UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14C

(Rule 14c-101)

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

|

|

|

|

|

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Information Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

x

|

|

Definitive Information Statement

|

TRANSENTERIX, INC.

(Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act. Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

TRANSENTERIX, INC.

635 Davis Drive, Suite 300

Morrisville, NC 27560

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT

OF THE MAJORITY STOCKHOLDERS IN LIEU OF A MEETING OF STOCKHOLDERS

FEBRUARY 21, 2014

WE ARE NOT ASKING YOU FOR A CONSENT OR PROXY AND

YOU ARE REQUESTED NOT TO SEND US A CONSENT OR PROXY.

Dear TransEnterix Stockholder:

The enclosed

Information Statement is being furnished by the Board of Directors (the “

Board

”) of TransEnterix, Inc., a Delaware corporation (the “

Company

”), to the holders of record (the

“

Stockholders

”) of our common stock, par value $0.001 per share (the “

Common Stock

”), at the close of business on February 12, 2014 (the “

Record Date

”), pursuant to Rule

14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”). The purpose of the enclosed Information Statement is to inform our Stockholders of action taken by written consent of the holders

of a majority of our voting stock to authorize the Board to effect a reverse stock split of our Common Stock as further described below. As of the Record Date, there were 244,272,728 shares of our Common Stock issued and outstanding and no shares of

Preferred Stock issued and outstanding. On February 12, 2014, the Company received written consents in lieu of a meeting of stockholders from holders of shares of Common Stock representing approximately 66% of the total issued and outstanding

shares of capital voting stock of the Company (the “

Majority Stockholders

”) to authorize the Board to file a Certificate of Amendment to our Amended and Restated Certificate of Incorporation (the “

Certificate of

Amendment

”) to effect, at a time within the discretion of our Board, a reverse stock split (pro-rata reduction of outstanding shares) of Common Stock at a reverse split ratio in the range of between 1-for-2 and 1-for-10 (the

“

Reverse Stock Split

”), which specific ratio will be determined by our Board, in its discretion, prior to authorizing the filing the Certificate of Amendment.

The approval of the Reverse Stock Split, in a ratio determined by the Board, and effected by the filing of the Certificate of Amendment (the

“

Action

”) was approved by the Board subject to obtaining subsequent stockholder approval. The Majority Stockholders approved the Action by written consent in lieu of a meeting on February 12, 2014. Accordingly, your

consent is not required and is not being solicited in connection with the approval of the Action. The Certificate of Amendment (which includes the Reverse Stock Split) will become effective when we file the Certificate of Amendment with the

Secretary of State of the State of Delaware. The Certificate of Amendment will not be filed, and will not become effective, until the date that is at least 20 days after the enclosed Information Statement is first mailed or otherwise delivered to

our Stockholders.

The Action taken by written consent was taken pursuant to Section 228 of the Delaware General Corporation

Law, referred to as the DGCL, which provides that any action that may be taken at a meeting of the stockholders may be taken by the written consent of the holders of the number of shares of voting stock required to approve the action at a meeting.

On such basis, in order to eliminate the costs and management time involved in holding a special meeting of stockholders, our Majority Stockholders approved the Action in accordance with the DGCL. This Information Statement is being furnished to all

of our Stockholders in accordance with Section 14(c) of the Exchange Act, and the rules promulgated by the SEC thereunder, solely for the purpose of informing our Stockholders of the actions taken by the written consent before they become

effective.

THE ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED TO STOCKHOLDERS ON OR ABOUT FEBRUARY 21, 2014. THIS

IS NOT A NOTICE OF SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH IS DESCRIBED HEREIN.

|

|

|

Sincerely yours,

|

|

|

|

|

Todd M. Pope

|

|

President and Chief Executive Officer

|

TRANSENTERIX, INC.

635 DAVIS DRIVE, SUITE 300

MORRISVILLE, NC 27560

INFORMATION STATEMENT

|

|

|

NO VOTE OR OTHER ACTION OF THE

COMPANY’S STOCKHOLDERS IS REQUIRED

IN CONNECTION WITH THIS INFORMATION STATEMENT

|

GENERAL INFORMATION

TransEnterix, Inc., a Delaware corporation, with its principal executive offices located at 635 Davis Drive, Suite 300, Morrisville, North

Carolina, 27560, is sending you the attached Notice and this Information Statement to notify you of an action that the holders of a majority of our outstanding voting stock have taken by written consent in lieu of a meeting of stockholders.

References in this Information Statement to the “Company,” “we,” “our,” “us” and “TransEnterix” are to TransEnterix, Inc.

The record date for determining stockholders of recorded entitled to receive this Information Statement is February 12, 2014 (the

“Record Date”). Copies of this Information Statement are being mailed on or about February 21, 2014 to the holders of record on the Record Date of the outstanding shares of our Common Stock (the “Stockholders”).

