JANUARY 28, 2014

|

SUMMARY PROSPECTUS

|

|

|

BlackRock Large Cap Series Funds,

Inc. | Investor and Institutional Shares

|

>

|

|

BlackRock Large Cap Core Plus Fund

Investor A:

BALPX • Investor C: BCLPX • Institutional: BILPX

|

Before you invest, you may want to

review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including

amendments and supplements) and other information about the Fund, including the Fund’s statement of additional information and shareholder report,

online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request

to

prospectus.request@blackrock.com

, or from your financial professional. The Fund’s prospectus and statement of additional information,

both dated January 28, 2014, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary

Prospectus.

This Summary Prospectus contains

information you should know before investing, including information about risks. Please read it before you invest and keep it for future

reference.

The Securities and Exchange

Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary

is a criminal offense.

|

Not FDIC Insured • May Lose Value • No Bank Guarantee

|

Summary Prospectus

Key Facts About BlackRock Large Cap

Core Plus Fund

Investment Objective

The investment objective of BlackRock Large Cap Core Plus Fund

(“Core Plus Fund” or the “Fund”), a series of BlackRock Large Cap Series Funds, Inc. (the “Corporation”), is to seek

long-term capital growth. In other words, the Fund tries to choose investments that will increase in value.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you

buy and hold shares of Core Plus Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at

least $25,000 in the fund complex advised by BlackRock Advisors, LLC (“BlackRock”) and its affiliates. More information about these and other

discounts is available from your financial professional or your selected securities dealer, investment adviser, service provider or industry

professional (including BlackRock, The PNC Financial Services Group, Inc. and their respective affiliates) (each a “Financial Intermediary”)

and in the “Details About the Share Classes” section on page 34 of the Fund’s prospectus and in the “Purchase of Shares”

section on page II-58 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid

directly from your investment)

|

|

|

|

Investor A

Shares

|

|

Investor C

Shares

|

|

Institutional

Shares

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

|

|

|

|

5.25

|

%

|

|

None

|

|

None

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is

lower)

|

|

|

|

None

1

|

|

|

1.00

|

%

2

|

|

None

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a

percentage of the value of your investment)

|

|

|

|

Investor A

Shares

|

|

Investor C

Shares

|

|

Institutional

Shares

|

|

Management Fee

|

|

|

|

|

1.20

|

%

|

|

|

1.20

|

%

|

|

|

1.20

|

%

|

|

Distribution and/or Service (12b-1) Fees

|

|

|

|

|

0.25

|

%

|

|

|

1.00

|

%

|

|

None

|

|

Other Expenses

|

|

|

|

|

1.20

|

%

|

|

|

1.26

|

%

|

|

|

1.21

|

%

|

|

Interest Expense/Stock Loan Fees

|

|

|

|

0.31%

|

|

0.31%

|

|

0.31%

|

|

Dividend Expense on Short Sales

|

|

|

|

0.40%

|

|

0.40%

|

|

0.40%

|

|

Miscellaneous Other Expenses

|

|

|

|

0.49%

|

|

0.55%

|

|

0.50%

|

|

Acquired Fund Fees and Expenses

3

|

|

|

|

|

0.01

|

%

|

|

|

0.01

|

%

|

|

|

0.01

|

%

|

|

Total Annual Fund Operating Expenses

3

|

|

|

|

|

2.66

|

%

|

|

|

3.47

|

%

|

|

|

2.42

|

%

|

|

Fee Waivers and/or Expense Reimbursements

4

|

|

|

|

|

(0.29

|

)%

|

|

|

(0.36

|

)%

|

|

|

(0.32

|

)%

|

|

Total Annual Fund Operating Expenses After Fee Waivers

and/or Expense

Reimbursements

4

|

|

|

|

|

2.37

|

%

|

|

|

3.11

|

%

|

|

|

2.10

|

%

|

|

1

|

|

A contingent deferred sales charge

(“CDSC”) of 1.00% is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge

was paid at time of purchase as part of an investment of $1,000,000 or more.

|

|

2

|

|

There is no CDSC on Investor C Shares after one

year.

|

|

3

|

|

The Total Annual Fund Operating Expenses do not

correlate to the ratio of expenses to average net assets given in the Fund’s most recent annual report which does not include the Acquired Fund

Fees and Expenses.

|

|

4

|

|

As described in the “Management of the

Funds” section of the Fund’s prospectus on pages 50-55, BlackRock has contractually agreed to waive and/or reimburse fees and/or expenses in

order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Dividend Expense, Interest Expense,

