UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________.

Commission file number 333-152608

|

MMEX RESOURCES CORPORATION

|

|

(Exact name of registrant as specified in charter)

|

|

Nevada

|

|

26-1749145

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

|

3616 Far West Blvd. #117-321

Austin, Texas 78731

|

|

(855) 880-0400

|

|

(Address of principal executive offices,

including zip code)

|

|

(Issuer’s telephone number,

including area code)

|

Securities registered under Section 12(g) of the Exchange Act: Class A Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the issuer is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price ($0.0002 per share) at October 31, 2019 (the second quarter end date) was approximately $626,000.

As of August 13, 2020, there were 13,352,828,472 shares of the issuer’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

MMEX RESOURCES CORPORATION

TABLE OF CONTENTS TO ANNUAL REPORT ON FORM 10-K

YEAR ENDED APRIL 30, 2020

PART 1

Special Note Regarding Forward-Looking Statements

This Annual Report contains certain forward-looking statements. When used in this Annual Report or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Annual Report are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

Item 1: Business

Background of the Company

MMEX Resources Corporation was formed as a Nevada corporation in 2005. The current management team lead an acquisition of the Company (then named Management Energy, Inc.) through a reverse merger completed on September 23, 2010 and changed the Company’s name to MMEX Mining Corporation on February 11, 2011. As of April 12, 2016, the Company changed its name from MMEX Mining Corporation to MMEX Resources Corporation to reflect the change in its business plan to an energy focus in the Americas.

We are a development stage company engaged in the exploration, extraction, refining and distribution of oil, gas, petroleum products and electric power. We plan to focus on the acquisition, development and financing of oil, gas, refining and electric power projects in the Americas using the expertise of our principals to identify, finance and acquire these projects.

The focus of our current business plan is to build crude oil distillation units and refining facilities in the Permian Basin in West Texas (hereinafter referred to as the “Projects”, or the “Distillation Unit” or the “CDU” or the “Refinery”). We intend to implement our current business plan now in several phases, First, through our subsidiary, Pecos Refining, we intend to build and commence operation of one 10,000 bpd crude oil Distillation Unit, now permitted by the TCEQ, that will produce a non-transportation grade diesel primarily for sale in the local market for drilling mud and frac fluids, along with naphtha and residual fuel oil to be sold to other refiners. In additional phases as separate projects we are contemplating building a second and possibly a third CDU with capacity of 10,000 bpd each. We contemplate that these projects will be built on land owned or land being negotiated for purchase by the Company. As of this date, we also are in negotiations to acquire an existing refinery in the Louisiana Gulf Coast-Mississippi River area with a capacity of 46,000 bpd (the “Louisiana Gulf Project”). Our ability to implement this business plan will depend upon the availability of debt and equity financing, as to which there can be no assurance.

INDUSTRY OVERVIEW

Background on Crude Distillation and Refining

Oil refining is the process of separating hydrocarbon molecules present in crude oil and converting them into marketable, finished petroleum products, such as gasoline, diesel fuel, jet fuel, lubricants and petrochemicals. The crude distillation unit is the first phase of the refining process as shown below.

A crude oil refinery is a group of industrial facilities that turns crude oil and other inputs into finished petroleum products. A refinery’s capacity refers to the maximum amount of crude oil designed to flow into the distillation unit of a refinery, also known as the crude unit. The diagram above presents a stylized version of the distillation process. Crude oil is made up of a mixture of hydrocarbons, and the distillation process aims to separate this crude oil into broad categories of its component hydrocarbons, or “fractions.” Crude oil is first heated and then put into a distillation column, also known as a still, where different products boil off and are recovered at different temperatures. Lighter products, such as butane and other liquid petroleum gases (LPG), gasoline blending components, and naphtha, are recovered at the lowest temperatures. Mid-range products include jet fuel, kerosene, and distillates (such as home heating oil and diesel fuel). The heaviest products such as residual fuel oil are recovered at temperatures sometimes over 1,000 degrees Fahrenheit.

The simplest refineries stop at this point. Although not shown in the simplified diagram above, most refineries in the United States reprocess the heavier fractions into lighter products to maximize the output of the most desirable products using more sophisticated refining equipment such as catalytic crackers, reformers, and cokers.

The Company CDU’s stop with the simple distillation components and will produce intermediate range products of Naphthas, Diesel and Residual Fuel Oil.

Industry Terminology

Crack Spreads

Crack spreads are a proxy for refining margins and refer to the margin that would be derived from the simultaneous purchase of crude oil and the sale of refined petroleum products, in each case at the then-prevailing price. The 2-1-1 crack spread assumes two barrels of crude oil will be converted, or “cracked,” into one barrel of gasoline and one barrel of heating oil or diesel fuel. Average 2-1-1 crack spreads vary from region to region throughout the United States, depending on the supply and demand balances of crude oils and refined products.

Actual refinery margins vary from benchmark crack spreads due to the actual crude oils used and products produced, transportation costs, regional differences and the timing of the purchase of the feedstock and sale of light products.

The Company CDU’s will have a crack spread margin that will be based most likely on the differential between the purchase of the crude oil in the area of operations based on a West Texas Intermediate (“WTI”) Midland posted price and sale price at the CDU plant site prior to sale. Transportation cost is then deducted depending on the contract term, but the crack spread for the Company CDU will be the margin between the purchase price and the sales price at the CDU plant shipping point.

Operating Costs

Major operating costs for refineries include employee labor, maintenance and energy. Employee labor and maintenance are relatively fixed costs that generally increase in proportion to inflation. By far, the predominant variable cost is energy such as natural gas, electricity and refinery fuel gas.

CDUs Location

The CDUs will be located in the Permian Basin of Texas. It is a well-known prolific oil producing area.

Prior to COVID 19, oil production growth in the Permian Basin from 2009-2019 increased by 3,200,000 BPD and is projected to increase by another 2,700,000 BPD by 2024.

The production from these US shale basins, including the Permian Basin, is predominantly light, sweet crude oil, with gravity in excess of 35 degrees API. As a result, coincident with the growth in crude oil from these shale basins, U.S. imports of light crude oil began declining in 2010.

Our project in the Permian Basin is a strategic location to take advantage of the energy pricing and demand uplift when we emerge from COVID 19.

Outlook for Refining with COVID 19

COVID 19 has changed the U.S. economy. The Oil Economy is not an exception.

The New York Times reported on Thursday, July 30:

“The coronavirus pandemic’s toll on the nation’s economy became emphatically clearer Thursday as the government detailed the most devastating three-month collapse on record, which wiped away nearly five years of growth.

Gross domestic product, the broadest measure of goods and services produced, fell 9.5 percent in the second quarter of the year as consumers cut back spending, businesses pared investments and global trade dried up, the Commerce Department said.

The drop — the equivalent of a 32.9 percent annual rate of decline — would have been even more severe without trillions of dollars in government aid to households and businesses.”

