Regulatory News:

Vivendi (Paris:VIV):

Change at constant

currency and

Change perimeter(1)

First Half 2020 Key Figures year-on-year year-on-year

Revenues EUR7,576 M +3.0% -2.0%

EBITA(2,3) EUR735 M +2.4% -3.8%

EBIT(3) EUR660 M +2.3%

Earnings attributable to

Vivendi SE

shareowners(3) EUR757 M +45.7%

Adjusted net income(2,3) EUR583 M +5.4%

This press release contains unaudited condensed financial

results established under IFRS, which were approved by Vivendi's

Management Board on July 27, 2020, and reviewed by the Vivendi

Audit Committee on July 28, 2020, and by Vivendi's Supervisory

Board on July 30, 2020.

Vivendi's Supervisory Board met today under the chairmanship of

Yannick Bolloré and reviewed the Group's financial results for the

half-year ended June 30, 2020, which were approved by the

Management Board on July 27, 2020.

-- For the first half of 2020, revenueswere EUR7,576 million, up to 3.0%

(-2.0% at constant currency and perimeter) compared to the first half of

2019. This increase was mainly due to the growth in revenues of Vivendi's

two main businesses, UMG and Canal+ Group, demonstrating the resilience

of their subscription-related activities. The increase was partially

offset by the slowdown in the revenues of Havas Group and Vivendi Village,

which were affected by the COVID-19 pandemic. For the second quarter of

2020, affected by the lockdown measures taken in most countries, revenues

were EUR3,706 million, down 4.8% (-7.9% at constant currency and

perimeter) compared to the second quarter of 2019.

-- EBITA was EUR735 million, an increase of 2.4% compared to the first half

of 2019 (-3.8% at constant currency and perimeter). The EBITA growth at

Universal Music Group (+EUR81 million) and Canal+ Group (+EUR20 million)

was notably offset by the EBITA slowdown at Havas Group (-EUR67 million).

-- Other financial charges and income were a net income of EUR417 million,

compared to a net income of EUR91 million for the first half of 2019,

representing a favorable change of EUR326 million. This amount included

the revaluation of the interests in Spotify and Tencent Music for a net

amount of EUR449 million, compared to EUR155 million for the same period

in 20194.

-- Provision for income taxes reported to net income was a net charge of

EUR299 million, compared to a net charge of EUR182 million for the same

period in 2019. This change notably reflected the increase in the

deferred tax charge related to the revaluation of the interests in

Spotify and Tencent Music (-EUR110 million, compared to -EUR37 million

for the first half of 2019).

-- Earnings attributable to non-controlling interests were EUR84 million,

compared to EUR10 million for the first half of 2019. This increase

mainly reflected the Tencent-led consortium's share (EUR64 million) of

Universal Music Group's net earnings as from March 31, 2020.

-- Earnings attributable to Vivendi SE shareowners amounted to a profit of

EUR757 million (or EUR0.66 per share - basic), compared to EUR520 million

for the first half of 2019 (or EUR0.41 per share - basic), an increase of

EUR237 million. This change mainly reflected the improvement in other

financial charges and income (+EUR326 million) generated by the

revaluation of the interests in Spotify and Tencent Music (+EUR294

million).

-- Adjusted net income was a profit of EUR583 million (or EUR0.51 per share

- basic), compared to EUR554 million for the first half of 2019 (or

EUR0.44 per share - basic), an increase of 5.4%.

-- The first half of 2020 was marked by strong cash generation (CFFO) of

EUR338 million, compared to EUR36 million in the first half of 2019,

thanks to Canal+ Group and after significant content investments by UMG.

-- Vivendi's balance sheet is particularly healthy. During the first half of

2020, Vivendi's net financial debt fell by EUR1,007 million, from

EUR4,064 million as of December 31, 2019 to EUR3,057 million as of June

30, 2020. This change notably includes a return to shareholders

(dividends and share buybacks) of EUR1.4 billion, compared to EUR3.3

billion in 2019 (dividends and share buybacks), and the sale of 10% of

UMG's share capital for EUR2.8 billion. The Group has significant

financing capacity. As of June 30, 2020, the Group's credit lines

(Vivendi SE and Havas SA) were available in the amount of EUR3.7 billion.

