UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

| Joby Aviation, Inc. |

| (Name of Issuer) |

| |

| Common Stock, par value $0.0001 per share |

| (Title of Class of Securities) |

| G65163 100 |

| (CUSIP Number) |

| Yoshihide Moriyama |

| Toyota Motor Corporation |

|

1 Toyota cho, Toyota City

Aichi 471-8571 Japan |

| +81-565-28-2121 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices

and Communications) |

| October 1, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box: ¨

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13D

| CUSIP No. G65163 100 |

|

Page 2 of 9 |

| 1 |

NAME OF REPORTING PERSON I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES

ONLY)

Toyota Motor Corporation |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (See Instructions)

WC |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Japan |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

72,871,831 |

| 8 |

SHARED VOTING POWER

5,880,780* |

| 9 |

SOLE DISPOSITIVE POWER

72,871,831 |

| 10 |

SHARED DISPOSITIVE POWER

5,880,780* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

78,752,611* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.0%** |

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO |

| |

|

|

|

* Includes (i) 5,813,286 Common Shares of the Issuer

issued to TVF (as defined herein) and (ii) 67,494 Common Shares of the Issuer issued to TVPF (as defined herein), in each case pursuant

to the Merger Agreement (as defined herein). See Item 3. TMC (as defined herein) has voting and dispositive power of the Common Shares

held by TVF and TVPF and therefore may be deemed to be the beneficial owner of such Common Shares.

** This percentage is calculated based upon 716,142,677

Common Shares issued and outstanding of the Issuer as set forth in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC

on August 8, 2024.

EXPLANATORY NOTE

This Amendment No. 1 (“Amendment”)

amends and supplements the Statement on Schedule 13D originally filed with the Securities and Exchange Commission (the “SEC”)

on August 20, 2021 (the “Original Statement”), which relates to the shares of common stock, par value $0.0001 per share

(the “Common Shares”), of Joby Aviation, Inc. (the “Issuer” or “Joby”). Except

as otherwise described herein, the information contained in the Original Statement remains in effect. Capitalized terms used but not defined

in this Amendment shall have the respective meanings set forth with respect thereto in the Original Statement.

| |

ITEM 2. |

IDENTITY AND BACKGROUND |

Item 2 is hereby amended solely

to amend and restate the list of Covered Persons on Schedule A hereto, which schedule is incorporated into this Item 2 by reference.

| |

ITEM 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item 3 is hereby amended and supplemented

as follows:

On October 1, 2024, the Issuer

entered into a stock purchase agreement (the “2024 Stock Purchase Agreement”) with TMC, providing for the issuance

and sale by the Issuer to TMC in a private placement of up to an aggregate of 99,403,579 Common Shares at a purchase price of $5.03 per

share, upon the terms and subject to the conditions set forth in the 2024 Stock Purchase Agreement (the “Private Placement”).

The Private Placement is structured in two equal tranches of approximately $250.0 million each. The Issuer will use the proceeds from

the Common Shares to support Joby’s certification efforts and commercial production of its electric air taxi.

The closing of the first tranche

(the “Initial Closing”) and the closing of the second tranche (the “Additional Closing”) contemplated

by the 2024 Stock Purchase Agreement are subject to certain customary conditions set forth in the 2024 Stock Purchase Agreement. The Initial

Closing is subject to conditions including, but not limited to: (i) the satisfaction of certain regulatory approvals or clearances, including

with respect to the Committee on Foreign Investment in the United States and under the United States Hart-Scott-Rodino Antitrust Improvements

Act of 1976, as amended, and the rules and regulations promulgated thereunder; (ii) the adoption of certain changes to the provisions

of Joby’s amended and restated bylaws concerning the ownership of common stock by non-citizens of the United States (the “Foreign

