0001642159

false

0001642159

2023-09-14

2023-09-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): September 14, 2023

SIGYN

THERAPEUTICS, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

333-204486 |

|

47-2573116 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 2468

Historic Decatur Road |

|

|

| Suite

140 |

|

|

| San

Diego, California |

|

92106 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 619.368.2000

Prior

address and phone number:

| 2468

Historic Decatur Road, Suite 140 |

|

|

| San

Diego, CA |

|

92106 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

619.353.0800

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

In

2021-2023, Sigyn Therapeutics, Inc. (the “Company”) issued original issue discount convertible notes with a principal

balance at June 30, 2023 of $3,051,516 to a number of accredited investors. These convertible notes matured or were to mature at various

dates through March 27, 2024. On September 14, 2023, the Company entered into Amendment Agreements with $2,161,316 principal amount of

these notes to extend the maturity date to August 30, 2024. As a result of these amendments, the parties agreed to increase the principal

amount to reflect an implied 12% interest rate from the date of the Amendment Agreement through the rescheduled maturity date. In

addition, the Amendment Agreement provides for an automatic conversion of the notes in accordance with their terms upon a listing of

the Company’s common stock on a national securities exchange such as NASDAQ or any tier of the New York Stock Exchange.

The

Company anticipates entering into similar amendment agreements with the remaining holders of the convertible notes, although there can

be no assurance to this effect.

The

description of the Amendment Agreement in this Item 1.01 is a summary only and is qualified by reference to the text of the Amendment

Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

ITEM

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

SIGYN

THERAPEUTICS, INC. |

| |

|

| Date:

September 19, 2023 |

By: |

/s/

James A. Joyce |

| |

|

James

A. Joyce, Chairman and CEO |

Exhibit

10.1

AMENDMENT

AGREEMENT

THIS

AMENDMENT AGREEMENT (this “Agreement”) is made as of September [*], 2023, among

Sigyn Therapeutics Inc., a Delaware corporation (the “Company”) and * (the “Holder”).

WHEREAS,

the Company has previously issued to Holder notes as set forth on Schedule A (each

a “Note” and collectively the “Notes”).

WHEREAS,

the parties wish to amend certain terms of the Notes.

NOW

THEREFORE IN CONSIDERATION OF the matters described above and of the mutual benefits and obligations

set forth in this Agreement, the receipt and sufficiency of which consideration is hereby acknowledged, the parties to this Agreement

agree as follows:

1.

Maturity Date. The Maturity Date of each Note set forth on Schedule B is hereby extended to August 30, 2024.

2.

New Principal Amount. The principal amount of each Note set forth on Schedule B shall be increased to the amounts set forth

on Schedule B.

3.

Exchange. Upon the Company’s common stock being listed for trade on a national securities exchange registered with

the SEC under Section 6 of the Securities Exchange Act of 1934 (the “New Trading Market”), and all the shares of common stock

issuable to Holder upon conversion of the Notes or any security for which the Notes are exchanged being listed for trade on the New Trading

Market, each Note will automatically be exchanged pursuant to an exemption from registration under Section 3(a)(9) of the Securities

Exchange Act for shares of Series A Convertible Preferred Stock issued by the Company. The number of shares of Series A Convertible Preferred

Stock to be issued shall be determined by calculating how many shares of common stock are issuable upon conversion of each Note and issuing

in exchange therefore a number of shares of Series A Convertible Preferred Stock that would convert into an equal amount of common stock.

4.

Rule 144. The Company acknowledges that the transactions contemplated herein shall not, the holding period of the Notes,

any Series A Convertible Preferred Stock issued in exchange for any Notes, and common stock issued in exchange for any Notes or Series

A Preferred Stock, for Rule 144 purposes shall commence as of the original issue date of the Note for which such Series A Convertible

Preferred Stock or common stock (directly or in exchange for any Series A Convertible Preferred Stock issued in exchange for any Note)

were issued.

5.

Company Representations. The Company hereby represents and warrants to Holder that (i) the Company has the requisite corporate

power and authority to enter into and to consummate the transactions contemplated by this Agreement, and (ii) the execution, delivery

and performance by the Company of this Agreement and the issuance of the securities contemplated hereby do not and will not (x) conflict

with or violate any provision of the Company’s certificate or articles of incorporation, bylaws or other organizational or charter

documents, (y) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default)

under, result in the creation of any lien upon any of the properties or assets of the Company, or give to others any rights of termination,

amendment, anti-dilution or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any

agreement, credit facility, debt or other instrument (evidencing a Company debt or otherwise) or other understanding to which the Company

is a party or by which any property or asset of the Company is bound or affected, other than securities issued to Holder by Company,

or (z) conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction

of any court or governmental authority to which the Company is subject (including federal and state securities laws and regulations),

or by which any property or asset of the Company is bound or affected; except in the case of each of clauses (y) and (z), such as could

not have or reasonably be expected to result in a Material Adverse Effect. All securities to be issued pursuant to this Agreement are

duly authorized and, when issued in accordance with the applicable agreement, will be duly and validly issued, fully paid and nonassessable,

free and clear of all liens imposed by the Company. The Company has reserved from its duly authorized capital stock the maximum number

of shares of common stock issuable pursuant to this Agreement; provided, however, that to the extent that the Company may not have sufficient

duly authorized capital stock to reserve the number of shares of common stock issuable pursuant to this Agreement, the Company shall

use commercially reasonable efforts to seek shareholder approval of an amendment to the Company’s articles of incorporation, as

appropriate, to make available such number of shares of common stock to reserve.

6.

No Further Changes. Except as explicitly set forth herein, all other agreements between the parties, including the Notes,

remain in full force and effect without any waivers or modifications.

7.

Counterparts/Execution. This Agreement may be executed in any number of counterparts and by the different signatories hereto

on separate counterparts, each of which, when so executed, shall be deemed an original, but all such counterparts shall constitute but

one and the same instrument. This Agreement may be executed by facsimile signature and delivered by facsimile transmission.

8.

Governing Law. It is the intention of the parties to this Agreement that this Agreement and the Performance under this

Agreement, and all suits and special proceedings under this Agreement and the Notes, be construed in accordance with and governed by

the laws of the State of Delaware, without regard to the jurisdiction in which any action or special proceeding may be instituted. Any

action to enforce the terms of this Agreement shall be brought solely in the state and Federal Courts located in the State of Delaware.

This section shall supersede any choice of law and forum selection terms on the Notes.

9.

Severability. In the event that any of the provisions of this Agreement are held to be invalid or unenforceable in whole

or in part, all other provisions will nevertheless continue to be valid and enforceable with the invalid or unenforceable parts severed

from the remainder of this Agreement.

[REST

OF THIS PAGE LEFT INTENTIONALLY BLANK]

IN

WITNESS WHEREOF the parties have duly executed this Amendment Agreement as of the date written above.

| Sigyn

Therapeutics Inc. |

|

| |

|

|

|

|

|

| By:

|

|

|

| Its:

|

|

|

| |

|

|

| * |

|

|

| |

|

|

|

|

|

| By:

|

|

|

| Its:

|

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

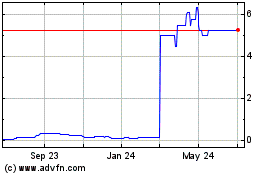

Sigyn Therapeutics (QB) (USOTC:SIGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

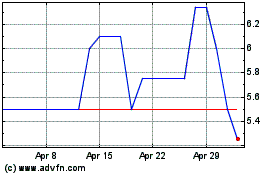

Sigyn Therapeutics (QB) (USOTC:SIGY)

Historical Stock Chart

From Nov 2023 to Nov 2024