UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

¨ |

| Filed by a Party other than the Registrant |

x |

Check the appropriate box:

| |

¨ |

Preliminary Proxy Statement |

| |

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x |

Definitive Proxy Statement |

| |

¨ |

Definitive Additional Materials |

| |

¨ |

Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| |

x |

No fee required. |

| |

¨ |

Fee paid previously with preliminary materials. |

| |

¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

December 15, 2023

Dear Fellow Stockholders of Ocean Power Technologies, Inc.:

Paragon Technologies, Inc. (“Paragon”)

is nominating four highly qualified director candidates for election to the board of directors of Ocean Power Technologies, Inc.

(“OPT”) at its annual meeting of stockholders to be held virtually on Wednesday, January 31, 2024, at 10:00 a.m., Eastern

Time (the “Annual Meeting”). We are furnishing the attached proxy statement and the enclosed BLUE universal

proxy card to holders of the shares of common stock of OPT, in connection with our solicitation of proxies for use at the Annual Meeting

and at any and all adjournments, continuations or postponements thereof.

As more fully discussed in this proxy statement,

we are soliciting proxies to be used at the Annual Meeting for the following items:

| 1. | To elect each of Paragon’s nominees as directors of OPT; |

| 2. | To vote on OPT’s proposal to approve an amendment to OPT’s 2015 Omnibus Incentive Plan (the

“2015 Plan”) to increase the number of shares of OPT’s common stock available for grant under the 2015 Plan from 4,382,036

to 7,282,036 and to amend the aggregate number of shares available for incentive awards; |

| 3. | To vote on OPT’s proposal to ratify, by a non-binding advisory vote, the adoption of OPT’s

Section 382 Tax Benefits Preservation Plan, dated as of June 29, 2023, by and between OPT and Computershare Trust Company, N.A.,

as Rights Agent; |

| 4. | To vote on OPT’s proposal to ratify, by a non-binding advisory vote, the selection of EisnerAmper

LLP as OPT’s independent registered public accounting firm for the fiscal year ending April 30, 2024; |

| 5. | To vote on OPT’s proposal to approve, by a non-binding advisory vote, the compensation of OPT’s

named executive officers; and |

| 6. | Transact such other business as may properly come before the meeting and any adjournment or postponement

thereof. |

THIS SOLICITATION IS BEING MADE BY PARAGON

AND OTHER PARTICIPANTS IN PARAGON’S SOLICITATION AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OF OPT.

OPT has said that it will disregard proxy

votes in favor of Paragon’s director nominees. Stockholders should review the section of this proxy statement titled “QUESTIONS

AND ANSWERS RELATING TO THIS PROXY SOLICITATION—Why is OPT saying it will disregard Paragon’s director nominations, and how

does that impact proxies that stockholders provide to Paragon?”

We urge you to elect the Paragon nominees to OPT’s

board of directors because, as further discussed in this proxy statement, we believe that our director candidates possess the skills,

experience and focus necessary to turn OPT around, but more importantly to create a company that works for the benefit of stockholders,

not the insiders. Our four director candidates, whose backgrounds are more fully described in the attached proxy statement, are Hesham

M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser.

According to publicly available information, OPT’s

current board of directors consists of six directors whose terms will expire at the Annual Meeting. OPT’s bylaws provide that members

of the board of directors are to be elected at each annual meeting of stockholders. We are soliciting proxies in support of Paragon’s

nominees. As a result, should a stockholder so authorize us, on the BLUE universal proxy card, we would cast votes “FOR”

the election of all of Paragon’s nominees.

We ask for your support by completing, signing,

dating and returning in the enclosed postage-paid envelope the enclosed BLUE universal proxy card from Paragon, or by instructing

us by telephone or via the internet as to how you would like your shares voted (instructions are on your BLUE universal

proxy card). If your shares of OPT are held in the name of a bank, broker or other nominee, only that nominee can vote such shares and

only upon receipt of your specific instruction. Accordingly, we urge you to complete, sign, date and return the enclosed BLUE

universal voting instruction form using the postage-paid envelope provided by your bank, broker or other nominee or vote by telephone

or via the internet by following the directions provided to you by your bank, broker or other nominee, or contact the person responsible

for your account and instruct that person to execute the BLUE universal proxy card on your behalf. Please follow any voting

instructions provided by your bank, broker or other nominee.

If you are a stockholder of record and already

have voted using OPT’s white proxy card or by telephone or via the internet by following the instructions provided to you by OPT,

you may revoke your previously submitted white proxy by signing and returning a later-dated BLUE universal proxy card using

the enclosed postage-paid envelope, by delivering a written notice of revocation to the Corporate Secretary of OPT, or by instructing

us by telephone or via the internet as to how you would like your shares voted (instructions are on your BLUE universal

proxy card). Only the latest validly executed proxy that you submit prior to the submission deadline will be counted. If you hold your

shares through a bank, broker or other nominee, and if you already have provided your bank, broker or other nominee with voting instructions

using OPT’s white voting instruction form or by telephone or via the internet, you may revoke your previously submitted voting instructions

by signing and submitting a later-dated BLUE universal voting instruction form using the postage-paid envelope provided

by your bank, broker or other nominee or by telephone or via the internet by following the instructions provided by your bank, broker

or other nominee. In that case, your bank, broker or other nominee will seek to give effect to only the latest-dated voting instructions

it receives from you.

If you have any questions or require any assistance

with providing your proxy or any other matters, please contact our proxy advisor, Alliance Advisors, by telephone at 855-200-8651 or by

email at OPTT@allianceadvisors.com.

Thank you for your support,

Paragon Technologies, Inc.

PROXY STATEMENT

This proxy statement

and enclosed BLUE universal proxy card are being provided by Paragon Technologies, Inc. (“Paragon”) in

connection with its solicitation of proxies from you, the holders of shares of common stock of Ocean Power Technologies, Inc., a

Delaware corporation (“OPT”), in connection with our solicitation of proxies for use at OPT’s 2023 annual meeting of

stockholders scheduled to be held virtually on Wednesday, January 31, 2024, at 10:00 a.m., Eastern Time, including any adjournments,

continuations or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”).

As more fully discussed

in this proxy statement, the terms of OPT’s current directors will expire at the Annual Meeting. Under the proxy rules, we may solicit

proxies in support of Paragon’s director nominees. This would enable a stockholder who desires to vote for up to a full complement

of six director nominees to use the BLUE universal proxy card or, if applicable, the BLUE voting instruction

form to vote for Paragon’s nominees.

Paragon’s

director nominees are Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs and Samuel S. Weiser. The backgrounds and qualifications of our director

candidates are described in this proxy statement in the section titled “Our Director Candidates.” Stockholders are permitted

to vote for any combination (up to six total) of Paragon’s nominees and OPT’s nominees on the BLUE universal

proxy card. If stockholders choose to vote for any of OPT’s nominees, we recommend that stockholders “WITHHOLD”

on Terence J. Cryan, Clyde W. Hewlett, Peter E. Slaiby and Philipp Stratmann, who we refer to as the “Opposed OPT Nominees.”

OPT’s other two nominees (Natalie Lorenz-Anderson and Diana G. Purcel) are referred to hereafter as the “Acceptable OPT Nominees.”

We make no recommendation regarding the Acceptable OPT Nominees.

THIS SOLICITATION

IS BEING MADE BY PARAGON AND OTHER PARTICIPANTS IN PARAGON’S SOLICITATION AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OF OPT.

OPT has said that it will disregard proxy

votes in favor of Paragon’s director nominees. Stockholders should review the section of this proxy statement titled “QUESTIONS

AND ANSWERS RELATING TO THIS PROXY SOLICITATION—Why is OPT saying it will disregard Paragon’s director nominations, and how

does that impact proxies that stockholders provide to Paragon?”

This proxy statement

and the enclosed BLUE universal proxy card are first being sent to OPT’s stockholders on or about December 18, 2023.