Ownership Requirement”); (iii) the authorization by Joby’s board of directors of certain changes to Article XIV of Joby’s

amended and restated certificate of incorporation concerning the Foreign Ownership Requirement (the “Charter Amendment”),

subject to approval by the stockholders of Joby at Joby’s annual meeting in 2025; (iv) the execution of an amendment and restatement

of the Amended and Restated Collaboration Agreement, dated August 30, 2019, between Joby and TMC; (v) the execution of a services agreement

between Joby and TMC; and (vi) certain other customary closing conditions. The Additional Closing is subject to conditions including, but not

limited to: (i) the execution of a strategic alliance agreement relating to, among other things, manufacturing arrangements, between Joby and

TMC; (ii) the approval of the Charter Amendment by the stockholders of Joby at Joby’s annual meeting in 2025; and (iii) certain

other customary closing conditions. The agreements to be entered into in connection with such conditions are subject to the receipt of

regulatory approvals, the parties negotiating and entering into definitive agreements and the conditions included within the applicable

definitive documents.

Pursuant to the 2024 Stock Purchase

Agreement, Joby shall, no later than the earlier of (i) 30 days after the date of the Additional Closing or (ii) September 30, 2025, file

with the SEC a registration statement on Form S-3/ASR, or such other form as required to effect a registration covering the resale of

the Registrable Shares (as defined in the 2024 Stock Purchase Agreement). TMC has certain demand registration rights and piggyback registration

rights pursuant to the terms of the 2024 Stock Purchase Agreement.

All funds for any Common Shares

purchased by TMC pursuant to the 2024 Stock Purchase Agreement will be obtained from the working capital of TMC.

| |

ITEM 4. |

PURPOSE OF TRANSACTION |

Item 4 is hereby amended and supplemented

as follows:

Item 3 summarizes certain provisions

of the 2024 Stock Purchase Agreement and is incorporated herein by reference.

| |

ITEM 5. |

INTEREST IN SECURITIES OF THE ISSUER |

Item 5(a) is hereby amended and

restated as follows:

(a) The aggregate number of Common

Shares to which this Amendment relates is 78,752,611 Common Shares as of the date hereof. Based on 716,142,677 Common Shares outstanding

(as described in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 8, 2024), the Common Shares reported on

this Amendment represent approximately 11.0% of the Issuer’s outstanding Common Shares. Of the 78,752,611 Common Shares to which

this Amendment relates, (i) 72,871,831 Common Shares are held of record by TMC, (ii) 5,813,286 Common Shares are held of record by Toyota

A.I. Ventures Fund I, L.P., a limited partnership formed under the laws of Delaware (“TVF”), and (iii) 67,494 Common

Shares are held of record by Toyota A.I. Ventures Parallel Fund I-A, L.P., a limited partnership formed under the laws of Delaware (“TVPF”).

TMC owns 100% of the manager and each of the general partners of both TVF and TVPF. As such, TMC may be deemed to beneficially own 78,752,611

Common Shares as it has voting and dispositive control over the Common Shares held by TVF and TVPF.

| |

ITEM 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

Item 6 of the Original Statement

is hereby amended and restated in its entirety as follows:

On the terms and subject to the

conditions set forth in the Memorandum of Understanding (“MOU”) dated February 23, 2021, between the Issuer and TMC,

TMC will be entitled to appoint (i) one director to the Issuer Board and (ii) one non-voting observer to the Issuer Board, in each case

until such time as the termination of the MOU. The foregoing appointments shall expire on the anniversary of the date on which TMC and

its affiliates no longer beneficially own at least 50% of the total Joby shares held by TMC and its affiliates immediately following the

Merger.

In connection with the closing

of the Business Combination, the Issuer, the Reporting Person and certain other stockholders entered into lock-up agreements (the “Lock-up

Agreements”) pursuant to which the Reporting Person is contractually restricted from selling or transferring any Common Shares

(the “Lock-up Shares”) for certain periods of time. Such lock-up restrictions began on August 10, 2021 (the “Closing”)

and expire in tranches of 20% of the total Lock-up Shares so restricted at each of (i) the earlier of (x) the one year anniversary of

Closing or (y) the date on which the last reported sale price of the Common Shares equals or exceeds $12.00 per share for any 20 trading

days within any 30-trading day period commencing at least 150 days after the Closing, (ii) the two-year anniversary of the Closing, (iii)

the three-year anniversary of the Closing, (iv) the four-year anniversary of the Closing and (v) the five-year anniversary of the Closing.

