UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 16,

2023

Commission File Number: 000-55992

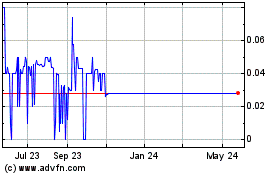

Red White & Bloom Brands Inc.

(Exact name of registrant as specified in its charter)

789 West Pender Street, Suite 810

Vancouver BC Canada V6C 1H2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover

Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Red White & Bloom Brands Inc. |

|

| |

|

|

|

| |

By: |

/s/ Edoardo Mattei |

|

| |

|

Edoardo Mattei |

|

| |

|

Chief Financial Officer |

|

| Date: June 27, 2023 |

|

|

|

Exhibit 99.1

Red White & Bloom

Brands Announces Appointment of Edoardo Mattei

as Chief Financial Officer

and Corporate Secretary

TORONTO, ONTARIO March 16, 2023 (GLOBE

NEWSWIRE) -- Red White & Bloom Brands Inc. ("RWB" or the "Company") (CSE: RWB and OTC: RWBYF), is

pleased to confirm the appointment of Mr. Edoardo (Eddie) Mattei as its Chief Financial Officer, subject to final US state regulatory

approval. As of December 1st, 2022, Eddie was contracted by the Company in a fractional role to assist with the orderly transition

and timely restructuring of the Company’s Finance, Information Technology, and Human Resources teams. Effective March 15, 2023,

subject to the aforementioned regulatory approval, Eddie will assume the role of Chief Financial Officer and will also be appointed the

Company's Corporate Secretary. Eddie will be based at the Company’s headquarters in Toronto, Ontario.

With over twenty years of experience in diverse industries, operating

in both public and private markets, Eddie brings a grounded CFO skillset to the Company having held leadership roles with responsibility

for financial reporting, corporate finance, domestic and international taxation, global treasury, business development, mergers, acquisitions

and divestitures, investor relations, information technology, human resources, and risk management.

Eddie holds an MBA from Wilfrid Laurier University and is a CPA

(CA) and started his career at Grant Thornton, LLP in Toronto.

"I am grateful for the opportunity to join RWB and to work

alongside a talented and hard-working team of individuals focused on the Company’s success. We have undertaken a comprehensive review

at our broader scope reporting skillsets, both within RWB and within our service provider network, and, as a result, have proactively

implemented value-added staffing, and system changes as well as instituted practices within RWB that will encourage collaborative workflows,

open dialogue, and a team-based approach to defining and executing solutions to challenges that we face as a public company in the cannabis

marketplace. All of these changes will ensure that the Company can and will continue to meet its reporting timelines, starting with the

Company’s 2022 year-end financial statements and associated disclosures, due May 1, 2023, in addition to improving the quality of

the information disseminated to our valued shareholders. I look forward to supporting Brad, Colby, and the entire RWB team, as we continue

on the Company’s path to success,” said Eddie Mattei, Chief Financial Officer of the Company.

"We are proud to welcome Eddie to our management team as

our new CFO," said Colby De Zen, President of RWB. "His practical financial and operational experience will be invaluable to

the Company as we continue to grow and expand our business and optimize the day-to-day operations of the Company.”

The Company further reports that it has issued 1,250,000 stock

options to an officer of the Company. The stock options are exercisable to acquire up to 1,250,000 common shares of the Company at an

exercise price of $0.10 for a period of ten years from issuance. The stock options vest quarterly over a period of two years commencing

on the first anniversary date of the grant. The terms for the grant are in line with the parameters set out in the Company’s existing

Employee Stock Option Plan (“ESOP”).

About Red White & Bloom Brands Inc.

Red White & Bloom is a multi-state cannabis operator and house

of premium brands in the U.S. legal cannabis sector. RWB is predominantly focusing its investments on the major U.S. markets, that include

Arizona, California, Florida, Massachusetts, Missouri, and Michigan.

For more information about Red White & Bloom Brands

Inc., please contact:

Edoardo (Eddie) Mattei, CFO

IR@RedWhiteBloom.com

Visit us on the web: https://www.redwhitebloom.com/

Follow us on social media:

|

@rwbbrands |

|

@redwhitebloombrands |

|

@redwhitebloombrands |

Neither the CSE nor its Regulation Services Provider (as that term

is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING INFORMATION

This press release contains forward-looking statements and information

that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words

"estimate", "project", "belief", "anticipate", "intend", "expect", "plan",

"predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology

are intended to identify forward-looking statements and information. There is no assurance that these transactions will yield results

in line with management expectations. Such statements and information reflect the current view of the Company with respect to risks and

uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information.

By their nature, forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be

materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such

factors include, among others, the following risks: risks associated with the implementation of the Company's business plan and matters

relating thereto, risks associated with the cannabis industry, competition, regulatory change, the need for additional financing, reliance

on key personnel, market size, and the volatility of the Company's common share price and volume. Forward-looking statements are made

based on management's beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to

update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned

against attributing undue certainty to forward-looking statements.

There are several important factors that could cause the Company's

actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include,

among others, risks related to the Company's proposed business, such as failure of the business strategy and government regulation; risks

related to the Company's operations, such as additional financing requirements and access to capital, reliance on key and qualified personnel,

insurance, competition, intellectual property, and reliable supply chains; risks related to the Company and its business generally; risks

related to regulatory approvals. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the

Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors

and other uncertainties and potential events. The Company has assumed a certain progression, which may not be realized. It has also assumed

that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ

materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can

be no assurance that such assumptions will reflect the actual outcome of such items or factors. While the Company may elect to, it does

not undertake to update this information at any particular time.

3

Exhibit 99.2

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF

THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE JANUARY 16, 2023.

Debenture No.

Principal Amount: CAD$ 17,000,000

Original Issue Date (“Issue Date”): September 15, 2022

CONVERTIBLE PROMISSORY NOTE

FOR VALUE RECEIVED, Red White & Bloom Brands Inc.,

a British Columbia corporation (hereinafter called the “Borrower”), hereby promises to pay to the order of C-Point

Investments Limited (the “Holder”) the sum of CAD$17,000,000.00 together with any interest as set forth herein, on

September 12, 2024 (the “Maturity Date”), whether at maturity or upon acceleration or by prepayment or otherwise. The

Borrower agrees to pay interest to the Holder on the unpaid principal amount of this Note from September 12, 2022 at a rate equal to eight

percent (8%) per annum until the full and final repayment of the principal amount of this Note. Interest shall be calculated monthly and

payable on the Maturity Date. Interest shall be computed on the basis of a 360-day year composed of twelve 30-day months. The September

30, 2022 interest payment will represent accrued interest for the period from September 12, 2022 to September 30, 2022. Any amount of

principal on this Note which is not paid when due shall bear interest at the rate of the lesser of (i) eight percent (8%) per annum and

(ii) the maximum amount permitted under law from the due date thereof until the same is paid (the “Default Interest”).

Default Interest shall commence accruing on the earlier of the Maturity Date and the date the principal hereunder is accelerated and shall

be computed on the basis of a 360-day year and the actual number of days elapsed. All payments due hereunder (to the extent not converted

in accordance with the terms hereof into common shares of the Borrower (the “Common Stock”)) shall be made in lawful

money of Canada. All payments shall be made at such address as the Holder shall hereafter give to the Borrower by written notice made

in accordance with the provisions of this Note. Whenever any amount expressed to be due by the terms of this Note is due on any day which

is not a business day, the same shall instead be due on the next succeeding day which is a business day and, in the case of any interest

payment date which is not the date on which this Note is paid in full, the extension of the due date thereof shall not be taken into account

for purposes of determining the amount of interest due on such date. As used in this Note, the term “business day” shall mean

any day other than a Saturday, Sunday or a day on which commercial banks in the city of Toronto, Ontario are authorized or required by

law or executive order to remain closed.

