Filed pursuant to Rule 424(b)(5)

Registration Number: 333-193235

The information in this preliminary prospectus is not complete

and may be changed. A registration statement relating to these securities has been declared effective by the Securities and Exchange Commission. The preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these

securities and we are not soliciting offers to buy these securities in any state or other jurisdiction where to offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 2, 2014

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated

April 2, 2014)

$50,000,000

Common Stock

$

per share

We are selling

shares of our common stock.

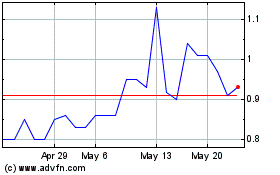

Our common stock is traded on

the OTCBB under the symbol “TRXC.” The last sale price of our common stock on April 1, 2014, as reported by the OTCBB, was $9.70 per share. Effective March 31, 2014, we implemented a 1-for-5 reverse stock split. Due to the

reverse stock split, beginning April 2, 2014 and continuing for 20 business days or until our listing on the NYSE MKT, whichever occurs first, our stock will trade under the symbol “TRXCD.” Unless otherwise indicated and

excluding historical financial statements incorporated herein, all relevant common share and per common share information in this prospectus supplement have been retroactively adjusted to reflect the 1-for-5 reverse stock split, but does not account

for any fractional shares.

Investing in our common stock involves risk. See “

Risk Factors

” beginning on page S-6.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commission

(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

We refer you to “Underwriting” beginning on page S-13 of this prospectus for additional information regarding underwriting compensation.

|

Certain of our existing stockholders that are affiliated with certain of our directors have indicated an interest in purchasing up to $5,000,000 of our common

stock. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, less or no shares in this offering to any of these stockholders. In addition, any of these

stockholders may determine to purchase more, less or no shares in this offering. The underwriters will receive the same underwriting discount on these shares purchased by these entities as they will on any other shares sold to the public in this

offering.

We estimate the total expenses of this offering, excluding the underwriting discounts and commissions, will be approximately $700,000. We have

granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to a total of additional shares of

our common stock at the public offering price per share, less the underwriting discounts and commissions.

The underwriters expect to deliver the shares on

or about April , 2014, subject to customary closing conditions.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved the securities described herein or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

Stifel

|

|

RBC Capital Markets

|

|

Ladenberg Thalmann

|

|

Raymond James

|

The date of this prospectus supplement is April , 2014.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the accompanying prospectus dated April 2, 2014 that is also a part of this document.

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under the shelf registration

process, from time to time, we may sell any of the securities described in the accompanying prospectus in one or more offerings. In this prospectus supplement, we provide you with specific information about this offering and the securities offered

hereby. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein include important information about us, our common stock and other information you should know before investing in our

common stock. This prospectus supplement also adds, updates and changes information contained in the accompanying prospectus. You should read both this prospectus supplement and the accompanying prospectus as well as the additional information and

documents described in this prospectus supplement under the headings “Where You Can Find More Information” and “Incorporation by Reference” before investing in our common stock. To the extent that any statement that we make in

this prospectus supplement differs from or is inconsistent with the statements made in the accompanying prospectus or in any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, the statements

made in the accompanying prospectus, or such an earlier filing, as applicable, are deemed modified or superseded by the statements made in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in

another document having a later date – for example, a document incorporated by reference in the accompanying prospectus – the statement having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and in the accompanying

prospectus filed by us with the SEC. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We

are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference is accurate only as of each of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

On September 3, 2013, SafeStitch Medical, Inc. completed a merger with TransEnterix Surgical, Inc. under which TransEnterix Surgical became a wholly

owned subsidiary of SafeStitch. On December 6, 2013, SafeStitch changed its name to TransEnterix, Inc. In this prospectus supplement, when we refer to ourself as a combination of SafeStitch and TransEnterix Surgical after giving effect to the

merger, we use the terms “TransEnterix,” the “Company,” “we,” “us,” and “ours.” When we refer to the historical business, operations and corporate status of the parent in the merger we use the term

“SafeStitch” and when we refer to the historical business, operations and corporate status of the subsidiary in the merger, we use the term “TransEnterix Surgical.”

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include trademarks,

service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective

owners.

S-ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement and

in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in shares of our common stock. The following summary

is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements and notes thereto appearing elsewhere in this prospectus supplement, the accompanying prospectus and the documents

incorporated by reference herein and therein. Before you decide to invest in shares of our common stock, to fully understand this offering and its consequences to you, you should read the entire prospectus supplement and the accompanying prospectus

carefully, including the risk factors beginning on page S-6 of this prospectus supplement and beginning on page 7 of the accompanying prospectus, and the consolidated financial statements and related notes included in this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference herein and therein.

TransEnterix, Inc.

Overview

We are a medical device

company that is pioneering the use of flexible instruments and robotics to improve minimally invasive surgery. We are currently focused on the development and future commercialization of our SurgiBot™ Surgical System, or SurgiBot System, a

minimally invasive surgical robotic system that is designed to utilize flexible instruments through articulating channels controlled directly by the surgeon, with robotic assistance, while the surgeon remains patient-side within the sterile field.

The flexible nature of the SurgiBot System would allow for multiple instruments to be introduced and deployed through a single site, thereby offering room for visualization and manipulation once in the body. The SurgiBot System also integrates

three-dimensional, or 3-D, high definition vision technology to improve the surgeon’s visualization and manipulation of instruments during surgery.

We believe the SurgiBot System addresses many of the challenges currently faced by patients, surgeons, hospitals and payors in laparoscopy and

robotic surgery through a combination of more advanced tools and robotic functionality, which are designed to: (i) empower surgeons with improved precision, strength and visualization; (ii) improve patient satisfaction and post-operative

recovery; and (iii) provide a cost-effective robotic system, compared to currently used alternatives, for a potentially wide range of clinical applications.

