Vivendi Says Acted In Line With Market Rules When Buying GVT

June 09 2010 - 12:23PM

Dow Jones News

French media company Vivendi SA (VIV.FR) Wednesday said that it

is confident it acted fully in line with Brazilian market

regulations when buying Brazilian telecom operator GVT last

year.

Brazilian market regulator CVM has opened an administrative

procedure against Vivendi over possible irregularities over the

purchase of GVT.

"We are fully confident that at all times we have acted fully in

line with Brazilian stockmarket regulations in acquiring GVT," a

company spokesman said.

The spokesman said that Vivendi has cooperated with the inquiry,

which opened in December last year, and is providing any

information requested.

Last November, Vivendi surprised investors by announcing that it

had guaranteed control of GVT through an agreement with the

controlling shareholders and options contracts to buy GVT stocks

from third parties. Vivendi paid 56 Brazilian reals ($29.94) a

share for GVT shares.

The company outflanked Spain's Telefonica SA (TEF) that had made

a bid of BRL50.50 for GVT shares.

CVM is investigating whether the options transaction followed

Brazilian legislation and whether Vivendi misled investors in some

way.

Media reports on Tuesday said that Vivendi could be fined up to

$1.6 billion if the CVM found any irregularities in the

purchase.

"We decline to comment on the process beyond saying that any

figures being arbitrarily thrown around are pure uninformed

fabrication," the spokesman added, referring to the media

reports.

-By Ruth Bender, Dow Jones Newswires; +33 1 40 17 17 54;

ruth.bender@dowjones.com

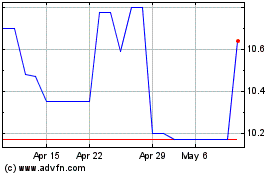

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

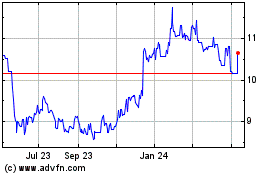

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2023 to Jul 2024