This Note is free from all taxes, liens,

claims and encumbrances with respect to the issue thereof and shall not be subject to preemptive rights or other similar rights of shareholders

of the Borrower and will not impose personal liability upon the holder thereof.

The following terms shall apply to this Note:

ARTICLE I. CONVERSION RIGHTS

1.1 Conversion Right. The Holder

shall have the right from time to time, and at any time, and ending on the Maturity Date to convert all or any part of the outstanding

and unpaid principal and/or interest of this Note into fully paid and non-assessable shares of Common Stock, as such Common Stock exists

on the Issue Date, or any shares of capital stock or other securities of the Borrower into which such Common Stock shall hereafter be

changed or reclassified at the Conversion Price (as defined below) determined as provided herein (a “Conversion”);

provided, however, that in no event shall the Holder be entitled to convert any portion of this Note in excess of that

portion of this Note upon conversion of which the sum of (1) the number of shares of Common Stock beneficially owned by the Holder and

its affiliates (other than shares of Common Stock which may be deemed beneficially owned through the ownership of the unconverted portion

of the Notes or the unexercised or unconverted portion of any other security of the Borrower subject to a limitation on conversion or

exercise analogous to the limitations contained herein) and (2) the number of shares of Common Stock issuable upon the conversion

of the portion of this Note with respect to which the determination of this proviso is being made, would result in beneficial ownership

by the Holder and its affiliates of more than 19.99% of the outstanding shares of Common Stock (the “Maximum Share Amount”).

For purposes of the proviso to the immediately preceding sentence, beneficial ownership shall be determined in accordance with Section

1.8(1) of National Instrument 62-104 Take-Over Bids and Issuer Bids (“NI 62-104”). The number of shares of

Common Stock to be issued upon each conversion of this Note shall be determined by dividing the Conversion Amount (as defined below)

by the applicable Conversion Price then in effect on the date specified in the notice of conversion, in the form attached hereto as Exhibit

A (the “Notice of Conversion”), delivered to Borrower by the Holder in accordance with Section 1.4 below; provided

that the Notice of Conversion is submitted by facsimile or e-mail (or by other means resulting in, or reasonably expected to result in,

notice) to the Borrower before 6:00 p.m. (Toronto Time) on such conversion date (the “Conversion Date”). The term

“Conversion Amount” means, with respect to any conversion of this Note, the sum of (1) the principal amount of this Note

to be converted in such conversion plus (2) at the Holder’s option, accrued and unpaid interest, if any.

The Borrower shall not effect any conversion

of this Note, and a Holder shall not have the right to convert any portion of this Note, pursuant to this Section 1.1 or otherwise, to

the extent that after giving effect to such issuance after conversion as set forth on the applicable Notice of Conversion, the Holder

(together with the Holder’s affiliates, and any other Persons acting as a group together with the Holder or any of the Holder’s

affiliates (such Persons, “Attribution Parties”)), would beneficially own in excess of the Beneficial Ownership Limitation

(as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and

its affiliates and Attribution Parties shall include the number of shares of Common Stock issuable upon conversion of this Note with respect

to which such determination is being made, but shall exclude the number of shares of Common Stock which would be issuable upon (i) conversion

of the remaining, non-converted portion of this Note beneficially owned by the Holder or any of its affiliates or Attribution Parties

and (ii) convert or conversion of the unconverted or non-converted portion of any other securities of the Borrower (including, without

limitation, any other Common Stock equivalents) subject to a limitation on conversion or convert analogous to the limitation contained

herein beneficially owned by the Holder or any of its affiliates or Attribution Parties. Except as set forth in the preceding sentence,

for purposes of this Section, beneficial ownership shall be calculated in accordance with applicable

regulatory definitions and the rules and regulations promulgated

thereunder, it being acknowledged by the Holder that the Borrower is not representing to the Holder that such calculation is in compliance

with Section 1.8(1) of NI 62-104 and the Holder is solely responsible for any filings required to be made in accordance therewith. To

the extent that the limitation contained in this Section applies, the determination of whether this Note is exercisable (in relation to

other securities owned by the Holder together with any affiliates and Attribution Parties) and of which portion of this Note is exercisable

shall be in the sole discretion of the Holder, and the submission of a Notice of Conversion shall be deemed to be the Holder’s determination

of whether this Note is exercisable (in relation to other securities owned by the Holder together with any affiliates and Attribution

Parties) and of which portion of this Note is exercisable, in each case subject to the Beneficial Ownership Limitation, and the Borrower

shall have no obligation to verify or confirm the accuracy of such determination. The “Beneficial Ownership Limitation” shall

be 19.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common

Stock issuable upon conversion of this Note. The limitations contained in this paragraph shall apply to a successor holder of this Note.

1.2 [reserved].

1.3 Conversion Price. Subject to the

adjustments described herein, the conversion price (the “Conversion Price”) shall equal CAD $0.20.

1.4 Authorized Shares. The Borrower

covenants that during the period the conversion right exists, the Borrower will reserve from its authorized and unissued Common Stock

a sufficient number of shares, free from preemptive rights, to provide for the issuance of Common Stock upon the full conversion of this

Note issued pursuant to the Purchase Agreement (the “Reserved Amount”). The Borrower represents that upon issuance,

such shares will be duly and validly issued, fully paid and non-assessable. In addition, if the Borrower shall issue any securities or

make any change to its capital structure which would change the number of shares of Common Stock into which the Notes shall be convertible

at the then current Conversion Price, the Borrower shall at the same time make proper provision so that thereafter there shall be a sufficient

number of shares of Common Stock authorized and reserved, free from preemptive rights, for conversion of the outstanding Notes. The Borrower

(i) acknowledges that it has irrevocably instructed its transfer agent to issue certificates for the Common Stock issuable upon conversion

of this Note, and (ii) agrees that its issuance of this Note shall constitute full authority to its officers and agents who are charged

with the duty of executing stock certificates to execute and issue the necessary certificates for shares of Common Stock in accordance

with the terms and conditions of this Note.

1.5 Method of Conversion.

(a) Mechanics of Conversion.

Subject to Section 1.1, this Note may be converted by the Holder in whole or in part at any time from time to time after the Issue Date,

by (A) submitting to the Borrower a Notice of Conversion (by facsimile, e-mail or other reasonable means of communication dispatched

on the Conversion Date prior to 6:00 p.m. (Toronto time) and (B) subject to Section 1.5(b), surrendering this Note at the principal office of the Borrower.

(b) Surrender of Note Upon Conversion.

Notwithstanding anything to the contrary set forth herein, upon conversion of this Note in accordance with the terms hereof, the Holder

shall not be required to physically surrender this Note to the Borrower unless the entire unpaid principal amount of this Note is so

converted. The Holder and the Borrower shall maintain records showing the principal amount so converted and the dates of such conversions

or shall use such other method, reasonably satisfactory to the Holder and the Borrower, so as not to require physical surrender of this

Note upon each such conversion. In the event of any dispute or discrepancy, such records of the Borrower shall, prima facie, be

controlling and determinative in the absence of manifest error. Notwithstanding the foregoing, if any portion of this Note is converted

as aforesaid, the Holder may not transfer this Note unless the Holder first physically surrenders this Note to the Borrower, whereupon

the Borrower will forthwith issue and deliver upon the order of the Holder a new Note of like tenor, registered as the Holder may request,

representing in the aggregate the remaining unpaid principal amount of this Note. The Holder and any assignee, by acceptance of this

Note, acknowledge and agree that, by reason of the provisions of this paragraph, following conversion of a portion of this Note, the

unpaid and unconverted principal amount of this Note represented by this Note may be less than the amount stated on the face hereof.

