Current Report Filing (8-k)

October 17 2022 - 1:39PM

Edgar (US Regulatory)

0001815632false00018156322022-10-172022-10-17iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2022

TEGO CYBER INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-563770 | | 84-2678167 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification ID No.) |

8565 South Eastern Avenue, Suite 150

Las Vegas, Nevada 89123

(Address of principal executive offices)(Zip Code)

(855) 939-0100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below).

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR240.13e-4(c)) |

| |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 13, 2022, Tego Cyber Inc., a Nevada corporation (the “Company”), entered a funding transaction totaling $75,000.00 ($67,500.00 net) as described below.

Securities Purchase Agreement, Promissory Note, and Common Stock Purchase Warrant Bigger Capital Funds, LP (“BCF”)

On October 13, 2022 (“Effective Date”), the Company executed the following agreements with BCF: (i) Securities Purchase Agreement; (ii) Promissory Note (“Note”); and (iii) Common Stock Purchase Warrant Agreement, (collectively the “BCF Agreements”). The Company entered into the BCF Agreements to acquire additional working capital.

The total amount of funding under the BCF Agreements is $67,500.00. The Note carries an original issue discount of $7,500 for total debt of $75,000.00 (“Debt”). The Company agreed to reserve 1,000,000 shares of its common stock for issuance if any Debt is converted. The Debt is due on or before April 13, 2023 (“Maturity Date”). The Debt carries an interest rate of ten percent (10%). The Maturity Date may be extended up to six (6) months following the date of the original Maturity Date at which time the interest rate increases to eighteen percent (18%). The Debt is convertible into the Company’s common stock after one hundred eighty (180) days from the Effective Day at a conversion price equal to the lower of the lowest trading price during the previous twenty (20) trading day period. The principal sum as well as any accrued and unpaid interest and other fees shall be due and payable on the Maturity Date.

The BCF Agreements are qualified in their entirety by reference to the BCF Agreements, copies of which are attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference into this Item 1.01. Certain capitalized terms used herein but not otherwise defined shall have the meaning ascribed thereto in the Transaction Documents.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in response to Item 1.01 of this report is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

See the disclosures made in Item 1.01, which are incorporated herein by reference. Any securities issued in the BCF Agreements were issued in a transaction exempt from registration pursuant to Section 4(a)(2) and Rule 506(b) Securities Act of 1933. The transactions did not involve a public offering, the sale of the securities was made without general solicitation or advertising, there was no underwriter, and no underwriting commissions were paid.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | TEGO CYBER INC. | |

| | | | |

| Date: October 17, 2022 | By: | /s/ Shannon Wilkinson | |

| | Shannon Wilkinson | |

| | | Chief Executive Officer | |

| | | | |

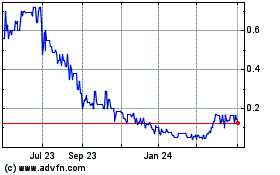

Tego Cyber (QB) (USOTC:TGCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

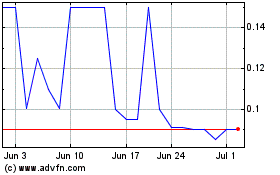

Tego Cyber (QB) (USOTC:TGCB)

Historical Stock Chart

From Jul 2023 to Jul 2024