As of June 30, 2020, the average "economic" term of the financial debt,

calculated based on the assumption that available medium-term credit

lines may be used to redeem the group's shortest-term borrowings, is 5.0

years. With consolidated equity of EUR17.4 billion, the gearing rate

(ratio of net debt to equity) was 17.5%.

Although the COVID-19 pandemic is having a more significant

impact on certain countries or businesses than others, Vivendi has

been able to demonstrate resilience and adapt in order to continue

to best serve and entertain its customers, while reducing costs to

preserve its margins. The business activities showed good

resistance, in particular music and pay television. However, as

anticipated when the first-quarter revenues were released, Havas

Group, Vivendi Village and Editis were affected by the effects of

the public health crisis. However, Editis has been enjoying a

strong rebound in its business since the end of the lockdown in

France.

Vivendi carefully analyzes the current and potential

consequences of the crisis. It is difficult at this time to

determine how it will impact its annual results. Businesses related

to advertising and live performance are likely to be affected

longer than others. Nevertheless, the Group remains confident in

the resilience of its main businesses. It continues to make every

effort to ensure the continuity of its activities and best serve

and entertain its customers and audiences while complying with the

authorities' guidelines in each country where it operates.

A review of the value of assets with an indefinite life, in

particular the goodwill, was performed. Taking into account the

performance achieved during the first half of the year by the

business units, Vivendi did not identify any indications of a

decrease in the recoverable amount compared to December 31, 2019,

based on the sensitivity analyses performed.

SUCCESSFUL OPENING OF UMG'S SHARE CAPITAL

On March 31, 2020, Vivendi completed the sale of 10% of UMG's

share capital to a consortium led by Tencent, based on an

enterprise value of EUR30 billion for 100% of UMG.

The consortium, led by Tencent and including Tencent Music

Entertainment and other financial co-investors, has the option to

acquire, on the same valuation basis, up to an additional 10% of

the share capital of UMG until January 15, 2021. This transaction

is complemented by a separate agreement allowing Tencent Music

Entertainment to acquire a minority stake in the capital of the UMG

subsidiary owning its Chinese activities.

Following the success of this important strategic agreement,

Vivendi is pursuing the possible sale of additional minority

interests in UMG with the assistance of several mandated banks. An

IPO is scheduled for early 2023 at the latest.

ACQUISITION BY BANIJAY OFEMOL SHINE GROUP

Banijay's acquisition of Endemol Shine Group was finalized on

July 3, 2020. This transaction creates the world leader in the

production and distribution of audiovisual content, with annual

revenues of around EUR2.7 billion (pro-forma 2019). Vivendi's

support for this transaction (the Group owns 32.9% of the new

entity) is part of its desire to build a world leader in culture,

at the crossroads of the entertainment, media and communication

industries.

Present in 22 countries, the new group has a portfolio of

world-famous audiovisual programs, both streamed programs (Big

Brother, Master Chef, The Wall, etc.) and scripted programs (Black

Mirror, Humans, Tin Star, ...). It also has an unrivaled

distribution network, the two entities having complementary

geographic locations.

SHARE BUYBACK PROGRAM

Between January 1 and March 6, 2020, Vivendi repurchased 23

million of its own shares, representing EUR559 million. Since April

20, 2020, the Group has repurchased 8.25 million of its own shares

(i.e., 0.70% of its share capital), representing EUR160

million.

As of July 29 2020, Vivendi holds 35.2 million treasury shares

(i.e., 2.97% of its share capital), of which 19.1 million shares

designated for cancellation, 7.5 million shares allocated to

covering performance share plans and 8.6 million allocated to

covering employee shareholding plans.

COMMENTS ON THE BUSINESSES

Universal Music Group

For the first half of 2020, Universal Music Group's (UMG)

revenues were EUR3,459 million, up 3.5% at constant currency and

perimeter compared to the first half of 2019 (+6.2% on an actual

basis).