(c) [reserved].

(d) Delivery of Common Stock

Upon Conversion. Upon receipt by the Borrower from the Holder of a facsimile transmission or e-mail (or other reasonable means of

communication) of a Notice of Conversion meeting the requirements for conversion as provided in this Section 1.5, the Borrower shall issue

and deliver or cause to be issued and delivered to or upon the order of the Holder certificates for the Common Stock issuable upon such

conversion within three (3) business days after such receipt (the “Deadline”) (and, solely in the case of conversion

of the entire unpaid principal amount hereof, surrender of this Note) in accordance with the terms hereof.

(e) Obligation of the Borrower

to Deliver Common Stock. Upon receipt by the Borrower of a Notice of Conversion, the Holder shall be deemed to be the holder of record

of the Common Stock issuable upon such conversion, the outstanding principal amount and the amount of accrued and unpaid interest on this

Note shall be reduced to reflect such conversion, and, unless the Borrower defaults on its obligations under this Article I, all rights

with respect to the portion of this Note being so converted shall forthwith terminate except the right to receive the Common Stock or

other securities, cash or other assets, as herein provided, on such conversion. If the Holder shall have given a Notice of Conversion

as provided herein, the Borrower’s obligation to issue and deliver the certificates for Common Stock shall be absolute and unconditional,

irrespective of the absence of any action by the Holder to enforce the same, any waiver or consent with respect to any provision thereof,

the recovery of any judgment against any person or any action to enforce the same, any failure or delay in the enforcement of any other

obligation of the Borrower to the holder of record, or any setoff, counterclaim, recoupment, limitation or termination, or any breach

or alleged breach by the Holder of any obligation to the Borrower, and irrespective of any other circumstance which might otherwise limit

such obligation of the Borrower to the Holder in connection with such conversion. The Conversion Date specified in the Notice of Conversion

shall be the Conversion Date so long as the Notice of Conversion is received by the Borrower before 6:00 p.m. (Toronto Time) on such date.

(f) Delivery of Common Stock

by Electronic Transfer. In lieu of delivering physical certificates representing the Common Stock issuable upon conversion, provided

the Borrower is participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer (“FAST”)

program, upon request of the Holder and its compliance with the provisions contained in Section 1.1 and in this Section 1.5, the Borrower

shall use its commercially reasonable best efforts to cause its transfer agent to electronically transmit the Common Stock issuable upon

conversion to the Holder by crediting the account of Holder’s Prime Broker with DTC through its Deposit Withdrawal At Custodian

(“DWAC”) system.

(g) Failure to Deliver Common

Stock Prior to Delivery Deadline. Without in any way limiting the Holder’s right to pursue other remedies, including actual

damages and/or equitable relief, the parties agree that if delivery of the Common Stock issuable upon conversion of this Note is not delivered

by the Deadline (other than a failure due to the circumstances described in Section 1.3 above, which failure shall be governed by such

Section) the Borrower shall pay to the Holder $100 per day in cash, for each day beyond the Deadline that the Borrower fails to deliver

such Common Stock until the Borrower issues and delivers a certificate to the Holder or credit the Holder’s balance account with

OTC for the number of shares of Common Stock to which the Holder is entitled upon such Holder’s conversion of any Conversion Amount

(under Holder’s and the Borrower’s expectation that any damages will tack back to the Issue Date). Such cash amount shall

be paid to Holder by the fifth (5th) day of the month following the month in which it has accrued or, at the option of the Holder (by

written notice to the Borrower by the first day of the month following the month in which it has accrued), shall be added to the principal

amount of this Note, in which event interest shall accrue thereon in accordance with the terms of this Note and such additional principal

amount shall be convertible into Common Stock in accordance with the terms of this Note. The Borrower agrees that the right to convert

is a valuable right to the Holder. The damages resulting from a failure, attempt to frustrate, interference with such conversion right

are difficult if not impossible to qualify. Accordingly the parties acknowledge that the liquidated damages provision contained in this

Section 1.5(g) are justified.

(h) Rescindment of

a Notice of Conversion. If (i) the Borrower fails to respond to Holder within one (1) business day from the Conversion Date confirming

the details of Notice of Conversion, (ii) the Borrower fails to provide any of the Common Stock requested in the Notice of Conversion

within two (2) business days from the date of receipt of the Note of Conversion, (iii) the Holder is unable to procure a legal opinion

required to have the Borrower’s Common Stock issued unrestricted and/or deposited to sell for any reason related to the Borrower’s

standing, (iv) the Holder is unable to deposit the Borrower’s Common Stock requested in the Notice of Conversion for any reason

related to the Borrower’s standing, (v) at any time after a missed Deadline, at the Holder’s sole discretion, or (vi) if OTC

Markets changes the Borrower’s designation to ‘Limited Information’ (Yield), ‘No Information’ (Stop Sign),

‘Caveat Emptor’ (Skull & Crossbones), ‘OTC’, ‘Other OTC’ or ‘Grey Market’ (Exclamation

Mark Sign) or other trading restriction on the day of or any day after the Conversion Date, the Holder maintains the option and sole discretion

to rescind the Notice of Conversion (“Rescindment”) with a “Notice of Rescindment.”

1.6 Concerning the Shares.

Until such time as the shares of Common

Stock issuable upon conversion of this Note have been registered under the Act or otherwise may be sold without any restriction as to

the number of securities as of a particular date that can then be immediately sold, each certificate for shares of Common Stock issuable

upon conversion of this Note that has not been so included in an effective registration statement or that has not been sold pursuant to

an effective registration statement or an exemption that permits removal of the legend, shall bear a legend substantially in the following

form, as appropriate:

“UNLESS PERMITTED UNDER SECURITIES

LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE [THE DATE THAT IS 4 MONTHS AND ONE DAY AFTER THE ISSUE DATE].”

Until the expiry of the applicable hold period, neither the Note

nor the underlying Common Stock can be traded through the facilities of the Canadian Securities Exchange.

1.7 Effect of Certain Events.

(a) Effect of Asset Sale.

The sale, conveyance or disposition of all or substantially all of the assets of the Borrower or any of its direct or indirect subsidiaries

shall be deemed to be an Event of Default (as defined in Article III) pursuant to which the Borrower shall be required to pay to the Holder

upon the consummation of and as a condition to such transaction an aggregate amount equal to the unpaid principal amount and unpaid interest

(if any). For clarity, Holder and the Borrower shall retain their respective rights to convert the principal and unpaid interest (if any)

hereunder until the date such sale transaction closes. “Person” shall mean any individual, corporation, limited liability

company, partnership, association, trust or other entity or organization.