The SurgiBot System is the powered and robotically-enabled next-generation platform technology of our SPIDER

®

Surgical System, or SPIDER System, which is a manual laparoscopic device we launched in 2010 that has been used in over 3,500 procedures to date. In developing the SurgiBot System, we have

leveraged the extensive research & development, clinical and commercial Spider System experience to combine the single-port capability, “true right/true left” ergonomics, and the internal triangulation of the SPIDER System with

robotic capabilities that provide higher levels of strength, precision and advanced vision capabilities. We intend to make submissions seeking U.S. Food and Drug Administration, or FDA, clearance and CE Mark approval of the SurgiBot System by the

end of 2014.

Our Market Opportunity

Over the past two decades, laparoscopic surgery has emerged as a minimally invasive alternative to open surgery. While traditional laparoscopy

has been a widely adopted minimally invasive alternative to many previously open procedures, it still has many limitations including: (i) requiring multiple incisions to achieve the optimal visualization and instrument triangulation required to

perform successful surgery; (ii) creating physical

S-1

challenges by forcing the surgeon’s hands and arms be placed in awkward angles and requiring the surgeon to hold instruments in fixed positions for long periods of time; (iii) requiring

a surgical assistant to stabilize and move a laparoscopic camera; (iv) creating a cumbersome and potentially tissue-damaging fulcrum at the patient’s abdominal wall where instruments are manipulated; (v) involving rigid instruments

that lack the internal articulation required to enhance dexterity in complex or difficult tasks, including dissection and retraction; and (vi) involving procedures that are performed with two dimensional, or 2-D, visualization of the operative

space, making depth perception difficult.

More recent attempts at minimally invasive surgery have leveraged robotic technology. Robotic

technologies improve upon many aspects of the laparoscopic surgical experience and have gained widespread adoption in urologic and gynecologic procedures. More recently, developed robotic approaches have been applied to many other clinical

applications, in particular general surgery. According to Intuitive Surgical, there were approximately 81,000 robotic-assisted general surgery procedures performed in 2013 in the U.S., which has grown from approximately 42,000 in 2012, an increase

of 93%. Despite recent advances, we believe that there are many limitations of current robotic-assisted surgery systems used in connection with general laparoscopic surgeries, including: (i) the large capital investment required; (ii) the

surgeon operating from outside of the sterile field; (iii) the challenges in maneuvering the patient once a large robotic system is fixed in place; and (iv) the risk of port site trauma by having the robotic arm fulcrum near the incision

in a patient’s abdominal wall.

Robotic technologies have experienced strong adoption among large hospitals, academic centers, and

teaching hospitals in the U.S. However, a majority of hospitals within the U.S. have not adopted robotic technology for abdominal surgeries due to cost and complexity, as well as the other limitations mentioned above. In addition to these hospitals,

there are over 5,000 surgery centers within the U.S. that have very low adoption of robotic technology for abdominal surgeries. We believe a smaller, more affordable surgical robot would provide the right solution for potential customers,

particularly in hospital and surgery center settings.

SurgiBot System Robotic Platform

We believe the SurgiBot System will address the needs of the large and growing, yet underserved, population of physicians, hospitals and

surgery centers who wish to offer the benefits of robotic assisted surgery at a lower cost than current solutions. The SurgiBot System is designed for a potentially wide range of clinical applications, including general, bariatric and gynecologic

surgery. We believe the number of addressable laparoscopic procedures for the SurgiBot System is approximately two million annually. In addition, we expect that hospitals and physicians will be able to utilize existing laparoscopic procedure codes

to receive reimbursement for procedures performed using the SurgiBot System.

Key features of the SurgiBot System are:

|

|

•

|

|

Precision and control with scaling

: The SurgiBot System allows the user to adjust the level of mechanized movement using scaled ratios;

|

|

|

•

|

|

Strength

: The SurgiBot System features motor driven-powered motion which is controlled by the surgeon;

|

|

|

•

|

|

Ergonomics

: The SurgiBot System stabilizes multiple instruments and a laparoscope, and allows the surgeon to reposition their hands in an ergonomic fashion;

|

|

|

•

|

|

Patient-side in sterile field

: The SurgiBot System is positioned next to the operating table, thereby allowing the surgeon, as operator, to remain in the sterile field next to the patient;

|

|

|

•

|

|

Internal triangulation

: The SurgiBot System utilizes a deployment mechanism to achieve triangulation of multiple instruments inside the body, as contrasted with other robotic systems that rely on crossing

instruments at the patient’s abdominal wall for single site surgery. The SurgiBot System allows for triangulation that can be repositioned in the surgical field during a procedure and maintained at positions throughout a body cavity; and

|

S-2

|

|

•

|

|

Direct surgeon connection to the instruments

: The SurgiBot System allows the surgeon-operator to maintain human tactile feedback along several degrees of motion. Existing robotic systems lack any such tactile

feedback.

|

In March 2014, we completed a pre-submission FDA filing for the SurgiBot System.

Our Strategy

Our goal is to

develop and commercialize a leading robotics platform with broad procedure applicability to address the challenges of current laparoscopic and robotic offerings. We intend to continue the development of and commence commercialization of the SurgiBot

System platform with more advanced tools and robotic functionality, which we believe will: (i) provide surgeons with improved precision, strength and visualization; (ii) improve patient satisfaction and post-operative recovery; and

(iii) provide a cost-effective robotic system, compared to existing alternatives. To achieve our objectives, we intend to:

|

|

•

|

|

Continue to conduct preclinical studies with surgeons;

|

|

|

•

|

|

Launch a flexible advanced energy device in the second quarter of 2014;

|

|

|

•

|

|

Begin first-in-man clinical studies for our SurgiBot System in the third quarter of 2014;

|

|

|

•

|

|

Submit regulatory filings for approval in the U.S. and Europe in the fourth quarter of 2014; and

|

|

|

•

|

|

Begin commercial sales of the SurgiBot System in the third quarter of 2015.

|

Recent Developments

On September 3, 2013, SafeStitch Medical, Inc. completed a merger with TransEnterix Surgical, Inc. under which became a

wholly owned subsidiary of SafeStitch.