Recorded music revenues grew by 3.7% at constant currency and

perimeter thanks to the growth in subscription and streaming

revenues (+12.4%) and the receipt of a digital royalty claim. This

increase was achieved despite the impact of the COVID-19 pandemic,

which mainly affected the second quarter of 2020. Physical sales

were down 22.4% compared to the first half of 2019, while download

sales declined by 23.1%.

Recorded music best sellers for the first half of 2020 included

new releases from The Weeknd, Justin Bieber, King & Prince,

Eminem and Lil Baby, as well as continued sales from Billie Eilish

and Post Malone.

UMG ended the first half of 2020 with seven of the Top 10 most

consumed artists in the United States, according to Nielsen. In

addition, UMG took a number of important steps in continuing to

expand its global footprint, opening offices in Morocco and Israel,

launching Def Jam Africa based in South Africa and Nigeria, and

announcing key partnerships with Sugar (Italy), The Aristokrat

Group (Africa), and Desi Melodies (India), among others.

Music publishing revenues grew by 21.2% at constant currency and

perimeter compared to the first half of 2019, driven by increased

subscription and streaming revenues, as well as the receipt of a

digital royalty claim, separate from the one mentioned in recorded

music.

For the first half of 2020, Universal Music Publishing Group

(UMPG) complemented strong results with a number of notable

signings around the world and across genres, including Taylor

Swift, Kenny Chesney, Surfaces, Luke Combs, Marisa Monte and

Meduza.

Merchandising and other revenues were down 41.4% at constant

currency and perimeter compared to the first half of 2019, due to

the impact of the COVID-19 pandemic on both touring and retail

activity.

For the first half of 2020, UMG's EBITA was EUR567 million, up

16.6% at constant currency and perimeter compared to the first half

of 2019 (+18.0% on an actual basis) driven by revenue growth and

cost control.

On July 22, 2020, UMG and Spotify announced a new, multi-year

global license agreement that further aligns the companies' efforts

to foster groundbreaking new features providing value for artists

and great experiences for music fans.

Canal+ Group

Canal+ Group's revenues were EUR2,674 million, up 6.2% compared

to the first half of 2019. At constant currency and perimeter,

revenues slightly decreased (-1.6%).

Canal+ Group's total subscriber portfolio (individual and

collective) reached 20.4 million, compared to 17.1 million for the

first half of 2019, including 8.6 million in mainland France.

Revenues from television operations in mainland France decreased

slightly compared to the first half of 2019 (-2.1% at constant

currency and perimeter), in a context marked by a downturn in the

advertising market due to the COVID-19 pandemic.

Revenues from international operations rose sharply by 30.5%

(+5.2% at constant currency and perimeter), thanks to the

outstanding year-on-year growth in the number of subscribers (+3.2

million), which was driven both by organic growth and the

integration of M7.

Studiocanal's revenues declined by 30.5% compared to the same

period in 2019, as theatrical film distribution was particularly

affected by the COVID-19 pandemic.

Canal+ Group's EBITA before restructuring charges was EUR329

million, compared to EUR236 million for the first half of 2019

(+16.2% at constant currency and perimeter). After restructuring

charges, EBITA was EUR300 million, compared to EUR233 million for

the same period in 2019 (+7.0% at constant currency and

perimeter).

Canal+ Group continues to focus on the tracking of its

expenditures and investments. The first half of 2020 confirmed

Canal+ Group's ambition to build, from a foundation of the best of

cinema, sports and series, a gateway to the world's leading

applications and channels. Canal+ Group became the exclusive French

distributor of the new Disney+ streaming service, available as part

of Canal+ offers since April 7. Canal+ Group can further extend the

reach of Disney+ through third-party distribution partners such as

Internet Service Provider. Since June 1, Canal+ Group became the

exclusive French distributor of beIN Sports channels to third-party

providers across all platforms in mainland France, for the next

five years.