(b) Effect of Merger, Consolidation,

Etc. If, at any time when this Note is issued and outstanding and prior to conversion of all of the Notes, there shall be any merger,

amalgamation, consolidation, exchange of shares, recapitalization, reorganization, or other similar event, as a result of which shares

of Common Stock shall be changed into the same or a different number of shares of another class or classes of stock or securities of

the Borrower or another entity, or the effectuation by the Borrower of a transaction or series of related transactions in which more

than 50% of the voting power of shares of Common Stock is disposed of, then, in Holder’s discretion, Holder may require one of

the following by providing written notice to the Borrower at any time no later than six (6) months after the date such transaction closes:

(i) the obligations outstanding hereunder shall be paid in

full no later than six (6) months after the date such transaction closes, and notwithstanding anything to the contrary herein, the failure

to make such payment in a timely manner shall be an automatic Event of Default under Section 3.1 and the obligations hereunder shall

accelerate and Default Interest shall begin to accrue automatically upon such failure to pay, whether or not Holder notifies the Borrower

of such acceleration or accrual; or

(ii)

Holder shall have the right to receive upon conversion of this Note, upon the basis and upon the terms and conditions specified herein

and in lieu of the shares of Common Stock immediately theretofore issuable upon conversion, such stock, securities or assets which the

Holder would have been entitled to receive in such transaction had this Note been converted in full immediately prior to such transaction

(without regard to any limitations on conversion set forth herein), and in any such case appropriate provisions shall be made with respect

to the rights and interests of the Holder of this Note to the end that the provisions hereof (including, without limitation, provisions

for adjustment of the Conversion Price and of the number of shares issuable upon conversion of the Note) shall thereafter be applicable,

as nearly as may be practicable in relation to any securities or assets thereafter deliverable upon the conversion hereof.

The Borrower shall not affect any transaction described in

this Section 1.7(b) unless (x) it first gives, to the extent practicable, thirty (30) days prior written notice (but in any event at

least fifteen (15) days prior written notice) of the record date of the special meeting of shareholders to approve, or if there is no

such record date, the consummation of, such merger, consolidation, exchange of shares, recapitalization, reorganization or other similar

event or sale of assets (during which time the Holder shall be entitled to convert this Note) and (y) the resulting successor or acquiring

entity (if not the Borrower) assumes by written instrument the obligations of this Note. The above provisions shall similarly apply to

successive consolidations, mergers, amalgamations, sales, transfers or share exchanges.

(c) Adjustment Due to Distribution.

If the Borrower shall declare or make any distribution of its assets (or rights to acquire its assets) to holders of Common Stock as a

dividend, stock repurchase, by way of return of capital or otherwise (including any dividend or distribution to the Borrower’s shareholders

in cash or shares (or rights to acquire shares) of capital stock of a subsidiary (i.e., a spin-off)) (a “Distribution”),

then the Holder of this Note shall be entitled, upon any conversion of this Note after the date of record for determining shareholders

entitled to such Distribution, to receive the amount of such assets which would have been payable to the Holder with respect to the shares

of Common Stock issuable upon such conversion had such Holder been the holder of such shares of Common Stock on the record date for the

determination of shareholders entitled to such Distribution.

(d) Purchase Rights. If,

at any time when any Notes are issued and outstanding, the Borrower issues any convertible securities or rights to purchase stock, warrants,

securities or other property (the “Purchase Rights”) pro rata to the record holders of any class of Common Stock, then the

Holder of this Note will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which

such Holder could have acquired if such Holder had held the number of shares of Common Stock acquirable upon complete conversion of this

Note (without regard to any limitations on conversion contained herein) immediately before the date on which a record is taken for the

grant, issuance or sale of such Purchase Rights or, if no such record is taken, the date as of which the record holders of Common Stock

are to be determined for the grant, issue or sale of such Purchase Rights.

(e) Notice of Adjustments.

Upon the occurrence of each adjustment or readjustment of the Conversion Price as a result of the events described in this Section 1.6,

the Borrower, at its expense, shall promptly, but no later than 10 business days after such adjustment or readjustment becomes effective,

compute such adjustment or readjustment and prepare and furnish to the Holder a certificate setting forth such adjustment or readjustment

and showing in detail the facts upon which such adjustment or readjustment is based. The Borrower shall, upon the written request at

any time of the Holder, furnish to such Holder a like certificate setting forth (i) such adjustment or readjustment, (ii) the Conversion

Price at the time in effect and (iii) the number of shares of Common Stock and the amount, if any, of other securities or property which

at the time would be received upon conversion of the Note.

1.8 Status as Shareholder. Upon submission of a Notice

of Conversion by a Holder, (i) the shares covered thereby (other than the shares, if any, which cannot be issued because their issuance

would exceed such Holder’s allocated portion of the Reserved Amount or Maximum Share Amount) shall be deemed converted into shares

of Common Stock and (ii) the Holder’s rights as a Holder of such converted portion of this Note shall cease and terminate, excepting

only the right to receive certificates for such shares of Common Stock and to any remedies provided herein or otherwise available at

law or in equity to such Holder because of a failure by the Borrower to comply with the terms of this Note. Notwithstanding the foregoing,

if a Holder has not received certificates for all shares of Common Stock prior to the tenth (10th) business day after the expiration

of the Deadline with respect to a conversion of any portion of this Note for any reason, then (unless the Holder otherwise elects to

retain its status as a holder of Common Stock by so notifying the Borrower) the Holder shall regain the rights of a Holder of this Note

with respect to such unconverted portions of this Note and the Borrower shall, as soon as practicable, return such unconverted Note to

the Holder or, if the Note has not been surrendered, adjust its records to reflect that such portion of this Note has not been converted.

In all cases, Holder shall retain all of its rights and remedies for the Borrower’s failure to convert this Note.

1.9 Security. As continuing security

for the due and timely payment by the Borrower of the obligations under this Article I, the Borrower shall grant a general security interest

in favour of the Holder over all of its present and future property, assets and undertakings and deliver to the Holder the security contemplated

in Section 1.7. Royal Group Resources Ltd. may act as agent of the Lender in connection with the security granted under this Debenture

(the “Agent”).

1.10 Prepayment. This

Note may be prepaid in whole or in part, subject to payment of a prepayment penalty in the amount of 7% of the amount of the principal

being paid; provided, that (i) the Borrower shall provide Holder with thirty (30) days’ advance notice of its intent to prepay this

Note, during which time Holder may convert this Note or any portion of this Note in accordance with the terms stated herein, and (ii)

if the Holder converts this Note pursuant to this Section 1.10, it shall not be restricted by the Maximum Share Amount.

1.11 Delivery of Security.

The Borrower covenants and agrees to execute and deliver to the Holder or the Agent the following agreements, security and instruments,

each in form and substance satisfactory to the Holder in its sole and absolute discretion, on or before October 31, 2022 (except otherwise

noted in this Section 1.11)(or such later date as the Holder or its Agent may agree in writing):

(a) a general security agreement

from the Borrower to and in favour of the Holder under which the Borrower shall, among other things, grant to and in favour of the Holder

a security interest and charge over all of property, assets and undertaking of the Borrower, and

such security interest and charge shall be a first ranking security interest in

and charge of such property, assets and undertaking;

(b) a securities pledge agreement

from the Borrower to and in favour of the Holder under which the Borrower shall, among other things, grant to and in favour of the Holder

a first priority security interest in, and pledge of the equity ownership interest held by the Borrower in RWB Michigan LLC;

(c) an unlimited guarantee and

general security agreement from RWB Platinum Vape Inc. to and in favour the Holder, pursuant to which

(i) under the unlimited guarantee, RWB Platinum Vape Inc. will guarantee the payment, performance and discharge in full of all debts, liabilities

and obligations of or owing by the Borrower to the Holder; and

(ii)

under such general security agreement, RWB Platinum Vape Inc. shall, among other things, grant to and in favour of the Lender a security

interest and charge over all of property, assets and undertaking of RWB Platinum Vape Inc., and such security interest and charge shall

be a second ranking security interest in and charge of such property, assets and undertaking (being only behind the security held by De

Zen Investments Canada Limited and Sergio De Zen Investments Limited);