New York Times “A Collapse That Wiped Out 5 Years of Growth, With No Bounce in Sight” July 30, 2020.

The U.S. Government Energy Information Administration (the “EIA”), has issued this recent report on the impact of COVID-19 to the energy industry:

“The disruptions to global petroleum supply and consumption as a result of COVID-19 and associated mitigation efforts have been significant. As road and air travel fell sharply when economies around the world went into lockdown in the first quarter and early second quarter of this year, global liquid fuels consumption fell more quickly than production. Based on the mismatch between production and consumption of liquid fuels, EIA estimates that global oil inventories increased by almost 1.3 billion barrels from the start of 2020 through the end of May. Inventory accumulation caused Brent crude oil spot prices to fall from a monthly average of $64 per barrel (b) in January to $18/b in April. In late April, when price declines were the steepest, market participants had concerns about the ability of global storage capacity to hold the quickly rising inventory.

U.S. Energy Information Administration “Short Term Energy Outlook (STEO) July 20, 2020.

We continue to believe that the world economy will improve over time, and with that the recovery of the energy industry including refining will return to its pre-Coronavirus levels. We just don’t know when that will be. However, we do agree with the recent Financial Times outlook:

“The coronavirus crisis has thrown the oil market out of balance and like other forecasters, we expect an unprecedented contraction in oil demand this year. But while some are arguing that we have seen the peak in 2019 with consumption never recovering, if anything, the pandemic is likely to significantly delay the structural transformation of the world’s economy away from oil. Although global consumption will fall this year by 11m barrels a day according to our estimates, or 11 per cent, from last year’s 100m b/d, there are still a series of factors providing underlying support for oil demand growth despite pressure to act against climate change.

Firstly, air travel is likely to recover. Consumption of jet fuel, the oil product worst affected by the pandemic as travel bans and lockdowns take effect, will rebound once people emerge out of isolation. It may just take a few years, but eventually the current concerns will wear off and the strong relationship between rising incomes and travel ambitions will return. In the meantime, road transport, which accounts for nearly half of global oil consumption, will prove resilient and may even benefit from the crisis. It is likely that people will use public transport less, given subways, buses and trains have been a major — if not the primary — transmission vector for the virus. Working from home is hardly an option for the majority of the workforce outside of the IT and professional service sectors, where it had already been an established practice among some before this recent crisis. This means increased reliance on cars once the lockdown measures ease will support petrol demand, potentially for years to come. Early signs of this can already be seen in China, where petrol consumption has nearly recovered to pre-coronavirus levels and many companies are encouraging or even mandating the usage of private cars for commuting, instead of public transport. Because of elevated levels of household debt, many consumers will postpone buying new cars. As existing vehicles stay on the road for longer, this will slow the rate of fuel economy improvements as old cars are not replaced by newer ones, meaning oil use will remain elevated.

The low oil price environment we are moving into will also incentivize car use, while reducing or even eliminating the fuel cost advantage of electric vehicles. Electrification will lose speed and internal combustion engines will continue to dominate as policymakers will be less forthcoming with the much-needed subsidies for electric cars at a time of economic crisis. There will also be less pressure to push for greater fuel efficiency with global CO2 emissions set to drop substantially in 2020.

Meanwhile, diesel demand will be supported by recovering economic activity and the delivery of goods, both nationally and internationally with increased levels of online shopping. Separately, the petrochemical sector could boost oil usage with many proposed single-use plastic bans now being reconsidered, postponed or cancelled. The pandemic has highlighted the need for single-use plastics in today’s world of high urbanization and population density with increased demands on sanitation, especially for packaging, food service containers, and notably protective gear for healthcare workers. A severe economic recession may disturb the near-term recovery in global oil demand, but it will rebound. This does not mean a peak in demand is not on the cards. The world is moving to cleaner fuels and climate change will remain high on the agenda. Demand will hit a ceiling, but not until late 2030s. Our consumption of oil will peak, just not yet.”

Financial Times, “Why the coronavirus crisis won’t mark a peak in oil demand. Transport demand will rebound while the pandemic will reboot the use of plastics.” April 2020.

The EIA forecasts U.S. liquid fuels consumption will average 18.3 million b/d in 2020, down 2.1 million b/d from 2019. Declines in U.S. liquid fuels consumption vary across products. From 2019 to 2020, EIA expects jet fuel consumption to fall by 31% and gasoline and distillate fuel consumption to both fall by 10%. The declines reflect travel restrictions and reduced economic activity related to COVID-19 mitigation efforts. EIA expects the largest declines in U.S. liquid fuels consumption have already occurred and consumption will generally rise through the second half of 2020 and in 2021. EIA forecasts U.S. liquid fuels consumption will average 19.9million b/d in 2021.

EIA; Oil Markets Have Now Shifted. The EIA STEO further states:

“The situation in oil markets has now shifted. EIA estimates that, in June, global consumption of petroleum and other liquid fuels was up 10 million barrels per day (b/d) from April levels as economies worldwide have begun emerging from lockdown. EIA estimates global supply has fallen by 12 million b/d during the same period as a result of reduced production from OPEC+ and price-driven declines and curtailments in the United States and Canada. These changes in EIA’s supply and demand estimates have shifted global oil markets from 21 million b/d of oversupply in April to inventory draws in June.

“EIA expects global oil inventories to generally draw through the end of 2021 as EIA forecasts global oil demand will continue to recover. Although EIA’s forecast consumption of global liquid fuels of 101.1 million b/d in the fourth quarter of 2021 would still be less than during the same period of 2019, it would be 16.7 million b/d more than in the second quarter of 2020. EIA also expects global oil supply to rise in the coming quarters. However, voluntary production restraint from OPEC+ producers, along with the lingering effects of low oil prices on U.S. tight oil production, will limit increases. As a result, EIA expects global oil inventories to decline at a rate of 1.8 million b/d through the end of 2021, eliminating most of the surplus that accumulated in early 2020. These inventory draws will likely put upward pressure on oil prices, but that pressure will be partly offset by high existing oil inventories, particularly in the second half of 2020, and a large amount of spare crude oil production capacity. The trajectory of both supply and demand are highly uncertain, however, and EIA will continue to closely track incoming data and oil market drivers in the coming months and adjust our forecasts accordingly. “

U.S. Energy Information Administration “Short Term Energy Outlook (STEO) July 20, 2020.