Proposals on the

following matters are also included on our BLUE universal proxy card:

| 1. | To vote on OPT’s proposal to approve an amendment to OPT’s 2015 Omnibus Incentive Plan (the

“2015 Plan”) to increase the number of shares of OPT’s common stock available for grant under the 2015 Plan from 4,382,036

to 7,282,036 and to amend the aggregate number of shares available for incentive awards; |

| 2. | To vote on OPT’s proposal to ratify, by a non-binding advisory vote, the adoption of OPT’s

Section 382 Tax Benefits Preservation Plan, dated as of June 29, 2023, by and between OPT and Computershare Trust Company, N.A.,

as Rights Agent (the “Tax Benefits Preservation Plan”); |

| 3. | To vote on OPT’s proposal to ratify, by a non-binding advisory vote, the selection of EisnerAmper

LLP as OPT’s independent registered public accounting firm for the fiscal year ending April 30, 2024; and |

| 4. | To vote on OPT’s proposal to approve, by a non-binding advisory vote, the compensation of OPT’s

named executive officers. |

Paragon recommends

that you vote “AGAINST” the approval of an amendment to OPT’s 2015 Plan, the ratification, by a non-binding

advisory vote, of the adoption of OPT’s Tax Benefits Preservation Plan, the ratification, by a non-binding advisory vote, of the

selection of EisnerAmper LLP as OPT’s independent registered public accounting firm for the fiscal year ending April 30, 2024,

and the approval, by a non-binding advisory vote, of the compensation of OPT’s named executive officers.

Except as set forth

in this proxy statement, Paragon is not aware of any other matter to be considered at the Annual Meeting. However, if Paragon learns of

any other proposals made at a reasonable time before the Annual Meeting, Paragon will either supplement this proxy statement and provide

stockholders with an opportunity to vote by proxy directly on such matters or will not exercise discretionary authority with respect thereto.

If other proposals are made thereafter, the persons named as proxies on the BLUE universal proxy card solicited by Paragon

will vote such proxies, to the extent authorized by Rule 14a-4(c)(3) under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), in their discretion with respect to such matters.

OPT has set

the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting as December 4, 2023 (the “Record

Date”). Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According

to OPT, as of the Record Date, there were 58,788,718 shares of common stock of OPT outstanding and entitled to vote at the Annual Meeting.

This solicitation

of proxies is being made by Paragon. Further information regarding Paragon and its affiliates is included in this proxy statement in the

section titled “Information About Us.” This solicitation of proxies is not being made by or on behalf of the board of directors

(sometimes referred to as the “board”) or management of OPT.

WE URGE YOU TO

VOTE THE ENCLOSED BLUE UNIVERSAL PROXY CARD FROM PARAGON TO ELECT OUR DIRECTOR CANDIDATES—BY PHONE, VIA THE INTERNET OR BY

SIGNING, DATING AND RETURNING IT IN THE POSTAGE-PAID ENVELOPE PROVIDED.

HOLDERS OF SHARES

AS OF THE RECORD DATE ARE URGED TO SUBMIT A BLUE UNIVERSAL PROXY CARD EVEN IF YOUR SHARES WERE SOLD AFTER THE RECORD DATE.

IF YOUR SHARES

ARE HELD IN THE NAME OF A BANK, BROKER OR OTHER NOMINEE ON THE RECORD DATE, ONLY THAT NOMINEE CAN VOTE THOSE SHARES AND ONLY UPON RECEIPT

OF YOUR SPECIFIC INSTRUCTIONS. ACCORDINGLY, WE URGE YOU TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED BLUE UNIVERSAL VOTING INSTRUCTION

FORM USING THE POSTAGE-PAID ENVELOPE PROVIDED BY YOUR BANK, BROKER OR OTHER NOMINEE OR VOTE BY TELEPHONE OR VIA THE INTERNET BY FOLLOWING

THE DIRECTIONS PROVIDED TO YOU BY YOUR BANK, BROKER OR OTHER NOMINEE, OR CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND INSTRUCT

THAT PERSON TO EXECUTE THE BLUE UNIVERSAL PROXY CARD ON YOUR BEHALF. PLEASE FOLLOW ANY VOTING INSTRUCTIONS PROVIDED BY YOUR BANK,

BROKER OR OTHER NOMINEE. IF YOU HAVE NOT RECEIVED A BLUE UNIVERSAL VOTING INSTRUCTION FORM FROM YOUR BANK, BROKER OR OTHER

NOMINEE, YOU SHOULD IMMEDIATELY CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT TO OBTAIN A BLUE UNIVERSAL VOTING INSTRUCTION FORM.

IF YOU ARE A

STOCKHOLDER OF RECORD AND ALREADY HAVE VOTED USING OPT’S WHITE PROXY CARD OR BY TELEPHONE OR VIA THE INTERNET BY FOLLOWING THE INSTRUCTIONS

PROVIDED TO YOU BY OPT, YOU MAY REVOKE YOUR PREVIOUSLY SUBMITTED WHITE PROXY BY SIGNING AND RETURNING A LATER-DATED BLUE UNIVERSAL

PROXY CARD USING THE ENCLOSED POSTAGE-PAID ENVELOPE, BY DELIVERING A WRITTEN NOTICE OF REVOCATION TO THE CORPORATE SECRETARY OF OPT, OR

BY INSTRUCTING US BY TELEPHONE OR VIA THE INTERNET AS TO HOW YOU WOULD LIKE YOUR SHARES VOTED (INSTRUCTIONS ARE ON YOUR BLUE UNIVERSAL

PROXY CARD). ONLY THE LATEST VALIDLY EXECUTED PROXY THAT YOU SUBMIT PRIOR TO THE SUBMISSION DEADLINE WILL BE COUNTED.

IF YOU ARE A

STREET-NAME HOLDER (I.E., IF YOUR SHARES ARE HELD FOR YOU BY A BANK, BROKER OR OTHER NOMINEE) AND IF YOU ALREADY HAVE PROVIDED YOUR

BANK, BROKER OR OTHER NOMINEE WITH VOTING INSTRUCTIONS USING OPT’S WHITE VOTING INSTRUCTION FORM OR BY TELEPHONE OR VIA THE

INTERNET, YOU MAY REVOKE YOUR PREVIOUSLY SUBMITTED VOTING INSTRUCTIONS BY SIGNING AND SUBMITTING A LATER-DATED BLUE UNIVERSAL

VOTING INSTRUCTION FORM USING THE POSTAGE-PAID ENVELOPE PROVIDED BY YOUR BANK, BROKER OR OTHER NOMINEE OR BY TELEPHONE OR VIA THE

INTERNET BY FOLLOWING THE INSTRUCTIONS PROVIDED BY YOUR BANK, BROKER OR OTHER NOMINEE. IN THAT CASE, YOUR BANK, BROKER OR OTHER NOMINEE

WILL SEEK TO GIVE EFFECT TO ONLY THE LATEST-DATED VOTING INSTRUCTIONS IT RECEIVES FROM YOU.

SEE THE BACK COVER PAGE OF THIS PROXY STATEMENT

FOR FURTHER INFORMATION ON HOW TO VOTE YOUR OPT SHARES.

QUESTIONS AND ANSWERS RELATING TO THIS PROXY

SOLICITATION

What are you asking OPT’s stockholders

to do?

We are asking for your support for the election

to OPT’s board of directors of our four director candidates, Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs and Samuel S. Weiser.

As described more fully in this proxy statement, we believe our director candidates possess the skills and experience necessary to lead

OPT in a new direction that we believe is urgently needed. Our director candidates will be responsible stewards of the trust placed in

them by OPT’s stockholders and will be committed to turning OPT around and making it successful for the benefit of all stockholders.

The OPT board of directors will ultimately be comprised of the six nominees who receive the most votes cast in favor of his or her election

at the Annual Meeting. We urge you to vote in favor of Paragon’s nominees.

Who are Paragon’s director candidates?

Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs

and Samuel S. Weiser are highly qualified individuals with significant business experience. The principal occupation and business experience

of each of these candidates is described in this proxy statement in the section titled “Our Director Candidates.” We believe

that each of our director candidates would be considered independent under the listing standards of the NYSE American LLC (“NYSE

American”), and none of our director candidates is affiliated with OPT or any of its subsidiaries. If elected to OPT’s board

of directors, our director candidates would owe fiduciary duties to all of OPT’s stockholders.

Who is entitled to vote?

If you are a record holder of OPT shares as of

the close of business on the Record Date for the Annual Meeting, which is December 4, 2023, you have the right to vote virtually

during the meeting or by proxy on the election of directors and any other matters that may properly come before the Annual Meeting. If

you are a record holder of OPT’s shares at the close of business on the Record Date, you will retain your right to vote or provide

a proxy even if you sell your OPT shares after the Record Date.