Action by Written Consent

The

following action was approved by the written consent of the holders of shares of Common Stock representing approximately 66% of the total issued and outstanding shares of capital voting stock of the Company (the “Majority Stockholders”) in

lieu of a meeting of stockholders to authorize the Board of Directors (the “Board”) to file a Certificate of Amendment to our Amended and Restated Certificate of Incorporation (the “Certificate of Amendment”) to effect, at a time

within the discretion of our Board, a reverse stock split (pro-rata reduction of outstanding shares) of Common Stock at a reverse split ratio in the range of between 1-for-2 and 1-for-10 (the “Reverse Stock Split”), which specific ratio

will be determined by our Board, in its discretion, prior to authorizing the filing the Certificate of Amendment (the “Action”). We have attached as

Schedule A

hereto a form of the proposed Certificate of Amendment.

The approval becomes effective on the date that is 20 days after this Information Statement is first mailed or otherwise delivered to our

security holders.

Stockholders Entitled to Receive Notice of Action by Written Consent

Stockholders may take action pursuant to a written consent in lieu of a meeting of stockholders in accordance with Section 228 of the

DGCL, which provides that the written consent of the holders of outstanding shares of voting stock, having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a meeting of stockholders, our Board elected to utilize the written consent of the holders of at least a majority in

interest of our voting securities for the Action. As required by the SEC rules and in accordance with Rule 14c-2(b) of the Exchange Act, we will mail the Notice and Information Statement to all of our Stockholders on or about February 21, 2014.

Only holders of record of our Common Stock at the close of business on the Record Date are entitled to notice of the action taken by

written consent.

Effective Date of Action by Written Consent

Pursuant to Rule 14c-2 promulgated under the Exchange Act, the earliest date that the corporate action being taken pursuant to the written

consent can become effective is 20 days after the first mailing or other delivery of this Information Statement. After the foregoing 20-day period, we will file the Certificate of Amendment with the Secretary of State of the State of Delaware, which

filing will result in the Reverse Stock Split. We recommend that you read this Information Statement in its entirety for a full description of the Action approved by the Majority Stockholders.

Dissenters’ Rights of Appraisal

No

dissenter’s rights are afforded to our stockholders under Delaware law as a result of the adoption of the Action.

Costs of the Information

Statement

We are mailing this Information Statement and will bear the costs associated therewith. We are not making any solicitation.

We will reimburse banks, brokerage firms, other custodians, nominees and fiduciaries for reasonable expenses incurred in sending the Information Statement to beneficial owners of our Common Stock.

ACTION TO BE TAKEN

With

respect to the Action described in this Information Statement, the Board reserves the right, notwithstanding that the Majority Stockholders have approved each action, to elect not to proceed with the Action if the Board, in its sole discretion,

determines that it is no longer in the Company’s best interests and the best interests of the Stockholders to consummate the Action.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains various “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which represent our expectations or beliefs concerning future events. When used in this Information Statement, the terms “anticipate,”

“believe,” “estimate,” “expect” and “intend” and words or phrases of similar import, as they relate to us, are intended to identify forward-looking statements. We undertake no obligation to update, and we do

not have a policy of updating or revising, these forward-looking statements.

2

ACTION: APPROVAL OF A CERTIFICATE OF AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF

INCORPORATION TO EFFECTUATE A REVERSE STOCK SPLIT

General – Reverse Stock Split

Our Board and the Majority Stockholders approved a reverse stock split in the range of between 1-for-2 and 1-for-10, which specific ratio will

be determined by our Board, in its discretion, prior to filing the Certificate of Amendment. In determining which Reverse Stock Split ratio to implement, the Board may consider a number of factors, including the historical and then current trading

price and trading volume of our Common Stock. Pursuant to the Reverse Stock Split, each number of specific shares of our Common Stock (between 2 and 10 depending on the ratio) will be automatically, without any further action by the Stockholders, be

combined and reclassified into one (1) validly issued, fully paid and nonassessable share of Common Stock, par value $0.001. The Reverse Stock Split does not affect the number of the Company’s authorized shares of Common Stock or Preferred

Stock; it only reduces the number of shares of Common Stock that will be issued and outstanding after the Reverse Stock Split in accordance with the Reverse Stock Split ratio. No fractional shares of Common Stock will be issued as the result of the

Reverse Stock Split. Instead, any fractional shares will be paid in cash, based on the fair market value of a share of our Common Stock on the date the Reverse Stock Split is effected. The Company anticipates that the effective date of the Reverse

Stock Split will be no earlier than 20 days after the date of mailing.

PLEASE NOTE THAT THE REVERSE STOCK SPLIT WILL NOT CHANGE YOUR

PROPORTIONATE EQUITY INTERESTS IN THE COMPANY, EXCEPT SUCH MINIMAL CHANGE AS MAY RESULT FROM THE CASHING OUT OF FRACTIONAL SHARES.