(d) within 30 days following the

repayment of the Amended and Restated Credit Agreement dated as of January 10, 2020 (as may be amended, restated, supplemented, or otherwise

modified from time to time) among Bridging Finance Inc., RWB Illinois Inc., Mid- American Growers, Inc., Pharmaco, Inc. and Michicann

Medical Inc. (the “RWB Michigan Bridging Loan”), an unlimited guarantee and general security agreement from Michicann

Medical Inc. to and in favour of the Holder, pursuant to which:

(i)

under the unlimited guarantee, Michicann Medical Inc. will guarantee the payment, performance and discharge in full of all debts, liabilities

and obligations of or owing by the Borrower to the Holder; and

(ii) under such general security agreement, Michicann Medical Inc. shall, among other things, grant to and in favour of the Holder a security

interest and charge over all of property, assets and undertaking of Michicann Medical Inc., and such security interest and charge shall

be a first ranking security interest in and charge of such property, assets and undertaking;

(e) within 30 days following the

written notice by the Holder to the Borrower requesting security from a direct or indirect subsidiary of the Borrower, an unlimited guarantee

and general security agreement from such subsidiary (excluding RWB Florida LLC and any subsidiary that is restricted from granting security

under the RWB Michigan Bridging Loan, until all amounts owing under such loan have been repaid) to and in favour of the Holder, pursuant

to which:

(i) under the unlimited guarantee, such subsidiary will guarantee the payment, performance and discharge in full of all debts, liabilities

and obligations of or owing by the Borrower to the Holder; and

(ii) under such general security agreement, such subsidiary shall, among other things, grant to and in favour of the Holder a security interest

and charge over all of property, assets and undertaking of such subsidiary, and such security interest and charge shall be a first ranking

security interest in and charge of such property, assets and undertaking; and

(iii) such corporate resolutions, certificates, registrations, filings, legal opinions and such other related documents with respect to the

foregoing set forth in this Section 1.11 as shall be requested by the Holder, in its sole and absolute discretion.

ARTICLE II. CERTAIN COVENANTS

2.1 Borrowings. Until the Maturity

Date, the Borrower shall not, without the Holder’s written consent, create, incur, assume guarantee, endorse, contingently agree

to purchase or otherwise become liable upon the obligation of any person, firm, partnership, joint venture or corporation, except by the

endorsement of negotiable instruments for deposit or collection, or suffer to exist any liability for borrowed money, except (a) borrowings

in existence or committed on the date hereof and of which the Borrower has informed Holder in writing prior to the date hereof, (b) indebtedness

to trade creditors financial institutions or other lenders incurred in the ordinary course of business or (c) borrowings, the proceeds

of which shall be used to repay this Note.

2.2 Sale of Assets. So long as the

Borrower shall have any obligation under this Note, the Borrower shall not, without the Holder’s written consent, sell, lease or

otherwise dispose of any significant portion of its assets or the assets of any direct or indirect subsidiary outside the ordinary course

of business. In no event while this Note is outstanding shall the Borrower sell, convey, assign, encumber, pledge, gift or transfer any

of the ownership interests in its direct or indirect subsidiaries or sell, lease, convey, assign, encumber, pledge, gift or transfer any

of the assets of its direct or indirect subsidiaries except for inventory and obsolete or worn or damaged equipment sold in the ordinary

course of business.

2.3 Preservation of Existence, etc.

The Borrower shall maintain and preserve, and cause each of its direct or indirect subsidiaries to maintain and preserve, its existence,

rights and privileges, and become or remain, and cause each of its direct or indirect subsidiaries (other than dormant subsidiaries that

have no or minimum assets) to become or remain, duly qualified and in good standing in each jurisdiction in which the character of the

properties owned or leased by it or in which the transaction of its business makes such qualification necessary.

2.4 Non-circumvention. The Borrower

hereby covenants and agrees that the Borrower will not, by amendment of its certificate of incorporation, notice of articles or articles,

or through any reorganization, transfer of assets, consolidation, merger, amalgamation, scheme of arrangement, dissolution, issue or sale

of securities, or any other voluntary action, avoid or seek to

avoid the observance or performance of any of the terms of

this Note, and will at all times in good faith carry out all the provisions of this Note and take all action as may be required to protect

the rights of the Holder.

2.5 Expenses. The Borrower

shall pay (a) all reasonable out-of-pocket expenses incurred by the Holder, including the reasonable fees, charges and disbursements of

counsel for the Holder and all applicable taxes, in connection with the preparation and administration of this Debenture and security

documents as described in Section 1.11 (the “Collateral Security”), together with any other document, instrument or

agreement now or hereafter entered into in connection with this Debenture and the Collateral Security, including without limitation, such

documents, instruments or agreements set out or described in Section 1.11, as such documents, instruments or agreements may be amended,

modified or supplemented from time to time (the “Loan Documents”), (b) all reasonable out-of-pocket expenses incurred

by the Holder and all applicable taxes, including the reasonable fees, charges and disbursements of counsel for the Holder, in connection

with any amendments, modifications or waivers of the provisions hereof or of any of the other Loan Documents (whether or not the transactions

contemplated hereby or thereby shall be consummated), and (c) all out-of-pocket expenses incurred by the Holder, including fees, charges

and disbursements of any counsel for the Holder and all applicable taxes, in connection with the assessment, enforcement or protection

of its rights in connection with this Debenture and the other Loan Documents. All amounts due under this Section 2.5 shall be payable

not later than five days after written demand therefor.

ARTICLE III. EVENTS OF DEFAULT

If any of the following events of default (each, an “Event of Default”)

shall occur:

3.1 Failure

to Pay Principal or Interest. The Borrower fails to pay the principal hereof or interest thereon when due on this Note, whether at

maturity, upon acceleration or otherwise.

3.2

Conversion and the Shares. the Borrower (i) fails to issue shares of Common Stock to the Holder (or announces or threatens in writing

that it will not honor its obligation to do so) upon exercise by the Holder of the conversion rights of the Holder in accordance with

the terms of this Note, (ii) fails to transfer or cause its transfer agent to transfer (issue) (electronically or in certificated form)

any certificate for shares of Common Stock issued to the Holder upon conversion of or otherwise pursuant to this Note as and when required

by this Note, (iii) directs its transfer agent not to transfer or delays, impairs, and/or hinders its transfer agent in transferring (or

issuing) (electronically or in certificated form) any certificate for shares of Common Stock to be issued to the Holder upon conversion

of or otherwise pursuant to this Note as and when required by this Note, (iv) fails to remove (or directs its transfer agent not to remove

or impairs, delays, and/or hinders its transfer agent from removing) any restrictive legend (or to withdraw any stop transfer instructions

in respect thereof) on any certificate for any shares of Common Stock issued to the Holder upon conversion of or otherwise pursuant to

this Note as and when required by this Note (or makes any written announcement, statement or threat that it does not intend to honor the

obligations described in this paragraph) and any such failure shall continue uncured (or any written announcement, statement or threat

not to honor its obligations shall not be rescinded in writing)

for three (3) business days after the Holder shall have delivered

a Notice of Conversion, (v) fails to remain current in its obligations to its transfer agent, (vi) causes a conversion of this Note to

be delayed, hindered or frustrated due to a balance owed by the Borrower to its transfer agent, (vii) fails to repay Holder, within forty

eight (48) hours of a demand from the Holder, any amount of funds advanced by Holder to the Borrower’s transfer agent in order to

process a conversion, and/or

(viii) fails to reserve sufficient amount of shares of common

stock to satisfy the Reserved Amount at all times.