Current Business Operations and Strategy

The Company’s business plan has not changed, and it continues to evolve into additional potential components:

|

|

♦

|

The addition of a 2nd CDU at our present site Pecos County Texas site and potentially a 3rd CDU at another location

|

|

|

♦

|

Adding a Crude by Rail transportation and export component

|

|

|

♦

|

Adding a Hydrotreater as separate component to produce transportation grade diesel

|

|

|

♦

|

Development of a Terminal and Storage facility on the Texas Gulf Coast

|

|

|

♦

|

Organization of a Trading Company for exporting physical petroleum products to Latin American markets

|

|

|

♦

|

Associated gas and gas liquids treating

|

|

|

♦

|

Development of a Solar Project to power the Projects by solar energy

|

|

|

♦

|

Acquisition of an existing refinery in the Louisiana Gulf Coast-Mississippi River area

|

Successful execution of our business plan is dependent upon obtaining sufficient debt and/or equity financing, as to which there can be no assurance.

Additional CDU Opportunities In additional phases as separate projects we are contemplating building a second and possibly a third CDU with capacity of 10,000 bpd each. We believe our focus should be with modular refinery CDUs and not the building and operation of the Large Refinery with up to 100,000 bpd capacity in West Texas. We contemplate that these projects would be built on land owned or land being negotiated for purchase by the Company. The Company is focusing on the Distillation Unit first in an effort to build and commence operations, and ultimately generate cash flow, on an expedited basis. The permitting process is significantly shorter for construction of the Distillation Unit and the first one was received by the Company on August 30, 2017. We expect the permitting process to be similar for the additional Distillation Units. The Company estimates the construction costs for a single CDU to be in the range of $113 Million.

These projects, if successfully completed, will be built on acreage located 20 miles northeast of Fort Stockton, Texas, near the Sulfur Junction spur of the Texas Pacifico Railroad. If successfully developed, the CDUs would connect to existing railways and pipelines to market diesel, gasoline, liquefied petroleum gas and other refined products within the U.S., with the potential to market these products and crude oil to western Mexico and South America.

Crude by Rail We are actively considering the inclusion in our Distillation Unit projects of a crude oil storage and dispatch facility (RSD). The RSD facilities will be constructed as part of the CDUs. We propose to charge a per barrel fee to receive, store and dispatch crude oil to the Texas Gulf Coast markets.

Hydrotreater We are also considering adding a distillate hydrotreater component to the two CDUs as a separate project. The distillate hydrotreater is a category of hydrotreaters that treats distillate streams from atmospheric distillation units to reduce their sulfur content and to improve their properties for blending into diesel. This would allow CDU’s to produce transportation grade diesel for the Permian Basin market. We have initiated a preliminary feasibility study. The separate Hydrotreater component, if built, is estimated to cost approximately $25 million.

Constructing the CDUs and Hydrotreater will require a significant number of governmental permits and approvals. On August 30, 2017, we received approval from the TCEQ for the air quality permit for the 1st Distillation Unit. We plan to file for additional permits with TCEQ as may be required. According to VFuels Oil & Gas Engineering, and Saulsbury Industries, our two EPC contractors, the construction for the 1st Distillation Unit would take approximately 12 to 15 months from the date the Notice to Proceed is issued by the Company, which cannot be issued until the financing is completed. The 2nd and 3rd CDU’s will take approximately the same amount of time from the date of the Notice to Proceed, which will be dependent on receiving TCEQ permit approvals and the closing of financing.

Texas Gulf Coast Terminal and Storage Facilities Transportation and delivery of products by rail has opened up for the Company an opportunity to acquire potentially storage space in existing terminal facilities in the Texas Gulf Coast area with access to water for export of petroleum products including crude oil. We are in active negotiation with terminal owners and potential joint venture partners for the terminal site, the storage tanks and the financing. If built, the Company operated storage facilities on the Texas Gulf Coast will enhance the marketing activities of the Company.

Trading Company The Company is considering a potential joint venture with international partners to begin a physical trading operation of petroleum products into Mexico, Panama and potentially other Central and Latin America locations. If we are successful in implementing the trading opportunities this will add to the Company’s marketing expansion plans.

The cost of construction for all of these components is very significant and we intend to finance 100% of such costs through debt and equity offerings. See “Business—Proposed Organizational Structure.”

Marketing We plan on marketing and distributing refined products in the Texas Gulf Coast, and the Western areas of the United States and Mexico, and we may export product to Latin America. We have signed three off-take agreements with significant balance sheet purchasers. The diesel produced by the Distillation Unit will be marketed and sold locally, primarily for use in drilling mud and frac fluids, and likely transported by truck or by existing railroad systems. If the Hydrotreater is built, the diesel purchaser has indicated that it will purchase all of the transportation grade diesel produced by the 2 CDUs and the Hydrotreater. The ATBs and Naphthas produced by the CDU’s will be marketed and sold to a Super Major International Petroleum and Trading company under two separate signed agreements providing for the right to purchase all additional production. We will deliver these products by rail to the destination points the buyer designates on the Texas Gulf Coast. Our location with rail access from the Texas Pacifico Railroad with interconnections to the Burlington Northern Santa Fe RR, the Union Pacific RR, the Fort Worth and Western RR and the Kansas City Southern RR is a key component to our transportation and market access.

The Projects will be located on the Texas Pacifico Railroad rail route 20 miles Northeast of Fort Stockton, Texas, approximately 1.5 miles from the Sulphur Junction on the Texas Pacifico Railroad. Once needed repairs are finished to the tracks and railway, the Texas Pacifico Railroad will connect to the Ferromex RR in Ojinago, Mexico, giving us access to the western Mexico markets.

The Texas Department of Transportation owns the Texas Pacifico Railroad, which runs from the San Angelo Junction, near Coleman, Texas, to the Texas-Mexico border at Presidio. The Texas Pacifico Railroad entails approximately 371 miles of track and interchanges or has trackage rights with BNSF Railway the Union Pacific Railroad and Fort Worth and Western Railroad, which in turn have interchanges or trackage rights with the Kansas City Southern Railroad. The Texas Pacifico Railroad is operated by Texas Pacifico Transportation LTD, a subsidiary of Grupo Mexico. Our planned Project is located on the Texas Pacifico Railroad rail route approximately 20 miles northeast of Fort Stockton, Texas, approximately 1.5 miles from the Sulphur Junction on the Texas Pacifico Railroad. The Texas Pacifico Railroad will connect to the Ferromex Railroad at Ojinaga, Mexico.

Associated Gas and Liquids Treating Along with the crude oil production in the Permian Basin and the Eagle Ford, tremendous amounts of associated natural gas and natural gas liquids are being produced and without markets, is being flared into the atmosphere allowing producers to continue the crude oil production. Prior to COVID 19, it was estimated that 740 million cubic feet per day are being flared, which represents $1.8 million per day cost at then current prices. That produces the equivalent green-house gas from 5 million cars driving per day according to the World Bank and the Environmental Protection Agency. Post COVID 19, the output of gas is projected to increase over 30% in the next five years according to the consultancy RBN Energy. Wall Street Journal July 18, 2019 (Rebecca Elliott)

The Company wants to be able to offer crude oil producers in the Permian Basin, particularly those near our location, a way to process their liquid-rich “associated” gas produced in tandem with the crude oil and the Company has commissioned an engineering consulting firm to present what technologies exist for small-scale, modular natural gas treating close to the wellhead and what the expected capital and operating expenses. We have also asked the consultancy to develop a capital and operating expense estimate to turn the produced gas into diesel fuels via a Fischer-Tropsch facility. Should these processes be economically viable and the Company able to finance and develop them, this may be another very strong business plan addition.