How do I vote my shares?

Stockholders of Record: If your shares

are held in your own name, please authorize a proxy to vote by signing and returning the enclosed BLUE universal

proxy card using the postage-paid envelope provided. You may also vote by telephone or via the internet following the voting instructions

on the BLUE universal proxy card.

Street Name Holders: If you hold your

shares in the name of one or more banks, brokers or other nominees, only they can vote your shares and only upon receipt of your specific

instructions. Accordingly, you should complete, sign, date and return the enclosed BLUE universal voting instruction

form or vote by telephone or via the internet by following the directions provided to you by your broker, bank or other nominee, or contact

the person responsible for your account and give instructions to them to sign and return a BLUE universal proxy

card representing your shares to elect our nominees to the board of directors.

See the back cover page of this proxy statement

for further information on how to vote your OPT shares.

If you have any questions or require any assistance

with providing your proxy or any other matters, please contact our proxy advisor, Alliance Advisors, by telephone at 855-200-8651 or by

email at OPTT@allianceadvisors.com.

How do you recommend that OPT’s stockholders

vote with respect to OPT’s nominees?

Stockholders are

permitted to vote for any combination (up to six total) of Paragon’s nominees and OPT’s nominees on the BLUE universal proxy

card. If stockholders choose to vote for any of OPT’s nominees, we recommend that stockholders “WITHHOLD” on

Terence J. Cryan, Clyde W. Hewlett, Peter E. Slaiby and Philipp Stratmann, who we refer to as the “Opposed OPT Nominees.”

OPT’s other two nominees (Natalie Lorenz-Anderson and Diana G. Purcel) are referred to hereafter as the “Acceptable OPT Nominees.”

We make no recommendation regarding the Acceptable OPT Nominees. We believe the best opportunity for Paragon’s nominees to be elected

is by voting “FOR” each of Paragon’s nominees and to “WITHHOLD” on or not vote “for”

the Opposed OPT Nominees on the BLUE universal proxy card.

What should I

do if I receive a white proxy card from OPT?

Paragon is using a universal proxy card for

voting on the election of directors at the Annual Meeting, which includes the names of all nominees for election to the OPT board of

directors, including Paragon’s nominees and OPT’s nominees. Stockholders have the ability to vote for up to six nominees

on Paragon’s enclosed BLUE universal proxy card. Stockholders may also vote on Paragon’s BLUE

universal proxy card for every other matter that OPT has indicated will be presented for a vote at the Annual Meeting. Accordingly, stockholders

can vote for all matters on Paragon’s BLUE universal proxy card.

OPT has said that it will disregard proxy

votes in favor of Paragon’s director nominees. Stockholders should review the section of this proxy statement titled “QUESTIONS

AND ANSWERS RELATING TO THIS PROXY SOLICITATION—Why is OPT saying it will disregard Paragon’s director nominations, and how

does that impact proxies that stockholders provide to Paragon?”

OPT is not using a universal proxy card. Rather

than give stockholders the ability to vote for Paragon’s nominees on a universal proxy card, OPT has indicated that “any

director nominations attempted by Paragon at the 2023 Annual Meeting will be disregarded, and no proxies or votes in favor of its purported

nominees will be recognized or tabulated at the 2023 Annual Meeting.” Whether OPT may lawfully disregard Paragon’s director

nominees is an issue that Paragon expects will be resolved by the Delaware courts. If you vote on OPT’s proxy card, you will not

be able to vote for Paragon’s nominees. If Paragon prevails in the litigation, then OPT’s proxy cards may be determined to

be deficient. If you vote for directors on Paragon’s universal proxy card, and OPT prevails in the litigation, then your votes

will not be counted. By voting on Paragon’s BLUE universal proxy card, you can send a message to OPT that you do not

support their actions in relation to the Annual Meeting and attempting to block the recognition of Paragon’s nominees.

Only the latest

validly executed proxy or, if applicable, voting instruction form that you submit will be counted; any proxy or, if applicable, voting

instruction form may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions below under “Can

I change my vote or revoke my proxy?” If you have any questions or require any assistance with voting your shares, please contact

our proxy advisor, Alliance Advisors, by telephone at 855-200-8651 or by email at OPTT@allianceadvisors.com.

Why is OPT saying it will disregard Paragon’s

director nominations, and how does that impact proxies that stockholders provide to Paragon?

Paragon submitted notice of its director nominees

to OPT pursuant to new advance notice bylaw provisions that OPT adopted after being informed of Paragon’s desire to obtain board

representation. OPT also adopted an NOL poison pill that prevents stockholders from acquiring more than 4.99% of OPT’s shares,

despite having significant NOLs for more than thirty years. In litigation filed by Paragon in which Paragon sought books and records

from OPT relating to suspected wrongdoing by OPT, a Delaware Court concluded that “the context and timing of the bylaw amendments

and poison pill suggest that thwarting the plaintiff was the board’s primary basis or driving purpose for such actions.”

OPT rejected Paragon’s nomination notice

on the basis of a lengthy list of “deficiencies” that OPT has expanded on several occasions, including after Paragon filed

litigation. Paragon filed litigation in Delaware on October 9, 2023 against OPT and each of its directors relating to what Paragon

believes is OPT’s acting in bad faith with respect to Paragon’s nomination notice. In connection with the litigation, Paragon

requested a preliminary injunction enjoining OPT from taking action to preclude Paragon’s director candidates from standing for

election at the Annual Meeting. In a decision issued on November 30, 2023, the Court issued its ruling and did not grant Paragon’s

requested relief on the basis that factual issues remain that would need to be resolved at a trial. Paragon intends to pursue this litigation

through trial.

OPT has indicated that “any director

nominations attempted by Paragon at the 2023 Annual Meeting will be disregarded, and no proxies or votes in favor of its purported nominees

will be recognized or tabulated at the 2023 Annual Meeting.” Paragon is proceeding with its solicitation of proxies at the Annual

Meeting, and expects that a final trial in the Delaware litigation will determine whether OPT did not have the legal right to reject

Paragon’s director nominations and did not have the legal right to disregard any proxies obtained by Paragon.

Whether OPT may lawfully disregard Paragon’s

director nominees is an issue that Paragon expects will be resolved by the Delaware Courts. If you vote on OPT’s proxy card, you

will not be able to vote for Paragon’s nominees. If Paragon prevails in the litigation, then OPT’s proxy cards may be determined

to be deficient. If you vote for directors on Paragon’s universal proxy card, and OPT prevails in the litigation, then your votes

will not be counted.

OPT could allow

Paragon’s director nominees to be recognized at the Annual Meeting, but instead has decided to attempt to block Paragon’s

nominees and not allow OPT’s stockholders to vote on Paragon’s director candidates. Paragon believes that OPT has carried

out a plan to block Paragon at every step of its campaign to nominate alternate directors for stockholders to consider. By voting

on Paragon’s BLUE universal proxy card, you can send a message to OPT that you do not support their actions in relation

to the Annual Meeting and attempting to block the recognition of Paragon’s nominees. By voting on Paragon’s BLUE universal

proxy card, you can send a message to OPT that you do not support OPT’s dismal financial record. Paragon intends to seek to enforce

the proxies it receives from stockholders in Court. Paragon believes that stockholders should ask OPT: why not just let stockholders

decide? What is OPT afraid of?

What if I submit

a proxy card with more than six nominees selected in Proposal 1?

You may vote “FOR”

up to a total of six nominees. If you vote using the BLUE universal proxy card for at least one nominee but fewer than six

nominees, your shares will be voted “FOR” only those nominees you have marked. If you vote using the BLUE

universal proxy card “FOR” more than six nominees, your votes on Proposal 1 regarding the nominees will be invalid

and will not be counted.

What is a quorum?

A quorum is the

minimum number of shares that must be represented at a duly called meeting of stockholders in person or by proxy in order to legally conduct

business at the meeting. According to OPT’s proxy statement, a majority of the shares of common stock entitled to vote at the Annual

Meeting must be represented electronically (given the virtual nature of the Annual Meeting) or by proxy at the Annual Meeting to constitute

a quorum for the transaction of business. According to OPT’s proxy statement, abstentions, withhold votes and broker non-votes (if

any) (as described below) are counted as present for purposes of determining the presence of a quorum at the Annual Meeting.