Purpose and Effect

of the Reverse Stock Split

Our Board believes that, among other reasons, the number of outstanding shares of Common Stock have

contributed to a lack of investor interest in the Company and has made it difficult for the Company to attract new investors. Our Board believes that it may be necessary and prudent for the Company to amend our Amended and Restated Certificate of

Incorporation to effect the Reverse Stock Split because it would reduce the number of outstanding shares of our Common Stock to a level more consistent with other public companies with a similar anticipated market capitalization. Additionally, a

Reverse Stock Split will have the immediate impact, which may be maintained, of raising the trading price and the minimum bid price of our Common Stock on the Over-the-Counter Bulletin Board, which was $1.65 per share as of February 11, 2014.

If we had effected a one-for-ten Reverse Stock Split on that day, the minimum bid price would have been $16.50 per share. We are interested in becoming listed on the NYSE MKT, which has a minimum bid price requirement for new applicants of $2.00 per

share. We believe that effecting the Reverse Stock Split will help us achieve such minimum bid price and allow us to meet the requirement to be listed. However, the effect of the Reverse Stock Split, if any, upon the sustained stock price for our

Common Stock cannot be predicted, and the history of similar stock split combinations for companies like us is varied. Further, we cannot assure you that the stock price of our Common Stock after the Reverse Stock Split will be maintained in

proportion to the reduction in the number of shares of Common Stock outstanding as a result of the Reverse Stock Split because, among other things, the stock price of our Common Stock may be based on our performance and other factors as well.

3

The following table sets forth the approximate effect of the Reverse Stock Split, as of the

Record Date, on the number of outstanding shares of Common Stock, the number of share underlying outstanding equity awards (restricted stock units and stock options) and warrants, and the number of shares available for future awards under the

Company’s 2007 Incentive Compensation Plan (the “2007 Plan”). This information is set forth (i) actual as of the Record Date, (ii) on a pro forma basis assuming that the Board decides to effect a 1-for-2 Reverse Stock Split

and (iii) on a pro forma basis assuming that the Board decides to effect a 1-for-10 Reverse Stock Split. The actual numbers following the Reverse Stock Split will vary slightly because any fractional shares will be paid in cash.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of February 12,

2014

|

|

|

Pro Forma Assuming a

1-for-2 Reverse Stock

Split

|

|

|

Pro Forma Assuming a

1-for-10 Reverse Stock

Split

|

|

|

Common Stock

|

|

|

244,272,728

|

|

|

|

122,136,364

|

|

|

|

24,427,272

|

|

|

Restricted Stock Units

|

|

|

1,050,000

|

|

|

|

525,000

|

|

|

|

105,000

|

|

|

Warrants

|

|

|

6,426,968

|

|

|

|

3,213,484

|

|

|

|

642,696

|

|

|

Options

|

|

|

19,053,473

|

|

|

|

9,526,737

|

|

|

|

1,905,347

|

|

|

2007 Plan – shares available for future awards

|

|

|

20,898,500

|

|

|

|

10,449,250

|

|

|

|

2,089,850

|

|

The principal effect of the Reverse Stock Split will be the reduction in the number of shares of

Common Stock issued and outstanding from the 244,272,728 shares issued and outstanding as of February 12, 2014, with the actual number outstanding to be dependent on the ratio selected by the Board. No shares of Preferred Stock are currently

outstanding, therefore there will be no impact on the Preferred Stock. The Reverse Stock Split will affect all of holders of our Common Stock uniformly and will not affect any Stockholder’s percentage ownership interest in the Company or

proportionate voting power, except to the extent that the Reverse Stock Split results in any of our Stockholders holding a fractional share of our Common Stock (which will be paid in cash). The Common Stock issued pursuant to the Reverse Stock Split

will remain fully paid and nonassessable. The Reverse Stock Split will not affect any rights, privileges or obligations with respect to the shares of Common Stock existing prior to the Reverse Stock Split, nor does it increase or decrease the

market capitalization of the Company. The Reverse Stock Split may increase the number of our Stockholders who own “odd lots” of less than 100 shares of our Common Stock. Brokerage commissions and other costs of transactions in odd lots are

generally higher than the costs of transactions of more than 100 shares of Common Stock. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” under Rule 13e-3 of the Exchange Act. We

will continue to be subject to the periodic reporting requirements of the Exchange Act.