Solar Project We have also commenced initial discussions regarding a solar power project to be located on leased acreage near the Refinery. If successfully financed and completed, we would expect to utilize a portion of the generated power for the Refinery, with the balance to be sold into the Texas grid. There is no assurance that the solar power project will be financed or constructed.

Financing The Company is currently seeking to locate the financing for the Projects. There is no assurance that the required debt and equity financing for the Projects will be obtained. The onset of the COVID-19 pandemic has made the climate for obtaining financing more challenging.

Management Expertise in Oil, Gas, Refining and Electric Power Project Development and Project Finance Development

The Board of Directors has decided to focus the Company’s efforts in the oil, gas, refining and electric power business in the U.S. and in Latin America. The principal reasons behind this focus is to capitalize on the experience and expertise of the MMEX management team, its directors and principal stockholders. MMEX management has over 30 years of experience in natural resource project development and project financing in North and South America and the U.K. In addition, MMEX directors and principal stockholders with oil, gas, refining and electric power experience will bring this expertise into the Company.

MMEX principals formed Maple Resources Corporation (“Maple Resources”) in 1986 to engage in the evaluation, acquisition and development of oil & gas, refining, power generation, natural gas transmission and processing energy projects in the western United States and Latin America. Maple Resources and its principals have engaged in a number of oil and gas acquisitions and dispositions and ultimately acquired assets that included 10 gas processing plants and approximately 770 miles of natural gas gathering lines and transmission infrastructure. In 1992, Maple Resources sold substantially all of its existing US-based assets and began to pursue energy projects in Latin America, particularly in Peru through its affiliate The Maple Gas Corporation del Peru Ltd (“Maple Peru”). In 1993, Maple Peru began developing the Aguaytía Project, an integrated natural gas and electric power generation and transmission project. This US$273 million project involved the first commercial development of a natural gas field in Peru, as well as the construction and operation of approximately 175 miles of hydrocarbon pipelines, a gas processing plant, a fractionation facility, a 153 MW power plant and the related 392 km of electricity transmission lines. The Aguaytía Project began commercial operation in 1998. Maple Peru also acquired a 4,000-bpd refinery in Pucallpa along with 3 producing oil fields.

Jack Hanks, our President and CEO, is no longer engaged in the active business operations of Maple Peru and is able to devote substantially all of his business time to his duties on behalf of the Company. Further, we do not anticipate that Maple Resources will present any conflicts of interest for the MMEX principals in carrying out their responsibilities on behalf of the Company.

Proposed Organizational Structure

The Company expects to operate the Projects through its subsidiary, Pecos Refining, and to acquire, if we are successful the Louisiana Gulf Coast refinery project through another subsidiary set up for such purpose. Currently, Pecos Refining is wholly owned by the Company and the Company serves as its sole manager. However, the construction of the Distillation Units, Hydrotreater, Terminals, Trading and other components and the Louisiana Gulf Coast Refinery will require substantial equity and debt financing, far beyond the expected resources of the Company, and we anticipate that the Subsidiaries will obtain equity and debt financing to finance the cost of construction. To the extent these Subsidiaries raise money through the issuance of equity securities, our ownership in the Subsidiaries will be diluted and our economic ownership of such entities may be a minority interest. As such, we will be entitled to only a portion of any future distributions made by these Subsidiaries. In addition, while intend to retain managerial control of the Subsidiaries, it is possible that equity investors will require representation on the board of managers in connection with their equity investments.

We anticipate these Subsidiaries will be able to finance approximately 65 to 70% of the total costs of the Distillation Units through debt financing, and the remaining 35 to 30% of the total costs would be financed through equity investments. We intend to pursue the required debt financing from banks or other large institutional investors. Traditionally, such debt financing is in the form of project financing, which among other terms will require the Subsidiary borrow to restrict its activities to the operation of the project financed by the lender, to pledge all assets of the project to the lender and to be subject to restrictive financial covenants. Such lenders further typically require engineering, marketing and feasibility studies as a condition precedent to the financing. In order to attract the significant capital necessary to build the Refinery, the Company will have to fund the cost of these reports and studies, likely out of equity raises. We have estimated that such cost will aggregate approximately $500,000.

Location and Logistics

The Refinery is proposed to be located in the Permian Basin, which holds some of the largest tapped and untapped oil and gas reserves in the world. The Permian Basis is located principally in West Texas. While production in the Permian Basin in the past had been in decline, the development of hydraulic fracturing in shale zones reversed the trend, and the cost of developing oil and gas reserves from shale formations (the driver of recent US increases in production) is lower in the Permian Basin than in other areas of the US. For this reason, the activity in the Permian Basin has recently been expanding and drawing the interest of major oil and gas companies. We believe that the Permian Basin will be the major domestic producing region in the country for decades to come.

The Projects will be located 20 miles northeast of Fort Stockton, Texas, near the Sulfur Junction spur of the Texas Pacifico Railroad and in the Permian Basin. The currently owned site consists of 126 acres and another 119 acres is under contract and the rail line runs through a corner of the owned property.

There are six refineries in the Permian Basin located at El Paso, Texas; McKee, Texas; Borger, Texas; Big Spring, Texas; and Artesia, New Mexico. The total capacity of these refineries is 640,500 bpd. These refineries are older refineries designed to process historic production from the Permian Basin. As such, these refineries do not take high-API production or discount it significantly, such as the production being produced from the hydraulically fractured shale zones in which the current increase in production is occurring in the Permian Basin. Moreover, the increasing amount of shale oil production has outpaced these refineries’ ability to process the new crude oil production. For these reasons, much of the new shale production is currently being exported out of the Permian Basin. Significant infrastructure improvements have been developed and announced to move Permian Basin production to the Texas Gulf Coast. According to the EIA, these infrastructure improvements have and will decrease the discount to WTI pricing that has often plagued the sale of Permian Basin shale crude in the recent past. The Company believes that while the construction of crude oil pipelines from the Permian Basin to the significant refining infrastructure in the Texas Gulf Coast will and have decreased discounts, trucking and pipeline companies will charge fees to transport the new shale production out of the Permian Basin, resulting, in effect, in a continued discount for such production, compared to the delivered price to our Projects.