On September 3, 2013, we consummated a private placement with certain of our investors who

are accredited investors in which we issued and sold an aggregate of $28.2 million, net of issuance costs, of our Series B Convertible Preferred Stock, par value $0.01 per share, or Series B Preferred Stock, to provide funding to support our

operations following the merger.

On December 6, 2013, we filed an Amended and Restated Certificate of Incorporation, or the Restated

Certificate, to change our name to TransEnterix, Inc. and to increase the authorized number of shares of common stock from 225 million to 750 million. In accordance with the terms of the Certificate of Designation of Series B Preferred Stock,

each outstanding share of Series B Preferred Stock automatically converted into two shares of our common stock upon the filing of the Restated Certificate. An aggregate of 15,139,409 shares of common stock were issued pursuant to the conversion of

the Series B Preferred Stock.

On March 17, 2014, we filed an application to list our shares of common stock on the NYSE MKT. On

April 1, 2014, we received authorization to list our shares on the NYSE MKT, subject to completion of this offering and meeting all relevant quantitative and qualitative listing criteria of the NYSE MKT. Although we believe our common stock

will be accepted for listing on the NYSE MKT, we cannot assure you that we will be able to sustain such listing. Assuming our application is accepted, we expect to continue trading under the ticker “TRXC” and discontinue trading on the OTC

Bulletin Board.

Effective March 31, 2014, we implemented a 1-for-5 reverse stock split. The reverse stock split was effected in

connection with our NYSE MKT application to assist in meeting the NYSE MKT minimum bid price requirement of a stock price of at least $2.00 per share. Due to the reverse stock split, beginning April 2, 2014 and continuing for 20 business days

or until our listing on the NYSE MKT, whichever occurs first, our stock will trade under the symbol “TRXCD.” Unless otherwise indicated and excluding historical financial statements

S-3

incorporated herein, all relevant common share and per common share information in this prospectus supplement have been retroactively adjusted to reflect the 1-for-5 reverse stock split, but does

not account for any fractional shares. Trading of our common stock on the OTCBB reflected the reverse split on April 2, 2014.

As of

March 31, 2014, our cash, cash equivalents and short-term investments were $8,630,262.

Corporate Information

We were organized as a Delaware corporation on August 19, 1988. Our principal executive offices are located at 635 Davis Drive, Suite

300, Morrisville, NC 27560. Our phone number is (919) 765-8400 and our Internet address is

www.transenterix.com

. In December 2013, we changed our name to TransEnterix, Inc. from SafeStitch Medical, Inc. The information on our website or

any other website is not incorporated by reference in this prospectus supplement and does not constitute a part of this prospectus supplement.

S-4

THE OFFERING

|

|

|

|

|

Common stock offered by us

|

|

$50 million of common stock, or shares

|

|

|

|

|

Option to purchase additional shares

|

|

shares

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

shares

|

|

|

|

|

Use of proceeds

|

|

We expect the net proceeds from this offering to be approximately $ million (or $ million if the underwriters exercise their option to

purchase additional shares in full), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We currently expect to use the net proceeds for research and development, sales, marketing and

commercialization related to the SurgiBot System, working capital and other general corporate purposes. See “Use of Proceeds” on page S-10 of this prospectus supplement.

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page S-6 of this prospectus supplement and on page 7 of the accompanying prospectus for a discussion of factors you should consider carefully when making a decision to invest in our

common stock.

|

|

|

|

|

OTCBB Symbol

|

|

TRXC

|

The number of shares of our common stock to be outstanding immediately after this offering is based on

48,841,547 shares outstanding as of December 31, 2013. This number of shares excludes the following:

|

|

•

|

|

3,822,887 shares of common stock issuable upon the exercise of outstanding options granted under our stock option plans at a weighted average exercise price of $1.30 per share;

|

|

|

•

|

|

1,285,394 shares of common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $1.65 per share;

|

|

|

•

|

|

210,000 shares of common stock issuable upon vesting of outstanding restricted stock units; and

|

|

|

•

|

|

4,169,100 shares of common stock available for future issuance under our stock option plans.

|

Except as otherwise indicated herein, all information in this prospectus supplement, including the number of shares that will be outstanding

after this offering, assumes or gives effect to:

|

|

•

|

|

a 1-for-5 reverse stock split of our common stock effected on March 31, 2014 but does not account for any fractional shares; and

|

|

|

•

|

|

no exercise of the underwriters’ option to purchase additional shares in this offering.

|

Certain of our existing stockholders that are affiliated with certain of our directors have indicated an interest of purchasing up to

$5,000,000 of our common stock. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, less or no shares in this offering to any of these stockholders. In

addition, any of these stockholders may determine to purchase more, less or no shares in this offering.

Due to the reverse stock split,

beginning April 2, 2014 and continuing for 20 business days or until our listing on the NYSE MKT, whichever occurs first, our stock will trade under the symbol “TRXCD.”

S-5

RISK FACTORS

Investing in our securities involves a high degree of risk. For a discussion of the factors you should carefully consider before deciding to

purchase any of our securities, please review “Part I, Item 1A—Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on March 5, 2014 and as amended March 14,

2014, March 31, 2014 and April 2, 2014, which is incorporated by reference in this prospectus supplement and the accompanying prospectus. The risks and uncertainties described in the documents incorporated by reference are not the only risks

and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and

results of operations would suffer. In that event, the market price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Related to This Offering

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the application of the net proceeds and could use them for purposes other than those

contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not

increase our results of operations or the market value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development and approval of our products and cause the price of

our common stock to decline.

A substantial number of shares of common stock may be sold in the market following this offering, which

may depress the market price for our common stock.

Sales of a substantial number of shares of our common stock in the public market

following this offering could cause the market price of our common stock to decline. Upon completion of this offering, based on our shares outstanding as of December 31, 2013, we will have outstanding an aggregate of

shares of common stock, assuming no exercise of outstanding options. All of the shares sold in this offering upon issuance will be, freely tradable

without restriction or further registration under the Securities Act of 1933, as amended, or the Securities Act, unless these shares are owned or purchased by “affiliates” as that term is defined in Rule 144 under the Securities Act. In

addition, we have also registered all of the shares of common stock that we may issue under our stock option plans, and as of December 31, 2013, a total of 3,822,887 shares of our common stock are issuable upon exercise of outstanding options

granted by us, at a weighted average exercise price of $1.30 per share, and a total of 4,169,100 shares of common stock remain available for future for issuance under such plans. As a result, these shares can be freely sold in the public market upon

issuance, subject to restrictions in our lock-up and voting agreements and under the securities laws.