As noted in the table above, under the 2007 Plan,

the number of shares reserved and available for issuance, and the number and exercise price of shares subject to all outstanding awards will be proportionately adjusted based on the Reverse Stock Split ratio selected by the Board of Directors. The

number of shares available under the 2007 Plan will be subject to increase as and when awards made under the 2007 Plan expire or are forfeited and are returned in accordance with the terms of the 2007 Plan, and will decrease as additional equity

awards are made. For an individual stock option award, assuming a 1-for-10 Reverse Stock Split is effected, the number of shares subject to an outstanding award under the 2007 Plan would be reduced by a factor of 10 and the exercise price per share

would be increased by a multiple of 10, such that upon an exercise the aggregate exercise price payable by the optionee to the Company would remain the same. For example, an outstanding stock option for 10,000 shares of Common Stock, exercisable at

$0.07 per share, would be adjusted as a result of a 1-for-10 Reverse Stock Split into an option exercisable for 1,000 shares of Common Stock at an exercise price of $0.70 per share.

The applicable exercise price for outstanding warrants will be adjusted similarly as described above in proportion to the Reverse Stock Split

ratio.

4

The Reverse Stock Split, as effected by the filing of the Certificate of Amendment, will decrease

the number of outstanding shares of Common Stock. Accordingly, more shares of Common Stock will be available for issuance as a result of the Reverse Stock Split. The Board believes that the availability of more shares of Common Stock for issuance

will allow the Company greater flexibility in pursuing financing from investors, meeting business needs as they arise, taking advantage of favorable opportunities, and responding to a changing corporate environment. In January 2014, the Company

filed a Registration Statement on Form S-3 to register for future sale securities of the Company with an aggregate value of $100,000,000. The Registration Statement is commonly referred to as a “shelf” registration statement in that, once

the Registration Statement is effective, the Company can initiate offerings of its securities as the need for capital arises. The Company expects that it will make an offering of its securities under the Registration Statement in 2014, but does not

currently know the amount of capital to be raised or the terms of the securities to be offered.

No further stockholder approval is

required to effect the Reverse Stock Split or to issue any additional shares of Common Stock.

Certain Risks Associated With the Reverse Stock

Split

You should recognize that you will own fewer shares of Common Stock than you currently own following the Reverse Stock Split.

While we hope that following the Reverse Stock Split the stock price of our Common Stock will be maintained or increased above the Reverse Stock Split-affected price, we cannot assure you that the Reverse Stock Split will increase the stock price of

our Common Stock by a multiple equal to the inverse of the Reverse Stock Split ratio for any sustained period or result in the permanent increase in our stock price (which is dependent upon many factors, including our performance and prospects).

Should the stock price of our Common Stock decline, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. Furthermore, the

possibility exists that potential liquidity in the stock price of our Common Stock could be adversely affected by the reduced number of shares of Common Stock that would be outstanding after the Reverse Stock Split. As a result, we cannot assure you

that the Reverse Stock Split will achieve the desired results that have been outlined above.

Anti-Takeover Effects of the Reverse Stock Split

THE OVERALL EFFECT OF THE REVERSE STOCK SPLIT MAY BE TO RENDER MORE DIFFICULT THE CONSUMMATION OF MERGERS WITH THE COMPANY OR THE ASSUMPTION OF

CONTROL BY A PRINCIPAL STOCKHOLDER, AND THUS MAKE IT DIFFICULT TO REMOVE MANAGEMENT.

A possible effect of the Reverse Stock Split is to

discourage a merger, tender offer or proxy contest, or the assumption of control by a holder of a large block of the Company’s voting securities and the removal of incumbent management. Since the Reverse Stock Split will reduce the number of

outstanding shares of Common Stock without reducing the number of authorized shares, the Company will be able to issue more shares of Common Stock after the Reverse Stock Split. Our management could use the additional shares of Common Stock

available for issuance to resist or frustrate a third-party take-over effort favored by a majority of the independent Stockholders that would provide an above market premium by issuing additional shares of Common Stock.

5

The Reverse Stock Split and the increase in the relative number of authorized shares of Common Stock is not the

result of an effort to accumulate the Company’s securities or to obtain control of the Company by means of a merger, tender offer, solicitation or otherwise. Nor is the Reverse Stock Split a plan by management to adopt a series of amendments to

the Company’s charter or Bylaws to institute an anti-takeover provision. The Company does not have any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences. The reason

for the Reverse Stock Split is to decrease the number of outstanding shares of Common Stock and sustain a stock price equal to or higher than the minimum bid price required by the NYSE MKT. Any issuance of additional shares of Common Stock also

could have the effect of diluting any future earnings per share and book value per share of the outstanding shares of our Common Stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to

obtain control of the Company.

Procedure For Effecting Reverse Stock Split And Exchange Of Stock Certificates

We anticipate that the Reverse Stock Split will become effective no earlier than 20 days after the date of the mailing (the “Effective

Date”). Beginning on the Effective Date, each stock certificate representing pre-Reverse Stock Split shares of Common Stock will be deemed for all corporate purposes to evidence ownership of post-Reverse Stock Split shares of Common Stock, as

the case may be, and evidence ownership of the number of shares shown on such certificate reduced according to the Reverse Stock Split ratio.