Further, if the Issuer completes a transaction that results in a change of control, the Lock-up Shares are released from restriction immediately

prior to such change of control.

In connection with the closing

of the Business Combination, the Issuer, the Reporting Person, and certain other stockholders of the Issuer and RTP entered into an Amended

and Restated Registration Rights Agreement (the “Registration Rights Agreement”). As required under the Registration

Rights Agreement, the Issuer filed a shelf registration statement with respect to the registrable securities under the Registration Rights

Agreement. Certain Joby stockholders and RTP stockholders, including the Reporting Person, may each request to sell all or any portion

of their registrable securities in an underwritten offering up to two times in any 12-month period, so long as the total offering price

is reasonably expected to exceed $100.0 million. The Issuer also agreed to provide “piggyback” registration rights, subject

to certain requirements and customary conditions. The Registration Rights Agreement also provides that the Issuer will pay certain expenses

relating to such registrations and indemnify the stockholders against certain liabilities.

Pursuant to the 2024 Stock Purchase

Agreement, the Issuer agreed to file a shelf registration statement on Form S-3/ASR, or such other form as required, no later than the

earlier of (i) 30 calendar days after the date of the Additional Closing, or (ii) September 30, 2025, to effect a registration covering the resale of the

Registrable Shares (as defined in the 2024 Stock Purchase Agreement). The Reporting Person may request to sell all or any portion of their

Registrable Shares in an underwritten offering, block trade, at the market or similar offering so long as the aggregate offering value

of the Registrable Shares to be sold in such offering is (i) equal to at least $50 million or (ii) covers all remaining Registrable Shares

held by TMC. The Issuer also agreed to provide “piggyback” registration rights, subject to certain requirements and customary

conditions. The 2024 Stock Purchase Agreement also provides that the Issuer will indemnify the Reporting Person against certain liabilities.

Item 3 summarizes certain provisions

of the 2024 Stock Purchase Agreement and is incorporated herein by reference.

The foregoing descriptions of

the MOU, Lock-up Agreement, Registration Rights Agreement and 2024 Stock Purchase Agreement are qualified in their entirety by reference

to each agreement, copies of which are filed as Exhibits 99.2, 99.3, 99.4 and 99.5, respectively, and are incorporated by reference in

this Item 6.

| |

ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| 99.5 |

Stock

Purchase Agreement, dated as of October 1, 2024, by and between Joby Aviation, Inc. and Toyota Motor Corporation (incorporated

by reference to Exhibit 10.1 to the Current Report on Form 8-K filed by the Issuer with the SEC on October 2, 2024). |

| 99.6 |

Power of attorney, dated October 2, 2024. |

SIGNATURES

After reasonable inquiry and to

the best of my knowledge and belief, each of the undersigned, severally and not jointly, certifies that the information set forth in this

statement is true, complete and correct.

Dated: October 2, 2024

| |

TOYOTA MOTOR CORPORATION

|

| |

|

|

| |

By: |

/s/ Masahiro Yamamoto |

| |

|

Name: Masahiro Yamamoto |

| |

|

Title: Chief Officer, Accounting Group |

SCHEDULE A

With respect to TMC, the name, present principal occupation

or employment and the name, principal business and address of any corporation or other organization in which such employment is conducted

and citizenship, of each executive officer and director of TMC is set forth below. For each such executive officer and director, the business

address is c/o Toyota Motor Corporation, 1 Toyota cho, Toyota City, Aichi 471-8571 Japan.

