CannabisNewsWire

Editorial Coverage: With Canada’s decision to decriminalize

cannabis nationwide and the 2018 U.S. Farm Bill’s provision to

potentially make industrial hemp and hemp-derived cannabidiol (CBD)

legal nationwide, the cannabis CBD product sector is gaining a

strong foundation.

- Analysts expect runaway growth in the cannabis and CBD

markets.

- Industry is scaling up amid regulatory reform.

- Underlying growth metrics are bullish for hydroponics suppliers

and cultivators alike.

- Branding and marketing are increasingly important and tied to

quality control.

Numerous interests stand to benefit as the cannabis sector

begins to hit its stride, ranging from cannabinoid biopharma

developers to cultivators with rapidly expanding acreage

footprints. Pick-and-shovel plays such as hydroponics supplier

Sugarmade, Inc. (OTCQB: SGMD) (SGMD

Profile) could be some of the biggest winners, quietly

supplying tons of hardware to a variety of end users without having

to jump through the all the legal hoops. Tilray, Inc.

(NASDAQ: TLRY), one of the first companies licensed to

produce medical cannabis as dried flower in Canada, has quickly

become known for its full-spectrum cold-extracted cannabinoids with

clearly indicated tetrahydrocannabinol (THC) and CBD potencies.

Canopy Growth Corporation (NYSE: CGC) (TSX: WEED)

has parlayed its leadership in cannabis and hemp with dried, oil

and softgel capsule products into a landmark $4 billion investment

from beer, wine and spirits major Constellation Brands, Inc.

Cronos Group, Inc. (NASDAQ: CRON) (TSX: CRON),

which operates two wholly owned Canada-licensed producers, is

making its presence felt across five continents. And Aphria

Inc. (NYSE: APHA) (TSX: APHA) is also making serious waves

as a globally minded cannabis producer, having just recently been

approved for uplisting to the New York Stock Exchange.

To view an infographic of this editorial, click here.

Historic Market Forces Create a Perfect

Storm

After more than eight decades of prohibition, cannabis has gone

from a black market to a tax revenue-generating multibillion-dollar

industry in a handful of years. It is an industry nipping at the

market share heels of sectors like alcoholic beverages, food and

drink, supplements and now even biopharmaceuticals. The market for

just one of over 100 different cannabinoids, the non-psychoactive

CBD, was recently projected to break $22 billion by

2022. CBD alone could have “profound impacts” across the

consumer packaged goods (CPG) and pharma industries according to

Brightfield Group, potentially outpacing the broader cannabis

market combined. It would be a major boon to the U.S. market if

industrial hemp and CBD become legal under the latest Farm

Bill.

Recent analysis in a report from Amadee & Company cites

baseline market metrics such as over 37 million people in the

United States using cannabis (both legally and illicitly) as

contributing to a North American market worth over $41 billion this

year, which is on track to hit $95

billion by 2026. The more conservative figures from Arcview

Market Research and its research partner BDS Analytics are the $9.2

billion in sales seen in 2017, and a projection of $47.3 billion within 10 years. Either way, investors

are looking at some low-hanging CAGR fruit, and the sector as a

whole has scaled up enough that it is now seemingly much easier to

pick winners that can thrive, regardless of potential governmental

policy drift.

Many End Markets - One Stop Shop for Hydro

Hardware

Sugarmade, Inc.

(OTCQB: SGMD), headquartered in northeastern Los

Angeles County on the edge of the Angeles National Forest, has

already established a formidable presence in the hydroponics supply

market with brands such as ZenHydro.com,

CarryOutSupplies.com and BudLife. The company

also recently launched a massive new $1 million initiative to

cement a foundational position in the emerging U.S. industrial hemp

and CBD market through an investment in privately held Hempistry,

Inc., a Kentucky-based farmer (23,000 acres) of an ultra-rich CBD

strain of hemp.

Hydroponics has rapidly emerged as the dominant strain in the

cannabis cultivation industry when it comes to medical cannabis, or

products that want to emphasize stringent environmental cultivation

controls and overall consistency. The KD Market

Insights report projects a six-year CAGR of 20.7 percent, as a

$5.22 billion 2017 hydroponics market grows to $13.84 billion in

2023. According to another report,

cannabis cultivation will be a major driver of sector growth, with

just the U.S. hydroponics market set to clock in at 20.3 percent

CAGR from 2018 to 2025, hitting around $3.7 billion.

These are significant advantages for SGMD as the company pursues

its binding definitive agreement to acquire Nevada-based Sky

Unlimited, LLC, which has developed a solid reputation throughout

the full spectrum of cultivation markets. Its robust AthenaUnited.com website lists everything from

advanced lighting systems such as Hortilux lamps and ballasts to

complete hydroponics kits such as the AeroFlo 60 aeroponic system

from General Hydroponics, which super-oxygenates the nutrient

solution. The AeroFlo line is a great example of a brand that

growers, academics and researchers alike have praised for

delivering consistently hearty growth rates and yields. Consumers

from various cultivation industries have come to trust that they

can find the best environmental control systems and cutting-edge

nutrients, as well as plant care and more general gardening

supplies on the site.