How do I vote

on the other matters being presented by OPT for vote at the Annual Meeting?

You can vote on

all matters to be presented at the Annual Meeting on Paragon’s BLUE universal proxy card.

According to OPT’s

proxy statement, the affirmative vote of the holders of a majority in voting power of the shares of OPT’s common stock, represented

by proxy or present at the Annual Meeting and voting on the matter, is required to approve Proposal 2 (the approval of an amendment to

OPT’s 2015 Plan), Proposal 3 (the ratification, by a non-binding advisory vote, of the Tax Benefits Preservation Plan), Proposal

4 (the ratification, by a non-binding advisory vote, of the selection of EisnerAmper LLP) and Proposal 5 (the approval, by a non-binding

advisory vote, of the executive compensation of OPT’s named executive officers). According to OPT’s proxy statement, abstentions

and broker non-votes, if any, will have no effect on the outcome of any of the foregoing proposals. However, we believe abstentions will

have the same effect as a vote “AGAINST” each of the foregoing proposals.

If your shares of

OPT are held in the name of a brokerage firm and the brokerage firm has not received voting instructions from the beneficial owner of

the shares with respect to a proposal that is not a routine matter, the brokerage firm cannot vote the shares on that proposal. This is

referred to as a “broker non-vote.” According to OPT’s proxy statement, broker discretionary voting is not permitted

on Proposal 1 (the election of directors), Proposal 2 (the approval of an amendment to OPT’s 2015 Plan), Proposal 3 (the ratification,

by a non-binding advisory vote, of the Tax Benefits Preservation Plan) and Proposal 5 (the approval, by a non-binding advisory vote, of

the executive compensation of OPT’s named executive officers). This means brokerage firms that have not received voting instructions

from their clients on these proposals may not vote on them. According to OPT’s proxy statement, broker discretionary voting will

also not be permitted on Proposal 4 (the ratification, by a non-binding advisory vote, of the selection of EisnerAmper LLP) if Paragon

delivers its proxy materials to your broker, bank, or other nominee on your behalf. Certain brokerage firms may not receive or may not

disseminate Paragon’s proxy materials to beneficial owners. According to OPT’s proxy statement, OPT believes such brokerage

firms may vote “broker non-votes” in their discretion on Proposal 4 on behalf of clients who have not furnished voting instructions

by the date of the Annual Meeting.

How do you recommend

that OPT’s stockholders vote with respect to the other matters being presented by OPT for vote at the Annual Meeting?

Paragon will vote its shares, and recommends

that you vote, “AGAINST” each of the approval of an amendment to OPT’s 2015 Plan, the ratification, by a non-binding

advisory vote, of the adoption of the Tax Benefits Preservation Plan, the ratification, by a non-binding advisory vote, of the selection

of EisnerAmper LLP as OPT’s independent registered public accounting firm for the fiscal year ending April 30, 2024, and the approval,

by a non-binding advisory vote, of the compensation of OPT’s named executive officers.

Can I change

my vote or revoke my proxy?

If you are the stockholder

of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Annual Meeting. Proxies

may be revoked by any of the following actions:

| • | signing, dating and returning the enclosed BLUE universal proxy card; |

| • | instructing Paragon by telephone or via the internet as to how you would like your shares voted (instructions

are on your BLUE universal proxy card); |

| • | delivering a written revocation or a later dated proxy for the Annual Meeting to the Corporate Secretary

of OPT; or |

| • | attending the virtual Annual Meeting and voting online during the Annual Meeting (although virtual attendance

at the Annual Meeting will not, by itself, revoke a proxy). |

If your shares are

held by a bank, broker or other nominee, you may revoke your previously submitted voting instructions by signing and submitting a later-dated

BLUE universal voting instruction form using the postage-paid envelope provided by your bank, broker or other nominee or

via telephone or the internet by following the instructions provided by your bank, broker or other nominee. If you virtually attend the

Annual Meeting and you beneficially own shares but are not the record owner, your mere attendance at the Annual Meeting WILL NOT

be sufficient to revoke your prior vote. You must have written authority from the record owner to vote your shares held in its name at

the Annual Meeting.

IF YOU HAVE ALREADY

VOTED USING OPT’S WHITE PROXY CARD, WE URGE YOU TO REVOKE IT BY FOLLOWING THE INSTRUCTIONS ABOVE. Although a revocation is effective

if delivered to OPT, we request that you mail or email a copy of the revocation to Alliance Advisors at the mail or email address included

on the back cover page of this proxy statement so that we will be aware of all revocations and can attempt to ensure they are honored.

If you have any

questions or require any assistance, contact our proxy advisor, Alliance Advisors, by telephone at 855-200-8651 or by email at OPTT@allianceadvisors.com.

What is the deadline

for providing a proxy?

We urge you to submit

your proxy to us or, if applicable, your voting instruction form to your broker, bank or nominee as soon as possible. For your proxy to

be voted at the Annual Meeting, we must receive it on or prior to the date of the Annual Meeting. The Annual Meeting is being held Wednesday,

January 31, 2024, at 10:00 a.m., Eastern Time, in virtual meeting format only, via live webcast. If your shares are held for you

by a bank, broker or other nominee, consult with your bank, broker or other nominee to ascertain the deadline for submitting voting instructions.

Who is making

this proxy solicitation?

This proxy solicitation

is being made by Paragon Technologies, Inc., a stockholder of OPT. Paragon is a Delaware corporation with its headquarters located

in Easton, Pennsylvania. Paragon is a holding company with diverse business activities, including material handling and order processing

solutions, distribution of IT equipment, consumer electronics and appliances, real estate investments, and investments in marketable securities.

Paragon’s board of directors consists of three of our director candidates, Hesham M. Gad, Jack H. Jacobs and Samuel S. Weiser.

Why is Paragon

making this proxy solicitation?

Paragon believes

that the OPT board is in desperate need of change. See “Why We are Soliciting Proxies” for additional information.

How many proxies

must be received for Paragon’s director candidates to be elected?

Under OPT’s

bylaws, stockholders are entitled to one vote for each share held by them on each matter coming before the Annual Meeting. According to

OPT’s proxy statement, OPT’s directors are elected by a plurality of the votes cast by holders of shares represented by proxy

or present at the Annual Meeting and entitled to vote on the election of directors, and cumulative voting is not permitted. A quorum must

also be present (as described above under “What is a quorum?”).

OPT is proposing

that six directors be elected at the Annual Meeting. Therefore, at the Annual Meeting, assuming a quorum is present, the six director

nominees receiving the highest number of votes, whether cast online during the Annual Meeting or by proxy, will be elected to OPT’s

board of directors. Because the six director candidates receiving the highest number of votes will be elected to OPT’s board, every

vote is important. We urge you to complete, sign, date and return in the enclosed postage-paid envelope the enclosed BLUE

universal proxy card (or, if applicable, your BLUE voting instruction form), or vote by telephone or via the internet following

the instructions on the BLUE universal proxy card, to elect our director candidates.

Why is Paragon

nominating only four director candidates when there are six members of OPT’s board of directors?

OPT’s

board of directors is currently composed of six directors, and although there are six directors standing for election at the Annual Meeting,

we have determined to nominate only four director candidates for the Annual Meeting. We are only nominating four candidates because if

all of our nominees are elected, our nominees will represent a majority of the board of directors, and we recognize the value in the

continuity of some representation of the existing board. Paragon initially provided notice to OPT of Paragon’s intent to nominate

five director nominees, but one of our director nominees withdrew as a nominee due to health reasons that he is still recovering from.

You can vote for our four candidates by submitting the BLUE proxy card. If we are successful in our solicitation, we expect

that OPT’s board of directors will be composed of our four nominees and the two nominees of OPT who receive the most votes cast

in favor of his or her election at the Annual Meeting.

There is no assurance

that any of OPT’s nominees will serve as directors if any or all of our nominees are elected. If we are successful in this proxy

solicitation, and OPT’s director nominees who are elected do not agree to serve, the newly constituted board may fill vacancies

on the board or reduce the size of the board. The names, backgrounds and qualifications of OPT’s director nominees and other information

about them can be found in OPT’s proxy statement for the Annual Meeting.