3.3

Breach of Covenants. The Borrower breaches any material covenant or other material term or condition contained in this Note and

such breach continues for a period of fifteen

(15) days after written notice thereof to the Borrower from the Holder.

3.4

Breach of Representations and Warranties. Any representation or warranty of the Borrower made herein or in any agreement, statement

or certificate given in writing pursuant hereto or in connection herewith, shall be false or misleading in any material respect when made

and the breach of which has (or with the passage of time will have) a material adverse effect on the rights of the Holder with respect

to this Note.

3.5

Receiver or Trustee. The Borrower or any direct or indirect subsidiary of the Borrower shall make an assignment for the benefit

of creditors or commence proceedings for its dissolution, or apply for or consent to the appointment of a receiver or trustee for it or

for a substantial part of its property or business, or such a receiver or trustee shall otherwise be appointed for the Borrower or for

a substantial part of its property or business without its consent and shall not be discharged within sixty (60) days after such appointment.

3.6

Judgments. Any money judgment, writ or similar process shall be entered or filed against the Borrower or any direct or indirect

subsidiary of the Borrower or any of its property or other assets for more than $625,000, and shall remain unvacated, unbonded or unstayed

for a period of forty five (45) days unless otherwise consented to by the Holder, which consent will not be unreasonably withheld.

3.7

Bankruptcy. Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings, voluntary or involuntary, for

relief under any bankruptcy law or any law for the relief of debtors shall be instituted by or against the Borrower or any direct or indirect

subsidiary of the Borrower, or the Borrower admits in writing its inability to pay its debts generally as they mature, or have filed against

it an involuntary petition for bankruptcy relief, all under federal, provincial or state laws as applicable or the Borrower admits in

writing its inability to pay its debts generally as they mature, or have filed against it an involuntary petition for bankruptcy relief,

all under international, federal or state laws as applicable.

3.8

Delisting of Common Stock. the Borrower shall fail to maintain the listing of the Common Stock on at least one of the OTC Pink,

OTCQB, Nasdaq National Market, Nasdaq Small Cap Market, New York Stock Exchange, NYSE MKT, CSE, TSX, TSX Venture Exchange or an equivalent

replacement exchange

3.9

Failure to Comply with the Exchange Act; Reporting Issuer Status. the Borrower shall fail to use commercially reasonable efforts

to comply with the reporting requirements under applicable securities laws and rules and policies (including but not limited to becoming

delinquent in its filings); and/or the Borrower fails to use commercially reasonable efforts to maintain its status as a “reporting

issuer” in British Columbia and Ontario, not in default of any requirement of the applicable securities laws.

3.10 Liquidation. Any dissolution, liquidation, or winding up of the Borrower or any substantial portion of its business including its

direct or indirect subsidiaries on an aggregate basis.

3.11 Cessation of Operations. Any permanent cessation of operations by the Borrower or the Borrower admits in writing it is otherwise

generally unable to pay its debts as such debts become due, provided, however, that any disclosure of the Borrower or the Borrower’s

ability to continue as a “going concern” shall not be an admission that the Borrower or Borrower cannot pay its debts as they

become due.

3.12 Cessation of Trading. Any cessation of trading of the Common Stock on at least one of the OTC Pink, OTCQB, Nasdaq National Market,

Nasdaq Small Cap Market, New York Stock Exchange, NYSE MKT, CSE, TSX or an equivalent replacement exchange, and such cessation of trading

shall continue for a period of five consecutive (5) Trading Days.

3.13 Bid Price. the Borrower shall lose the “bid” price for its Common Stock ($0.0001 on the “Ask” with zero

market makers on the “Bid” per Level 2) and/or a market (including the OTC Pink, OTCQB, OTCQX or an equivalent replacement

exchange).

3.14

OTC Markets Designation. OTC Markets changes the Borrower’s designation to ‘No Information’ (Stop Sign), ‘Caveat

Emptor’ (Skull and Crossbones), or ‘OTC’, ‘Other OTC’ or ‘Grey Market’ (Exclamation Mark Sign).

3.16

Cross-Default. Notwithstanding anything to the contrary contained in this Note, a breach or default of any covenant or other term

or condition contained in any agreement relating to debt in excess of $100,000, where such default would entitle the holder to accelerate

repayment of the debt and such default is not cured or waived in writing within the lesser of (i) any applicable grace period, and (ii)

thirty (30) business days.

3.17

Replacement of Transfer Agent. In the event that the Borrower proposes to replace its transfer agent, the Borrower fails to provide,

prior to the effective date of such replacement, a fully executed Irrevocable Transfer Agent Instructions in a form as initially delivered

pursuant to this Note (including but not limited to the provision to irrevocably reserve shares of Common Stock in the Reserved Amount)

signed by the successor transfer agent to the Borrower.

3.18

Maintenance of Assets. The failure by the Borrower to maintain in any material respect any material intellectual property rights,

personal, real property or other assets which are necessary to conduct its business (whether now or in the future), or any disposition

or

conveyance of any material asset of the Borrower or any of

its director or indirect subsidiary outside the ordinary course of business. For greater certainty, the purchase or sale of any property

or assets of RWB Florida or the equity securities of RWB Florida shall not constitute ordinary course of business.

3.19

Change of Control. The occurrence of any of the following: (1) the consummation of any transaction or series of transactions (including,

without limitation, any merger or consolidation) the result of which is that any Person or Persons (other than the Borrower or its subsidiaries)

becomes the beneficial owner, directly or indirectly, of more than 50% of the voting securities of the Borrower; (2) a merger, amalgamation,

plan of arrangement, sale, consolidation or similar transaction of the Borrower or any subsidiary of the Borrower; or effect, approve

or authorize any change of control, or any recapitalization or reorganization of the Borrower or any subsidiary of the Borrower; or a

sale, transfer, conveyance, pledge, encumbrance, sub-license, assignment or other disposition, directly or indirectly, of all or substantially

all of the licenses, trademarks, patents, trade secrets or other intellectual property rights of the Borrower (including subsidiaries);

or (3) the direct or indirect sale, transfer, conveyance or other disposition in one or more series of related transactions, of all or

substantially all of the assets of the Borrower and the assets of its subsidiaries, taken as a whole, to one or more Persons (other than

the Borrower or its subsidiaries).

From and after the date of this Note, an Event of Default

shall not be deemed to have occurred unless and until the Holder has notified the Borrower in writing of such Event of Default and the

Borrower has failed to cure such Event of Default or has failed to pay the Note in full, in either case, within fifteen (15) business

days (or such longer period as may be provided in such Event of Default) after the Borrower receives such notice.

Upon the occurrence of any Event of Default, the Note shall

become immediately due and payable and the interest shall increase to Default Interest (a) with respect to Events of Default other than

those set forth in Section 3.7 above (but subject to Section 1.7(b)), upon Holder’s delivery of written notice of acceleration to

Borrower, and (b) with respect to an Event of Default under Section 3.7, automatically and without notice. In addition, Holder shall be

entitled to all other remedies under law and equity, including those of a secured creditor. If the Holder shall commence an action or

proceeding to enforce any provisions of this Note, including, without limitation, engaging legal counsel, then if the Holder prevails

in such action, the Holder shall be reimbursed by the Borrower for its attorneys' fees and other costs and expenses incurred in the investigation,

preparation and prosecution of such action or proceeding.

ARTICLE IV. MISCELLANEOUS

4.1 Failure or Indulgence Not Waiver.

No failure or delay on the part of the Holder in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof,

nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other

right, power or privileges. All rights and remedies existing hereunder are cumulative to, and not exclusive of, any rights or remedies

otherwise available.