Ready to Launch

Sugarmade will retain all employees and completely assume all

operations and liabilities via the acquisition. The company

anticipates that the Sky Unlimited deal will be highly accretive

for shareholders and has further increased the previous 500 percent

annual revenue growth projection made back in July, of $30 million

during 2019, to a whopping $70 million. This handsome increase owes

a lot to how easily integrated the parallel business lines of Sky

Unlimited and Athena are to SGMD’s existing model, as well as the

extent to which the deal will allow Sugarmade to not only access

the larger commercial cultivation market more directly but also

enhance its emphasis on brands in a market where brand loyalty

still means a great deal.

Scheduled for January 2019, the deal is subject to an extensive

audit of the Sky Unlimited operations, but confidence is high that

this latest acquisitive foray by Sugarmade will spell share price

appreciation gold for the company’s shareholders. In fact, things

are apparently looking so good overall for the company that

management has begun positioning for a potential NASDAQ uplisting,

tapping the requisite legal team to expedite the process.

Symbiosis amid Competition

The broader market is set up nicely for SGMD to take advantage

of, but the reality is more symbiotic than predatory.

Tilray, Inc. (NASDAQ: TLRY) was the first

company to legally export medical cannabis from North America to

Europe, Australia and New Zealand. One of the top names in both

cultivation and research, Tilray is on deck to report Q3 financials

this Nov. 13 after a strong quarter in which the company

successfully closed a $450 million private placement funding run

with qualified institutional buyers. The company is one of the

pioneers in clear labeling of THC and CBD concentrations and has a

public-facing dedication to compliant and effective products that

lead the industry by example.

Canopy Growth Corporation (NYSE: CGC) (TSX:

WEED) prides itself on the highest quality cannabis,

whether it is ultimately distributed as dried flower, oils and

concentrates, or precisely formulated softgels. The company has a

strong hand in industrial hemp for producing CBD, and now that

alcoholic drinks giant Constellation Brands (which has over 100

brands to its name) recently closed its $4 billion investment in

the company, Canopy is poised to strike hard and fast across the

more than 30 countries worldwide that are in the process of

advancing some form of permissible cannabis regulation for adult

use or medicinal purposes.

Cronos Group, Inc. (NASDAQ: CRON) (TSX: CRON)

is increasingly a global player, with operations in Canada,

Colombia, Germany, Poland, Israel and Australia. The company

launched its second recreational cannabis brand this year and has

two wholly owned Canada-licensed producers to its name, as well as

a 21.5 percent stake in British Columbia-based Whistler Medical

Marijuana Company, which is licensed to produce and sell medical

marijuana and cannabis oil.

When Aphria Inc. (NYSE: APHA) (TSX: APHA)

uplisted from the OTCQB to the NYSE, it was not just big news for

the company but for the cannabis industry and smallcap markets as a

whole. Aphria has seen an impressive rise from a relatively small

player to a true global leader in cannabis. The company’s rigorous

study of the end-user market and ingenious development of a variety

of brands to suit every buyer segment has delivered bottom-line

results across the company’s entire line of capsules, oral

solutions, oil syringes and single-unit vaporizer cartridges.

Once-in-a-lifetime Early-adopter

Opportunity

As attitudes and regulations open up the global market for the

end products being developed in the cannabis market, from

commercial drinks containing CBD to lab-grown cannabinoid biopharma

indications, some of these smaller companies are starting to look

to many analysts like potential all-stars. Differentiating factors

such as brand presence, product execution and market

access/penetration are important analytical vectors. However, key

capabilities such as being a picks-and-shovels supplier are of

particular note, whether one is talking about hydroponics hardware

for production or producing the raw cannabis that other companies

rely on.

For more information on Sugarmade, visit Sugarmade, Inc.

(OTCQB: SGMD)

About CannabisNewsWire

CannabisNewsWire (CNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

CannabisNewsBreaks that summarize

corporate news and information, (3) enhanced press release

services, (4) social media distribution and optimization services,

and (5) a full array of corporate communication solutions. As a

multifaceted financial news and content distribution company with

an extensive team of contributing journalists and writers, CNW is

uniquely positioned to best serve private and public companies that

desire to reach a wide audience of investors, consumers,

journalists and the general public. CNW has an ever-growing

distribution network of more than 5,000 key syndication outlets

across the country. By cutting through the overload of information

in today’s market, CNW brings its clients unparalleled visibility,

recognition and brand awareness. CNW is where news, content and

information converge.

Receive Text Alerts

from CannabisNewsWire: Text "Cannabis" to

21000

For more information please visit https://www.CannabisNewsWire.com and

or https://CannabisNewsWire.News

Please see full terms of use and disclaimers on the

CannabisNewsWire website applicable to all content provided by CNW,

wherever published or re-published: http://CNW.fm/Disclaimer

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

DISCLAIMER: CannabisNewsWire (CNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by CNW are

solely those of CNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable CNW for any investment

decisions by their readers or subscribers. CNW is a news

dissemination and financial marketing solutions provider and is NOT

registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, CNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

CNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and CNW undertakes no

obligation to update such statements.

Source:

CannabisNewsWire

Contact:

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

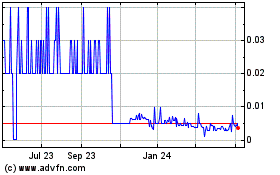

Sugarmade (CE) (USOTC:SGMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

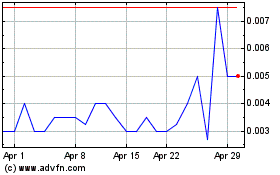

Sugarmade (CE) (USOTC:SGMD)

Historical Stock Chart

From Jan 2024 to Jan 2025