How can I attend

the virtual Annual Meeting?

The following is

based on information provided in OPT’s proxy statement.

The Annual Meeting

is scheduled to be held at 10:00 a.m., Eastern Time, on Wednesday, January 31, 2024 in a virtual only meeting format via live webcast

at www.cesonlineservices.com/optt23_vm. You will not be able to attend the Annual Meeting at a physical location. To attend the Annual

Meeting, you must pre-register at www.cesonlineservices.com/optt23_vm by 10:00 a.m., Eastern Time on January 30, 2024.

You will need to

have your control number contained on our voting instruction form, universal proxy card, or other communication available to complete

your registration request. Upon completing registration, participants will receive further instructions via email, including unique links

that will allow them to access the Annual Meeting. Stockholders may log into the meeting platform beginning at 9:30 a.m., Eastern Time,

on January 31, 2024. You are encouraged to log in prior to the Annual Meeting’s start time by following the instructions found

in the reminder email sent the day before the Annual Meeting.

If you are a beneficial

holder, you must obtain a “legal proxy” from your broker, bank or other nominee in order to vote at the Annual Meeting. If

you need assistance with registration or voting, or have any questions, please contact Alliance Advisors, our proxy advisor, by telephone

at 855-200-8651 or by email at OPTT@allianceadvisors.com.

Where can I find

additional information concerning OPT and the Annual Meeting?

Pursuant to Rule 14a-5(c) promulgated

under the Exchange Act, we have omitted from this proxy statement certain disclosures required by applicable law to be included in OPT’s

proxy statement in connection with the Annual Meeting, which can be found, free of charge, on the Securities and Exchange Commission’s

(the “SEC”) website at https://www.sec.gov, including:

| • | Item 5 of Schedule 14A (interest of certain persons in matters to be acted upon, other than the participants

in Paragon’s proxy solicitation); |

| • | Item 6 of Schedule 14A (voting securities and principal holders thereof, other than the participants in

Paragon’s proxy solicitation); |

| • | Item 7 of Schedule 14A (information about directors and executive officers and corporate governance matters); |

| • | Item 8 of Schedule 14A (compensation of directors and executive officers); |

| • | Item 9 of Schedule 14A (independent public accountants); |

| • | Information concerning OPT’s proposal regarding the approval of an amendment to the 2015 Plan; |

| • | Information concerning OPT’s proposal regarding the ratification, by a non-binding advisory vote,

of the adoption of the Tax Benefits Preservation Plan; |

| • | Information concerning OPT’s proposal regarding the ratification, by a non-binding advisory vote,

of the selection of EisnerAmper LLP as OPT’s independent registered public accounting firm for the fiscal year ending April 30,

2024; and |

| • | Informing concerning OPT’s proposal regarding the approval, by a non-binding advisory vote, of the

compensation of OPT’s named executive officers. |

Please refer to OPT’s proxy statement for

such information. Except as otherwise noted herein, the information in this proxy statement concerning OPT has been taken from or is based

upon documents and records on file with the SEC and other publicly available information. We take no responsibility for the accuracy or

completeness of information contained in OPT’s proxy statement.

This proxy statement and all other solicitation

materials in connection with this proxy solicitation will be available on the internet, free of charge, on the SEC’s website at

https://www.sec.gov.

Who should I call if I have any questions?

If you have any questions, require any assistance

in voting your OPT shares, need any additional copies of our proxy materials, or have any other questions, please contact Alliance Advisors,

our proxy advisor, by telephone at 855-200-8651 or by email at OPTT@allianceadvisors.com.

WHY WE ARE SOLICITING PROXIES

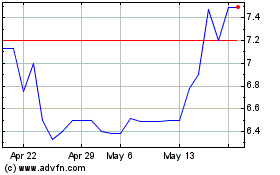

Paragon believes the dismal financial and

corporate governance record at OPT speaks for itself. OPT’s stock price has declined from $4,000 per share in 2007 and $586

per share since chairman Terence J. Cryan joined the board in 2012. OPT’s stock price closed at $0.39 per share on the Record

Date and $0.34 per share on December 8, 2023.

In its 40-year history, OPT has never reported

a profit and its accumulated losses equal $287.1 million as of July 30, 2023. OPT has lost over $160.0 million since chairman

Cryan joined the board. During its fiscal year 2023, OPT had revenues of only $2.7 million and losses of $26.3 million. Despite these

losses, CEO Philipp Stratmann has said OPT’s “strategy is working” and that he is “pleased” with OPT’s

results. OPT’s CFO has said that OPT is “managing costs tightly” while reporting that costs will not be cut during fiscal

2024.

The OPT

board has funded its massive losses through successive dilutive equity issuances. OPT has raised more than $80 million through

dilutive equity issuances between April 2022 and July 2023. In August 2023, OPT announced yet another dilutive equity issuance

of up to $13.8 million through an ATM offering, at a time when its stock price has been declining rapidly. This

repeated dilution has little impact on the board, as OPT’s directors own less than 1.0% of OPT’s

outstanding shares, most of which represents equity granted to themselves.

Despite the massive losses and severe equity

dilution, the OPT board has saw fit to reward itself with increasing compensation. The OPT board paid itself and its executives total

compensation of nearly $2.7 million during fiscal 2023 when its total revenues were $2.7 million. The OPT board has nearly tripled board

and executive compensation from $1.2 million in fiscal 2020 to more than $3.0 million in fiscal 2022, with CEO Stratmann alone receiving

nearly $1.0 million in total compensation during fiscal 2022. The OPT board has doubled its own compensation across five directors from

$397,000 to over $837,000 between fiscal 2020 and fiscal 2022.

Despite the embarrassing performance by the

OPT board, the board has sought to entrench itself and block Paragon’s ability to nominate directors at every step of the way,

including by adopting an NOL poison pill and burdensome new advance notice bylaws under false pretenses, leading a Delaware court

to conclude that Paragon “demonstrated a credible basis to suspect wrongdoing” carried out by the directors and officers

of OPT. The Delaware court noted “[t]he disconnect between the defendant’s financial picture and the defendant’s

public statements,” which “raises credible suspicions about the defendant’s management and operations.” The court

also concluded that “the context and timing of the bylaw amendments and poison pill suggest that thwarting the plaintiff was the

board’s primary basis or driving purpose for such actions.”

The Delaware court concluded that there has

been a disconnect between OPT’s public statements and OPT’s actual performance. Along these lines, OPT reported after

its fiscal 2023 that “We do not know whether we will be able to successfully commercialize

our products and services or whether we can achieve profitability,” but then suddenly reported only a few months later in a short

press release in connection with this election contest that “OPT expects…to reach profitability during calendar year

2025 using current capital resources.”

Paragon believes that the OPT board is in desperate

need of change. We believe that our director candidates possess the skills, experience and focus necessary to turn OPT around, but more

importantly to create a company that works for the benefit of stockholders, not the insiders.

We urge stockholders to vote “FOR”

the election of each of Paragon’s nominees.

OUR DIRECTOR CANDIDATES

OPT reports that its board of directors is currently

comprised of six directors, who serve one-year terms and are elected for a new one-year term at each annual meeting of stockholders. Under

OPT’s bylaws and applicable law, each of our candidates, if elected, would hold office until OPT’s 2024 annual meeting of

stockholders, and until such person’s successor has been duly elected and qualified or until their earlier death, resignation or

removal.

OPT is proposing that six directors be elected

at the Annual Meeting. Therefore, at the Annual Meeting, assuming a quorum is present, the six director nominees receiving the highest

number of votes, whether online during the meeting or by proxy, will be elected to OPT’s board of directors.

Each of our director candidates has consented

in writing to be nominated as a director of OPT, to being named as a director nominee in this proxy statement and to serve on OPT’s

board of directors if elected or appointed to the board of directors. At the Annual Meeting, we plan to nominate each of these director

candidates for election to OPT’s board of directors. Copies of the consents that have been signed by our nominees are included in

this proxy statement as Appendix A.