In connection with the merger and

the private placement financing described in the summary of this prospectus supplement, each of the investors participating in the private placement, the largest stockholders of each of SafeStitch and TransEnterix Surgical prior to the merger (many

of whom were investors in the private placement), and members of our Board of Directors, agreed to enter into a lock-up and voting agreement, pursuant to which such persons agreed not to sell, transfer or otherwise convey any of the Company’s

securities held by them for designated periods following the merger closing date. The total number of our shares subject to the lock-up and voting agreements at the time of the merger was 45,367,165 shares, comprising approximately 93% of our stock

on the effective date of the merger. The lock-up and voting agreements provide that such persons may sell, transfer or convey: (1) up to 50% of the locked-up shares (22,683,583 shares) after September 3, 2014 (the one-year anniversary of

the merger closing date); (2) an additional 11,341,791 shares after March 3, 2015 (the eighteen-month anniversary of the merger closing date); and (3) the remaining

S-6

11,341,791 shares on September 3, 2015 (the two-year anniversary of the merger closing date). The restrictions on transfer contained in the lock-up and voting agreements cease to apply to

all of the locked-up shares following the second anniversary of the merger closing date. These limitations may add to the low volume of shares of our common stock that trade on the OTCBB during the time periods described. After the expiration of

these lock-up periods, there may be significant sales of shares of our common stock by the stockholders who received shares in the merger.

Investors in this offering will pay a much higher price than the book value of our stock.

Since the price per share of our common stock being offered will be substantially higher than the net tangible book value per share of our

common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Our net tangible book value as of December 31, 2013 was approximately $8.4 million, or $0.17 per share. After

giving effect to the sale of shares of our common stock in this offering at the public offering price of $ per share and based on our net tangible book value as of

December 31, 2013, if you purchase shares of common stock in this offering, you would suffer immediate and substantial dilution of $ per share in the net tangible book

value of the common stock. See the section titled “Dilution” below for a more detailed discussion of the dilution you would incur if you purchase common stock in this offering.

You may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we may in the future offer and issue additional shares of our common stock or other securities

convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in

this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or

exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

In addition,

we have a significant number of stock options outstanding. To the extent that outstanding stock options have been or may be exercised or other shares issued, you may experience further dilution. Further, we may choose to raise additional capital due

to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

On March 31, 2014, we implemented a reverse stock split of our common stock, which could result in increased volatility in the price

and trading volume of our common stock and cause a decline in the value of our common stock.

On February 12, 2014, the holders

of approximately 66% of our voting securities authorized a Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split in the range of one-for-two to one-for-ten, with the actual

ratio to be determined by the Board of Directors in its sole discretion, within such range. On March 6, 2014, the Board approved a one-for-five reverse stock split. On March 31, 2014, we filed an amendment to our Certificate of

Incorporation to implement the reverse stock split and trading on a post-split basis commenced on April 2, 2014.

While there will

not be any change in a stockholder’s economic interest in the Company as a result of such a reverse stock split, stockholders may not view such a reverse stock split in a favorable manner. If such a reverse stock split is not viewed favorably

by stockholders, this could result in increased volatility in the price and trading volume of our common stock, which could also cause a decline in the value of our common stock. There can be no assurance that the per share market price of our

common stock following the reverse stock split will increase and be maintained in proportion to the reduction in the number of shares of our common stock outstanding before the reverse stock split.

S-7

While the Board of Directors believes that a higher stock price per share, and a lower number of

outstanding shares may help generate investor interest, there can be no assurance that the reverse stock split will result in a per-share price that will attract institutional investors or investment funds or that such share price will satisfy the

investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our common stock may not necessarily improve.

S-8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements within the meaning of Section 27A of the Securities Act, and

Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). All statements, other than statements of historical fact, included or incorporated by reference in this prospectus supplement regarding our strategy, future

operations, collaborations, intellectual property, cash resources, financial position, future revenues, projected costs, prospects, plans and objectives are forward-looking statements. The words “believes,” “anticipates,”

“estimates,” “plans,” “expects,” “intends,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and

“would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or

expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. There are a number of important factors that could cause our actual results to differ materially from those indicated

or implied by forward-looking statements. These important factors include those set forth above under the heading “Risk Factors” in this prospectus supplement, the accompanying prospectus and in the reports incorporated by reference herein

and therein. These factors and the other cautionary statements made in this prospectus supplement or incorporated by reference herein should be read as being applicable to all related forward-looking statements whenever they appear in this

prospectus supplement or in the reports incorporated by reference herein. In addition, any forward-looking statements represent our estimates only as of the date that this prospectus supplement is filed with the SEC, and should not be relied upon as

representing our estimates as of any subsequent date. We do not assume any obligation to update any forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

S-9

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering, based on the sale of

shares of our common stock at the public offering price of $ per share, after deducting

underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million (or approximately

$ million if the underwriters’ option to purchase additional shares is exercised in full).

We currently intend to use the net proceeds of this offering for research and development, sales, marketing and commercialization related to

the SurgiBot System, working capital and other general corporate purposes. While we have estimated the particular uses for the net proceeds of this offering, we have not determined the amounts we plan to spend on any of the areas listed above or the

timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds from this offering for any purpose, and investors will be relying on the judgment of our management with regard to the use of these net

proceeds. Pending use of the net proceeds as described above, we intend to invest the net proceeds in money-market funds or U.S. treasuries until we use them for their stated purpose.