4.2 Notices. All notices, demands,

requests, consents, approvals, and other communications required or permitted hereunder shall be in writing and, unless otherwise specified

herein, shall be (i) personally served, (ii) deposited in the mail, registered or certified, return receipt requested, postage prepaid,

(iii) delivered by reputable air courier service with charges prepaid, or (iv) transmitted by hand delivery, telegram, electronic mail,

or facsimile, addressed as set forth below or to such other address as such party shall have specified most recently by written notice.

Any notice or other communication required or permitted to be given hereunder shall be deemed effective (a) upon hand delivery or delivery

by electronic mail or facsimile, with accurate confirmation generated by the transmitting facsimile machine, at the address or number

designated below (if delivered on a business day during normal business hours where such notice is to be received), or the first business

day following such delivery (if delivered other than on a business day during normal business hours where such notice is to be received)

or

(b) on the second business day following the date of mailing

by express courier service, fully prepaid, addressed to such address, or upon actual receipt of such mailing, whichever shall first occur.

The addresses for such communications shall be:

If to the Borrower or the Borrower, to:

Red White and Bloom Brands Inc.

810-789 West Pender Street

Vancouver, British

Columbia

Canada, V6C 1H2

Attn: Brad Rogers or CEO

Email: [redacted]

With a copy to (which copy shall not constitute notice):

Gowling WLG

1 First Canadian Place

100 King Street West, Suite 1600

Toronto, Ontario M5X 1G5

Attn: [redacted]

Email: [redacted]

If to the Holder:

C-Point Investments Limited

Attn: Colby De Zen

Email: [redacted]

With a copy to (which copy shall not constitute notice):

McCarthy Tétrault

Suite 5300

TD Bank Tower

Box 48, 66 Wellington Street West

Toronto, Ontario M5K 1E6

Attn: [redacted]

Email: [redacted]

4.3 Amendments. This Note and any

provision hereof may only be amended by an instrument in writing signed by the Borrower and the Holder. The term “Note” and

all reference thereto, as used throughout this instrument, shall mean this instrument (and the other Notes issued pursuant to the Purchase

Agreement) as originally executed, or if later amended or supplemented, then as so amended or supplemented.

4.4 Assignability. This Note shall

be binding upon the Borrower and its successors and assigns, and shall inure to be the benefit of the Holder and its successors and assigns.

Borrower shall not assign this Note or any rights or obligations hereunder without the prior written consent of Holder. Holder may assign

its rights hereunder without approval of Borrower.

4.5 Governing Law. This Note shall

be governed by and construed in accordance with the laws of the Province of Ontario without regard to principles of conflicts of laws.

Any action brought by either party against the other concerning the transactions contemplated by this Note shall be brought only in the

courts of Ontario located in Toronto, Ontario. The parties to this Note hereby irrevocably waive any objection to jurisdiction and venue

of any action instituted hereunder and shall not assert any defense based on lack of jurisdiction or venue or based upon forum non

conveniens. Each party hereby irrevocably waives personal service of process and consents to process being served in any suit, action

or proceeding in connection with this Note by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence

of delivery) to such party at the address in effect for notices to it under this Note and agrees that such service shall constitute good

and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve

process in any other manner permitted by law.

4.6 Notice of Corporate Events.

Except as otherwise provided below, the Holder of this Note shall have no rights as a Holder of Common Stock unless and only to the extent

that it converts this Note into Common Stock. The Borrower shall provide the Holder with prior notification of any meeting of the Borrower’s

shareholders (and copies of proxy materials and other information sent to shareholders). In the event of any taking by the Borrower of

a record of its shareholders for the purpose of determining shareholders who are entitled to receive payment of any dividend or other

distribution, any right to subscribe for, purchase or otherwise acquire (including by way of merger, consolidation, reclassification or

recapitalization) any share of any class or any other securities or property, or to receive any other right, or for the purpose of determining

shareholders who are entitled to vote in connection with any proposed sale, lease or conveyance of all or substantially all of the assets

of the Borrower or any proposed liquidation, dissolution or winding up of the Borrower, the Borrower shall mail a notice to the Holder,

at least twenty (20) days prior to the record date specified therein (or thirty (30) days prior to the consummation of the transaction

or event, whichever is earlier), of the date on which any such record is to be taken for the purpose of such dividend, distribution, right

or other event, and a brief

statement regarding the amount and character of such dividend,

distribution, right or other event to the extent known at such time. The Borrower shall make a public announcement of any event requiring

notification to the Holder hereunder substantially simultaneously with the notification to the Holder.

4.7 Usury. If it shall be found that

any interest or other amount deemed interest due hereunder violates the applicable law governing usury, the applicable provision shall

automatically be revised to equal the maximum rate of interest or other amount deemed interest permitted under applicable law. The Borrower

covenants (to the extent that it may lawfully do so) that it will not seek to claim or take advantage of any law that would prohibit or

forgive the Borrower from paying all or a portion of the principal or interest on this Note.

4.8 Remedies. The Borrower acknowledges

that a breach by it of its obligations hereunder will cause irreparable harm to the Holder, by vitiating the intent and purpose of the

transaction contemplated hereby. Accordingly, the Borrower acknowledges that the remedy at law for a breach of its obligations under this

Note will be inadequate and agrees, in the event of a breach or threatened breach by the Borrower of the provisions of this Note, that

the Holder shall be entitled, in addition to all other available remedies at law or in equity, and in addition to the penalties assessable

herein, to an injunction or injunctions restraining, preventing or curing any breach of this Note and to enforce specifically the terms

and provisions thereof, without the necessity of showing economic loss and without any bond or other security being required. No provision

of this Note shall alter or impair the obligation of the Borrower, which is absolute and unconditional, to pay the principal of, and interest

on, this Note at the time, place, and rate, and in the form, herein prescribed.

4.9 Severability. In the event that

any provision of this Note is invalid or unenforceable under any applicable statute or rule of law, then such provision shall be deemed

inoperative to the extent that it may conflict therewith and shall be deemed modified to conform with such statute or rule of law. Any

provision hereof which may prove invalid or unenforceable under any law shall not affect the validity or enforceability of any other provision

hereof.

4.10 Waiver. Borrower

and any endorsers, sureties or guarantors hereof jointly and severally waive presentment and demand for payment, notice of intent to accelerate

maturity, notice of acceleration of maturity, protest and notice of protest and non-payment, all applicable exemption rights, valuation

and appraisement, notice of demand, and all other notices in connection with the delivery, acceptance, performance, default or enforcement

of the payment of this Note and the bringing of suit and diligence in taking any action to collect any sums owing hereunder.

DocuSign Envelope ID: 17C5778D-3C21-4EEE-9EC1-87666DBF611A

IN WITNESS WHEREOF, Borrower has caused this Note to be signed

in its name by its duly authorized officer as of the date first above written.

Borrower:

RED WHITE & BLOOM BRANDS INC.

By: /s/ "Brad Rogers"

Name: Brad Rogers

Title: Chief Executive Officer

Holder:

C-POINT

INVESTMENTS LIMITED

By: /s/ "Colby De Zen"

Name: Colby De Zen

Title:

President

EXHIBIT A

NOTICE OF CONVERSION

The undersigned hereby elects to convert

$ _______principal amount of the Note (defined below) [together with $ _______of accrued and unpaid interest thereto, totaling

$ _______] into that number of shares of Common Shares to be issued pursuant to the conversion of the Note (“Common Shares”)

as set forth below, of Red White & Bloom Brands Inc., a corporation formed under the laws of British Columbia (the “Company”),

according to the conditions of the convertible note of the Borrower dated as of September , 2022 (the “Note”), as of the date

written below. No fee will be charged to the Holder for any conversion, except for transfer taxes, if any.