Stockholders are permitted to vote for any combination

(up to six total) of Paragon’s nominees and OPT’s nominees on the BLUE universal proxy card. If stockholders

choose to vote for any of OPT’s nominees, we recommend that stockholders “WITHHOLD” on Terence J. Cryan, Clyde

W. Hewlett, Peter E. Slaiby and Philipp Stratmann, who we refer to as the “Opposed OPT Nominees.” OPT’s other two nominees

(Natalie Lorenz-Anderson and Diana G. Purcel) are referred to hereafter as the “Acceptable OPT Nominees.” We make no recommendation

regarding the Acceptable OPT Nominees. We believe the best opportunity for Paragon’s nominees to be elected is by voting “FOR”

each of Paragon’s nominees and to “WITHHOLD” on or not vote “for” the Opposed OPT Nominees on the

BLUE universal proxy card.

Paragon intends to vote all of its shares “FOR”

each of Paragon’s nominees and to “WITHHOLD” on each of the Opposed OPT Nominees and each of the Acceptable OPT

Nominees. If each of Paragon’s nominees are elected, they will represent four out of six members of OPT’s board of directors.

In the event Paragon’s nominees do not constitute a majority of the OPT board of directors following the Annual Meeting, there can

be no assurance that Paragon’s nominees will be able to implement any actions that the participants in Paragon’s proxy solicitation

may believe are necessary to enhance stockholder value. There is no assurance that any of OPT’s nominees will serve as directors

if all or some of Paragon’s nominees are elected.

Our Candidates

The following sets forth information about each

of Paragon’s director candidates. Included below is the name, age, present principal occupation, and other biographical and experience

information for each of our director candidates. We believe that each of our director candidates would be considered independent under

the applicable SEC rules and regulations and listing standards of the NYSE American, and none of our director candidates is affiliated

with OPT or any of its subsidiaries. If elected to OPT’s board of directors, our director candidates would owe fiduciary duties

to all of OPT’s stockholders.

Hesham (Sham) M. Gad, 45, has been Chief

Executive Officer of Paragon Technologies, Inc. since June 2014, Chairman of Paragon’s Board of Directors since March 2012,

and a director of Paragon since 2010. Mr. Gad has also served as Secretary of Paragon since October 2023. Paragon is a holding

company with diverse business activities, including material handling and order processing solutions, distribution of IT equipment, consumer

electronics and appliances, real estate investments, and investments in marketable securities. From 2013 to 2017, Mr. Gad served

as Chairman and Chief Executive Officer of SED International Holdings, Inc., a multinational distributor of IT and computing products.

From 2018 to 2021, Mr. Gad served as the Treasurer and member of the Board of Directors of CityCenter Luxury Residences Unit Owners

Association. Mr. Gad has served since December 2022 as an advisory board member for Serving Our Kids, a non-profit organization

in Nevada that is dedicated to helping food insecure children improve their overall health, nutrition and educational lifestyle. Mr. Gad

is the author of “The Business of Value Investing: Six Essential Elements to Buying Companies Like Warren Buffett.” Mr. Gad

is a graduate of the University of Georgia, with a B.A. in Business Administration and an M.B.A., and the Stanford University Graduate

School of Business Executive Program.

Director Qualifications: Mr. Gad’s

role and responsibilities as an operating executive, including strategy oversight and implementation, capital allocation, leadership,

restructuring and contract negotiation, as Chief Executive Officer of Paragon make him acutely qualified to serve on OPT’s board.

He also has extensive experience in the area of financial markets and investments, qualifications valuable to a publicly traded company.

Mr. Gad is qualified to serve as an audit committee member or chairperson and as an “audit committee financial expert”

under SEC rules. Mr. Gad has experience serving as a director on a public company board after board control and management changed

through a proxy contest.

Business address: Paragon Technologies, Inc.,

101 Larry Holmes Drive, Suite 500, Easton, Pennsylvania 18042.

Shawn M. Harpen, 55, is currently the Chief

Executive Officer, Chief Financial Officer, Secretary and Advisor of Px3 Legal Consulting Corporation in California, which she founded

in 2022 to assist clients in governance, policy development, and other matters. Ms. Harpen,

an attorney with more than 20 years of experience, turned her focus to climate change and environmental, social and governance (ESG) matters

after establishing in 2010 the legal department of Patron Spirits International AG, which manufactures and distributes alcoholic beverages,

and serving as its Chief Legal Officer, General Counsel, Chief Compliance Officer and Corporate Secretary for nearly a decade. In 2018,

she guided Patron through its sale to Bacardi-Martini, B.V. and remained with the organization for another year to assist with integration.

Before joining Patron, Ms. Harpen served clients in private practice at two international law firms. From 2008 to 2010, she

was a partner with Jones Day and, from 2001 to 2008, she was an attorney with McDermott Will & Emery, where she was promoted

to partner. She represented directors, officers and issuers in complex commercial litigation as well as securities class and derivative

actions. She also advised on corporate compliance, governance, policy development and business transactions. Separate from her primary

occupation, in 2020, Ms. Harpen was named Personal Representative of the Estate of Sonia Y. Lee and Trustee of the Sonia Y. Lee Living

Trust, a position she continues to hold, and was the court-appointed Practice Administrator of the Sonia Y. Lee Professional Law Corporation

(d/b/a SKS Law Group) through dissolution of the entity in May 2022. She also served as a member of the Board of Directors of CityCenter

Luxury Residences Unit Owners Association from 2019 to 2021. Ms. Harpen has been a member of the Board of Directors and Chair of

the Audit Committee of Starlight Children’s Foundation since 2021, as well as a member of its Corporate Development and Fundraising

Committee. She also is an American Bar Association (ABA) Presidential-appointed Special Advisor to the ABA Standing Committee on

Professional Regulation, an appointed member of the Local Rules Advisory Committee of the United States District Court for the Central

District of California, a Life Fellow of the American Bar Foundation, and a Fellow of the Litigation Counsel of America. She has

served as the appointed Chair of both the State Bar of California Standing Committee on Professional Responsibility and Conduct and

the State Bar of Nevada Standing Committee on Ethics and Professional Responsibility. Ms. Harpen is licensed to practice law in California

and has a B.A. and a J.D. from the University of Toledo. She also has a public leadership credential from the Harvard University John

F. Kennedy School of Government and is an A.L.M. Candidate in Sustainability at Harvard University Extension School, where she has obtained

Graduate Certificates in Environmental Policy and International Development as well as Corporate Sustainability and Innovation.

Director Qualifications: Ms. Harpen

has significant experience in corporate governance, sustainability, legal ethics, government policy and environmental, social and governance

(ESG) matters.

Business address: Px3 Legal Consulting

Corporation, 668 N. Coast Highway #223, Laguna Beach, California 92651.

Jack H. Jacobs, 78, has been a director

of Paragon Technologies, Inc. since 2012. Paragon is a holding company with diverse business activities, including material handling

and order processing solutions, distribution of IT equipment, consumer electronics and appliances, real estate investments, and investments

in marketable securities. Colonel Jacobs is the Melcher Family Senior Fellow of Politics and Professor of Humanities and Public Affairs

at the United States Military Academy at West Point, where he has been teaching since 2005, and a principal of The Fitzroy Group, Ltd.,

a firm that specializes in the development of residential real estate in London and invests both for its own account and in joint ventures

with other institutions, for over 20 years. He has served as an on-air military analyst for NBC News since 2002, where shows on which

he appeared were nominated for Emmys. He was also a member of the team that produced the segment “Iraq: The Long Way Out,”

which won the 2011 Murrow Award. Colonel Jacobs was a co-founder and Chief Operating Officer of AutoFinance Group Inc., one of the firms

to pioneer the securitization of debt instruments, from 1988 to 1989; the firm was subsequently sold to KeyBank. He was a Managing Director

of Bankers Trust Corporation, a diversified financial institution and investment bank, where he ran foreign exchange options worldwide

and was a partner in the institutional hedge fund business. Colonel Jacobs’ military career included two tours of duty in Vietnam

where he was among the most highly decorated soldiers, earning three Bronze Stars, two Silver Stars, and the Medal of Honor, the nation’s

highest combat decoration. He retired from active military duty as a Colonel in 1987. Colonel Jacobs previously served as a member of

the Board of Directors of Resonant Inc. (formerly Nasdaq: RESN) from 2018 to March 2022, when it was acquired by a subsidiary of

Murata Manufacturing Co., Ltd. From 2016 to November 2022, Colonel Jacobs served as a member of the Board of Directors of Datatrak

International, Inc. (OTCMKTS: DTRK); from July 2018 to October 2020, he served as a member of the Board of Directors of

Ballantyne Strong, Inc. (NYSE American: BTN); from 2007 to 2012, he served as a member of the Board of Directors of Xedar Corporation,

a public company; from June 2006 to 2009, he was a director of Visual Management Systems, a private company; and he was a director

of BioNeutral Group, Inc., a public company, until 2009. From October 17, 2013 to October 28, 2013, Colonel Jacobs served

on the Board of Directors of SED International Holdings, Inc. He was previously a director of Premier Exhibitions, Inc. until

March 16, 2015. Colonel Jacobs has been a member of the Board of Trustees of the USO of New York since January 2012, a member

of the Board of Directors of the Medal of Honor Museum Foundation since June 2019, and a member of the Board of Directors of the

Children of Fallen Patriots Foundation since 2008. He is the author of the books “If Not Now, When?: Duty and Sacrifice in America’s

Time of Need” and “Basic.” Colonel Jacobs received a Bachelor of Arts and a Master’s degree from Rutgers University.

