Current Report Filing (8-k)

April 14 2014 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 14, 2014

Date of Report (date of earliest event reported)

TransEnterix,

Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-19437 |

|

11-2962080 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

635 Davis Drive, Suite 300

Morrisville, North Carolina 27560

(Address of principal executive offices)

919-765-8400

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On April 2, 2014, TransEnterix, Inc. (the “Company”) issued a press

release announcing that it intended to conduct a public offering (the “Offering”) of shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”). On April 2, 2014, the Company also filed a

preliminary prospectus supplement with respect to the Offering (the “Preliminary Prospectus Supplement”) with the Securities and Exchange Commission (the “SEC”). In the Preliminary Prospectus Supplement, the Company indicated

that it expected to issue and sell $50 million of Common Stock. On April 14, 2014, the Company agreed to sell 12,500,000 shares of Common Stock at a public offering price of $4.00 per share for aggregate gross proceeds of $50 million in an

underwritten firm commitment public offering. The Company has granted the underwriters an option, exercisable for 30 days, to purchase up to an additional 1,875,000 shares of Common Stock to cover over-allotments. Certain of the Company’s

existing stockholders that are affiliated with certain of the Company’s directors have agreed to purchase $10 million of Common Stock in the Offering.

The Common Stock is being offered and sold pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-193235) registering an

aggregate of $100 million of designated securities of the Company. The shelf registration statement was declared effective by the SEC on April 2, 2014.

On March 31, 2014, the Company effected a one-for-five reverse stock split of its Common Stock. All relevant common share and per common share

information in this Current Report have been retroactively adjusted to reflect the reverse stock split, without accounting for any fractional shares.

Capitalization

The following table sets forth the

Company’s consolidated cash, cash equivalents and short-term investments, current portion of the Company’s notes payable and the Company’s capitalization as of December 31, 2013:

| |

• |

|

on an actual basis; and |

| |

• |

|

on an adjusted basis after giving effect to the Company’s sale of 12,500,000 shares of Common Stock at a public offering price of $4.00 per share and the net proceeds of the Offering after deducting the

underwriting discounts and commissions of $0.24 and estimated offering expenses payable by the Company. |

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, 2013 |

|

| |

Actual |

|

|

As Adjusted |

|

| |

(In thousands) |

|

| Cash, cash equivalents, and short-term investments |

|

$ |

16,205 |

|

|

$ |

62,405 |

|

|

|

|

|

|

|

|

|

|

| Note payable – current portion |

|

|

3,879 |

|

|

|

3,879 |

|

|

|

|

|

|

|

|

|

|

| Note payable – less current portion |

|

|

4,602 |

|

|

|

4,602 |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock $0.001 par value, 750,000,000 shares authorized at December 31, 2013; 48,841,547 shares issued and outstanding at

December 31, 2013, actual; 61,341,547 shares issued and outstanding at December 31, 2013, as adjusted |

|

|

244 |

|

|

|

257 |

|

| Additional paid-in capital |

|

|

203,043 |

|

|

|

249,230 |

|

| Accumulated deficit |

|

|

(98,264 |

) |

|

|

(98,264 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

105,023 |

|

|

|

151,223 |

|

|

|

|

|

|

|

|

|

|

| Total capitalization |

|

$ |

109,625 |

|

|

$ |

155,825 |

|

|

|

|

|

|

|

|

|

|

Dilution

Purchasers of shares of Common Stock in the Offering will experience dilution to the extent of the difference between the offering price per share of Common

Stock and the net tangible book value per share of the Company’s Common stock immediately after the Offering. The Company’s net tangible book value as of December 31, 2013, was approximately $8.4 million, or $0.17 per share of

Common Stock. Net tangible book value per share is equal to total tangible assets minus total liabilities, all divided by the number of shares of Common Stock outstanding.

After giving effect to the sale of 12,500,000 shares of Common Stock by the Company at a public offering price of $4.00 per share, less the estimated

offering expenses, the Company’s as adjusted net tangible book value at December 31, 2013, would have been approximately $54,630, or $0.89 per share. This represents an immediate increase in the net tangible book value of $0.72 per

share to existing stockholders and an immediate dilution of $3.11 per share to investors in the Offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

| Public Offering price per share |

|

|

|

|

|

$ |

4.00 |

|

|

|

|

| Net tangible book value per share as of December 31, 2013 |

|

$ |

0.17 |

|

|

|

|

|

|

|

|

| Increase in net tangible book value per share attributable to the Offering |

|

$ |

0.72 |

|

|

|

|

|

|

|

|

| As adjusted net tangible book value per share after the Offering |

|

|

|

|

|

$ |

0.89 |

|

|

|

|

| Dilution in tangible book value per share to new investors |

|

$ |

(3.11 |

) |

|

|

|

|

If the underwriters exercise in full their option to purchase additional shares in the Offering, the as adjusted net tangible

book value after the Offering would be $0.98 per share, representing an increase in net tangible book value of $0.81 per share to existing shareholders and immediate dilution in net tangible book value of $3.02 per share to investors participating

in the Offering.

The number of shares of Common Stock outstanding used in both the table and calculations above is based on 48,841,547 shares outstanding

as of December 31, 2013. This number of shares does not include shares of Common Stock subject to the underwriters’ option to purchase additional shares and also excludes:

| |

• |

|

3,822,887 shares of Common Stock issuable upon the exercise of outstanding options granted under the Company’s stock option plans at a weighted average exercise price of $1.30 per share; |

| |

• |

|

1,285,394 shares of Common Stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $1.65 per share; |

| |

• |

|

210,000 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and |

| |

• |

|

4,169,100 shares of Common Stock available for future issuance under the Company’s stock option plans. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

TRANSENTERIX, INC. |

|

|

| Date: April 14, 2014 |

|

/s/ Joseph P. Slattery |

|

|

Joseph P. Slattery |

|

|

Executive Vice President and Chief Financial

Officer |

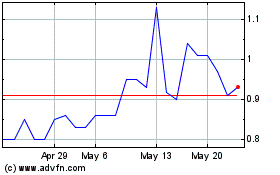

Safeguard Scientifics (QX) (USOTC:SFES)

Historical Stock Chart

From Nov 2024 to Dec 2024

Safeguard Scientifics (QX) (USOTC:SFES)

Historical Stock Chart

From Dec 2023 to Dec 2024