Further, prior to filing the Restated Certificate reflecting the Reverse Stock Split, we must first notify the Financial Industry Regulatory

Authority (“FINRA”) by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to our anticipated date of the Reverse Stock Split.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNLESS AND UNTIL REQUESTED TO DO SO.

Fractional Shares

No fractional shares

of Common Stock will be issued as the result of the Reverse Stock Split with any such fractional share paid in cash based on the fair market value of our Common Stock on the Effective Date.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the beneficial ownership of Common Stock by: (i) each person known by us to

be the beneficial owner of more than 5% of our outstanding Common Stock currently; (ii) each of our current directors; (iii) each of our current named executive officers; and (iv) all of our current executive officers and directors as

a group. Ownership information is set forth as of February 12, 2014. Unless otherwise noted, each of the following disclaims any beneficial ownership of the shares, except to the extent of his, her or its pecuniary interest, if any, in such

shares. Unless otherwise indicated, the mailing address of each individual is c/o TransEnterix, Inc., 635 Davis Drive, Suite 300, Morrisville, NC 27560.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of February 12, 2014

|

|

|

Name and Address of Beneficial Owner

|

|

Number of Shares of

Common Stock (1)

|

|

|

Percentage of

Outstanding

Common Shares (2)

|

|

|

Paul LaViolette (3)

|

|

|

34,002,689

|

|

|

|

13.9

|

%

|

|

David Milne (4)

|

|

|

33,983,464

|

|

|

|

13.9

|

%

|

|

William N. Starling (5)

|

|

|

28,165,414

|

|

|

|

11.5

|

%

|

|

Jane H. Hsiao, Ph.D., MBA (6)(20)

|

|

|

24,476,151

|

|

|

|

9.9

|

%

|

|

Phillip Frost, M.D. (7)(13)(20)

|

|

|

21,802,346

|

|

|

|

8.9

|

%

|

|

Dennis J. Dougherty (8)

|

|

|

17,615,990

|

|

|

|

7.2

|

%

|

|

Todd M. Pope (9)

|

|

|

4,040,187

|

|

|

|

1.6

|

%

|

|

Richard M. Mueller (10)

|

|

|

1,756,923

|

|

|

|

|

*

|

|

Richard C. Pfenniger, Jr. (11)

|

|

|

357,000

|

|

|

|

|

*

|

|

Joseph P. Slattery

|

|

|

250,000

|

|

|

|

|

*

|

|

Aftab R. Kherani, M.D.

|

|

|

0

|

|

|

|

|

*

|

|

All Executive Officers and Directors as a group (11 persons) (12)

|

|

|

132,466,700

|

|

|

|

52.2

|

%

|

|

Frost Gamma Investments Trust (13)

|

|

|

21,542,346

|

|

|

|

8.8

|

%

|

|

Aisling Capital III, L.P. (14)

|

|

|

36,490,260

|

|

|

|

14.9

|

%

|

|

SV Life Sciences Fund (15)

|

|

|

33,983,464

|

|

|

|

13.9

|

%

|

|

Synergy Life Science Partners, L.P. (16)

|

|

|

27,448,207

|

|

|

|

10.4

|

%

|

|

StepStone Funds (17)

|

|

|

17,402,565

|

|

|

|

7.1

|

%

|

|

Intersouth Partners VII, L.P. (18)

|

|

|

17,615,990

|

|

|

|

7.2

|

%

|

|

Quaker Bioventures II, L.P (19)

|

|

|

12,582,848

|

|

|

|

5.2

|

%

|

|

(1)

|

A person is deemed to be the beneficial owner of shares of Common Stock underlying options and warrants held by that person that are exercisable as of February 12, 2014 or that will become exercisable within 60

days thereafter.

|

|

(2)

|

Based on 244,272,728 shares of Common Stock outstanding as of February 12, 2014. Each beneficial owner’s percentage ownership is determined assuming that options and warrants that are held by such person (but

not those held by any other person) and that are exercisable as of February 12, 2014 or that will become exercisable within 60 days thereafter have been exercised into Common Stock. The additional shares resulting from such exercise are

included in both the numerator and denominator for such beneficial owner for purposes of their calculation.

|

7

|

(3)

|

Includes 33,045,287 shares held by SV Life Sciences Fund IV, L.P. and 938,177 shares held by SV Life Sciences Fund IV Strategic Partners, L.P. Paul LaViolette is a partner of SVLSF IV, LLC, a control person of both SV

Life Sciences Fund IV, L.P. and SV Life Sciences Fund IV Strategic Partners, L.P. Also includes options to purchase 19,225 shares of Common Stock.

|

|

(4)

|

Includes 33,045,287 shares held by SV Life Sciences Fund IV, L.P. and 938,177 shares held by SV Life Sciences Fund IV Strategic Partners, L.P. David Milne is a managing partner of SVLSF IV, LLC. a control person of both