Director Qualifications: Colonel Jacobs

would bring extensive executive management and leadership skills to OPT’s board. He also has extensive experience as a director

of public companies and other organizations. His distinguished military experience and position at West Point could prove to be beneficial

to OPT in its dealings with the U.S. government and other potential customers and business partners. He is qualified to serve as an audit

committee member or chairperson and as an “audit committee financial expert” under SEC rules. Colonel Jacobs has experience

serving as a director on public company boards after board control and management changed through a proxy contest.

Business addresses: Paragon Technologies, Inc.,

101 Larry Holmes Drive, Suite 500, Easton, Pennsylvania 18042; NBC, 30 Rockefeller Plaza, New York, New York 10112; West Point, 606

Thayer Road, West Point, New York 10996; and The Fitzroy Group, Ltd., Olympia House, Armitage Road, London NW11 8RQ.

Samuel S. Weiser, 63, has been a director

of Paragon Technologies, Inc. since 2012. Paragon is a holding company with diverse business activities, including material handling

and order processing solutions, distribution of IT equipment, consumer electronics and appliances, real estate investments, and investments

in marketable securities. He serves as an advisor to Sentinel Group Holdings, LLC, the successor to Axess Equity Partners, LLC, a privately

held business focused on sourcing unique private equity, real estate and investment funds catering to family offices and high net worth

investors, where he has served since July 2020. Mr. Weiser is also founder, President and Chief Executive Officer of Foxdale

Management LLC, a consulting firm that provides operational consulting, strategic planning, and litigation support services in securities

related disputes, which has been operating since 2003. Through Foxdale, he has served since May 2020 as the Chief Financial Officer

for WR Group Inc., a consumer products company focused on health and beauty industry segments. He also serves as the Chief Financial Officer

of Altsmark, a software solution firm for the private capital sector, since January 2021. He is also the founder and Chief Executive

Officer of JMP OppZone Services, LLC, a fund administration and business support services firm focused on supporting investment activities

in designated opportunity zones that were created as part of the Tax Cuts and Jobs Act of 2017 to drive investment into depressed areas

of the country. JMP began operations in May 2019. From August 2009 until April 2015, he was a member of the Board of Directors

and from August 2014 until April 2015 was Executive Chairman of Premier Exhibitions, Inc., a provider of museum quality

touring exhibitions then listed on Nasdaq. In addition, Mr. Weiser served as President and Chief Executive Officer of Premier Exhibitions, Inc.

from November 2011 until June 2014. Mr. Weiser was a member of SED International Holdings, Inc.’s Board of Directors

from October 2013 until October 2014. Previously, Mr. Weiser served as a member and Chief Operating Officer of Sellers

Capital LLC, an investment management firm, from 2007 to 2010. From 2005 to 2007, he was a Managing Director responsible for the Hedge

Fund Consulting Group within Citigroup Inc.’s Global Prime Brokerage Division. Mr. Weiser also served as Chairman of the Managed

Funds Association, a lobbying organization for the hedge fund industry, from 2001 to 2003, and was formerly a partner in Ernst and Young.

He received his B.A. in Economics from Colby College and an M.A. in Accounting from George Washington University.

Director Qualifications: Mr. Weiser

has extensive financial, operational and turnaround consulting experience. He is qualified to serve as an audit committee member or chairperson

and as an “audit committee financial expert” under SEC rules. Mr. Weiser has experience serving as a director on public

company boards after board control and management changed through a proxy contest.

Business addresses: Paragon Technologies, Inc.,

101 Larry Holmes Drive, Suite 500, Easton, Pennsylvania 18042; Foxdale Management LLC, 565 Willow Road, Winnetka, Illinois 60093.

Other Disclosures

Paragon, together with the other participants

named herein, represents that (i) they intend to, or are part of a group which intends to, deliver a proxy statement and form of

proxy to holders of at least the percentage of OPT’s outstanding capital stock required to elect the Paragon nominees at the Annual

Meeting and (ii) they intend to, or are part of a group which intends to, solicit the holders of shares representing at least 67%

of the voting power of shares entitled to vote on the election of directors in support of the Paragon nominees.

Paragon is required to include all nominees for

election on its BLUE universal proxy card. For additional information regarding OPT’s nominees and any other related

information, please refer to OPT’s proxy statement. You will receive solicitation materials from OPT, including a proxy statement

and a white universal proxy card. We are not responsible for the accuracy or completeness of any information provided by or relating to

OPT or its nominees contained in the solicitation materials filed or disseminated by or on behalf of OPT or any other statements that

OPT makes. Stockholders will be able to obtain, free of charge, copies of all proxy statements, any amendments or supplements thereto

and any other documents (including the BLUE universal proxy card) when filed by the applicable party with the SEC in connection

with the annual meeting at the SEC’s website (http://www.sec.gov).

Pending Litigation with OPT

Litigation Regarding Books and Records Investigation

On July 27, 2023, Paragon filed a complaint

in the Delaware Court of Chancery to enforce its rights, pursuant to Section 220 of the Delaware General Corporation Law, to inspect

the books and records of OPT. On July 17, 2023, Paragon sent a demand letter to OPT requesting to inspect OPT’s books and records

for the purpose of investigating alleged wrongdoing and mismanagement by OPT’s board and members of management, inquiring into the

independence of the members of OPT’s board, assessing possible breaches of fiduciary duty by OPT’s directors and officers,

and communicating with other stockholders of OPT regarding matters relating to their interests as stockholders. OPT denied Paragon’s

inspection demand in its entirety.

During the trial on October 4, 2023, Paragon

expressed concerns about, among other things, OPT’s alarming financial losses, skyrocketing expenses, and increasing director and

officer compensation. Paragon also raised concerns about measures that OPT’s board of directors has taken for the apparent purpose

of interfering with Paragon’s efforts to elect new directors at the Annual Meeting.

On October 20, 2023, the Delaware Court of

Chancery ruled in favor of Paragon, finding in a Final Report of the Magistrate that Paragon “demonstrated a credible basis to suspect

wrongdoing” by the directors and officers of OPT and ordered OPT to provide Paragon with certain books and records for an investigation.

As part of the Final Report, the Magistrate found that the “disconnect between [OPT’s] financial picture and [OPT’s]

public statements raises credible suspicions about [OPT’s] management and operations.” The Magistrate also found that “the

context and timing of the bylaw amendments and poison pill suggest that thwarting the plaintiff was the board’s primary basis or

driving purpose for such actions.”

On October 25, 2023, OPT filed a notice

of exceptions to the Final Report. On December 8, 2023, Paragon filed an answering brief in opposition to OPT’s notice of exceptions

to the Magistrate’s Final Report.

Breach of Fiduciary Duty Litigation

On October 9, 2023, Paragon filed litigation

in the Delaware Court of Chancery against OPT and each of OPT’s directors, Terence J. Cryan, Philipp Stratmann, Peter E. Slaiby,

Clyde W. Hewlett, Natalie Lorenz-Anderson and Diana G. Purcel, relating to what Paragon believes is OPT’s acting in bad faith with

respect to Paragon’s nomination notice provided in connection with the Annual Meeting and failure to approve Paragon’s request

for an exemption pursuant to the terms of OPT’s NOL poison pill adopted on June 29, 2023, subject to a condition that Paragon

not exceed ownership of 19.9% of OPT’s outstanding shares of common stock. The litigation asserts claims for breach of fiduciary

duty against each of the directors and requests declaratory and injunctive relief enjoining the defendants from taking action to preclude

Paragon’s director candidates from standing for election at the Annual Meeting and providing that the NOL poison pill exemption

is granted. A hearing date of November 28, 2023 was set for the Court to consider Paragon’s request for an injunction prohibiting

OPT from preventing Paragon’s candidates from standing for election at the Annual Meeting.