S-10

CAPITALIZATION

The following table sets forth our consolidated cash, cash equivalents and short-term investments, current portion of our notes payable and

our capitalization as of December 31, 2013:

|

|

•

|

|

on an actual basis; and

|

|

|

•

|

|

on an adjusted basis after giving effect to our sale of shares of common stock offered hereby at a public offering price of $ per share and the net

proceeds of such offering after deducting the underwriting discounts and commissions of $ per share and estimated offering expenses payable by us.

|

You should read this table along with our historical consolidated financial statements and related notes and the other financial information

included and incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2013

|

|

|

|

|

Actual

|

|

|

As

Adjusted

|

|

|

|

|

(In thousands)

|

|

|

Cash, cash equivalents, and short-term investments

|

|

$

|

16,205

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note payable – current portion

|

|

|

3,879

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note payable – less current portion

|

|

|

4,602

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock $0.001 par value, 750,000,000 shares authorized at December 31, 2013; 48,841,547 shares issued and outstanding at

December 31, 2013, actual; shares issued and outstanding at December 31, 2013, as adjusted

|

|

|

244

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

203,043

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

(98,264

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

105,023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

109,625

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

S-11

DILUTION

If you purchase any of the shares of common stock offered by this prospectus supplement, you will experience dilution to the extent of the

difference between the offering price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of December 31, 2013, was

approximately $8.4 million, or $0.17 per share of common stock. Net tangible book value per share is equal to our total tangible assets minus total liabilities, all divided by the number of shares of common stock outstanding.

After giving effect to the sale of shares of common stock by us at a public offering price of

$ per share, less the estimated offering expenses, our as adjusted net tangible book value at December 31, 2013, would have been approximately

$ , or $ per share. This represents an immediate increase in the net tangible book value of

$ per share to existing stockholders and an immediate dilution of $ per share to investors in

this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

Public Offering price per share

|

|

|

|

|

|

$

|

|

|

|

Net tangible book value per share as of December 31, 2013

|

|

$

|

0.17

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering

|

|

|

|

|

|

$

|

|

|

|

Dilution in tangible book value per share to new investors

|

|

$

|

|

|

|

|

|

|

If the underwriters exercise in full their option to purchase

additional shares, the as adjusted net tangible book value after this offering would be $

per share, representing an increase in net tangible book value of $

per share to existing shareholders and immediate dilution in net tangible book value of

$ per share to investors participating in this offering.

Certain of our existing stockholders that are affiliated with certain of our directors have indicated an interest of purchasing up to

$5,000,000 of our common stock.

The number of shares of common stock outstanding used in both the table and calculations above is based on

48,841,547 shares outstanding as of December 31, 2013. This number of shares does not include shares of common stock subject to the underwriters’ option to purchase additional shares and also excludes:

|

|

•

|

|

3,822,887 shares of common stock issuable upon the exercise of outstanding options granted under our stock option plans at a weighted average exercise price of $1.30 per share;

|

|

|

•

|

|

1,285,394 shares of common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $1.65 per share;

|

|

|

•

|

|

210,000 shares of common stock issuable upon vesting of outstanding restricted stock units; and

|

|

|

•

|

|

4,169,100 shares of common stock available for future issuance under our stock option plans.

|

S-12

UNDERWRITING

Stifel, Nicolaus & Company, Incorporated and RBC Capital Markets, LLC are acting as joint book-running managers of the offering and

as representatives of the underwriters named below. Subject to the terms and conditions set forth in an underwriting agreement dated the date of this prospectus supplement, each of the underwriters named below has severally agreed to purchase from

us the aggregate number of shares of common stock set forth opposite their respective names below:

|

|

|

|

|

Underwriters

|

|

Number of Shares

|

|

Stifel, Nicolaus & Company, Incorporated

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

Landenburg Thalmann & Co

|

|

|

|

Raymond James Financial, Inc

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

The underwriting agreement provides that the obligations of the several underwriters to purchase the shares of

common stock included in this offering are subject to various conditions, including approval of legal matters by counsel. The nature of the underwriters’ obligations commits them to purchase and pay for all of the shares of common stock listed

above, other than those covered by the over-allotment option described below, if any are purchased.

The underwriters expect to deliver

the shares of common stock to purchasers on or about , 2014.

Over-Allotment Option

We have granted

an option, exercisable for 30 days from the date of this prospectus supplement, to the underwriters to purchase up to a total of additional shares of our

common stock from us at the public offering price, less the underwriting discounts and commissions payable by us, as set forth on the cover page of this prospectus supplement. If the underwriters exercise this option in whole or in part, then each

of the underwriters will be separately committed, subject to the conditions described in the underwriting agreement, to purchase the additional shares of our common stock in proportion to their respective commitments set forth in the table above.

The underwriters may exercise the option solely for the purpose of covering over-allotments, if any, in connection with this offering. Any shares of common stock issued or sold under the option will be issued and sold on the same terms and

conditions as the other shares of common stock that are the subject of this offering.

Commissions and Discounts

The underwriters propose to offer the shares of common stock directly to the public at the public offering price set forth on the cover page

of this prospectus supplement, and at this price less a concession not in excess of $ per share of common stock to other dealers. After this offering,

the offering price, concessions, and other selling terms may be changed by the underwriters. Our common stock is offered subject to receipt and acceptance by the underwriters and to the other conditions, including the right to reject orders in whole

or in part.

The following table summarizes the compensation to be paid to the underwriters by us and the proceeds, before expenses,

payable to us:

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

|

Without

Over-Allotment

|

|

With

Over-Allotment

|

|

Public offering price

|

|

|

|

|

|

|

|

Underwriting discount

|

|

|

|

|

|

|

|

Proceeds, before expenses, to us

|

|

|

|

|

|

|

Certain of our existing stockholders that are affiliated with certain of our directors have indicated an

interest of purchasing up to $5,000,000 of our common stock. The underwriters will receive the same underwriting discount on these shares purchased by these entities as they will on any other shares sold to the public in this offering.

S-13

We estimate that the total expenses of this offering payable by us, excluding underwriting

discounts and commissions, will be approximately $700,000. We have agreed to reimburse the underwriters for certain expenses in an amount up to $50,000.