SV Life Sciences Fund IV, L.P. and SV Life Sciences Fund IV Strategic Partners, L.P.

|

|

(5)

|

Includes 25,487,597 shares of Common Stock held by Synergy Life Science Partners, L.P., and 1,960,610 shares of Common Stock held by Synecor, L.L.C. William N. Starling is a managing director of Synergy Life Science

Partners, L.P. and the chief executive officer of Synecor, L.L.C. Also includes options to purchase 18,020 shares of Common Stock.

|

|

(6)

|

Includes options to purchase 375,000 shares of Common Stock, and warrants to acquire 2,000,000 shares of Common Stock. Dr. Hsiao’s Common Stock holdings also include beneficial ownership of shares held by Hsu

Gamma Investments, L.P. (“Hsu Gamma”), which holds 6,288,470 shares of Common Stock. Dr. Hsiao is the general partner of Hsu Gamma.

|

|

(7)

|

Includes options to purchase 260,000 shares of Common Stock and beneficial ownership of shares held by Frost Gamma Investments Trust (see note 13).

|

|

(8)

|

Consists of 17,615,990 shares of Common Stock held by Intersouth Partners VII, L.P. Dennis Dougherty is a principal of a control person of Intersouth Partners VII,

L.P.

|

|

(9)

|

Consists of options to purchase 4,040,187 shares of Common Stock.

|

|

(10)

|

Consists of options to purchase 1,756,923 shares of Common Stock.

|

|

(11)

|

Includes options to purchase 117,000 shares of Common Stock.

|

|

(12)

|

Includes options to purchase 6,586,355 shares of Common Stock and warrants to purchase 3,000,000 shares of Common Stock.

|

|

(13)

|

Frost Gamma Investments Trust holds 20,542,346 shares of Common Stock and warrants to purchase 1,000,000 shares of Common Stock. Dr. Phillip Frost is the trustee, and Frost Gamma Limited Partnership is the sole and

exclusive beneficiary, of Frost Gamma Investments Trust. Dr. Frost is one of two limited partners of Frost Gamma Limited Partnership. The general partner of Frost Gamma Limited Partnership is Frost Gamma Inc. and the sole shareholder of Frost

Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is also the sole shareholder of Frost-Nevada Corporation.

|

|

(14)

|

The address of Aisling Capital III, LP is 888 Seventh Avenue, 30th Floor, New York, NY 10106. Based on information made available to the Company and on the Schedule

13D filings made by Aisling Capital III, LP, Steve Elms, Dennis Purcell and Andrew Schiff share voting and investment control over the shares of Common Stock held by Aisling Capital III, LP.

|

|

(15)

|

Consists of 33,045,287 shares held by SV Life Sciences Fund IV, L.P. and 938,177 shares held by SV Life Sciences Fund IV Strategic Partners, L.P. The address of each

of SV Life Sciences Fund IV, L.P., SV Life Sciences Fund IV Strategic Partners, L.P. and SVLSF IV, LLC, their control person, is One Boston Place Suite 3900, 201 Washington Street, Boston, MA 02108. Based on information made available to the Company

and on the Schedule 13G filings made by SV Life Sciences Fund IV, L.P. and SV Life Sciences Fund IV Strategic Partners, L.P., no individuals are identified as having or sharing voting or investment control over the shares of Common Stock owned by

such entities.

|

|

(16)

|

Consists of 25,487,597 shares of Common Stock held by Synergy Life Science Partners, L.P., and 1,960,610 shares of Common Stock held by Synecor, L.L.C. The address of

each of Synergy Life Science Fund and Synecor, L.L.C. is 3284 Alpine Road, Portola Valley, CA 94028. Based on information made available to the Company and on the Schedule 13D filings made by these entities, William N. Starling, Richard S. Stack and

Mudit K. Jain share voting and investment control over the shares of Common Stock held by such entities.

|

|

(17)

|

The address of the StepStone Funds is 4350 La Jolla Village Drive, Suite 800, San Diego, CA 92122. Based on information made available to the Company and on the

Schedule 13G filings made by the StepStone Funds with the SEC with respect to the Company’s shares, the StepStone Funds consist of StepStone Pioneer Capital Buyout Fund II, L.P., StepStone Pioneer Capital II, L.P., and

StepStone-SYN

Investments, L.L.L.P.; no individuals are identified as having or sharing voting or investment control over the shares of Common Stock owned by the StepStone Funds.

|

8

|

(18)

|

The address of Intersouth Partners VII, L.P. is 102 City Hall Plaza, Suite 200, Durham, NC 27701. Based on information made available to the Company and on the

Schedule 13G filings made by Intersouth Partners VII, L.P., Dennis J. Dougherty and Mitch Mumma share voting and investment power over the shares of Common Stock held by such entity.