Havas Group

As anticipated, the second quarter of 2020 was significantly

impacted by the COVID-19 pandemic. Havas Group reacted swiftly to

ensure the safety of its employees and continuity of business for

all its clients around the world. This unprecedented public health

crisis has affected the entire communications industry, as some

advertisers were forced to postpone or cancel a number of

campaigns. All divisions felt the impact, except for Havas Health

& You, which continues to report positive performance thanks to

the gains in market share achieved last year.

In these highly challenging times, for the first half of 2020,

Havas Group reported revenues of EUR1,019 million, down 8.5%. Net

revenues(5) were EUR977 million, down 7.9% compared to the first

half of 2019. Organic growth was -11.2% (-3.3% for the first

quarter of 2020 and -18.3% for the second quarter); exchange rates

had a positive impact of 0.9%, and acquisitions contributed

2.4%.

In terms of regions, at the end of June, North America delivered

a satisfactory performance thanks to a resilient market and growth

in health communications. Europe was severely affected by the

pandemic. However, the agencies in the United Kingdom and Germany

have proven more resistant than others. Both Asia-Pacific and Latin

America recorded sharp declines.

For the first half of 2020, EBITA was EUR46 million, compared to

EUR108 million for the same period in 2019. This change was due to

the sharp downturns in activity reported by both the Media and

Creative divisions.

A cost-reduction plan was implemented in both divisions in the

early weeks of the crisis and, by the end of June, Havas Group had

already absorbed nearly half the decline in revenues (before

restructuring costs).

Editis

For the first half of 2020, Editis' revenues were EUR262

million, down 15.1% at constant currency and perimeter compared to

the first half of 2019. The COVID-19 pandemic impacted all of

Editis' activities with the shut-down of most of the publishing

sector's points of sale.

However, a strong market recovery, especially for Editis, which

enjoyed a revenue increase of 38.0% in June, helped offset the

negative impact of the lockdown period on sales. Editis' revenues

were down approximately 40% between March, April and May compared

to the same period in 2019.

In addition, nine of Editis' titles were among the Top 25

best-sellers in the first half of 2020, up 50% compared to the same

period in 2019, including Au soleil redouté by Michel Bussi, La

Vallée by Bernard Minier, Nos résiliences by Agnès Martin-Lugand or

Fait maison by Cyril Lignac.

Editis also takes pride in the prestigious literary awards its

authors have received, such as the "Grand Prix du polar des

Lectrices de Elle" awarded to Tess Sharpe for Mon Territoire, the

"Prix Maison de la Presse 2020" awarded to Caroline Laurent for

Rivage de la colère, and the "Prix France Télévisions

#MonLivreDeLété" awarded to François Durpaire for Histoire mondiale

du bonheur.

Publishing houses such as the Trédaniel Group, L'Iconoclaste and

Les Arènes chose Editis as their distribution and/or diffusion

partner starting in 2021.

For the first half of 2020, impacted by the lockdown, Editis'

EBITA was -EUR21 million, compared to -EUR5 million for the same

period in 2019 (pro forma).

Other businesses

For the second quarter of 2020, Gameloft's revenues were EUR69

million, up 6.5% year-on-year, with sales on OTT platforms (Apple,

Google, Microsoft, etc.) up by 16.3%. For the first half of 2020,

revenues were EUR130 million, down 2.2% year-on-year. Gameloft's

sales on OTT platforms increased by 3.6% for the first half of 2020

and accounted for 76% of Gameloft's total sales. Gameloft

registered 1.6 million downloads per day across all platforms in

the first half of 2020.

The lockdown measures imposed in Europe and Africa during the

first half of 2020 had a significant impact on Vivendi Village.

After a very strong start to the year, the live performance, venues

and ticketing activities came to a virtual standstill in the second

quarter of 2020. Cost-reduction measures have been put in place. In

addition, live performance has launched innovative initiatives to

maintain a connection with festival-goer communities: in London,

Junction 2V, held on July 11 and 12, 2020, was an entirely virtual

festival, and smaller festivals will be organized this summer.

