and the United Way. He retired from the firm in 1998 and Currently resides in Georgia.

William D. Bertsche, Director (Since 1995)

Mr. Bertsche was educated at Santa Rosa College in Santa Rosa, California and at River Falls College in Wisconsin. At an early age, Mr. Bertsche managed a family business in the dairy industry and since has managed private business ventures in the private security industry. He is an entrepreneur and has been selfemployed for the better part of his life and currently resides in Virginia.

Geoffrey T. Chalmers, Director (Since 2003)

Mr. Chalmers is a graduate of Harvard College and Columbia Law School. He has been a practicing attorney for over 35 years in corporate and securities law, having acted as general counsel to several public and private companies, including broker dealers. He is engaged in private practice.

Item 5.

Executive Compensation

The following table sets forth the current annual salary of our highest-paid officer:

|

|

|

|

|

|

|

Name or Group

|

|

Title

|

|

Compensation

|

|

|

|

|

|

|

|

William J. Raike, III

|

|

Chairman, President and CEO

|

|

$331,040

|

|

|

|

|

|

|

|

TOTAL SALARIES FOR THE YEAR 2008

OF OFFICERS AND DIRECTORS AS A GROUP EXCLUDING W.J. RAIKE

|

|

|

|

$52,698

|

The total bonus earned in 2008 by Mr. Raike was $201,040.

In January, 1998 our Board Adopted the Raike Financial Stock Option Plan and authorized the reservation of 800,000 shares of our Common Stock for issuance pursuant to the Plan. The Plan is intended to provide qualified stock options under the Internal Revenue Code to employees, registered representatives, consultants and others in the service of the Company, in recognition of services rendered.

The options are to be issued upon such terms and restrictions as shall be determined by the Compensation Committee of our Board of Directors.

Neither the options nor the underlying Common Stock are registered for public sale under the securities laws. The options Common Stock cannot be transferred unless so registered or pursuant to an opinion of counsel that such registration is not required. In December 1998, we adopted the 1998 Employee Stock Option Plan, (the "Plan"). See below under "Executive Compensation." During 1998, 1999 and 2000 the Company did not grant any options or issue any shares under the Plan.

In 2001 555,500 options were issued to 21 persons. In 2002 no options were issued. In 2003, 14,500 options were issued. In 2004, 2005 and 2006 no options were issued.

In May 2007, the Board of Directors approved increasing the total shares available for potential future option grants to 25 million shares. During July 2007, 2,257,000 options were issued.

No directors and officers currently hold any options.

Item 6.

Certain Relationships

The majority shareholder receives consulting fees in the amount of $130,000 annually. In addition, the Company pays a bonus equal to 2.5% of revenues to the majority shareholder. The majority shareholder's spouse also receives consulting fees of $120,000 annually. During the year ended December 31, 2008 and 2007, the majority shareholder earned a bonus of $201,040 and $202,914, respectively.

Item 7.

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

There have been no changes in accountants or disagreements with accountants on accounting and financial disclosure during 2008 or through March 31, 2009.

Item 8.

Financial Information

Further financial information may be found in the Company's reports filed with the U.S. Securities Exchange Commission at www.sec.gov. Copies of these reports will be furnished on request by calling (770) 516-6996.

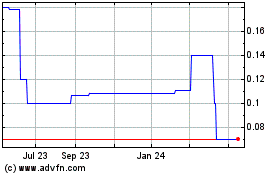

Woodstock (CE) (USOTC:WSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Woodstock (CE) (USOTC:WSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024