Indemnification of Underwriters

We will

indemnify the underwriters against some civil liabilities, including liabilities under the Securities Act and liabilities arising from breaches of our representations and warranties contained in the underwriting agreement. If we are unable to

provide this indemnification, we will contribute to payments the underwriters may be required to make in respect of those liabilities.

No Sales of

Similar Securities

The underwriters will require all of our directors and officers and certain of our stockholders to agree not to

offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of common stock or any securities convertible into or exchangeable for shares of common stock except for the shares of common stock offered in this offering

without the prior written consent of Stifel, Nicolaus & Company, Incorporated for a period of 90 days after the date of this prospectus supplement, subject to specified limited exceptions. Stifel, Nicolaus & Company, Incorporated

and RBC Capital Markets, LLC in their sole discretion may release any of the securities subject to these agreements at any time.

We have

agreed that for a period of 90 days after the date of this prospectus supplement, we will not, without the prior written consent of Stifel, Nicolaus & Company, Incorporated and RBC Capital Markets, LLC, offer, sell or otherwise dispose of

any shares of common stock, except for the shares of common stock offered in this offering, the shares of common stock issuable upon exercise of outstanding options on the date of this prospectus supplement and other specified limited exceptions.

The 90-day restricted period in all of the agreements is subject to extension if (i) during the last 17 days of the restricted

period we issue an earnings release or material news or a material event relating to us occurs or (ii) prior to the expiration of the restricted period, we announce that we will release earnings results during the 16-day period following the

last day of the lock-up period, in which case the restrictions imposed in these lock-up agreements shall continue to apply until the expiration of the 18-day period beginning on the issuance of the earnings release or the occurrence of the material

news or material event, unless Stifel, Nicolaus & Company, Incorporated and RBC Capital Markets, LLC waive the extension in writing.

Over the

Counter Bulletin Board

Our common stock is listed on the OTCBB under the symbol “TRXC.” Due to the reverse stock split,

beginning April 2, 2014 and continuing for 20 business days or until our listing on the NYSE MKT, whichever occurs first, our stock will trade under the symbol “TRXCD.”

Passive Market-Making

In connection

with the offering, the underwriters may engage in passive market-making transactions in the common stock on the OTCBB in accordance with Rule 103 of Regulation M under the Exchange Act during the period before the commencement of offers or sales of

common stock and extending through the completion and distribution. A passive market-maker must display its bids at a price not in excess of the highest independent bid of the security. However, if all independent bids are lowered below the passive

market-maker’s bid that bid must be lowered when specified purchase limits are exceeded.

Short Sales, Stabilizing Transactions, and Penalty Bids

In order to facilitate this offering, persons participating in this offering may engage in transactions that stabilize, maintain, or

otherwise affect the price of our common stock during and after this offering. Specifically, the underwriters may engage in the following activities in accordance with the rules of the SEC.

S-14

Short sales.

Short sales involve the sales by the underwriters of a greater number of

shares than they are required to purchase in the offering. Covered short sales are short sales made in an amount not greater than the underwriters’ over-allotment option to purchase additional shares from us in this offering. The underwriters

may close out any covered short position by either exercising their over-allotment option to purchase shares or purchasing shares in the open market. In determining the source of shares to close out the covered short position, the underwriters will

consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the over-allotment option. Naked short sales are any short sales in excess of such

over-allotment option. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the

price of the common stock in the open market after pricing that could adversely affect investors who purchase in this offering.

Stabilizing transactions.

The underwriters may make bids for or purchases of the shares for the purpose of pegging, fixing, or

maintaining the price of the shares, so long as stabilizing bids do not exceed a specified maximum. Purchases to cover short positions and stabilizing purchases, as well as other purchases by the underwriters for their own accounts, may have the

effect of preventing or slowing a decline in the market price of the shares of common stock. They may also cause the price of the shares of common stock to be higher than the price that would otherwise exist in the open market in the absence of

these transactions.

Penalty bids.

If the underwriters purchase shares in the open market in a stabilizing transaction or syndicate

covering transaction, they may reclaim a selling concession from the underwriters and selling group members who sold those shares as part of this offering. Stabilization and syndicate covering transactions may cause the price of the shares to be

higher than it would be in the absence of these transactions. The imposition of a penalty bid might also have an effect on the price of the shares if it discourages resales of the shares.

The transactions above may occur on the OTCBB or otherwise. Neither we nor the underwriters make any representation or prediction as to the

effect that the transactions described above may have on the price of the shares. If these transactions are commenced, they may be discontinued without notice at any time.

Discretionary Sales

The underwriters

have informed us that they do not expect to confirm sales of common stock offered by this prospectus supplement to accounts over which they exercise discretionary authority without obtaining the specific approval of the account holder.

Electronic Distribution

A prospectus

supplement in electronic format may be made available on the internet sites or through other online services maintained by one or more of the underwriters participating in this offering, or by their affiliates. In connection with this offering, the

underwriters or certain of the securities dealers may distribute prospectus supplements electronically. The underwriters may agree to allocate a number of shares of common stock for sale to its online brokerage account holders. The underwriters may

make internet distributions on the same basis as other allocations. Other than the prospectus supplement in electronic format, the information on any underwriter’s website and any information contained in any other website maintained by an

underwriter is not part of the prospectus or the registration statement of which this prospectus forms a part, has not been approved or endorsed by us or any underwriter in its capacity as underwriter and should not be relied upon by investors.

Conflicts of Interest

The underwriters

and their respective affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, principal investment, hedging,

financing and brokerage activities. Certain of the

S-15

underwriters and their affiliates have in the past provided, and may in the future from time to time provide, investment banking and other financing and banking services to us, for which they

have in the past received, and may in the future receive, customary fees and reimbursement for their expenses. In the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad

array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments including bank loans) for their own account and for the accounts of their customers and may at any time hold long and

short positions in such securities and instruments. Such investment and securities activities may involve securities and/or instruments of ours or our affiliates. The underwriters and their affiliates may also make investment recommendations and/or

publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

One of our directors, Dr. Phillip Frost is the trustee of Frost Gamma Investments Trust which owns approximately 8.8% of our common stock.