In the first half of 2020, the revenues of New Initiatives,

which brings together the Dailymotion and GVA entities, were EUR28

million, compared to EUR34 million in the first half of 2019.

In the first half of 2020, Dailymotion's audience for premium

content grew by more than 35% compared to the first half of 2019.

This growth was driven in particular by new partnerships such as

those with CNN and Barstool Sports in the United States, Ooreka and

Numerama in France, Daily Mail in the United Kingdom, Film Affinity

in Spain, Bilan in Switzerland, Cocina al Natural in Mexico, News

Nation in India and Amarin in Thailand. Dailymotion's programmatic

monetization platform also continues to grow with the integration

of Amazon, following that of The Trade Desk, DV 360 and

Verizon.

GVA, a telecoms operator in Africa, launched the sale of its

very high-speed Internet offers in March 2020 in two new capitals,

Abidjan (Côte d'Ivoire) and Kigali (Rwanda), strengthening its

presence on the continent. In June 2020, after launching its

Canalbox PREMIUM offer (50 Mb/s) and CanalboxPRO offers in Pointe

Noire (Republic of the Congo) the previous year, GVA expanded its

commercial offer by launching START (very high speed at 10

Mb/s).

CALAR

October 20, 2020: Q3 2020 revenues release June 22, 2021: annual

shareholders meeting with the payment of the 2020 dividend under

the same conditions as before.

For additional information, please refer to the "Financial

Report and Unaudited Condensed Financial Statements for the

half-year ended June 30, 2020" which will be released later online

on Vivendi's website (www.vivendi.com).

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group with European roots. In

content creation, Vivendi owns powerful, complementary assets in

music (Universal Music Group), movies and series (Canal+ Group),

publishing (Editis) and mobile games (Gameloft) which are the most

popular forms of entertainment content in the world today. In the

distribution market, Vivendi has acquired the Dailymotion platform

and repositioned it to create a new digital showcase for its

content. The Group has also joined forces with several telecom

operators and platforms to maximize the reach of its distribution

networks. In communications, through Havas. the Group possesses

unique creative expertise in promoting free content and producing

short formats, which are increasingly viewed on mobile devices. In

addition, through Vivendi Village, the Group explores new forms of

business in live entertainment, franchises and ticketing that are

complementary to its core activities. Vivendi's various businesses

cohesively work together as an integrated industrial group to

create greater value. www.vivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect Vivendi's

financial condition, results of operations, business, strategy,

plans and outlook, including the impact of certain transactions and

the payment of dividends and distribution, as well as share

repurchases. Although Vivendi believes that such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including, but not limited to, the risks related to

antitrust and other regulatory approvals as well as any other

approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des marchés financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des marchés financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Although the COVID-19 pandemic is having a more significant

impact on certain countries or businesses than others, Vivendi has

been able to demonstrate resilience and adapt in order to continue

to best serve and entertain its customers, while reducing costs to

preserve its margins. The business activities showed good

resistance, in particular music and pay television. However, as

anticipated when the first-quarter revenues were released, Havas

Group, Vivendi Village and Editis were affected by the effects of

the public health crisis. However, Editis has been enjoying a

strong rebound in its business since the end of the lockdown in

France.

Vivendi carefully analyzes the current and potential

consequences of the crisis. It is difficult at this time to

determine how it will impact its annual results. Businesses related

to advertising and live performance are likely to be affected

longer than others. Nevertheless, the Group remains confident in

the resilience of its main businesses. It continues to make every

effort to ensure the continuity of its activities and best serve

and entertain its customers and audiences while complying with the

authorities' guidelines in each country where it operates.

A review of the value of assets with an indefinite life, in

particular the goodwill, was performed. Taking into account the

performance achieved during the first half of the year by the

business units, Vivendi did not identify any indications of a

decrease in the recoverable amount compared to December 31, 2019,

based on the sensitivity analyses performed.

Unsponsored ADRs. Vivendi does not sponsor any American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is "unsponsored" and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:

Arnaud de Puyfontaine

Chief Executive Officer

Hervé Philippe

Member of the Management Board and Chief Financial Officer

Date: July 30, 2020

6:15pm Paris time -- 5:15pm London time -- 12:15pm New York

time

Media invited on a listen-only basis.