The Projects will be located near the major producing shale areas of the Permian Basin in Reeves and Pecos counties. It is estimated that approximately 250,000 Bbls per day is being produced in the area of the Projects . The estimates of crude production and potential production from “drilled uncompleted” wells in our area far exceed the 20,000 BPD capacity of the proposed two CDU’s. The crude oil purchase offers are subject to substantial conditions and there is no assurance that the purchase arrangements can be successfully implemented. But the Company believes there are a number of alternative means of delivering the ever-increasing supply of oil shale production from the Permian Basin to the Refinery site, whether by truck, construction of gathering pipelines by another company or by rail.

Transportation

We will likely be transporting refined products primarily by rail. Both the U.S. Department of Transportation and its agency, the Federal Railroad Administration, have issued regulations pertaining to the shipment of crude oil and refined products. In addition, TxDOT has its own set of regulations pertaining to these matters, and Mexico will have additional regulations governing the transport of refined products and crude oil. As part of the construction of the Refinery, we will develop procedures and policies in connection with our shipping partners and buyers to comply with all relevant regulations.

We intend to transport the diesel production from our Distillation Unit by truck or by existing railroad systems within the Permian Basin for use in drilling fracking markets. We intend to transport other of our refined products, principally ATBs and naphtha, to other refineries, primarily in the Port Arthur, Beaumont, Houston and Corpus Christi, Texas areas, by pipeline and existing railroad systems for further processing.

TxDOT owns the Texas Pacifico Railroad, which runs from the San Angelo Junction, near Coleman, Texas, to the Texas-Mexico border at Presidio. The Texas Pacifico Railroad entails approximately 371 miles of track and interchanges with BNSF Railway, the Union Pacific Railroad and Fort Worth and Western Railroad, which in turn connects into the Kansas City Southern Railroad. The Texas Pacifico Railroad is operated by Texas Pacifico Transportation LTD, a subsidiary of Grupo Mexico. Our planned Projects are located on the Texas Pacifico Railroad rail route approximately 20 miles northeast of Fort Stockton, Texas, approximately 1.5 miles from the Sulphur Junction on the Texas Pacifico Railroad. The Texas Pacifico Railroad will connect to the Ferromex Railroad at Ojinaga, Mexico.

We plan to transport refined product on the Texas Pacifico Railroad and significant investments are required to upgrade the railroad. TxDOT owns the Texas Pacifico Railroad, which runs from the San Angelo Junction, near Coleman, Texas, to the Texas-Mexico border at Presidio. There are two significant infrastructure improvement projects that TxDOT must be complete before we will be able to use the Texas Pacifico Railroad to transport our production to Mexico as we have planned.

The first one has been completed. The international railroad bridge, located at the southwestern end of the rail line connecting Presidio, TX to Ojinaga, Mexico burned on two separate occasions, February 29, 2008 and March 1, 2009. TxDOT and Texas Pacifico Transportation LTD, the company that operates the Texas Pacifico Railroad, has rebuilt the bridge allowing access to Mexico and increased business potential.

The second one is a work in progress but well underway. On September 3, 2019 TxDOT announced:

“The Texas Transportation Commission last week approved the state Department of Transportation‘s (TXDOT) 10-year transportation plan, which includes $59.7 million in projects to rehabilitate hundreds of miles of the South Orient Railroad line (SORR).Funding has been secured for more than 205 miles of projects along the state-owned rail line, which extends from San Angelo Junction through San Angelo to Presidio at the Texas-Mexico border. TXDOT is using a combination of federal, state and local funds, as well as private contributions from Texas Pacifico Transportation Ltd. to pay for the projects. Texas Pacifico operates the line under a lease agreement. So far, completed projects have rehabilitated 167 miles of rail line through 2017. Additional projects are slated for more than 205 miles of track, according to TXDOT’s report on the 10-year plan.”

Texas Department of Transportation Press Release September 3, 2019.

There is no assurance that these capital improvements will be made. If these capital improvements are not made, our business prospects for Mexico exports on the TXPF could be materially negatively impacted.

With the proposed Company terminal and storage facilities and the trading company operations, the Company will have additional rail and ship/barge access to eastern Mexico areas and to other Latin America destinations from the Texas Gulf Coast. The Company believes that the market exists in Eastern Mexico and in Latin America for the refined products that it plans to ship, but it has no arrangements currently in place to market and sell its products in those areas.

Construction of the Projects

The Distillation Units would cover approximately 15 acres each of the 126 acres property which is owned.

The Company has hired VFuels Oil & Gas Engineering and Saulsbury Industries (the “EPCs”) with respect to the construction of the 1st CDU. The total indicated cost estimate including continencies and owner costs plus or minus 10% is $112 Million for the 1st CDU including contingencies. Once we close on the financing and issue the notice to proceed, the completion and start-up date guaranteed by the EPCs is 15 months. We expect the 2nd CDU to be less in cost than the 1st CDU and the Hydrotreater capex to be in the range of $25,000,000. The total indicated cost of the 1st CDU, the 2nd CDU and the Hydrotreater is in the range of $250 million.

Employees

As of April 30, 2020, we had no employees but rather to reduce costs our key management team is working under consulting agreements. Our two directors have not received any compensation. We contract for all professional services when needed.

Legal Proceedings

See Item 3 of this Report.

Environmental Regulations Pertaining to Refinery Operations.

The operations of the Refinery will be subject to complex and frequently changing federal, state, and local laws and regulations relating to the protection of health and the environment, including laws and regulations that govern the handling and release of crude oil and other liquid hydrocarbon materials. As with the industry generally, compliance with existing and anticipated environmental laws and regulations increases our overall cost of business, including our capital costs to construct, maintain, operate, and upgrade equipment and facilities. While these laws and regulations affect our maintenance, capital expenditures and net income, we do not believe they affect our competitive position, as the operations of our competitors are similarly affected. Violations of environmental laws or regulations can result in the imposition of significant administrative, civil and criminal fines and penalties and, in some instances, injunctions banning or delaying certain activities. We will adopt policies and procedures to ensure compliance with applicable environmental laws and regulations. However, these laws and regulations are subject to frequent change at the federal, state and local levels, and the legislative and regulatory trend has been to place increasingly stringent limitations on activities that may affect the environment.

Clean Air Act.

The environmental laws and regulations applicable to the Refinery include permitting and monitoring activities relating to air emissions under the federal Clean Air Act, and its implementing regulations, as well as comparable state and local statutes and regulations. Failure to comply with these rules can result in severe penalties and potential shut down of facilities. We will be required to develop policies and procedures to comply with all these laws and regulations.

Greenhouse Gas Emissions.

