NBC Universal Benchmark Deal Offers Cheap Comcast Exposure

April 27 2010 - 11:26AM

Dow Jones News

NBC Universal Inc. is priming a benchmark-sized debt offering

for sale Tuesday, offering five-, 10- and 30-year senior unsecured

fixed-rate notes.

The size of Tuesday's debt sale is not set, but it is part of

NBC's efforts to borrow a total of $9.1 billion as the network

leaves General Electric Co. (GE) and is acquired by Comcast Corp.

(CMCSA).

Some of the proceeds from Tuesday's deal will be used to pay

down NBC's existing two-year term loan with part also applied

toward the $5.8 billion that GE paid to Vivendi SA (VIVDY) for its

20% stake in NBC Universal.

The proposed notes will also reduce NBCU's commitments under its

bridge loan.

Preliminary price guidance for the five-year piece is in the 130

basis points over Treasurys area; 150 basis points for the 10-year

piece and about 185 basis points over Treasurys for the 30-year

tranche. Those levels offer investors between 20-25 basis points in

concession, according to one investor looking at the deal who said

he would be buying it since it would give him "cheap CMSCA

exposure."

Final size of the offering has yet to be determined, but volume

will likely be attributable to investor demand.

The deal will include a change of control option--a built-in

insurance policy that's triggered when a company changes control

for any reason thereby altering its value. Investors are keen on

this kind of covenant in sectors that are prone to merger and

acquisition activity. The change of control option will be

triggered if the Comcast/NBC merger has not been closed buy June

10, 2011.

The Federal Communications Commission had set May 3 as the

deadline for comment on Comcast's bid to acquire 51% of NBC, but

pushed that deadline back last week as U.S. regulators requested

more information on the mega merger.

The offering has been rated Baa2 by Moody's Investors Service

and BBB+ by Standard & Poor's and will be sold via active

bookrunners Goldman Sachs (GS), JP Morgan (JPM) and Morgan Stanley

(MS). Bank of America Merrill Lynch (BAC) and Citigroup Inc. (C)

are passive bookrunners for the offering.

Pricing is expected this session in the private placement Rule

144a market.

-By Kellie Geressy-Nilsen, Dow Jones Newswires; 212-416-2225;

kellie.geressy@dowjones.com

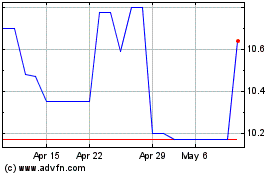

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

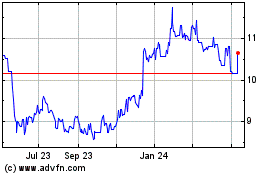

Vivendi (PK) (USOTC:VIVEF)

Historical Stock Chart

From Jul 2023 to Jul 2024