Current Report Filing (8-k)

November 29 2021 - 4:02PM

Edgar (US Regulatory)

0001645260

false

0001645260

2021-11-18

2021-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November

18, 2021

Todos

Medical Ltd.

(Exact

name of registrant as specified in its charter)

|

Israel

|

|

000-56026

|

|

n/a

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

IRS

Employer

|

|

of

incorporation or organization)

|

|

File

Number)

|

|

Identification

No.)

|

121

Derech Menachem Begin, 30th Floor

Tel

Aviv, 6701203 Israel

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: 972 (52) 642-0126

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth

company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement

On

November 18, 2021, Todos Medical Ltd. (the “Company”) entered into a license agreement (the “License Agreement”)

with T-Cell Protect Hellas S.A. (“T-Cell Protect”) pursuant to which the Company will license the European manufacturing

and distribution rights to a product based on the Company’s Tollovid® and Tollovid Daily™ 3CL protease inhibitor and

immune support dietary supplements to T-Cell Protect (the “Product”). The License Agreement became effective on November

22, 2021 when the Company received a purchase order for 50,000 bottles of Tollovid Daily, per the terms of the License Agreement.

The Product is expected to be marketed under the T-Cell Protect brand in Europe. In addition, the Company will grant to T-Cell Protect

an exclusive license to manufacture, sell and distribute the Product in Greece. The License Agreement provides for royalty in the low

double digits to the Company and a minimum of 500,000 bottles in sales over the 18 months after the date of the License Agreement. In

the event T-Cell Protect establishes its own manufacturing of the Product in the European market, the 500,000 minimum referred to in

the previous sentence will become a minimum sales requirement. In the License Agreement, T-Cell Protect acknowledged that the Company

intends to assign the License Agreement to a subsidiary being formed by the Company to focus on the development of 3CL protease biology

called 3CL Sciences, Inc. (“3CL Sciences”).

On

November 22, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”) with T-Cell pursuant to which the

Company issued a promissory convertible note (the “Note”) to T-Cell Protect in the principal amount of €1,000,000 (the

“Transaction”). The Note has a maturity date of one year from the date of issuance and pays interest at a rate of 10% per

annum. The Note is convertible into shares of Common Stock (the “Conversion Shares”) at a conversion price of $0.0599 (the

“Conversion Price). At any time prior to the Company uplisting its ordinary shares to a national securities exchange, T-Cell Protect

may exchange the Note into either (a) a direct equity investment in 3CL Sciences at the same terms as a financing round of at least $5,000,000

(the “Sub”) or (b) into a note in the Sub, bearing 10% interest that converts into direct equity in the Sub at the same terms

as a financing round of at least $5,000,000. The proceeds from this Transaction are intended to be used for the clinical development

of Tollovir, the Company’s therapeutic candidate for hospitalized COVID-19 patients.

On

November 24, 2021, the Company entered into a binding letter of intent (the “LOI”) with NLC Pharma Ltd. (“NLC”)

pursuant to which 3CL Sciences will purchase all therapeutic, diagnostic, dietary supplement and pharmaceutical assets from NLC that

relate to 3CL protease biology in exchange for a 40% equity interest in 3CL Sciences that NLC will own, single digit royalties and Company

ordinary shares. Promptly following execution of the LOI, the Company will deliver $325,000 to pay outstanding invoices related to the

interim analysis of the ongoing clinical trial of Tollovir. The Company shall be responsible for providing or assisting in the raising

of a total of $10 million into 3CL Sciences over a period of 7 months from execution of the LOI. The Company and NLC agree to identify

a seasoned biopharmaceutical CEO to run 3CL Sciences going forward. The board of directors of 3CL Sciences will be made up of five (5)

individuals: two (2) appointed by the Company, two (2) appointed by NLC and one (1) to be mutually agreed upon by the Company and NLC.

In addition, NLC will be granted one (1) seat on the Company’s Board of Directors. A press release announcing the LOI is attached

as Exhibit 99.1 to this Current Report on Form 8-K.

The

Company has agreed to file a registration statement with the Securities and Exchange Commission registering for resale the Conversion

Shares (the “Registration Statement).

The

foregoing descriptions of the License Agreement, SPA, the Note and LOI do not purport to be complete and are qualified in their entirety

by reference to the full text of the License Agreement, SPA, Note and LOI, forms of which are attached as Exhibit 10.1 , 10.2, 10.3 and

10.4, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 3.02.

The

issuance of the securities described in item 1.01 was deemed to be exempt from the registration requirements of the Securities Act of

1933, as amended (the “Securities Act”), by virtue of Section 4(a)(2) and Rule 506 promulgated thereunder.

Item

9.01.Financial Statements and Exhibits

(d)

Exhibits.

*

Pursuant to Item 601(b)(10) of Regulation S-K, certain confidential portions of this exhibit were omitted by means of marking such portions

with an asterisk because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly

disclosed.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

November 29, 2021

|

|

TODOS

MEDICAL LTD.

|

|

|

|

|

|

By:

|

/s/

Gerald Commissiong

|

|

|

|

Gerald

Commissiong

|

|

|

|

Chief

Executive Officer

|

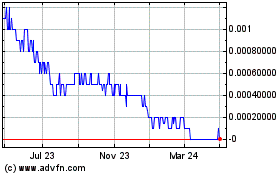

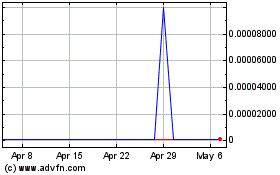

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Sep 2023 to Sep 2024