Form 8-K - Current report

September 22 2023 - 4:30PM

Edgar (US Regulatory)

0001592782

false

0001592782

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 18, 2023

NUKKLEUS INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-55922 |

|

38-3912845 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

525 Washington Blvd.

Jersey City, New Jersey 07310

(Address of principal executive offices)

212-791-4663

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Not applicable |

|

|

|

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03.

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement or a Registrant.

On

September 18, 2023, Nukkleus Inc. (the “Company”) issued a promissory note (the “Note”) in the

principal amount of $270,000 to Emil Assentato in consideration of cash proceeds in the amount of $270,000. The Note bears interest

of 5.0% per annum and is due and payable on September 18, 2026. Mr. Assentato is the Chief Executive Officer and a director of the

Company. The terms of the loan were approved by the non-interested members of the Company’s Board of Directors. The Company

used $245,000 of the proceeds to make a payment to FX Direct Dealer LLC (“FX Direct”) reducing the outstanding debt owed

by the Company to FX Direct. FX Direct is a wholly owned subsidiary of Currency Mountain Holdings LLC (“CMH”). Max

Q Investments LLC (“Max Q”) owns 80% of CMH. Mr. Assentato directly owns approximately 85% of Max Q, and indirectly owns

an additional 1%.

The

foregoing description is qualified in its entirety by reference to the Note, a copy of which is attached as Exhibit 10.1 hereto and is

incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

NUKKLEUS INC. |

| |

|

|

| Date: September 22, 2023 |

By: |

/s/ Emil Assentato |

| |

Name: |

Emil Assentato |

| |

Title: |

President and Chief Executive Officer |

Exhibit 10.1

PROMISSORY NOTE

|

Amount: $270,000 |

| |

|

|

New York, New York |

| |

|

| |

September 18, 2023 |

FOR VALUE RECEIVED, and subject to the

terms and conditions set forth in this Promissory Note (“Note”),

Nukkleus, Inc. (the “Payor”), hereby unconditionally promises

to pay on demand to the order of Emil Assentato or its assigns (the “Payee”),

in lawful money of the United States of America in immediately available funds, at such location as the Payee shall designate, all unpaid

advances of principal made from time to time by the Payee to the Payor, on the date three years after the date hereof, or if such a date

is not a business day, then the next succeeding business day (the “Maturity

Date”), and to pay interest on the unpaid principal amount hereof at the rates specified below.

The Payor further agrees to pay interest

to the Payee on the unpaid principal amount hereof from the date hereof at a rate per annum equal to 5% until the Maturity Date, and thereafter,

until payment in full of the principal amount hereof (whether before or after judgment). Interest shall be payable on the Maturity Date,

on the date of any prepayment and, after the Maturity Date, on demand.

The Payor may prepay the principal

amount of this Note in whole or in part at any time or from time to time without premium or penalty; provided that each prepayment shall

be accompanied by payment of accrued interest to the date of prepayment.

Upon the commencement by or against

the Payor of any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation

or similar proceeding of any jurisdiction relating to the Payor or its debts, the unpaid principal amount hereof shall become immediately

due and payable without presentment, demand, protest or notice of any kind in connection with this Note.

The Payee is hereby authorized to record

all loans and advances made by it to the Payor (all of which shall be evidenced by this Note), and all repayments or prepayments thereof,

in its books and records, such books and records constituting prima facie evidence of the accuracy of the information contained therein.

The Payor hereby waives diligence,

presentment, demand, protest or notice of any kind in connection with this Note. All payments under this Note shall be made without offset,

counterclaim or deduction of any kind.

This Note shall

be binding upon the Payor and its successors and assigns, and the terms and provisions of this Note shall inure to the benefit of the

Payee and its successors and assigns, including subsequent holders hereof. The Payor’s obligations under this Note may not be assigned

without the prior written consent of the Payee.

THIS NOTE SHALL BE GOVERNED

BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have executed

this Note as of the date first above written.

| |

Nukkleus Inc. |

| |

as Payor |

| |

|

| |

By: |

/s/ Emil Assentato |

| |

Name: |

Emil Assentato |

| |

Title: |

President & CEO |

| |

|

| |

Emil Assentato |

| |

as Payee |

| |

|

| |

By: |

/s/ Emil Assentato |

| |

Name: |

Emil Assentato |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Nukkleus (PK) (USOTC:NUKK)

Historical Stock Chart

From Apr 2024 to May 2024

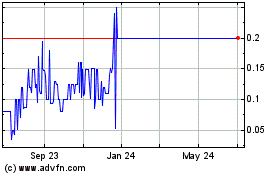

Nukkleus (PK) (USOTC:NUKK)

Historical Stock Chart

From May 2023 to May 2024