Directors of TMC

| Name |

Present Principal Occupation or Employment |

Citizenship |

| Akio Toyoda |

Chairman of the Board of Directors |

Japan |

| Shigeru Hayakawa |

Vice Chairman of the Board of Directors |

Japan |

| Koji Sato |

President, Member of the Board of Directors |

Japan |

| Hiroki Nakajima |

Member of the Board of Directors |

Japan |

| Yoichi Miyazaki |

Member of the Board of Directors |

Japan |

| Simon Humphries |

Member of the Board of Directors |

United Kingdom |

| Ikuro Sugawara |

Member of the Board of Directors |

Japan |

| Sir Philip Craven |

Member of the Board of Directors |

United Kingdom |

| Masahiko Oshima |

Member of the Board of Directors |

Japan |

| Emi Osono |

Member of the Board of Directors |

Japan |

| Takeshi Shirane |

Audit & Supervisory Board Member |

Japan |

| Masahide Yasuda |

Audit & Supervisory Board Member |

Japan |

| Katsuyuki Ogura |

Audit & Supervisory Board Member |

Japan |

| George Olcott |

Audit & Supervisory Board Member |

United Kingdom |

| Catherine O’Connell |

Audit & Supervisory Board Member |

New Zealand |

| Hiromi Osada |

Audit & Supervisory Board Member |

Japan |

Executive Officers of TMC

| Name |

Present Principal Occupation or Employment |

Citizenship |

| Koji Sato |

President, Operating Officer |

Japan |

| Hiroki Nakajima |

Executive Vice President, Operating Officer |

Japan |

| Yoichi Miyazaki |

Executive Vice President, Operating Officer |

Japan |

| Tetsuo Ogawa |

Operating Officer |

Japan |

| Tatsuro Ueda |

Operating Officer |

Japan |

| Jun Nagata |

Operating Officer |

Japan |

| Simon Humphries |

Operating Officer |

United Kingdom |

| Kazuaki Shingo |

Operating Officer |

Japan |

EXHIBIT 99.6

POWER OF ATTORNEY

The person whose signature appears

below, being an authorized representative of Toyota Motor Corporation (the “Company”), hereby makes, constitutes and appoints

Masahiro Yamamoto, Chief Officer, Accounting Group of the Company, as a true and lawful attorney-in-fact for the Company, for the purpose

of, from time to time, executing in the Company’s name or on the Company’s behalf, any and all documents, certificates, instruments,

statements, other filings and amendments to the foregoing (collectively, “documents”) determined by the Company to be necessary

or appropriate to comply with ownership or control-person reporting requirements imposed by any United States federal, state or local

governmental or regulatory authority, including, without limitation, Forms 3, 4, 5, 13D, and 13G and any amendments to any of the foregoing

as may be required to be filed with the U.S. Securities and Exchange Commission, and delivering, furnishing or filing any such documents

with the appropriate governmental, regulatory authority or other person, and giving and granting to the attorney-in-fact power and authority

to act in the premises as fully and to all intents and purposes as the Company might or could do if personally present by one of its authorized

signatories, hereby ratifying and confirming all that said attorney-in-fact shall lawfully do or cause to be done by virtue hereof. Any

such determination by the attorney-in-fact shall be conclusively evidenced by such attorney-in-fact’s execution, delivery, furnishing

or filing of the applicable document.

| | /s/ Yoichi Miyazaki |

| | Name: | Yoichi Miyazaki |

| Title: | Member of the Board of Directors,

Executive Vice President |

| | Date: | October 2, 2024 |

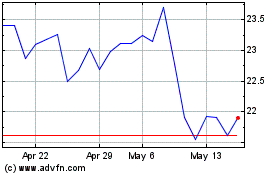

Toyota Motor (PK) (USOTC:TOYOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

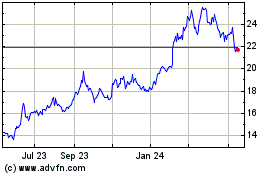

Toyota Motor (PK) (USOTC:TOYOF)

Historical Stock Chart

From Nov 2023 to Nov 2024