Internet: The conference can be followed on the Internet at:

www.vivendi.com/en/investment-analysts/ (audiocast)

Dial-in details for the conference call that will be held in

English:

France +33 (0) 1 7099 4740

UK +44 (0) 20 3003 2666

USA +1 212 999 6659

Code Vivendi

The dial-in numbers for the conference call and replay, an audio

webcast and the presentation slides will be available on our

website www.vivendi.com.

APPIX I

VIVI

CONDENSED STATEMENT OF EARNINGS

(IFRS, unaudited)

Six months ended June 30, % Change

2020 2019

REVENUES 7,576 7,353 + 3.0%

Cost of revenues (4,101) (4,054)

Selling, general and administrative

expenses excluding amortization of

intangible assets acquired through

business combinations (2,629) (2,543)

Income from operations* 846 756 + 11.8%

Restructuring charges (53) (22)

Other operating charges and income (58) (16)

Adjusted earnings before interest

and income taxes (EBITA)* 735 718 + 2.4%

Amortization and depreciation of

intangible assets acquired through

business combinations (75) (73)

Other charges and income - -

EARNINGS BEFORE INTEREST AND INCOME

TAXES (EBIT) 660 645 + 2.3%

Income from equity affiliates -

non-operational 64 (8)

Interest (16) (21)

Income from investments 15 5

Other financial charges and income 417 91

416 75

Earnings before provision for

income taxes 1,140 712 + 60.0%

Provision for income taxes (299) (182)

Earnings from continuing operations 841 530 + 58.6%

Earnings from discontinued

operations - -

Earnings 841 530 + 58.6%

Non-controlling interests (84) (10)

EARNINGS ATTRIBUTABLE TO VIVI SE

SHAREOWNERS 757 520 + 45.7%

Earnings attributable to Vivendi SE

shareowners per share - basic (in

euros) 0.66 0.41

Earnings attributable to Vivendi SE

shareowners per share - diluted

(in euros) 0.65 0.41

Adjusted net income* 583 554 + 5.4%

Adjusted net income per share -

basic (in euros)* 0.51 0.44

Adjusted net income per share -

diluted (in euros)* 0.50 0.43

In millions of euros, except per share amounts.

* non-GAAP measures.

The non-GAAP measures of "Income from operations", "adjusted

earnings before interest and income taxes (EBITA)" and "adjusted

net income" should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance. Vivendi considers these to be relevant indicators of

the group's operating and financial performance. Vivendi Management

uses income from operations, EBITA and adjusted net income for

reporting, management and planning purposes because they exclude

most non-recurring and non-operating items from the measurement of

the business segments' performances. Furthermore, as of June 30,

2020, in the context of the COVID-19 pandemic, Vivendi has not

changed the definition of these indicators, which are therefore

comparable to fiscal year 2019.

For any additional information, please refer to the "Financial

Report for the half-year 2020", which will be released online later

on Vivendi's website (www.vivendi.com).

APPIX I (Cont'd)

VIVI

CONDENSED STATEMENT OF EARNINGS

(IFRS, unaudited)

Reconciliation of earnings attributable to Vivendi SE

shareowners to adjusted net income

Six months ended June 30,

(in millions of euros) 2020 2019

Earnings attributable to Vivendi SE shareowners

(a) 757 520

Adjustments

Amortization and depreciation of intangible

assets acquired through business combinations 75 73

Amortization of intangible assets related to

equity affiliates 30 30

Other financial charges and income (417) (91)

Provision for income taxes on adjustments 106 34

Impact of adjustments on non-controlling

interests 32 (12)

Adjusted net income 583 554

1. As reported in the Condensed Statement of Earnings.

Adjusted Statement of Earnings

Six months ended June 30, % Change

(in millions of euros) 2020 2019

Revenues 7,576 7,353 + 3.0%

Income from operations 846 756 + 11.8%

EBITA 735 718 + 2.4%

Other charges and income - -

Income from equity affiliates -

non-operational 94 22

Interest (16) (21)