|

|

(19)

|

The address of Quaker Bioventures II, L.P is 2929 Arch Street, Philadelphia, PA 19104. Based on the Schedule 13G filed by this entity on February 13, 2014, no

individuals are identified as having or sharing voting or investment control over the shares of Common Stock held by such entity.

|

|

(20)

|

The address of this stockholder is 4400 Biscayne Blvd, Miami, FL 33137.

|

INTERESTS

OF CERTAIN PERSONS ON MATTERS TO BE ACTED UPON

None of the persons who have served as our officers or directors since the beginning

of our last fiscal year, or any associates of such persons, have any substantial interest, direct or indirect, in the Reverse Stock Split, other than the interests held by such persons through their respective beneficial ownership of the shares of

our capital stock set forth above in the section entitled “Security Ownership of Certain Beneficial Owners and Management.”

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

We will only deliver one Information Statement to multiple security holders sharing an address unless we have received contrary instructions

from one or more of the security holders. Upon written or oral request, we will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to

which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple

copies are now delivered.

We undertake to provide without charge to each person to whom a copy of this Information Statement has been

delivered, upon request, by first class mail or other equally prompt means, a copy of any or all of the documents incorporated by reference in this Information Statement, other than the exhibits to these documents, unless the exhibits are

specifically incorporated by reference into the information that this Information Statement incorporates. You may obtain any of the documents incorporated by reference through the Securities and Exchange Commission (the “SEC”) or the

SEC’s website as described above or on our corporate website at www.transenterix.com. You may request copies of the documents incorporated by reference in this Information Statement, at no cost, by writing or telephoning us at:

635 Davis Drive

Suite 300

Morrisville, NC 27560

Phone Number

919-765-8400

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current reports and other information with the SEC. Our filings with the SEC are available to the public on the

SEC’s website at www.sec.gov. Those filings are also available to the public on our corporate website at www.transenterix.com. The information we file with the SEC or contained on, or linked to through, our corporate website or any other

website that we may maintain is not part of this Information Statement. You may also read and copy, at the SEC’s prescribed rates, any document we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E.,

Washington, D.C. 20549. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room.

Statements contained in this Information Statement concerning the provisions of any documents are necessarily summaries of those documents,

and each statement is qualified in its entirety by reference to the copy of the document filed with the SEC.

9

SCHEDULE A

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

TRANSENTERIX, INC.

TransEnterix, Inc., a

corporation organized and existing under the laws of the State of Delaware (the “

Corporation

”), certifies that:

1. The name of the Corporation is TransEnterix, Inc. The Corporation was originally incorporated under the name “NCS Ventures Corp”.

The Corporation’s original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on August 19, 1988.

2. This Certificate of Amendment to the Amended and Restated Certificate of Incorporation (the “

Certificate of

Incorporation

”) was duly adopted in accordance with Section 242 of the General Corporation Law of the State of Delaware, and has been duly approved by the written consent of the stockholders of the Corporation in accordance with

Section 228 of the General Corporation Law of the State of Delaware.

3. The text of the Certificate of Incorporation is amended to

read as set forth in EXHIBIT A attached hereto.

IN WITNESS WHEREOF, TransEnterix, Inc. has caused this Certificate of Amendment to its Amended and

Restated Certificate of Incorporation to be signed by Todd M. Pope, a duly authorized officer of the Corporation, on , 2014.

|

|

|

|

|

Todd M. Pope,

|

|

President and Chief Executive Officer

|

A-1

EXHIBIT A

Article FOURTH is hereby amended to be and read in full as follows:

“FOURTH: Immediately following the filing and effectiveness of this Certificate of Amendment to the Amended and Restated Certificate of

Incorporation (the “

Effective Time

”), and without any further action on the part of the Corporation or any stockholder, each currently outstanding [ ]

shares of common stock of the Corporation will be combined and converted into one (1) share of common stock of the Corporation (the “

Reverse Split

”). No fractional shares shall be issued upon the Reverse Split. In lieu

of the issuance of fractional shares and in accordance with Section 155 of the DGCL, the Corporation shall pay in cash the fair value of such fraction of a share immediately upon the consummation of the Reverse Split. Following the Reverse

Split, each record holder of a certificate shall be deemed to be the holder of record of the number of shares of common stock as effected by the Reverse Split, notwithstanding that the certificates representing such shares of common stock shall not

have been surrendered at the office of the Corporation. The Corporation shall, upon request of each record holder of a certificate, issue and deliver to such holder in exchange for such certificate a new certificate representing the reduced number

of shares after giving effect to the Reverse Split. All further references to numbers of shares and all further amounts stated on a per share basis contained in this Certificate of Amendment to the Amended and Restated Certificate of Incorporation

are referenced and stated after giving effect to the Reverse Split.

