Current Report Filing (8-k)

March 10 2021 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 205490

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OFTHE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 5, 2021

|

MMEX RESOURCES CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

333-152608

|

|

26-1749145

|

|

(State of

incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification Number)

|

3616 Far West Blvd., #117-321

Austin, Texas 78731

(Address of principal executive offices)

Registrant’s telephone number, including area code: (855) 880-0400

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the reporting obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 of the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) Exchange Act

Securities registered pursuant to Section 12(b) of the Act: N/A

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 5, 2021, we finalized an agreement, effective as of February 22, 2021, with GS Capital Partners, LLC to extend the maturity date of the outstanding convertible promissory notes we had previously issued to such lender from August 31, 2021 to the earlier of (i) December 31, 2021 or (ii) our consummation of an equity or equity-based financing sufficient to retire such outstanding note. The lender agreed to such extension in consideration of our transfer of an additional reserve of shares of common stock to the account of such lender for issuance pursuant to the outstanding convertible notes issued to such lender in accordance with their terms.

The lender also agreed to release the prior pledge to such lender by our holders of 1,000 shares of Series A Preferred Stock (constituting 100% of the outstanding shares of Series A Preferred Stock) and to dismiss with prejudice the Joint Motion for Agreed Judgment which had been previously made in favor of the lender.

On March 8, 2021, we reached an agreement with JSJ Investments Inc. to transfer an additional reserve of shares of common stock to the account of such lender for issuance pursuant to the outstanding convertible note issued to such lender in accordance with its terms and in full satisfaction and cancelation of the convertible note.

Separately, we finalized agreements with GS Capital Partners, LLC and JSJ Investments Inc. to extend credit to us as follows:

|

|

·

|

On March 5, 2021, GS Capital Partners, LLC funded $250,000 pursuant to a promissory note due on the earlier of (i) December 31, 2021 or (ii) our consummation of an equity or equity-based financing sufficient to retire such outstanding note. The note bears interest at the rate of 10% per annum. The note is unsecured and is not convertible into our equity securities. The note allows for future mutually agreed drawdowns of a maximum additional $750,000.

|

|

|

|

|

|

|

·

|

On March 8, 2021, JSJ Investments Inc. funded $75,000 pursuant to a promissory note due December 31, 2021. The note bears interest at the rate of 10% per annum. The note is unsecured and is not convertible into our equity securities.

|

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

See Item 1.01 regarding our recently incurred indebtedness to noteholders.

Item 3.02 Unregistered Sales of Equity Securities

In our report on Form 8-K on May 12, 2020, we disclosed that we were obligated to issue shares of our common stock to related parties or third -party consultants in consideration of accrued liabilities to such persons and/or convertible notes issued as payment in satisfaction of such liabilities. We did not issue such shares when owed because no authorized shares of common stock were then available for issuance due to requirements that we maintain certain reserves in favor of the holders of our outstanding convertible notes. After completing the process of increasing our increasing our authorized shares of common stock to 37 billion shares, our reserves of available authorized shares have been increased. Accordingly, on March 8, 2021, we issued additional shares pursuant to the foregoing commitments. The issuances described in this Item 3.02 are exempt from registration pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MMEX Resources Corporation

|

|

|

|

|

|

|

|

Date: March 10, 2021

|

By:

|

/s/ Jack W. Hanks

|

|

|

|

|

Jack W. Hanks,

|

|

|

|

|

President and Chief Executive Officer

|

|

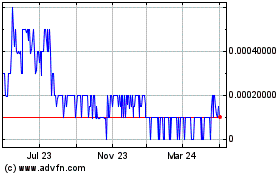

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

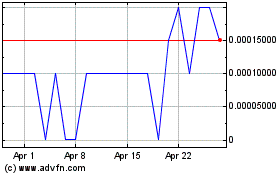

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Jul 2023 to Jul 2024