Frost Gamma Investments Trust owns greater than 10% of Ladenburg Thalmann Financial Services, or LTFS, and Dr. Frost is also Chairman of the Board of LTFS. LTFS is affiliated with Ladenburg Thalmann & Co., one of the underwriters in this

offering.

Notice to Prospective Investors in the European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member

State”), each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and

will not make an offer of shares to the public in that Relevant Member State prior to the publication of a prospectus in relation to the shares which has been approved by the competent authority in that Relevant Member State or, where appropriate,

approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it may, with effect from and including the Relevant Implementation Date,

make an offer of shares to the public in that Relevant Member State at any time:

|

|

•

|

|

to legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities;

|

|

|

•

|

|

to any legal entity which has two or more of (1) an average of at least 250 employees during the last financial year; (2) a total balance sheet of more than €43,000,000; and (3) an annual net

turnover of more than €50,000,000, as shown in its last annual or consolidated accounts;

|

|

|

•

|

|

to fewer than 100 natural or legal persons (other than qualified investors as defined in the Prospectus Directive) subject to obtaining the prior consent of the representatives for any such offer; or

|

|

|

•

|

|

in any other circumstances which do not require the publication by our company of a prospectus pursuant to Article 3 of the Prospectus Directive.

|

For the purposes of this provision, the expression an “offer of shares to the public” in relation to any shares in any Relevant

Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or subscribe the shares, as the same may be varied

in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, and the expression Prospectus Directive means Directive 2003/71/EC and includes any relevant implementing measure in each Relevant

Member State.

Notice to Prospective Investors in the United Kingdom

This prospectus is only being distributed to, and is only directed at, persons in the United Kingdom that are qualified investors within the

meaning of Article 2(1)(e) of the Prospectus Directive that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion)

S-16

Order 2005 (the “Order”) or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (each

such person being referred to as a “relevant person”). This prospectus and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the

United Kingdom. Any person in the United Kingdom that is not a relevant person should not act or rely on this document or any of its contents.

Notice

to Prospective Investors in Switzerland

This document as well as any other material relating to the shares which are the subject of

the offering contemplated by this prospectus (the “Shares”) do not constitute an issue prospectus pursuant to Article 652a of the Swiss Code of Obligations. The Shares will not be listed on the SWX Swiss Exchange and, therefore, the

documents relating to the Shares, including, but not limited to, this document, do not claim to comply with the disclosure standards of the listing rules of SWX Swiss Exchange and corresponding prospectus schemes annexed to the listing rules of the

SWX Swiss Exchange.

The Shares are being offered in Switzerland by way of a private placement, i.e. to a small number of selected

investors only, without any public offer and only to investors who do not purchase the Shares with the intention to distribute them to the public. The investors will be individually approached by our company from time to time.

This document as well as any other material relating to the Shares are personal and confidential and do not constitute an offer to any other

person. This document may only be used by those investors to whom it has been handed out in connection with the offering described herein and may neither directly nor indirectly be distributed or made available to other persons without express

consent of our company. It may not be used in connection with any other offer and shall in particular not be copied and/or distributed to the public in (or from) Switzerland.

Miscellaneous

The transfer agent and

registrar for our common stock is Continental Stock Transfer & Trust.

LEGAL MATTERS

Certain legal matters with respect to the securities offered hereby have been passed upon by Ballard Spahr LLP. Cooley LLP, New York, New York

is counsel for the underwriters in connection with this offering.

EXPERTS

The consolidated financial statements as of December 31, 2013 and 2012 and for each of the two years in the period ended

December 31, 2013 incorporated by reference in this Prospectus have been so incorporated in reliance on the report of BDO USA, LLP, an independent registered public accounting firm, (the report on the consolidated financial statements contains

an explanatory paragraph regarding the Company’s ability to continue as a going concern) incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed with the SEC under

the Securities Act. This prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement. We have omitted certain parts of the registration statement in accordance with the rules and

regulations of the SEC. For further information, we refer you to the registration statement, including its exhibits and schedules. Statements contained in this prospectus supplement and the accompanying prospectus about the provisions or contents of

any contract,

S-17

agreement or any other document referred to are not necessarily complete. Please refer to the actual exhibit for a more complete description of the matters involved.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings, including the

registration statement and exhibits, are available to the public at the SEC’s website at

http://www.sec.gov

. You may also read, without charge, and copy the documents we file, at the SEC’s public reference rooms at 100 F Street,

N.E., Room 1580, Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms.

We maintain an Internet site at

www.transenterix.com

. We have not incorporated by reference into this prospectus supplement or the

accompanying prospectus the information on our website, and you should not consider any of the information posted on or hyper-linked to our website to be a part of this prospectus supplement or the accompanying prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC, which means we can disclose important

information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus supplement, and certain information that we will later file with the SEC will automatically update and

supersede this information. We incorporate by reference the documents listed below as well as any future filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement until we

sell all of the securities under this prospectus supplement, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.” The following documents filed with the

SEC are incorporated by reference in this prospectus supplement and the accompanying prospectus:

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC on March 5, 2014, as amended by Amendment No. 1 to our Annual Report on Form 10-K filed with the SEC on

March 14, 2014, as amended by Amendment No. 2 to our Annual Report on Form 10-K filed with the SEC on March 31, 2014, as amended by Amendment No. 3 to our Annual Report on Form 10-K filed with the SEC on April 2, 2014;

|

|

|

•

|

|

our Current Report on Form 8-K/A filed on November 13, 2013 (Item 9.01) and our Currents Report on Form 8-K filed with the SEC on February 19, 2014 (Items 5.02, 5.05 and 5.07), April 1, 2014 (Items

5.03 and 9.01), April 1, 2014 (Items 8.01 and 9.01) and April 2, 2014 (Items 8.01 and 9.01);

|

|

|

•

|

|

our definitive Information Statement on Schedule 14C filed February 21, 2014; and

|

|

|

•

|

|

the description of the Company’s common stock contained in the Registration Statement on Form 8-A filed on July 30, 1991 and in the Current Report on Form 8-K filed on March 31, 2014 (Item 8.01).

|

We will furnish to you, on written or oral request, a copy of any or all of the documents that have been incorporated by

reference, including exhibits to these documents. You may request a copy of these filings at no cost by writing or telephoning our Secretary at the following address and telephone number:

TransEnterix, Inc.