Box Checked as to applicable instructions:

[ ] Company shall electronically transmit

the Common Shares issuable pursuant to this Notice of Conversion to the account of the undersigned or its nominee with DTC through its

Deposit Withdrawal At Custodian system (“DWAC Transfer”).

Name of DTC Prime Broker:

Account Number:

[ ] The undersigned hereby requests

that Company issue a certificate or certificates for the number of shares of Common Shares set forth below (which numbers are based on

the Holder’s calculation attached hereto) in the name(s) specified immediately below or, if additional space is necessary, on an

attachment hereto:

Name: [NAME]

Address: [ADDRESS]

| Date of Conversion: |

__________________ |

| Applicable Conversion Price: |

$ ________________ |

| Number of Common Shares to be Issued |

|

| Pursuant to Conversion of the Note: |

__________________ |

| Amount of Principal Balance Due remaining |

|

| Under the Note after this conversion: |

__________________ |

| Accrued and unpaid interest remaining: |

__________________ |

C-POINT INVESTMENTS LIMITED.

By: ____________________________

Name: [NAME]

Title: [TITLE]

Date: [DATE]

Exhibit 99.3

U.S. $20,112,015.00 Effective Ju . h , e 4, 2021 NOTE BEING INDEBTED, FOR VALUE RECEIVED, the undersigned, jointly and severally, if p,ore than one, (the "Borrower") promises to pay to the order of M&V INVESTMENT ONE LLC, a Florida limited liability company (the "Lender"), or its successors or assigns, at its offices at 6903 Congress Street, iNew Port Richey, FL 33653 , the sum of TWENTY MILLION ONE HUNDRED TWELVE THOUSAND FIFTEEN AND 00/100 DOLLARS ($20,112,015.00), together with interest on the unpaid balance, calculated in t e manner hereinafter stated, from the dates of disbursements until maturity, both principal and interest being payabl in lawful money of the United States of America. INTEREST RATE . The interest charged on the unpaid principal balance owed pursuant to this Note is an interest rate of eight percent ( 8 . 00 % ) per annum (the "Base Interest Rate") . Interest shall be calculated onia 360 - day year based on actual days elapsed . Interest on $ 18 , 896 , 390 . 00 shall be charged from the effective date of this Note through June 10 , 2021 . Thereafter interest on $ 20 , 112 , 015 . 00 shall be payable in accordance with th payment provisions of this Note as set forth below . ADDITIONAL INTEREST . In addition to the Base Interest Rate, the Borrower shall owe : additional interest on the principal balance, and Adjusted Principal Balance, as applicable (the "Additional Interest"), which Additional Interest shall be due upon the execution of this Note and on the Anniversary Date and Second Anniversary Date . The payment of Additional Interest shall be made by Red, White and Bloom Brands, Inc . , a British Columbia corporation (the "Guarantor") issuing Common Shares of the Guarantor . Upon the execution of this Note, the Guarantor shall issue to the Lender 753 , 385 Common Shares of the Guarantor . Thereafter, on the Anniversary Date and on the Second Anniversary Date, the Guarantor shall issue Common Shares ofthe,Guarantor in an amount equal to four ( 4 % ) percent of the Adjusted Principal Balance existing at the time of the Anniversary Date and Second Anniversary Date, as applicable, based on the Canadian Securities Exchange at the volume weighted average trading price for a period of fifteen ( 15 ) consecutive trading days prior to the Anniversary Date and Second Anniversary Date, as applicable, of this Note . In the event the Guarantor defaults under its obligation to issue Common Shares of the Guarantor to the Lender, as Additional Interest, then at the option of the Lender, the Lender shall be entitled to the cash equivalent of the Additional Interest . ' PAYMENTS . Interest only payments, at the Base Interest Rate, shall accrue annually and shall be added to the principal balance (the "Adjusted Principal Balance") on each anniversary date of the Note (the "Anniversary Date") of the Loan commencing on June 4 , 2022 and thereafter on June 4 , 2023 (the "Second Anniversary Date") and on June 4 , 2024 (the "Maturity Date"), at which time the then Adjusted Principal Balance remaining, together with the interest accrued thereon and the Additional Interest shall be fully due and payable without demand . CONVERSION TO EQUITY . As additional consideration advancing the funds to the Borrower in accordance with terms of this Note, the Borrower and Guarantor have agreed that the Lender can convert all or any portion of the Adjusted Principal Balance of this Note at a price of US $ 2 . 75 per share of Common' Shares of Guarantor (subject to standard adjustments for reorganization transactions such as share consolidations or splits) at any time prior to the Maturity Date by surrendering the Note at the office of the Guarantor with written notice of such conversion . The Note shall be deemed to be surrendered for conversion on the date (the "Date of Conversion") on which it is so surrendered, and in the event that the Note is surrendered by mail or other means of delivery, on the date in which it is received by the Guarantor during regular business hours, provided that if the Note is strrendered for conversion on a day on which the register of the Guarantor's securities is closed, the Date of Conversibn shall be the date such register is next reopened . The Lender will be entitled to be entered into in the books ofthe[Guarantor as at the applicable Date of Conversion as the holder of the number of Common Shares of the Guarantorinto which this Note is converted in accordance with the provisions hereof and, as soon as practicable thereafter, the Borrower will cause the Guarantor to deliver to Lender a certificate or direct registration statement for such Comtrion Shares entered . The Lender acknowledges that the Guarantor is not required to issue fractional Common Sliares upon conversion of the Note . If any fractional interest in a Common Share would, but for the provisions hereof, be deliverable upon the conversion of any amount of the Note, the number of Common Shares to which the Lender is entitled upon conversion will be rounded down to the next whole number . Upon conversion, the Borrower 1 will cause PREPARED FOR AND RETURN TO: Joseph W. Gaynor, Esq. Johnson , Pope, Bokor, Ruppel & Bums, LLP 911 Chesblut Street, Cleanvater, Florida 33756

2 the Guarantor to cancel the Note, and the Lender shall cancel the Note, provided : (i) all accrued interest ' has been paid by the Borrower, and (ii) Additional Interest as set forth in the Note has been either paid by the Borrofver or the Guarantor has satisfied its obligations with respect to the transfer of Common Shares of Guarantor to ,satisfy the Additional Interest owed the Lender ; and (iii) the amount of the Principal or Adjusted Principal not conyerted has been paid by the Borrower or the Guarantor . INTEREST LIMITATION . Notwithstanding any other provision of the Note or of any o the Loan Documents or any other instrument executed in connection with the loan evidenced hereby, it is expressly agreed that the amounts payable under this Note or under the other aforesaid instruments for the payment of inteiest or any other payment in the nature of or which would be considered as interest or other charge for the use or loanj of money shall not exceed the highest rate allowed by law, from time to time, to be charged by the Lender . In th event the provisions of this Note or the other documents referred to in this paragraph regarding the payment of interest or other payments in the nature of or which would be considered as interest or other charges for the use hr loan of money operate to produce a rate that exceeds such limitation, then the excess over such limitation Jm not be payable and the amount otherwise agreed to have been paid shall be reduced by the excess so that suchjlimitation will not be exceeded, and if any payment actually made shall result in such limitation being exceeded, the amount of the excess shall constitute and be treated as a payment on the principal hereof and shall operate to rel!uce such principal by the amount of such excess, or if in excess of the pr . incipal indebtedness, such excess shall be