Acquired Fund Fees and Expenses and certain other Fund expenses) as a percentage of average daily net assets to 1.65% (for Investor A Shares), 2.39%

(for Investor C Shares) and 1.38% (for Institutional Shares) until February 1, 2015. The agreement may be terminated upon 90 days’ notice by a

majority of the non-interested directors of the Corporation or by a vote of a majority of the outstanding voting securities of Core Plus

Fund.

|

2

Example:

This Example is intended to help you compare the cost of investing

in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated

and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the

Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would

be:

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Investor A Shares

|

|

|

|

$

|

753

|

|

|

$

|

1,282

|

|

|

$

|

1,837

|

|

|

$

|

3,341

|

|

|

Investor C Shares

|

|

|

|

$

|

414

|

|

|

$

|

1,032

|

|

|

$

|

1,772

|

|

|

$

|

3,724

|

|

|

Institutional Shares

|

|

|

|

$

|

213

|

|

|

$

|

724

|

|

|

$

|

1,262

|

|

|

$

|

2,732

|

|

You would pay the following expenses if you did not redeem your

shares:

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Investor C Shares

|

|

|

|

$

|

314

|

|

|

$

|

1,032

|

|

|

$

|

1,772

|

|

|

$

|

3,724

|

|

The Fund pays transaction costs, such as commissions, when it buys

and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result

in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example,

affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 65% of the average value of its

portfolio.

Principal Investment Strategies of the Fund

Core Plus Fund pursues its investment objective by establishing

long and short positions in a diversified portfolio of equity securities issued primarily by large cap companies located in the United States. Equity

securities consist primarily of common stock, preferred stock, securities convertible into common stock and securities or other instruments whose price

is linked to the value of common stock. Large cap companies are companies that at the time of purchase have a market capitalization equal to or greater

than the top 80% of the companies that comprise the Russell 1000

®

Index. As of June 28, 2013, the most recent rebalance date, the

lowest market capitalization in this group was $3.8 billion. The market capitalizations of companies in the index change with market conditions and the

composition of the index.

The Fund will use an investment approach that emphasizes a blend

of both growth and value. Growth companies are those whose earnings growth potential appears to the Fund management team to be greater than the market

in general and whose revenue growth is expected to continue for an extended period. Stocks of growth companies typically pay relatively low dividends

and sell at relatively high valuations. Value companies are those that appear to be undervalued by the market as measured by certain financial

formulas. Under normal circumstances, the Fund seeks to achieve its objective by investing at least 80% of its net assets in equity securities,

primarily common stock, of large cap companies that BlackRock selects from those that are, at the time of purchase, included in the Fund’s

benchmark, the Russell 1000

®

Index. For this purpose, net assets include assets acquired through the investment of the proceeds of the

short sales or any borrowings or other forms of leverage for investment purposes.

The Fund takes long positions primarily in large cap companies

that BlackRock has identified as attractive and short positions in such securities that BlackRock has identified as overvalued or poised for

underperformance. A long position refers to a security that the Fund holds in its portfolio, while a short position refers to a security the Fund does

not hold but has sold short by delivery of a borrowed security. The Fund will normally hold long positions in equity securities representing up to 130%

of its assets. The Fund will generally hold approximately 30% of its assets in short positions. When the Fund takes a long position, it purchases the

security outright. When the Fund takes a short position, it sells a security that it has borrowed.

3

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in

Core Plus Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose

part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The following is a summary

description of principal risks of investing in the Fund.

|

n

|

|

Equity Securities Risk

— Stock markets are

volatile. The price of an equity security fluctuates based on changes in a company’s financial condition and overall market and economic

conditions.

|

|

n

|

|

Investment Style Risk

— Under certain market

conditions, growth investments have performed better during the later stages of economic expansion and value investments have performed better during

periods of economic recovery. Therefore, these investment styles may over time go in and out of favor. At times when the investment style used by the

Fund is out of favor, the Fund may underperform other equity funds that use different investment styles.

|

|

n

|

|

Market Risk and Selection Risk

— Market risk is

the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and

unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the

securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money.

|

|

n

|

|

Short Sales Risk

— Because making short sales

in securities that it does not own exposes the Fund to the risks associated with those securities, such short sales involve speculative exposure risk.