Attention:

Joshua Weingard, Chief Legal Officer and Secretary

635 Davis Drive, Suite 300

Morrisville, NC 27560

Telephone

No.: (919) 765-8400

S-18

PROSPECTUS

$100,000,000

Common Stock

Preferred

Stock

Warrants

Debt Securities

Units

We may offer and sell from time to time, in one or more offerings, up to $100,000,000 of any combination of common stock, preferred stock, warrants and debt

securities, either individually or units consisting of any two or more of such securities. We may also offer securities upon the exercise of warrants.

Each time we sell securities pursuant to this prospectus, we will provide the specific terms of the securities offered in a supplement to this prospectus. The

prospectus supplements will also describe the specific manner in which we will offer these securities and may also supplement, update or amend information contained in this prospectus. You should read this prospectus and any related prospectus

supplement carefully before you invest in our securities.

The securities may be sold on a delayed or continuous basis directly by us, through dealers,

agents or underwriters designated from time to time, or through any combination of these methods. If any dealers, agents or underwriters are involved in the sale of the securities in respect of which this prospectus is being delivered, we will

disclose their names and the nature of our arrangements with them in any prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in the applicable prospectus supplement.

Our common stock is traded on the OTC Bulletin Board under the symbol “TRXC.” On April 1, 2014, the closing price of our common stock was $9.70

per share.

Investing in our securities involves a high degree of risk. See “

RISK FACTORS

” on page 7.

This prospectus may not be used to offer or sell securities unless accompanied by a prospectus supplement for the securities being sold.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is April 2, 2014.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and in any prospectus supplement

(including in any documents incorporated by reference herein or therein). We have not authorized anyone to provide you with any different information. We are offering to sell our securities, and seeking offers to buy, only in jurisdictions where

offers and sales are permitted.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our securities. You should read this entire prospectus carefully, especially the “

Risk Factors

” section beginning on page 8 and our financial statements and the related notes incorporated by reference

into this prospectus, before making an investment decision.

Company Overview

On September 3, 2013, SafeStitch Medical, Inc. completed a merger with TransEnterix Surgical, Inc. under which TransEnterix Surgical

became a wholly owned subsidiary of SafeStitch. On December 6, 2013, SafeStitch changed its name to TransEnterix, Inc. and its trading symbol to “TRXC.” In connection with the merger, we also consummated a financing by the sale of

shares of Series B Convertible Preferred Stock.

In this prospectus, when we refer to the registrant as a combination of SafeStitch and

TransEnterix Surgical after giving effect to the merger, we use the terms “TransEnterix,” the “Company,” “we,” “us,” and “ours”. When we refer to the historical business, operations and corporate

status of the parent in the merger we use the term “SafeStitch” and when we refer to the historical business, operations and corporate status of the subsidiary in the merger, we use the term “TransEnterix Surgical.”

Reverse Stock Split

On

February 12, 2014, the holders of approximately 66% of our common stock authorized a Certificate of Amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split in the range of one-for-two to one-for-ten,

with the actual ratio to be determined within such range by our Board of Directors in its sole discretion. Subsequently, our Board of Directors approved a one-for-five reverse stock split of our common stock.

The reverse stock split was effected in connection with our application to list our common stock for trading on the NYSE MKT to assist in

meeting the NYSE MKT minimum bid price requirement of a stock price of at least $2.00 per share. We submitted an application to have our common stock listed for trading on the NYSE MKT on March 17, 2014. On April 1, 2014, we received

authorization to list our shares on the NYSE MKT, subject to completion of a public offering of common shares and meeting all relevant quantitative and qualitative listing criteria of the NYSE MKT. Trading of our common stock on the OTCBB will

reflect the reverse stock split on April 2, 2014.

On March 31, 2014, we filed the Certificate of Amendment to our Certificate

of Incorporation to effect the reverse stock split. The relevant common share and per common share information in this prospectus have been retroactively adjusted to reflect the impact of the reverse stock split.

1

The following table reflects, for the fiscal years presented therein, the retroactive impact of

the reverse stock split on selected common share and per-common share information and includes selected financial data for such periods. As a smaller reporting company, we are presenting such financial data for the past two fiscal years.

|

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended

December 31,

|

|

|

|

|

2013

|

|

|

2012

|

|

|

|

|

(In thousands)

|

|

|

Total assets

|

|

$

|

116,714

|

|

|

$

|

17,560

|

|

|

Long-term liabilities

|

|

$

|

4,602

|

|

|

$

|

8,590

|

|

|

Redeemable convertible preferred stock

|

|

$

|

—

|

|

|

$

|

75,005

|

|

|

Sales

|

|

$

|

1,431

|

|

|

$

|

2,115

|

|

|

Operating loss

|

|

$

|

(25,604

|

)

|

|

$

|

(15,074

|

)

|

|

Net loss

|

|

$

|

(28,358

|

)

|

|

$

|

(15,425

|

)

|

|

Net loss per share – basic and diluted

|

|

$

|

(2.23

|

)

|

|

$

|

(14.31

|

)

|

|

Weighted average common shares outstanding – basic and diluted

|

|

|

12,731

|

|

|

|

1,078

|

|

The Merger

On August 13, 2013, SafeStitch, a wholly owned subsidiary of SafeStitch named Tweety Acquisition Corp., and TransEnterix Surgical entered

into an agreement and plan of merger, amended on August 30, 2013, under which the parties agreed to enter into the merger described above. The main rationale for the merger was to strengthen capital raising opportunities for TransEnterix

Surgical’s primary product candidate, the SurgiBot™ System (described below), through the private placement financing described in the prospectus, and the ability to access public markets for future financings. Pursuant to the merger