2nd UPDATE: Telefonica 1Q Profit Up But Spain Still Drags

May 13 2010 - 5:47AM

Dow Jones News

Telefonica SA (TEF) said Thursday its first-quarter net profit

rose slightly as its European and Latin American operations helped

compensate for a drop in revenue in its recession-stricken Spanish

market.

Telefonica, Europe's second-largest telecommunications company

by market capitalization behind the U.K.'s Vodafone Group PLC

(VOD), said net profit rose 2% to EUR1.66 billion, missing

analysts' forecasts of EUR1.80 billion.

Madrid-based Telefonica also reiterated its guidance until 2012

that include an earnings per share of EUR2.10 and revenue growth of

between 1% and 4% on the year.

The results were disappointing, said ING analyst Georgios

Ierodiaconou, noting Spain was particularly weak. He added the

results now make meeting its targets difficult, particularly a

previous commitment to pay a EUR1.75 per share dividend in 2012.

"Flexibility for acquisitions, spectrum auctions, buybacks and

dividends is becoming limited," Ierodiaconou said.

At 0912 GMT, Telefonica's shares fell 1.6% to EUR15.79,

underperforming an overall negative Spanish market.

Telefonica said operating income before depreciation and

amortization, or Oibda, fell 4.1% to EUR5.11 billion for the

period, while total revenue increased 1.7% to EUR13.93 billion.

Revenue in Latin America rose 4.2% to EUR5.62 billion in the

period, but a slowdown in growth and an increasing reliance on

inflation-prone markets has forced the company to change course and

step up efforts to strengthen its foothold in the region.

Earlier this week, Telefonica made a EUR5.7 billion offer for

Portugal Telecom SGPS SA's (PT) stake in the joint venture both

companies control in Brazil.

"The bid for Vivo has opened the M&A can of worms again and

it seems that Telefonica is in a tough spot strategically," CM

Capital Markets' Dirk Schnitker said.

Latin America has traditionally been Telefonica's main growth

market, but the company has faced a series of recent setbacks in

the region.

Telefonica was outbid by French media conglomerate Vivendi SA

(VIV.FR) for Brazilian telecommunications company GVT (GVTT3.BR).

In January, it also said it would have to wipe EUR1.81 billion from

its Venezuelan assets after the country's government devalued the

bolivar. Venezuela's hyperinflationary economy also slashed revenue

in the country by 44% to EUR491 million in the quarter.

Meanwhile, in Europe Telefonica faces increased competition, the

continued fallout from the economic crisis and the impact of

regulatory pressure on its revenue.

In recent months, Telefonica has lowered tariffs to hold on to

customers. It also lost exclusivity on Apple Inc's (AAPL)

iPhone.

Revenue in Spain, where unemployment tops 20% and low-cost

competition has increased, fell 5.7% to EUR4.63 billion.

In Europe, where Telefonica operates under the O2 brand outside

Spain, revenue increased 7.4% to EUR3.49 billion.

Company Web site: http://www.telefonica.com

-By Jason Sinclair, Dow Jones Newswires, 34 913958127,

jason.sinclair@dowjones.com

Order free Annual Report for Vivendi Universal SA

Visit http://djnweurope.ar.wilink.com/?ticker=FR0000127771 or

call +44 (0)208 391 6028

Order free Annual Report for Vodafone Group PLC

Visit http://djnweurope.ar.wilink.com/?ticker=GB00B16GWD56 or

call +44 (0)208 391 6028

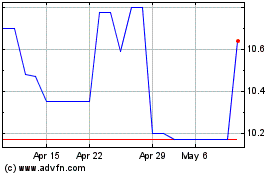

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

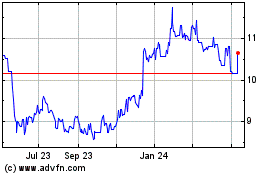

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2023 to Jul 2024