The Fund may incur a loss as a result of a short sale if the price of the security increases between the date of the short sale and the date on which

the Fund replaces the borrowed security.

|

Performance Information

The information shows you how Core Plus Fund’s performance

has varied year by year and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of

the Russell 1000

®

Index. As with all such investments, past performance (before and after taxes) is not an indication of future

results. Sales charges are not reflected in the bar chart. If they were, returns would be less than those shown. However, the table includes all

applicable fees and sales charges. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the

Fund’s returns would have been lower. Updated information on the Fund’s performance, including its current net asset value, can be obtained

by visiting http://www.blackrock.com/funds or can be obtained by phone at (800) 882-0052.

Investor A Shares

ANNUAL TOTAL RETURNS

Core Plus

Fund

As of 12/31

During the period shown in the bar chart, the highest return for a

quarter was 14.18% (quarter ended December 31, 2011) and the lowest return for a quarter was –20.63% (quarter ended September 30,

2011).

4

As of 12/31/13

Average Annual Total Returns

|

1 Year

|

5 Years

|

Since

Inception

(December 19, 2007)

|

|

BlackRock Large Cap Core Plus Fund — Investor A

|

|

|

|

|

Return Before Taxes

|

25.01%

|

13.84%

|

4.92%

|

|

Return After Taxes on Distributions

|

25.01%

|

13.69%

|

4.81%

|

|

Return After Taxes on Distributions and Sale of Shares

|

14.15%

|

11.04%

|

3.79%

|

|

BlackRock Large Cap Core Plus Fund — Investor C

|

|

|

|

|

Return Before Taxes

|

29.94%

|

14.23%

|

5.10%

|

|

BlackRock Large Cap Core Plus Fund — Institutional

|

|

|

|

|

Return Before Taxes

|

32.30%

|

15.37%

|

6.17%

|

|

Russell 1000

®

Index

(Reflects no deduction for fees, expenses or taxes)

|

33.11%

|

18.59%

|

6.72%

|

After-tax returns are calculated using the historical highest

individual Federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the

investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares

through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Investor A Shares only, and

the after-tax returns for Investor C and Institutional Shares will vary.

Investment Manager

Core Plus Fund’s investment manager is BlackRock Advisors,

LLC (previously defined as “BlackRock”). The Fund’s sub-adviser is BlackRock Investment Management, LLC (the “Sub-Adviser”).

Where applicable, “BlackRock” refers also to the Sub-Adviser.

Portfolio Manager

Name

|

Portfolio Manager

of the Fund

Since

|

Title

|

|

Peter Stournaras, CFA

|

2010

|

Managing Director of BlackRock, Inc.

|

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New

York Stock Exchange is open. To purchase or sell shares you should contact your Financial Intermediary, or, if you hold your shares through the Fund,

you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds, P.O. Box 9819, Providence, Rhode Island 02940-8019), or by the

Internet at www.blackrock.com/funds. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce

or waive the minimums in some cases:

|

|

Investor A and Investor C

Shares

|

|

Institutional Shares

|

|

Minimum Initial Investment

|

|

$1,000 for all accounts except:

· $250 for

certain fee-based programs.

· $100 for certain employer-sponsored retirement

plans.

· $50, if establishing an Automatic Investment Plan.

|

|

$2 million for institutions and individuals.

Institutional Shares are available to clients of registered

investment advisers who have $250,000 invested in the Fund.

|

|

Minimum Additional Investment

|

|

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a

lower minimum).

|

|

No subsequent minimum.

|

5

Tax Information

The Fund’s dividends and distributions may be subject to

Federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement

plan, in which case you may be subject to Federal income tax upon withdrawal from such tax deferred arrangements.

Payments to Broker/Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a Financial

Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale

of Fund shares and related services. These payments may create a conflict of interest by influencing the Financial Intermediary and your individual

financial professional to recommend the Fund over another investment. Ask your individual financial professional or visit your Financial

Intermediary’s website for more information.

6

[This page intentionally left blank]

|

INVESTMENT COMPANY ACT FILE #811-09637

© BlackRock Advisors, LLC

SPRO-LCCP-0114

|

|

|

|

|

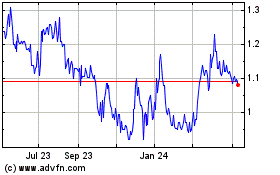

Probe Gold (QB) (USOTC:PROBF)

Historical Stock Chart

From Apr 2024 to May 2024

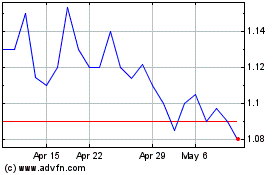

Probe Gold (QB) (USOTC:PROBF)

Historical Stock Chart

From May 2023 to May 2024