Various legislative and regulatory measures to address greenhouse gas (“GHG”) emissions, including carbon dioxide and methane emissions, are in different phases of implementation and discussion. At the federal legislative level, both houses of Congress have considered legislation to reduce GHG emissions, including proposals to: (i) establish a cap-and-trade system, (ii) create a federal renewable or “clean” energy standard requiring electric utilities to provide a certain percentage of power from such sources, and (iii) create enhanced incentives for use of renewable energy and increased energy efficiency in energy supply and use. A number of states, both individually and on a regional basis, have adopted measures to reduce carbon dioxide and other GHG emissions, including statewide GHG inventories and regional GHG cap-and-trade initiatives. The EPA has also begun to regulate GHG emissions under the authority granted to it by the federal Clean Air Act. The EPA has adopted regulations limiting emissions of GHGs from motor vehicles, addressing the permitting of GHG emissions from stationary sources, and requiring the reporting of GHG emissions from specified large GHG emission sources, including petroleum refineries. The implementation of EPA regulations could result in increased costs to (i) operate and maintain our facilities, (ii) install new emission controls on our facilities and (iii) administer and manage any GHG emissions program. Increased costs associated with compliance with any current or future legislation or regulation of GHG emissions, if it occurs, may have a material adverse effect on our financial condition, results of operations and cash flows. In addition, climate change legislation and regulations may result in increased costs not only for our business but also for our customers, thereby potentially decreasing demand for our products and services. Decreased demand for our products and services may have a material adverse effect on our financial condition, results of operations and cash flows.

Release of Hazardous Substances.

Environmental laws and regulations affecting our operations also relate to the release of hazardous substances or solid wastes into the soil, groundwater, and surface water, and include measures to control pollution of the environment. These laws generally regulate the generation, storage, treatment, transportation, and disposal of solid and hazardous waste. They also require corrective action, including investigation and remediation, at a facility where such waste may have been released or disposed. There are risks of accidental releases into the environment associated with our operations, such as releases of crude oil or hazardous substances from our pipelines or storage facilities. To the extent an event is not covered by our insurance policies, accidental releases could subject us to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage, and fines or penalties for any related violations of environmental laws or regulations.

CERCLA.

The Refinery property and any wastes disposed therefrom may be subject to the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the federal Resource Conservation and Recovery Act, and comparable Texas state laws. CERCLA and comparable state laws may impose liability without regard to fault or the legality of the original conduct on certain classes of persons regarding the presence or release of a hazardous substance in (or into) the environment, which may include the disposal of wastes generated by the Refinery, even if the wastes are taken from the Refinery by others and disposed by them. We will develop procedures and policies to ensure compliance with these laws.

Our operations may potentially result in the discharge of regulated substances, including crude oil, refined products, or natural gas liquids. The federal Clean Air Act and comparable state laws impose restrictions and strict controls regarding the discharge of regulated substances into waters of the United States or state waters. We will develop policies and procedures to ensure compliance with these rules.

Renewable Identification Numbers.

In 2007, the EPA promulgated the Renewable Fuel Standard (“RFS”), which requires refiners to blend “renewable fuels” in with their transportation fuels or purchase renewable fuel credits, known as renewable identification numbers (“RINs”), in lieu of blending. Under the Clean Air Act, the EPA is required to determine and publish the applicable annual renewable fuel percentage standards for each compliance year by November 30 of the prior year. However, the EPA has repeatedly missed that deadline. The percentage standards represent the ratio of renewable fuel volume to gasoline and diesel volume. For all domestically sold gasoline and diesel fuels we produce at the Refinery, we will be required to blend renewable fuels into our gasoline and diesel fuel or purchase RINs in lieu of blending. The Refinery intends to purchase RINs on the open market or waiver credits from the EPA to comply with the RFS. While we cannot predict the future prices of RINs or waiver credits, the price of RINs can be extremely volatile. RINs will constitute a genuinely significant cost of operations for the Refinery relative to domestically sold gasoline and diesel, which is why we intend to export gasoline and diesel to the fullest extent possible.

If the Refinery’s gasoline or diesel is sold domestically, we and other similarly situated refiners may become more reliant on the purchase of RINs and waiver credits on the open market to comply with the RFS in the future. The cost of RINs is dependent upon a variety of factors, which include the volume mandates set by EPA, the availability of RINs for purchase, the price at which RINs can be purchased, transportation fuel production levels and the mix of our petroleum products, all of which can vary significantly from quarter to quarter. In addition, numerous instances of fraudulent RINs being made available on the market have led EPA to impose penalties on RIN purchasers, even those with no knowledge of the fraudulent nature of the RINs. If we purchase invalid RINs or fail to properly keep records in accordance with EPA’s rules and regulations, we could be subject to fines and penalties.

Safety, Security and Insurance Concerns in Operating Refineries.

The Refinery will be subject to the Department of Homeland Security’s Chemical Facility Anti-Terrorism Standards, which are designed to regulate the security of high-risk chemical facilities, and to the Transportation Security Administration’s Pipeline Security Guidelines and Transportation Worker Identification Credential program. We will have to have an internal program of inspection designed to monitor and enforce compliance with all of these requirements, and we will need to develop a Facility Security Plan as required under the relevant law. We will also have to have in place procedures to monitor compliance with all applicable laws and regulations regarding the security of all our facilities.

The Refinery will also be subject to the requirements of the Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We will also be subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. We will take measures to ensure that our operations are in substantial compliance with OSHA requirements, including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.

Item 1A: Risk Factors

As a smaller reporting company, we are not required to provide the information required by this Item.

Item 1B: Unresolved Staff Comments.

None.

Item 2: Properties.

Our executive offices are located at 3616 Far West Blvd. #117-321, Austin, Texas 78731. We also maintain a satellite office in Fort Stockton, Texas near the site of our proposed refinery project.

On July 28, 2017, we acquired the 126-acre parcel of the land, which is the site for our planned Distillation Unit, at a purchase price of $550 per acre, or $67,088. We continue to negotiate with the seller of the property to acquire an additional 38-acre parcel, which is the site for the planned Large Refinery, at a price of $550 per acre, or approximately $210,000. We will be required to obtain additional financing to complete this purchase. We have not yet received any financing commitment for such purchase.

Item 3: Legal Proceedings.

On July 14, 2020, a consultant for rail services to the Company filed a complaint against the Company and its CEO Jack W Hanks, an individual, for payment of $100,000 of consulting fees. The Court Action is filed as CRU Trading Co, Plaintiff, v. MMEX Resources Corp and Jack W. Hanks in the District Court of Harris, County Texas Cause No. 2020-41853/Court;165. The Company, based on consultation with legal counsel, believes the complaint is without merit. The Company and Mr. Hanks are represented by counsel and have filed a verified denial.

On March 31, 2020, the Company entered into an amendment to the convertible debt notes with GS Capital Partners, LLC (“GS Capital”) to extend the maturity dates to November 20, 2020. As consideration for the extension, the parties agreed to a Joint Motion for Agreed Judgement to include the $1,094,750 principal amount of the notes and accrued interest of $487,166. In the event the notes are not paid in full, the Joint Motion may be filed by GS Capital and judgment entered against the Company. The holders of the Company’s Series A Preferred Stock have pledged their shares to GS Capital to secure the outstanding indebtedness of the Company to GS. If the indebtedness is not paid on or before its scheduled maturity date of November 20, 2020, GS Capital would be entitled to foreclose on such shares and would have 51% of the voting power of the Company’s equity securities.

