Merge Posts Q4 Earnings, Revs Fall - Analyst Blog

February 24 2014 - 9:00AM

Zacks

Merge Healthcare

Incorporated (MRGE) reported fourth-quarter 2013

adjusted net income per share of 3 cents, bouncing back from a

loss of 4 cents incurred in the year-ago quarter. However, reported

net loss of $0.3 million or break-even results in the fourth

quarter of 2013 compared favorably with the year-ago net loss of

$17.3 million or loss of 19 cents per share. Full year adjusted EPS

was a penny, a huge improvement from the year-ago loss of 23

cents.

Quarter in

Detail

Total revenue in the reported

quarter declined 17.1% year over year to $53.6 million. On a pro

forma basis, sales declined 17.2% year over year to $53.9 million,

lagging the Zacks Consensus Estimate of $58 million. Of the total

revenue, 64% was generated from subscription and other predictable

sources. Subscription backlog grew 39% over the prior-year quarter,

with improvements in both the Merge Healthcare and DNA

segments.

Segments in

Detail

Merge Healthcare primarily derives

revenues from three segments – Software and others (33.4% of total

sales in the quarter), Professional services (18.2%), and

Maintenance and EDI (48.4%). While maintenance and EDI registered

revenues of $26.1 million, down 10.1%, the Software and others

segment experienced a decline of 29.5% to $17.8 million. Revenues

in the Professional services segment dropped 6.7% year over year to

$9.7 million in the quarter.

Operational

Update

Total costs (excluding depreciation

and amortization) fell 23.1% year over year to $32.3 million.

Fourth-quarter adjusted gross margin expanded a massive 309 basis

points (bps) from the year-ago quarter to 60.2%.

Sales and marketing expenses were

down 33.5% year over year (to $7.6 million) while product research

and development expenses declined 9.4% (to $7.4 million) on a

year-over-year basis. General and administrative expenses slashed

50.8% from the year-ago quarter (to $9.1 million).

Consequently, adjusted operating profit stood at $8.1 million

against operating loss of $1.2 million in the year-ago quarter. The

adjustments excluded restructuring and acquisition-related costs,

depreciation and amortization.

Financial

Update

Merge Healthcare exited the quarter

with cash (including restricted cash) of $19.7 million, compared

with $35.8 million at the end of 2012. Cash generated from business

operations was $21.3 million versus cash outflow of $0.880 million

in the year-ago quarter.

2014 Outlook

The company provided a basic

guidance for 2014. Merge expects net sales in 2014 to remain in the

range of $212-$225 (essentially flat with 2013 sales) leading to

adjusted net income per share in the range of 16 cents to 21 cents.

The Zacks Consensus Estimate for revenues of $217 million remains

within the guided range.

Our Take

Disappointing fourth-quarter

results combined with declining sales at Merge Healthcare raise an

alarm. On a positive note, increase in subscription-based

backlog was the highlight of the quarter. On the other hand, Merge

Healthcare’s growth prospects are highly subject to capital

investments by hospitals for advanced imaging solutions, which are

in turn, dependent upon generic economic conditions.

Currently, the stock carries a

Zacks Rank #5 (Strong Sell). Some of the better-ranked stocks in

the medical information systems industry are Computer

Programs & Systems Inc. (CPSI) with a Zacks Rank #1

(Strong Buy), and Omnicell, Inc. (OMCL) and

athenahealth, Inc. (ATHN), both carrying a Zacks

Rank #2 (Buy).

ATHENAHEALTH IN (ATHN): Free Stock Analysis Report

COMPUTER PRGRMS (CPSI): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

OMNICELL INC (OMCL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

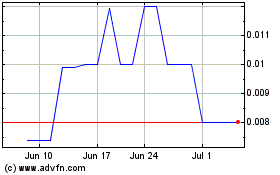

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024