On November 30, 2023, the Court issued its

ruling and did not grant Paragon’s requested relief on the basis that factual issues remain that would need to be resolved at a

trial.

Paragon intends to move forward with its election

contest and nominate its four director candidates at the Annual Meeting.

Paragon expects that a final trial in the

Delaware litigation, and potential additional litigation, may be required after the Annual Meeting to resolve issues relating to the

election contest, including whether OPT’s board has the right to disregard proxies that stockholders provide to Paragon, whether

OPT should have used a universal proxy card to solicit proxies from stockholders, and other potential disputes relating to OPT’s

handling of the Annual Meeting.

In considering this proxy statement and the

request to grant a proxy voting “FOR” Paragon’s nominees, you should consider the risk that, if OPT prevails

in the litigation described above, then your votes will not be counted. If you vote on OPT’s proxy card, you will not be able to

vote for Paragon’s nominees. If Paragon prevails in the litigation that is likely to follow the Annual Meeting, then OPT’s

proxy cards may be determined to be deficient.

We recommend and urge you to vote “FOR”

the election of each of our director candidates and “WITHHOLD” on each of the Opposed OPT Nominees.

HOW TO PROVIDE A PROXY TO US

We urge you to complete, sign, date and return

in the enclosed postage-paid envelope the enclosed BLUE universal proxy card to elect our director candidates, or vote by

telephone or via the internet following the instructions on the BLUE universal proxy card. If you hold shares of OPT through

a bank, broker or other nominee, you must provide voting instructions to that entity. If you have not received a BLUE universal

voting instruction form from your bank, broker or other nominee, you should immediately contact the person responsible for your account

to obtain a BLUE voting instruction form. See the back cover page of this proxy statement for further information

on how to vote your OPT shares.

If you have any questions or require any assistance

with providing your proxy or any other matters, please contact our proxy advisor, Alliance Advisors, by telephone at 855-200-8651 or by

email at OPTT@allianceadvisors.com.

Your proxy will authorize the proxy holders named

on the proxy, with full powers of substitution and resubstitution, to raise and second motions to nominate candidates for election to

OPT’s board of directors and to vote all OPT shares that you hold as of the Record Date at the Annual Meeting and at any adjournments,

continuations or postponements of such meeting and at any meeting called in lieu of such meeting, in each case subject to applicable law.

Any proxy may be revoked prior to the proxy being

voted at the Annual Meeting. If you are the stockholder of record, you may change your proxy instructions or revoke your proxy at any

time before your proxy is voted at the Annual Meeting by taking any of the following actions: signing, dating and returning the enclosed

BLUE universal proxy card; instructing Paragon by telephone or via the internet as to how you would like your shares voted

(instructions are on your BLUE universal proxy card); or delivering a written revocation or a later dated proxy for the

Annual Meeting to the Corporate Secretary of OPT. You can also attend the virtual Annual Meeting and vote online during the Annual Meeting

(although virtual attendance at the Annual Meeting will not, by itself, revoke a proxy).

If your shares are held by a bank, broker or other

nominee, you may revoke your previously submitted voting instructions by signing and submitting a later-dated BLUE universal

voting instruction form using the postage-paid envelope provided by your bank, broker or other nominee or via telephone or the internet

by following the instructions provided by your bank, broker or other nominee. If you virtually attend the Annual Meeting and you beneficially

own shares but are not the record owner, your mere attendance at the Annual Meeting WILL NOT be sufficient to revoke your prior

vote. You must have written authority from the record owner to vote your shares held in its name at the Annual Meeting.

Although a revocation is effective if delivered

to OPT, we request that you mail or email a copy of the revocation to Alliance Advisors at the mail or email address included on the back

cover page of this proxy statement so that we will be aware of all revocations and can attempt to ensure they are honored.

Your proxy will be voted as directed by you

thereon and in the discretion of the proxy holders with respect to any other matters that may properly come before the Annual Meeting,

including any matters incidental to the conduct of the meeting. If no choice is specified by you, the proxy holders will vote (1) “FOR”

each of our nominees and to “WITHHOLD” on each of the Opposed OPT Nominees and each of the Acceptable OPT Nominees;

(2) “AGAINST” approval of an amendment to the 2015 Plan to increase the number of shares of OPT’s common

stock available for grant under the 2015 Plan from 4,382,036 to 7,282,036 and to amend the aggregate number of shares available for incentive

awards; (3) “AGAINST” ratification, by a non-binding advisory vote, of the adoption of the Tax Benefits Preservation

Plan; (4) “AGAINST” ratification, by a non-binding advisory vote, of the selection of EisnerAmper LLP as OPT’s

independent registered public accounting firm for the fiscal year ending April 30, 2024; (5) “AGAINST” approval,

by a non-binding advisory vote, of the compensation of OPT’s named executive officers; and (6) in the proxy holders’

discretion as to other matters that may come before the Annual Meeting.

If Paragon abandons this solicitation or does

not solicit the holders of at least 67% of the voting power of shares entitled to vote on the election, then any votes cast in favor of

Paragon’s nominees would be disregarded and would not be counted for purposes of the election of directors, though such shares would

still be counted for purposes of determining whether a quorum exists and stockholders would be able to cast a later-dated vote by mail,

by telephone or via the internet using OPT’s white proxy card.

OPT has said that it will disregard proxies

provided to Paragon relating to the election of directors. Stockholders should review the section of this proxy statement titled “QUESTIONS

AND ANSWERS RELATING TO THIS PROXY SOLICITATION—Why is OPT saying it will disregard Paragon’s director nominations, and how

does that impact proxies that stockholders provide to Paragon?”

Your vote is important. Please complete, sign,

date and return the enclosed BLUE universal proxy card in the enclosed postage-paid envelope, or vote by telephone or via the internet

following the instructions on the BLUE universal proxy card, today. If you hold OPT shares through a bank, broker or other nominee,

please vote in favor of our director candidates by providing voting instructions to your bank, broker or such other nominee. If you have

not received a BLUE universal voting instruction form from your bank, broker or other nominee, you should immediately contact the

person responsible for your account to obtain a BLUE universal voting instruction form. See the back cover page of this proxy

statement for further information on how to vote your OPT shares.

OTHER MATTERS BEING PRESENTED BY OPT AT THE

ANNUAL MEETING

Proposal 2: Approval of an Amendment to the

2015 Plan

Based on information contained in OPT’s

proxy statement, OPT is requesting approval of an amendment to its 2015 Plan to increase the number of shares of OPT’s common stock

available for grant under the 2015 Plan from 4,382,036 to 7,282,036 and to amend the aggregate number of shares available for incentive

awards at the Annual Meeting.

Paragon will vote its shares, and recommends

that you vote your shares, “AGAINST” this proposal.

You may vote on this proposal on the enclosed

BLUE universal proxy card (or through the BLUE voting instruction form provided by your bank, broker or other

nominee) or by telephone or via the internet following the instructions on the BLUE universal proxy card (or BLUE

voting instruction form). If you indicate your vote with respect to this proposal on our BLUE universal proxy card,

we will vote your shares as instructed. If you return our BLUE universal proxy card and do not include directions on how

to vote with respect to this proposal, the proxy holders will vote your shares “AGAINST” this proposal.

Proposal 3: Ratification of the Adoption of

the Tax Benefits Preservation Plan

Based on information contained in OPT’s

proxy statement, OPT is requesting ratification, by a non-binding advisory vote, of the adoption of the Tax Benefits Preservation Plan

at the Annual Meeting.

Paragon will vote its shares, and recommends that

you vote your shares, “AGAINST” this proposal.

You may vote on this proposal on the enclosed

BLUE universal proxy card (or through the BLUE voting instruction form provided by your bank, broker or other

nominee) or by telephone or via the internet following the instructions on the BLUE universal proxy card (or BLUE