Income from investments 15 5

Adjusted earnings from continuing

operations before provision for

income taxes 828 724 + 14.4%

Provision for income taxes (193) (148)

Adjusted net income before

non-controlling interests 635 576

Non-controlling interests (52) (22)

Adjusted net income 583 554 + 5.4%

APPIX II

VIVI

REVENUES, INCOME FROM OPERATIONS AND EBITA BY BUSINESS

SEGMENT

(IFRS, unaudited)

Six months ended

June 30,

% Change

at

constant

% Change currency

at and

(in millions of constant perimeter

euros) 2020 2019 % Change currency (a)

Revenues

Universal Music

Group 3,459 3,258 +6.2% +4.5% +3.5%

Canal+ Group 2,674 2,518 +6.2% +6.5% -1.6%

Havas Group 1,019 1,114 -8.5% -9.4% -11.7%

Editis 262 260 +0.6% +0.6% -15.1%

Gameloft 130 133 -2.2% -3.0% -3.0%

Vivendi Village 26 66 -61.0% -61.2% -62.0%

New Initiatives 28 34 -18.3% -18.3% -18.3%

Elimination of

intersegment

transactions (22) (30)

Total Vivendi 7,576 7,353 +3.0% +2.2% -2.0%

Income from

operations

Universal Music

Group 597 501 +19.1% +17.6% +17.7%

Canal+ Group 334 235 +41.9% +42.7% +18.4%

Havas Group 61 121 -50.0% -51.1% -52.2%

Editis (16) 6 na na na

Gameloft (12) (9) -40.9% -42.5% -42.5%

Vivendi Village (26) (9) x 2.9 x 2.9 x 2.1

New Initiatives (34) (31) -8.5% -8.5% -8.5%

Corporate (58) (58) -0.5% -0.2% -0.2%

Total Vivendi 846 756 +11.8% +10.6% +5.3%

EBITA

Universal Music

Group 567 481 +18.0% +16.5% +16.6%

Canal+ Group 300 233 +28.7% +29.4% +7.0%

Havas Group 46 108 -57.1% -58.3% -59.3%

Editis (21) 4 na na na

Gameloft (14) (11) -30.9% -34.6% -34.6%

Vivendi Village (27) (9) x 3.0 x 3.0 x 2.3

New Initiatives (42) (29) -45.2% -45.2% -45.2%

Corporate (74) (59) -24.8% -24.4% -24.4%

Total Vivendi 735 718 +2.4% +1.3% -3.8%

1. Constant perimeter notably reflects the impacts of the acquisition of M7

by Canal+ Group (September 12, 2019), the acquisition of the remaining

interest in Ingrooves Music Group, which was consolidated by Universal

Music Group (March 15, 2019) and the acquisition of Editis (January 31,

2019).

APPIX II (Cont'd)

VIVI

QUARTERLY REVENUES BY BUSINESS SEGMENT

(IFRS, unaudited)

2020

Three months Three months

(in millions of ended March ended June

euros) 31, 30,

Revenues

Universal Music

Group 1,769 1,690

Canal+ Group 1,372 1,302

Havas Group 524 495

Editis 116 146

Gameloft 61 69

Vivendi Village 23 3

New Initiatives 15 13

Elimination of

intersegment

transactions (10) (12)

Total Vivendi 3,870 3,706

2019

Three months Three months

Three months Three months ended ended

(in millions of ended March ended June September December

euros) 31, 30, 30, 31,

Revenues

Universal Music

Group 1,502 1,756 1,800 2,101

Canal+ Group 1,252 1,266 1,285 1,465

Havas Group 525 589 567 698

Editis (a) 89 171 210 217

Gameloft 68 65 61 65

Vivendi Village 23 43 42 33

New Initiatives 15 19 16 20

Elimination of

intersegment

transactions (15) (15) (11) (24)

Total Vivendi 3,459 3,894 3,970 4,575

-- As a reminder, Vivendi has fully consolidated Editis since February 1,

2019.