Item 4: Mine Safety Disclosures.

Not Applicable.

PART II

Item 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

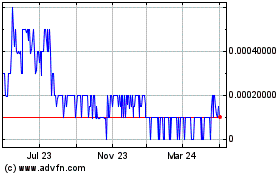

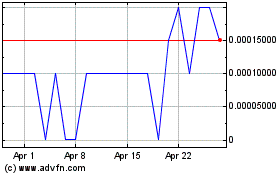

Since April 10, 2018, our common stock has been listed on the OTC Pink under the symbol “MMEX”. The OTC Market is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current “bids” and “asks”, as well as volume information. From November 2, 2017 through April 9, 2018, our Class A common stock was listed on the OTCQB and prior to November 2, 2017, our Class A common stock was quoted on the OTC Pink tier. The following table indicates the quarterly high and low bid price for our common stock for the fiscal years ending April 30, 2020 and 2019. Such inter-dealer quotations do not necessarily represent actual transactions and do not reflect retail mark-ups, mark-downs or commissions. On September 14, 2018, the Company amended its articles of incorporation to provide for a 1 for 100 reverse stock split of our common shares. The Company has given retroactive effect to the reverse stock split for all periods presented.

|

|

|

High

|

|

|

Low

|

|

|

Fiscal year ended April 30, 2019

|

|

|

|

|

|

|

|

Quarter ended July 31, 2018

|

|

$

|

0.52

|

|

|

$

|

0.29

|

|

|

Quarter ended October 31, 2018

|

|

$

|

0.48

|

|

|

$

|

0.11

|

|

|

Quarter ended January 31, 2019

|

|

$

|

0.40

|

|

|

$

|

0.05

|

|

|

Quarter Ended April 30, 2019

|

|

$

|

0.10

|

|

|

$

|

0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ended April 30, 2020

|

|

|

|

|

|

|

|

|

|

Quarter ended July 31, 2019

|

|

$

|

0.0250

|

|

|

$

|

0.0005

|

|

|

Quarter ended October 31, 2019

|

|

$

|

0.0008

|

|

|

$

|

0.0001

|

|

|

Quarter ended January 31, 2020

|

|

$

|

0.0002

|

|

|

$

|

0.0001

|

|

|

Quarter Ended April 30, 2020

|

|

$

|

0.0002

|

|

|

$

|

0.0001

|

|

On July 31, 2020, the closing bid price of our common stock as reported on the OTC Pink was $.0001.

The number of holders of record of the Company’s common stock as of April 30, 2020 was 159 as reported by our transfer agent. This number does not include an undetermined number of stockholders whose stock is held in “street” or “nominee” name.

We have not declared or paid any cash or other dividends on our common stock to date for the last two (2) fiscal years and have no intention of doing so in the foreseeable future.

We did not repurchase any of our equity securities during the fourth quarter of fiscal 2020.

Recent Sales of Unregistered Securities not previously reported in the Company’s Form 10-Q

During the fourth quarter ended April 30, 2020, we did not issue any unregistered shares of our common stock.

Outstanding Equity Awards at Fiscal Year-End

|

Plan Category

|

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a)

|

|

|

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b)

|

|

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities in Column (a) (d)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Compensation Plans Approved by Security Holders

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Equity Compensation Plans Not Approved by Security Holders (1)

|

|

|

448,037,755

|

|

|

$

|

1.00

|

|

|

|

0

|

|

|

Total

|

|

|

448,037,755

|

|

|

$

|

1.00

|

|

|

|

0

|

|

|

|

(1)

|

Consists of warrants to purchase 446,037,755 common shares and options to purchase 2,000,000 common shares.

|

Penny Stock

Our stock is considered to be a penny stock. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Item 6: Selected Financial Data

As a smaller reporting company, we are not required to provide the information required by this Item.

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under Special Note Regarding Forward-Looking Statements and Business sections in this Annual Report. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

The following discussion and analysis constitutes forward-looking statements for purposes of the Securities Act and the Exchange Act and as such involves known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect”, “estimate”, “anticipate”, “predict”, “believes”, “plan”, “seek”, “objective” and similar expressions are intended to identify forward-looking statements or elsewhere in this report. Important factors that could cause our actual results, performance or achievement to differ materially from our expectations are discussed in detail in Item 1 above. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by such factors. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Notwithstanding the foregoing, we are not entitled to rely on the safe harbor for forward looking statements under 27A of the Securities Act or 21E of the Exchange Act as long as our stock is classified as a penny stock within the meaning of Rule 3a51-1 of the Exchange Act. A penny stock is generally defined to be any equity security that has a market price (as defined in Rule 3a51-1) of less than $5.00 per share, subject to certain exceptions.

The following discussion should be read in conjunction with the Consolidated Financial Statements, including the notes thereto.

Overview

Business Plan

MMEX Resources Corporation was formed as a Nevada corporation in 2005. The current management team lead an acquisition of the Company (then named Management Energy, Inc.) through a reverse merger completed on September 23, 2010 and changed the Company’s name to MMEX Mining Corporation on February 11, 2011. As of April 12, 2016, the Company changed its name from MMEX Mining Corporation to MMEX Resources Corporation to reflect the change in its business plan to an energy focus in the Americas.

We are a development stage company engaged in the exploration, extraction, refining and distribution of oil, gas, petroleum products and electric power. We plan to focus on the acquisition, development and financing of oil, gas, refining and electric power projects in the Americas using the expertise of our principals to identify, finance and acquire these projects.

The focus of our current business plan is to build crude oil distillation units and refining facilities in the Permian Basin in West Texas (hereinafter referred to as the “Projects”, or the “Distillation Unit” or the “CDU” or the “Refinery”). We intend to implement our current business plan now in several phases, First, through our subsidiary, Pecos Refining, we intend to build and commence operation of one 10,000 bpd crude oil Distillation Unit, now permitted by the TCEQ, that will produce a non-transportation grade diesel primarily for sale in the local market for drilling mud and frac fluids, along with naphtha and residual fuel oil to be sold to other refiners. In additional phases as separate projects we are contemplating building a second and possibly a third CDU with capacity of 10,000 bpd each. We contemplate that these projects will be built on land owned or land being negotiated for purchase by the Company. As of this date, we also are in negotiations to acquire an existing refinery in the Louisiana Gulf Coast-Mississippi River area with a capacity of 46,000 bpd (the “Louisiana Gulf Project”).

