Filed Pursuant to Rule 424(b)(3)

Registration No. 333-271193

Prospectus Supplement No. 6

(to Prospectus dated April 20, 2023)

UPHEALTH, Inc.

9,000,000 Shares of Common Stock

This prospectus supplement (this “Supplement No. 6”) relates to the prospectus dated April 20, 2023 (as amended from time to time, the “Prospectus”), related to the resale from time to time by the selling stockholder named in the Prospectus or its permitted transferees (the “Selling Stockholder”) of up to 9,000,000 shares of the common stock, par value $0.0001 per share (“Common Stock”), of UpHealth, Inc., a Delaware corporation (the “Company”), consisting of (i) 1,650,000 shares of Common Stock that have been issued to the Selling Stockholder, (ii) 3,000,000 shares of Common Stock that are issuable upon the exercise of the Series A Warrant (as defined in the Prospectus) acquired by a certain accredited investor (the “Purchaser”), (iii) 3,000,000 shares of Common Stock that are issuable upon the exercise of the Series B Warrant (as defined in the Prospectus) acquired by the Purchaser, and (iv) 1,350,000 shares of Common Stock that are issuable upon the exercise of the Pre-Funded Warrant (as defined in the Prospectus) acquired by the Purchaser, which were issued in a private placement pursuant to the terms of the Securities Purchase Agreement (as defined in the Prospectus).

The purpose of this Supplement No. 6 is to update and supplement the information in the Prospectus with respect to the information contained in the following reports of the Company:

•The Company’s Current Report on Form 8-K as filed with the SEC on February 20, 2024, which is attached hereto.

This Supplement No. 6 updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This Supplement No. 6 should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this Supplement No. 6, you should rely on the information in this Supplement No. 6.

Our Common Stock is currently listed on the New York Stock Exchange (“NYSE”), however, the NYSE has commenced delisting proceedings in respect of our Common Stock, as previously reported in the Company’s Current Report on Form 8-K filed with the SEC on December 13, 2023, and has suspended trading pending the completion of such proceedings. As a result, our Common Stock commenced trading in the over-the-counter market on December 12, 2023 under the trading symbol “UPHL.” The Company on December 26, 2023 filed an appeal with the NYSE that the Common Stock remain listed on the NYSE and requested a hearing before the NYSE Regulatory Oversight Committee’s Committee for Review. On January 12, 2024, the NYSE granted the Company’s request for a hearing, which is expected to take place on April 17, 2024.

Investing in our securities involves a high degree of risk. You should carefully review the risks and uncertainties that are described under the heading “Risk Factors” beginning on page 8 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or this Supplement No. 6 or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 20, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 13, 2024

Date of Report (date of earliest event reported)

UpHealth, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-38924 (Commission File Number) | 83-3838045 (I.R.S. Employer Identification Number) |

| | | | | | | | |

| 14000 S. Military Trail, Suite 203 | |

| Delray Beach, FL 33484 | |

| (Address of principal executive offices, including zip code) | |

| | |

(888) 424-3646 |

| (Registrant's telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | UPH(1) | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

___________________________________________________

(1)On December 11, 2023, UpHealth, Inc. (the “Company”) received written notice from the staff of NYSE Regulation that it has commenced proceedings to delist the common stock, par value $0.0001 per share, of the Company (ticker symbol: UPH) (the “Common Stock”), from the New York Stock Exchange (“NYSE”), and suspended trading in the Common Stock pending the completion of such proceedings. As a result, effective December 12, 2023, the Common Stock is trading in the over-the-counter market under the symbol “UPHL”. The Company timely filed an appeal of this determination with the NYSE and requested a hearing before the NYSE Regulatory Oversight Committee’s Committee for Review. On January 12, 2024, the NYSE granted the Company’s request for a hearing, which is expected to take place on April 17, 2024.

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 13, 2024 (the “Grant Date”), the Board of Directors (the “Board”) of UpHealth, Inc. (the “Company”), upon the recommendation of the Compensation Committee of the Board, approved the grant to Martin Beck, the Company’s Chief Executive Officer, under the Company’s 2021 Equity Incentive Plan (the “Plan”), of an option to purchase 1,300,000 shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”), at an exercise price per share of Common Stock equal to $0.385 (the “Option”). The Option will be an “incentive stock option” to the maximum extent permitted by the Internal Revenue Code limits, and will be subject to the terms of the Plan and its applicable form of option grant notice and agreement as previously disclosed by the Company (the “Option Agreement”). The Option Agreement provides that the Option, which may only be exercised for vested shares, became vested and immediately exercisable on the Grant Date with respect to 650,000 of the shares subject to the Option, and the remaining 650,000 shares will vest and become exercisable under the Option in twelve equal quarterly installments over a three-year period with the initial vesting of such quarterly installments occurring on May 22, 2024, and each subsequent quarterly installment vesting on the following August 22, November 22, March 7 and May 22, with the Option being fully vested and exercisable on March 7, 2027, subject to Mr. Beck’s continued services with the Company through the applicable vesting dates; provided, that such quarterly vesting and exercisability of the Option will accelerate in full upon the earlier to occur of (i) a Change in Control (as defined in the Plan) which is not related to the closing of the transactions contemplated by the Membership Interests Purchase Agreement entered into on November 16, 2023 by and among the Company and its wholly-owned subsidiary, Cloudbreak Health, LLC, and Forest Buyer, LLC, an affiliate of GTCR LLC, or (ii) if the Common Stock is listed on a national securities exchange and the volume-weighted average price per share of the Common Stock over a consecutive 90 calendar day period is at least $1.00, in each case, with such acceleration subject to Mr. Beck remaining employed with the Company through the date of the applicable event set forth in (i) or (ii) above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 20, 2024

UPHEALTH, INC.

| | | | | |

By: | /s/ Jay W. Jennings |

Name: | Jay W. Jennings |

Title: | Chief Financial Officer |

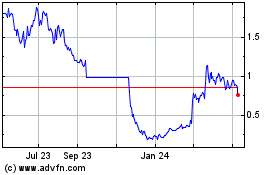

UpHealth (CE) (USOTC:UPHL)

Historical Stock Chart

From Jan 2025 to Feb 2025

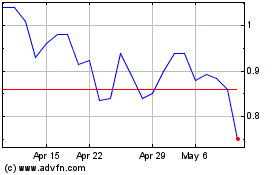

UpHealth (CE) (USOTC:UPHL)

Historical Stock Chart

From Feb 2024 to Feb 2025