APPIX III

VIVI

CONDENSED STATEMENT OF FINANCIAL POSITION

(IFRS, unaudited)

June 30, 2020 December 31,

(in millions of euros) (unaudited) 2019

ASSETS

Goodwill 14,603 14,690

Non-current content assets 2,970 2,746

Other intangible assets 851 883

Property, plant and equipment 1,117 1,097

Rights-of-use relating to leases 1,190 1,245

Investments in equity affiliates 3,508 3,520

Non-current financial assets 3,162 2,263

Deferred tax assets 824 782

Non-current assets 28,225 27,226

Inventories 297 277

Current tax receivables 98 374

Current content assets 966 1,423

Trade accounts receivable and other 4,909 5,661

Current financial assets 328 255

Cash and cash equivalents 2,374 2,130

Current assets 8,972 10,120

TOTAL ASSETS 37,197 37,346

EQUITY AND LIABILITIES

Share capital 6,520 6,515

Additional paid-in capital 2,363 2,353

Treasury shares (1,007) (694)

Retained earnings and other 8,845 7,179

Vivendi SE shareowners' equity 16,721 15,353

Non-controlling interests 701 222

Total equity 17,422 15,575

Non-current provisions 1,028 1,127

Long-term borrowings and other financial

liabilities 4,184 5,160

Deferred tax liabilities 1,158 1,037

Long-term lease liabilities 1,194 1,223

Other non-current liabilities 169 183

Non-current liabilities 7,733 8,730

Current provisions 575 494

Short-term borrowings and other financial

liabilities 1,706 1,777

Trade accounts payable and other 9,354 10,494

Short-term lease liabilities 210 236

Current tax payables 197 40

Current liabilities 12,042 13,041

Total liabilities 19,775 21,771

TOTAL EQUITY AND LIABILITIES 37,197 37,346

(1) Constant perimeter notably reflects the impacts of the

acquisition of M7 by Canal+ Group (September 12, 2019), the

acquisition of the remaining interest in Ingrooves Music Group,

which was consolidated by Universal Music Group (effective as of

March 15, 2019) and the acquisition of Editis (January 31,

2019).

(2) Non-GAAP measures. As of June 30, 2020, in the context of

the COVID-19 pandemic, Vivendi has not changed the definition of

these indicators, which are therefore comparable to those for the

fiscal year 2019.

(3) A reconciliation of EBIT to EBITA and to income from

operations, as well as a reconciliation of earnings attributable to

Vivendi SA shareowners to adjusted net income, are presented in

Appendix I.

(4) As a reminder, in Vivendi's Consolidated Financial

Statements, in accordance with IFRS 10, the capital gain on the

sale of 10% of UMG's share capital, equal to the difference between

the sale price of EUR2,838 million and the value of non-controlling

interests in the Consolidated Financial Statements of EUR458

million, will be directly recorded as an increase in equity

attributable to Vivendi SE shareowners for EUR2,380 million. In

accordance with applicable accounting standards, the capital gain

on the sale of 10% of UMG's share capital was recorded in earnings

in Vivendi's Statutory Financial Statements.

(5) Net revenues correspond to revenues less pass-through costs

rebilled to customers.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200730005889/en/

CONTACT: Media

Paris

Jean-Louis Erneux

+33 (0)1 71 71 15 84

Solange Maulini

+33 (0) 1 71 71 11 73

Investor Relations

Paris

Xavier Le Roy

+33 (0) 1 71 71 18 77

Nathalie Pellet

+33 (0)1 71 71 11 24

Delphine Maillet

+33 (0)1 71 71 17 20

SOURCE: Vivendi

Copyright Business Wire 2020

(END) Dow Jones Newswires

July 30, 2020 13:58 ET (17:58 GMT)

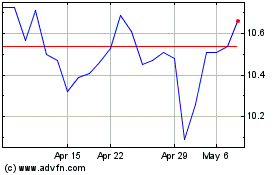

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Apr 2023 to Apr 2024