The aggregate number of shares of all classes of capital stock which

the Corporation shall have authority to issue is 775,000,000, of which 750,000,000 shall be common stock, par value $0.001 per share, and 25,000,000 shall be preferred stock, par value $0.01 per share. The board of directors of the Corporation may

determine the times when, the terms under which and the consideration for which the Corporation shall issue, dispose of or receive subscriptions for its shares, including treasury shares, or acquire its own shares. The consideration for the issuance

of the shares shall be paid in full before their issuance and shall not be less than the par value per share. Upon payment of such consideration, such shares shall be deemed to be fully paid and nonassessable by the Corporation.

A description of the different classes and series of the Corporation’s capital stock and a statement of the powers, designations,

preferences, limitations and relative rights of the shares of each class of and series of capital stock are as follows:

A.

Common

Stock

. Except as provided in this Article (or in any resolution or resolutions adopted by the board of directors pursuant hereto) the holders of the common stock shall exclusively possess all voting power. Each holder of shares of common stock

shall be entitled to one vote for each share held by such holder. There shall be no cumulative voting rights in the election of directors. Each share of common stock shall have the same relative rights as and be identical in all respects with all

shares of common stock.

Whenever there shall have been paid, or declared and set aside for payment, to the holders of the outstanding shares of any class

of stock having preference over the common stock as to the payment of dividends, the full amount of dividends and/or sinking fund or other retirement payments, if any, to which such holders are respectively entitled in preference to the common

stock, then dividends may be paid on the common stock and on any class or series of stock entitled to participate therewith as to dividends, out of any assets legally available for the payment of dividends but only when and as declared by the board

of directors.

In the event of any liquidation, dissolution or winding up of the Corporation, after there shall have been paid to or set aside for the

holders of any class having preferences over the common stock in the event of liquidation, dissolution or winding up of the full preferential amounts to which they are respectively entitled, the holders of the common stock, and of any class or

series of stock entitled to participate therewith, in whole or in part, as to distribution of assets, shall be entitled after payment or provision for payment of all debts and liabilities of the Corporation, to receive the remaining assets of the

Corporation available for distribution, in cash or in kind.

B.

Preferred Stock

. The board of directors of the Corporation is

authorized, subject to limitations prescribed by law and the provisions of this Article, to provide by resolution for the issuance of preferred stock in series, including convertible preferred stock, to establish from time to time the number of

shares to be included in each such series, and to fix the designations, powers, preferences and relative, participating, optional and other special rights of the shares of each such series and the qualifications, limitations or restrictions thereof.

A-2

The authority of the board of directors with respect to each series shall include, but not be limited to,

determination of the following:

(a) The number of shares constituting that series and the distinctive designation of that series;

(b) The dividend rate on the shares of that series, whether dividends shall be cumulative, and, if so, from which date or dates, and the

relative rights of priority, if any, of payment of dividends on shares of that series;

(c) Whether that series shall have voting rights,

in addition to the voting rights provided by law, and, if so, the terms of such rights;

(d) Whether that series shall have conversion

privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the board of directors shall determine;

(e) Whether or not the shares of that series shall be redeemable, and, if so, the terms and conditions of such redemption, including the date

or dates after which they shall be redeemable, and the amounts per share payable in case of redemption, which amounts may vary under different conditions and at different redemption dates;

(f) Whether the series shall have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amounts of

such sinking fund;

(g) The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution, or

winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series; and

(h) Any other

relative rights, preferences and limitations of that series.

No holder of any of the shares of any class of the Corporation shall be entitled as of right

to subscribe for, purchase or otherwise acquire any shares of any class of the Corporation which the Corporation proposes to issue or any rights or options which the Corporation proposes to grant for the purchase of shares of any class of the

Corporation or for the purchase of any shares, bonds, securities or obligations of the Corporation which are convertible into or exchangeable for, or which carry any rights, to subscribe for, purchase or otherwise acquire shares of any class of the

Corporation; and any and all of such shares, bonds, securities or obligations of the Corporation, whether now or hereafter authorized or created, may be issued, or may be reissued or transferred if the same have been reacquired and have treasury

status, and any and all of such rights and options may be granted by the board of directors to such persons, firms, corporations and associations, and for such lawful consideration, and on such terms, as the board of directors in its discretion may

determine, without first offering the same, or any thereof, to any said holder.”

A-3

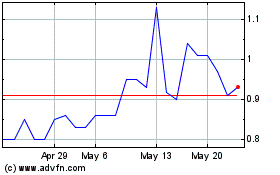

Safeguard Scientifics (QX) (USOTC:SFES)

Historical Stock Chart

From Nov 2024 to Dec 2024

Safeguard Scientifics (QX) (USOTC:SFES)

Historical Stock Chart

From Dec 2023 to Dec 2024