Initially, Pecos Refining, the owner of the 1st Distillation Unit, and the other entities we may form to own and operate the 2nd and 3rd Distillation Units, and the Hydrotreater will be wholly owned subsidiaries of the Company. However, the construction of the Distillation Units and Hydrotreater will require substantial equity and debt financing, far beyond the expected resources of the Company, and we anticipate that these Subsidiaries will obtain equity and debt financing to finance the cost of construction. We anticipate these Subsidiaries will be able to finance approximately 65 to 70% of the total costs of the Distillation Units through debt financing, and the remaining 35 to 30% of the total costs would be financed through equity investments. To the extent these Subsidiaries raise money through the issuance of equity securities, our ownership will be diluted. We intend to retain managerial control of the Subsidiaries; however, our economic ownership of such entities may be a minority interest. As such, we will be entitled to only a portion of any future distributions made by these Subsidiaries.

Current Business Operations and Strategy

The Company’s business plan has not changed and it continues to evolve into additional potential components:

|

|

♦

|

The addition of a 2nd CDU at our present site Pecos County Texas site and potentially a 3rd CDU at another location

|

|

|

♦

|

Adding a Crude by Rail transportation and export component

|

|

|

♦

|

Adding a Hydrotreater as separate component to produce transportation grade diesel

|

|

|

♦

|

Development of a Terminal and Storage facility on the Texas Gulf Coast

|

|

|

♦

|

Organization of a Trading Company for exporting physical petroleum products to Latin American markets

|

|

|

♦

|

Associated gas and gas liquids treating

|

|

|

♦

|

Development of a Solar Project to power the Projects by solar energy

|

|

|

♦

|

Acquisition of an existing refinery in the Louisiana Gulf Coast-Mississippi River area

|

We plan on marketing and distributing refined products in the Western areas of the United States and Mexico, and we may export product to Latin America. The Projects will be located on the Texas Pacifico Railroad rail route 20 miles Northeast of Fort Stockton, Texas, approximately 1.5 miles from the Sulphur Junction on the Texas Pacifico Railroad. Once needed repairs are finished to the tracks and railway, the Texas Pacifico Railroad will connect to the Ferromex RR in Ojinago, Mexico, giving us access to the western Mexico markets.

The Company has hired VFuels Oil & Gas Engineering and Saulsbury Industries (the “EPCs”) with respect to the construction of the 1st CDU. The total indicated cost estimate including continencies and owner costs plus or minus 10% is $ 112 Million for the 1st CDU. Once we close on the financing and issue the notice to proceed, the completion and start-up date guaranteed by the EPCs is 15 months. We expect the 2nd CDU to be less in cost than the 1st CDU and the Hydrotreater capex to be in the range of $25,000,000. The total indicated cost of the 1st CDU, the 2nd CDU and the Hydrotreater is in the range of $250 million.

Constructing the Projects will require a significant number of governmental permits and approvals. The principal permit for the construction of any of the Projects is the Air Permit issued by TCEQ and significant construction will not begin until we have received the Air Permit. The Company has received the Air Permit for the 1st Distillation Unit.

Through April 30, 2020, we have had no revenues and have reported continuing losses from operations.

Results of Operations

We recorded a net loss of $4,393,689 or $(0.00) per share, for the fiscal year ended April 30, 2020, compared to net income of $3,986,830 or $(0.13) per share, for the fiscal year ended April 30, 2019. As discussed below, the net income or loss for any fiscal year fluctuates materially due to non-operating gains and losses.

Revenues

We have not yet begun to generate revenues.

General and Administrative Expenses

Our general and administrative expenses decreased $426,790 to $904,306 for the year ended April 30, 2020 from $1,331,096 for the year ended April 30, 2019. The decrease resulted from lower salaries, travel and other expenses associated with securing debt financing and administrative activities of our refinery project due to limitations on funding during the current fiscal year.

Refinery Start-Up Costs

During the year ended April 30, 2019, the expenditures for the development of our proposed crude oil refinery in Pecos County, Texas decreased from the prior fiscal year due to financing constraints. We expense all costs incurred prior to opening the refinery, including acquisition of refinery rights, planning, design and permitting. Such costs totaled $214,439 and $531,983 for the years ended April 30, 2020 and 2019, respectively.

Depreciation and Amortization Expense

Our depreciation and amortization expenses remained somewhat constant, totaling $34,663 and $30,914 for the years ended April 30, 2020 and 2019, respectively. The expense results from the depreciation of refinery land improvements and amortization of refinery land easements.

Other Income (Expense)

Our interest expense decreased $129,704 to $1,846,603 for the year ended April 30, 2020 from $1,976,307 for the year ended April 30, 2019. We had no material new non-related party convertible debt in the current fiscal year third and fourth quarters, resulting in less amortization of debt discount to interest expense, which was partially offset by the increase in loan penalties and default interest.

For the years ended April 30, 2020 and 2019, we reported losses on derivative liabilities of $1,402,233 and $128,860, respectively. In a series of subscription agreements, we have issued warrants that contain certain anti-dilution provisions that we have identified as derivatives. We also identified the variable conversion feature of certain convertible notes payable as derivatives. We estimate the fair value of the derivatives using multinomial lattice models that value the warrants based on a probability weighted cash flow model using projections of the various potential outcomes. These estimates are based on multiple inputs, including the market price of our stock, interest rates, our stock price volatility and management’s estimates of various potential equity financing transactions. These inputs are subject to significant changes from period to period and to management’s judgment; therefore, the estimated fair value of the derivative liabilities will fluctuate from period to period, and the fluctuation may be material.

We reported a gain on extinguishment of debt of $8,555 for the year ended April 30, 2020 compared to a gain on extinguishment of debt of $14,239 for the year ended April 30, 2019. The gain on extinguishment of debt generally results from the settlement and extinguishment of convertible notes payable and certain accounts payable and accrued expenses. Where shares of our common stock are issued in extinguishment of debt, we record the value of the shares issued at the current market price, which at times differs from the book value of the debt extinguished, resulting in a gain or loss on extinguishment of debt.

For the year ended April 30, 2019, we reported a loss on conversion of debt to common stock of $1,909. We had no gain or loss on conversion of debt for the year ended April 30, 2020.

Net Income (Loss)

As a result of the above, we reported net losses of $4,393,689 and $3,986,830 for the years ended April 30, 2020 and 2019, respectively.

Non-Controlling Interest in Income of Consolidated Subsidiaries

Currently, we have no activity in our consolidated subsidiaries. Non-controlling interest in income of consolidated subsidiaries was $0 for the years ended April 30, 2020 and 2019.

Net Loss Attributable to the Company

Because we had no non-controlling interest in income of consolidated subsidiaries, net loss attributed to the Company was the same as net loss.

Liquidity and Capital Resources

Working Capital

As of April 30, 2020, we had current assets of $89,975, comprised of cash of $66,830 and prepaid expenses and other current assets of $23,145, and current liabilities of $6,322,880, resulting in a working capital deficit of $6,232,905. Included in our current liabilities as of April 30, 2020 are derivative liabilities of $2,607,433, which we do not anticipate will require the payment of cash.

Sources and Uses of Cash